|

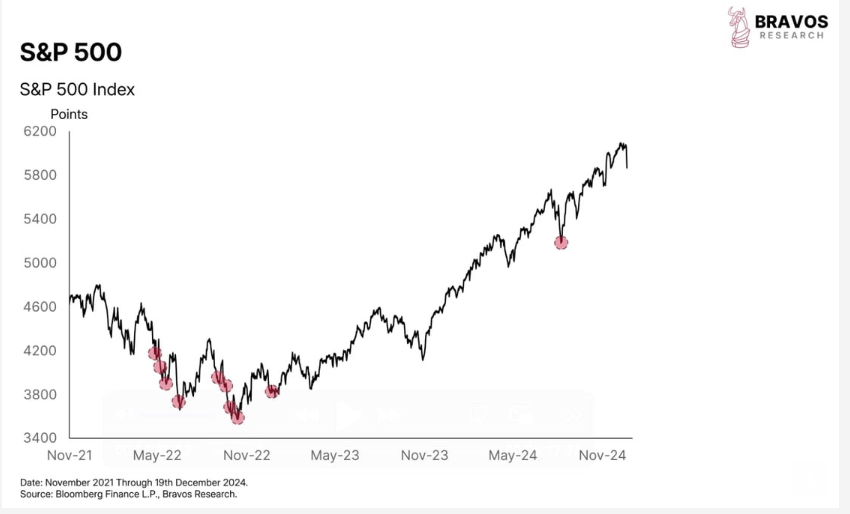

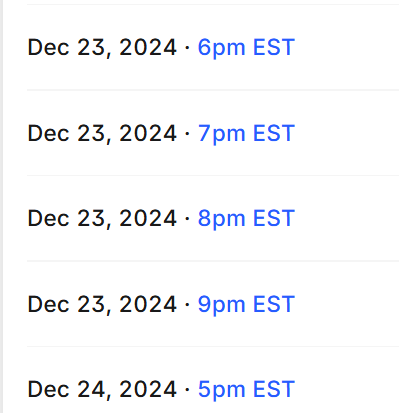

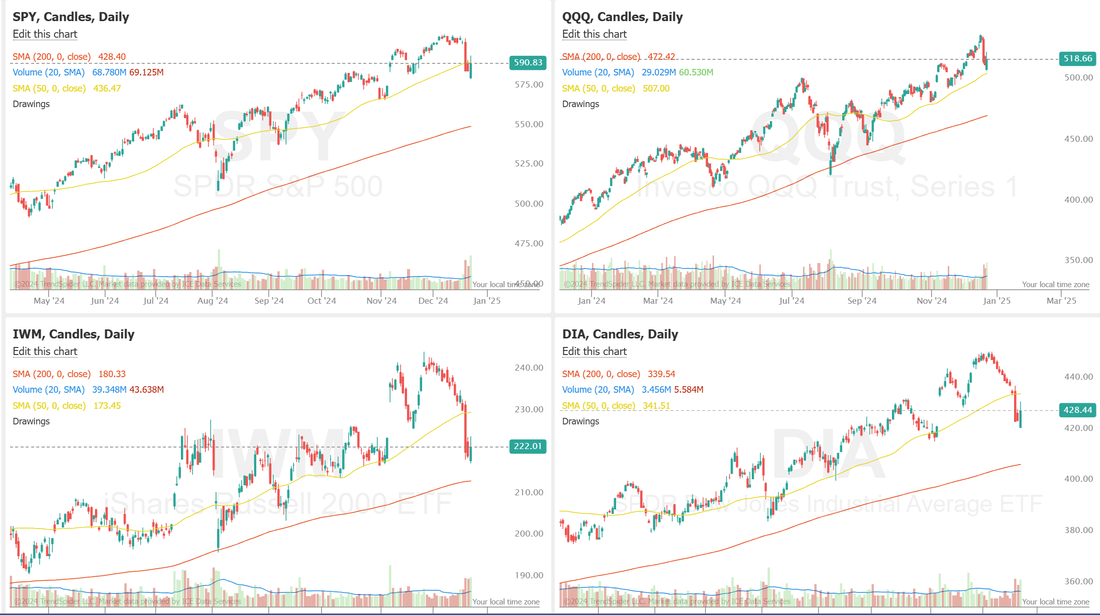

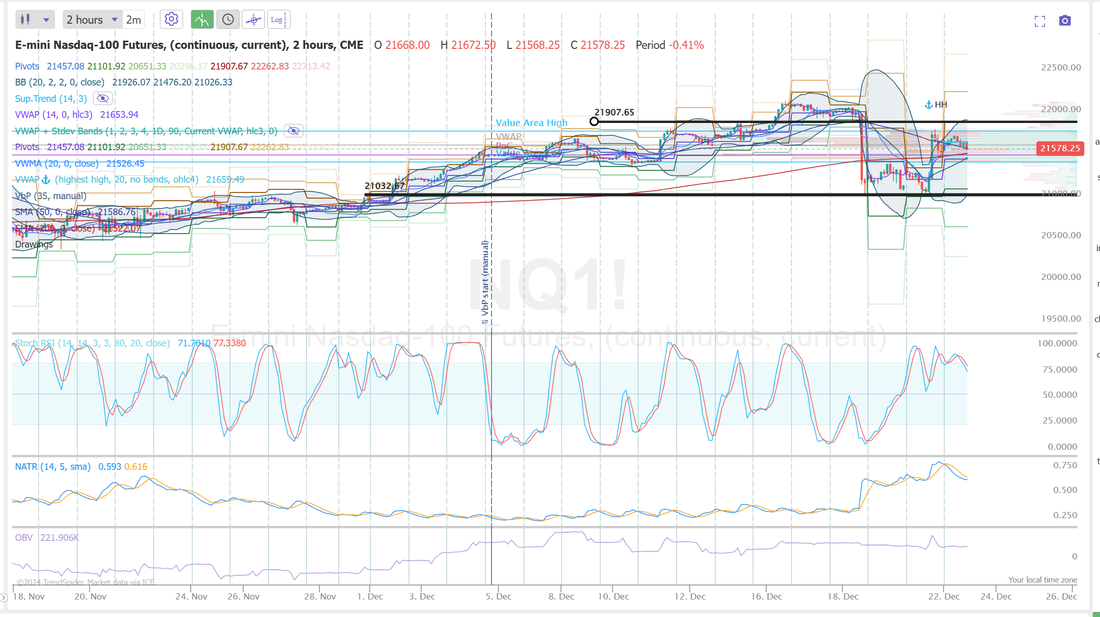

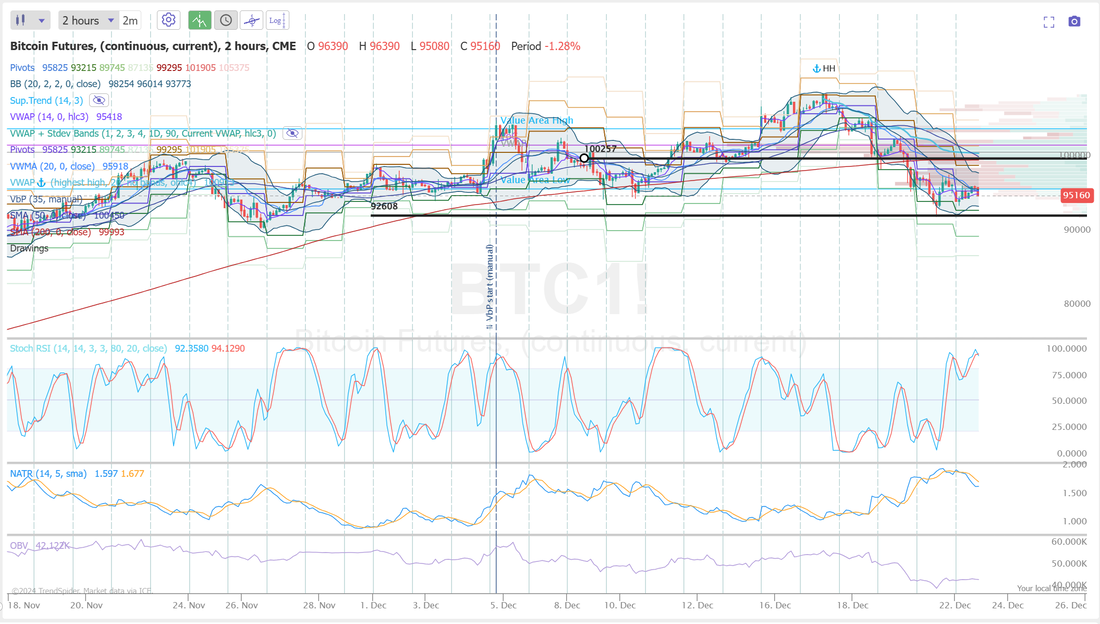

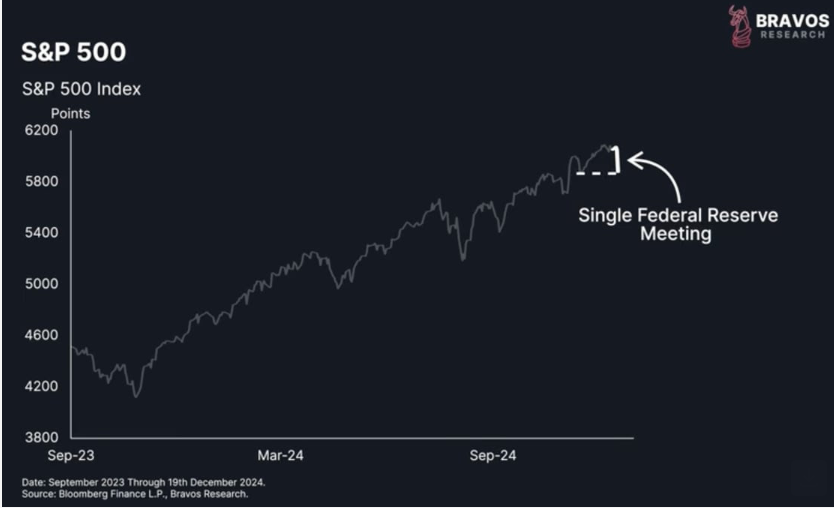

Good morning traders! Welcome back to a holiday shortened trading week. I hope everyone is set for Christmas. Markets are closed Weds.but we'll be trading Thurs. and Fri. They can be light volume or heavy volume, depending on price action. I feel like we are at a possible turning point or inflextion point in the markets. Here's some data from the great Bravos research. The US stock market just erased 2 months of gains in a single day, dropping 3% after the Federal Reserve meeting. In just 1 hour, Fed Chairman Jerome Powell managed to kill all the market's built-up complacency and greed.  This correction's speed is particularly noteworthy. Looking back over recent years, such rapid declines often spark comparisons to the 2022 bear market. Our results from last Friday were mixed with some positives. We close out our BWB and BF on SPX at a loss. Down -$4,200 which was not what we wanted but, we did bring in a substantial amount of income off of those over the past week. The bright spot was our 1HTE's on Bitcoin. 5 trades. 4 wins/ 1 loss for a total of just under $1,300 of income for the day. It will likely take a few months of trading these to find the most appropriate setups. We've already learned that, while you can trade it all day long, the first four hours are yielding us the best setups. We've yet to establish position sizing or income goals for this trade. We'll keep collecting data and update it on the website 1HTE.com as we aquire it. I believe there is a good chance we could generate $400 dollars a day consistently. This would be a nice add to our exsisting scalping program. Let's take a look at the markets: We start off the day with a neutral rating. These are tough days to predict so I won't! No bias or lean for me today other than to repeat...I wouldn't be surprised to see us rollover here and continue the downward, post- FOMC move. Neutral rated days don't usually last long before we get some directional bias back but in many ways todays rating makes a lot of sense. As you can see, all the indices we track and trade are now right back to previous consolidation zones. If we hung out here for a few days it would make sense. If we used this level as a spring board to go higher, I don't think anyone would be surprised and if we continued to roll over and head down I think we'd all say, "I saw that coming" so....neutral is an appropriate rating for today. The key question now is: how long will the selling persist? After a sharp and significant correction on Wednesday and Thursday, the markets saw a strong bounce on Friday, but it remains to be seen whether this is the start of a sustained recovery or just a temporary reprieve. Let’s take a closer look at the charts and assess how things are shaping up as we head into Christmas week. The SPY took the lightest hit this week, closing at $591.15 (–2.17%). After slicing through the 50-SMA on Wednesday, Thursday’s attempt to reclaim it hit a wall, and Friday’s sharp rebound stalled at the same level. Next week sets the stage for a showdown: a successful reclaim of the 50-SMA could keep buyers in the game, but failure might hand control back to sellers, with the 100-SMA at $573 squarely in sight. Though the QQQ took a bigger hit than the SPY, closing the week at $518.66 (-2.24%), its setup appears far more constructive. Despite the sharp correction, it never traded below the 50-SMA and ended the week with a strong close above this key level—signaling buyers remain firmly in control for now. IWM took the brunt of this week’s correction, filling the election gap and closing sharply lower at $221.92 (-4.79%). After breaking below both the 50-SMA and 100-SMA on Wednesday, Friday’s impressive rally still fell short of reclaiming either level—leaving price with plenty of ground to make up next week. One benefit to last weeks sell off is that I.V. has returned! It's not what it should be (IMHO) but, it's better than we've had as of late. Let's look at our intra-day levels for 0DTE. /ES: 6049 is new resistance with 5889 support. NQ: We've got a pretty wide range on Nasdaq which may not help us much today. 21,907 resistance with 21,032 support. BTC: Bitcoin has lost some of its mojo after the hawkish FED words last week. Back down below the ever important 100,000 mark. 100,256 is now resistance with 92,608 acting as support. /NG, /MNQ scalping, LEN?, LEVI, LRN, MRNA, FSLR, SHOP, PYPL, ODTE's, 1HTE's. No earnings trades for this whole week. We may have a shot at some Theta fairys however, if premium holds up. See you all in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |