|

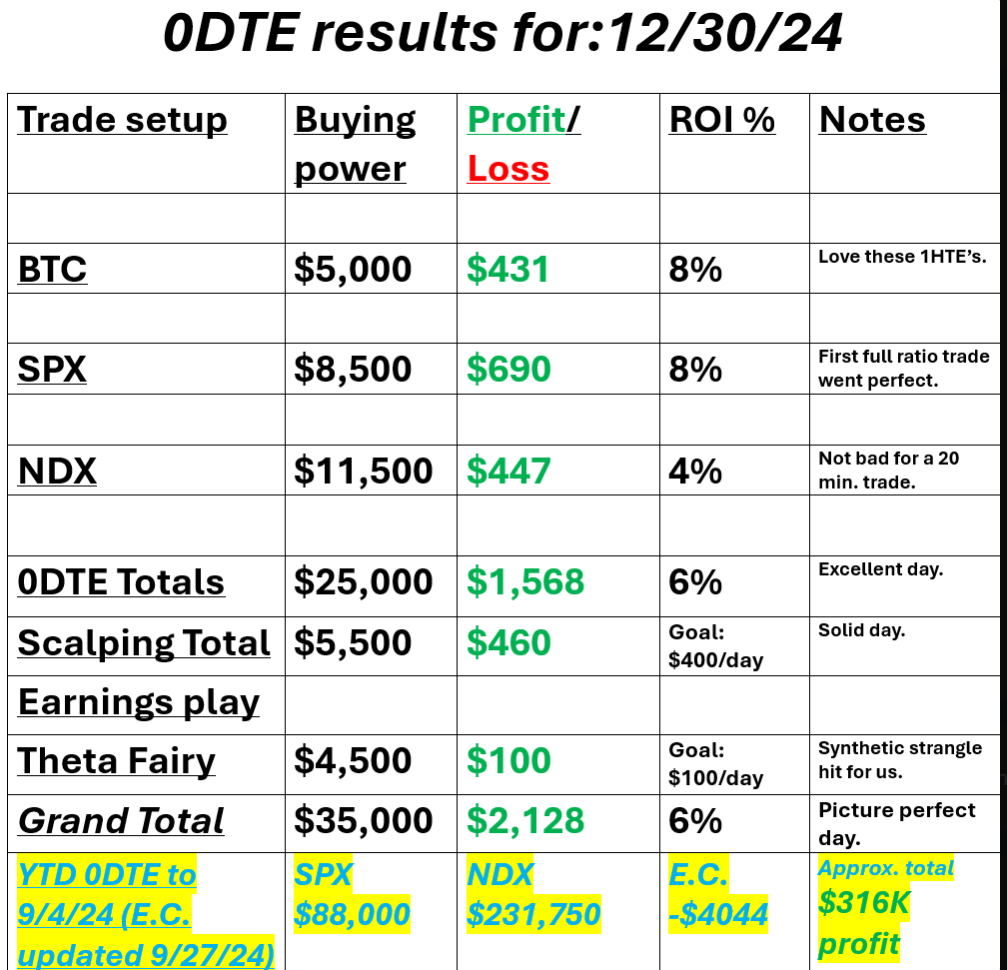

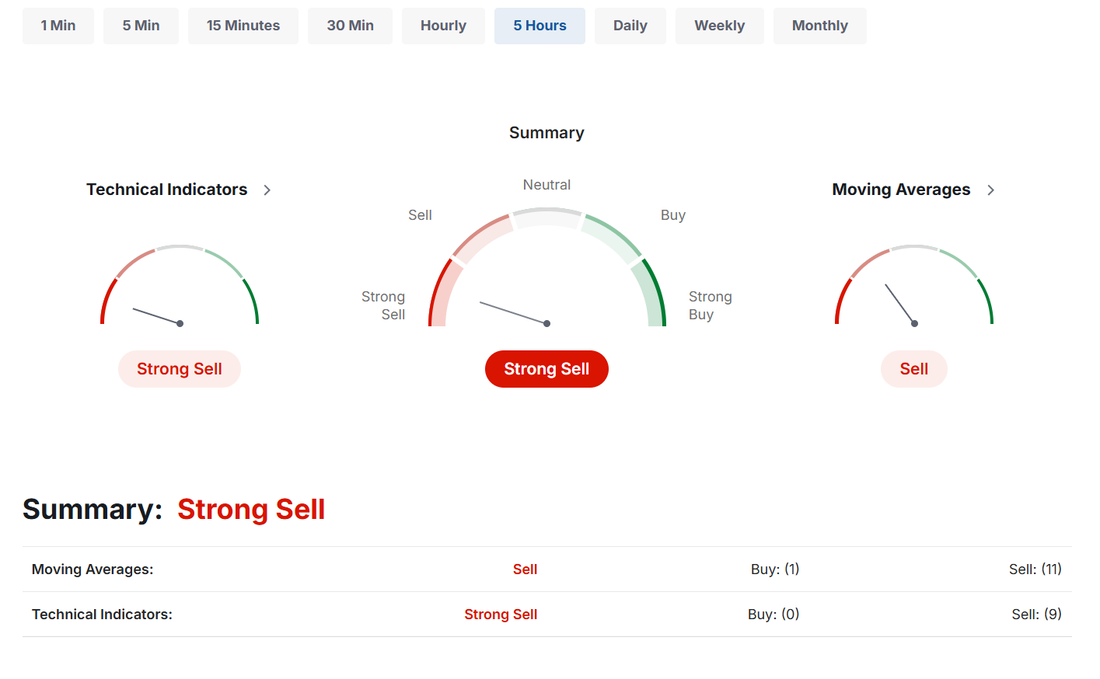

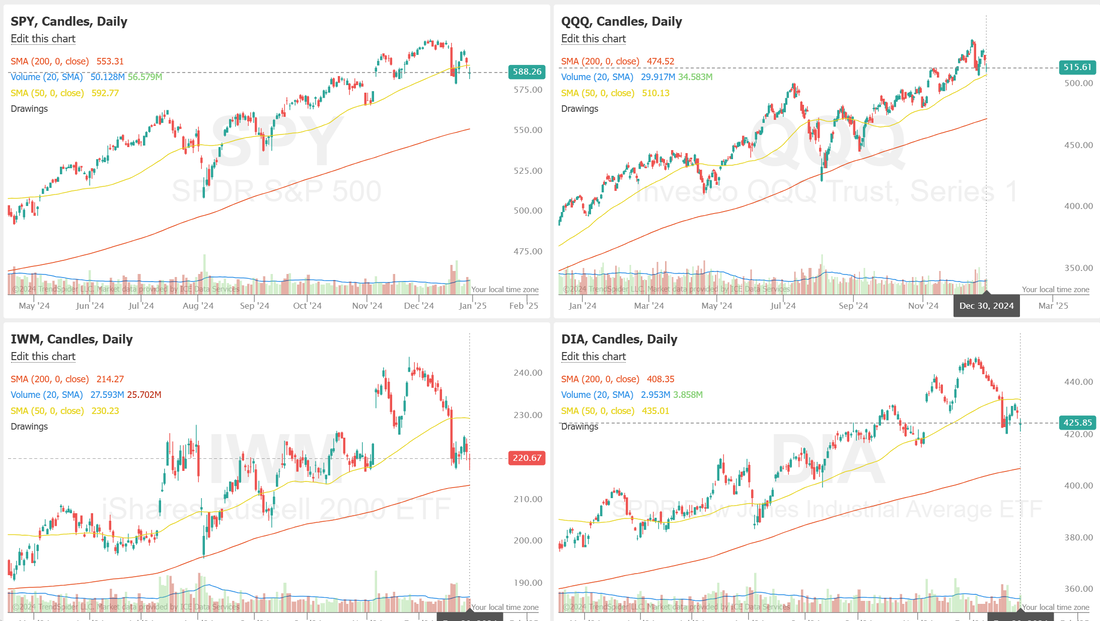

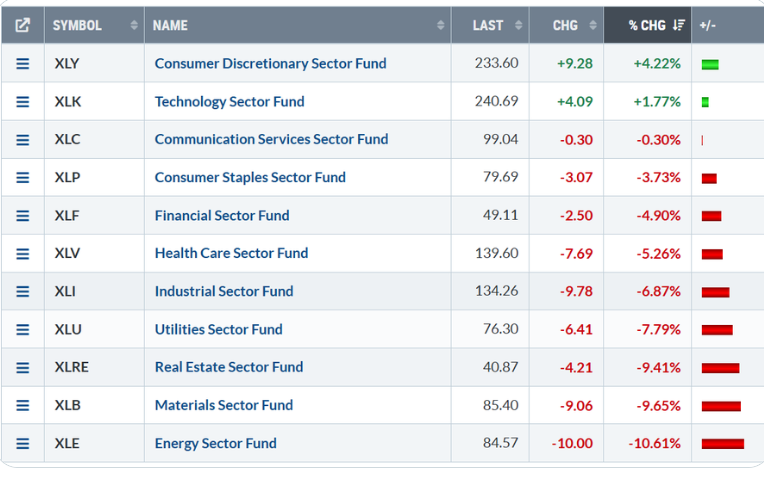

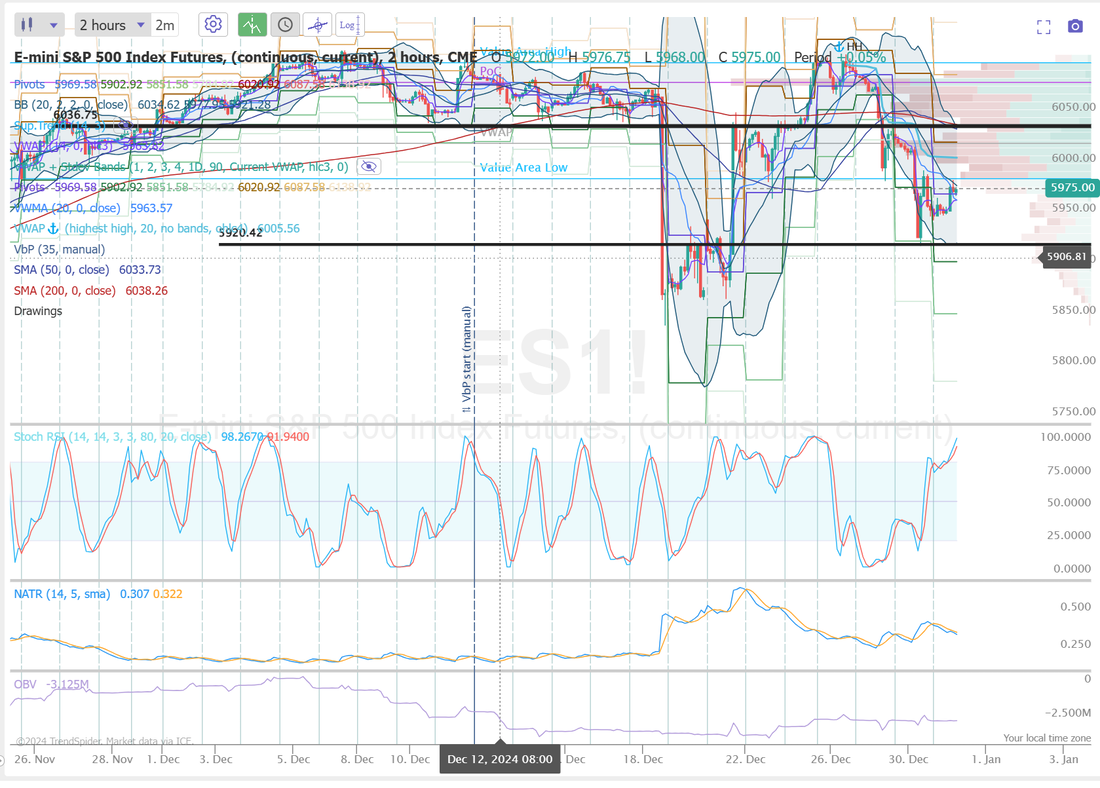

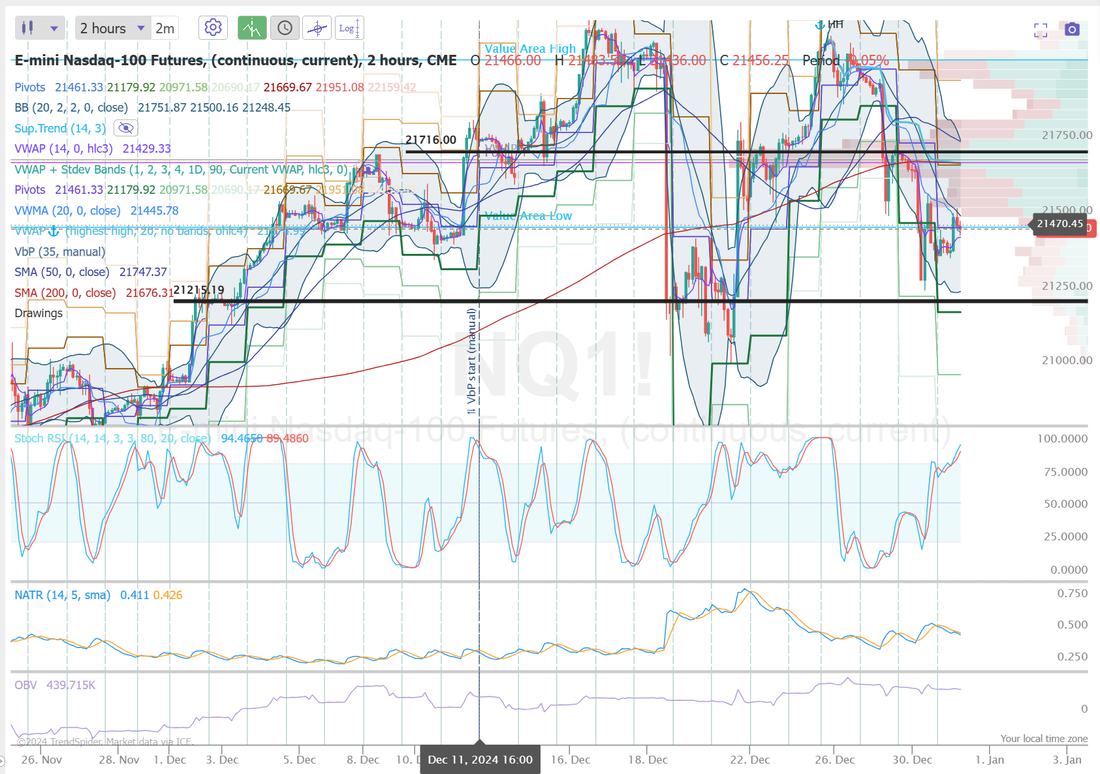

Welcome to the last trading day of the year! Happy New year! We talked about goals in our zoom yesterday and I put out a quarter million dollar goal for our day trade results for next year. We'll be tracking our progress here in the blog on a daily and monthly basis. We have put on some modified ratio 0DTE trades over the past week but yesterday was probably the first "offical day" setup. It performed as expected. Super high P.O.P. of 95%+. Low stress, Low work requirement. High consistency. The rest of this week is very low volume and I'll also be up in the mountians with my family until next Monday with limited internet. That means no Zoom feed on Thurs. but we'll be trading both Thurs. and Friday with a primary focus on the 0DTE ratio trades and the 1HTE Bitcoin setups. Take a look at our results from yesterday. I'm thrilled with how things went. Let's take a look at the markets. Sell mode is still got a firm grip on the market. Yesterday was a strange day but maybe typical of the holiday week. Low volume and erradic moves. We started the day with a big selloff and worked to climb back all day. Our levels held perfectly and it made for an easy day. My lean of bias for today is still slightly bearish. We are back down to some decent support levels but the pressure still seems down. March S&P 500 E-Mini futures (ESH25) are up +0.26%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.30% this morning, pointing to a positive start on Wall Street in the final trading session of 2024. In yesterday’s trading session, Wall Street’s main stock indexes ended lower, with the benchmark S&P 500, the blue-chip Dow, and the tech-heavy Nasdaq 100 falling to 1-week lows. Mega-cap technology stocks retreated, with Tesla (TSLA) dropping over -3% and Meta Platforms (META) sliding more than -1%. Also, chip stocks came under pressure, with Micron Technology (MU) and On Semiconductor (ON) slumping over -3%. In addition, MicroStrategy (MSTR) plunged more than -8% and was the top percentage loser on the Nasdaq 100 after the company disclosed that it had bought 2,138 bitcoins for $209 million in the past week. On the bullish side, American Airlines (AAL) rose over +1% after Raymond James upgraded the stock to Outperform from Market Perform with a $24 price target. Economic data released on Monday showed that the U.S. Chicago PMI unexpectedly fell to a 7-month low of 36.9 in December, missing the 42.7 consensus. At the same time, U.S. November pending home sales climbed +2.2% m/m, stronger than expectations of +0.9% m/m. Meanwhile, the U.S. stock and bond markets will be closed on Wednesday for the New Year’s Day holiday. Also, the U.S. bond market will close early at 2 p.m. Eastern Time today for New Year’s Eve. Optimism about interest rate cuts, enhancements in corporate profitability due to artificial intelligence integration, and expectations that President-elect Donald Trump’s policies could stimulate economic growth have driven much of this year’s gains on Wall Street. The benchmark S&P 500 index has been in a bull market for over two years and is set to finish its second consecutive year with gains exceeding +20%. The blue-chip Dow and tech-heavy Nasdaq 100 indexes are poised to end 2024 higher by about +13% and +26%, respectively. “Investors are looking forward to two big things [next year]: whether Trump’s policies are going to be pro-growth or not, and if the Fed is going to continue injecting easy money into the system,” said Adam Sarhan, chief executive at 50 Park Investments. U.S. rate futures have priced in an 88.8% chance of no rate change and an 11.2% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Today, investors will focus on the U.S. S&P/CS HPI Composite - 20 n.s.a., which is set to be released in a couple of hours. Economists forecast this figure to be +4.1% y/y in October, compared to +4.6% y/y in September. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.521%, down -0.53%. Our trade docket for the rest of the week will be light and primarily focused on the 0DTE ratio trades and 1HTE Bitcoin setups. The goal of $1,000 a day in profits is the target for us going into 2025. Some days will be better...some days will be worse but that's the goal. 251 trading days in the year. Let's shoot for a $250,000 year. Todays focus: /ES (Theta fairy), /MNQ (Scalping) /NG, ODTE ratio trades, 1HTE Bitcoin setups. The S&P 500 is currently off -1.6% in December, but under the hood it's a bloodbath. I would bet we can count on one hand, maybe only a few fingers, the number of months where 6 or more sectors fell -5% or worse with the S&P 500 not even down -2%. $spy US equity funds saw a -$35.3 BILLION net outflow last week, the largest weekly outflow since December 2022. This is a sharp contrast to the ~$14 billion of weekly net INFLOWS seen since Fed interest rate cuts began. What does this mean as we head into 2025? Let's look at our key intra-day levels for todays setups: /ES: Our levels for today are exactly the same as yesterday. Our 5920 support held perfectly and 6036 remains resistance. Will 5920 be tested again today? /NQ: Also working the same levels as yesterday with 21716 resistance and 21215 working as support. BTC: Bitcoin gave us two nice setups yesterday. While resistance of 97,207 is the same as yesterday, it looks much more vunerable and with a little bullishness we could easily push to 99,000. 92,608 continues to look like a solid support and it's from that side of the trade that we will most likely trade today. We are getting closer to a take profit on our Theta fairy. That would be a nice start to our day. I'll see you all in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |