|

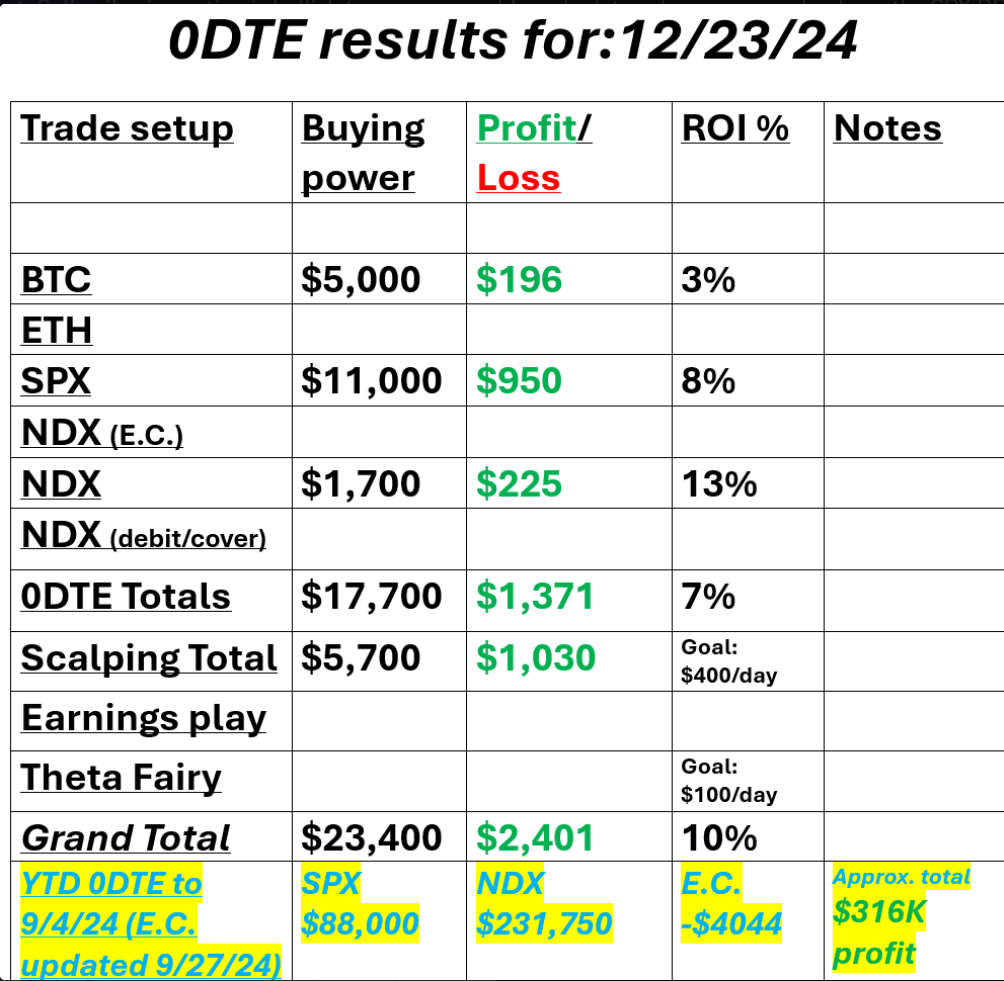

Welcome back traders! Merry and Happy Christmas eve! We had a solid day yesterday with everything clicking. See our results below: We have a shortened trading session today before the Holiday break so todays blog will be short and sweet. /MNQ scalping, /NG, LEN?, LRN?, NUKK, SPX 0DTE only and 1HTE BTC March S&P 500 E-Mini futures (ESH25) are up +0.14%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.18% this morning ahead of a holiday-shortened pre-Christmas trading session. The U.S. stock markets will close early at 1 p.m. Eastern Time today and remain closed on Wednesday in observance of the Christmas holiday. In yesterday’s trading session, Wall Street’s main stock indexes ended higher. Qualcomm (QCOM) rose over +3% after a U.S. federal jury ruled that the company’s central processors are properly licensed under its agreement with Arm Holdings. Also, chip stocks advanced, with GlobalFoundries (GFS) and Broadcom (AVGO) climbing more than +5%. In addition, Eli Lilly (LLY) gained over +3% after the FDA approved the company’s weight-loss drug Zepbound for moderate-to-severe obstructive sleep apnea in adults with obesity. On the bearish side, Walmart (WMT) dropped more than -2% and was the top percentage loser on the Dow after the Consumer Financial Protection Bureau filed a lawsuit against the retail giant and financial technology firm Branch for allegedly “taking advantage” of over one million delivery drivers. Economic data released on Monday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to 104.7 in December, weaker than expectations of 112.9. Also, U.S. November durable goods orders slipped -1.1% m/m, weaker than expectations of -0.3% m/m, while core durable goods orders, which exclude transportation, fell -0.1% m/m, weaker than expectations of +0.3% m/m. In addition, U.S. new home sales rose +5.9% m/m to 664K in November, just below the consensus estimate of 666K. “The economic outlook is deteriorating,” said Neil Dutta at Renaissance Macro Research. “This was true before the Fed’s December confab and remains true after. The risk of the Fed flip-flopping is quite high.” Meanwhile, U.S. rate futures have priced in a 91.4% chance of no rate change and an 8.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Today, investors will focus on the U.S. Richmond Fed Manufacturing Index, which is set to be released in a couple of hours. Economists estimate this figure to come in at -10 in December, compared to last month’s value of -14. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.594%, down -0.11%. Simple day today with just a few hours of opportunity. I hope you all have a great Christmas. See you all Thursday.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |