|

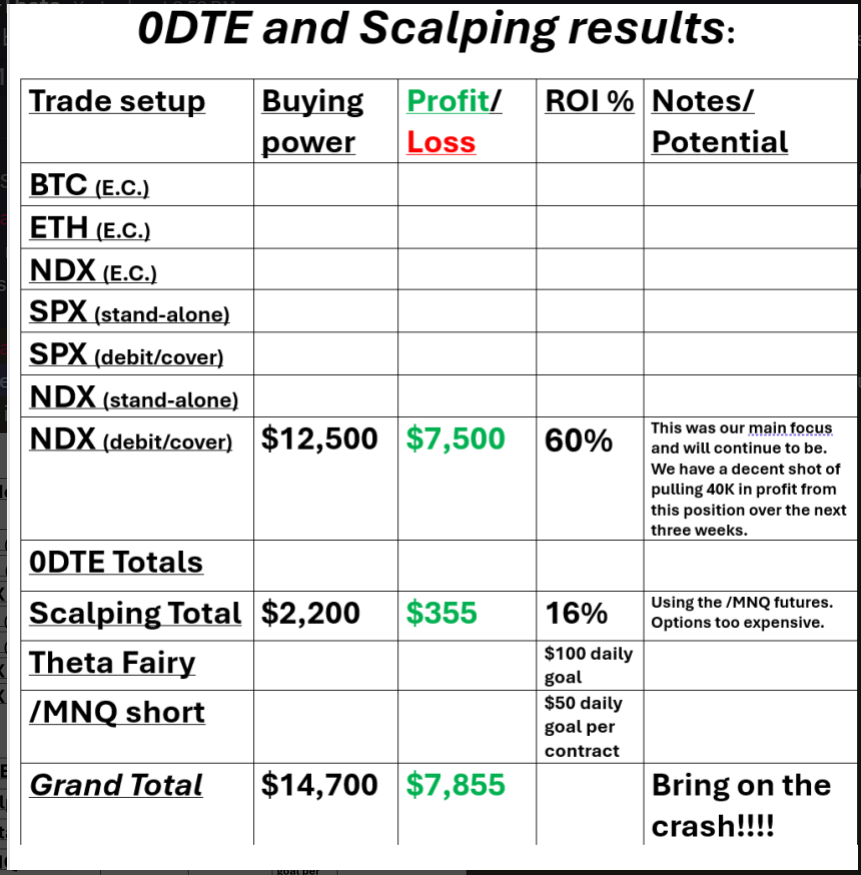

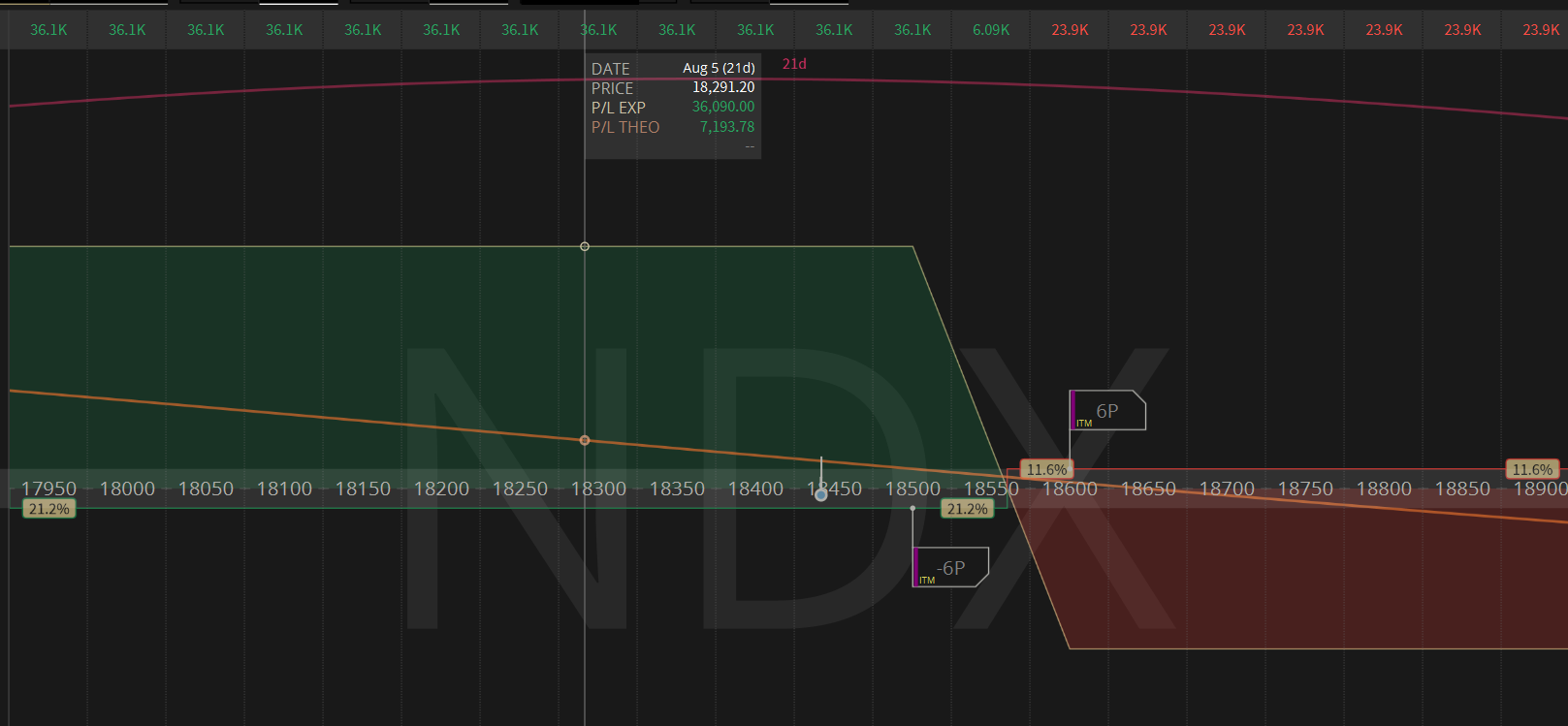

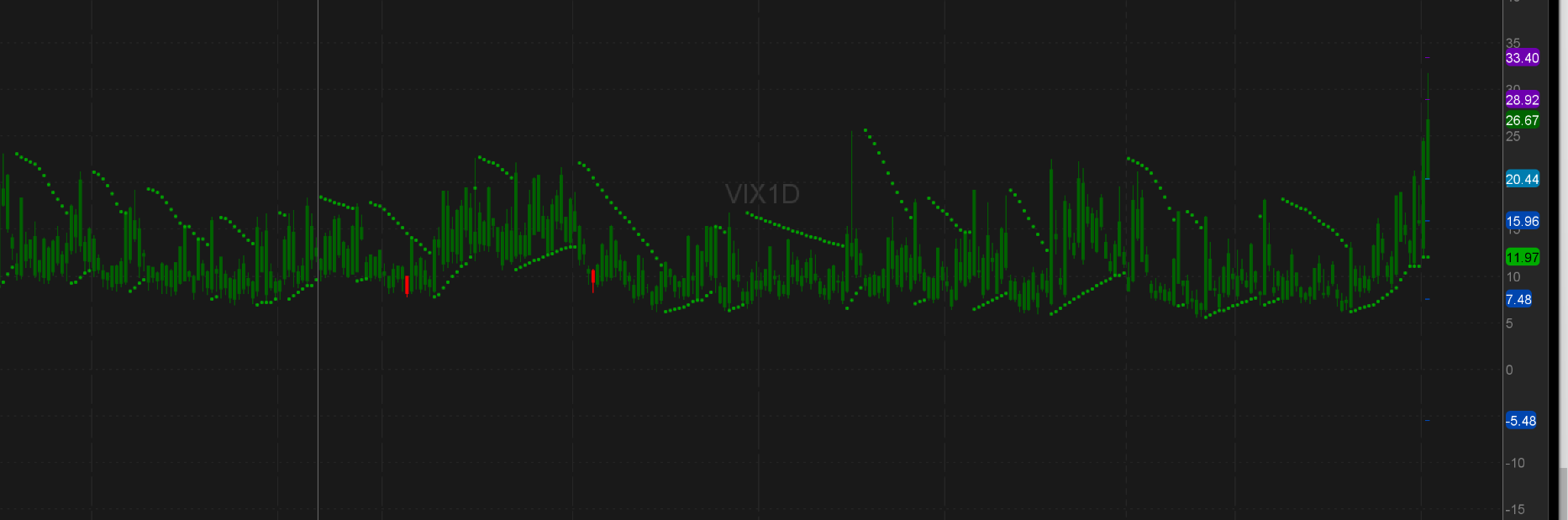

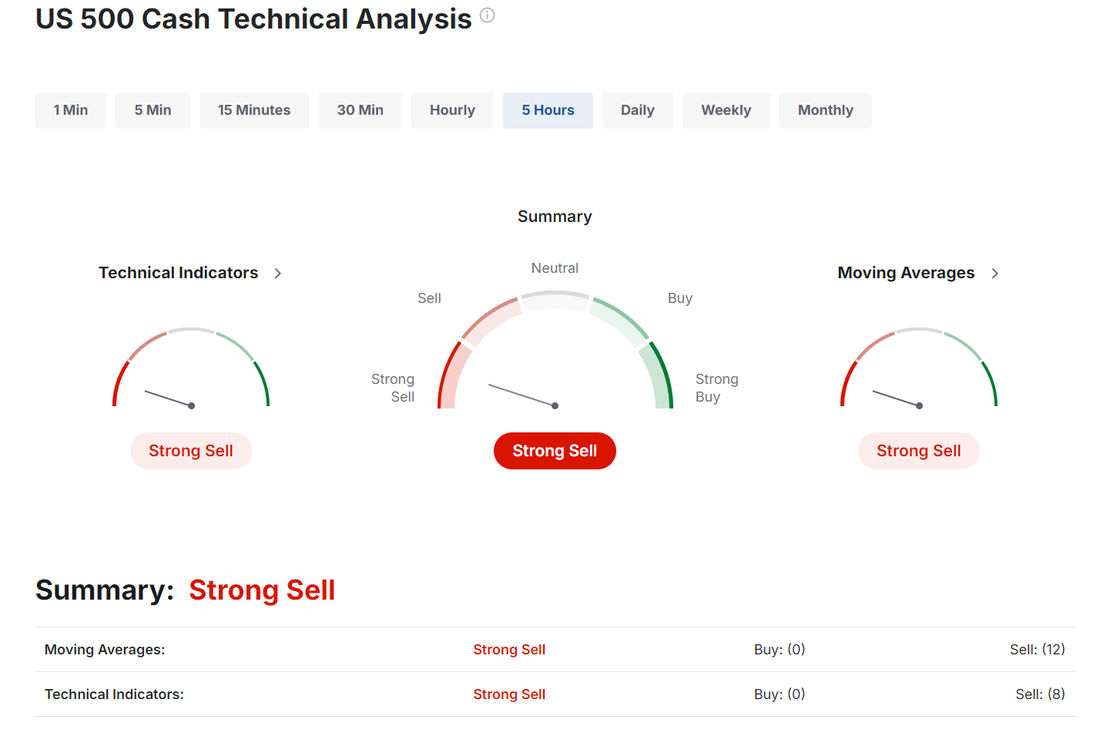

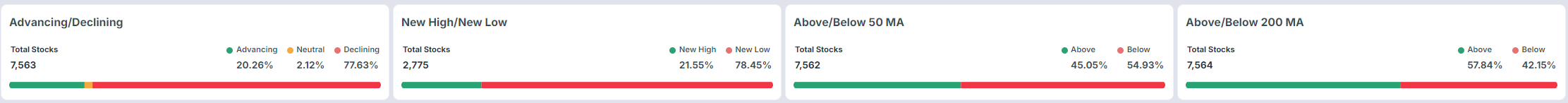

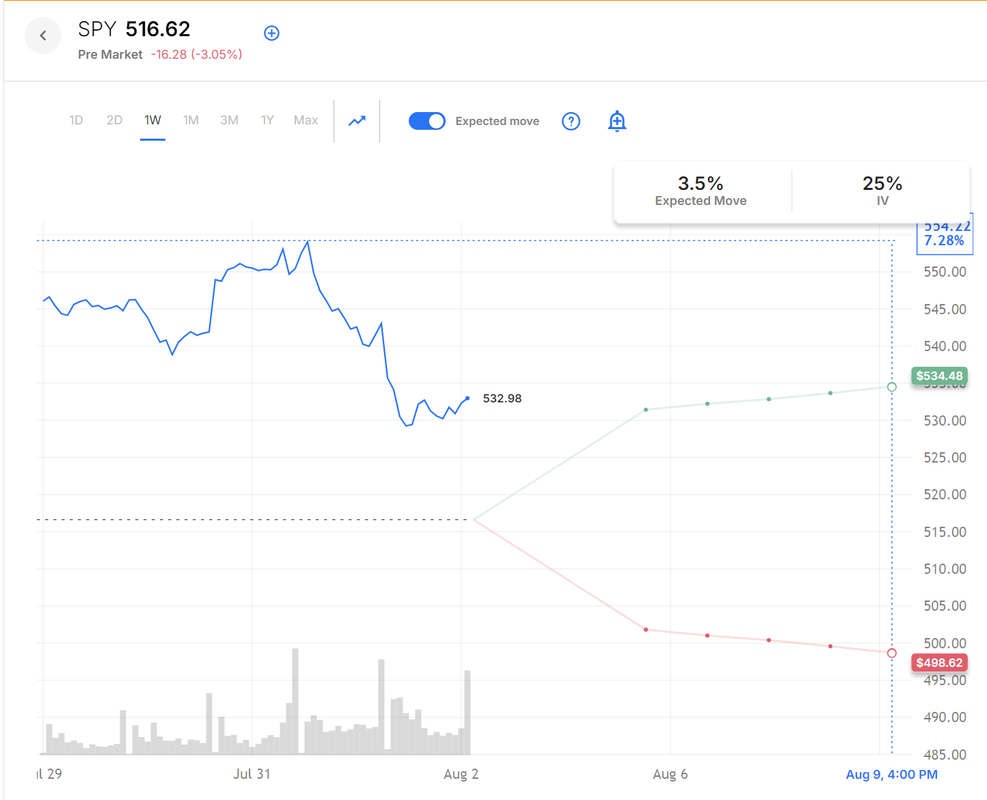

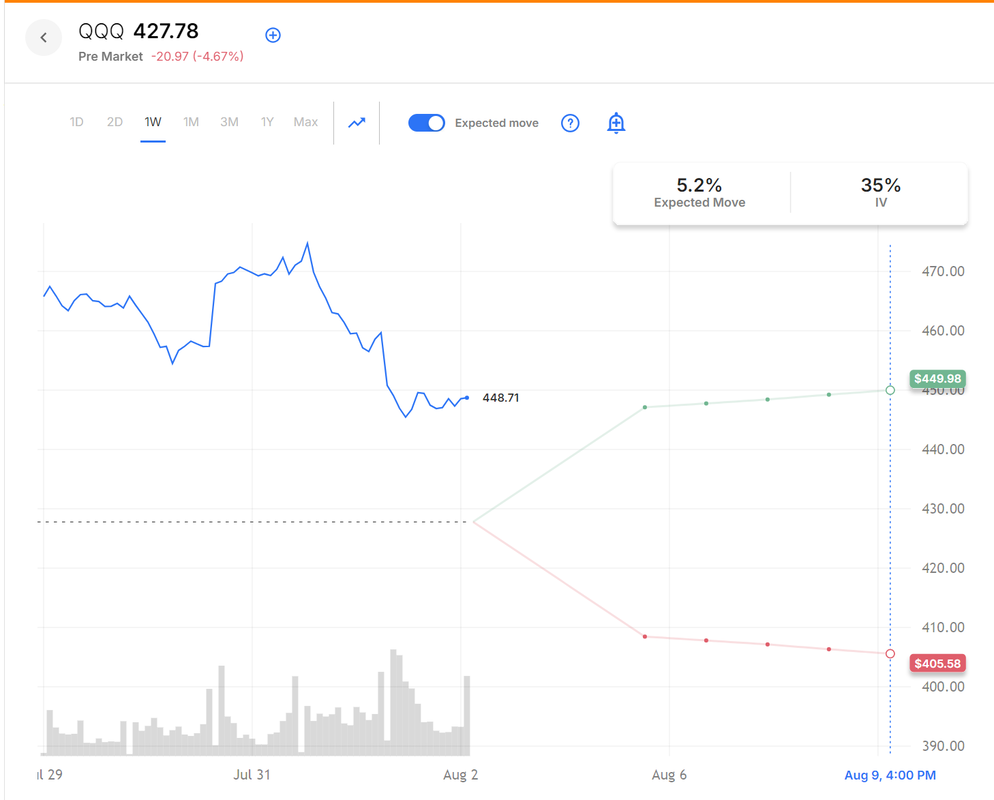

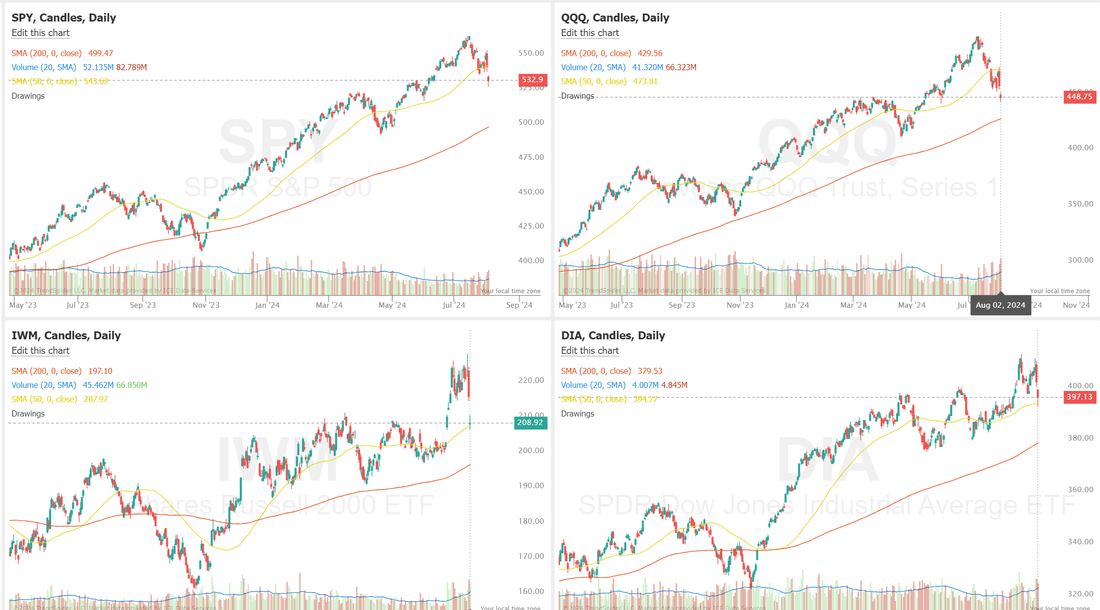

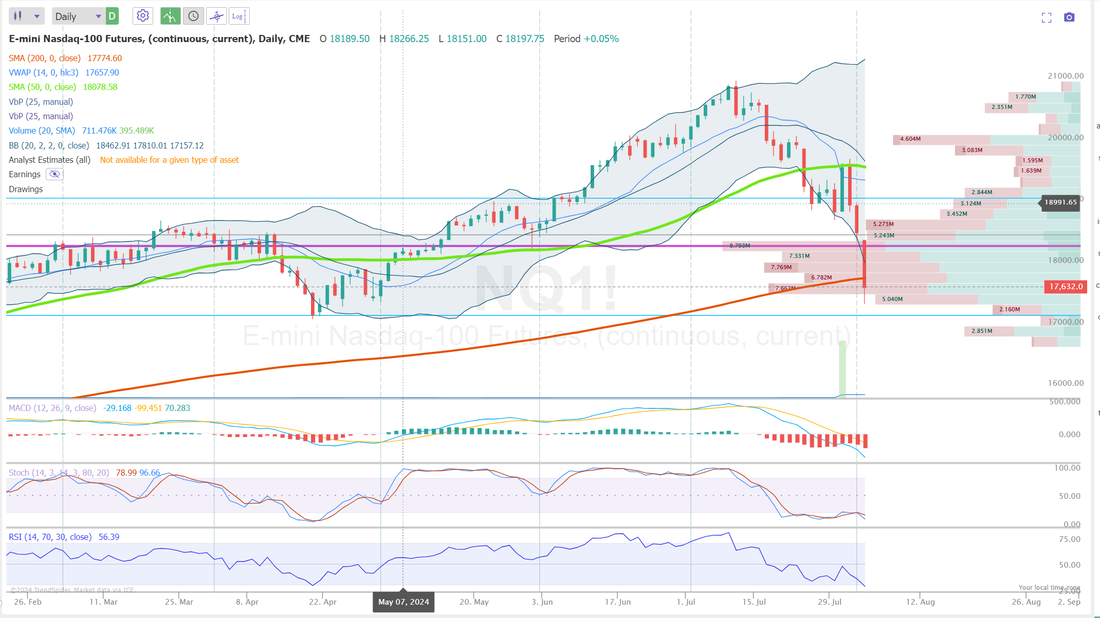

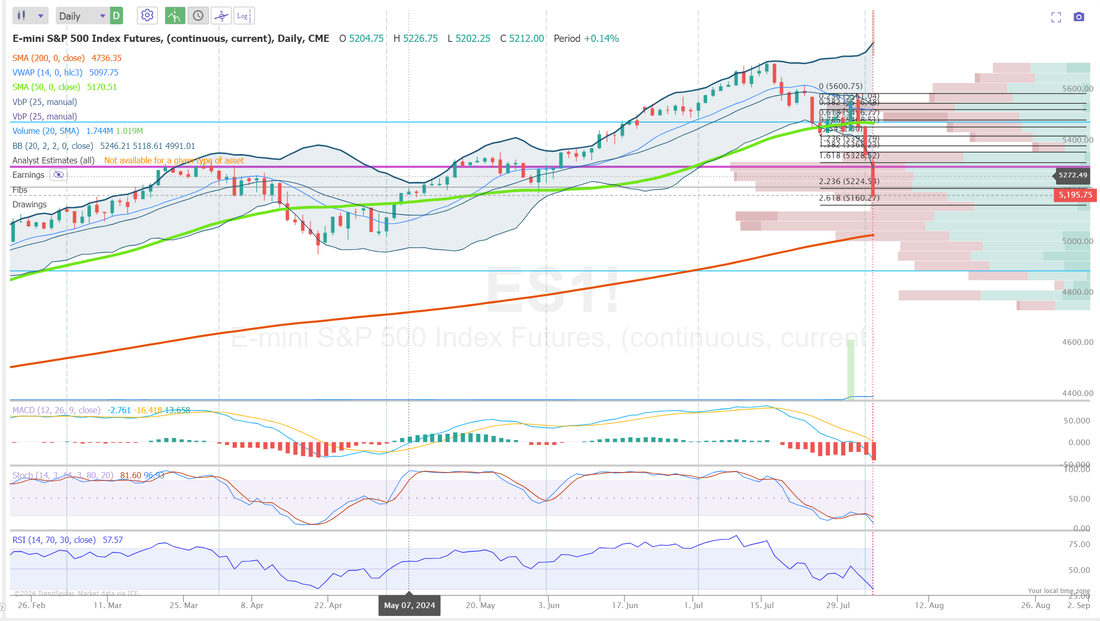

Welcome back traders! This coming week looks to be a huge potential gain for us! Something we've been setting up for a while now. More on that in a minute. Let's take a look at our past Friday results and see how that will continue to play out for us this week. We had an exceptional day on Friday. Now, there were a lot of traders who shorted on Friday and did well also but, I don't know many who had the setup we had. Risking $390 to make a potential $7,500 payoff. We've had plenty of $7,500 profit days but that usually involves deploying 50K+ of captial and taking much bigger risks. Folks, global markets are tanking. THIS IS WHEN IT MATTERS WHO YOU FOLLOW AND WHAT TRADES YOU DO. This is where a trade setup is laid bare for all to see. Is it a turd or a diamond? Late last week we talked about a potential market downturn. We loaded up on our NDX debit/0DTE setup. It had a pretty big payoff potential of $36,000 potential profit but it's the daily cash flow potential of over $7,000 dollar a day that's exciting! If you are trading with us you've seen up pull in our horns. Trim our market exposure. Load up on a bearish stance. Focus more closely on just one or two trades a day. That focus will continue for us today. No promises. No guarantees, of course but....I'd be dissapointed if we couldn't haul in $10,000 in premium today! Maybe we will. Maybe we won't but, that's certainly on the table today as a very real potential. Let's take a look at the markets. The one day VIX is soaring. This is the best premium we've seen all year! Be careful though. The premium skew is heavy! Puts are way more expensive than calls so if you're an option seller you're NOT going to get compensated as well on the call side. That means you need to sell puts but who wants to sell puts in front of this freight train? Well...we do! Our NDX debit is set up perfectly to take advantage of days like today. We've got three weeks left to work this trade daily with 0DTE's. Let's hope the market stays weak for the rest of this month! Technicals are obviously flashing bearish this morning. The market breadth is ugly we more stocks dipping below their 50DMA. 3.5% expected move this week on the SPY! 5.2% expected move for the QQQ's! This is what we've been waiting for folks! September S&P 500 E-Mini futures (ESU24) are down -2.48%, and September Nasdaq 100 E-Mini futures (NQU24) are down -4.10% this morning, extending last week’s losses as concerns intensified that the Federal Reserve is lagging in providing policy support for a slowing U.S. economy. The market turmoil is increasing expectations for an emergency policy response from the Fed. Traders are now assigning a 30% probability to a 25 basis point interest rate cut within a week. Sentiment was also dampened by news that Berkshire Hathaway Inc. had reduced its stake in Apple by nearly 50% as part of a significant selling spree in the second quarter. As a result, shares of Apple (AAPL) slumped over -7% in pre-market trading. In Friday’s trading session, Wall Street’s major averages ended in the red, with the benchmark S&P 500 plunging to an 8-week low, the tech-heavy Nasdaq 100 sliding to a 2-month low, and the blue-chip Dow dropping to a 3-week low. Intel (INTC) crashed over -26% and was the top percentage loser on all three major Wall Street averages after the semiconductor giant reported downbeat Q2 results, offered below-consensus Q3 guidance, and said it would cut over 15% of its workforce as well as suspend its dividend. Also, Amazon.com (AMZN) slumped more than -8% after the e-commerce and cloud giant reported weaker-than-expected Q2 revenue and issued disappointing Q3 guidance. In addition, Snap (SNAP) plummeted nearly -27% after the company reported weaker-than-anticipated Q2 revenue and provided gloomy Q3 adjusted EBITDA guidance. On the bullish side, Clorox (CLX) climbed over +7% and was the top percentage gainer on the S&P 500 after reporting better-than-expected Q4 adjusted EPS and offering a strong FY25 adjusted EPS forecast. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose by 114K jobs last month, significantly below the consensus estimate of 176K. Also, the U.S. July unemployment rate unexpectedly climbed to a 2-3/4 year high of 4.3%, weaker than expectations of no change at 4.1%. In addition, U.S. average hourly earnings came in at +0.2% m/m and +3.6% y/y in July, weaker than expectations of +0.3% m/m and +3.7% y/y. Finally, U.S. June factory orders fell -3.3% m/m, weaker than expectations of -2.7% m/m and the biggest decline in 4 years. “Bad news is no longer good news for stocks,” said John Lynch at Comerica Wealth Management. “Of course, we’re in a period of seasonal weakness, but sentiment is fragile given economic, political, and geopolitical developments. Pressure will escalate on the Federal Reserve.” Chicago Fed President Austan Goolsbee emphasized on Friday that the central bank will not overreact to any single report, noting that policymakers will receive a lot of data before the Fed’s next meeting. Goolsbee, speaking after the release of the weaker-than-expected employment report, stated that it is the Fed’s job to discern the “through line” of the data and proceed in a “steady” manner. However, “if unemployment is going to go up higher than the neutral rate, that is exactly the kind of pinching on the other side of the mandate that the law says the Fed has to think about and respond to,” Goolsbee said in an interview with Bloomberg Television’s Michael McKee and Sonali Basak. Meanwhile, U.S. rate futures have priced in a 4.5% probability of a 25 basis point rate cut and a 95.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. Second-quarter earnings season continues, and investors await new reports from notable companies this week, including The Walt Disney Company (DIS), Caterpillar (CAT), Eli Lilly (LLY), Palantir Technologies (PLTR), Gilead Sciences (GILD), CVS Health (CVS), Duke Energy (DUK), Occidental Petroleum (OXY), Realty Income (O), Shopify (SHOP), Uber Technologies (UBER), Paramount Global (PARA), Lucid Group (LCID), Warner Bros. Discovery (WBD), Rivian Automotive (RIVN) and Beyond Meat (BYND). Market participants will also be monitoring several economic data releases in the coming week, including the U.S. Trade Balance, Exports, Imports, Crude Oil Inventories, Consumer Credit, Initial Jobless Claims, Wholesale Inventories, and Wholesale Trade Sales. In addition, San Francisco Fed President Mary Daly and Richmond Fed President Thomas Barkin will be making appearances this week. Today, all eyes are focused on the U.S. ISM Non-Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the July ISM Non-Manufacturing PMI will come in at 51.4, compared to the previous month’s figure of 48.8. Also, investors will likely focus on the U.S. S&P Global Services PMI, which stood at 55.3 in June. Economists foresee the July figure to be 56.0. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.750%, down -0.98%. Let me stress it once again. Every trade is profitable and every day in the market is a good one....for someone. If you lose money in a trade someone made it. You money didn't vanish into thin air. It went into someones pocket. That pocket looks like it's going to be ours! #1. We ALWAYS carry bearish positons. #2. We pay close attention to market internals. The money we made with Fridays crash and the potential huge payoff we may (or may not) have today was all setup way in advance! You can't buy life insurance when you need it! You need to have it BEFORE. #3.Position size so you have dry powder to work with. Our high cash position gives us flexibility to trade today. #4. Learn to love bearish markets. This is almost always where to bulk of the money is made (and lost). This is our opportunity to shine! If you're not trading with us in our live trading room, make sure to come back here tomorrow to see how we did today. If it's not impressive it will be my fault....not the markets. Let's take a look at the markets today, focusing only on the downside as that's where the premium lies. Fridays bearish move took most of the indices back below the all important 50DMA. Those indices that didn't break below look to do so today. The IWM and DIA look to go negative on the year! Let's start with the Nasdaq since that's going to be our main focus trade for the next three weeks. The biggest thing to note on the daily chart is that this mornings selloff pushes us below the 200DMA. This is huge folks. Intra-day /NQ: support levels: 17348/17185. If we break below 17185 the next support is all the way down at 16434. Let's go! /ES: We will potentially setup a small /ES trade today but the risk profile is not near as good as our NDX setup. The less tech heavy /ES is still above it's 200DMA. There's two key support levels on /ES. 5156 is the first. If that breaks down we have to go all the way down to 5048 to find the next support. Bitcoin: BTC is in full on crash mode. Sinking from 70,000 to 50,000 in a little over a weeks time. This level puts us back at the Feb. consolidation zone and could provide a good long entry. Still too early to tell. Our trade docket today: NDX debit baby! We will continue to cash flow this trade. I don't want to get too excited. I don't want to cash the checks before they arrive and I certainly don't want to jinx us but...this trade has a realistic shot at bringing us in over $70,000 dollars in profit over the next three weeks. That's a long time and anything can happen so let's not get ahead of ourselves but, it sure looks great right now. We'll also look to work a few of our last remaining positions that we have't already pulled. I'll also look to possibly add a small /ES 0DTE and scalping will focus on using the /MNQ futures as options here are too expensive to be buying. My bias today: Bearish. Let's go bears! Let's have a great day folks! Today WILL bring us wonderfull opportunities. It's our job to capitalize. I'm excited to see how we do.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |