|

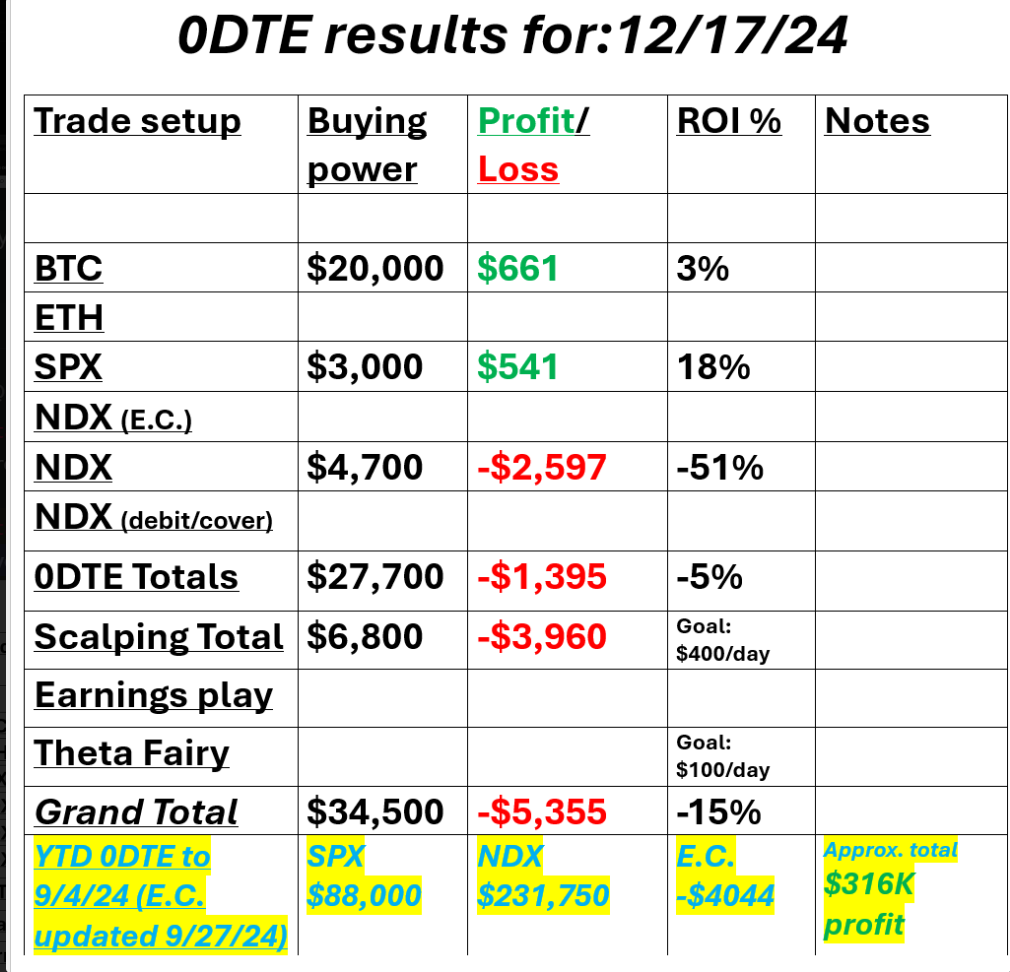

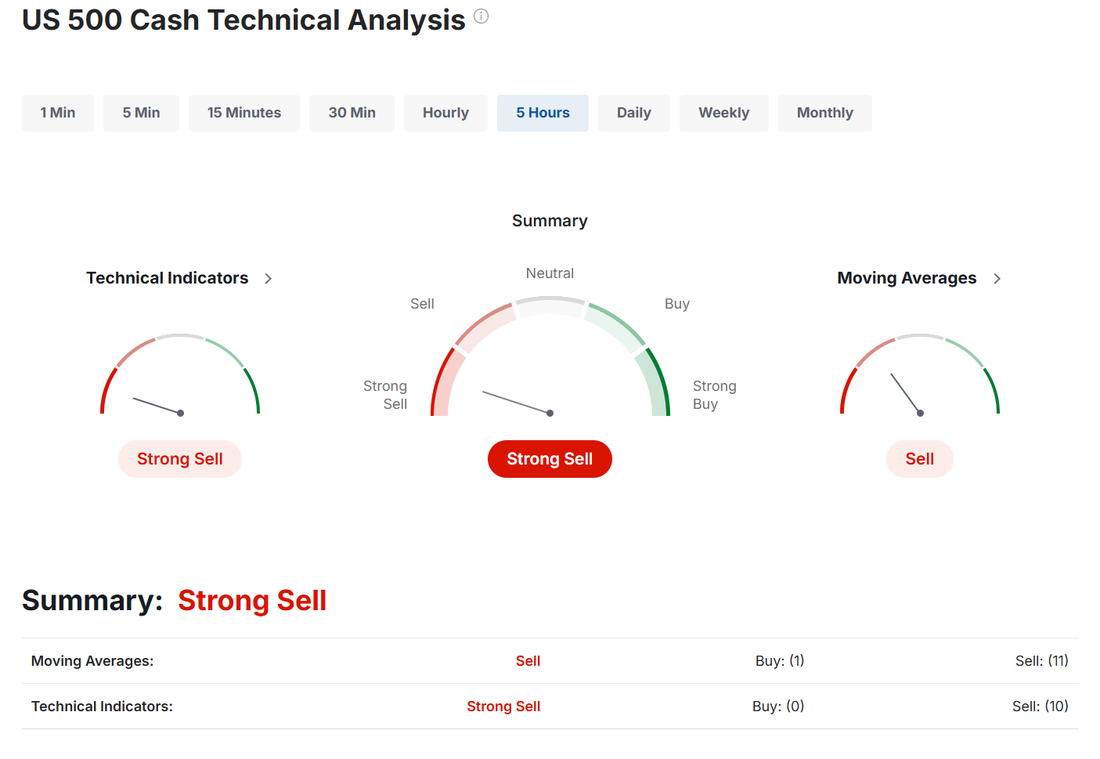

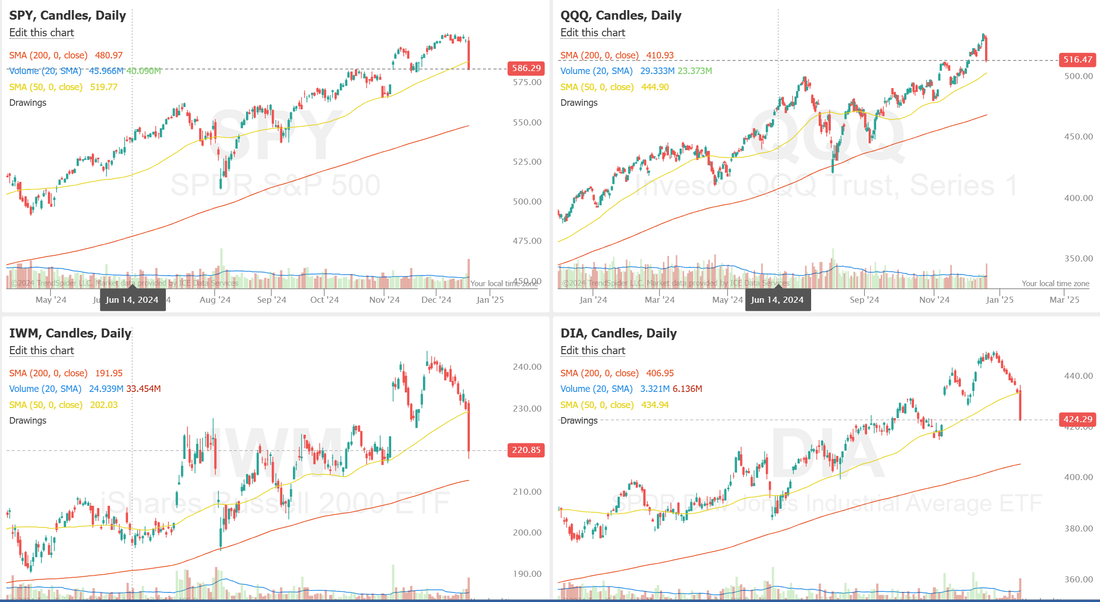

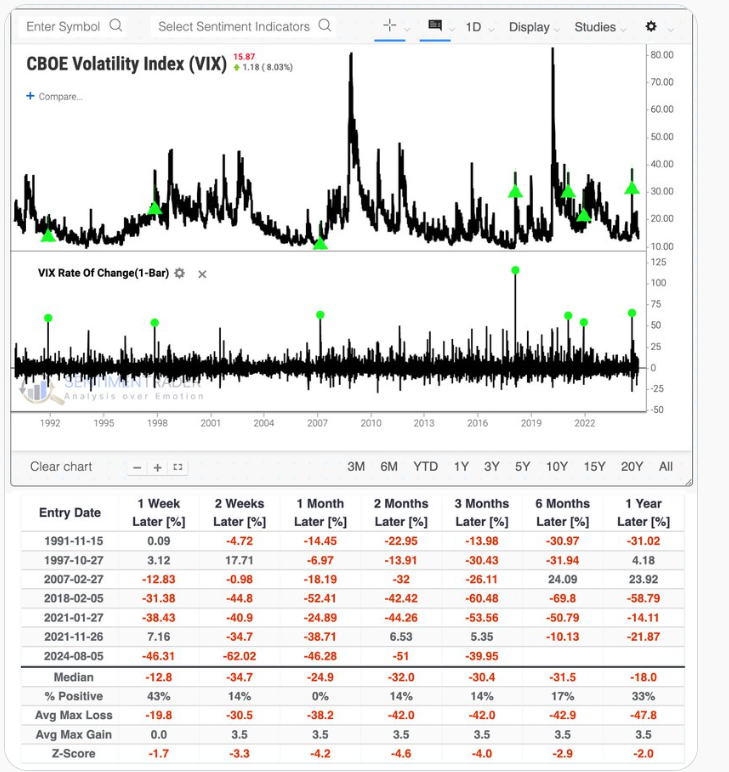

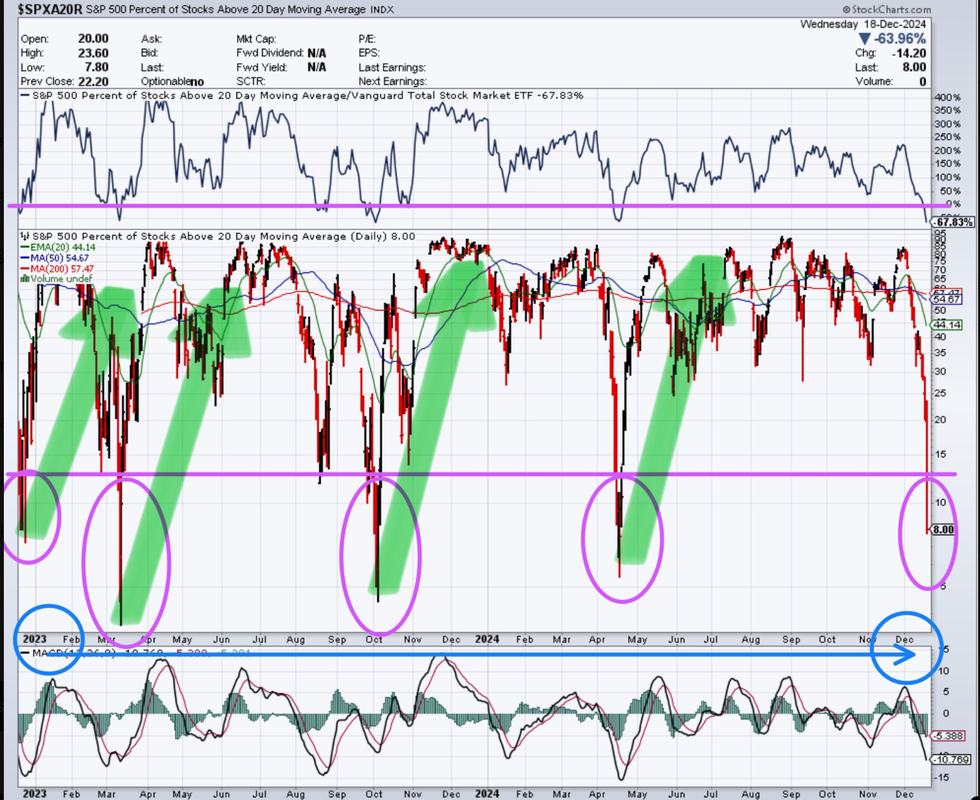

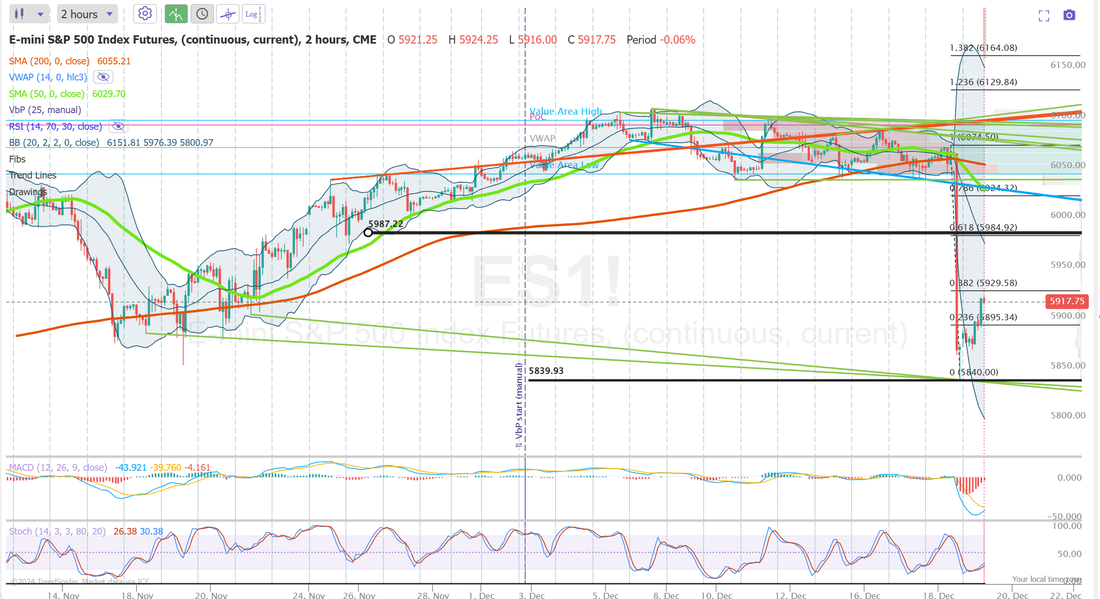

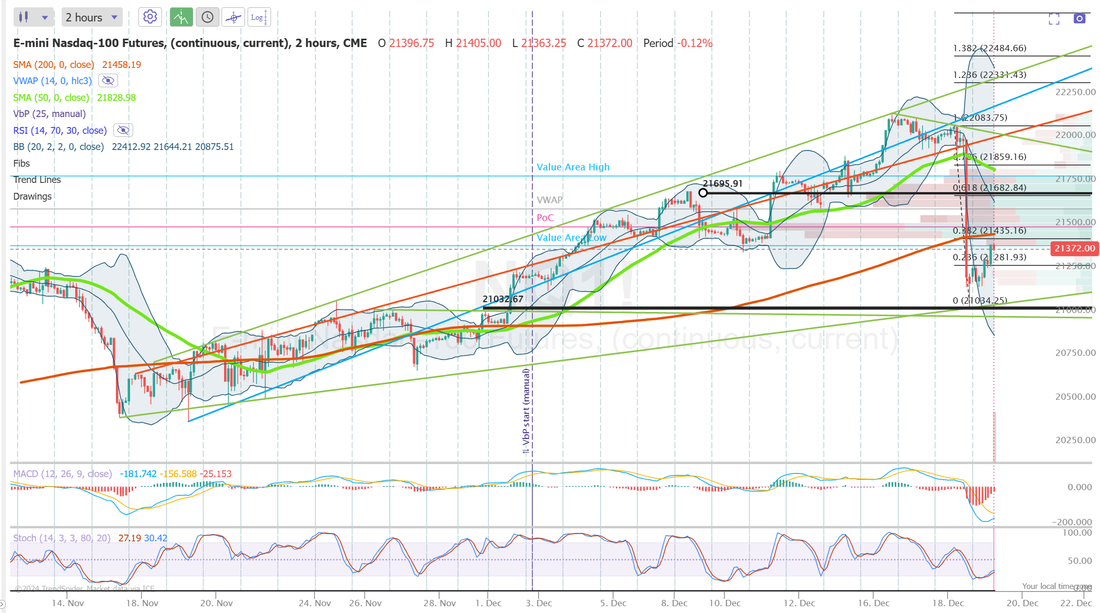

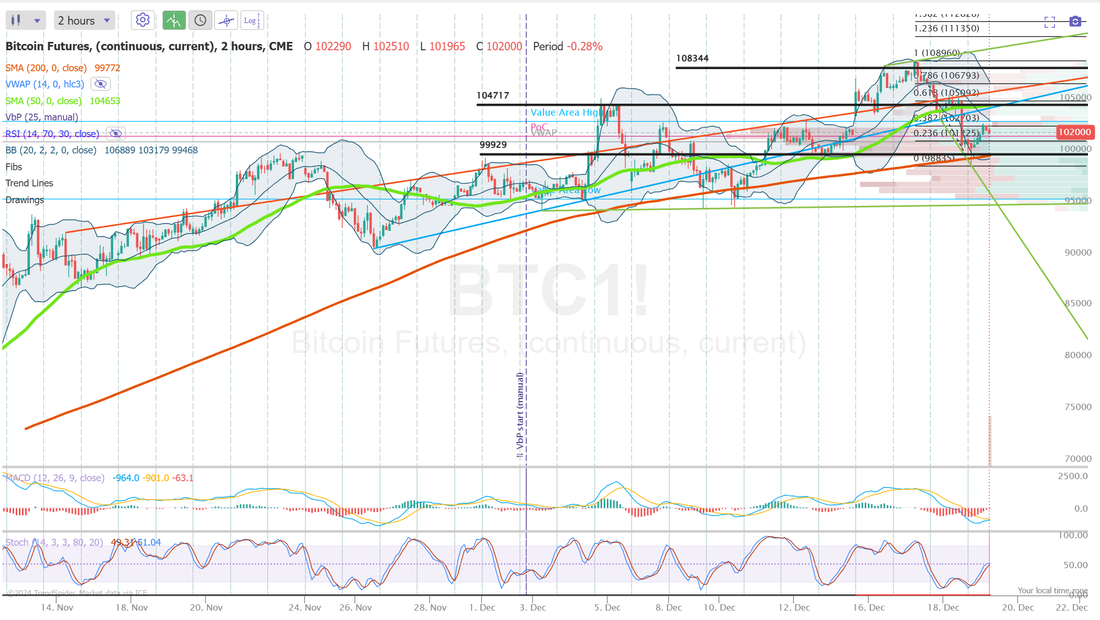

Welcome back to the post mortem on the FOMC day! It wasn't a good day for Powell. Hawkish sentiment pushed this bull market right into a nice little correction. futures are up as I type but...the damage may be done. Is this going to be a hard stop bounce or are we now in a correction phase? Hard to say yet. My short puts got run over in my scalp and my NDX. See my results below: Let's take a look at the markets and what yesterdays down move has done. Probably not a surprise that the indicators have flipped to sell mode. We now have three of the four indices that we trade, down below the 50DMA. This is bearish. A note from Capital Group. "Remember when the Bee Gees’ "Stayin’ Alive" was the biggest hit on the radio? If so, you were around the last time the Dow Jones Industrial Average had a nine-day losing streak, which was reached Tuesday. The only exchange-traded fund to track the oldest stock market benchmark, the SPDR Dow Jones Industrial Average ETF (DIA), fell another 2.6% Wednesday on inflation concerns, extending the longest stretch of consecutive losses for the index since 1978." I've been talking about the divergence in the market for a long time. Take a look at these. Every time the VIX jumped by 50% in a single session, it plunged over the next month. Every. Single. Time. Is this going to be different? Seems like it could be, but we all know the danger of "this time is different." In the last TWO YEARS, anytime the S&P 500 has had ALL of its stocks below their respective 20 DAY MOVING AVERAGE on this indicator below 10, and we’re at 8 , we have had the bottom of every correction and pullback and it led to SIGNIFICANT rallies, will this time be different? BREAKING: The S&P 500 falls sharply after the Fed cuts rates by 25 basis points, but raises inflation forecast. The Fed reduced their outlook from 3 to 2 rate cuts in 2025 and raised inflation expectations from 2.1% to 2.5%. Inflation is back. My lean or bias today is bullish: Futures are up. Even if this is the start of a bearish down leg, we almost always have a knee jerk reaction the next day and get some relief. Trade docket: /SI, /ZW, LEN, LEVI, MRNA?, NKE, FDX, MU, 0DTE's. December S&P 500 E-Mini futures (ESZ24) are up +0.40%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.52% this morning, partially rebounding from yesterday’s dramatic selloff after the Federal Reserve forecast fewer interest rate cuts next year, while investors awaited a raft of U.S. economic data and an earnings report from the world’s largest shoemaker Nike. As widely expected, the Federal Reserve lowered its benchmark interest rate by a quarter percentage point yesterday. The Federal Open Market Committee voted 11-1 to reduce the federal funds rate to a range of 4.25% to 4.50%, marking its third consecutive rate cut. The central bank stated that while inflation has moved closer to the 2% target, it remains “somewhat elevated,” and labor market conditions have “generally eased.” The Fed’s updated Summary of Economic Projections showed that officials now anticipate the benchmark rate reaching a range of 3.75% to 4.00% by the end of 2025, implying only two quarter-percentage-point cuts, compared to the four cuts projected in September. “In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the FOMC’s statement said. At a press conference, Fed Chair Jerome Powell reiterated that the central bank would exercise greater caution as it considers further adjustments to the policy rate. He also stated that interest rates continue to “meaningfully” restrain economic activity and that the committee is “on track to continue to cut.” “Dots are hawkish even relative to what were fairly hawkish expectations going in - it’s taking much longer to get to ‘neutral’ - in fact it doesn’t get there in the forecast horizon,” said Scott Ladner of Horizon Investments. In yesterday’s trading session, Wall Street’s major indexes closed sharply lower. Heico (HEI) slumped over -8% after reporting weaker-than-expected FQ4 revenue. Also, mega-cap technology stocks retreated, with Tesla (TSLA) plunging more than -8% and Amazon.com (AMZN) falling over -4%. In addition, General Mills (GIS) slid more than -3% after the Cheerios maker lowered its full-year adjusted EPS forecast. On the bullish side, Jabil Inc. (JBL) climbed over +7% and was the top percentage gainer on the S&P 500 after the electronic circuit manufacturing company posted better-than-expected FQ1 results and raised its full-year guidance. Economic data released on Wedensday showed that U.S. housing starts unexpectedly fell -1.8% m/m to 1.289M in November, weaker than expectations of 1.350M. Also, U.S. building permits, a proxy for future construction, rose +6.1% m/m to a 9-month high of 1.505M in November, stronger than expectations of 1.430M. In addition, the U.S. Q3 current account deficit was a record -$310.9B, wider than expectations of -$286.0B. Today, all eyes are on the Commerce Department’s final estimate of gross domestic product, which is set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP growth will stand at +2.8% q/q in the third quarter, compared to the second-quarter figure of +3.0% q/q. Investors will also focus on the U.S. Philadelphia Fed Manufacturing Index, which came in at -5.5 in November. Economists expect the December figure to be 2.9. U.S. Existing Home Sales data will be released today. Economists foresee this figure to stand at 4.09M in November, compared to 3.96M in October. U.S. Initial Jobless Claims data will be reported today. Economists estimate this figure will be 229K, down from last week’s 242K. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the November figure to be -0.1% m/m, compared to the previous number of -0.4% m/m. Meanwhile, notable companies like Nike (NKE), FedEx (FDX), Accenture (ACN), Cintas (CTAS), and Darden Restaurants (DRI) are set to report their quarterly results today. U.S. rate futures have priced in a 91.4% probability of no rate change and an 8.6% chance of a 25 basis point rate cut at the next central bank meeting in January. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.530%, up +0.64%. Let's take a look at the intra-day 0DTE levels: /ES: Well. We've been looking for a new trading range. Here it is. 5987 is the new resistance with 5839 working as support. Wide levels for the /NQ: 21,690 is resistance with 21,032 acting as support. A couple key levels on BTC. 104,717 is first resistance with 108,344 above that. 99,979 is support. We are getting close to the 1HTE options rollout. It will start on Bitcoin and eventually work into SPX/NDX as liquidity builds. It may be live today. I'll be sure to let you know if we can start trading them.

See you all in the trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |