|

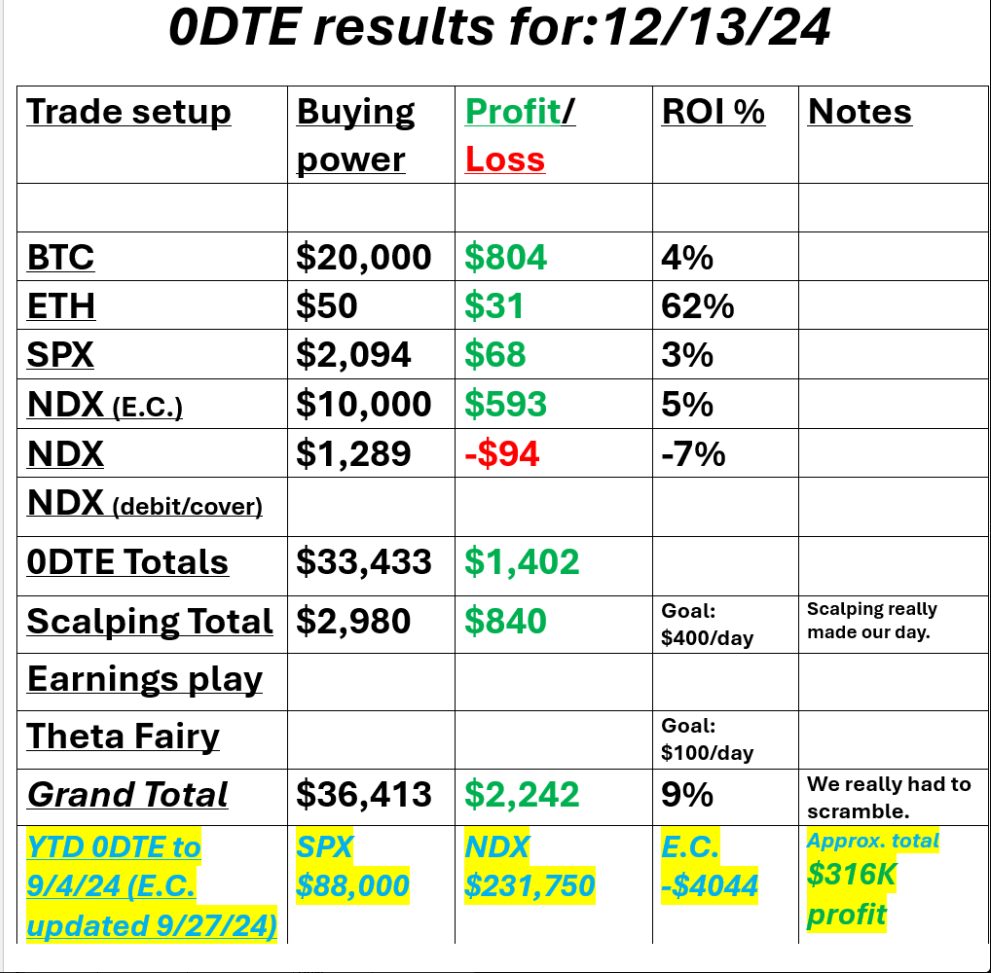

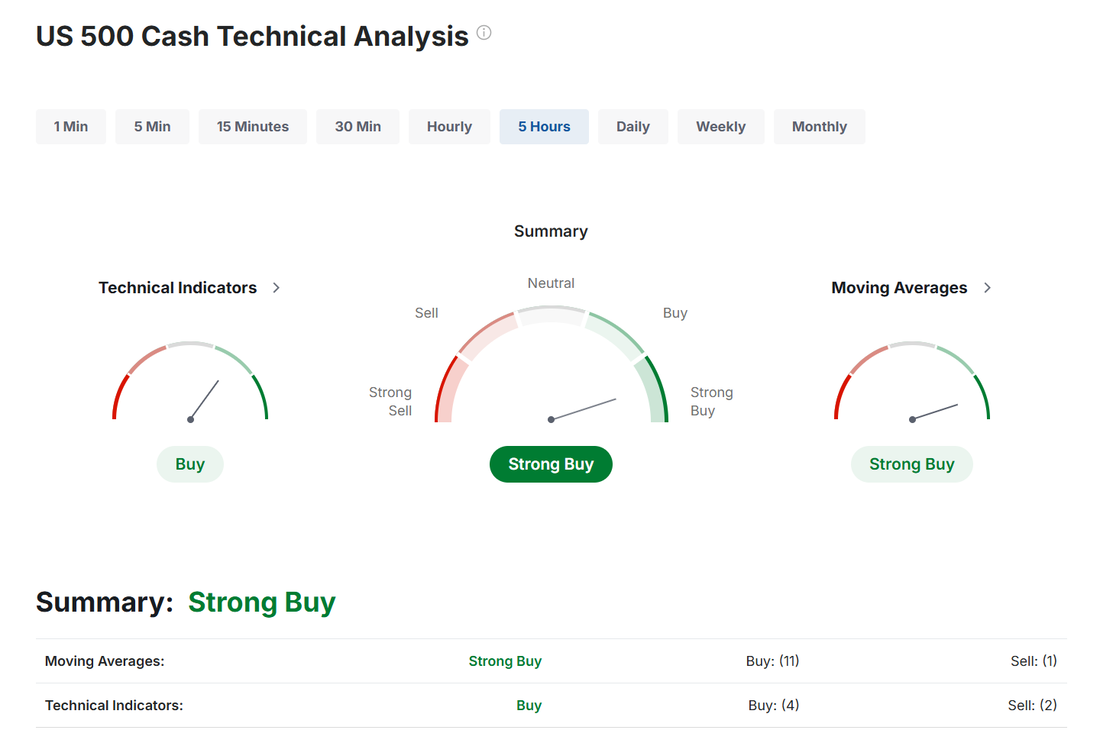

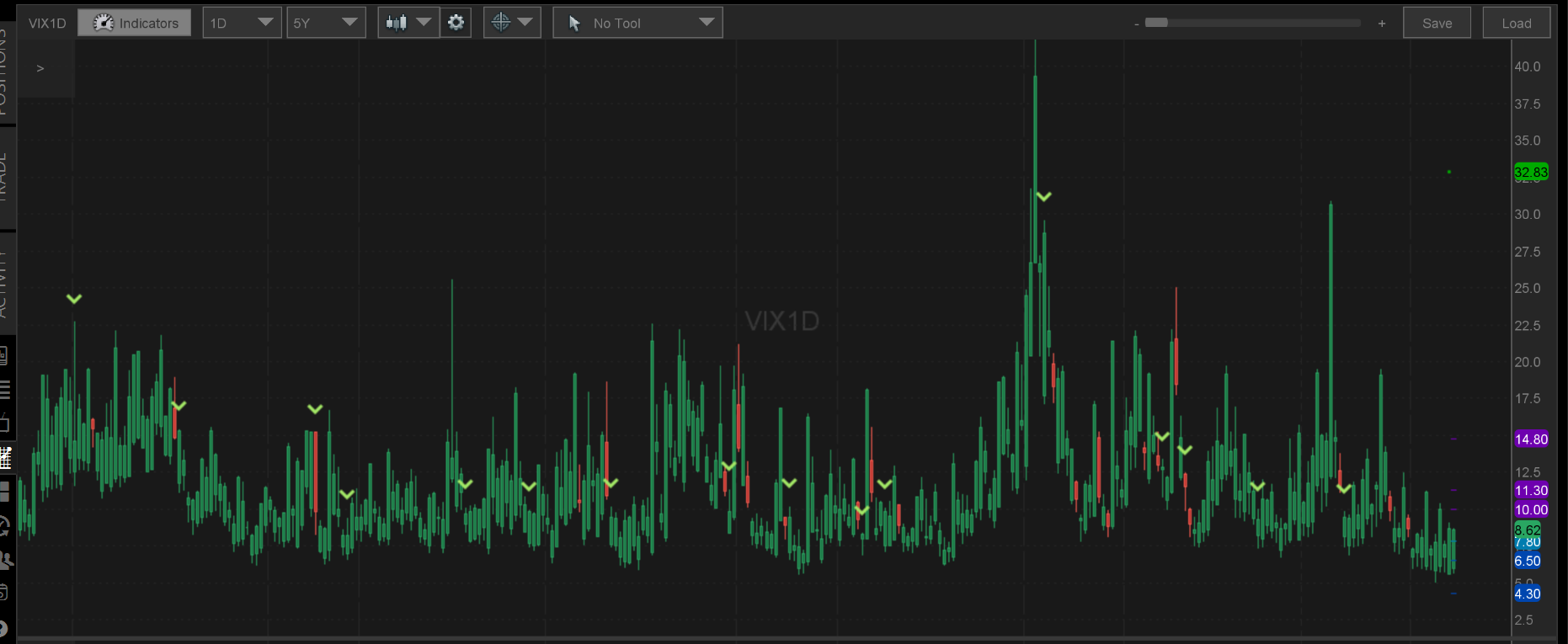

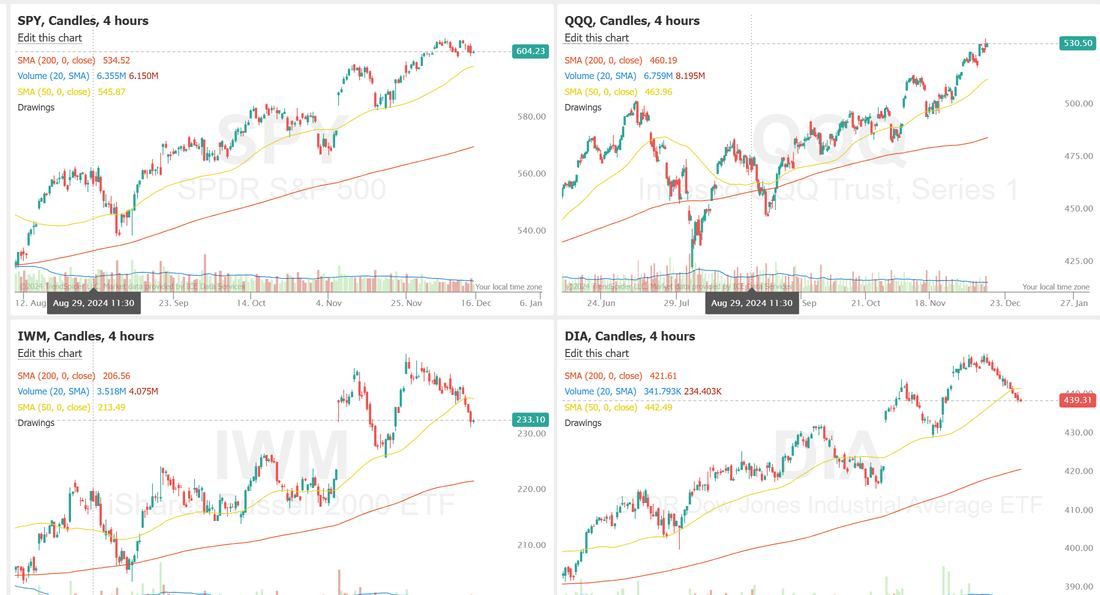

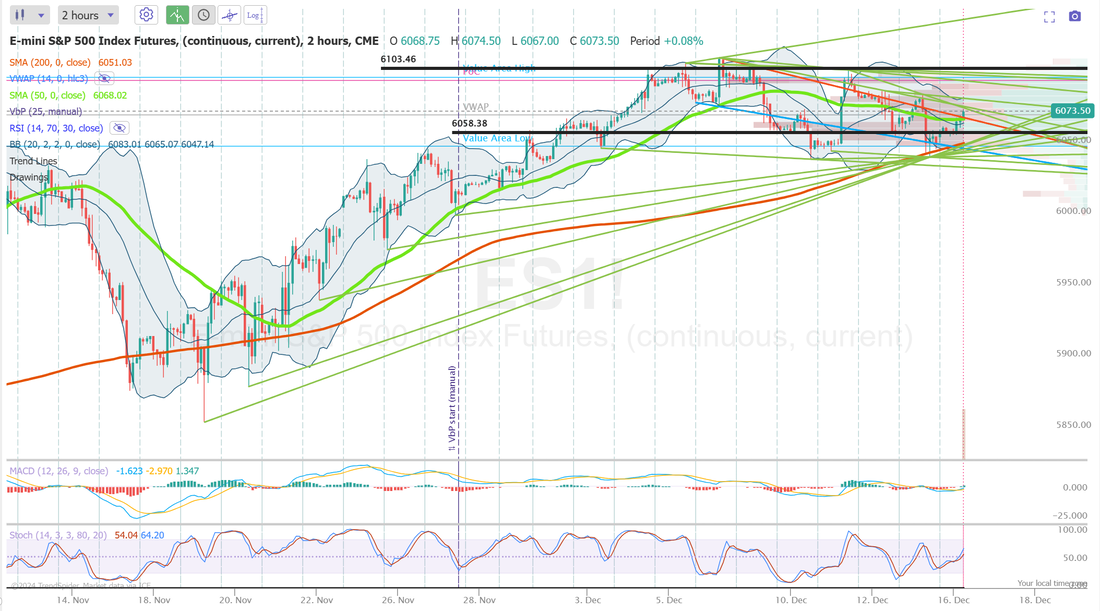

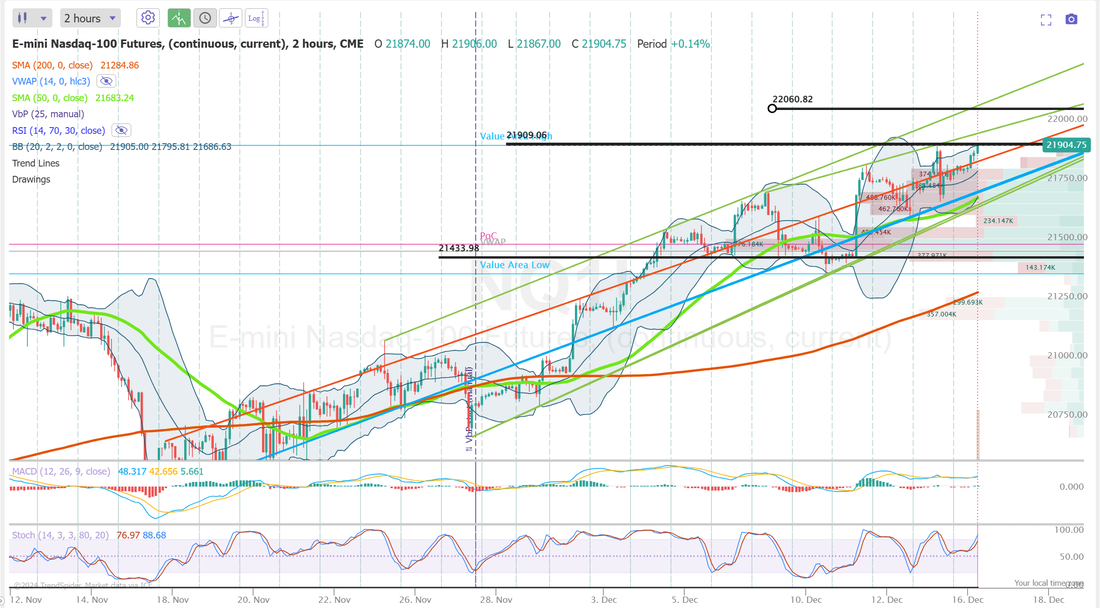

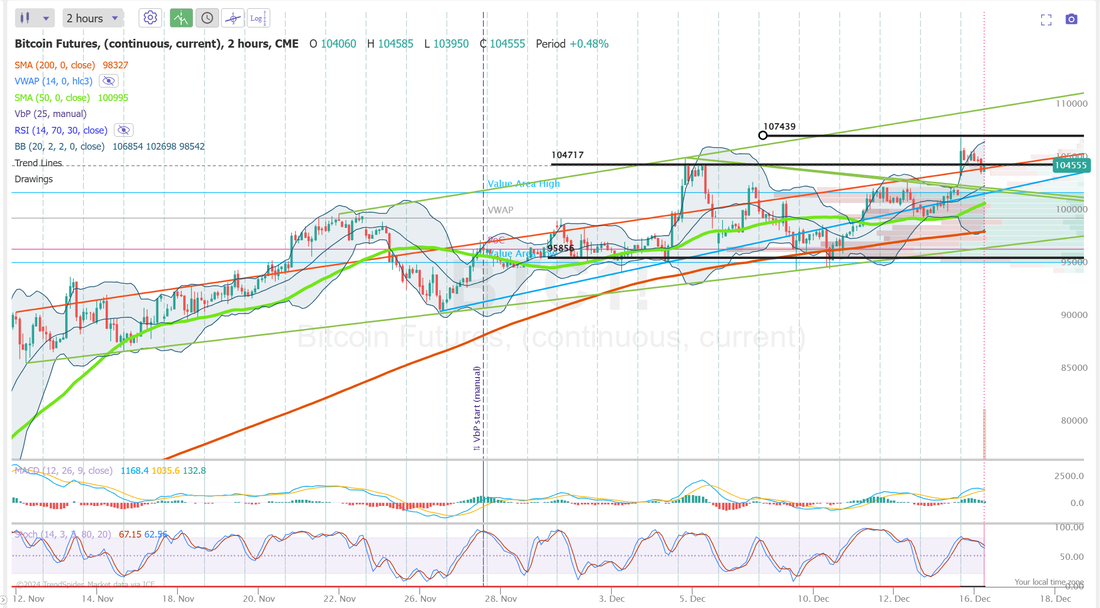

Welcome back traders! New week...same old low I.V.! That may change this week though. We had our extended family Christmas get together yesterday. The Christmas season is in full swing. I love this time of year. I hope you all have a wonderful holiday season. Let's take a look at our results from last Friday. On the surface, the numbers look good and "normal" for a successful day for us but oh man!...We had to stretch to get it done. If it weren't for scalping and the Event contracts we wouldn't have much to show. We've got FOMC coming up Weds. and that could just be the catalyst we need to get things moving again. Let's take a look at the markets as we start this new week. After recording some weakness for the first time in weeks, we get some strength to start off the week. This week brings the highly anticipated FOMC meeting, with the markets currently pricing in a 97% probability of a 25 basis point rate cut. The question remains: will this be sufficient to revitalize the underperforming indexes, or are we poised for a deeper market downturn? Let’s dig into the charts and see where things ended up. The SPY continued to show signs of weakness, failing to put in a new high on Wednesday and closing the week lower, at $604.21 (–0.60%). With the GoNoGo Squeeze oscillator at the zero line and the next horizontal support level just below, bulls will be hoping for price stabilization in the coming sessions. A break below the zero line, coupled with a loss of the horizontal support, would signal a significant shift in momentum and the potential for a more pronounced downside correction. The QQQ took the lead again this week, but only closing slightly higher at $530.53 (+0.76%). In comparison to its peers, the chart appears notably more constructive, with the GoNoGo Squeeze oscillator line well above the zero level and the price comfortably above the nearest horizontal support level. The index’s reaction to next week’s FOMC decision could provide significant insight into the overall market’s resilience as we head into the final weeks of the year. Unfortunately for small-cap bulls, IWM was yet again the weakest index of the group, closing notably lower at $233.07 (-2.47%). The orange grid on the GoNoGo Squeeze indicator has now hit the max compression reading, suggesting that the next move will be a powerful one. With this in mind, keep an eye on the blue oscillator line, as the direction it breaks will be a strong indication of where price is headed next. If that move is lower, all eyes will be on the summer highs, around $225. Let's take a look at the expected moves for the week. The expected move in the SPY is still almost 40% lower than we would like for selling options. The QQQ's are better. We may focus our 0DTE's today on the NDX instead of the SPX. Once I.V. pops above 14 the selling of options should carry a viable risk/reward. That's not happening today! Our trade docket today is fairly light for a Monday. It will pick up Weds. with FOMC release. MRNA, /NG, PLTR, /MCL, /ZN?, 0DTE's. We've also got eight potential earnings trade setups this week. My lean or bias is bullish today. The trend is your freind, until it isn't. Right now that's up for the SPX and NDX. There is however, a divergence in the major indices with the DIA and IWM continuing to roll over. While our major focus is on the SPX and NDX, keep an eye on the DIA and IWM. If they continue to roll over from here they could build enough momentum to drag everything else with them. Let's take a look at our intra-day levels. Today may be another day like Friday where we really need the Event contracts to pull their weight. /ES: We continue to be stuck in the same chop zone. 6103 is resistance with 6058 still acting as support. It's weak support but support, nonetheless. /NQ: The Nasdaq has shown some incredible strength lately. We are pushing on the closest resistance of 21909 as we speak. The next resistance is up at 22060. Support continues to be 21434. BTC: Bitcoin popped to another ATH. Will it hold or retrace? 104,717 is the resistance area its hovering around right now. 107,439 is next. Support is down at 98,388. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |