|

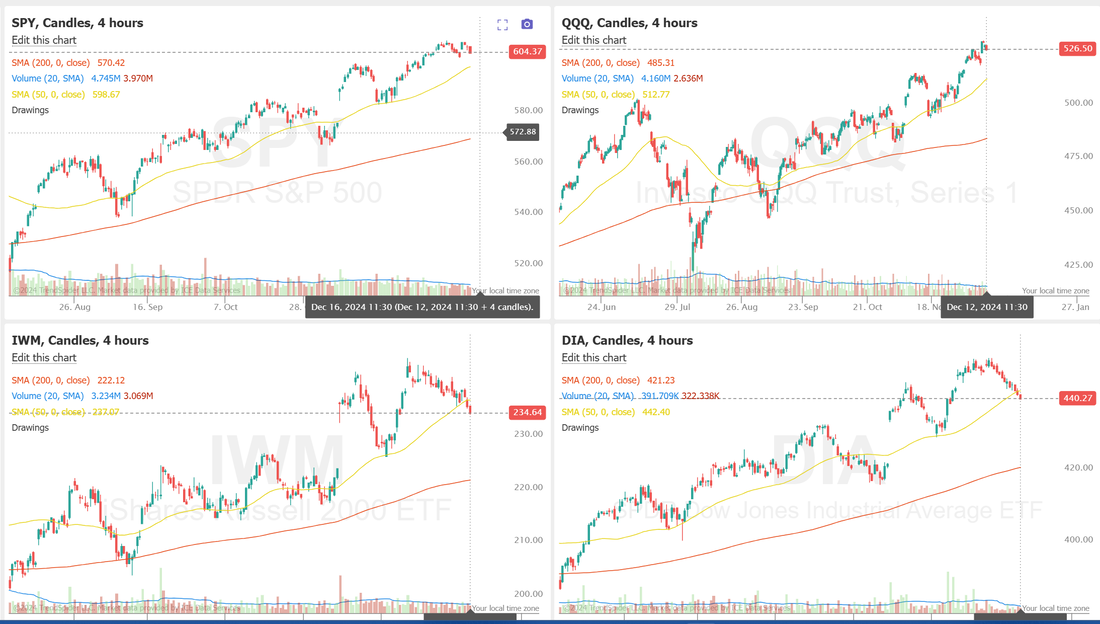

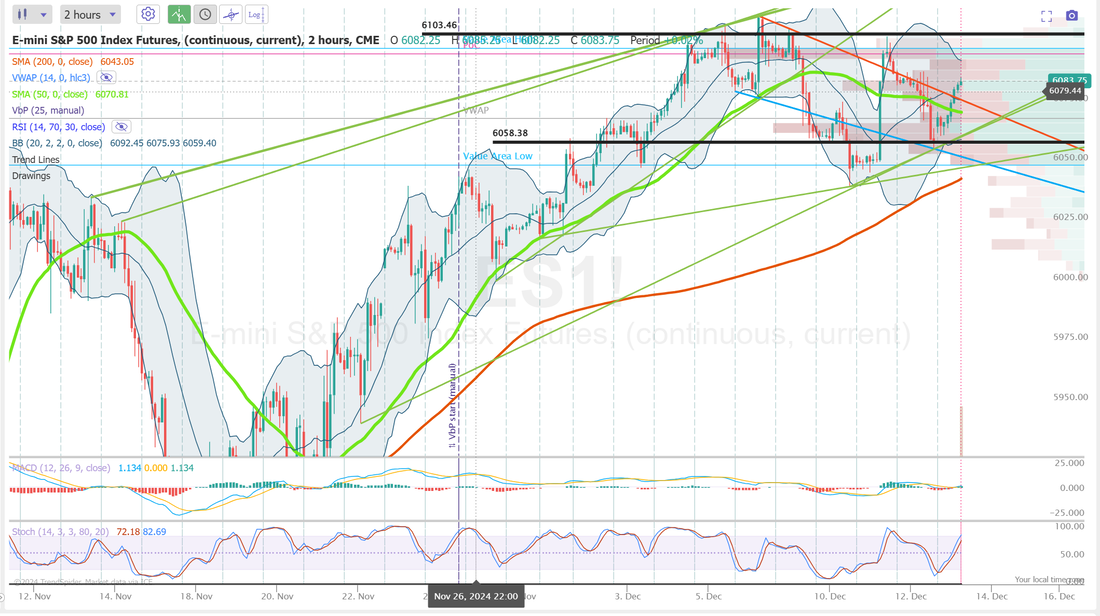

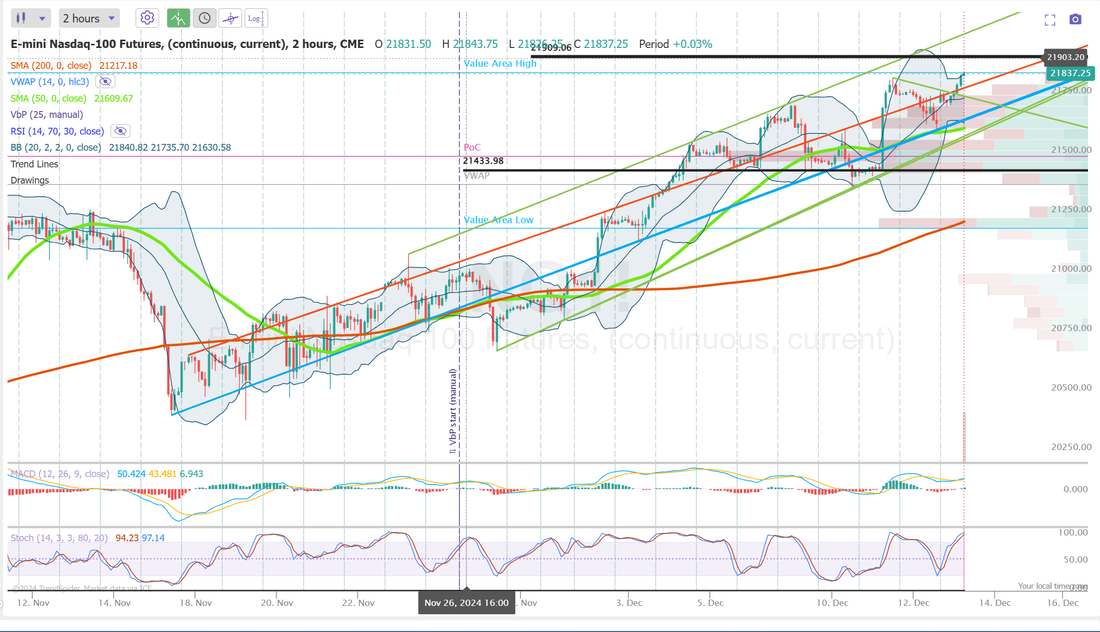

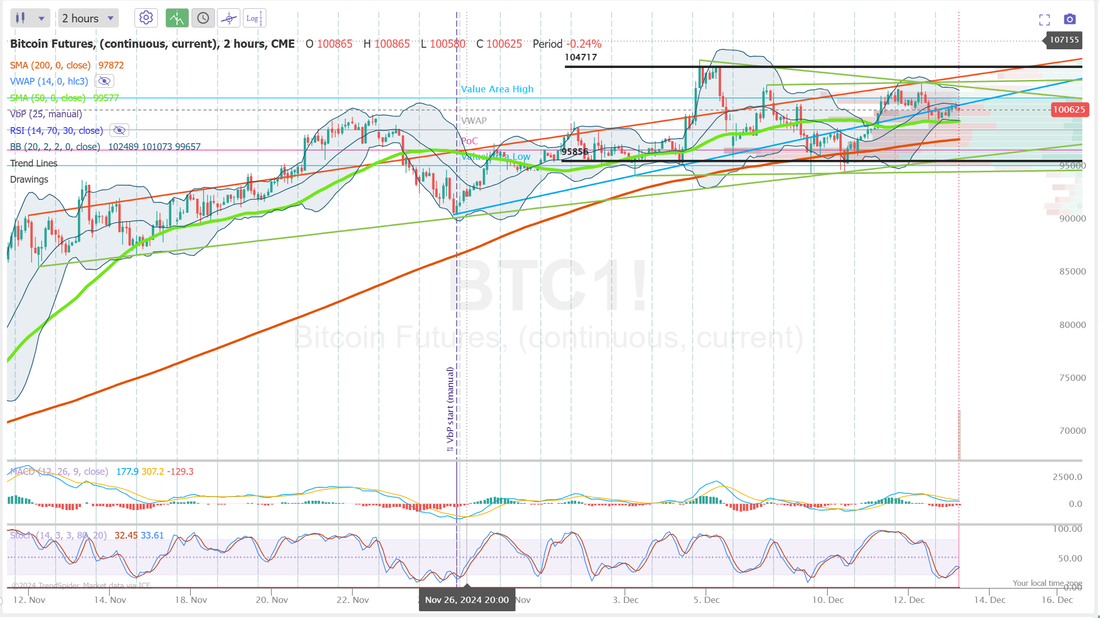

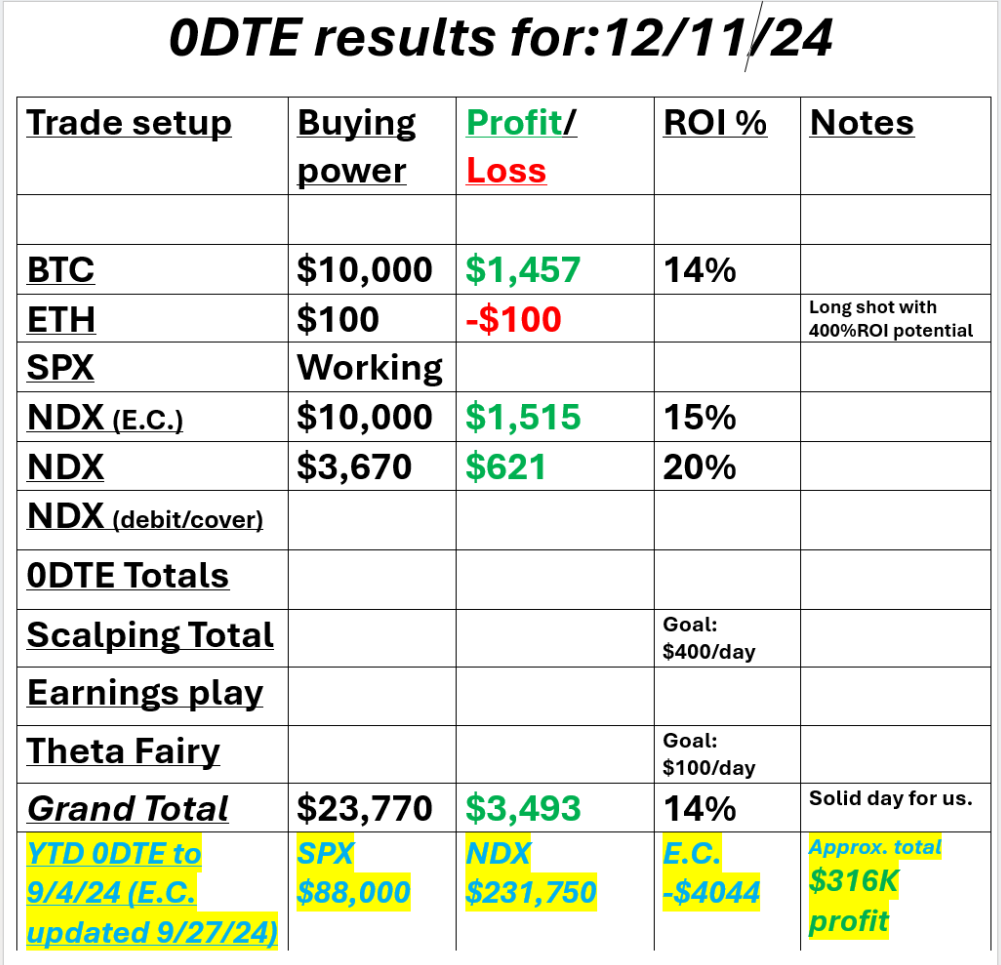

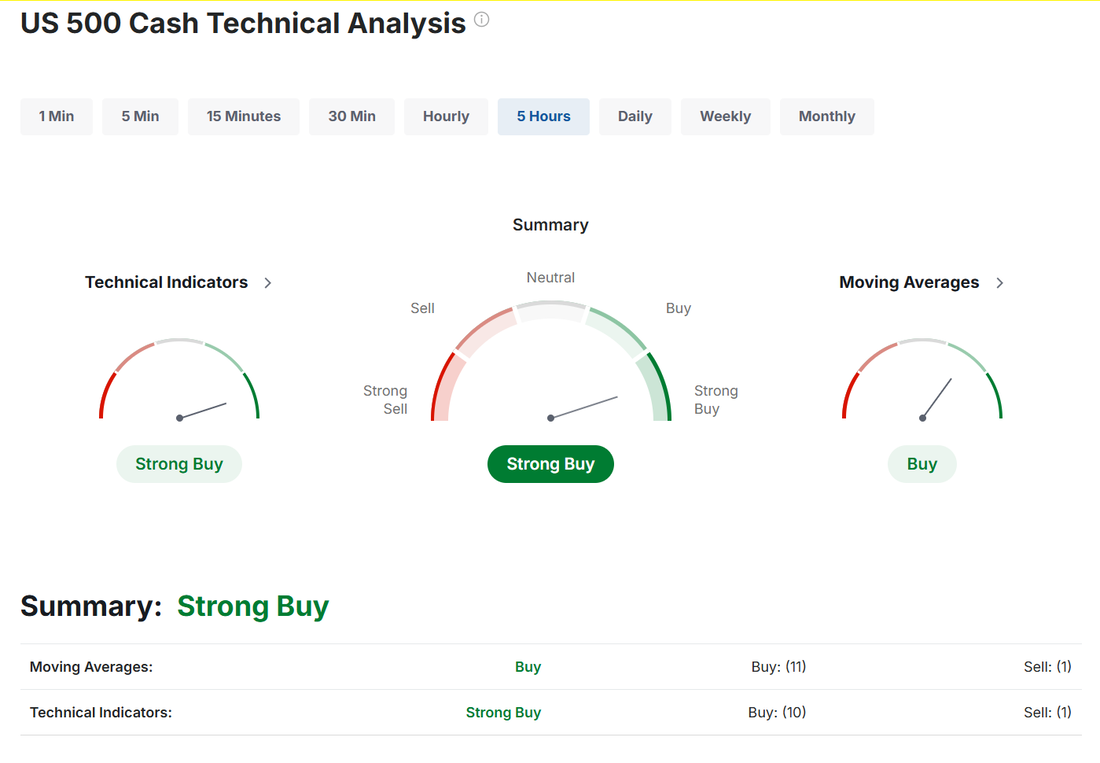

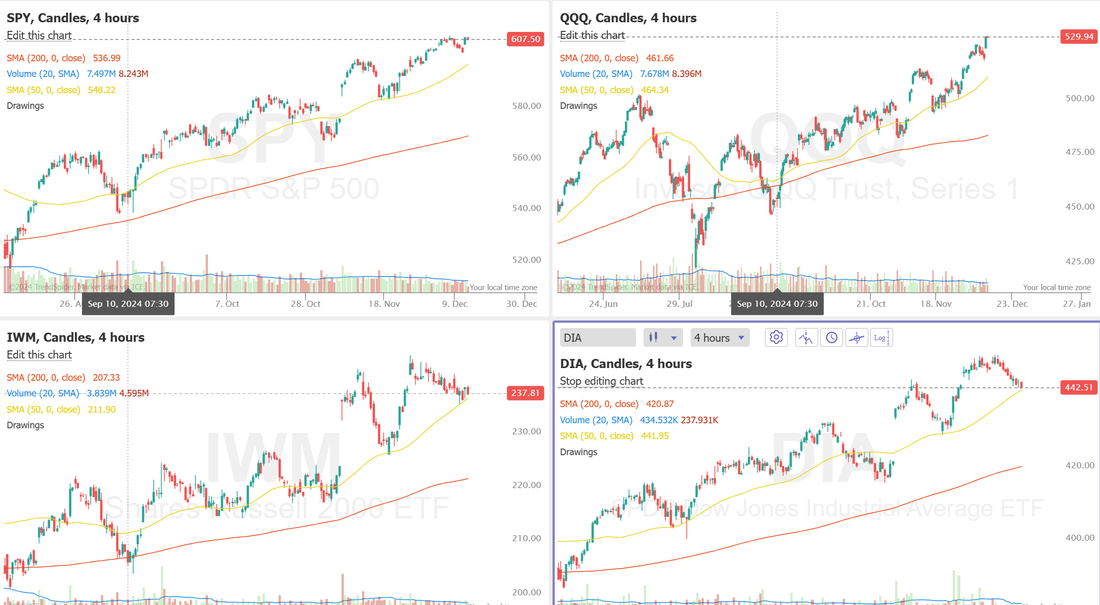

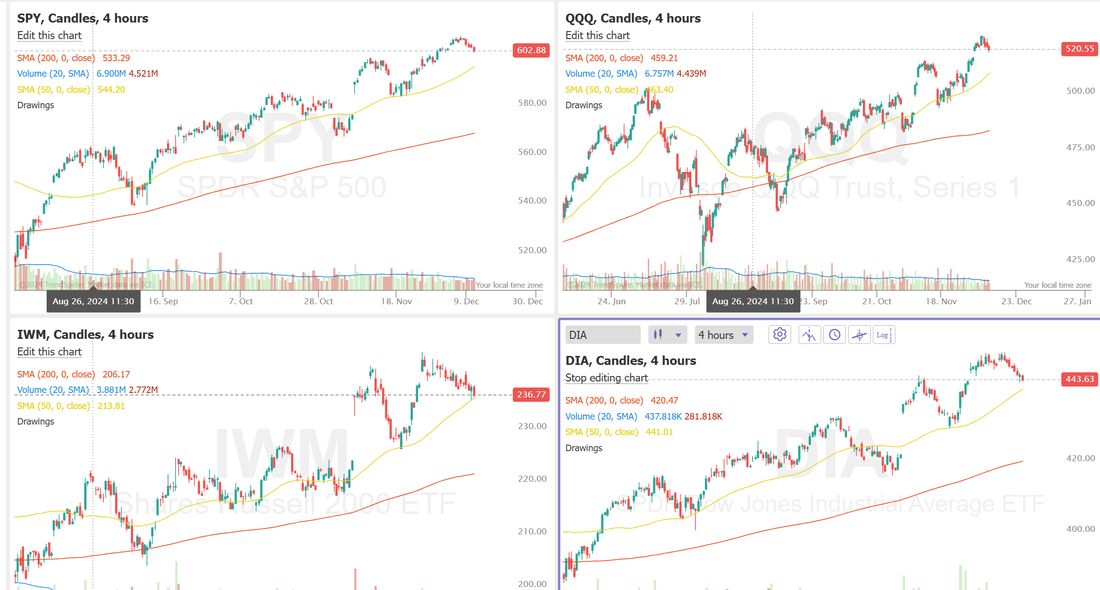

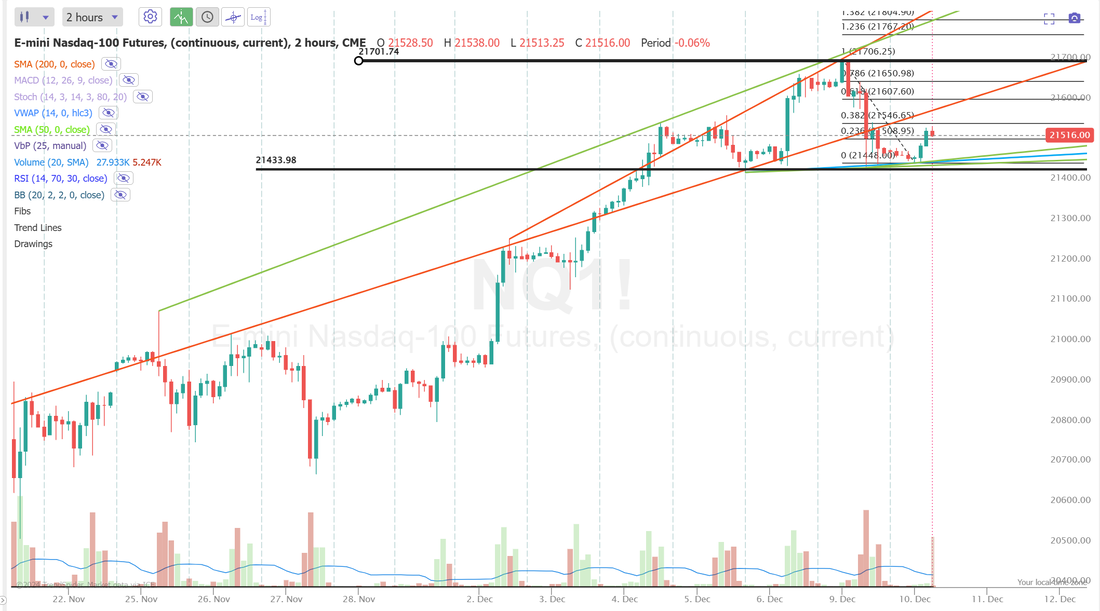

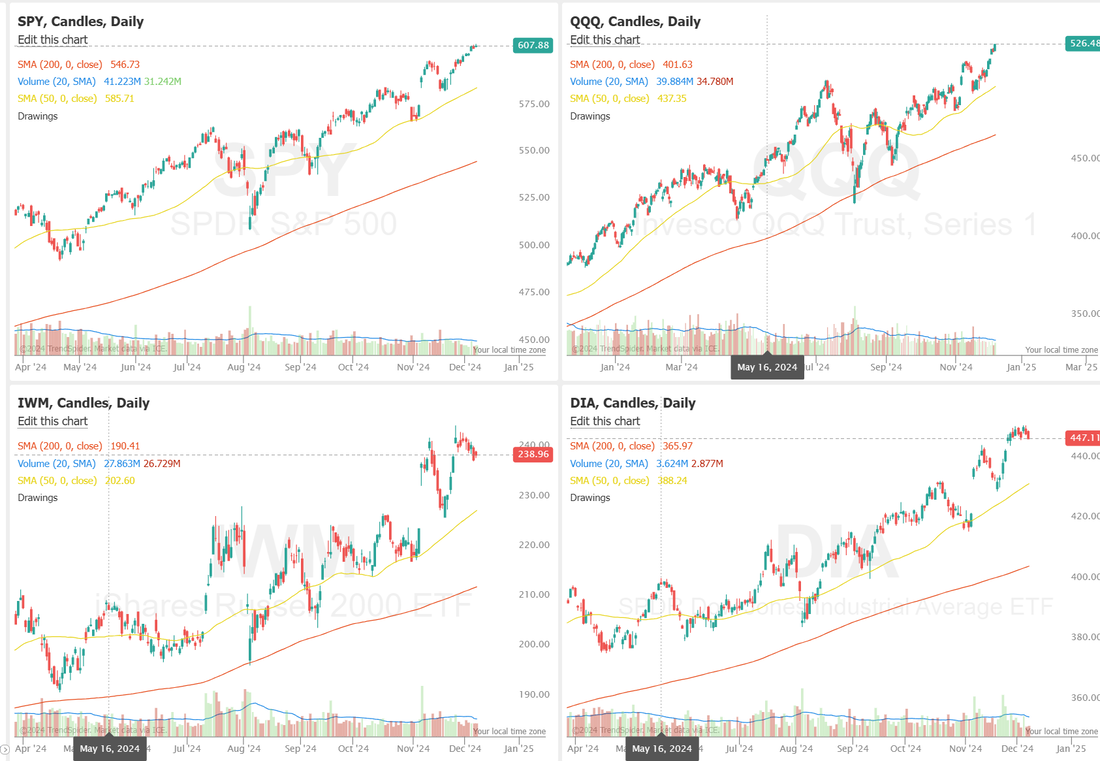

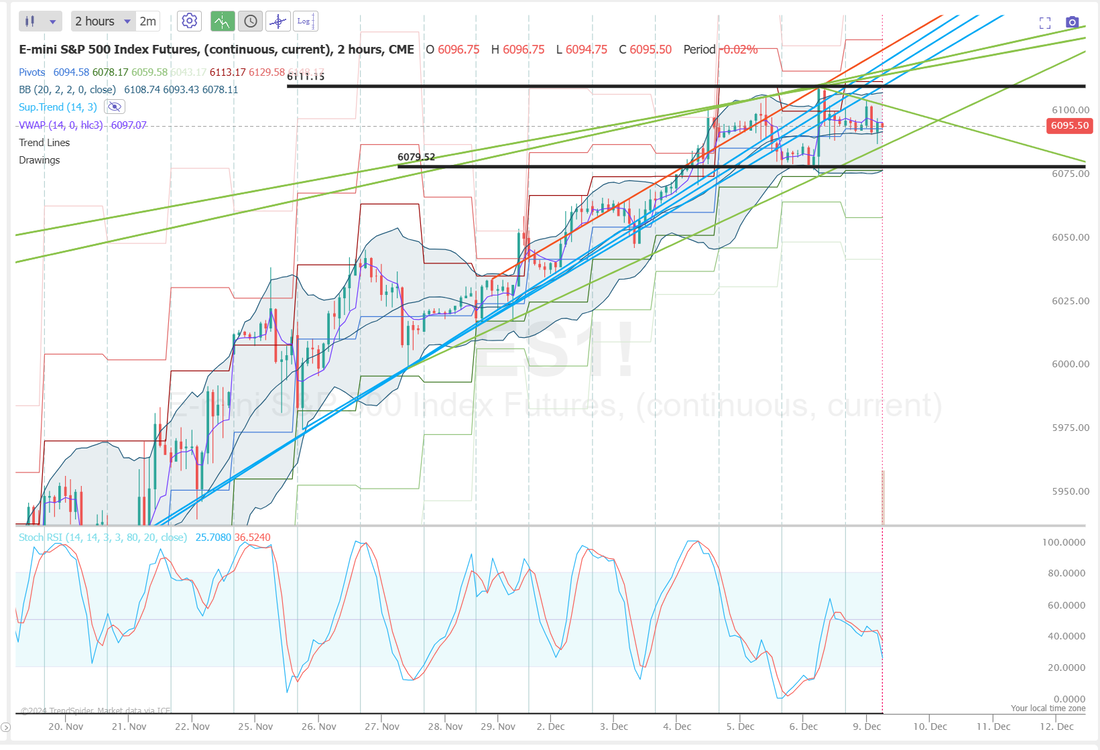

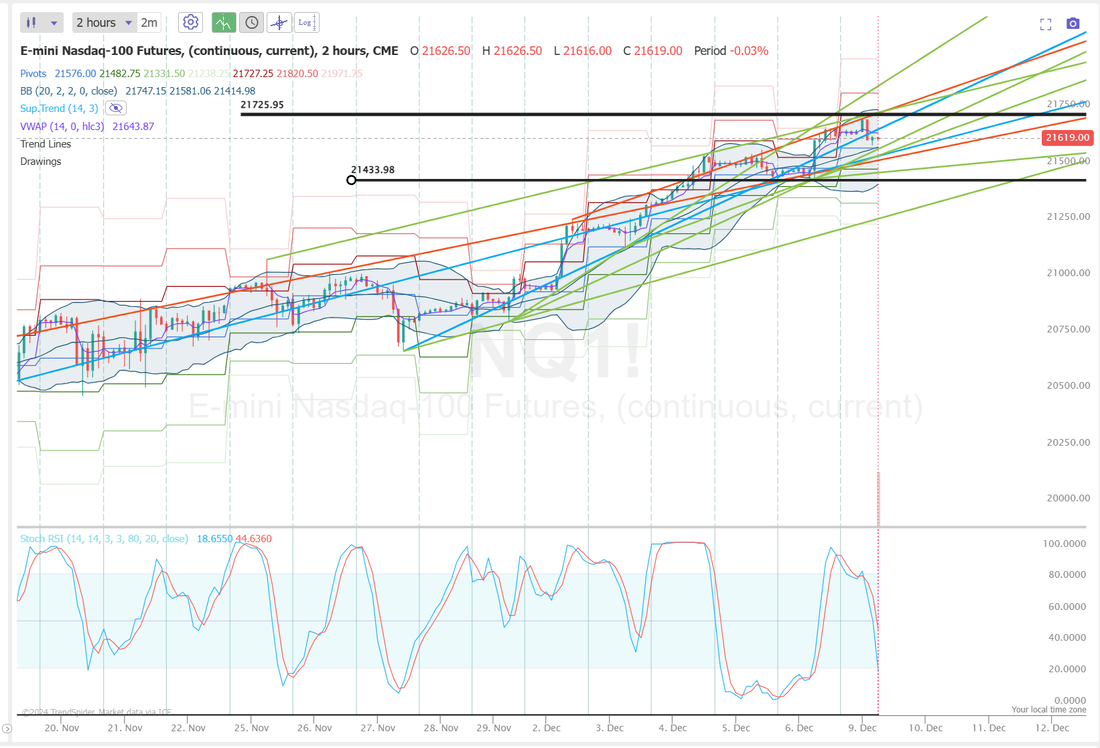

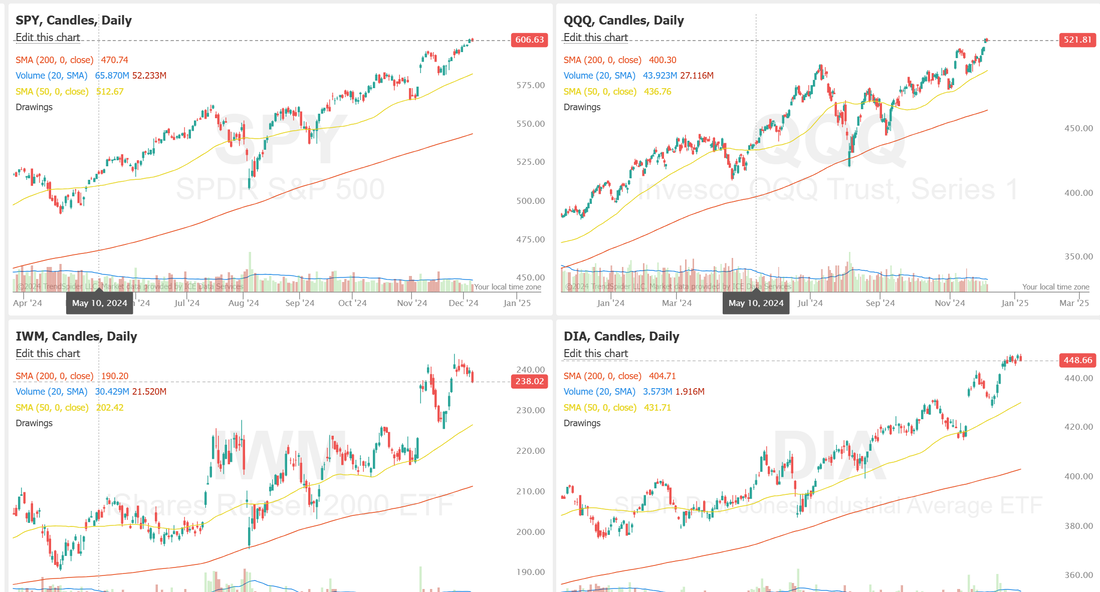

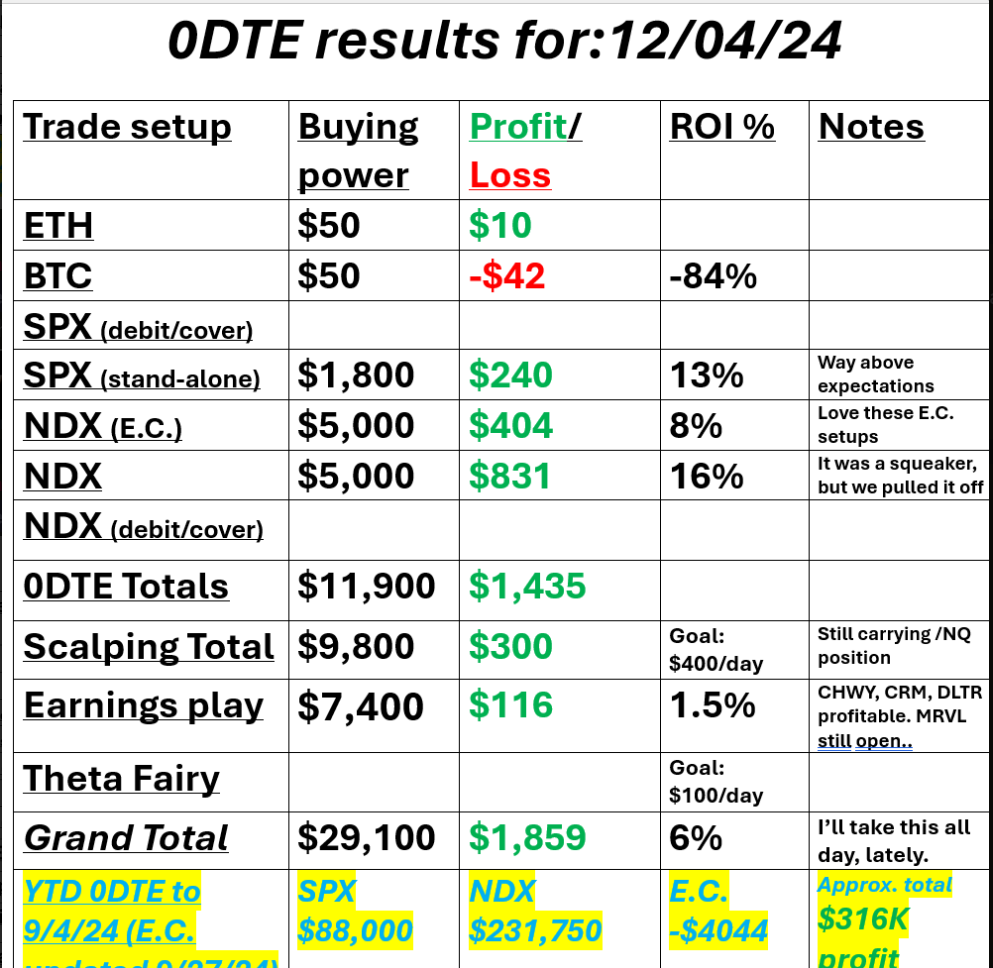

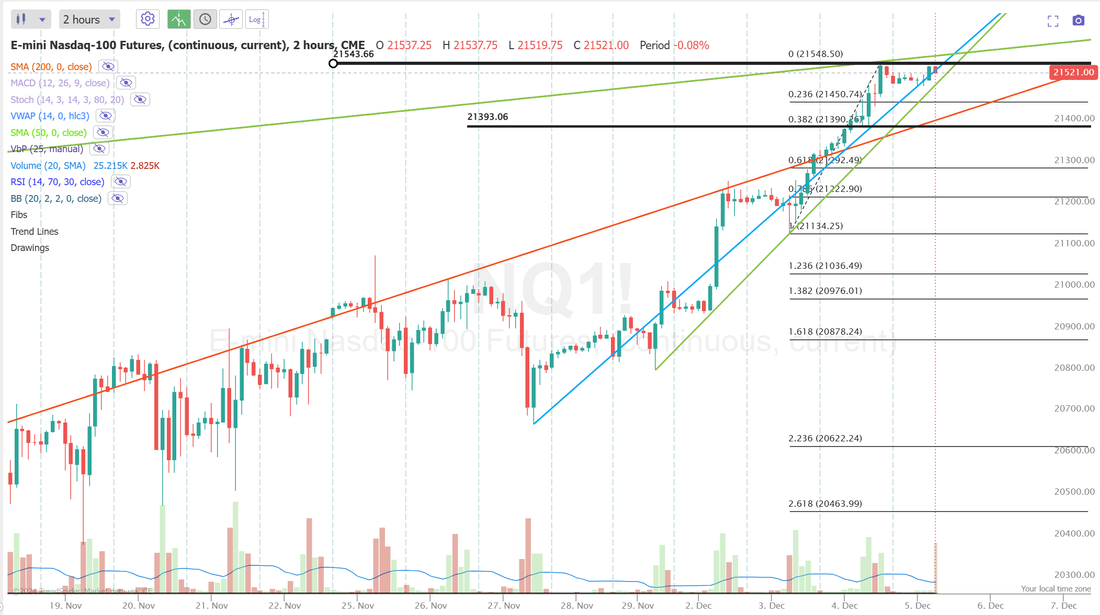

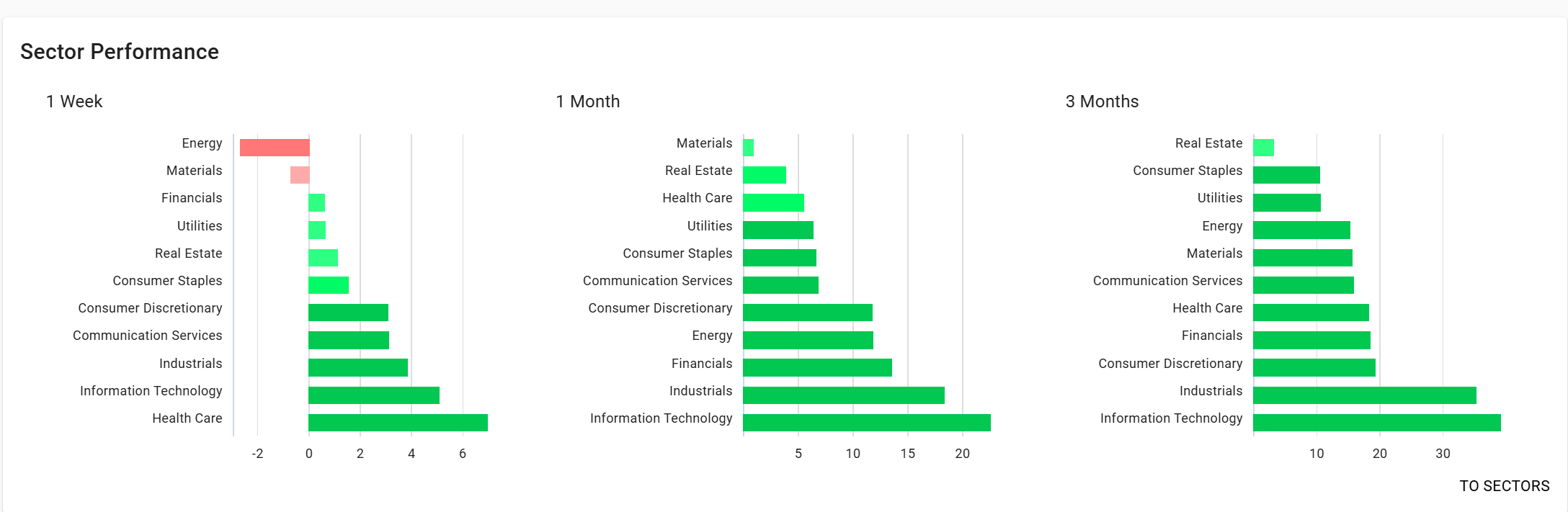

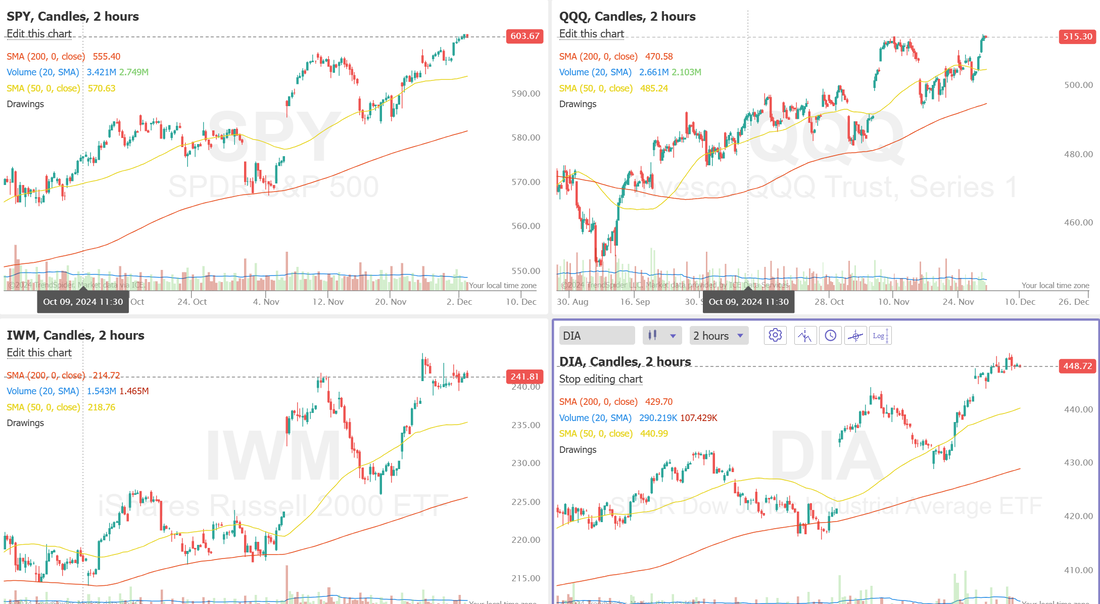

Good morning and good Friday to you all! We had a solid day yesterday. Nat gas took a little work to get back in line but when doesn't it!. See our results below: Let's take a look at the markets: Bullish bias is pretty locked in, I'd say. We are seeing a break though between the QQQ's and SPY vs. the DIA and IWM. Both the IWM and DIA are now down through there respective 50DMA. That's bearish looking to me. The $DJIA has casually dropped over 1,000 points since last week's peak and nobody's even taking about it... Trade docket for today: Should be super easy and stress-free. We've got oil (/MCL) that we'll be working and possibly a take profit on MRNA/MRK pairs trade although it will likely continue into next week and finally, our 0DTE's. The Event contract 0DTE's have been better than our standard setups lately. We'll look to get all three of those back on today as well as some butterfly setups on NDX and SPX. We may look for 0DTE opportunites on MSTR, TSLA, and SMCI as well, although the premium doesn't look good right now. We switched out our normal weekly credit strangles this week with a copper, silver and wheat trade and those don't need any attention today. Let's take a look at the intra-day levels for our 0DTEs. /ES: Exact same levels as yesterday. It's a wide "chop zone" of 50+ points. 6103 is still resistance with 6058 acting as support. Once again...I think a couple of well placed butterflies around PoC and large vol nodes might be the best setup for today. /NQ: Nasdaq has been on a tear lately. Levels today are the same as yesterday but I don't think any of us would be surprised if we broke through the resistance line. Resistance at 21909 and support at 21433. We'll work some butterflies on NDX as well today. They will likely be lower probabilities of success but much better potential payouts than SPX. BTC: Bitcoin has really been an excellent 0DTE for us lately. It also continues to channel in a "chop zone". 104717 is still resistance and 95858 is acting as support. Depending on available premium and pricing as well as, of course, price action, I may look to double my recent exposure on our BTC day trade from 10K to 20K. We'll see... My lean or bias today: Full on bullish. I could be a contrarian looking for the reversal to the downside but that may be a suckers game right now. The market just seems to want to go higher. See you all in the live trading room! Also...have a great weekend!

0 Comments

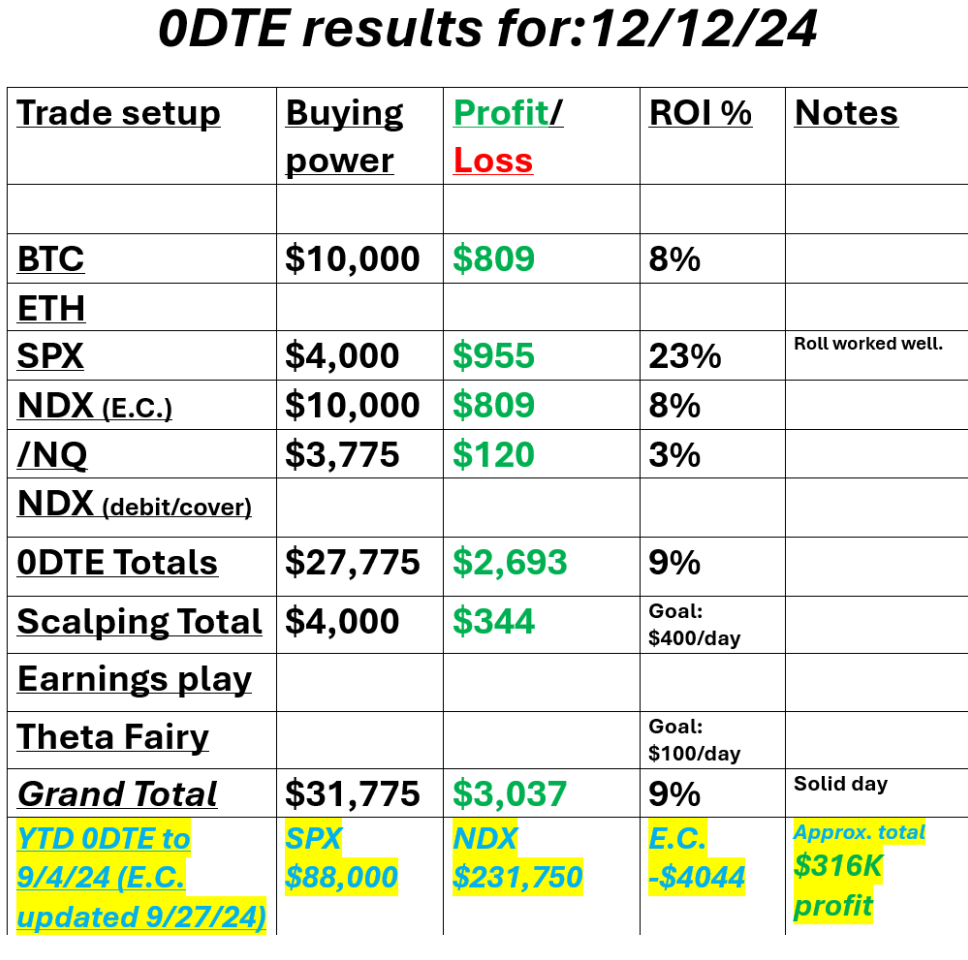

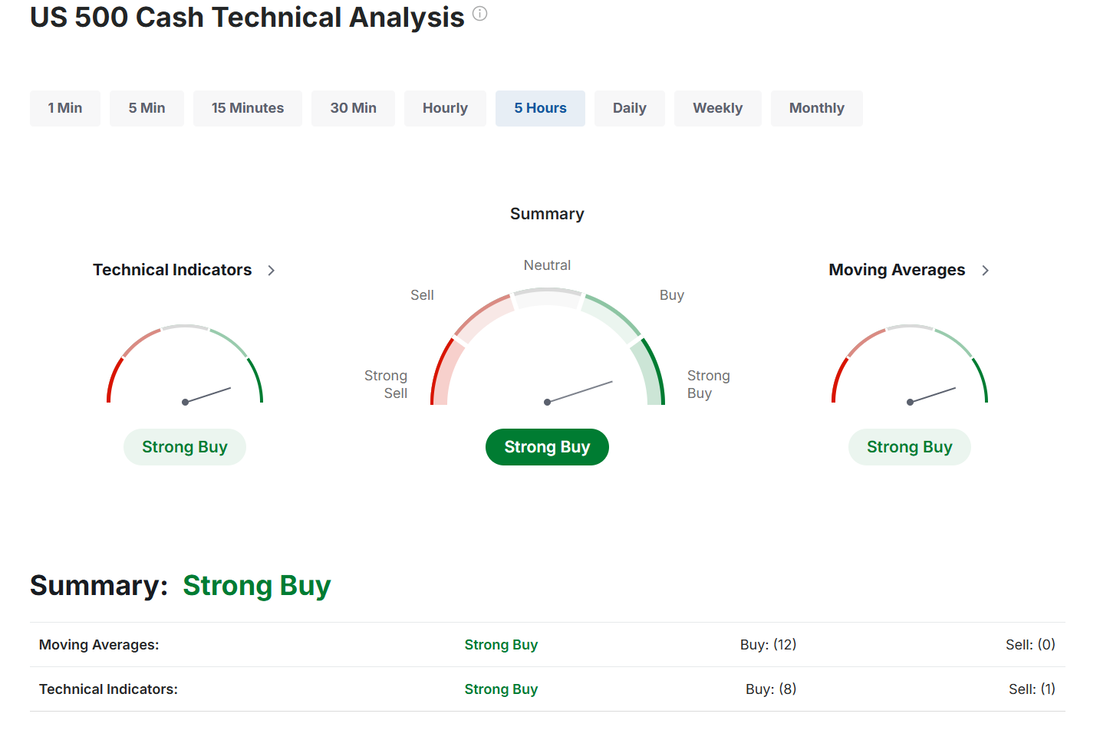

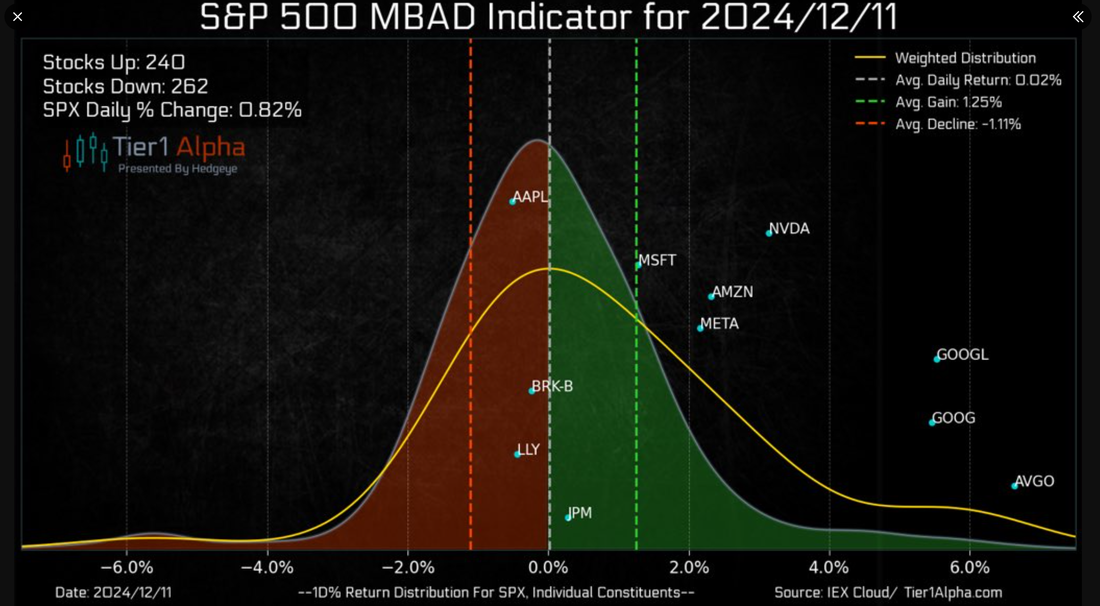

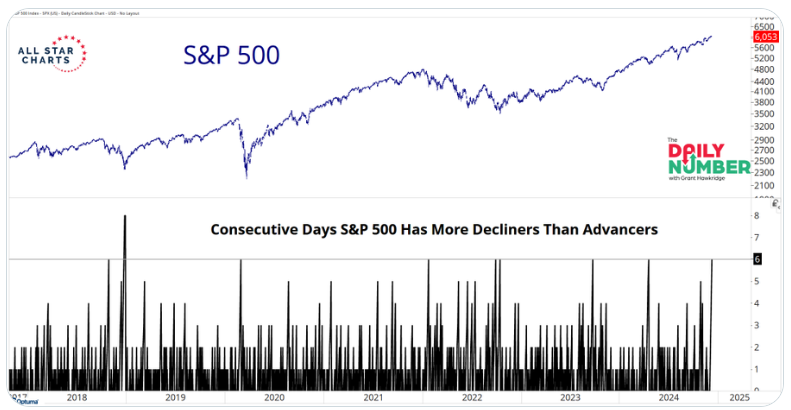

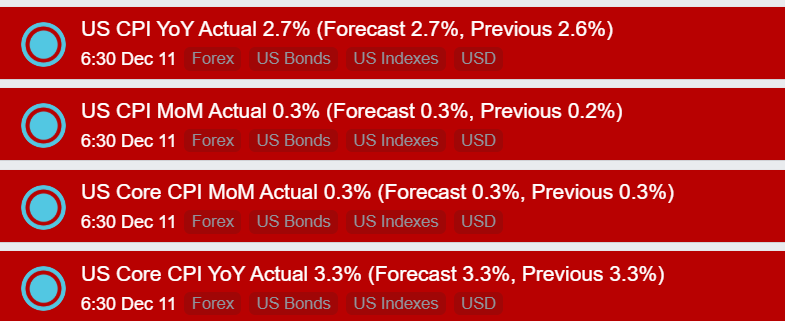

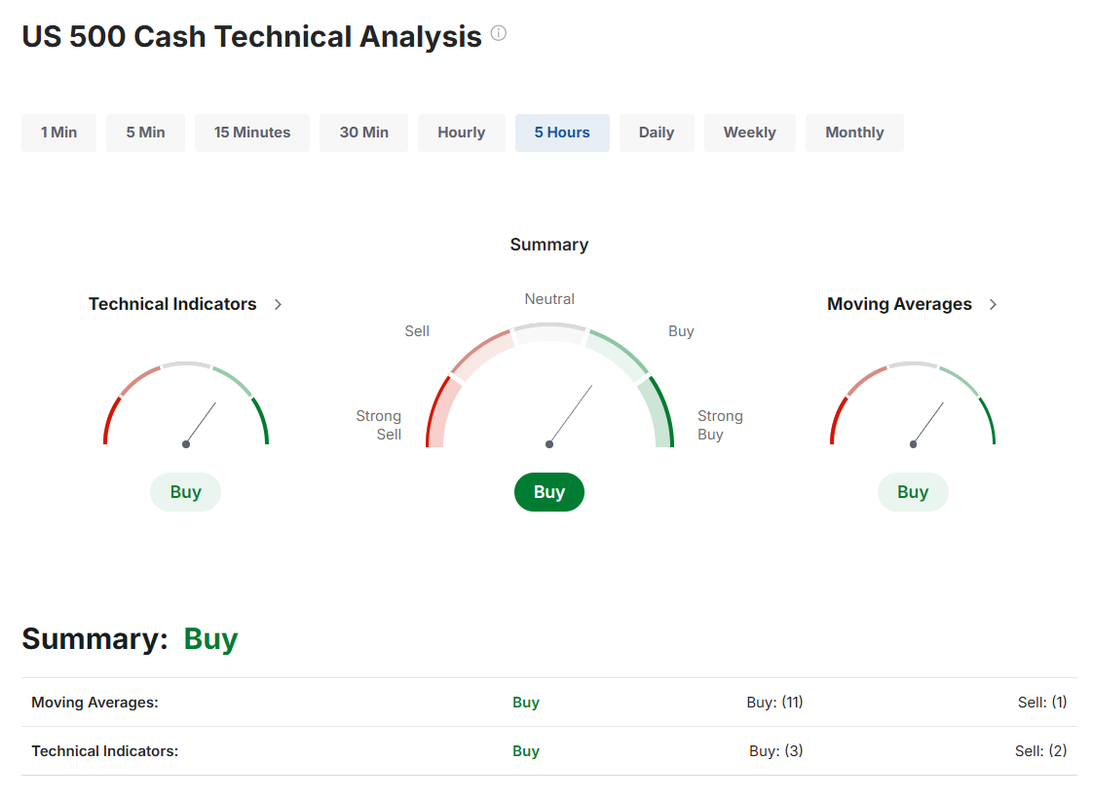

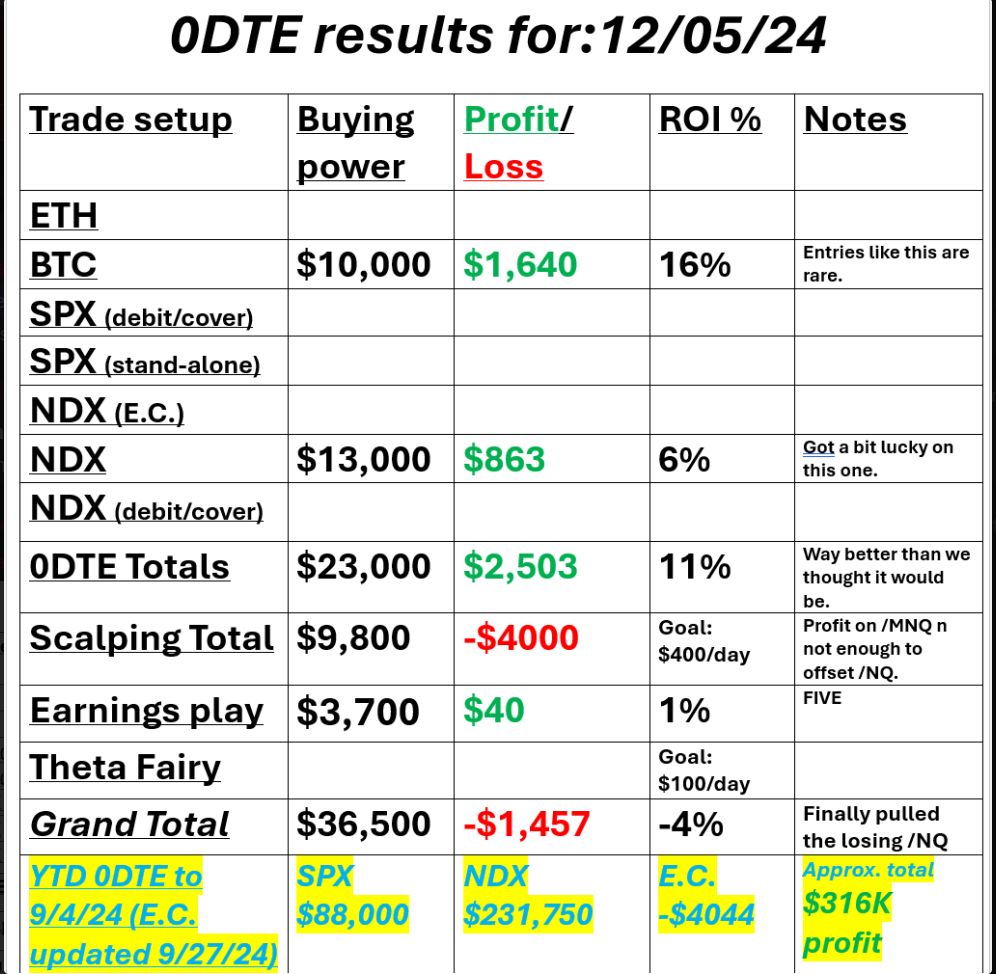

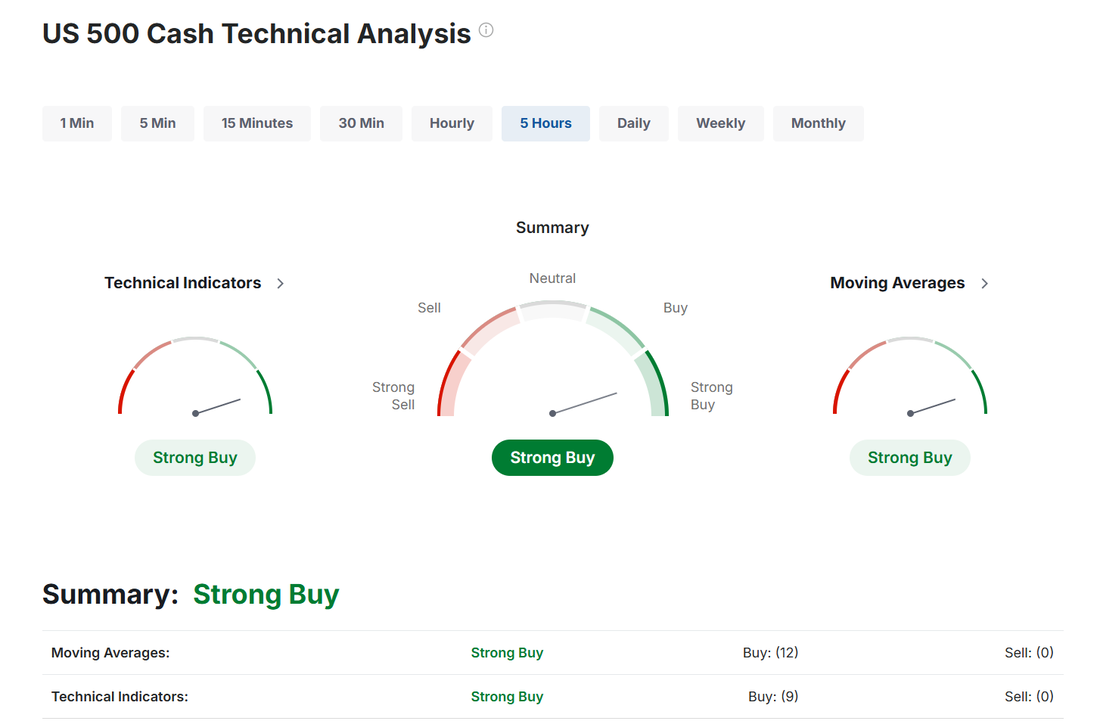

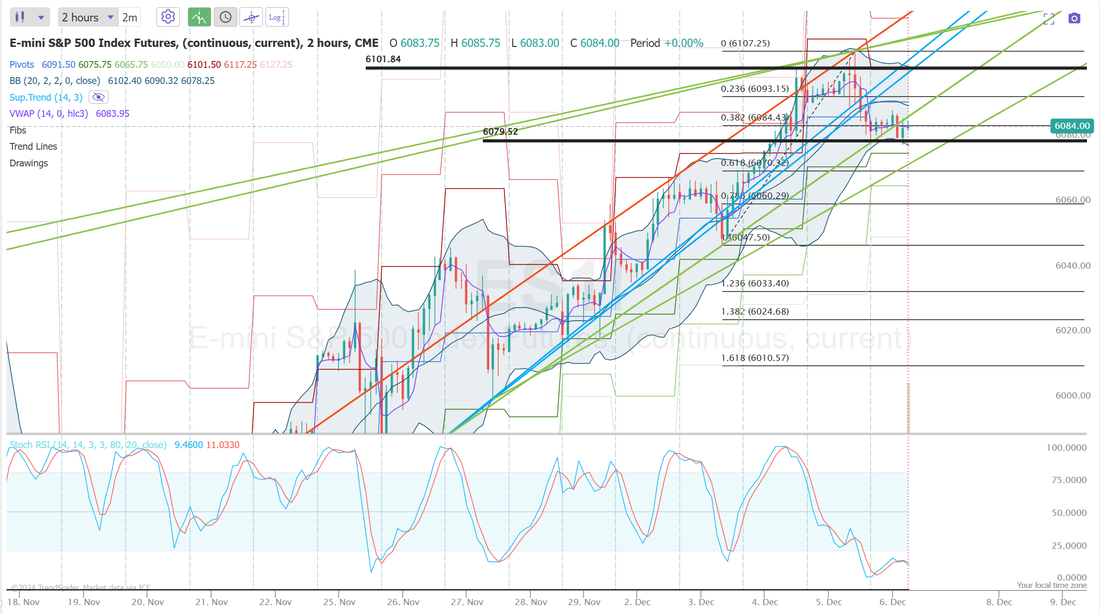

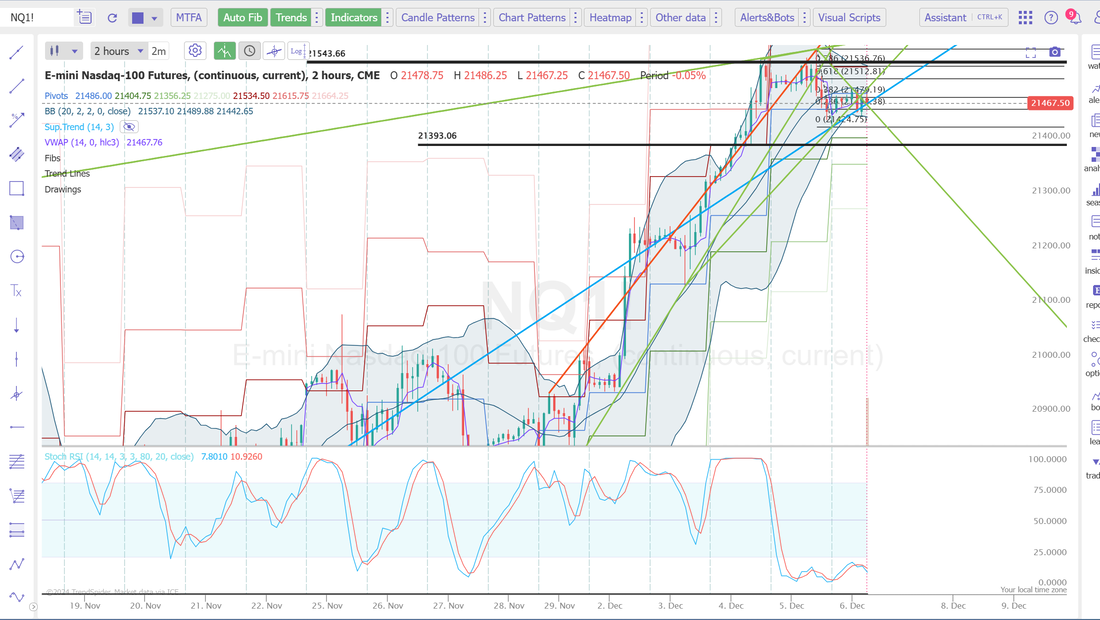

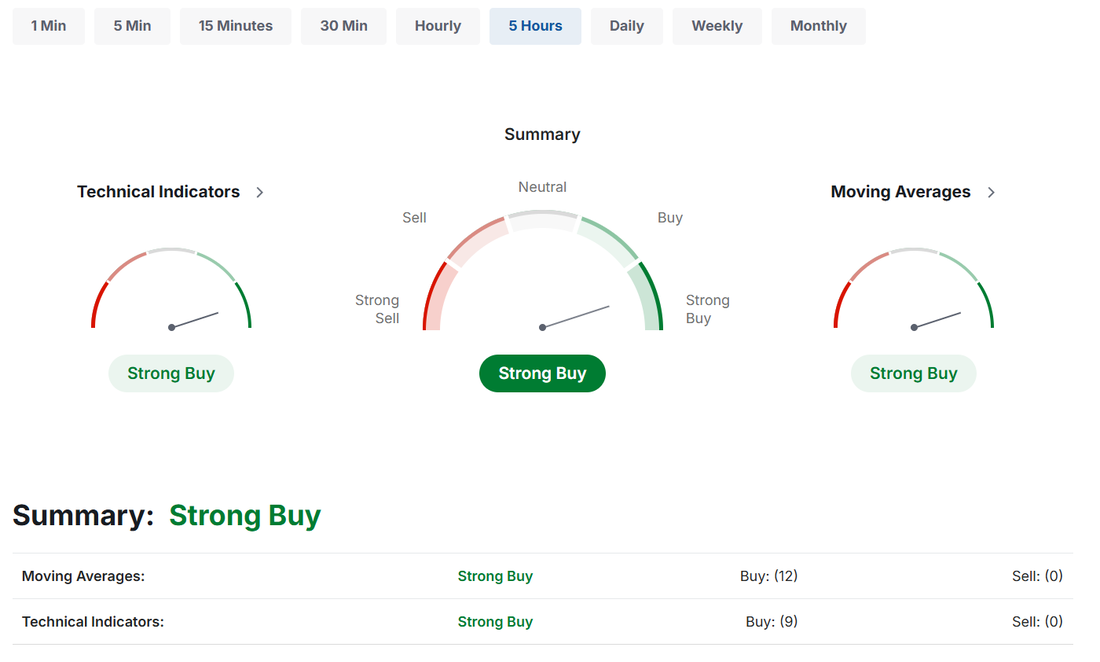

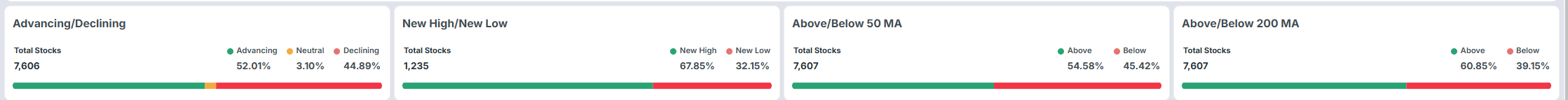

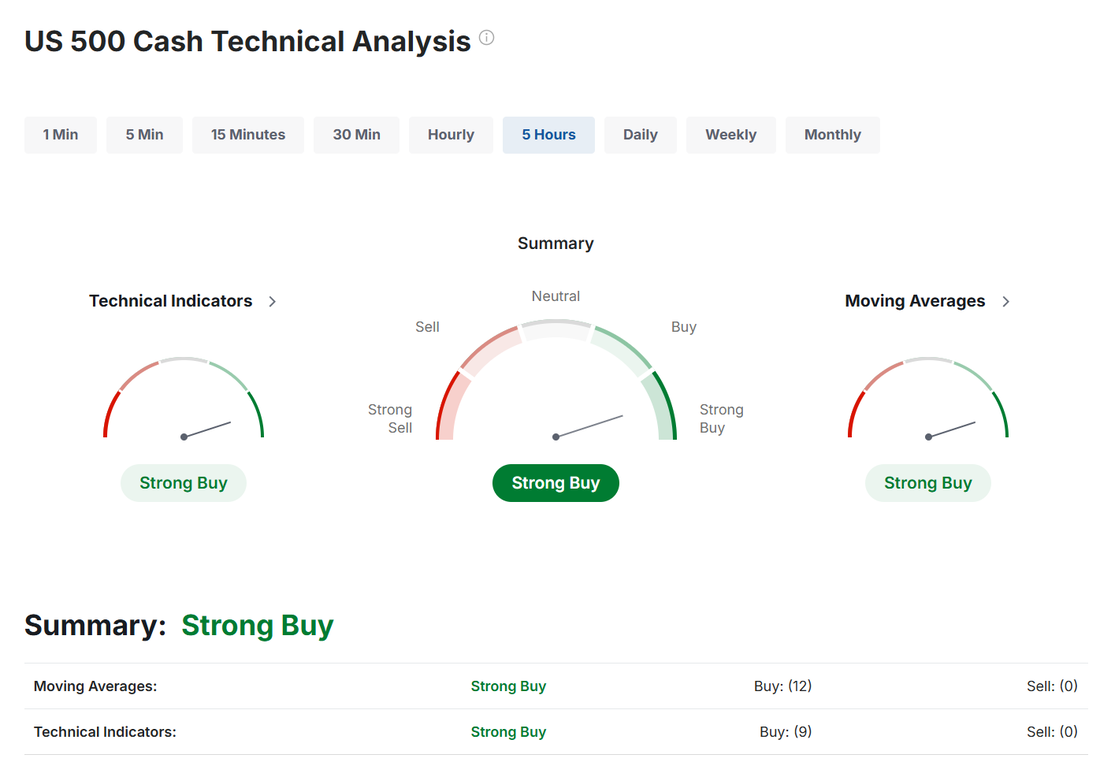

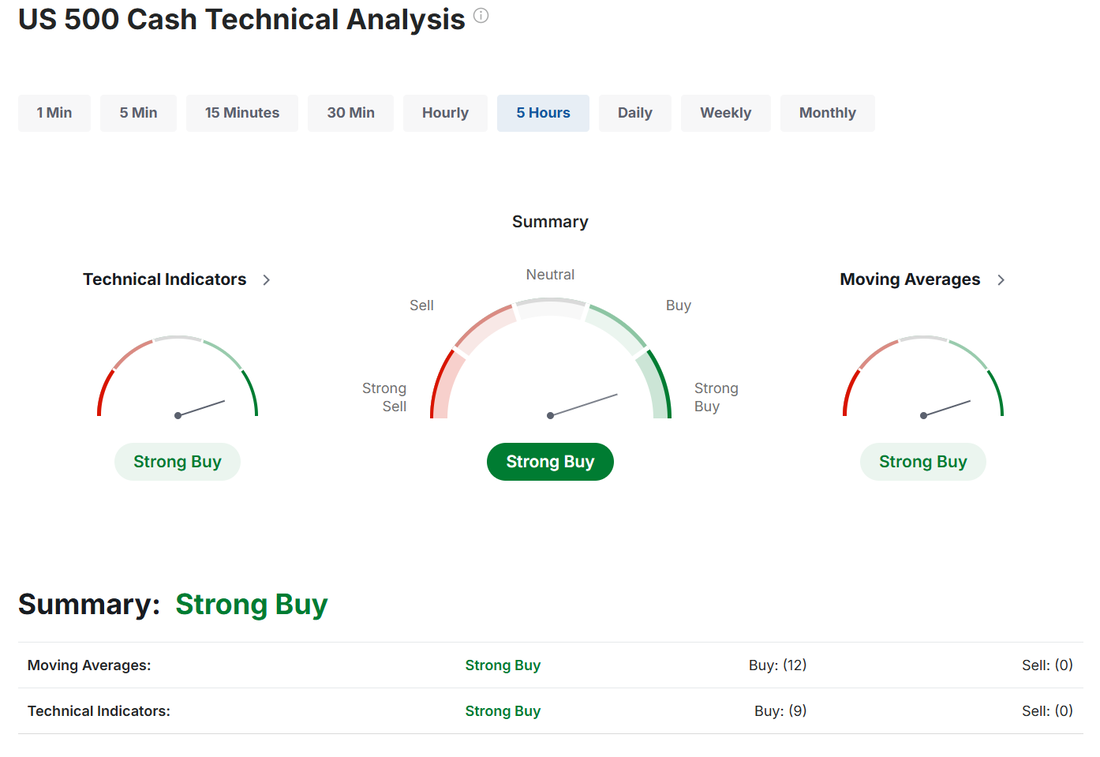

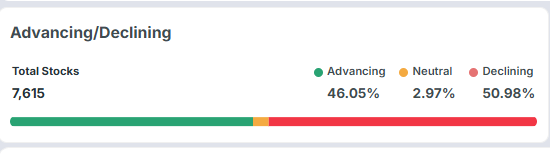

Welcome back traders! CPI came and went. Now we have PPI and Jobless claims kicking off today. I was super happy with our results yesterday. Not because it was a home run day but rather, risk management was strong. Debit trades folks...that's a better risk/reward right now. Here's our results from yesterday. Let's take a look at what's happening in the market. Yesterdays rally brought the technicals back to buy mode. Most indices were actually flat to down but the QQQ's continue to rip. Up to new ATH. December S&P 500 E-Mini futures (ESZ24) are down -0.15%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.23% this morning as Treasury yields marched higher, while investors awaited crucial U.S. producer inflation data as well as the European Central Bank’s interest rate decision. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the tech-heavy Nasdaq 100 notching a new record high. Broadcom (AVGO) climbed over +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after The Information reported that Apple was working with the chipmaker on a server chip exclusively designed for artificial intelligence. Also, megacap technology stocks advanced, with Tesla (TSLA) gaining more than +5% and Nvidia (NVDA) rising over +3%. In addition, GameStop (GME) rose more than +7% after the videogame retailer reported a surprise Q3 profit. On the bearish side, Walgreens Boots Alliance (WBA) slid over -5% after analysts cast doubt on the likelihood of Sycamore Partners acquiring the drugstore chain. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices increased +0.3% m/m in November, in line with expectations. On an annual basis, headline inflation picked up to +2.7% in November from +2.6% in October, in line with expectations. Also, the November core CPI, which excludes volatile food and fuel prices, remained unchanged from October at +3.3% y/y, right on expectations. “The debate for the FOMC next week between cut or skip is over. This inflation print should be risk asset friendly and provide a tailwind to equity markets as we move through one of the strongest seasonal periods of the year,” said Jeff Schulze at ClearBridge Investments. Meanwhile, U.S. rate futures have priced in a 98.6% chance of a 25 basis point rate cut at the upcoming monetary policy meeting. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. November PPI will come in at +0.2% m/m and +2.6% y/y, compared to the previous figures of +0.2% m/m and +2.4% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect November figures to be +0.2% m/m and +3.2% y/y, compared to October’s numbers of +0.3% m/m and +3.1% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure to arrive at 221K, compared to last week’s number of 224K. On the earnings front, notable companies like Broadcom (AVGO), Costco (COST), and Ciena (CIEN) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.300%, up +0.66%. Short trade docket today. Most of our model portfolio is good to hold, as is. /ZW and 0DTE;s on the agenda today. Even with an "up" day, more stocks are declining than gaining. Let's take a look at our intra-day levels for our 0DTE setups: /ES; Yesterdays levels guide us into todays setup. 6104 is resistance with 6058 acting as suppport. /NQ: 21,912 is resistance with 21,430 acting as support. BTC: 104,719 is resistance with 96,071 acting as support. PPI numbers are out. Hotter than expected. My bias or lean today is bearish. With a hot PPI and the QQQ's hitting a new ATH yesterday while there were more decliners than advancers makes me think we pull back today. See you all in the trading room soon. We have two 0DTE's already going that should cash flow for us today.

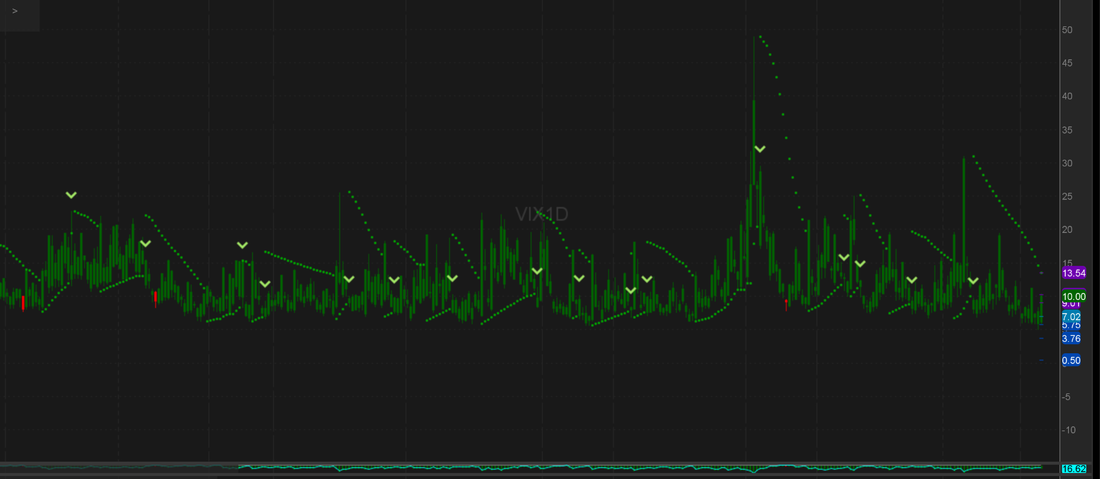

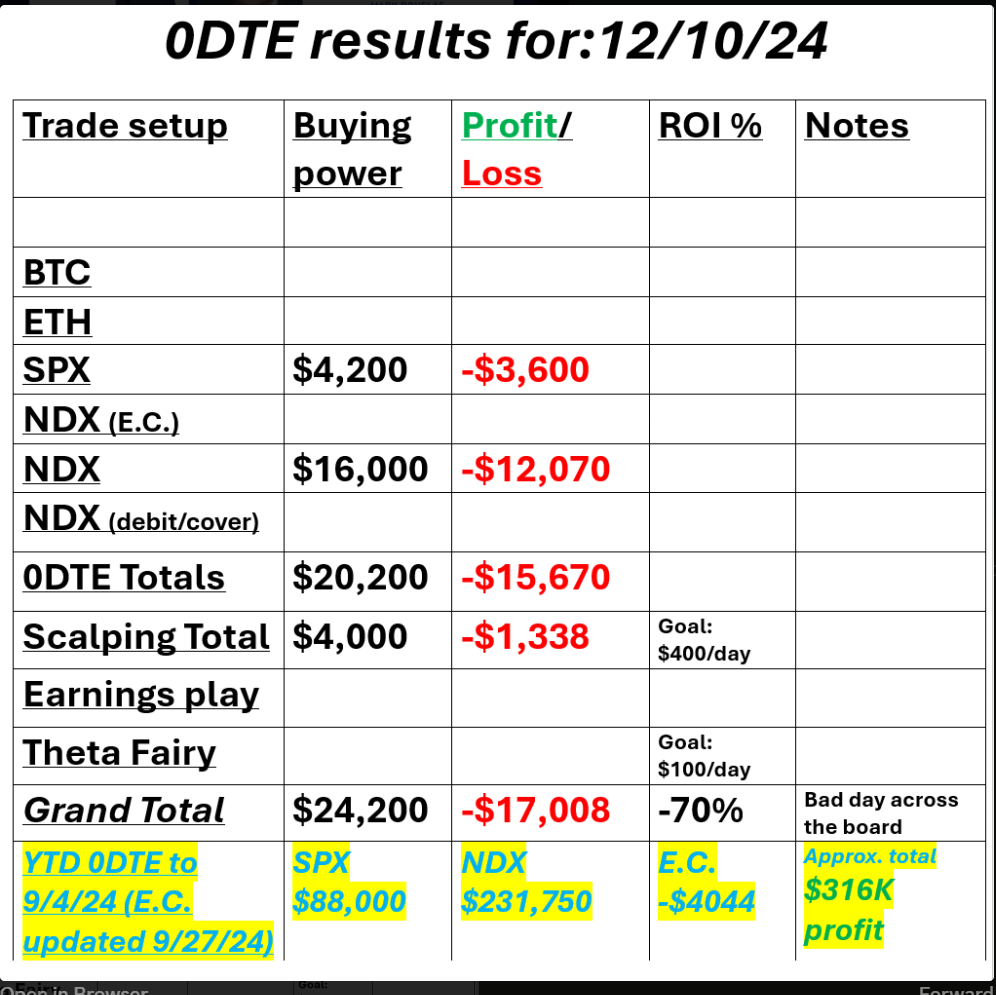

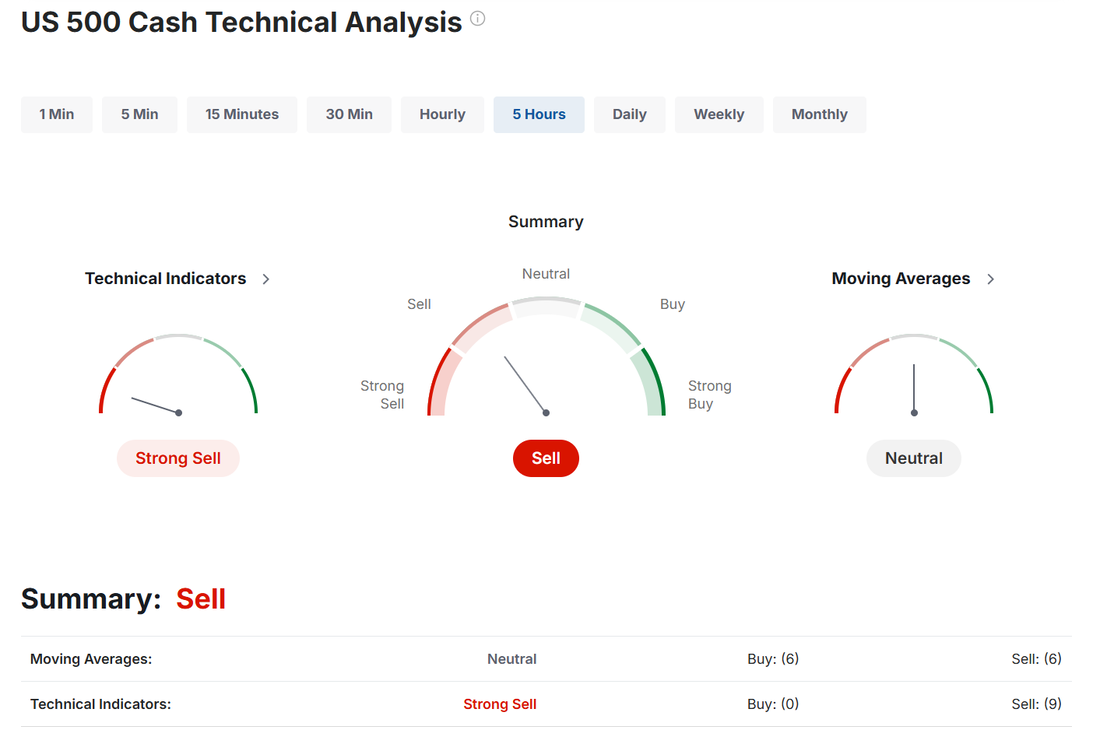

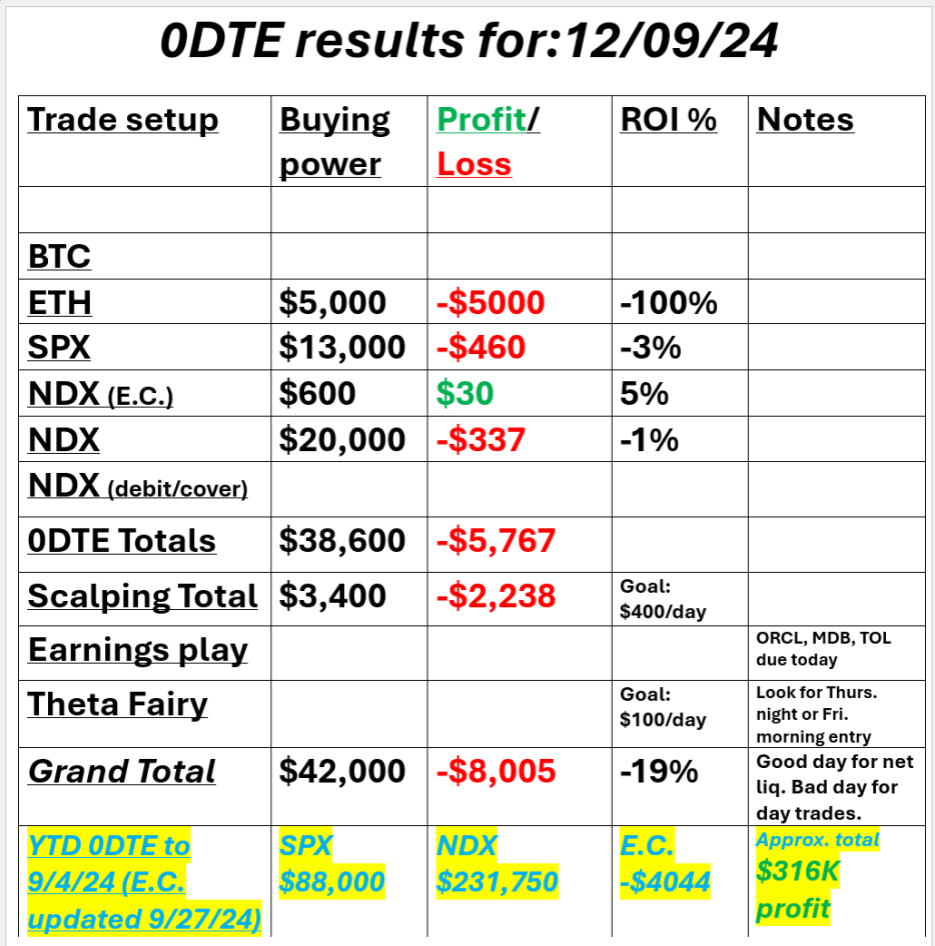

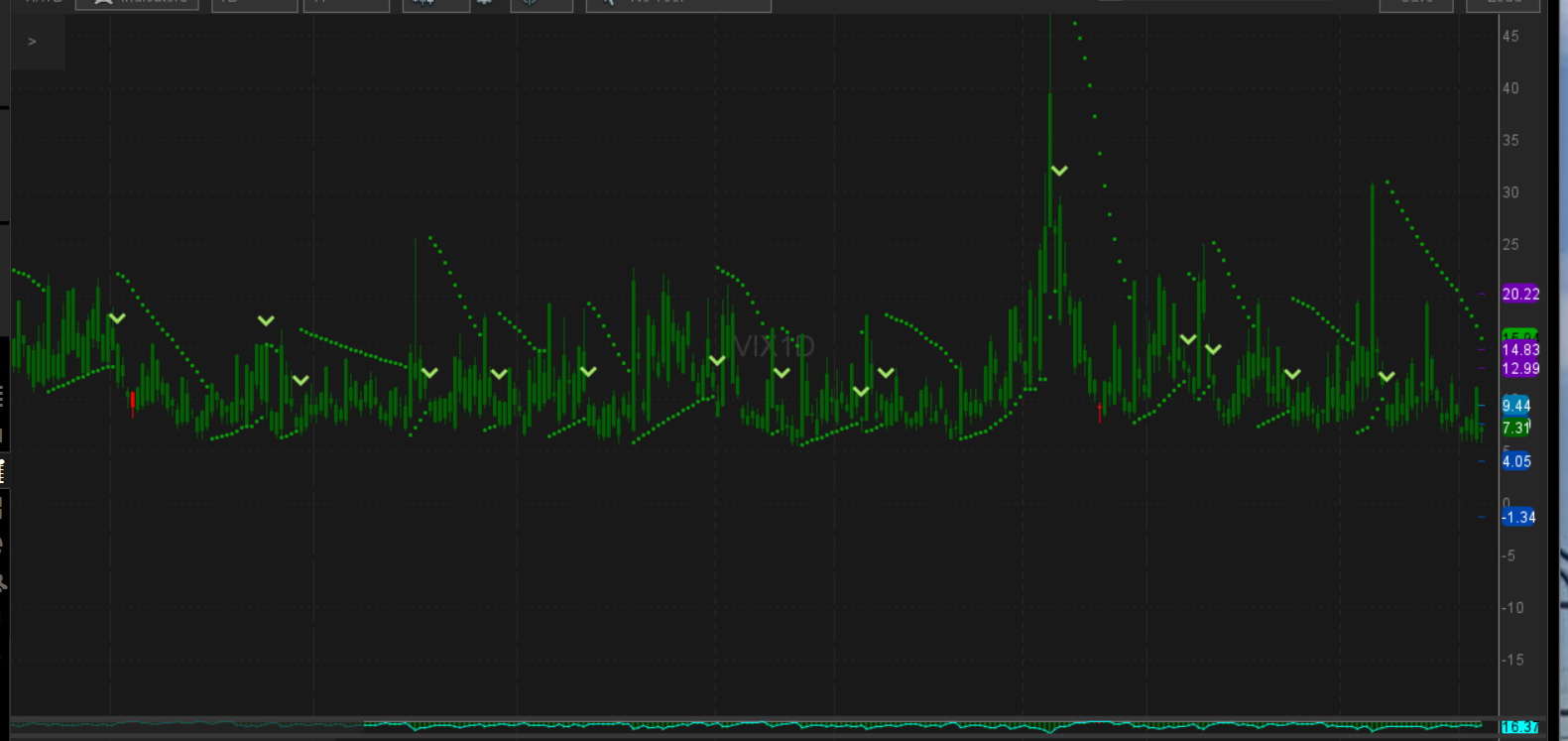

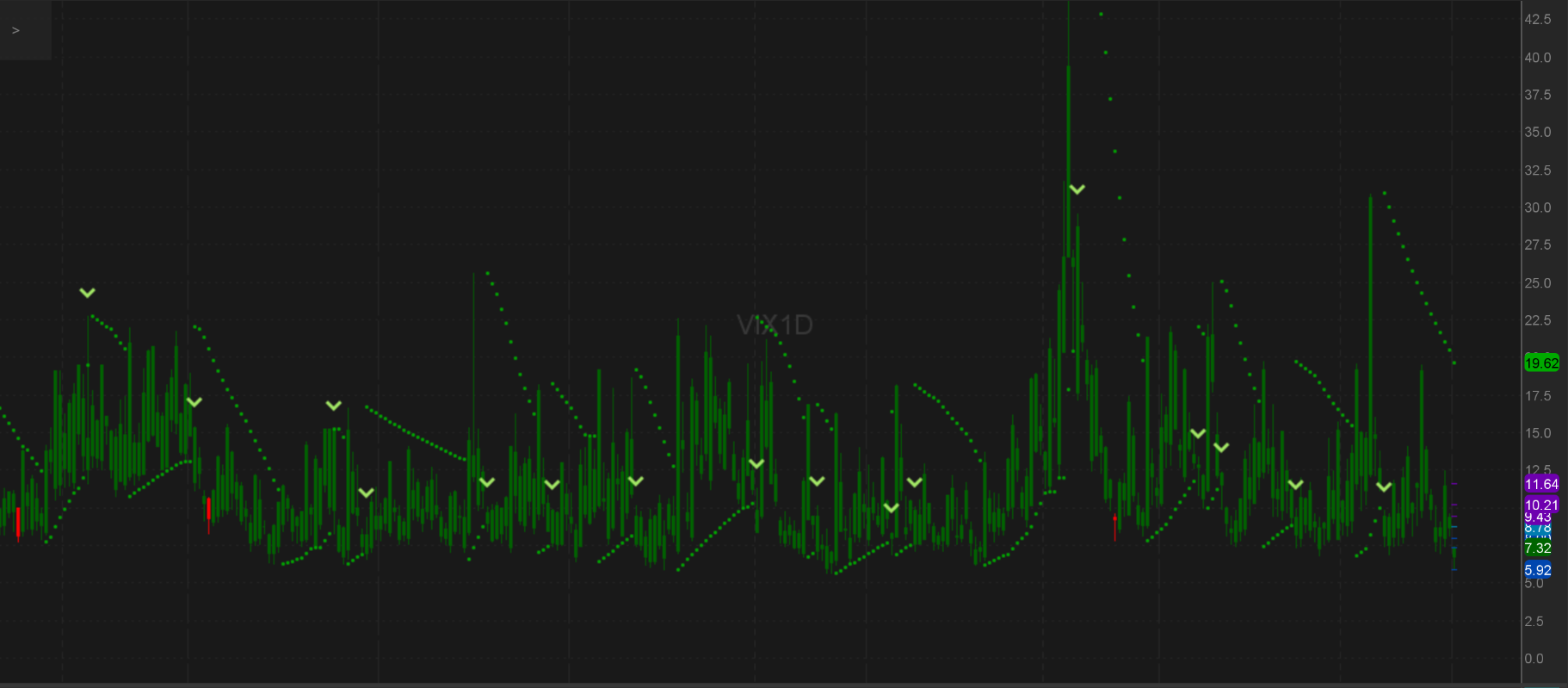

Welcome to CPI day traders! That's our main economic news driver for today. We'll see if the "buy the dip" apprears today. I was wrong yesterday. I thought we'd trend higher. Instead is was lower for most of the day. I got shellaced yesterday! Everything day trading wise lost money. What happened? Two things, I think. #1. We really need to be out of our postions prior to the power hour. Sometimes it's hard but it's but it's a real neccesity now with such low I.V. the Gamma effect is bigger. #2. If the VIX1D is below 14 we need to stick to debit anchor positions. We can work credit trades around it but the debit needs to carry the weight of the trades success/failure. Debit trades as anchor positions will lower our win % but they will get our risk/reward back in line. Were is the VIX1D now? Below 10. You can check out my miserable results from yesterday below: Let's take a look at the markets. Markets are flashing a mild sell signal. I don't buy too much into it unles the selling continues today. The rolling over continues. It's not super strong but were working on a few days now of retrace. I'm mostly focused on IWM and DIA which are both back to key consolidation zones. They are also close to their respective 50DMA. A further drop below could open up the selling. December S&P 500 E-Mini futures (ESZ24) are trending up +0.10% this morning as investors awaited the all-important U.S. inflation report for clues on whether the Federal Reserve will lower or hold interest rates next week. In yesterday’s trading session, Wall Street’s main stock indexes closed in the red. MongoDB (MDB) tumbled over -16% and was the top percentage loser on the Nasdaq 100 after the company announced that its Chief Operating Officer and Chief Financial Officer, Michael Gordon, would step down on January 31st. Also, Moderna (MRNA) slumped more than -9% and was the top percentage loser on the S&P 500 after BofA reinstated coverage of the stock with an Underperform rating. In addition, Oracle (ORCL) slid over -6% after the IT giant reported weaker-than-expected FQ2 results. On the bullish side, Walgreens Boots Alliance (WBA) soared more than +17% and was the top percentage gainer on the S&P 500 after the Wall Street Journal reported that the drugstore chain was in talks to sell itself to private equity firm Sycamore Partners. Also, Alphabet (GOOGL) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after the tech titan discussed breakthroughs made through the use of its new Willow quantum computing chip. Economic data released on Tuesday showed that U.S. Q3 nonfarm productivity was unrevised at +2.2% q/q, while Q3 unit labor costs were revised lower to +0.8% q/q from +1.9% q/q, a smaller increase than expectations of +1.3% q/q. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. November CPI will come in at +0.3% m/m and +2.7% y/y, compared to the previous numbers of +0.2% m/m and +2.6% y/y. The U.S. Core CPI will also be closely watched today. Economists anticipate the core CPI to be +0.3% m/m and +3.3% y/y in November, matching October’s figures. A survey conducted by 22V Research showed that 37% of investors expect the market response to the consumer inflation report to be “risk-off.” Also, investors are evenly split between those predicting a “risk-on” reaction and those expecting it to be “mixed/negligible.” “A softer print can clear the path for a year-end rally, with the second half of December being the second strongest period of the year. On the contrary, a firmer print can revamp volatility,” a team led by Ohsung Kwon said. U.S. rate futures have priced in an 86.1% chance of a 25 basis point rate cut and a 13.9% chance of no rate change at the December FOMC meeting. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ4 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.245%, up +0.52%. CPI should be the big driver today. Our trade docket is light today. /ZW, IWM, CAVA, FDX, MRNA, 0DTE's. One thing I"m thinking about today: We have now experienced 6 consecutive days with more S&P 500 stocks declining than advancing. When we dig into the data, the top 10 stocks by market cap have an average return of 4.9% since last Monday, while the rest of the S&P 500 has an average return of -1.8%. Is this large-cap leadership going to be the theme for 2025? CPI data release: My bias or lean today: I'm back to bullish. I was wrong yesterday but I think CPI pushes us higher today. Let's take a look at the intra-day levels for our 0DTE's today: /ES looks to recapture the support level from yesterday. CPI data release is helping. 6097 is resistance with yesterdays support of 6058 still in play. Below 6058 is 6036. /NQ is much the same story. Yesterdays support/resistance is the same. Resistance at 21,704 with Support at 21,436 and a secondary support below that at 21,330. BTC: We didn't get a Bitcoin trade on yesterday. It's a little tougher when its consolidating vs. trending. We'll try again today. 100,808 continues to be resistance with support coming in around 94,639. Look for debit trade "anchor" positions for our 0DTE's until the VIX can get some juice back in it. That may not happen for a very long time unless we get a substantial retrace. See you all in the trading room shortly.

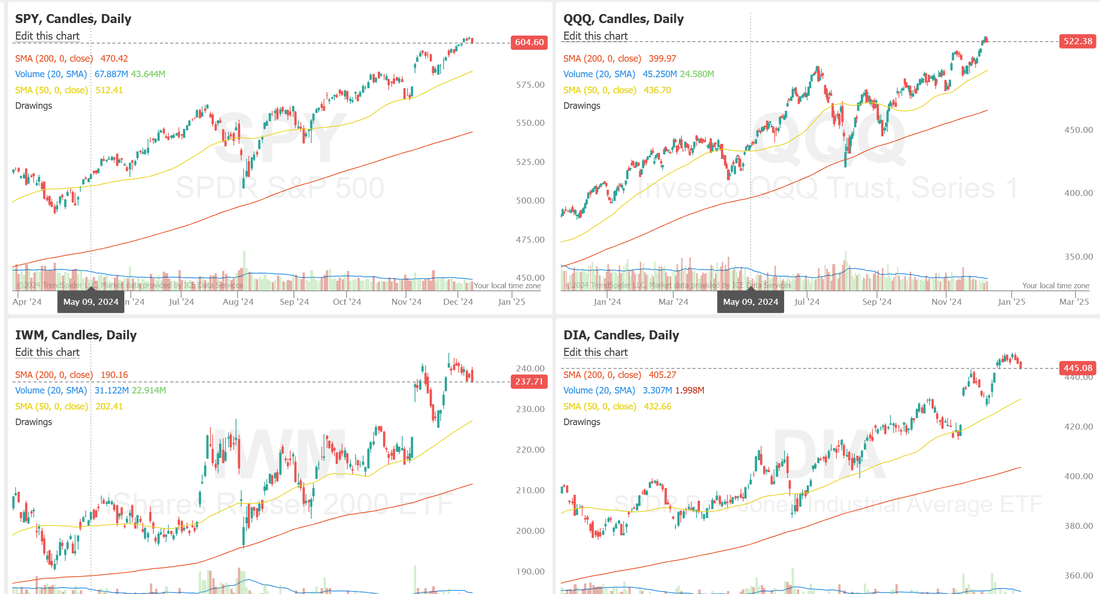

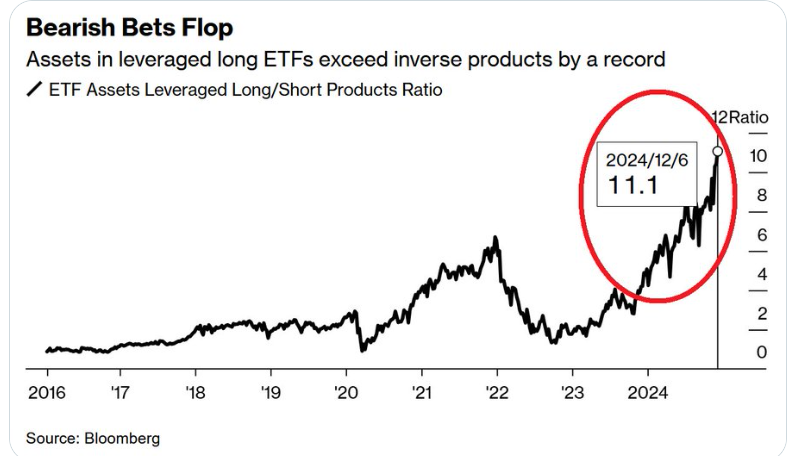

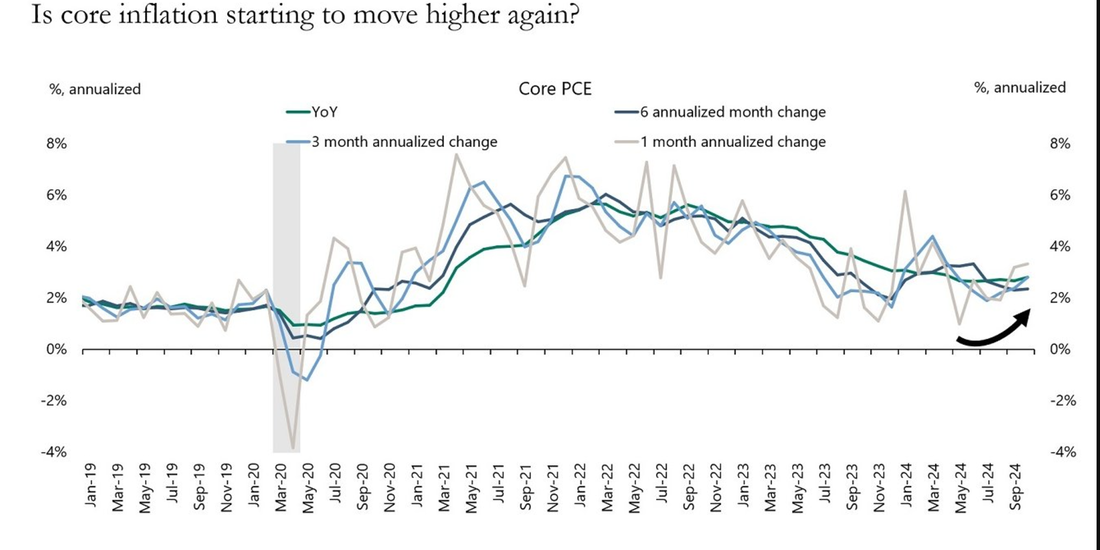

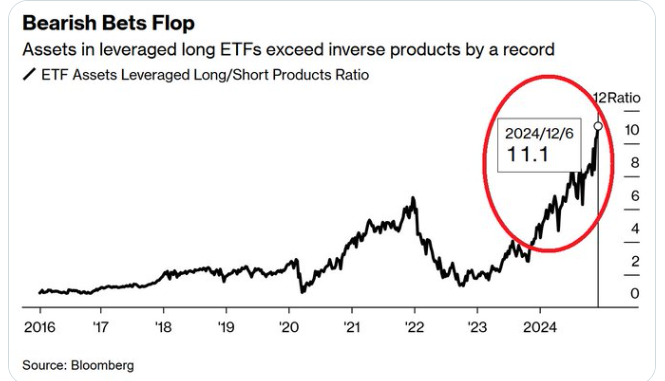

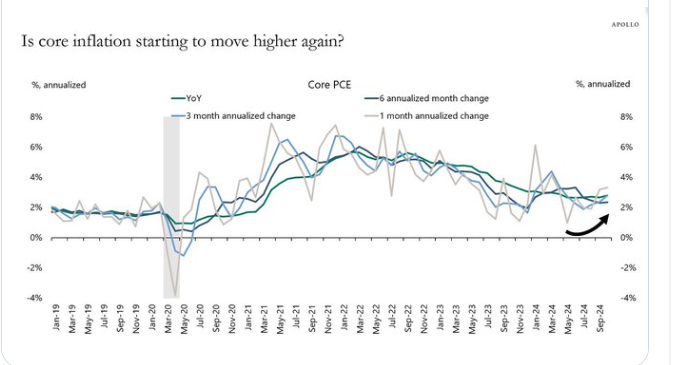

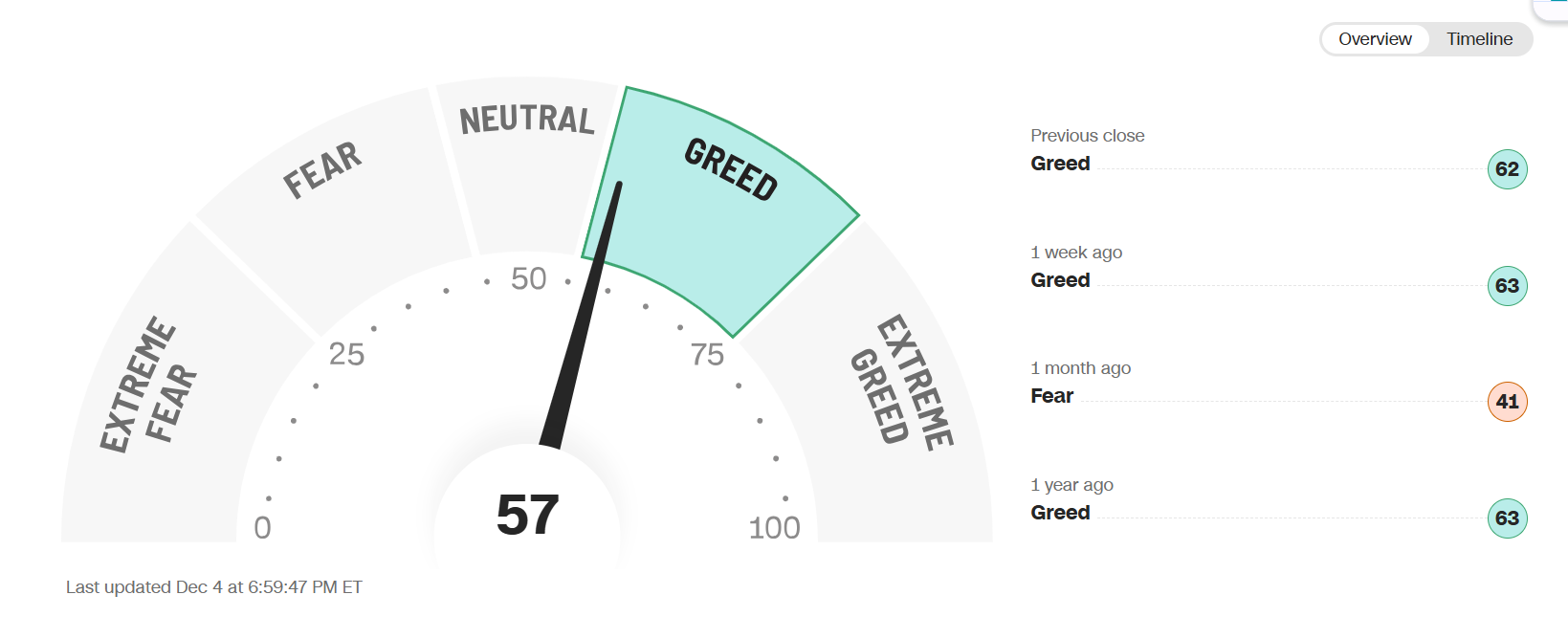

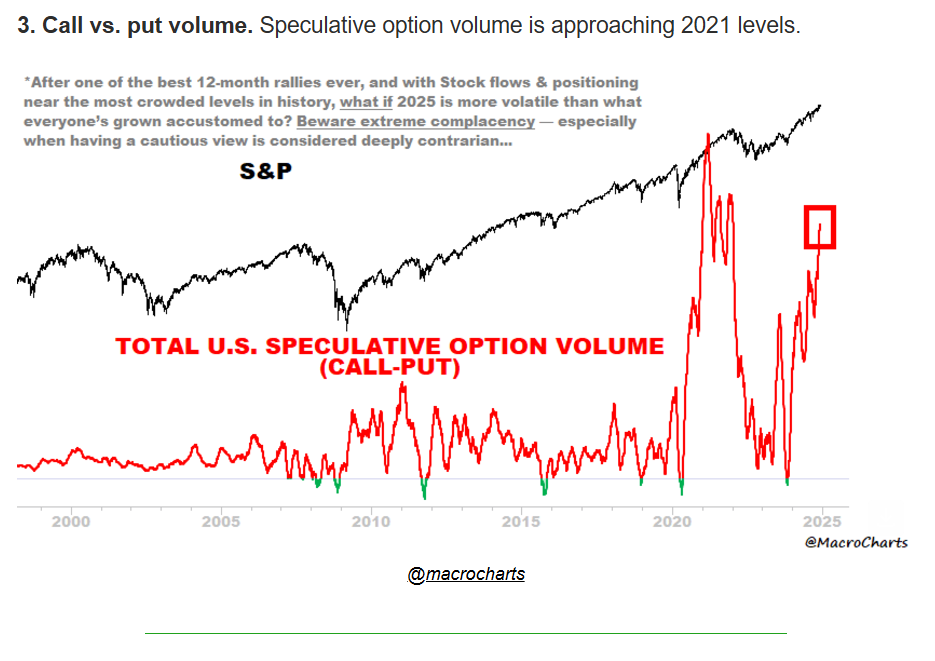

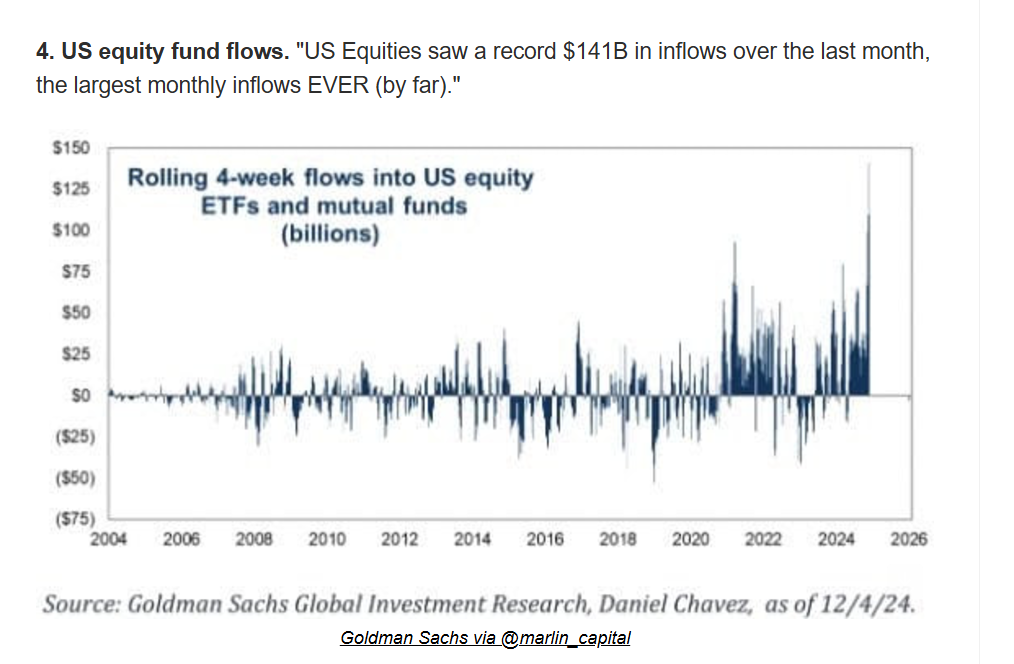

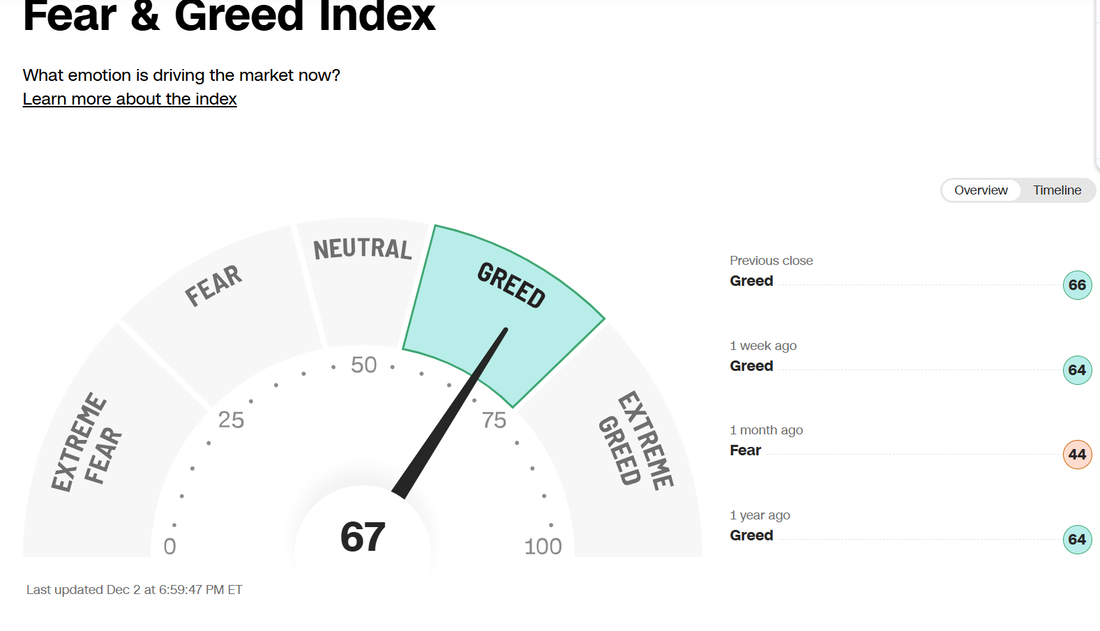

Welcome back traders! We had a very mixed day yesterday. Our net liq. (or account value) was up nicely on the day but virtually every day trade lost money. DOCU, NatGas, IWM, LRN, MRNA, PLTR, UAL all worked together to rescue the day. Let's see if we can get BOTH day trades and the model porfolio to work together today. Here's our results from yesterday. Yesterday brought the first real selloff we've seen in about a month! The question today is, does it get bought up or is it the trigger we've been waiting for to usher in a downside move? I favor the "buy the dip" as that's what's happend on EVERY single sell like this over the majority of this year. Technicals swung to a neutral to start the day. We are absolutely seeing a retrace or, in a best case scenario, a pause in the major indicies but...we are also back to key support levels in the weakest of the two. The IWM and the DIA. Today could be key. Will they hold or not? My bias or lean today is that A) the "buy the dip" that has happened some much this year after sell days continues and B) the critical support levels that we are back to on IWM and DIA hold. This puts me as slightly bullish today. December S&P 500 E-Mini futures (ESZ24) are up +0.03%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.04% this morning after three major U.S. benchmark indices finished the regular session lower as investors grew more cautious ahead of Wednesday’s release of a key U.S. inflation report. In yesterday’s trading session, the benchmark S&P 500 and tech-heavy Nasdaq 100 retreated from record highs, while the blue-chip Dow dropped to a 1-1/2 week low. Omnicom Group (OMC) plunged over -10% and was the top percentage loser on the S&P 500 after agreeing to acquire Interpublic Group in a deal valued at $13.3 billion, excluding debt. Also, Comcast (CMCSA) slid more than -9% after the head of its cable business said the company expects a Q4 broadband subscriber loss of just over 100,000. In addition, Nvidia (NVDA) fell over -2% after China Central Television reported that the State Administration for Market Regulation had launched an investigation into the chipmaker over alleged violations of anti-monopoly laws. On the bullish side, Hershey (HSY) climbed more than +10% and was the top percentage gainer on the S&P 500 after Bloomberg reported that Mondelez International was exploring an acquisition of the chocolate maker. Economic data released on Monday showed that U.S. wholesale inventories rose +0.2% m/m in October, in line with expectations. Meanwhile, market participants are awaiting the U.S. consumer inflation report for November, due on Wednesday, that will help shape the outlook for Federal Reserve monetary policy. The CPI is expected to pick up slightly to +2.7% y/y from +2.6% y/y in October, while the core CPI is projected to remain unchanged from October at +3.3% y/y. “This Wednesday’s inflation data may hold the key to the Fed’s next move,” said Jay Woods at Freedom Capital Markets. “So far results have been in line with economists’ expectations and haven’t scared the market. However, an upward surprise should raise eyebrows at the Fed and could put another rate cut on pause.” U.S. rate futures have priced in an 86.1% chance of a 25 basis point rate cut and a 13.9% chance of no rate change at December’s policy meeting. Today, investors will focus on U.S. Unit Labor Costs and Nonfarm Productivity data, set to be released in a couple of hours. Economists forecast final Q3 Unit Labor Costs to be +1.3% q/q and Nonfarm Productivity to be +2.3% q/q, compared to the second-quarter numbers of +0.4% q/q and +2.5% q/q, respectively. Investors will also keep an eye on earnings reports from several notable companies today, including AutoZone (AZO), Ferguson (FERG), and GameStop (GME). In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.217%, up +0.41%. Here's a couple items I'm thinking about today: The ratio of assets in leveraged long ETFs to short ETFs hit 11.1x, the most on RECORD. The difference has TRIPLED this year and is nearly 2 TIMES larger than at the 2021 market frenzy top. Greed has rarely been greater. Core inflation actually seems to be rising! Could this put the FED in a position to actually need to raise rates next year? ORCL, MDB, TOL, GME, PLAY, AZO?, /HG, /MCL, /SI, DOCU, MRNA, PLTR, UAL, 0DTE's. Let's look at our intra-day levels for 0DTE's. /ES: Two key areas of focus for me today. 6098 is resistance with 6058 acting as support. Below 6058 there is a LOT of downside potential. /NQ: 21,701 is a clear resistance with 21,423 working as support. We had some pretty decent selling volume yesterday and that support level was tested several times and held. If we lose that today it could usher in more selling. That support level of 21,423 is my main focus today. BTC: Crypto, specifically ETH is what hurt my results the most yesterday. We are now into a new trading range on Bitcoin with 100,696 working as resistnace and 94,585 as support. We were incredibly fortunate that our account net liq was up yesterday with the poor results of the day trades. The model portfolio looks like it's set to do its part, once again today so let's see if we can do our part on the day trades.

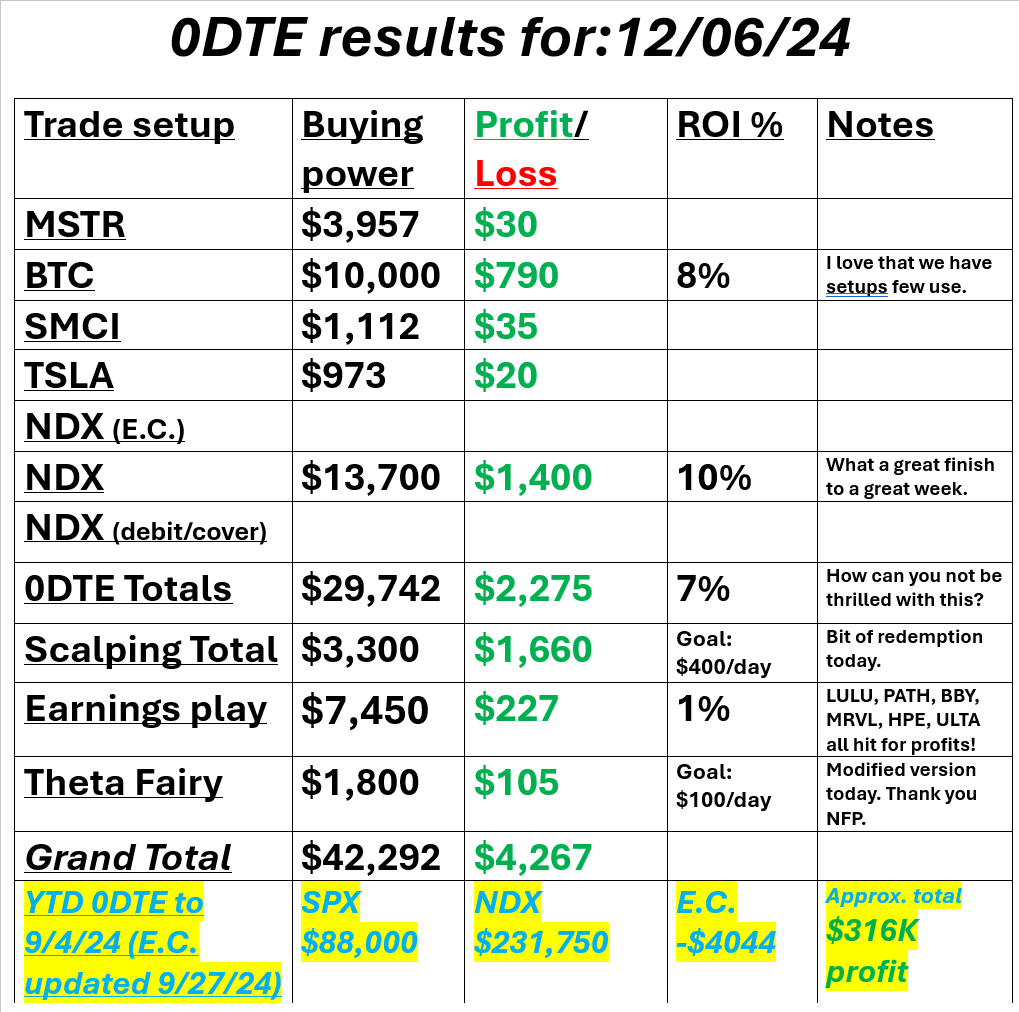

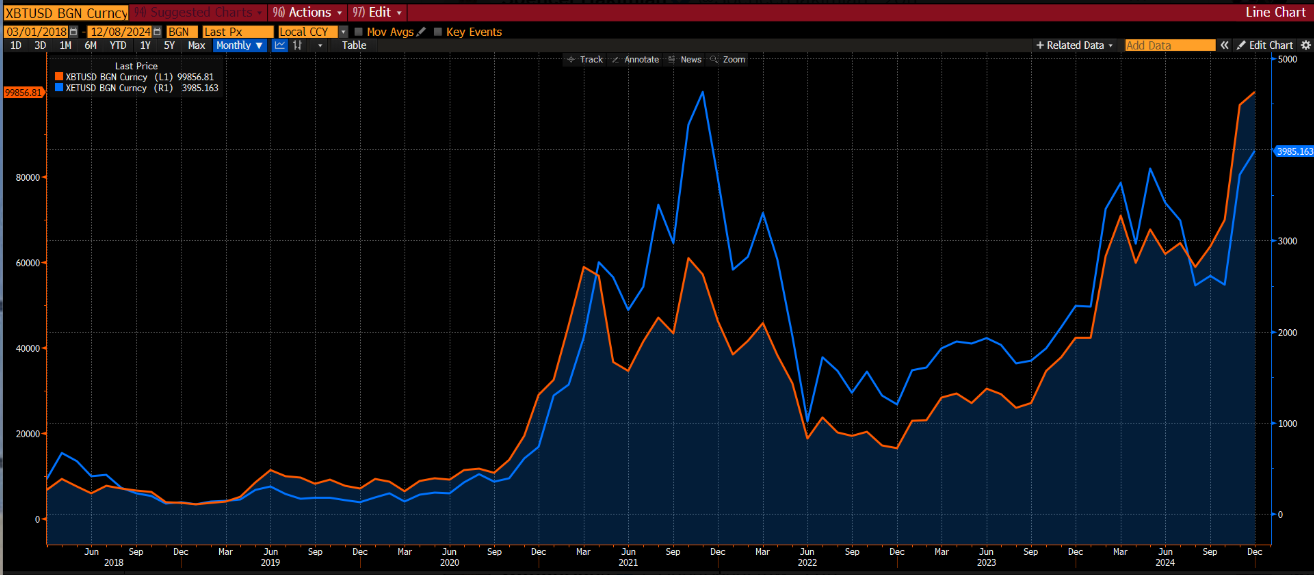

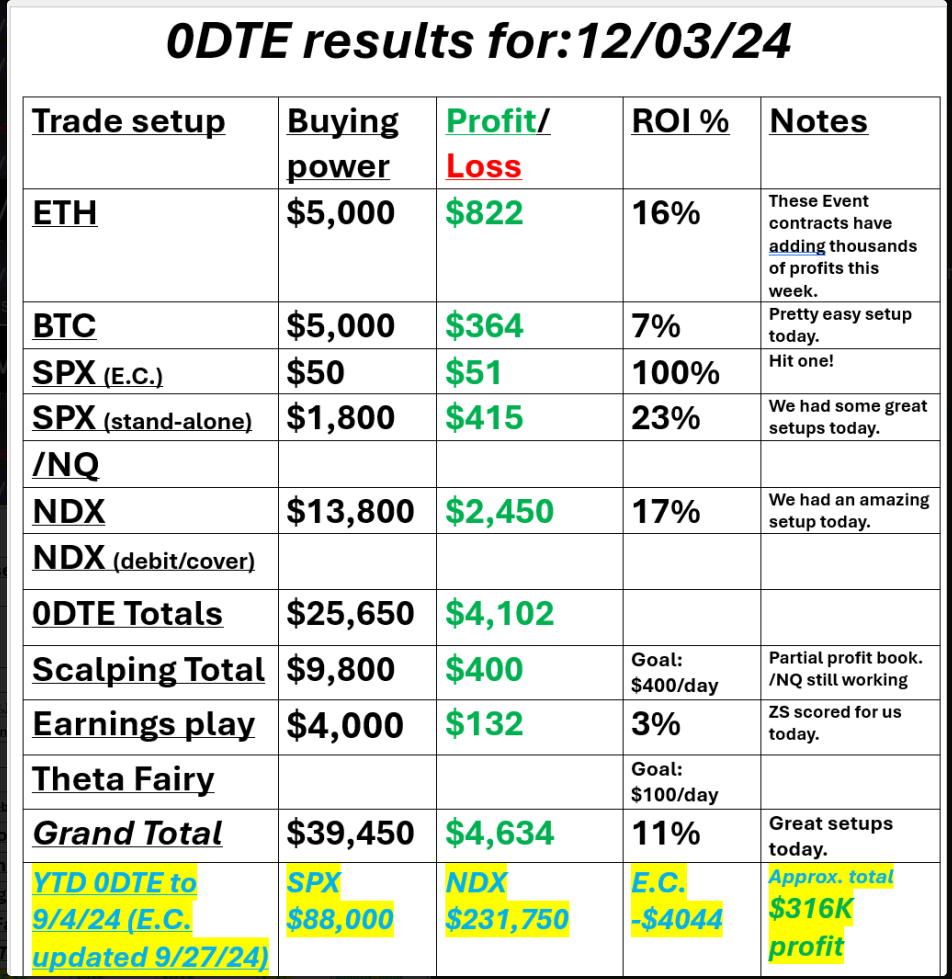

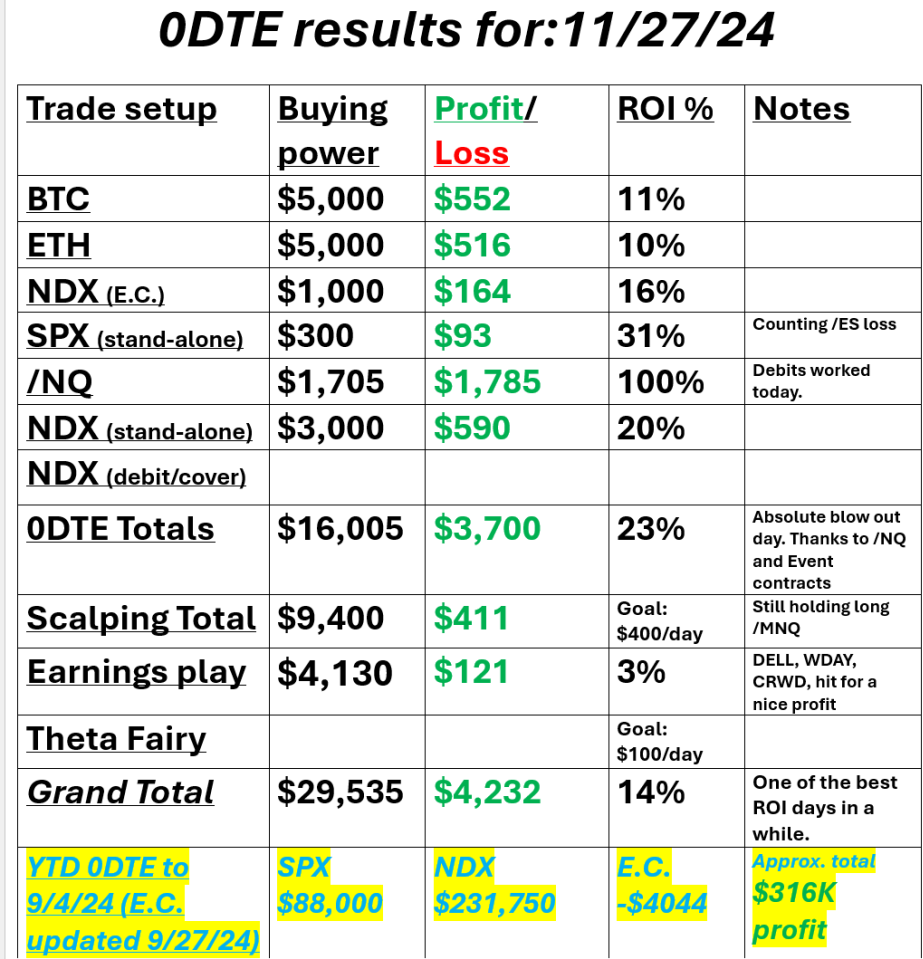

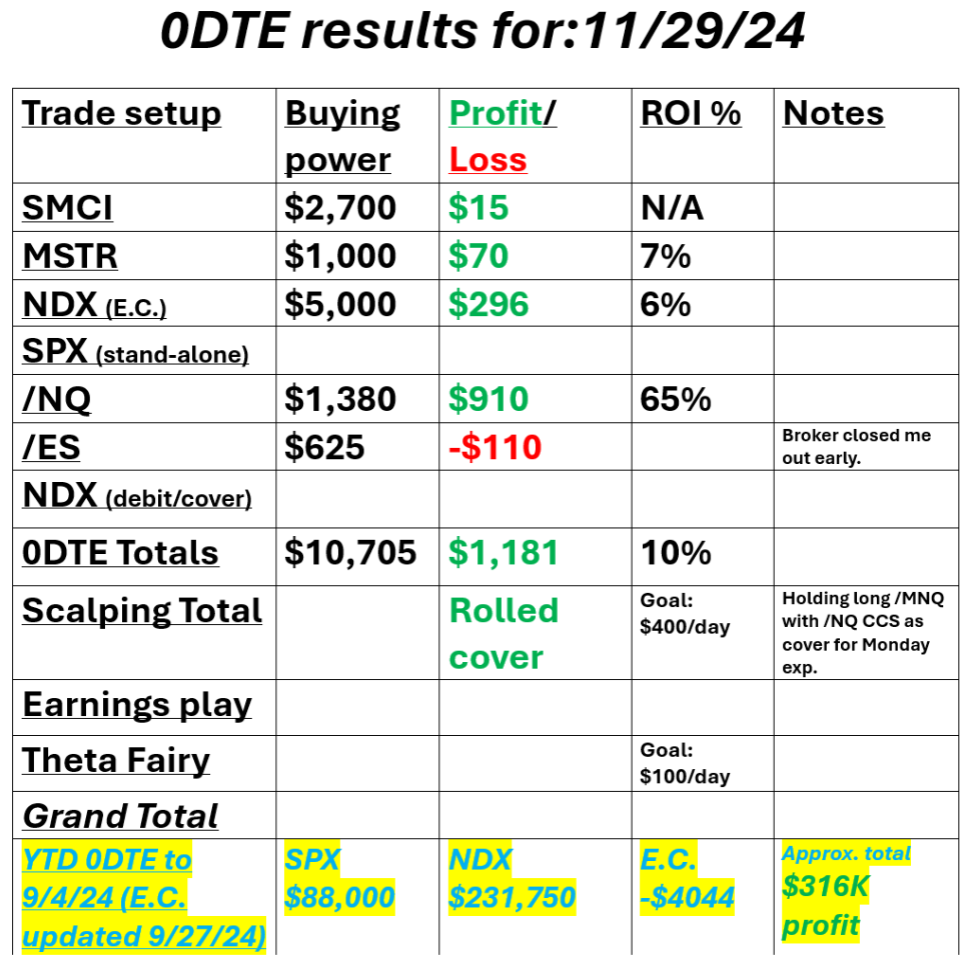

Welcome back traders! It's a new week. We just came off an absolute stellar set of results last week. Was it our highest grossing profit week ever? Not even close! It was, however a very tough market enviroment for credit traders and we do A LOT of credit trades. We had a home run day last Friday to cap of winning days all week long. I'm so grateful for last weeks results. We earned them. See our Friday results below: Who doesn't love putting $4,000 bucks in their pocket? An offshoot of this horrible I.V. enviroment has been that we've had to get more creative (and better) at setups. I'd love to say we are just brilliant traders but honestly, the setups were key. Let's take a look at the markets to start this new week. Bulls are hanging on but starting to look a bit tired. Two things appear clear. #1. The bull just keeps on marching. #2. It's looking tired. SPY is maintaining. IWM and DIA are looking more weak than strong. It's only the QQQ's that are still blasting higher. December S&P 500 E-Mini futures (ESZ24) are down -0.10%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.14% this morning as investors looked ahead to the release of U.S. inflation data later in the week, which will be scrutinized by Federal Reserve officials before their final meeting this year. In Friday’s trading session, Wall Street’s major equity averages closed mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching new record highs. Lululemon Athletica (LULU) surged over +15% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the athleisure retailer posted solid Q3 results and raised its full-year guidance. Also, Hewlett Packard Enterprise (HPE) climbed more than +10% after the IT giant reported better-than-expected FQ4 results. In addition, DocuSign (DOCU) jumped over +27% after the company reported stronger-than-expected Q3 results and issued above-consensus Q4 revenue guidance. On the bearish side, Smith & Wesson Brands (SWBI) tumbled more than -20% after posting downbeat FQ2 results. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls increased by 227K in November, topping the 218K consensus estimate. At the same time, the U.S. November unemployment rate unexpectedly rose to 4.2%, weaker than expectations of no change at 4.1%. Also, U.S. average hourly earnings rose +0.4% m/m and +4.0% y/y in November, stronger than expectations of +0.3% m/m and +3.9% y/y. Finally, the University of Michigan’s U.S. consumer sentiment index rose to an 8-month high of 74.0 in December, stronger than expectations of 73.1. “[November’s] jobs report came out right in the ‘Goldilocks’ zone,” said Josh Jamner at ClearBridge Investments. “With things more or less steady, the Fed should be in a position to continue to ease monetary policy over the next several months, and recent comments suggest the pace at which they will do so will be more gradual in 2025.” Cleveland Fed President Beth Hammack stated on Friday that the U.S. central bank is “at or near” the point where it should moderate the pace of interest rate cuts, pointing to a robust economy and still-elevated inflation. Also, Fed Governor Michelle Bowman said, “I would prefer that we proceed cautiously and gradually in lowering the policy rate as inflation remains elevated.” Meanwhile, U.S. rate futures have priced in an 87.1% chance of a 25 basis point rate cut and a 12.9% probability of no rate change at the Fed’s monetary policy committee meeting later this month. In the coming week, the U.S. consumer inflation report for November will be the main highlight. Also, investors will be keeping an eye on other economic data releases, including U.S. PPI, Core PPI, Nonfarm Productivity, Unit Labor Costs, Initial Jobless Claims, Crude Oil Inventories, the Export Price Index, and the Import Price Index. Market participants will also focus on earnings reports from several high-profile companies, with Broadcom (AVGO), Adobe (ADBE), Costco (COST), Oracle (ORCL), MongoDB (MDB), Toll Brothers (TOL), AutoZone (AZO), and GameStop (GME) scheduled to release their quarterly results this week. Federal Reserve officials are in a media blackout period before the December meeting, so they are prohibited from making public comments this week. Today, investors will focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final October figure to be +0.2% m/m, compared to -0.2% m/m in September. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.161%, up +0.29%. Trade docket for today: It's a busy one. ORCL, AI, MBD, TUL, AZO potential earnings trades. /NG, CAVA?, DOCU, IWM, LRN?, MRNA, PLTR, /SI, /ZW, /MCL and CTGO, DAN, GNK and KOD adds on our pairs trades. Expected moves for the week are low, once again. That's O.K.. We've had low I.V. for weeks now and done just fine. We'll look at starting today with some Iron Flys or Chicken Iron condors. Just when you think the VIX can't go any lower...it does. A couple things I'm thinking about today. The ratio of assets in leveraged long ETFs to short ETFs hit 11.1x, the most on RECORD. The difference has TRIPLED this year and is nearly 2 TIMES larger than at the 2021 market frenzy top. Greed has rarely been greater. Here's something scary out of Apollo group: Via Apollo: "GDP growth in the third quarter came in at 2.8%, and the Atlanta Fed estimates GDP growth in the fourth quarter will be 3.3%. Combined with the recent uptrend in inflation, the probability is rising that the Fed may have to raise interest rates in 2025" Bitcoin almost 2x since 2021 peak. Ethereum still -15% off 2021 peak. Institutional demand is just not there yet for Ethereum. Bitcoin is the first mover. And its owners are getting paid for that. I think Ethereum catches up and it the better risk/reward going into 2025. We have a small long position we've been building. /ES: Is in a tight range with 6111 working as resistance and 6078 acting as support. /NQ: Over the last week the Nasdaq was the biggest winner. It finally threw of the shackles and exploded higher. 21,725 is new resistance wit 21,433 acting as support. Bitcoins been very, very good to us lately! Talk about a daily ATM machine! We'll look to put another substantial BTC trade on today. 104,704 is new resistance with 97,200 acting as support.

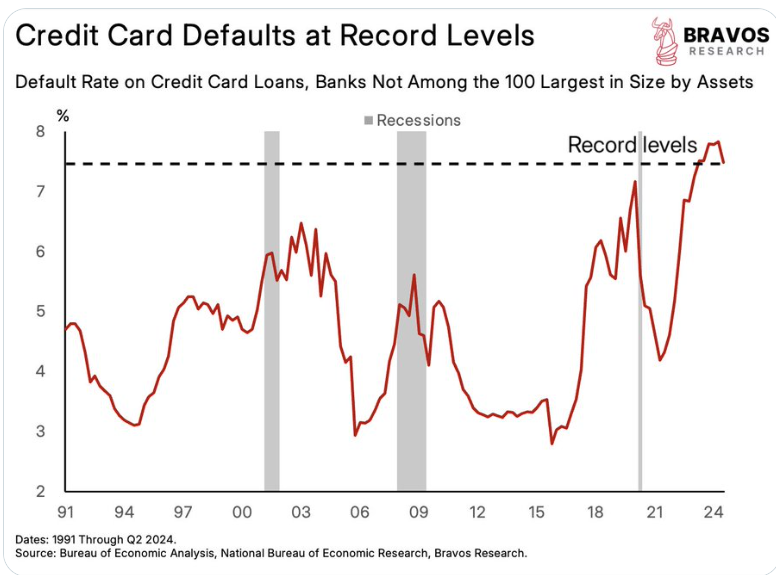

Welcome to Friday! I have to say, I'm pretty happy with our week so far. It's been a week of different setups but it largely worked out for us. Here's our results from yesterday: Markets still look bullish: We continue to bounce along the ATH lines with IWM continuing to show the most weakness. Our IWM trade it built with a bit of a brearish slant. December S&P 500 E-Mini futures (ESZ24) are trending down -0.08% this morning as investors cautiously awaited the all-important U.S. jobs report that will help determine whether the Federal Reserve will lower or hold interest rates later this month. In yesterday’s trading session, Wall Street’s major indices ended lower. Synopsys (SNPS) plunged over -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chip design software firm provided below-consensus 2025 revenue guidance. Also, SentinelOne (S) slumped more than -13% after the cybersecurity company reported a wider-than-expected Q3 loss. In addition, American Eagle Outfitters (AEO) tumbled over -14% after reporting weaker-than-expected Q3 revenue and cutting its full-year comparable sales forecast. On the bullish side, Brown-Forman (BF.B) climbed more than +10% and was the top percentage gainer on the S&P 500 after the company posted upbeat FQ2 results. Also, Tesla (TSLA) gained over +3% after BofA raised its price target on the stock to $400 from $350. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by +9K to a 6-week high of 224K, compared with the 215K expected. Also, the U.S. October trade deficit narrowed to -$73.80B from -$83.80B in September, better than expectations of -$75.70B. “We’ll get a fuller picture from [Friday’s] monthly jobs report, but for now, the story continues to be a labor market that occasionally appears to bend, but avoids breaking,” said Chris Larkin at E*Trade from Morgan Stanley. Meanwhile, U.S. rate futures have priced in a 67.5% chance of a 25 basis point rate cut and a 32.5% chance of no rate change at December’s monetary policy meeting. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that November Nonfarm Payrolls will come in at 218K, compared to October’s figure of 12K. A survey conducted by 22V Research revealed that 45% of investors expect key U.S. jobs data to be “mixed/negligible,” 32% anticipate it will be “risk-off,” and 23% foresee “risk-on.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect November figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.4% m/m and +4.0% y/y. The U.S. Unemployment Rate will be reported today. Economists foresee this figure to remain steady at 4.1% in November. The University of Michigan’s U.S. Consumer Sentiment Index will come in today. Economists forecast the preliminary December figure to be 73.1, up from last month’s figure of 71.8. U.S. Consumer Credit data will be released today as well. Economists expect this figure to stand at $10.10B in October, compared to the previous figure of $6.00B. In addition, market participants will be anticipating speeches from Chicago Fed President Austan Goolsbee, Cleveland Fed President Beth Hammack, and San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.195%, up +0.32%. My lean or bias today is still neutral. That worked fairly well for us yesterday. We seem to be pausing here for now. A couple things I'm thinking about today: Credit card defaults are rising at record levels This is WORSE than the 2008 Financial Crisis S&P 500 price to book basically at 2000 levels. Not sure if you all remember 2000? QQQ scalping. BBY, DOCU, HPE, LULU, MRNA, MRVL, PATh, ULTA, 0DTE's, /ES (Thetafairy). Let's take a look at our intra-day levels for 0DTE's. /ES. We've rotated from the resistance band to the support band. 6093 is first resistance today with 6101 next. 6079 is first support with 6070 and 6060 next. /NQ. Range is a bit bigger here. 21,542 is resistance with 21,389 support. Not much change from yesterday. BTC: Taking a pause after the massive explosion to the upside. 103,445 new resistance with 96,304 working now as support. Let's get a nice solid finish to the week! Our Theta fairy and earnings trades could be a nice finish today.

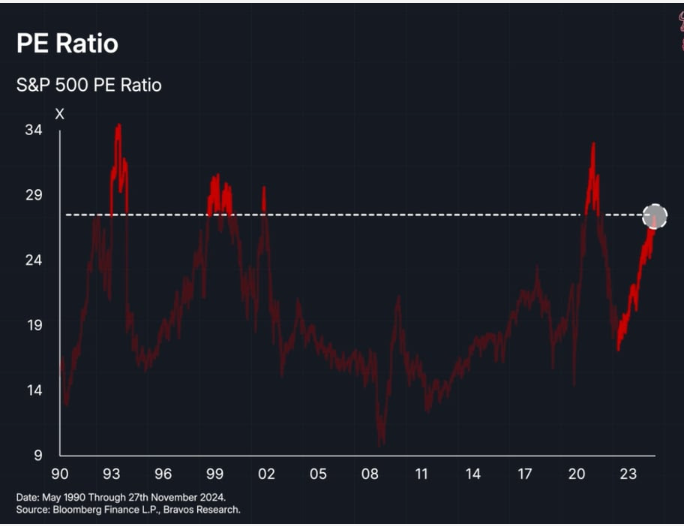

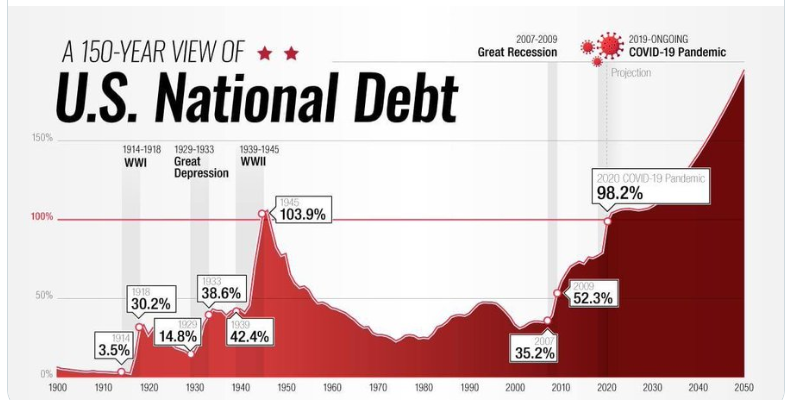

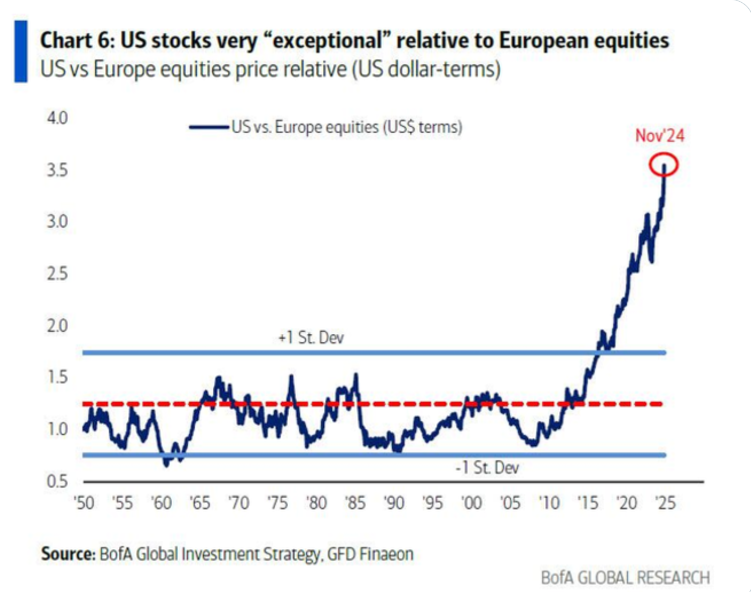

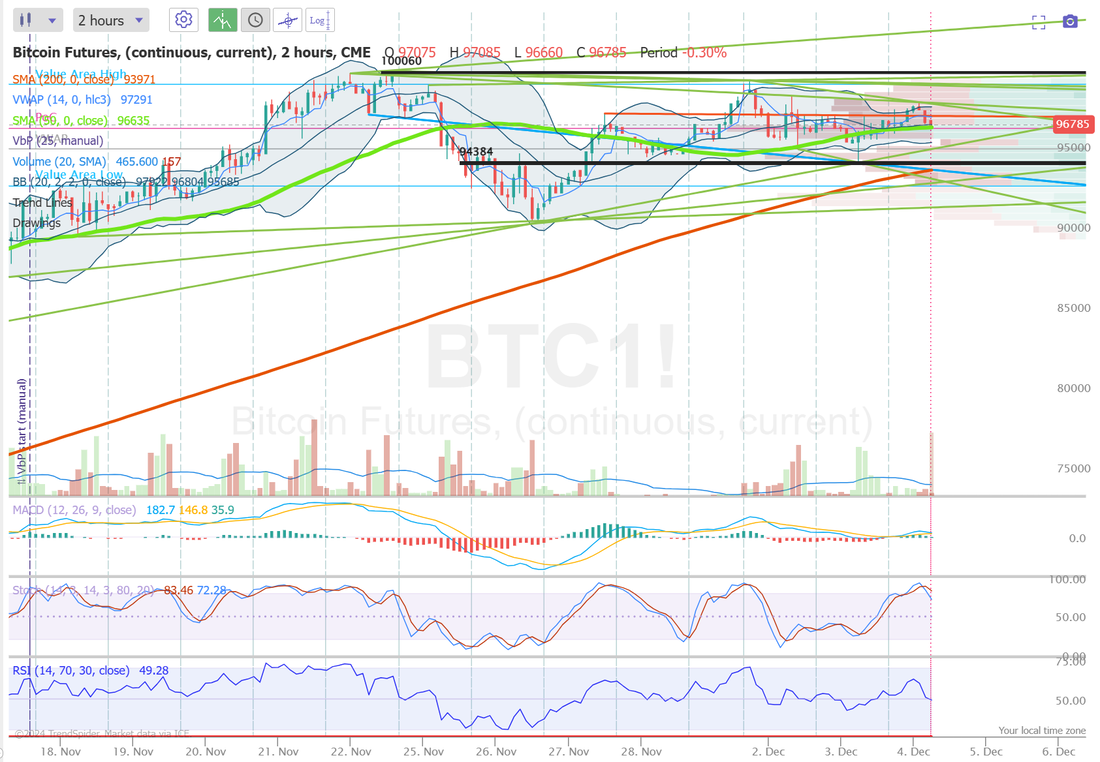

What a day yesterday! This is such a tough market for credit traders. If you build soley credit setups, even if you win you lose because your risk/reward is horrible and you are trading setups with no positive expectancy. If you trade debit setups you need big moves and those have been rare. Traders are really between a rock and a hard place right now. We stayed on top of our setups and managed risk well. Even with the cost of adjustments our day went pretty darn well. Our net liq was up and all our 0DTE's made money with the exception of our small BTC trade. Check our performance below: Let's take a look at the markets. Technicals are still bullish. It would take a pretty decent retrace to change that at this point. "ATH's all day long" seems to be the theme right now. IWM is wavering a bit but it sure looks like we are coiling to push higher. We are at an amazing 12 days of up, up, up on the SPX. It WILL pause and retrace at some point...it always does but when? Nobody knows. The fear and greed index isn't off the charts greedy as you'd suspect when we keep bouncing to new ATH's. No matter how much bullishness we get, I wouldn't be doing my job if I didn't make the counter argument for downside. The market's PE ratio has climbed to heights seen only 2 times before - in 2021 and the late 1990s. Currently, it’s sitting in the 90th percentile of the last 40 years. The US govt brings in about $5 trillion per year in revenue from taxes, fees and tariffs. The US govt is on pace to spend about $1.4 trillion for interest payments on the $36 trillion in debt during 2025. That will be about 28% of all govt revenue going to interest payments. The last time U.S. stocks were this overvalued versus the rest of the world was... well, never. As strong as the market is the A/D line isn't that impressive and you'd think more stocks would be above their respective 50/200 DMA. Volume has been dropping during this current bull run going all the way back to October. December S&P 500 E-Mini futures (ESZ24) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.13% this morning, taking a breather after yesterday’s rally, while investors turned their attention to U.S. jobless claims numbers due later today and key non-farm payrolls data scheduled for Friday. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher, with the S&P 500, the Dow, and the Nasdaq 100 posting new all-time highs. Marvell Technology (MRVL) soared over +23% and was the top percentage gainer on the Nasdaq 100 after the company posted upbeat Q3 results and issued above-consensus Q4 guidance. Also, Salesforce (CRM) climbed about +11% and was the top percentage gainer on the S&P 500 and Dow after the software giant reported better-than-expected Q3 revenue and raised the lower end of its full-year revenue forecast. In addition, Pure Storage (PSTG) surged over +22% after the data storage company reported stronger-than-expected Q3 results and lifted its annual revenue outlook. On the bearish side, The Campbell’s Company (CPB) slid more than -6% after reporting weaker-than-expected FQ1 net sales. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 146K in November, down from 184K in October (revised from 233K) and missing the consensus estimate of 152K. Also, the U.S. November ISM services index fell to 52.1, weaker than expectations of 55.7. In addition, the final estimate of the U.S. November S&P Global services PMI was revised lower to 56.1 from the 57.0 preliminary reading. Finally, U.S. factory orders rose +0.2% m/m in October, in line with expectations. Fed Chair Jerome Powell said Wednesday that the U.S. economy is in “very good shape.” He added that policymakers could afford to be “a little more cautious” with lowering rates. Also, St. Louis Fed President Alberto Musalem stated, “It seems important to maintain policy optionality, and the time may be approaching to consider slowing the pace of interest rate reductions or pausing, to carefully assess the current economic environment, incoming information, and evolving outlook.” In addition, San Francisco Fed President Mary Daly stated that there is no immediate urgency to lower rates. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity saw a slight increase in November following little change in previous months, with U.S. businesses becoming more optimistic about demand prospects. The report noted that modest or moderate growth in three regions offset flat or slightly declining activity in two others. The Fed’s districts also reported that prices increased at a modest pace. “Though growth in economic activity was generally small, expectations for growth rose moderately across most geographies and sectors,” according to the Beige Book. “Business contacts expressed optimism that demand will rise in coming months. Consumer spending was generally stable.” U.S. rate futures have priced in a 74.0% chance of a 25 basis point rate cut and a 26.0% chance of no rate change at December’s policy meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists estimate this figure to arrive at 215K, compared to last week’s number of 213K. The U.S. Trade Balance data will be released today as well. Economists forecast this figure to stand at -$75.70B in October, compared to the previous figure of -$84.40B. On the earnings front, notable companies like Dollar General (DG), Kroger (KR), DocuSign (DOCU), Hewlett Packard Enterprise (HPE), GitLab (GTLB), Lululemon Athletica (LULU), and Ulta Beauty (ULTA) are scheduled to report their quarterly figures today. In addition, market participants will be looking toward a speech from Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.214%, up +0.77%. My bias or lean today is more neutral. Two weeks of nothing but up? I think we are due for a pause. DOCU, HPE, ULTA, FIVE, /MNQ, /NQ scalping should finish this position up today. BBY?, MRVL, LULU, Possible Theta Fairy after the close, 0DTE's. Don't sleep on the E.C. setups, especially Bitcoin today. They could be good. Let's take a look at the intra-day levels for us today: /ES: We are pinched into an incredibly tight range to start today. Jobless claims numbers may shake us out to one side or the other. 6101 is earn term resistance and 6079 is support. A break above would be bullish for my setups. A break below would provide for bearish setups. /NQ: Nasdaq has a very asymmetric setup going into today. Resistance is close and support is a ways down. Would anyone be surprised to see a 300 point downday? Resistance is close at 21,549 with support down at 21,393. BTC: Well...? It did it! Absolutely crazy. Bitcoin pushed over $100,000 mark. As I've mentioned many times, I'm not a "crypto" guy. I don't understand it. It's not backed by anything. It holds no "store of value" which, by the way, is the main definition of "currency". The risk/reward was compelling though. I opened a Coinbase.com account and would add a few hundred dollars each month. Small enought that if it went bust it wouldn't be a big deal. When I got to $4,000 invested I thought, "that's enough". That account hit $19,000 last night! Woulda, coulda , shoulda. I guess we just hold now until it hits $1,000,000 right? Right? BTC Levels: 105,379 is new resistance with the all important 100,000 working as support. I'm keen to get a bigger size BTC trade on today. I'm super happy with our results yesterday. If we could do that again today I'd be thrilled.

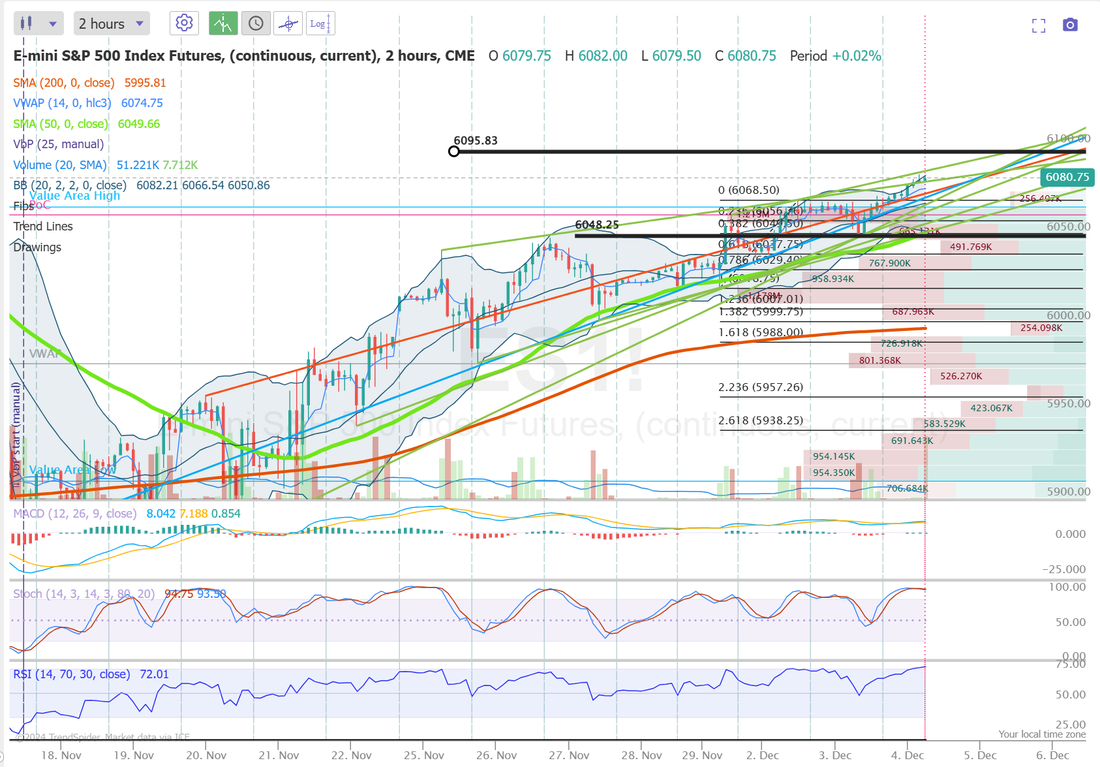

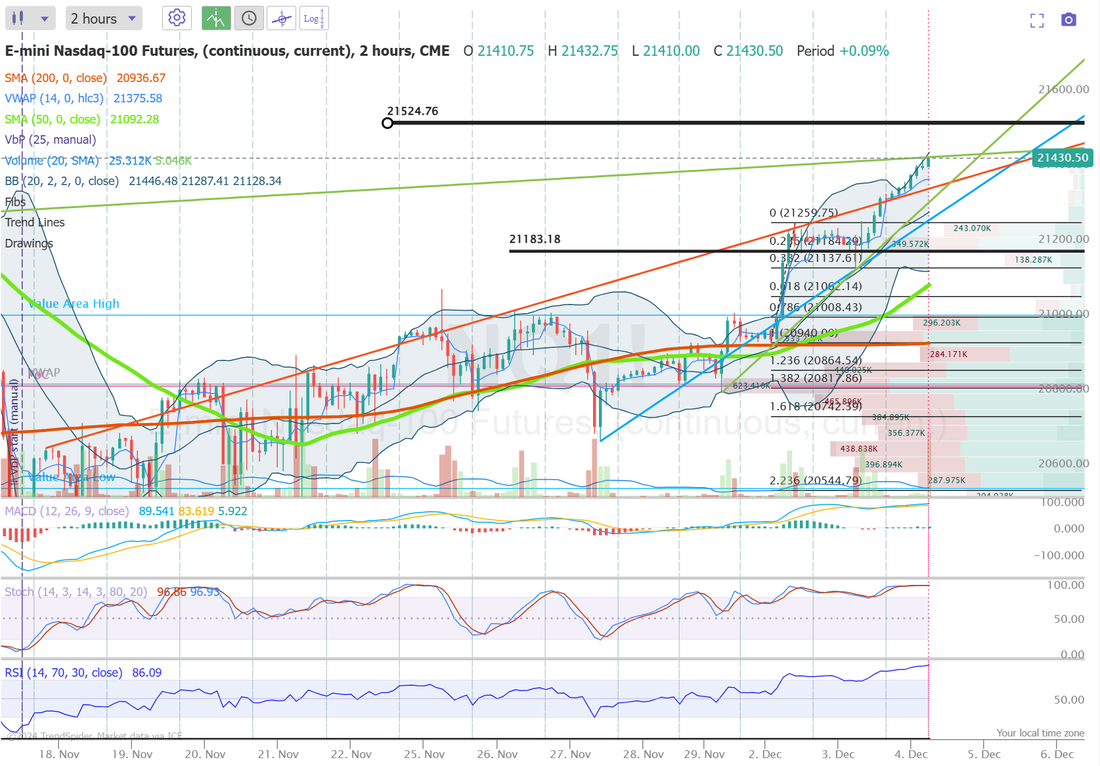

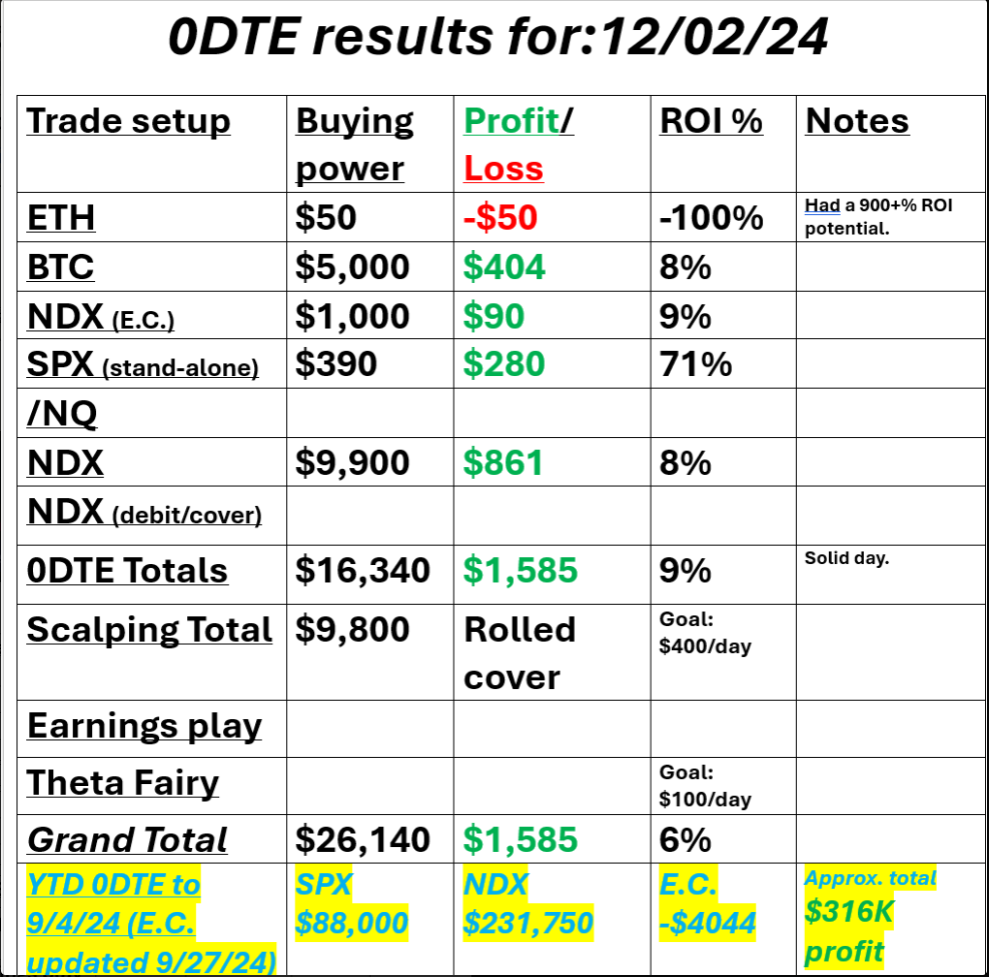

Welcome back traders to Wednesday! We had a really nice result yesterday and it was all in the setups. It's been very challenging in this low I.V. world we are currently living in but we made it work. I will also say that the event contracts 0DTES...when the setup is there, and its not always there, man...they are tremendous in terms of risk/reward. Check out our results below: Let's take a look at the market: My bias or lean is bullish. Surprise surprise! Really, what else can you be right now. Are we overstretched to the upside? Are we due for a pullback after continually ripping to the upside for the past week? Probably but...there's no sign of it happening quite yet. December S&P 500 E-Mini futures (ESZ24) are trending up +0.24% this morning as investors awaited a fresh batch of U.S. economic data and remarks from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the tech-heavy Nasdaq 100 notching a new all-time high. Palantir Technologies (PLTR) climbed over +6% and was the top percentage gainer on the S&P 500 after announcing it was granted FedRAMP High Authorization for two of its cloud-based services. Also, AT&T (T) advanced more than +4% after unveiling its three-year strategy. In addition, Credo Technology (CRDO) jumped over +47% after the technology company posted upbeat FQ2 results and issued strong FQ3 revenue guidance. On the bearish side, Microchip Technology (MCHP) slumped -7% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company lowered its FQ3 revenue forecast and said it would close a plant in Arizona. Also, Zscaler (ZS) slid more than -4% after the cloud-based cybersecurity platform provided a soft FQ2 forecast. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings increased to 7.744M in October, stronger than expectations of 7.510M. “In the context of a gradually cooling labor market on the cusp of a soft landing, [Tuesday’s] JOLTS report is about as good as can reasonably be expected. Layoffs remained low and openings ticked up alongside quits - signs that employer and job seeker confidence, respectively, are improving,” said Cory Stahle, an economist at Indeed Hiring Lab. Fed Governor Adriana Kugler on Tuesday voiced confidence in the direction of inflation and broader economic conditions, while emphasizing that the Fed’s policy decisions remain data-dependent. “The labor market remains solid, and inflation appears to be on a sustainable path to our 2% goal, even if there have been some bumps along the way,” Kugler said. Also, San Francisco Fed President Mary Daly stated that an interest rate cut this month is not guaranteed but remains on the table. “Whether it’ll be in December or sometime later, that’s a question we’ll have a chance to debate and discuss in our next meeting, but the point is we have to keep policy moving down to accommodate the economy,” Daly said. In addition, Chicago Fed President Austan Goolsbee said, “Over the next year it feels to me like rates come down a fair amount from where they are now.” U.S. rate futures have priced in a 73.8% chance of a 25 basis point rate cut and a 26.2% chance of no rate change at the conclusion of the Fed’s December meeting. Meanwhile, Fed Chair Jerome Powell is scheduled to participate in a moderated discussion at the New York Times DealBook Summit later in the day. Market participants will look for any hints about whether the central bank will cut rates in December. Also, St. Louis Fed President Alberto Musalem will speak today. On the earnings front, notable companies like Chewy (CHWY), Campbell Soup (CPB), Dollar Tree (DLTR), Foot Locker (FL), Hormel Foods (HRL), Five Below (FIVE), and Synopsys (SNPS) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the November ADP Nonfarm Employment Change will stand at 152K, compared to the October figure of 233K. Investors will also focus on the U.S. ISM Non-Manufacturing PMI and the S&P Global Services PMI. Economists foresee the November ISM Non-Manufacturing PMI to arrive at 55.7 and the S&P Global Services PMI to be 57.0, compared to the previous values of 56.0 and 55.0, respectively. U.S. Factory Orders data will come in today. Economists forecast this figure to be +0.2% m/m in October, compared to the previous number of -0.5% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.6M, compared to last week’s value of -1.8M. Later today, the Federal Reserve will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Federal Reserve districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.254%, up +0.74%. Trade docket for today: CAVA?, CHWY, CRM, DLTR, FDX?, IWM , MRVL, FIVE, 0DTE's Let's take a look at the intra-day levels for our 0DTE's today: /ES: Range is tightening up. Indicators look stretched to the upside with overbought readings abundant. 6080 would be the first upward target with 6095 being the top of the expected range for today. 6048 is support now. /NQ: The Nasdaq finally had it's break out move and hit new ATH's. It also caught up with the momentum of the SPX. 21,525 is the upper expected move today on the resistance side with 21,183 acting as new support. BTC: We've had some tremendous results with Bitcoin lately. We went almost two weeks without finding a setup and lately it's just been wonderful. Patience and sitting on your hands when the trade isn't there is hard to do but pays off...eventually. Our range today is exactly the same as yesterday. 100,080 resistance with 94,384 support. Yesterday was incredibly active with putting on trades all day. Today will be a bit more mild. I look forward to seeing you all in the trading room.

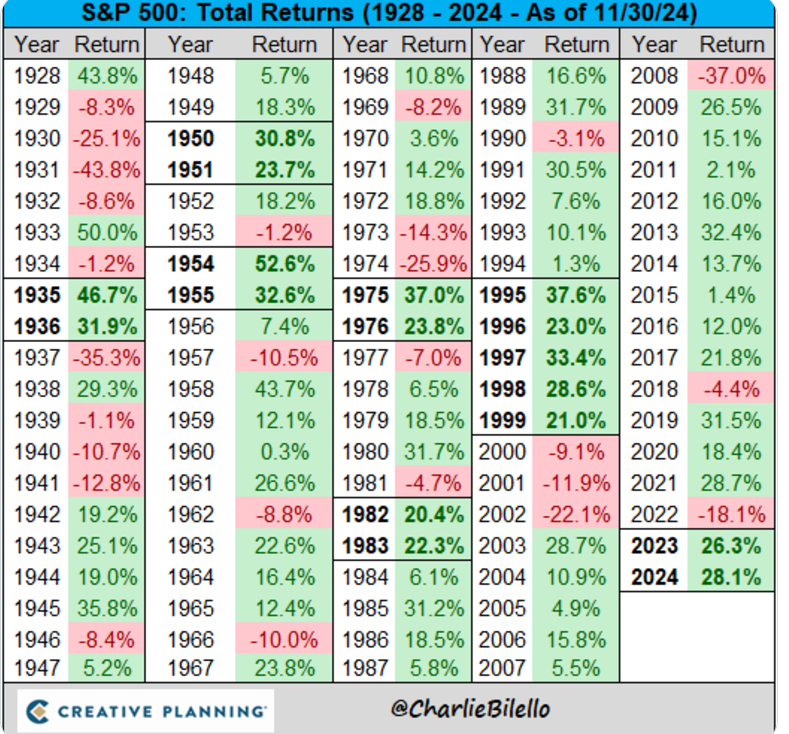

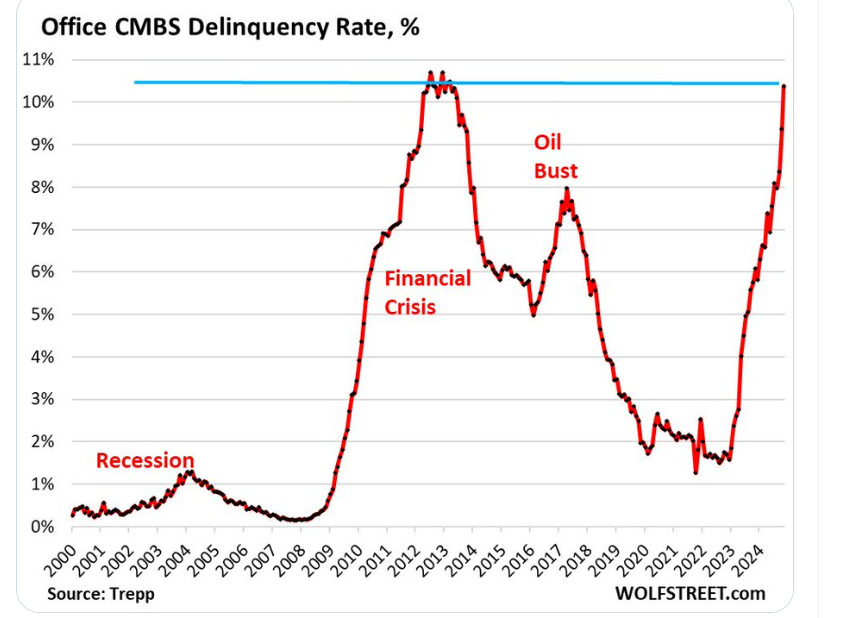

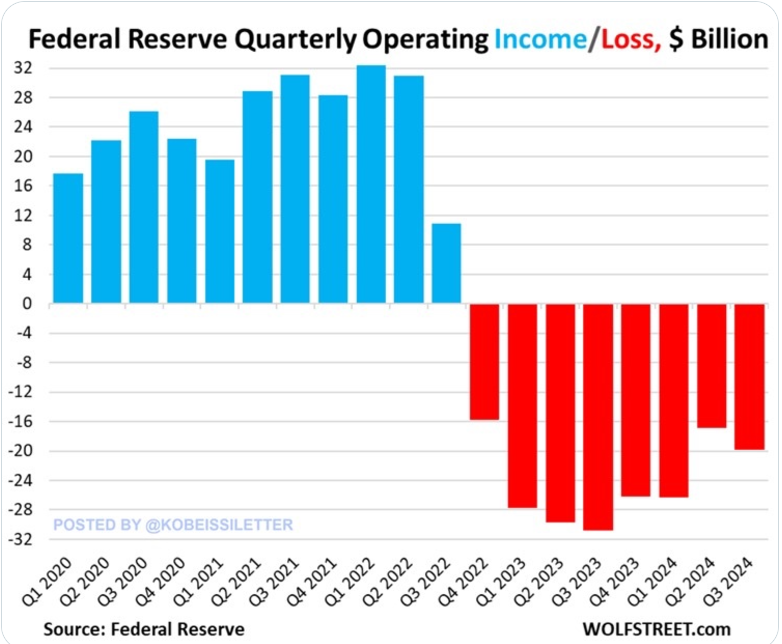

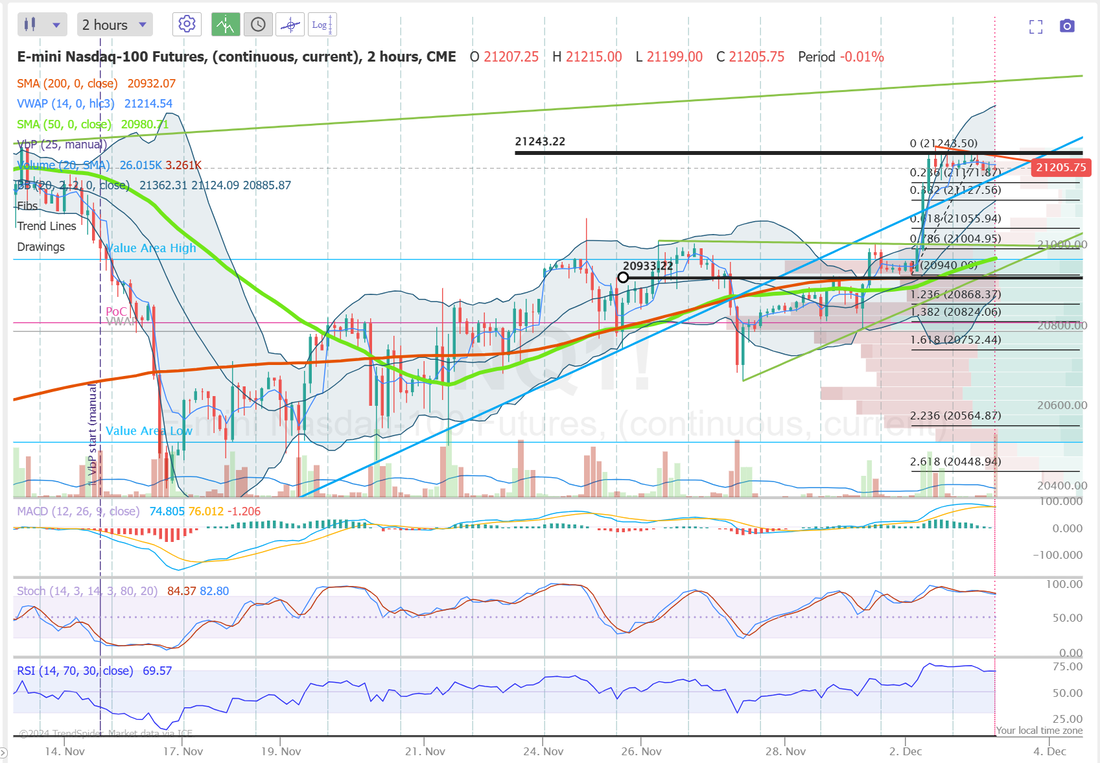

Welcome back! I've had some technical issues that were finally resolved by just removing an ad blocker! I've got some catching up to to. Here's our last Thursday, Friday results. All in all I'm pretty impressed and happy with our holiday light trading schedule. Here's our results from yesterday. Markets seem to be at nose bleed levels but economics look good. The S&P 500 is currently on pace for back-to-back years with a total return above 20%. The last time that happened: 1998-1999 The delinquency rate on US commercial mortgage-backed securities (CMBS) for offices SURGED to 10.7%, the highest in 11 YEARS. Office CMBS delinquencies have risen even faster than during the Great Financial Crisis. Commercial real estate crisis is getting worse. The Federal Reserve just reported a $19.9 BILLION operating loss in Q3 2024 up from $16.9 billion in Q2. This marks the 8th consecutive quarter of operating losses for the central bank. As a result, cumulative operating losses reached a massive $210 billion over the last 2 years. This comes as the Fed has been paying hundreds of billions in interest to banks and money market funds. At the same time, income the Fed has earned on Treasuries and Mortgage-Backed-Securities has declined. Even the Fed is losing money. It's been pretty much up, up and away for every market sector. Buy mode is still solidly in place. We are starting to get some divergence. While the SPY continues to charge onward and upward, the QQQ looks like its stalling out and the IWM and DIA are in a holding pattern. I.V. for this week is basically non-exsistent. And the one day VIX is not giving much hope. A one day VIX below 8? That's rare indeed. Yesterdays price action was not really meaningful in terms of providing directional bias. My bias or lean today is neutral. We seem to be treading water here just under the ATH's. Trade docket for today: /MNQ, /NQ scalping, BBY?, IWM, LEVI?, ZS, CRM, MRVL, CHWY, DLTR, FL, 0DTE's and...we'll be working on 10 new pairs setups today. 10 short and 10 long. I'll detail each in the chat room with charts and position sizing. December S&P 500 E-Mini futures (ESZ24) are up +0.01%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.01% this morning as market participants braced for the latest reading on U.S. job openings while also awaiting comments from Federal Reserve officials. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching new all-time highs. Super Micro Computer (SMCI) soared over +28% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the server maker said that a review by a special committee found “no evidence of misconduct on the part of management or the board of directors and that the audit committee acted independently.” Also, Tesla (TSLA) advanced more than +3% after Roth Capital Partners upgraded the stock to Buy from Neutral with a price target of $380. In addition, The Gap (GAP) climbed over +6% after JPMorgan Chase upgraded the stock to Overweight from Neutral with a price target of $30. On the bearish side, PG&E (PCG) slid about -5% after launching concurrent public offerings of $1.2 billion of common stock and $1.2 billion of mandatory convertible preferred stock. Economic data released on Monday showed that the U.S. ISM manufacturing index rose to a 5-month high of 48.4 in November, stronger than expectations of 47.7. Also, the U.S. November S&P Global manufacturing PMI was revised upward to 49.7, beating the consensus of 48.8. In addition, U.S. construction spending rose +0.4% m/m in October, stronger than expectations of +0.2% m/m. “This week is the last truly important economic data week of 2024,” said Tom Essaye at The Sevens Report. “If results are Goldilocks, then investors will expect a soft landing and a December rate cut. That will keep positive seasonals in place for a year-end grind higher.” Atlanta Fed President Raphael Bostic stated Monday that he is uncertain about the need for an interest rate cut this month but believes policymakers should continue reducing rates in the coming months. Also, New York Fed President John Williams said, “I expect it will be appropriate to continue to move to a more neutral policy setting over time,” adding that “the path for the policy will depend on the data.” At the same time, Fed Governor Christopher Waller expressed his inclination to support another rate cut at the December meeting. However, he noted that data to be released before then might justify keeping interest rates unchanged. Meanwhile, U.S. rate futures have priced in a 72.5% probability of a 25 basis point rate cut and a 27.5% chance of no rate change at the December FOMC meeting. On the earnings front, notable companies like Salesforce (CRM), Marvell (MRVL), and Okta Inc. (OKTA) are set to report their quarterly figures today. Today, all eyes are on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the October JOLTs Job Openings will arrive at 7.510M, compared to the September figure of 7.443M. Market participants will also focus on speeches from Fed Governor Adriana Kugler and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.217%, up +0.57%. Let's take a look at our intra-day levels: /ES; 6069 is new resistance with 6037 acting as new support. /NQ: Yesterdays move created a new trading zone and a bit of a volume gap to the downside. 21243 was pretty strong resistance yesterday and 20933 is new support. BTC: Bitcoin scored for us again yesterday. It's been a good profit center for us lately. 100,060 seems like a very solid resistance and will likely be what we trade off today. 94,384 is the first support to the downside. Let's get going! I'm excited to get the new pairs trades working today! See you all in the trading room.

|

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |