|

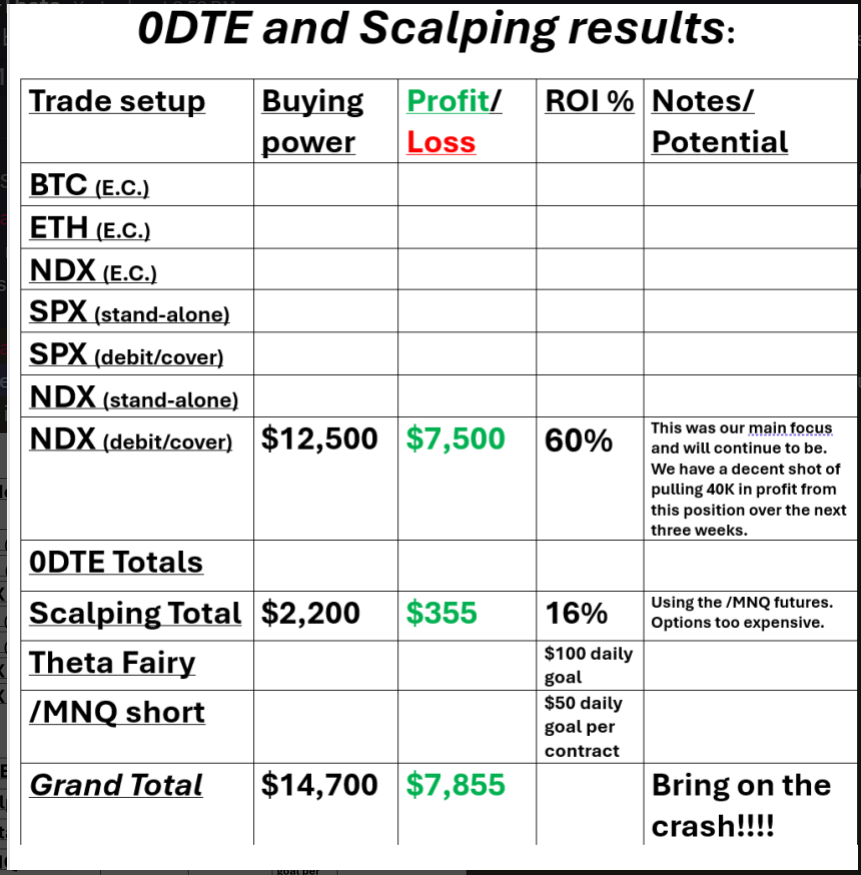

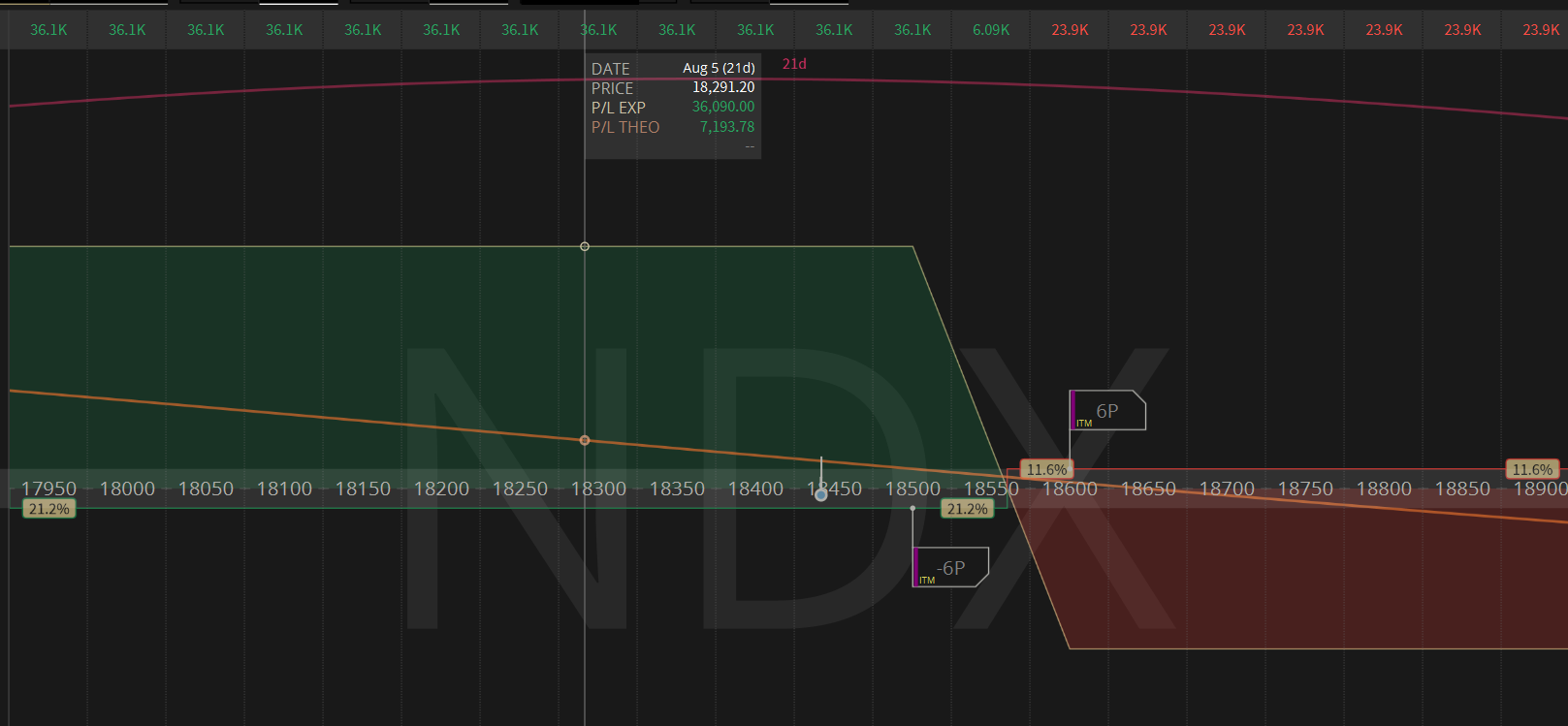

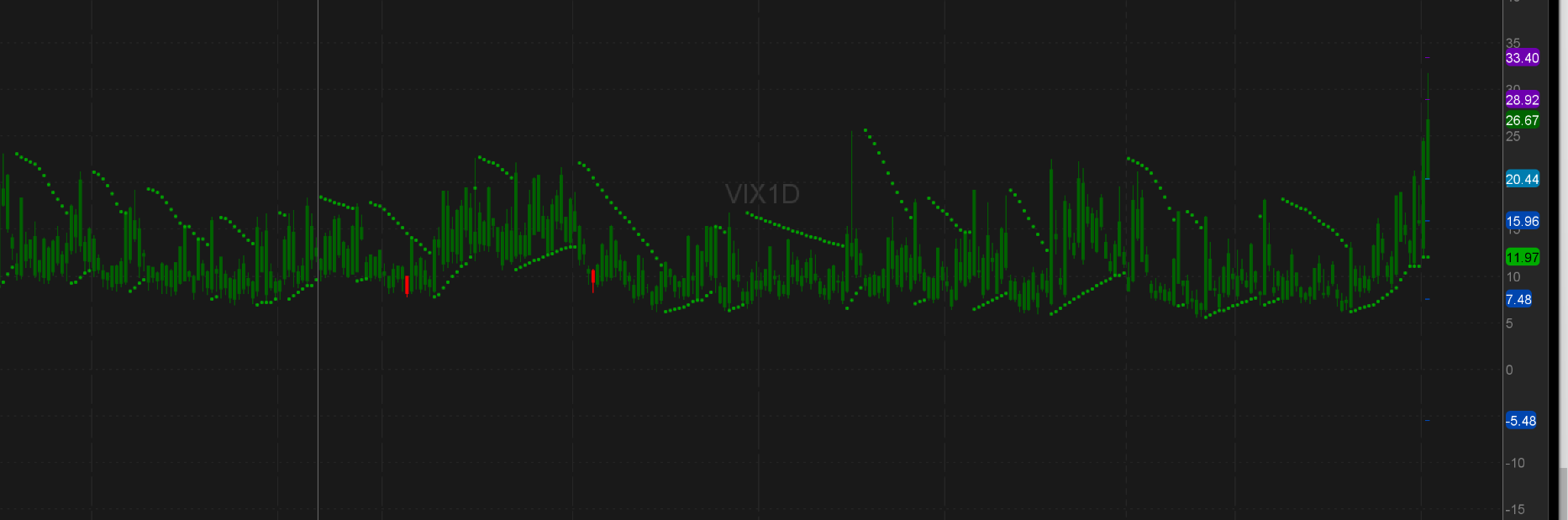

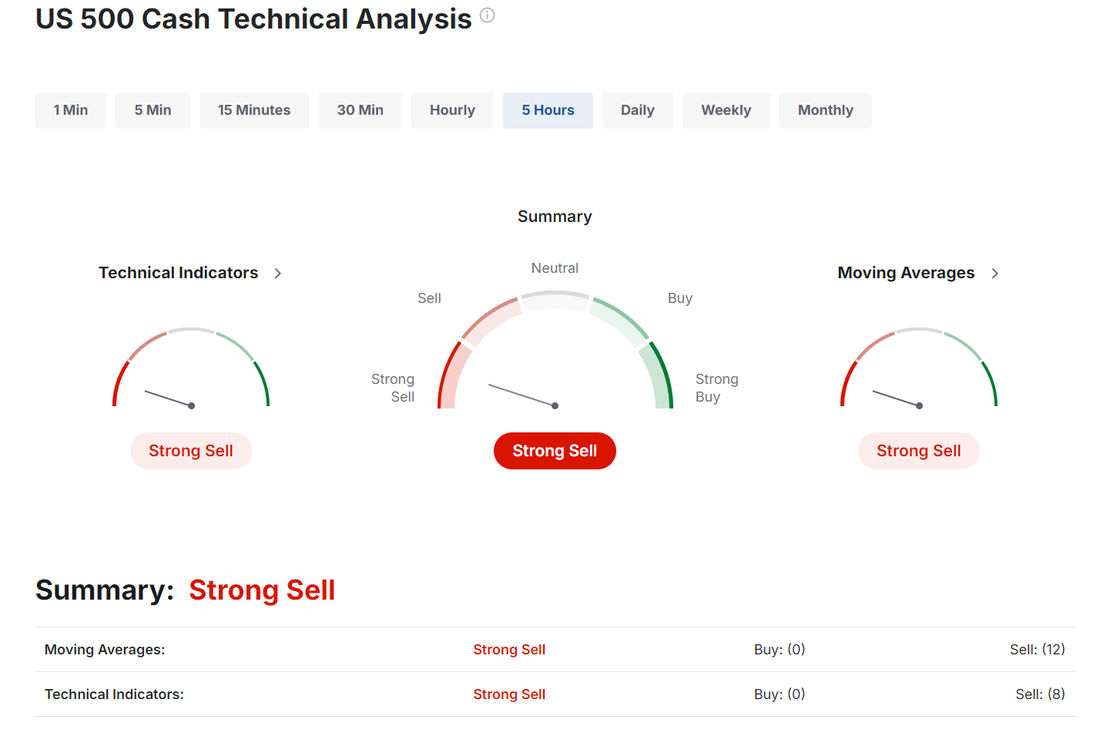

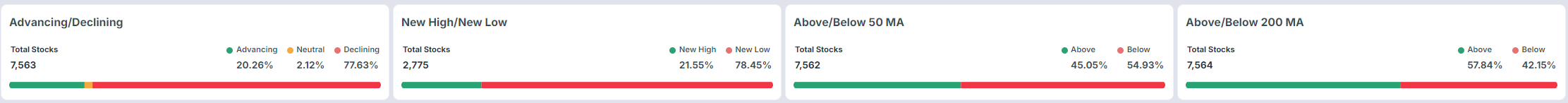

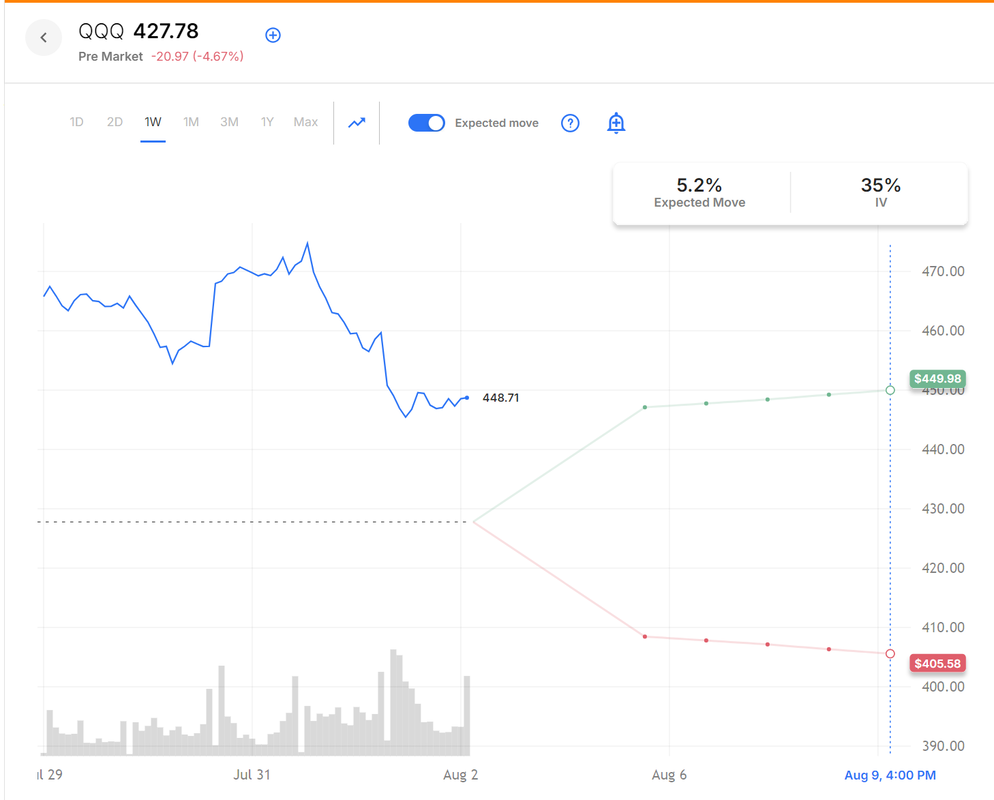

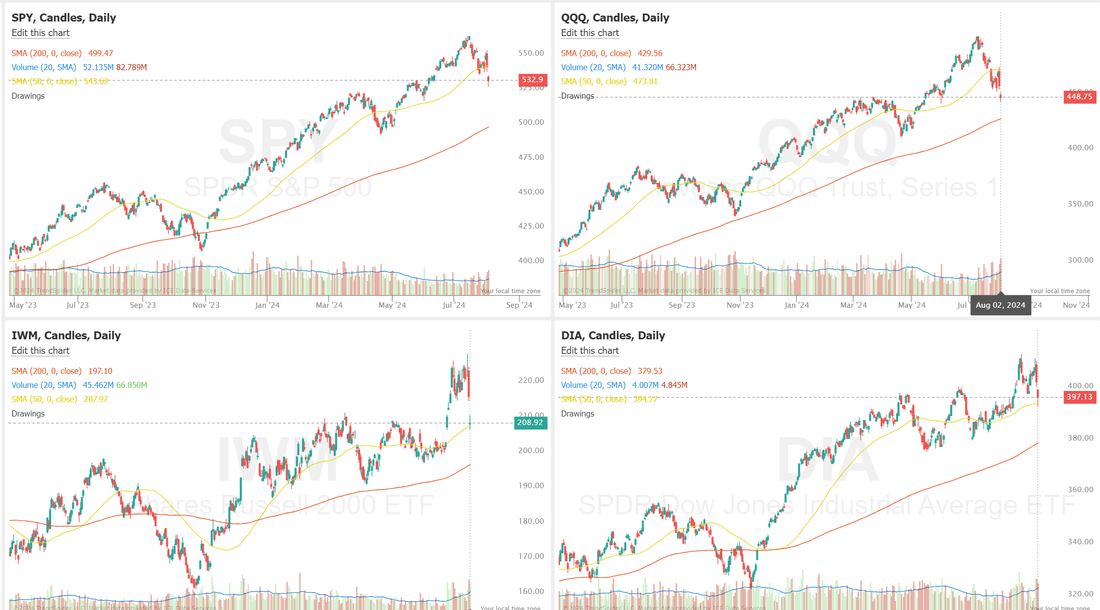

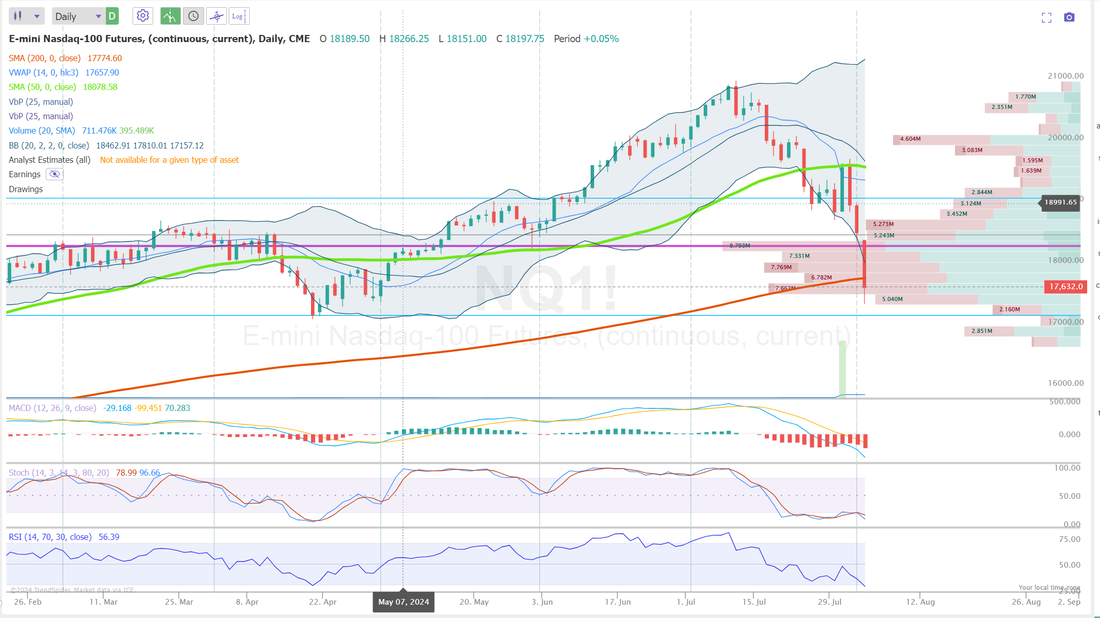

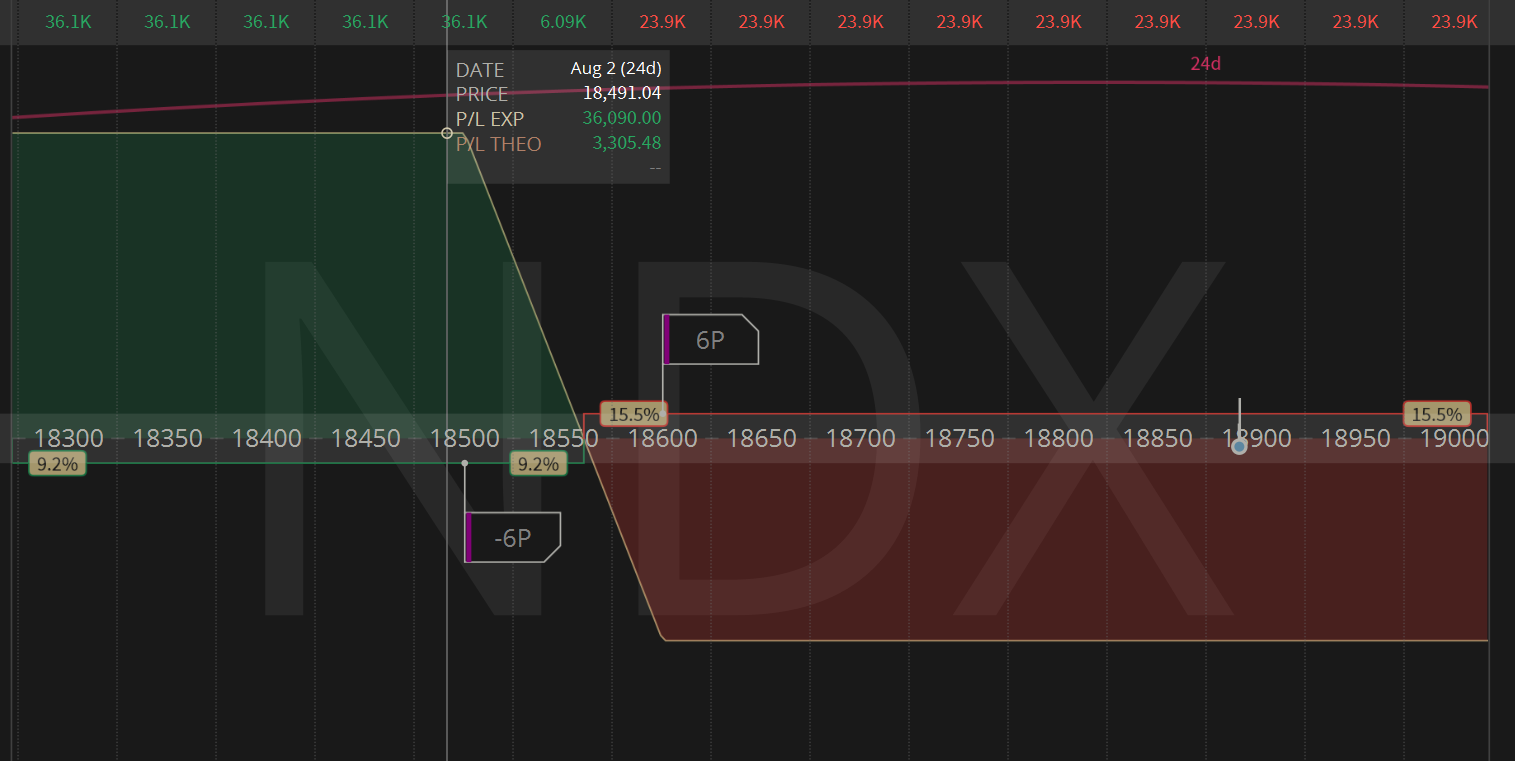

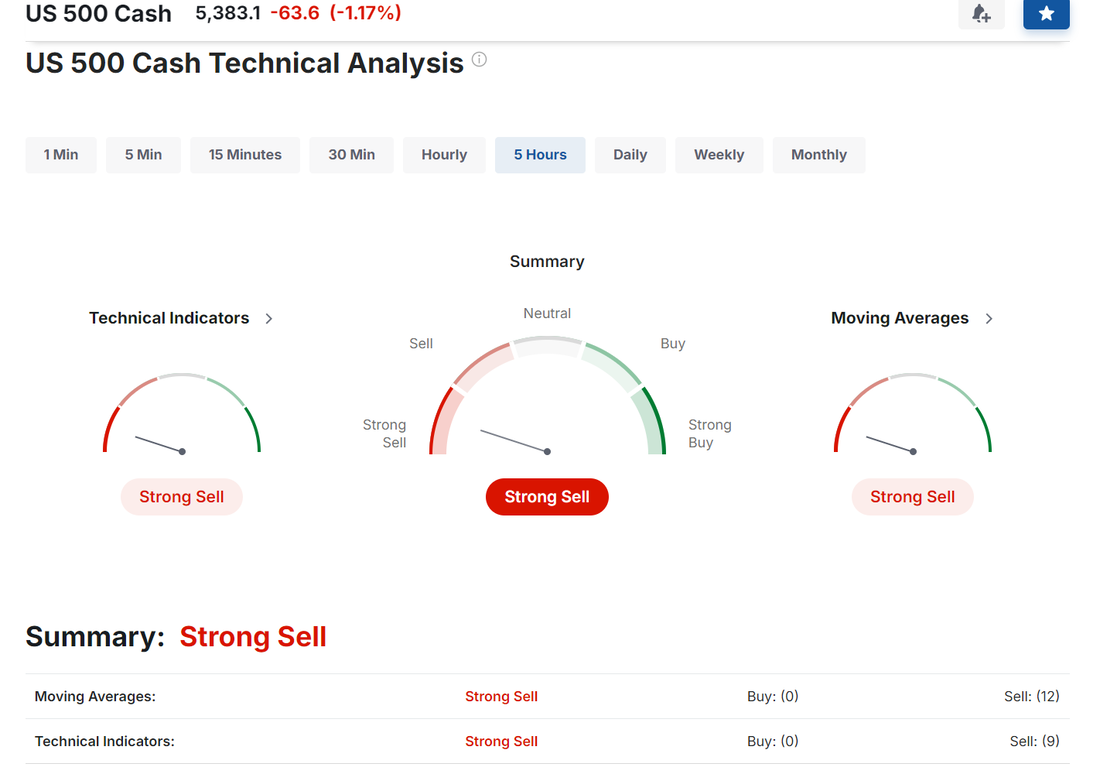

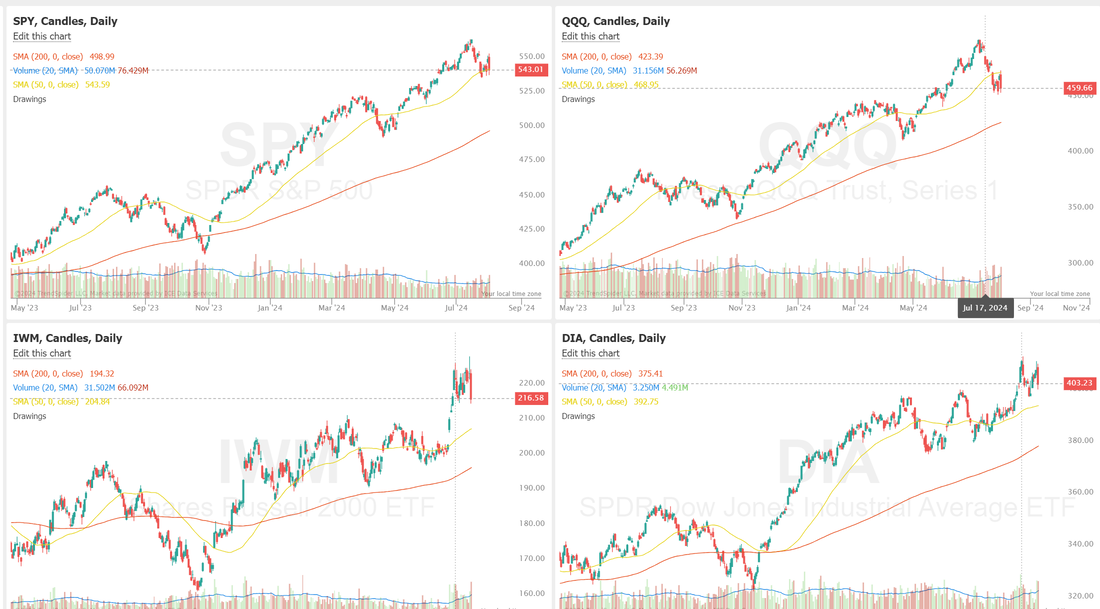

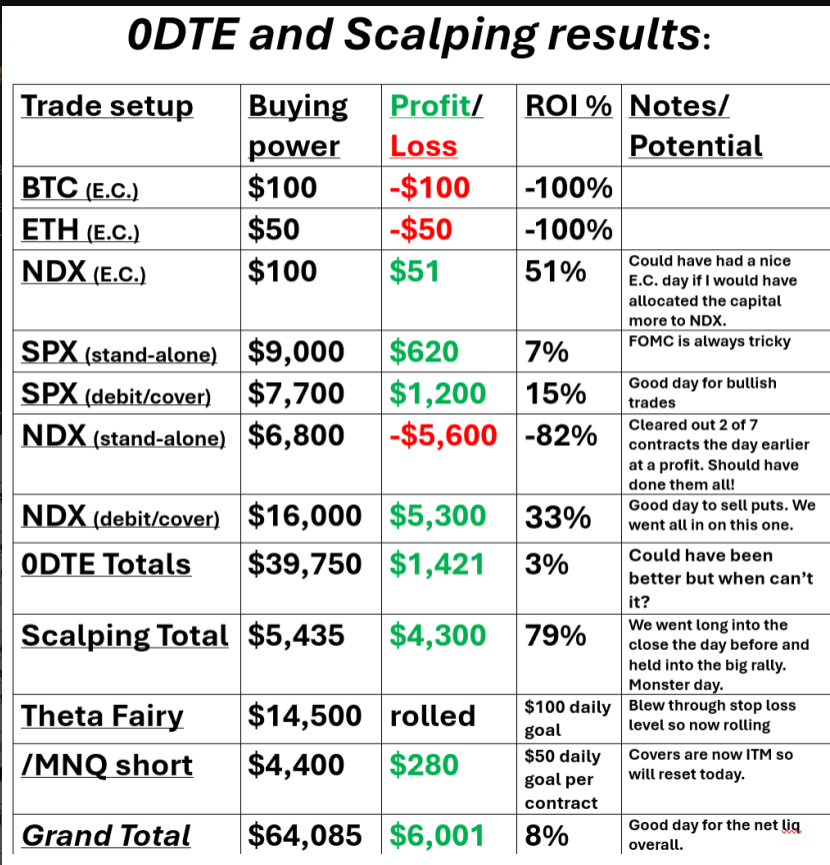

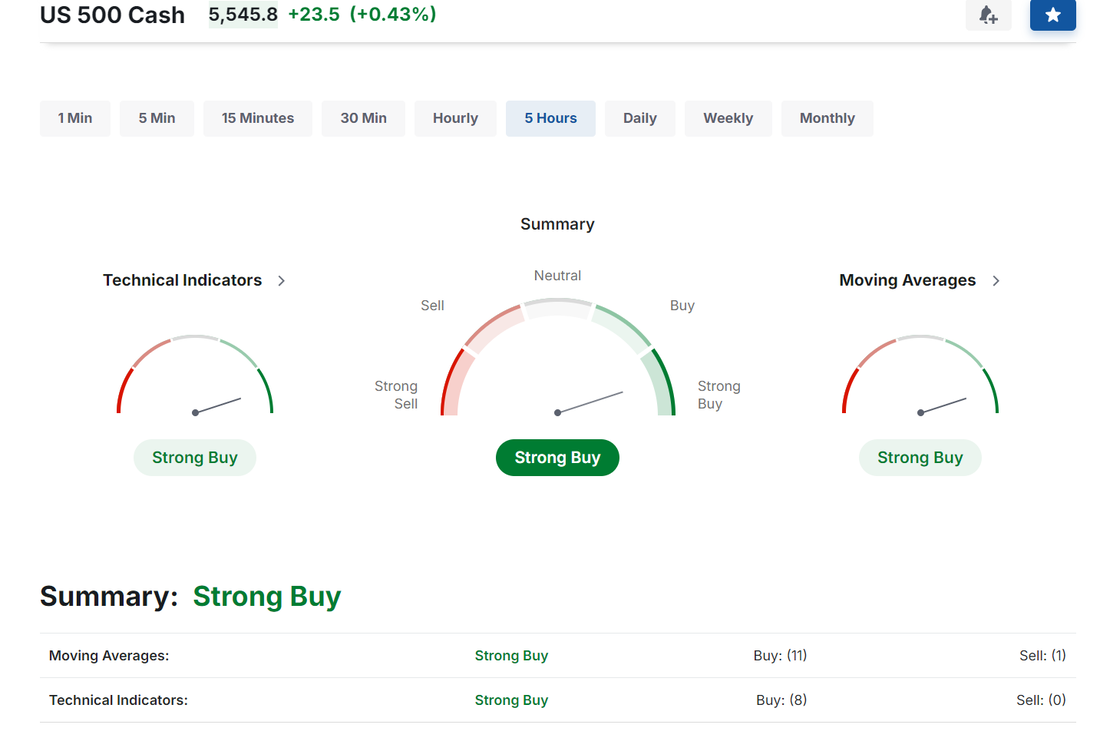

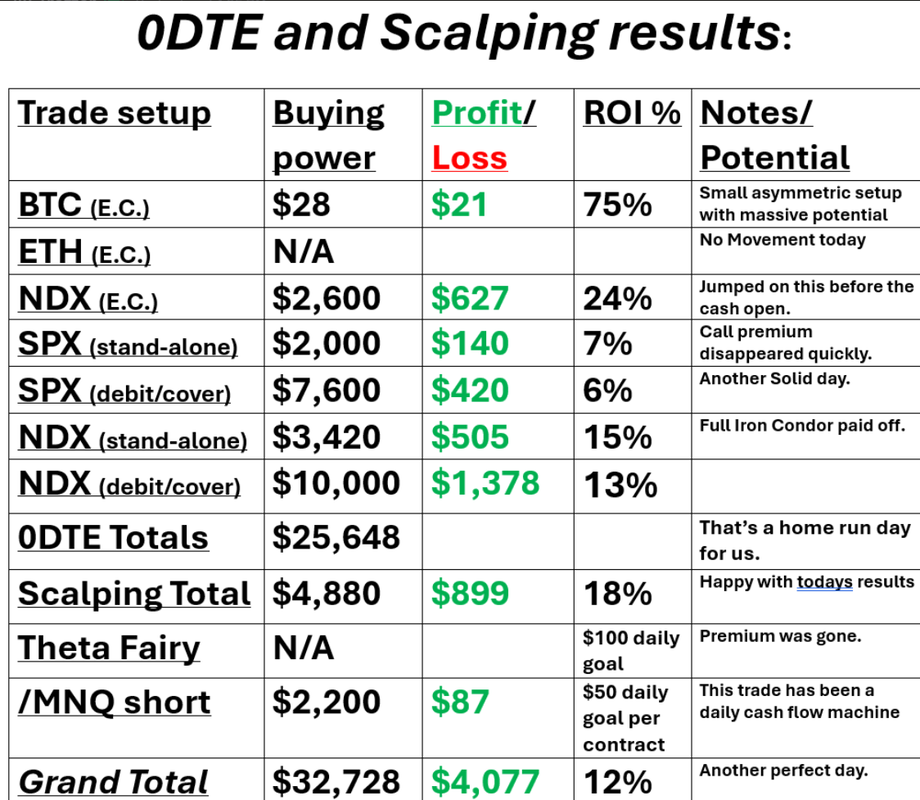

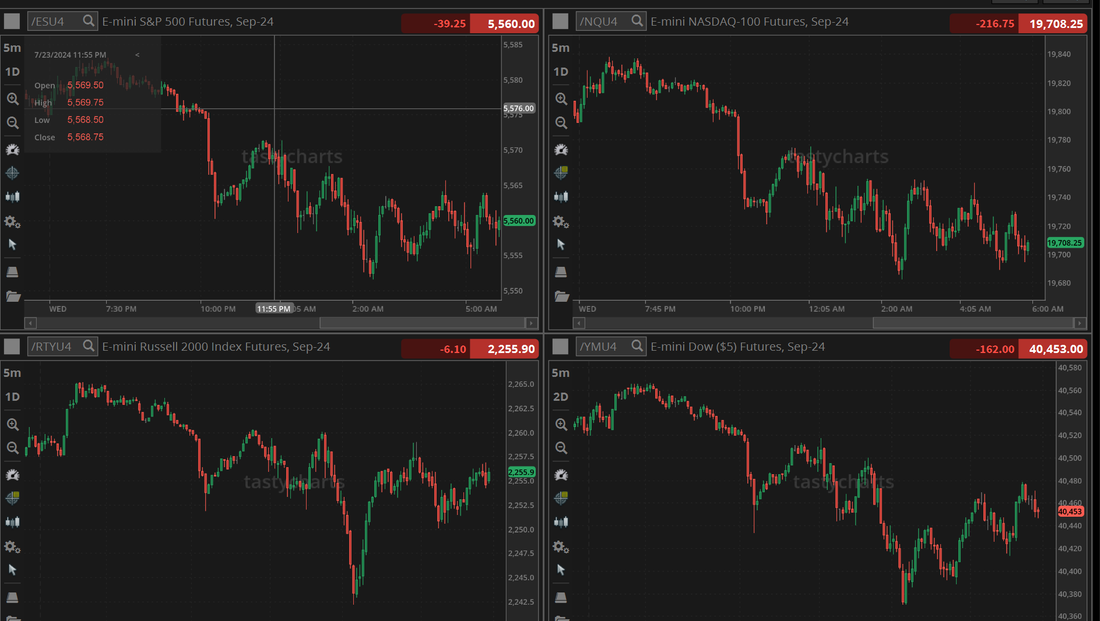

Welcome back traders! This coming week looks to be a huge potential gain for us! Something we've been setting up for a while now. More on that in a minute. Let's take a look at our past Friday results and see how that will continue to play out for us this week. We had an exceptional day on Friday. Now, there were a lot of traders who shorted on Friday and did well also but, I don't know many who had the setup we had. Risking $390 to make a potential $7,500 payoff. We've had plenty of $7,500 profit days but that usually involves deploying 50K+ of captial and taking much bigger risks. Folks, global markets are tanking. THIS IS WHEN IT MATTERS WHO YOU FOLLOW AND WHAT TRADES YOU DO. This is where a trade setup is laid bare for all to see. Is it a turd or a diamond? Late last week we talked about a potential market downturn. We loaded up on our NDX debit/0DTE setup. It had a pretty big payoff potential of $36,000 potential profit but it's the daily cash flow potential of over $7,000 dollar a day that's exciting! If you are trading with us you've seen up pull in our horns. Trim our market exposure. Load up on a bearish stance. Focus more closely on just one or two trades a day. That focus will continue for us today. No promises. No guarantees, of course but....I'd be dissapointed if we couldn't haul in $10,000 in premium today! Maybe we will. Maybe we won't but, that's certainly on the table today as a very real potential. Let's take a look at the markets. The one day VIX is soaring. This is the best premium we've seen all year! Be careful though. The premium skew is heavy! Puts are way more expensive than calls so if you're an option seller you're NOT going to get compensated as well on the call side. That means you need to sell puts but who wants to sell puts in front of this freight train? Well...we do! Our NDX debit is set up perfectly to take advantage of days like today. We've got three weeks left to work this trade daily with 0DTE's. Let's hope the market stays weak for the rest of this month! Technicals are obviously flashing bearish this morning. The market breadth is ugly we more stocks dipping below their 50DMA. 3.5% expected move this week on the SPY! 5.2% expected move for the QQQ's! This is what we've been waiting for folks! September S&P 500 E-Mini futures (ESU24) are down -2.48%, and September Nasdaq 100 E-Mini futures (NQU24) are down -4.10% this morning, extending last week’s losses as concerns intensified that the Federal Reserve is lagging in providing policy support for a slowing U.S. economy. The market turmoil is increasing expectations for an emergency policy response from the Fed. Traders are now assigning a 30% probability to a 25 basis point interest rate cut within a week. Sentiment was also dampened by news that Berkshire Hathaway Inc. had reduced its stake in Apple by nearly 50% as part of a significant selling spree in the second quarter. As a result, shares of Apple (AAPL) slumped over -7% in pre-market trading. In Friday’s trading session, Wall Street’s major averages ended in the red, with the benchmark S&P 500 plunging to an 8-week low, the tech-heavy Nasdaq 100 sliding to a 2-month low, and the blue-chip Dow dropping to a 3-week low. Intel (INTC) crashed over -26% and was the top percentage loser on all three major Wall Street averages after the semiconductor giant reported downbeat Q2 results, offered below-consensus Q3 guidance, and said it would cut over 15% of its workforce as well as suspend its dividend. Also, Amazon.com (AMZN) slumped more than -8% after the e-commerce and cloud giant reported weaker-than-expected Q2 revenue and issued disappointing Q3 guidance. In addition, Snap (SNAP) plummeted nearly -27% after the company reported weaker-than-anticipated Q2 revenue and provided gloomy Q3 adjusted EBITDA guidance. On the bullish side, Clorox (CLX) climbed over +7% and was the top percentage gainer on the S&P 500 after reporting better-than-expected Q4 adjusted EPS and offering a strong FY25 adjusted EPS forecast. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose by 114K jobs last month, significantly below the consensus estimate of 176K. Also, the U.S. July unemployment rate unexpectedly climbed to a 2-3/4 year high of 4.3%, weaker than expectations of no change at 4.1%. In addition, U.S. average hourly earnings came in at +0.2% m/m and +3.6% y/y in July, weaker than expectations of +0.3% m/m and +3.7% y/y. Finally, U.S. June factory orders fell -3.3% m/m, weaker than expectations of -2.7% m/m and the biggest decline in 4 years. “Bad news is no longer good news for stocks,” said John Lynch at Comerica Wealth Management. “Of course, we’re in a period of seasonal weakness, but sentiment is fragile given economic, political, and geopolitical developments. Pressure will escalate on the Federal Reserve.” Chicago Fed President Austan Goolsbee emphasized on Friday that the central bank will not overreact to any single report, noting that policymakers will receive a lot of data before the Fed’s next meeting. Goolsbee, speaking after the release of the weaker-than-expected employment report, stated that it is the Fed’s job to discern the “through line” of the data and proceed in a “steady” manner. However, “if unemployment is going to go up higher than the neutral rate, that is exactly the kind of pinching on the other side of the mandate that the law says the Fed has to think about and respond to,” Goolsbee said in an interview with Bloomberg Television’s Michael McKee and Sonali Basak. Meanwhile, U.S. rate futures have priced in a 4.5% probability of a 25 basis point rate cut and a 95.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. Second-quarter earnings season continues, and investors await new reports from notable companies this week, including The Walt Disney Company (DIS), Caterpillar (CAT), Eli Lilly (LLY), Palantir Technologies (PLTR), Gilead Sciences (GILD), CVS Health (CVS), Duke Energy (DUK), Occidental Petroleum (OXY), Realty Income (O), Shopify (SHOP), Uber Technologies (UBER), Paramount Global (PARA), Lucid Group (LCID), Warner Bros. Discovery (WBD), Rivian Automotive (RIVN) and Beyond Meat (BYND). Market participants will also be monitoring several economic data releases in the coming week, including the U.S. Trade Balance, Exports, Imports, Crude Oil Inventories, Consumer Credit, Initial Jobless Claims, Wholesale Inventories, and Wholesale Trade Sales. In addition, San Francisco Fed President Mary Daly and Richmond Fed President Thomas Barkin will be making appearances this week. Today, all eyes are focused on the U.S. ISM Non-Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the July ISM Non-Manufacturing PMI will come in at 51.4, compared to the previous month’s figure of 48.8. Also, investors will likely focus on the U.S. S&P Global Services PMI, which stood at 55.3 in June. Economists foresee the July figure to be 56.0. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.750%, down -0.98%. Let me stress it once again. Every trade is profitable and every day in the market is a good one....for someone. If you lose money in a trade someone made it. You money didn't vanish into thin air. It went into someones pocket. That pocket looks like it's going to be ours! #1. We ALWAYS carry bearish positons. #2. We pay close attention to market internals. The money we made with Fridays crash and the potential huge payoff we may (or may not) have today was all setup way in advance! You can't buy life insurance when you need it! You need to have it BEFORE. #3.Position size so you have dry powder to work with. Our high cash position gives us flexibility to trade today. #4. Learn to love bearish markets. This is almost always where to bulk of the money is made (and lost). This is our opportunity to shine! If you're not trading with us in our live trading room, make sure to come back here tomorrow to see how we did today. If it's not impressive it will be my fault....not the markets. Let's take a look at the markets today, focusing only on the downside as that's where the premium lies. Fridays bearish move took most of the indices back below the all important 50DMA. Those indices that didn't break below look to do so today. The IWM and DIA look to go negative on the year! Let's start with the Nasdaq since that's going to be our main focus trade for the next three weeks. The biggest thing to note on the daily chart is that this mornings selloff pushes us below the 200DMA. This is huge folks. Intra-day /NQ: support levels: 17348/17185. If we break below 17185 the next support is all the way down at 16434. Let's go! /ES: We will potentially setup a small /ES trade today but the risk profile is not near as good as our NDX setup. The less tech heavy /ES is still above it's 200DMA. There's two key support levels on /ES. 5156 is the first. If that breaks down we have to go all the way down to 5048 to find the next support. Bitcoin: BTC is in full on crash mode. Sinking from 70,000 to 50,000 in a little over a weeks time. This level puts us back at the Feb. consolidation zone and could provide a good long entry. Still too early to tell. Our trade docket today: NDX debit baby! We will continue to cash flow this trade. I don't want to get too excited. I don't want to cash the checks before they arrive and I certainly don't want to jinx us but...this trade has a realistic shot at bringing us in over $70,000 dollars in profit over the next three weeks. That's a long time and anything can happen so let's not get ahead of ourselves but, it sure looks great right now. We'll also look to work a few of our last remaining positions that we have't already pulled. I'll also look to possibly add a small /ES 0DTE and scalping will focus on using the /MNQ futures as options here are too expensive to be buying. My bias today: Bearish. Let's go bears! Let's have a great day folks! Today WILL bring us wonderfull opportunities. It's our job to capitalize. I'm excited to see how we do.

0 Comments

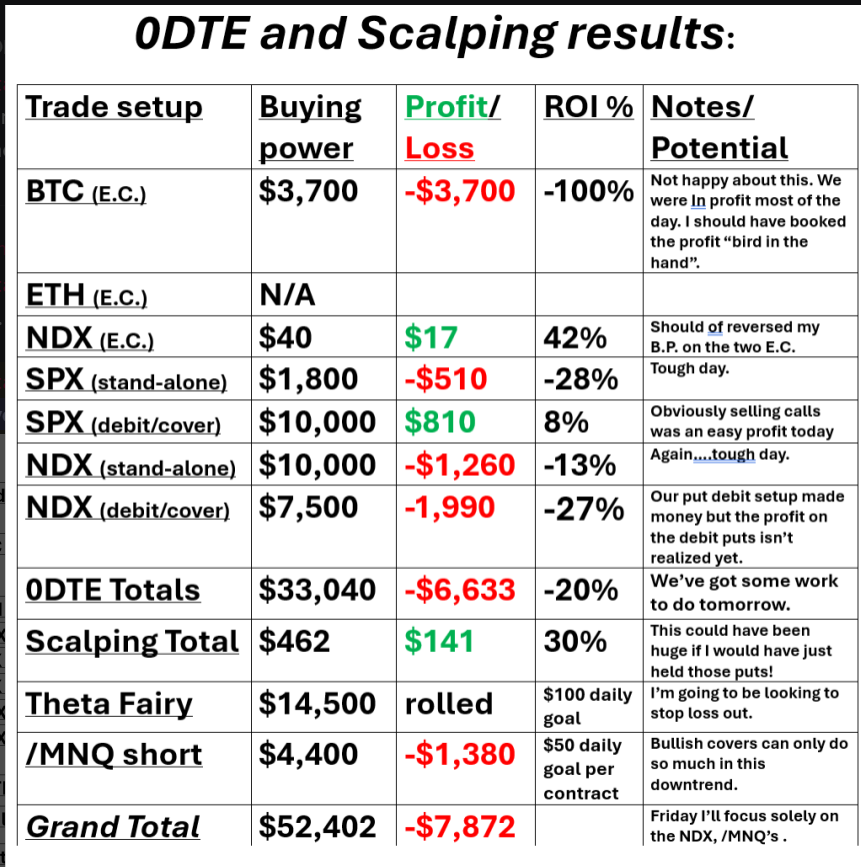

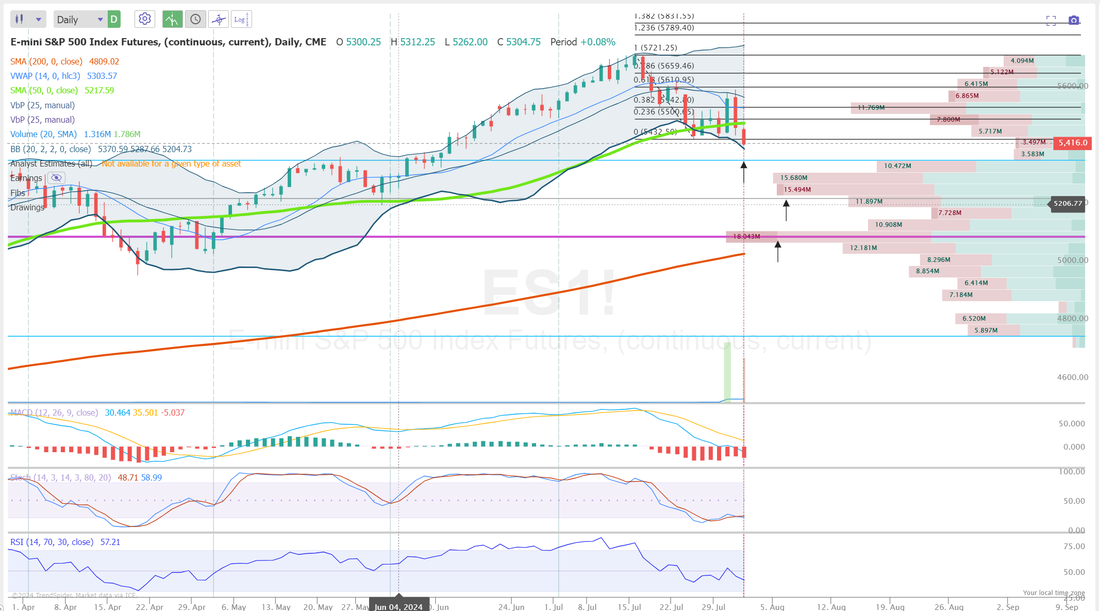

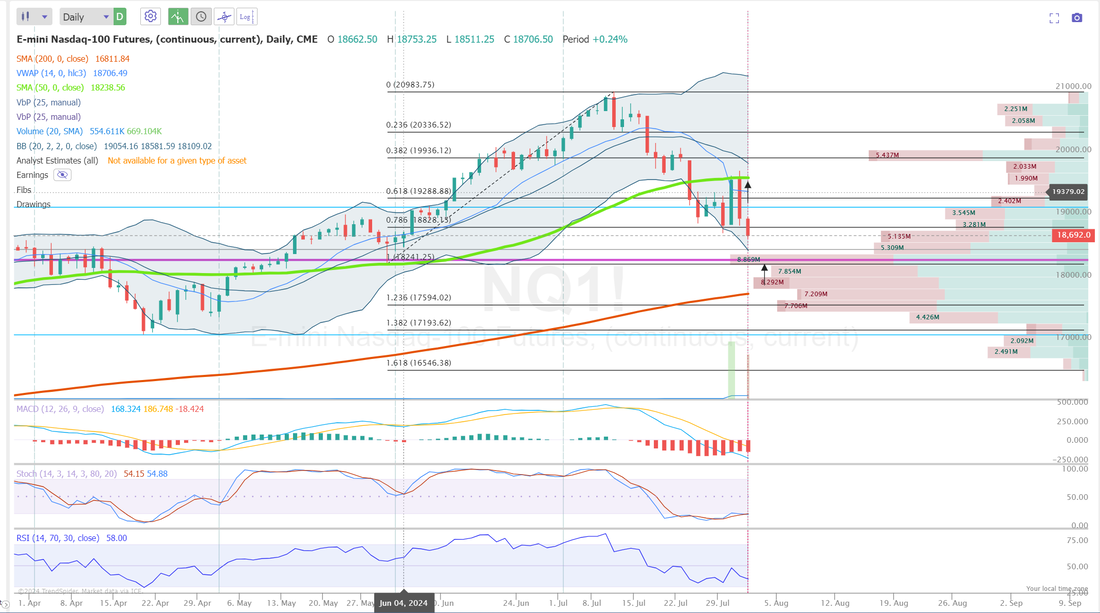

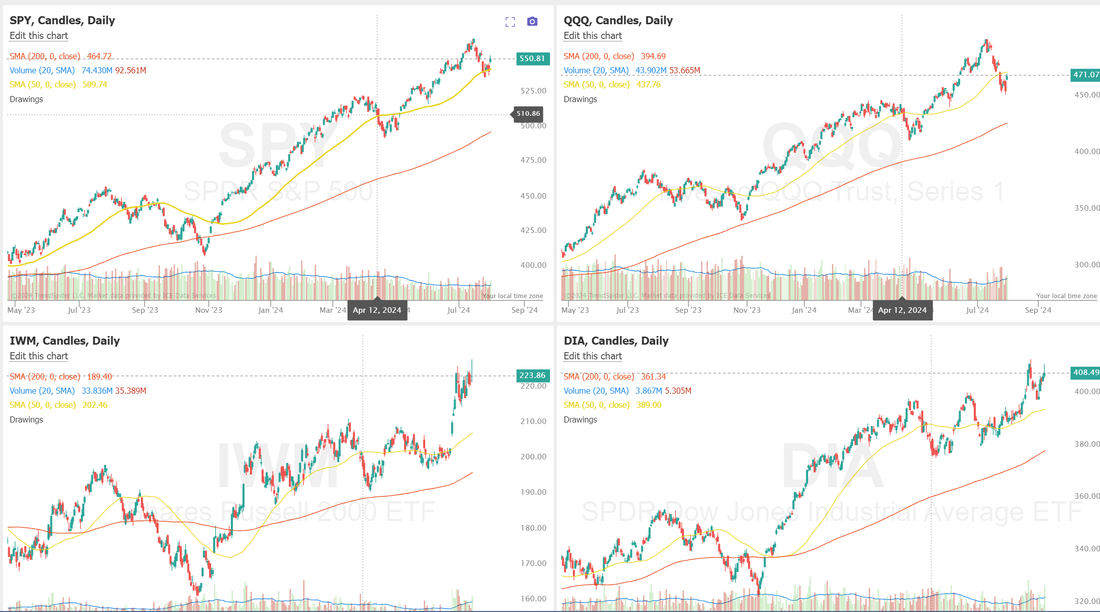

Good morning traders. I think it will be a good morning but, yesterday was a bad one. At least for me, For how happy I was with the profit we pulled Weds. on FOMC day, that's how depressed I was yesterday with my poor results. Here's a look at my days activity. Lots of trades we super close to profits but that doesn't count for much at the end of the day. Close doesn't pay the bills. I'll try to recoup today with focusing my trading efforts. /MNQ futures contracts for scalping (no options unless it's to cover the futures position) and Our NDX debit setup. Our NDX debit is our best shot at recouping the losses from yesterday. It's got $33,000 of profit potential in it and with futures down again this morning its already profitable but could get much better. This will be my focus today, along with scalping the /MNQ futures. What's happening to the market? Two things. Tech weakness. That continues today with poor earnings reception out of some big tech names. Also, Jobs. Jobs, jobs, jobs. Game of trades put out a wonderful analysis of this, which I shared with our trading community a couple days ago. It certainly looks spot on. Check it out and give them a follow. The put up good research. Let's take a look at the market internals. Technicals are bearish. No big surprise here. IWM and DIA have given up their recent parabolic gains but the SPY and QQQ, with all the damage they've taken, are still sitting close to or just above their 50DMA and are back to consolidation zones that we established in May. From a big picture perspective it looks pretty calm. From an intra-day perspective its a lot of volatility. Over the last week the sector rotation out of Tech and into "safer" sectors has accelerated. Let's take a look at a couple key levels in the indices that I'm watching. There are several key levels on the /ES. To the upside 5485 is key. That's the 50DMA. Bulls need to retake that to get any upward momentum. On the downside I have three levels I'm watching. 5359/5228/5094 (see arrows. PoC is 5094) /NQ has been weaker than the /ES. Two levels stick out to me. 19,633 on the upside (this is the 50DMA) and 18,318 on the downside. (this is PoC) Bitcoin continues to be tough to trade directionally here. 65,400 is right around the PoC and the 50DMA. We may wait for the next directional trend to start before trading it. September Nasdaq 100 E-Mini futures (NQU24) are trending down -1.81% this morning as fears of a U.S. slowdown and disappointing quarterly results from industry heavyweights such as Intel and Amazon weighed on sentiment, with the focus now shifting to the highly anticipated U.S. payrolls reading due later in the day. Amazon (AMZN) slumped over -9% in pre-market trading after the e-commerce and cloud giant reported weaker-than-expected Q2 revenue and issued disappointing Q3 guidance. Also, Intel (INTC) plummeted more than -21% in pre-market trading after the semiconductor giant reported downbeat Q2 results, provided below-consensus Q3 guidance, and said it would cut over 15% of its workforce as well as suspend its dividend starting in the fourth quarter. In yesterday’s trading session, Wall Street’s major indexes closed lower. Moderna (MRNA) plummeted over -21% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the biotech firm slashed its full-year net product sales guidance. Also, Western Digital (WDC) plunged more than -9% after the company provided below-consensus Q1 revenue guidance. In addition, Arm (ARM) slumped over -15% after the chip designer issued soft Q2 revenue guidance. On the bullish side, C.H. Robinson Worldwide (CHRW) climbed more than +14% and was the top percentage gainer on the S&P 500 after reporting better-than-expected Q2 adjusted EPS. Also, Meta Platforms (META) advanced over +4% and was the top percentage gainer on the Nasdaq 100 after the social media heavyweight posted upbeat Q2 results and issued a solid Q3 revenue forecast. Economic data on Thursday showed that the U.S. ISM manufacturing index unexpectedly fell to 46.8 in July, weaker than expectations of 48.8 and the steepest pace of contraction in 8 months. Also, U.S. Q2 nonfarm productivity advanced +2.3% q/q, stronger than expectations of +1.7% q/q, while U.S. Q2 unit labor costs rose +0.9% q/q, weaker than expectations of +1.8% q/q. In addition, U.S. construction spending unexpectedly fell -0.3% m/m in June, weaker than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose +14K to a nearly 1-year high of 249K, compared with the 236K expected. “The labor market has been flashing warning signals over the past several months,” said Chris Senyek at Wolfe Research. “History suggests Powell is walking a very fine line on potentially waiting too long to start cutting rates before it’s too late.” Meanwhile, U.S. rate futures have priced in a 100% probability of at least a 25 basis point rate cut at the next FOMC meeting in September. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Enbridge (ENB), and Church & Dwight (CHD) are set to report their quarterly figures today. Today, all eyes are focused on U.S. Nonfarm Payrolls data, set to be released in a couple of hours. Economists, on average, forecast that July Nonfarm Payrolls will come in at 176K, compared to last month’s figure of 206K. A survey conducted by 22V Research revealed that 42% of investors believe the market reaction to the jobs report will be “risk-off,” 36% said “negligible/mixed,” and only 22% anticipate “risk-on.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect July’s figures to be +0.3% m/m and +3.7% y/y, compared to the previous numbers of +0.3% m/m and +3.9% y/y. U.S. Factory Orders data will come in today. Economists foresee this figure to stand at -2.7% m/m in June, compared to the previous number of -0.5% m/m. The U.S. Unemployment Rate will be reported today as well. Economists foresee this figure to remain steady at 4.1% in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.951%, down -0.61%. My bias today is bullish. It's not uncommon for a big algo move on FOMC days to get completely reversed the next day. Taken in context Wed. and Thurs. price action netted out to being not much of a move. The poor tech earnings this morning are tanking futures, once gain and that, along with yesterday certainly makes things look ugly. I believe that we may have a good chance to aborb the poor earnings today and get a bounce from the selloff we are currently seeing in the futures. I'm allready in one long /MNQ contract in scalping and may sell a 0DTE covered call on it today. My plan for today, once again: Focused effort today on our debit NDX position. I don't want 7 trades to keep track of today. be quicker to take both profits and losses on it as the day progresses. I'll use the /NQ futures again to work the put covers so I have more flexibility and time, should I need it.

My biggest focus and advice for today to myself and all of you? Don't revenge trade today! Let's be patient with entries and quick with exits. Welcome back! FOMC has come and gone and it didn't disappoint. I'm getting a late start so todays blog will be short. Here's a look at our results from yesterday. September Nasdaq 100 E-Mini futures (NQU24) are up +0.36% this morning as strong quarterly results from Meta Platforms and dovish comments from Federal Reserve Chair Jerome Powell boosted sentiment, while investors awaited a new round of U.S. economic data and earnings reports. Meta Platforms (META) climbed over +6% in pre-market trading after the company reported stronger-than-expected Q2 results and issued solid Q3 revenue guidance. As widely expected, yesterday the Federal Reserve kept the federal funds rate in a range of 5.25% to 5.50%, a level it has held since last July. At the same time, policymakers made several changes to the language of a statement issued after their two-day meeting. The committee altered its language to state it is “attentive to the risks to both sides of its dual mandate,” moving away from previous wording that concentrated solely on inflation risks. The Fed also adjusted its language to note that price pressures remain “somewhat” elevated and to acknowledge “some further progress” toward its inflation goal, a change from “modest further progress” in the previous statement. In addition, Fed Chair Jerome Powell stated at his post-monetary policy decision press conference that a rate cut “could be on the table as soon as September” if inflation continues to move toward the central bank’s 2% target. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching 1-week highs and the blue-chip Dow posting a 1-1/2 week high. Nvidia (NVDA) surged over +12% and was the top percentage gainer on the Nasdaq 100 after Morgan Stanley named the chip giant a top U.S. chip stock pick following the stock’s recent selloff. Also, Advanced Micro Devices (AMD) gained more than +4% after the semiconductor company reported stronger-than-expected Q2 results, offered a solid Q3 revenue forecast, and boosted its full-year guidance for artificial intelligence chip sales. In addition, Match Group (MTCH) climbed over +13% after the company reported better-than-expected Q2 revenue and announced plans to cut about 6% of its staff. On the bearish side, Humana (HUM) plunged more than -10% and was the top percentage loser on the S&P 500 after the health insurer cut its full-year GAAP EPS guidance and warned of higher hospital admissions. The ADP National Employment report on Wednesday showed private payrolls rose by 122K jobs in July, significantly lower than the consensus figure of 147K. Also, the U.S. employment cost index, a key gauge of U.S. labor costs, rose +0.9% q/q in the second quarter, weaker than expectations of +1.0% q/q. In addition, the U.S. July Chicago PMI fell to 45.3, a smaller decline than expectations of 44.8. Finally, U.S. pending home sales rose +4.8% m/m in June, stronger than expectations of +1.4% m/m and the biggest increase in 6 months. Second-quarter corporate earnings season continues in full flow, with investors awaiting new reports today from notable companies such as Amazon (AMZN), Apple (AAPL), Intel (INTC), Block (SQ), DoorDash (DASH), Cigna (CI), ConocoPhillips (COP), Roblox (RBLX), and DraftKings (DKNG). On the economic data front, all eyes are focused on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the July ISM Manufacturing PMI will arrive at 48.8, compared to last month’s figure of 48.5. Also, investors will likely focus on the U.S. S&P Global Manufacturing PMI, which stood at 51.6 in June. Economists foresee the July figure to be 49.5. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q2 Unit Labor Costs to be at +1.8% q/q and Q2 Nonfarm Productivity to stand at +1.7% q/q, compared to the first-quarter numbers of +4.0% q/q and +0.2% q/q, respectively. U.S. Construction Spending data will be reported today. Economists foresee this figure to stand at +0.2% m/m in June, compared to the previous number of -0.1% m/m. U.S. Initial Jobless Claims data will come in today as well. Economists estimate this figure to be 236K, compared to last week’s value of 235K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.055%, down -1.22%. Market technicals are bullish Most indices have easily cleared their respective 50DMA's save for the QQQ's which look to do so today. Trade docket for today: /ES, /MCL, /MNQ, /ZN, CRM, CVNA, DJT, EBAY, IWM, META, MGM, MRK, NVDA, QCOM, QQQ. 0DTE's (I'll be using futures today for our covers and going a little heaver on position size. This will allow me greater control if we need adjustments outside of the cash market time frame). No scalping for me today and tomorrow. I'll be in and out too much to monitor but I'll be running the zoom feed for you all. My bias today: I'm not sure! I don't really have one. Clearly yesterday was bullish. Technicals are bullish and futures are up as I type. I wouldn't be surprised if we took a breather and consolidated today. I certainly wouldn't be surprised if the bullish trend continued and I wouldn't be surprised if we gave back a bit of those monster gains from yesterday. I'll just remain neutral and patient and trade what I see today. Intra-day levels: /ES; 5595* (key level. this was a heavy resistance yesterday)/5606/5631* (key level. high of the day yesterday) to the upside. 5558/5533/5508* (key level. PoC) to the downside. /NQ; Two key levels for me today. 19,724 is resistance and high of the day yesterday. 19487 is support and weakness could come below that. Bitcoin: BTC fell apart late in the day yesterday and ruined my crypto 0DTE's. I'm watching 63,949 level of support (red line) If we can hold that for a few hours into the trading day that my be my signal for a bullish entry on the 0DTE. I hope you all have a great day today. Premium is down a tad today after that monster rally but it's still good. Let's make it happen.

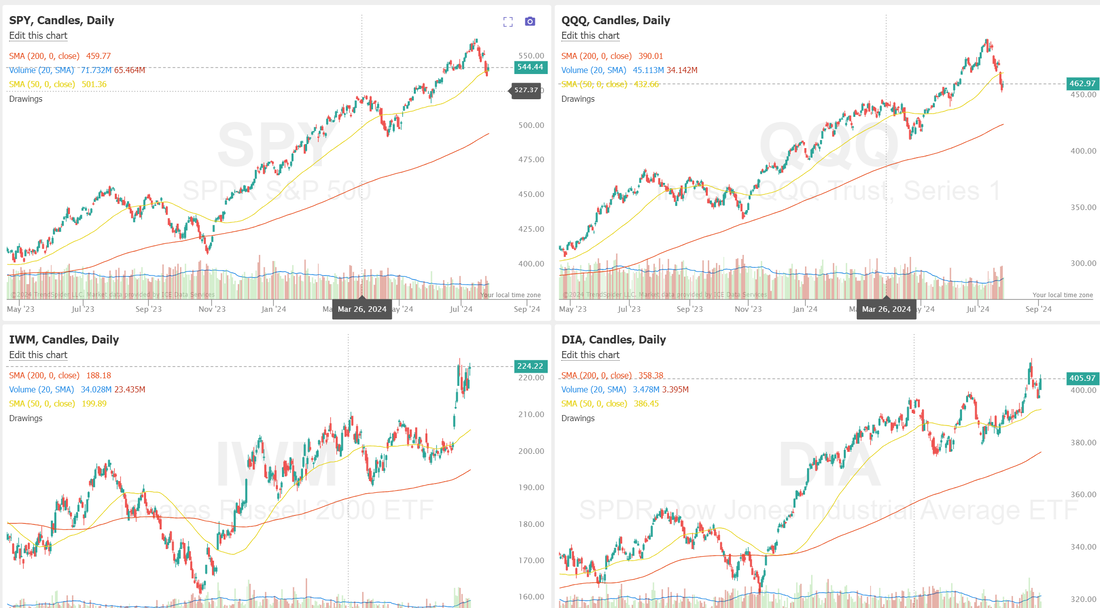

Welcome back to FOMC day! Lots of traders dread today and some simply take the day off. We love it! Mostly we just sit on our hands all day until the last 90 minutes. That's when things get exciting. I'm super happy with our trading results from yesterday. I was down 8-10K for a good part of the day. We worked and worked and worked our 0DTE's and all in all I have to say it was a good day. Let's take a look at our results. I'd like to say we are out of the woods and all our rolled trades but alas no. We've still got a rolled call side on NDX that we will need to deal with today. Let's take a look at the markets. Futures are up this morning. Retracing everything the market gave away yesterday. It's like yesterday never happened. Back to a bullish bias. There was some damage done yesterday with the QQQ's continuing to be the weakest, staying down below the 50DMA. The SPY however, found support there and held firm. The IWM and DIA seem impervious to anything negative. Their strength is impressive. Most of the internal metrics we look at continue to point to bullish price action. Our trade docket and plan of attack for today: /ES (theta fairy), /MNQ, QQQ, 0DTE's, Scalping all on the agenda today as well as a bunch of potential earnings plays in META, QCOM, ARM, EBAY, CVNA, ETSY, MGM, RIG, RIOT. As far as our 0DTE implementation today, we usually wait until the last 90 min. of the day to put them on. FOMC minutes come out and 30 min. later Powell speaks. About 15-20 min. into his speech is usually when the algos pick up on a word of phase he uses and the markets start to move. Unually the first intial move gets faded. That's when we like to pounce. The 1 day VIX is showing the I.V. we like to see. Premiums should be excellent today. NYSE Up volume is still positive vs. down volume. The RUT continues to have elements that keep hitting new highs. But I believe we are overstretched here on the IWM. Diminished buying vol. Price action stalled out the last three days and Stoch in over bought zone. No levels or bias lean for me today as is the case every FOMC day. We will just trade what we see. Here's your cheat sheet for Powell today. September S&P 500 E-Mini futures (ESU24) are up +0.98%, and September Nasdaq 100 E-Mini futures (NQU24) are up +1.57% this morning as expectations mounted that Fed Chair Jerome Powell might signal a potential rate cut for September, while investors also awaited a fresh batch of U.S. economic data and an earnings report from Meta Platforms. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. CrowdStrike Holdings (CRWD) slumped over -9% and was the top percentage loser on the Nasdaq 100 after CNBC reported that Delta Air Lines had hired lawyers to seek compensation from the cybersecurity firm and Microsoft over the operations meltdown experienced during the global IT outage. Also, Merck & Co. (MRK) slid more than -9% and was the top percentage loser on the S&P 500 and Dow after the pharma giant cut its full-year adjusted EPS forecast. In addition, Procter & Gamble (PG) fell over -4% after reporting weaker-than-expected Q4 sales. On the bullish side, Howmet Aerospace (HWM) surged more than +13% and was the top percentage gainer on the S&P 500 after the supplier to Boeing lifted its FY24 adjusted EPS guidance. Also, PayPal Holdings (PYPL) climbed over +8% and was the top percentage gainer on the Nasdaq 100 after posting upbeat Q2 results and boosting its annual earnings guidance. A Labor Department report on Tuesday showed that U.S. JOLTs job openings fell to 8.184M in June, compared to an expected figure of 8.020M. Also, the Conference Board’s U.S. July consumer confidence index inched up to 100.3, stronger than expectations of 99.7. In addition, the U.S. S&P/CS HPI Composite - 20 n.s.a. rose +6.8% y/y in May, stronger than expectations of +6.5% y/y. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. While the Fed is anticipated to maintain benchmark rates at the highest level in more than two decades, market participants will be closely monitoring for any hints that the start of policy easing is near. “If the Fed does not signal a September rate cut, markets could get a bit ugly given recent tech weakness - especially if earnings underwhelm,” said Tom Essaye at The Sevens Report. Meanwhile, U.S. rate futures have priced in a 99.7% chance of at least a 25 basis point rate cut at September’s monetary policy meeting and a 60.6% probability of a 25 basis point rate cut at the November meeting. On the earnings front, notable companies like Meta Platforms (META), Qualcomm (QCOM), Western Digital Corporation (WDC), Arm Holdings (ARM), Boeing (BA), eBay (EBAY), Altria (MO), and Marriott International (MAR) are slated to release their quarterly results today. On the economic data front, investors will direct their attention to the U.S. ADP Nonfarm Employment Change data, set to be released in a couple of hours. Economists, on average, forecast that the July ADP Nonfarm Employment Change will stand at 147K, compared to the previous number of 150K. Also, investors will focus on the U.S. Chicago PMI, which stood at 47.4 in June. Economists foresee the July figure to be 44.8. The U.S. Employment Cost Index will be reported today. Economists foresee this figure to arrive at +1.0% q/q in the second quarter, compared to the first-quarter number of +1.2% q/q. U.S. Pending Home Sales data will come in today. Economists expect June’s figure to be +1.4% m/m, compared to last month’s figure of -2.1% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.600M, compared to last week’s value of -3.741M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.138%, down -0.07%. Let's have a great day folks. FOMC days always give us the potential we need. It's up to us to properly execute on that.

Welcome back traders. We had a solid day yesterday. It could have been much better. It could have been worse. Our net liq was up on the day and several of our 0DTE setups worked but my QQQ hedge in scalping to protect our NDX rolled puts lost money and our Event Contract 0DTE just missed out on profits on the NDX. Here's a look at our results from all our day trades. Our working order for a Theta fairy hit on both the entry and take profit so that result will post to todays P/L matrix. This is our big NDX roll we've been working since last week. I positve day here would help a bunch. There's almost 10K of profit sitting in it. September S&P 500 E-Mini futures (ESU24) are trending up +0.17% this morning as market participants braced for the start of the Federal Reserve’s two-day policy meeting while also awaiting the latest reading on U.S. job openings as well as an earnings report from tech giant Microsoft. In yesterday’s trading session, Wall Street’s major indexes ended mixed. ON Semiconductor (ON) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the semiconductor maker reported better-than-expected Q2 results. Also, Tesla (TSLA) advanced more than +5% after Morgan Stanley named the electric vehicle giant as its new “Top Pick” within the U.S. auto sector. In addition, McDonald’s (MCD) climbed over +3% and was the top percentage gainer on the Dow despite posting downbeat Q2 results, as executives pledged to launch new promotions. On the bearish side, Arm (ARM) slumped more than -5% and was the top percentage loser on the Nasdaq 100 after HSBC downgraded the stock to Reduce from Hold. The Federal Reserve begins its two-day meeting later in the day. Fed officials, who have maintained interest rates at a more than two-decade high for a full year, are widely anticipated to keep them unchanged again when their two-day meeting concludes on Wednesday. Instead, investors expect policymakers to lower their benchmark rate in September as the risk of jeopardizing a solid yet moderating job market increases. Second-quarter corporate earnings season is in full swing, with investors awaiting new reports today from notable companies such as Microsoft (MSFT), Procter & Gamble (PG), Merck (MRK), Advanced Micro Devices (AMD), Pfizer (PFE), and Starbucks (SBUX). On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, set to be released in a couple of hours. Economists, on average, forecast that the June JOLTs Job Openings will come in at 8.020M, compared to the previous figure of 8.140M. Also, investors will focus on the U.S. CB Consumer Confidence Index, which arrived at 100.4 in June. Economists foresee the July figure to be 99.7. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today as well. Economists expect May’s figure to be +6.5% y/y, compared to the previous number of +7.2% y/y. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.185%, up +0.19%. Trade docket for today: Theta Fairy, /MNQ, CRWD, FSLR, MRK, PG, QQQ, MSFT, AMD, SBUX, 0DTE's, Scalping My bias today is bullish. If jobless claims don't rock the boat I think we go higher today. Market technicals as ever so slightly bullish We continue to be stuck in a consolidating pattern on most of the indices. Let's look at my intra-day levels for 0DTE trades: /ES; 5516/5523/5533*(key level. above it we could get some upside)/5552 to the upside. 5507*(key level. PoC)/5493/5480*(key level. below it we could build some downside)/5470 to the downside. /NQ; 19315/19369*(key level high of yesterday)/19448/19493 to the upside. 19191/19147/19080*(key level. below is a lot of downside pressure)/19004 to the downside. BTC: Bitcoin gave back some of its weekend gains on Monday. Its new support is 66,428 and resistance is 68,585. Good fortune today traders. Let's see if we can get our rolled NDX puts to the finish line.

Welcome back to a new trading week! Last week was a tough one for a lot of traders. It did however bring back the I.V. we've been missing. We had a decent day on Friday with some of our rolled positions going out at a profit but our NDX rolls are still going. It looks like we can get a couple take profits on those today if the futures hold. Here's a look at our day last Friday. Let's take a look at the markets. Technicals are swinging back to buy mode this morning. It's really a tale of two different money flows. The SPY and QQQ are still stuck in a consolidation zone while the IWM and DIA continue to look to new bullish highs. After finding nearly perfect resistance at the 1.618 golden Fibonacci extension last week, the SPY reversed sharply lower to find itself at the bottom of the ascending channel, closing the week at $548.99 (-1.96%). A weekly bearish engulfing candle suggests the possibility of further downside, which is supported by the price closing below the daily 8/21 EMA cloud. The pain continued for the QQQ this week, which closed at $475.24 (-3.96%). With the price breaking down below the ascending channel and a seemingly imminent bearish 8/21 EMA cross on the horizon, the area of low volume looks primed for an eventual test. The rotation into small caps continued this week, gaining over 6% before a strong reversal on Wednesday. Despite this, the IWM closed higher for the second week in a row at $216.84 (+1.74%), but put in a concerning Shooting Star weekly candle as the price fell back into the ascending channel. Bulls will be looking for the 8/21 EMA cloud to act as support next week. Let's take a look at the expected moves for the week. I.V. looks solid for us. Let's see if it holds through the week. eptember S&P 500 E-Mini futures (ESU24) are up +0.29%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.38% this morning as market participants looked ahead to earnings reports from major tech names, the Federal Reserve’s policy meeting, as well as the release of the U.S. jobs report later in the week. In Friday’s trading session, Wall Street’s major averages ended in the green. 3M Company (MMM) soared about +23% and was the top percentage gainer on the S&P 500 and Dow after the company posted upbeat Q2 results and raised the lower end of its full-year adjusted EPS guidance. Also, Charter Communications (CHTR) surged more than +16% and was the top percentage gainer on the Nasdaq 100 after the cable and internet company reported better-than-expected Q2 results. In addition, Deckers Outdoor (DECK) climbed over +6% after the company reported stronger-than-expected Q1 results and raised its FY25 EPS guidance. On the bearish side, DexCom (DXCM) plummeted more than -40% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the diabetes device maker reported mixed Q2 results, issued below-consensus Q3 revenue guidance, and lowered its FY24 revenue outlook. Data from the U.S. Department of Commerce on Friday showed that the U.S. core PCE price index, a key inflation gauge monitored by the Federal Reserve, came in at +0.2% m/m and +2.6% y/y in June, compared to expectations of +0.2% m/m and +2.5% y/y. Also, U.S. June personal spending rose +0.3% m/m, in line with expectations, while U.S. June personal income rose +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, the University of Michigan U.S. consumer sentiment index was revised upward to 66.4 in July, stronger than expectations of 66.0. The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Open Market Committee is widely anticipated to maintain rates at the current range of 5.25% to 5.50%, with investors and economists believing that the central bank won’t adjust rates until its meeting in September. At the same time, economists surveyed by Bloomberg News expect the Fed to signal its intention to lower interest rates in September at the conclusion of its meeting on Wednesday. Meanwhile, U.S. rate futures have priced in a 99.6% chance of at least a 25 basis point rate cut at the September FOMC meeting and a 61.4% probability of a 25 basis point rate cut at the conclusion of the Fed’s November meeting. Second-quarter earnings season continues in full force, and investors anticipate fresh reports from major companies this week, including Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), Apple (AAPL), Starbucks (SBUX), McDonald’s (MCD), Boeing (BA), Mastercard (MA), Pfizer (PFE), Moderna (MRNA), Merck (MRK), Chevron (CVX), ExxonMobil (XOM), SoFi Technologies (SOFI), Advanced Micro Devices (AMD), Intel (INTC), and Qualcomm (QCOM). On the economic data front, the U.S. Nonfarm Payrolls report for July will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. CB Consumer Confidence Index, JOLTs Job Openings, S&P/CS HPI Composite - 20 n.s.a., ADP Nonfarm Employment Change, Employment Cost Index, Chicago PMI, Pending Home Sales, Crude Oil Inventories, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), S&P Global Manufacturing PMI, Construction Spending, ISM Manufacturing PMI, Average Hourly Earnings, Unemployment Rate, and Factory Orders. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.169%, down -0.77%. Our trade docket for today is fairly busy: /MNQ, /NG, /ZC, /ZN, DIA, DJT, F, IWM, NVDA, QQQ/SPY, UPST, ORCL, CCL, CRM, PLTR, PYPL, SHOP, MRK, PG, 0DTE's, Scalping. Intra-day levels for me: /ES; 5529/5536/5554* (key level bulls need to clear today)/5588 to the upside. 5507/5493/5478* (key level of support. If we lose this we have some downside potential)/5457. /NQ; 19329/19374* (key level of 50 period M.A.)/19396/19575/ to the upside. 19,266,19218,19153,19105 to the downside. BTC; Had a nice run up over the weekend. 73,000 is the new resistance and 68829 support. We needed this push up we are currently getting with the futures. If we could exit our SPY/QQQ trades and Some of our NDX puts today it would be a fantastic day for us. Let's go get some today traders!

Welcome back traders and happy Friday! We didn't make much progress yesterday as I had to roll both put and call sides of some of our 0DTES. We did have some success with Scalping and our NDX event contract 0DTE. Both of these can provide some needed buffers when the market is crazy. If you'd like to trade these daily setups with us I'll provide the links below. Some of you have inquired about access prop funds to trade with. I love and endorse Apex. I think its a great training tool. You can check it out here. While our results from yesterday didn't look very good, our rolls into today look to hopefully yield some good results. Here's what we did achieve yesterday. Technicals are still in sell mode but it wouldn't take much to flip back to buy mode. We seem overstretched to the downside. Yesterdays price action didn't do much to change the directional landscape. A nice push up and then a finish at the days lows. With the exception of the Russell, which is on a parabolic rip, all the indices we trade are still stuck around the new support/resistance area that was established about one month ago. The fear and greed index is starting to flash a buy signal Tech was ugly yesterday but the overall market actually looked pretty healthy. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Edwards Lifesciences (EW) plummeted over -31% and was the top percentage loser on the S&P 500 after the company reported weaker-than-anticipated Q2 revenue, issued lackluster Q3 guidance, and cut its annual guidance for sales of some heart valve replacements. Also, Lululemon Athletica (LULU) slumped more than -9% and was the top percentage loser on the Nasdaq 100 after Citi downgraded the stock to Neutral from Buy. In addition, Ford Motor (F) tumbled over -18% after the carmaker reported downbeat Q2 results. On the bullish side, ServiceNow (NOW) surged more than +13% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and raised its FY24 subscription revenue guidance. Also, International Business Machines (IBM) climbed over +4% and was the top percentage gainer on the Dow after the IT giant reported better-than-expected Q2 results and raised its full-year free cash flow forecast. The U.S. Department of Commerce’s preliminary reading on Thursday showed that the U.S. economy grew at a +2.8% annualized rate in the second quarter, surpassing the +2.0% consensus estimate and accelerating from +1.4% in the prior quarter. Also, the U.S. Q2 core personal consumption expenditures price index rose +2.90%, slowing from +3.70% in Q1. In addition, U.S. June durable goods orders unexpectedly plunged -6.6% m/m, weaker than expectations of +0.3% m/m, while U.S. June core durable goods orders rose +0.5% m/m, stronger than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -10K to 235K, compared with the 237K expected. “Goldilocks is getting stronger and the risk of stagflation is fading,” said David Russell at TradeStation. “There’s not much ‘stag; and not much ‘flation’. This kind of GDP report is a potential tailwind for corporate earnings that keeps us on pace for lower rates going forward.” Meanwhile, U.S. rate futures have priced in a 6.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 99.8% probability of at least a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Bristol-Myers Squibb (BMY), Colgate-Palmolive (CL), Charter Communications (CHTR), and 3M (MMM) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.5% y/y in June, compared to last month’s figures of +0.1% m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists forecast June Personal Spending to be at +0.3% m/m and June Personal Income to come in at +0.4% m/m, compared to the May numbers of +0.2% m/m and +0.5% m/m, respectively. The U.S. Michigan Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 66.0 in July, compared to 68.2 in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.252%, down -0.17%. PCE numbers out shortly, should be the news catalyst for the day. My bias for today is bullish. Our trade docket for today: DELL, DIA, BMY, DLR, IWM, NVDA, QQQ/SPY, LULU, DXCM, SNOW, 0DTE's. Intra-day levels for me: /ES; 5494/5509/5533*(50 period M.A. on 2hr. chart)/5572 to the upside. 5472/5454/5432 to the downside. /NQ; 19346/19525/19619/19721 to the upside. 19057/18971/18882/18716 to the downside. Bitcoin; BTC had a strong upward push overnight. 68,588 is the new resistance. 66,484 is support. Let's bring some of that rolled premium in today! Have a great weekend.

Welcome back traders! Well...how was your day yesterday? Those were some big, substantivie moves. It's been a long time since the SP500 took a 2%+ move. The SPY is also having a rotation problem. The largest fund to track the key stock market benchmark, the SPDR S&P 500 Trust ETF (SPY), is losing to 10 major market segments over the past month. What do all the recent market leaders have in common? They have little to zero exposure to the mega-cap tech stocks known as the Magnificent 7. Since July 1, the Mag 7 have collectively declined by more than 12%, as measured by the Roundhill Magnificent Seven ETF (MAGS). The Mag 7 stocks comprise roughly one-third of the cap-weighted S&P 500 index, which until this month had outperformed most of the market segments that are now beating it. The greatest example of the turn in market performance is the iShares Russell 2000 ETF (IWM), which is up nearly 8% in the past month, compared to SPY’s 0.8% decline. Other market segments that are outperforming the S&P 500 include midcap and value stocks, a range of sectors including real estate, consumer discretionary, and financials, as well as commodities and alternative assets like gold and bitcoin. Let's take a look at my results from yesterday. We had to roll so many of our puts yesterday that we won't really see the true results of our day until the close of todays market. There are a lot of warning signs out there. No surprise. Technicals are in full sell mode. Futures are down again this morning as I type. And volatility is spiking. I.V. is certainly not a problem now for option sellers. The motto may be, "Be careful what you wish for." We've (I) have been complaining about low I.V. for what seems like ages. That's not a problem today! The real impact of yestedays selloff is still unkown. If you look at the four major indices we trade all it's done is bring us back to previous resistance levels that are now, of course, support. The question that needs to be answered is, does it hold? If we lose these new support levels it certainly looks like we not only have downside ahead but plenty of it! The NDX looks to have approx. 1,000 points of downside to it's PoC (Point of control purple line) The SPX has close to 400 points of potential downside before we hit PoC. It's a big day for economic news. Jobless claims, Durable goods and GDP all hit this morning. In yesterday’s trading session, Wall Street’s major indices ended lower, with the tech-heavy Nasdaq 100 suffering its largest single-day percentage drop since October 2022. Tesla (TSLA) plunged over -12% and was the top percentage loser on the Nasdaq 100 after the electric vehicle giant reported weaker-than-expected Q2 adjusted EPS and postponed its Robotaxi event to October. Also, Alphabet (GOOGL) slumped more than -5% after the Google parent reported higher-than-expected Q2 capital spending, and its chief indicated that patience would be required to see concrete results from artificial intelligence investments. In addition, Lamb Weston (LW) plummeted over -28% and was the top percentage loser on the S&P 500 after reporting downbeat Q4 results and providing below-consensus FY25 guidance. On the bullish side, Enphase Energy (ENPH) surged more than +12% and was the top percentage gainer on the S&P 500 after the company reported strong Q3 bookings. Also, AT&T (T) rose over +5% after the telecommunications company reported better-than-expected wireless subscriber additions in Q2. “The market is not impressed with the start of earnings season for the mega tech stocks,” said Kathleen Brooks, research director at XTB. “There was a lot resting on these results and we don’t think that they give clear answers to questions about the effectiveness and profit potential for AI right now.” Economic data on Wednesday showed that the U.S. S&P Global manufacturing PMI unexpectedly fell to 49.5 in July, weaker than expectations of 51.7. Also, U.S. June new home sales unexpectedly fell -0.6% m/m to 617K, weaker than expectations of 639K. At the same time, the U.S. S&P Global services PMI rose to 56.0 in July, stronger than expectations of 54.7. Meanwhile, U.S. rate futures have priced in a 10.9% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 98.7% probability of at least a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies such as AbbVie (ABBV), Union Pacific (UNP), Northrop Grumman (NOC), Rtx Corp. (RTX), Honeywell (HON), Keurig Dr Pepper (KDP), Deckers Outdoor (DECK), and Southwest Airlines (LUV) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the first estimate of U.S. second-quarter gross domestic product, due later in the day. Economists, on average, forecast that U.S. GDP will stand at +2.0% q/q in the second quarter, compared to the first-quarter figure of +1.4% q/q. Also, investors will focus on U.S. Durable Goods Orders data, which came in at +0.1% m/m in May. Economists foresee the June figure to be +0.3% m/m. U.S. Core Durable Goods Orders data will be reported today. Economists foresee this figure to come in at +0.2% m/m in June, compared to the previous number of -0.1% m/m. U.S. Initial Jobless Claims data will come in today as well. Economists estimate this figure to be 237K, compared to last week’s value of 243K. My bias or lean today is nothing! I was clearly wrong yesterday. I thought we would get a little bounce. It was nothing but straight down all day. With yesterdays move and all the news catalysts coming this morning I'm just going to react to what the market gives us. No intra-day levels for me. Let's just let the day play out and be patient with our entries. Trade docket for today: /MCL, /MNQ, /ZN, /NG, CMG, CRWD, DELL, DIA, DJT, F, IWM, LUV, LVS, NVDA, QQQ/SPY, UPST, CMG? DLR, JNPR, BMY. Be patient today and trade small. Stay safe. Nothing wrong with simple preservaton in times like this and remember...cash is a position.

Welcome back my fellow traders! We had another stellar day yesterday. We generate enough trades, daily and weekly that our diversification is pretty strong but that can also eliminate "home run" type days as it's statistically difficult to have all your trades end up winners every day. Yesterday was another exception for us with everything working well. Not shown in our results is a last scalp we took going into the close. That resulted in a $600 profit so we are starting today off on the right foot. Take a look at our results for the day. Let's take a look at the markets. Technicals are back to sell mode after horrible Tesla earnings and poor reception to GOOG results. Futures are hammered down, as I said, based on poor tech earnings. I wouldn't be surprised to see a rebound today. September Nasdaq 100 E-Mini futures (NQU24) are trending down -1.04% this morning as Alphabet’s cautious outlook on AI progress and Tesla’s profit miss, coupled with a delay in its Robotaxi event, weighed on sentiment, while investors awaited U.S. business activity data and the next round of corporate earnings reports. Tesla (TSLA) slumped over -7% in pre-market trading after the electric vehicle giant reported weaker-than-expected Q2 adjusted EPS and postponed its Robotaxi event to October. Also, Alphabet (GOOGL) fell more than -3% in pre-market trading after the tech giant reported higher-than-expected Q2 capital spending, and its chief indicated that patience will be required to see concrete results from artificial intelligence investments. In yesterday’s trading session, Wall Street’s main stock indexes closed in the red. UPS (UPS) tumbled over -12% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q2 results. Also, NXP Semiconductors (NXPI) slid more than -7% after the company provided disappointing Q3 guidance. On the bullish side, Pentair (PNR) climbed +9% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and updated its full-year adjusted EPS guidance to around $4.25 from $4.15-$4.25. In addition, Arm (ARM) rose about +5% and was the top percentage gainer on the Nasdaq 100 following a note from M Science stating that all new Arm deployments in the first half of July were powered by Amazon Graviton GPUs. Economic data on Tuesday showed that U.S. existing home sales fell -5.4% m/m to 3.89M in June, weaker than expectations of 3.99M. Also, the July Richmond Fed manufacturing index came in at -17, weaker than expectations of -7. Second-quarter corporate earnings season rolls on, with investors awaiting fresh reports from notable companies today, including IBM (IBM), AT&T (T), Chipotle Mexican Grill (CMG), Thermo Fisher Scientific (TMO), General Dynamics (GD), Ford Motor (F), and Las Vegas Sands (LVS). On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the July Manufacturing PMI will come in at 51.7, compared to last month’s value of 51.6. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 55.3 in June. Economists foresee the preliminary July figure to be 54.7. U.S. New Home Sales data will be reported today. Economists foresee this figure to stand at 639K in June, compared to the previous number of 619K. The U.S. Building Permits data will come in today. Economists expect June’s figure to be 1.446M, compared to 1.399M in May. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.600M, compared to last week’s value of -4.870M. Meanwhile, investor focus also rests on the U.S. core personal consumption expenditures price index for June, the Fed’s first-line inflation gauge, which is set for release on Friday. The reading could provide insights into whether policymakers might lower interest rates in September. U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 91.7% probability of a 25 basis point rate cut at the September meeting. My bias today is bullish! As I mentioned, I think we take some time this morning to absorb the poor TSLA/GOOG results and then work back higher. By bullish, I don't mean we neccessarily finish green. Just that we work our way back up from the NDX being down 220 points as the futures indicate right now. Trade docket for today: /MNQ, DJT, ENPH, GOOG, TSLA, V?, F, LUV,AAL, CMG, LVS, WM, 0DTE's, Scalping, We continue to be stuck around our currrent levels. We need a break out, either up or down, at this point, to establish a new trend. Price action from yesterday was more neutral in nature. Key economic indicator for us today is the PMI. With PMI out this morning I don't usually publish levels as day's like today are more Algo driven. Of note is the fact the the Ether ETF started trading. This isn't having the same impact as the BTC ETF's but should be overall positive for crypto. We should have a better chance today of getting all seven of our daily 0DTE's working.

Let's have a great day folks. If we can make half as much as we did yesterday I'll call that a success. |

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |