|

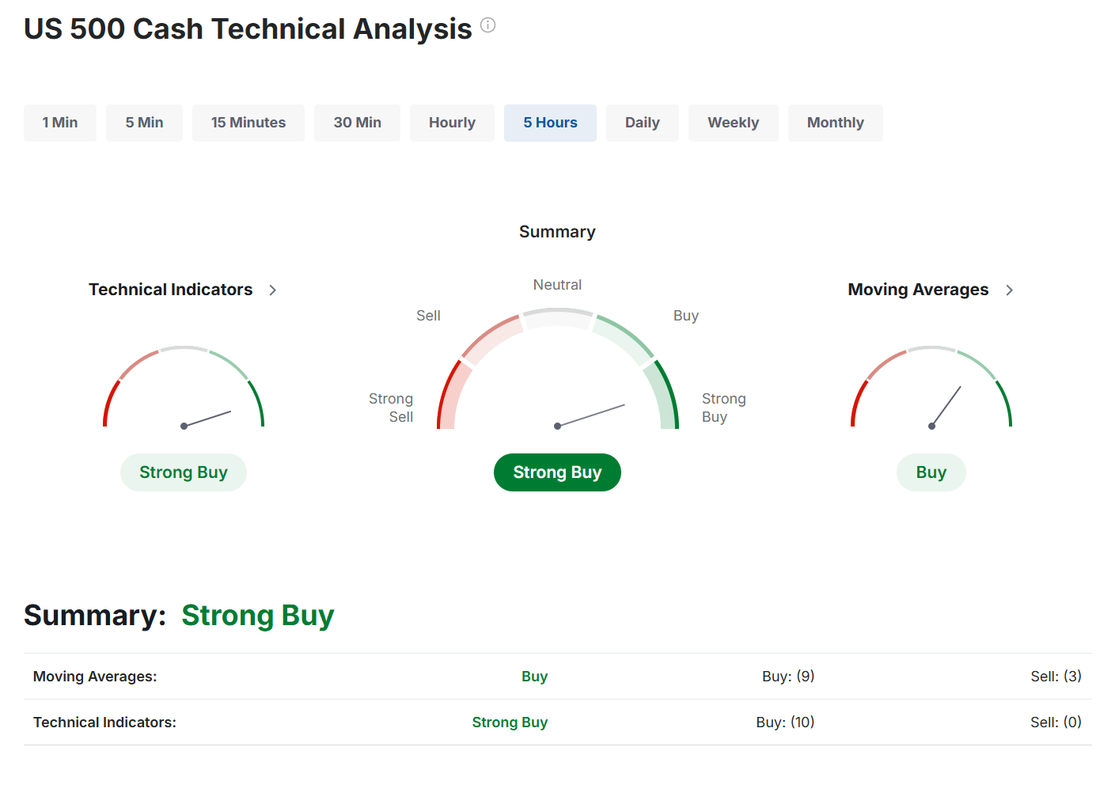

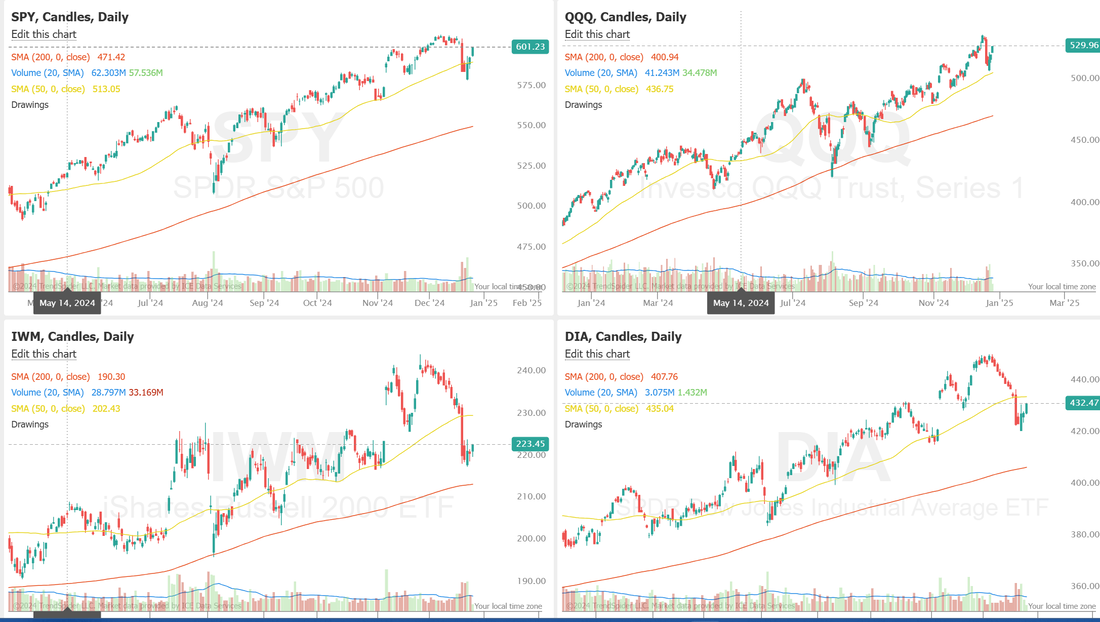

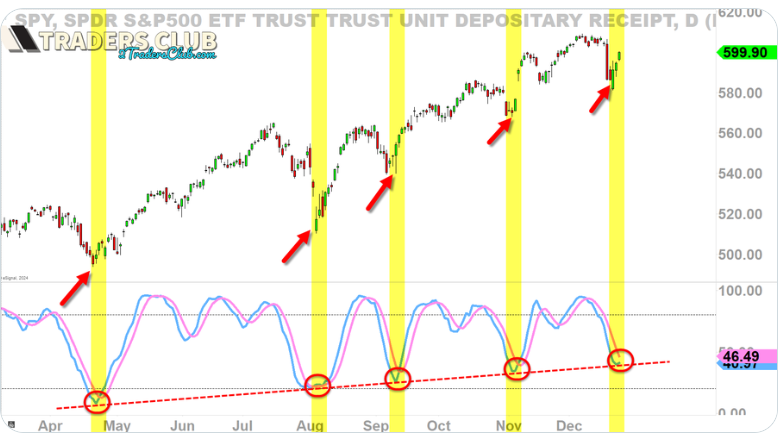

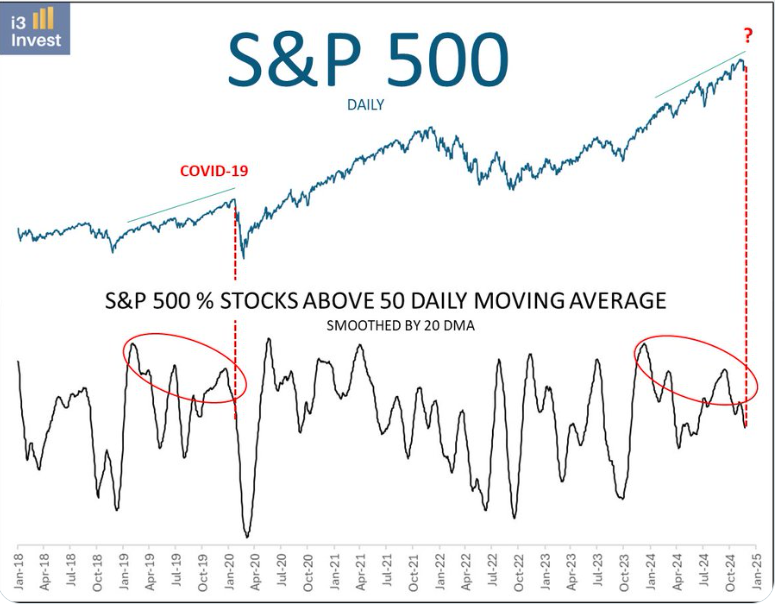

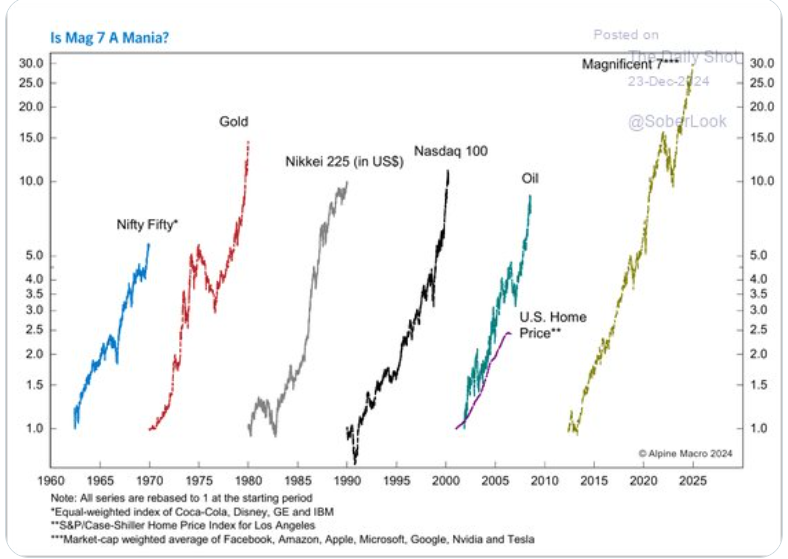

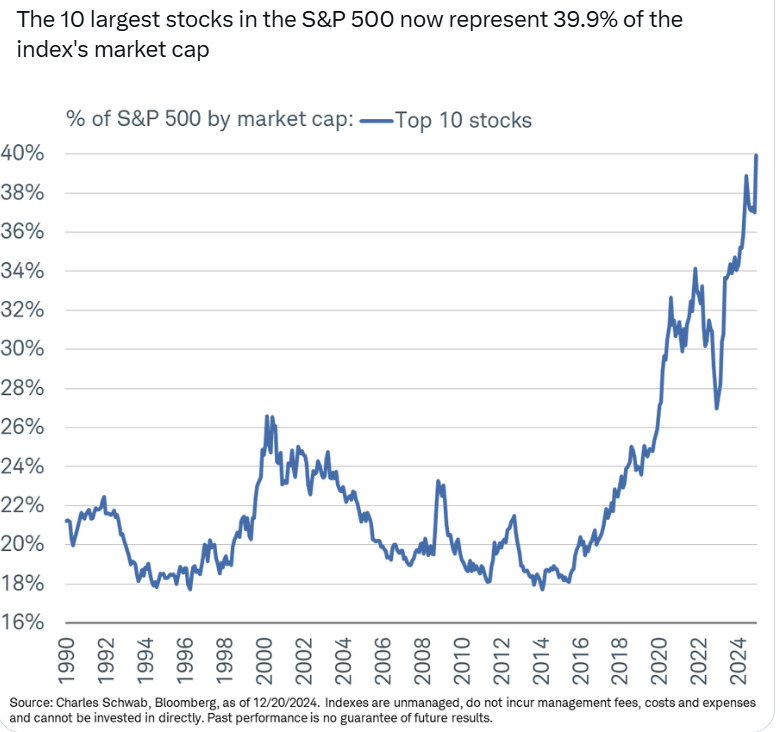

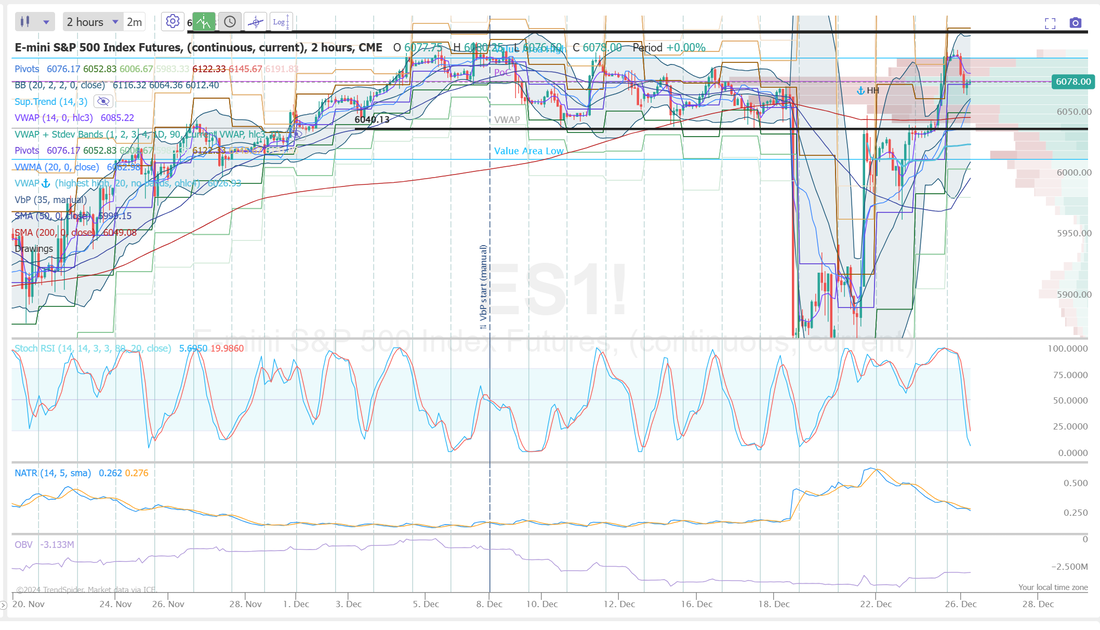

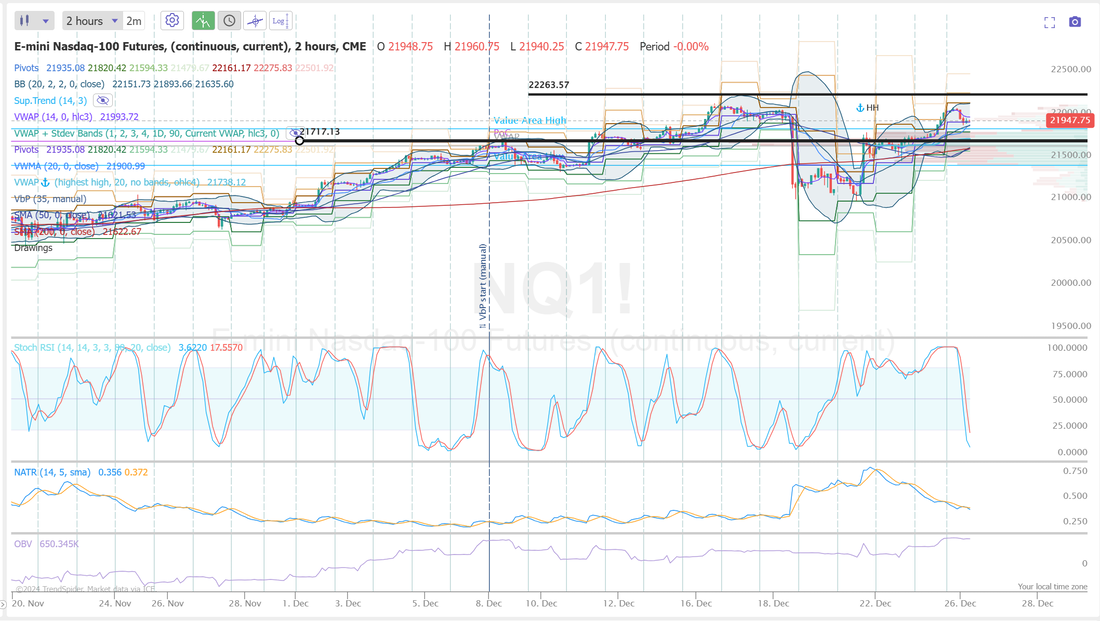

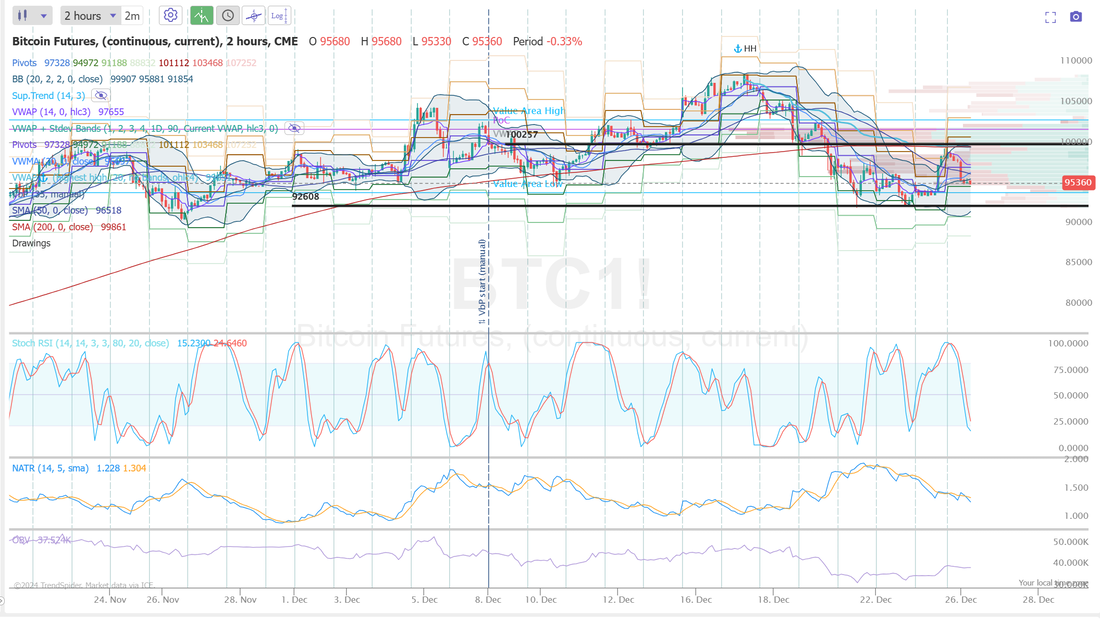

Welcome back traders! I hope you all had a wonderful Christmas and were able to celebrate with family and friends. That's ultimately the greatest asset we can ever possess. We are back at it today and even though our trade docket will be light for the rest of the week, today is a HUGE day for us. My net liq is already up over $7,000 this morning just on our futures positions. We have a big /NQ cover on our /MNQ short position. Our Dec. Nat gas position could yield $5,000 of profit today and our /SI position expires today as is very close to a take profit. Let's take a look at the market. The Santa Claus rally seems to be the real deal. Sure, IWM and DIA are still struggling below their 50DMA but everything else looks pretty solid and techs are back participating. March S&P 500 E-Mini futures (ESH25) are down -0.45%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.52% this morning as Treasury yields climbed after cash trading resumed following the Christmas holiday, with investors turning their attention to U.S. jobless claims numbers due later today. In Tuesday’s trading session, Wall Street’s three main equity benchmarks closed in the green. All the Magnificent 7 megacap technology stocks advanced, with Tesla (TSLA) climbing over +7% to lead gainers in the S&P 500. Also, chip stocks extended gains after the Biden administration launched a probe into Chinese chips, with Broadcom (AVGO) rising more than +3% and Advanced Micro Devices (AMD) gaining over +1%. In addition, NeueHealth (NEUE) soared more than +74% after the company announced that it had agreed to be taken private by New Enterprise Associates in a $1.3 billion deal. “Santa Claus rally could still be alive, with strong seasonality into the end of the year,” said London Stockton at Ned Davis Research. A Santa Claus rally refers to the consistent gains observed in the stock market over the final five trading days of December and the first two trading days of January. Since 1950, the S&P 500 has delivered average and median returns of 1.3% during this period, significantly exceeding the market’s average seven-day gain of 0.3%, according to Adam Turnquist at LPL Financial. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing index came in at -10 in December, in line with expectations. Meanwhile, U.S. rate futures have priced in a 91.4% chance of no rate change and an 8.6% chance of a 25 basis point rate cut at the next central bank meeting in January. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists estimate this figure will come in at 223K, compared to last week’s 220K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.621%, up +0.72%. Most major markets in Europe remain closed today. Trade docket today (and tomorrow) should be pretty light but that doesn't mean we won't have profit potential. We'll be scalping with /MNQ and /NQ. Our big trade today is Dec. Nat Gas. We could have a 4K+ payoff today. /SI is also expiring today and we have a good shot at a profit. I'll also try to get more NUKK shorts on. We'll continue to work the current SPX 0DTE. Once we get a clean exit on it we'll start with our SPX ratio trades. We'll also see if we can get some BTC 1HTE trades on. Some things I'm thinking about today: It certainly looks like we are getting a bullish signal. However, divergence is still strong. I would also be remiss if I didn't mention that bubbles DO happen. To make things more scary, we are in a "concentration bubble". My lean or bias today is neutral. Light vol day. Price action may be jerky but I imagine we have a good shot at staying inside the current chop zone. Let's take a look at todays intra-day levels. /ES: We've been toying with the ATH level for four weeks now. 6120 is todays resistance with 6040 acting as support. /NQ : 22,263 is current resistance with 21705 acting as an important support. This is also VWAP on the 2hr. chart. BTC: Bitcoin continues to channel in the same chop zone for the last 10 days. 100,252 is still resistance with 92,601 acting as support. This consolidating chop zone action makes it tougher to get solid 1HTE trades on but we'll give it our best shot today. I'll see you all (or at least those who are still trading this week) in the zoom shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |