|

Welcome back! We had a solid day yesteray to start the week off. Crypto didn't have much directional bias and we waited too long on the NDX to get any decent event contract 0DTES but everything else clicked for us. Here are our results. The market held its ground yesterday as we continue to wait for the next big directional move. We've moved back to a slightly bullish technical bias. My lean today is neutral. The "Magnificent seven" are due for earnings and I'm sure that will give us some directional push. September S&P 500 E-Mini futures (ESU24) are up +0.02%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.11% this morning as investor attention shifted from U.S. politics to a deluge of corporate earnings reports, with particular emphasis on results from “Magnificent Seven” companies Tesla and Alphabet. In yesterday’s trading session, Wall Street’s major indexes ended higher. IQVIA Holdings (IQV) surged over +9% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and raised its FY24 guidance. Also, ON Semiconductor (ON) advanced more than +6% and was the top percentage gainer on the Nasdaq 100 after the company announced it had signed a multi-year deal with Volkswagen to be the main supplier of a complete power box solution for its next-generation electric vehicles. In addition, Nvidia (NVDA) rose over +4% after Reuters reported that the company is developing a version of its new flagship AI chips for the China market that will comply with existing U.S. export controls. On the bearish side, CrowdStrike Holdings (CRWD) tumbled more than -13% and was the top percentage loser on the S&P 500 and Nasdaq 100 after several brokerages downgraded their ratings and reduced their price targets on the stock following a software update from the company that triggered a global IT outage last Friday. Also, Verizon (VZ) slid over -6% and was the top percentage loser on the Dow after reporting weaker-than-expected Q2 revenue. Second-quarter earnings season is gathering pace, with investors awaiting new reports from big-name companies such as Alphabet (GOOGL), Tesla (TSLA), Visa (V), Coca-Cola (KO), Philip Morris International (PM), UPS (UPS), Lockheed Martin (LMT), and General Motors (GM). On the economic data front, investors will focus on U.S. Existing Home Sales data, set to be released in a couple of hours. Economists, on average, forecast that June Existing Home Sales will stand at 3.99M, compared to last month’s figure of 4.11M. The U.S. Richmond Manufacturing Index will be reported today as well. Economists estimate July’s figure to be -7, compared to the previous number of -10. Meanwhile, investor focus also rests on the U.S. core personal consumption expenditures price index for June, the Fed’s first-line inflation gauge, which is set for release on Friday. The reading could provide insights into whether policymakers might lower interest rates in September. U.S. rate futures have priced in a 2.6% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month and a 91.7% probability of a 25 basis point rate cut at the September FOMC meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.241%, down -0.47%. Our trade docket for today is fairly busy. CRWD, /ZN, /MCL, WYNN, NVDA, GOOG, TSLA, V, ENPH, T, SPY/QQQ adn all our 0DTE's. Intra-day levels for me: /ES; 5629/5639/5650/5659 to the upside. 5598/5587/5577/5569 to the downside. /NQ; 20046/20101/20160/20229 to the upside. 19951/19896/19802/19740 to the downside. Bitcoin; 68,700 is resistance. 65,941 is support. Let's have another great day folks! I.V. is still pretty strong!

0 Comments

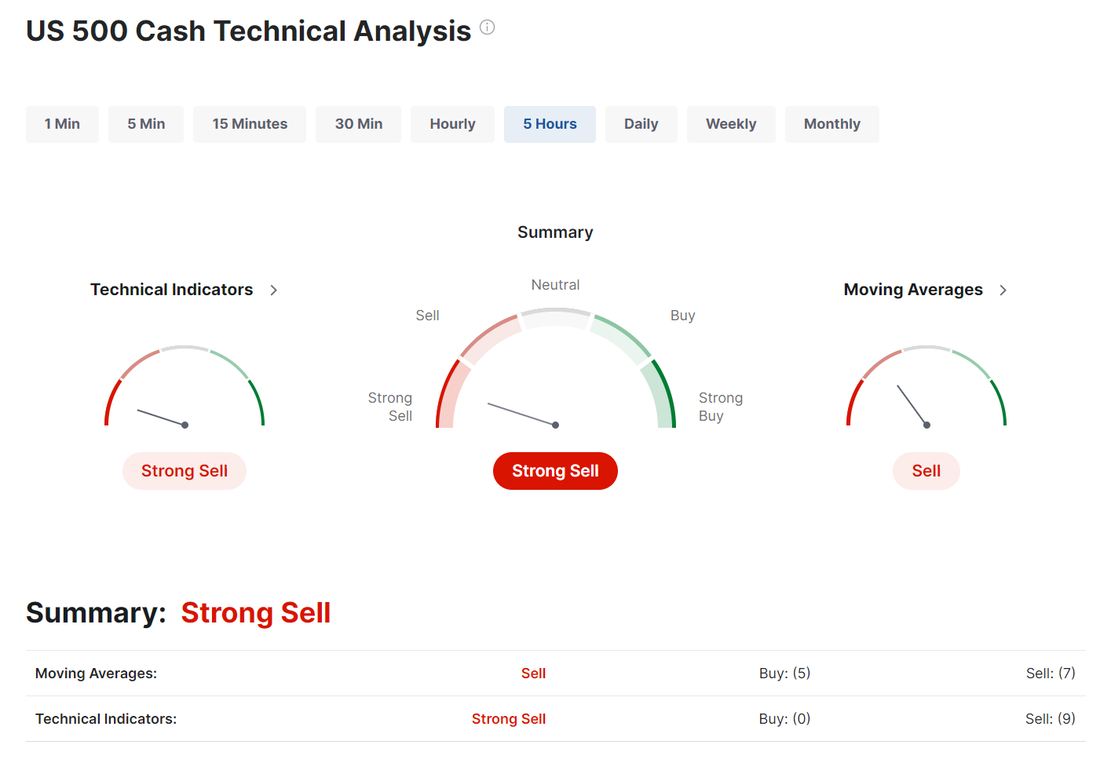

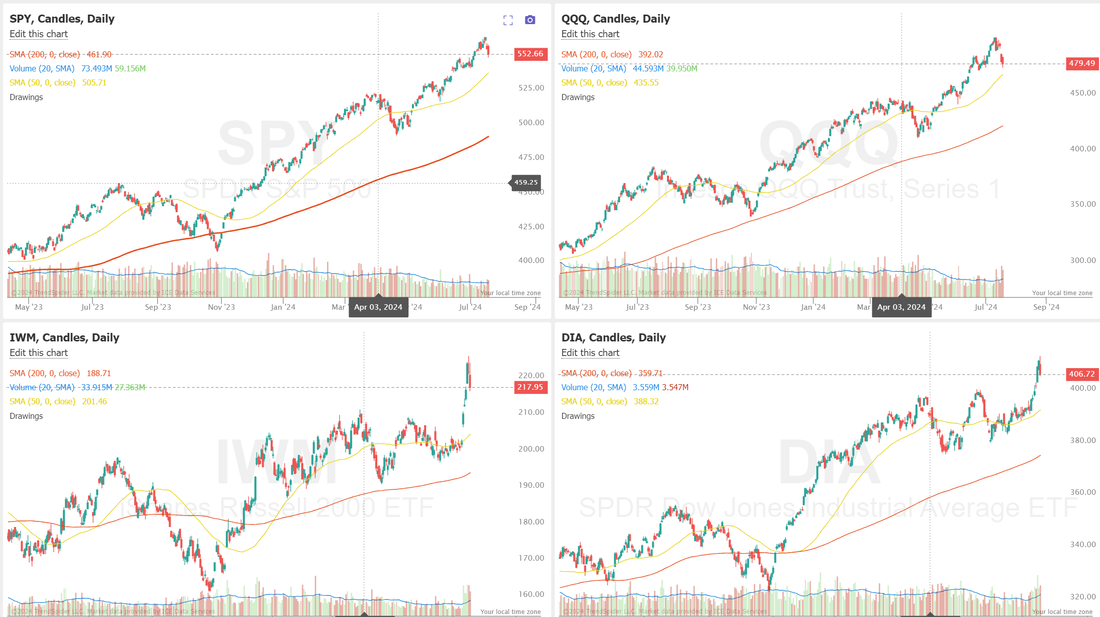

Welcome back to a new week of trading folks! We start this week with a little better I.V. than we've had lately. That's a hopeful sign! We've got our daily /MNQ trade working and we were finally able to get some good premium on the Thetafairy last week. We have a working order on a new one going as I type. Last Fridays results were a mixed bag for me. I took a big swing on Bitcoin that missed and scalping was a loss. I did carry over a small long scalp from Friday that looks to print profits at the open today. Here's a look at my results from Friday. Let's take a look at the market technicals. Futures are up smartly, as I type but technicals are still bearish. That makes sense as we've had over a week of nothing but down. SPY and QQQ are back to kety support levels and the parabolic upward moves on IWM and DIA have taken a breather. This week, the retreat from high-flying tech names into more rate-sensitive ones began to take hold, with both the Nasdaq and the S&P 500 posting their second-largest weekly losses of the year. This shift is driven by growing optimism among traders about potential interest rate cuts, which would favor small-cap stocks and companies facing higher financing costs. Notably, the CME FedWatch tool indicates a 95% probability that the Federal Reserve will reduce rates in September. In other news;

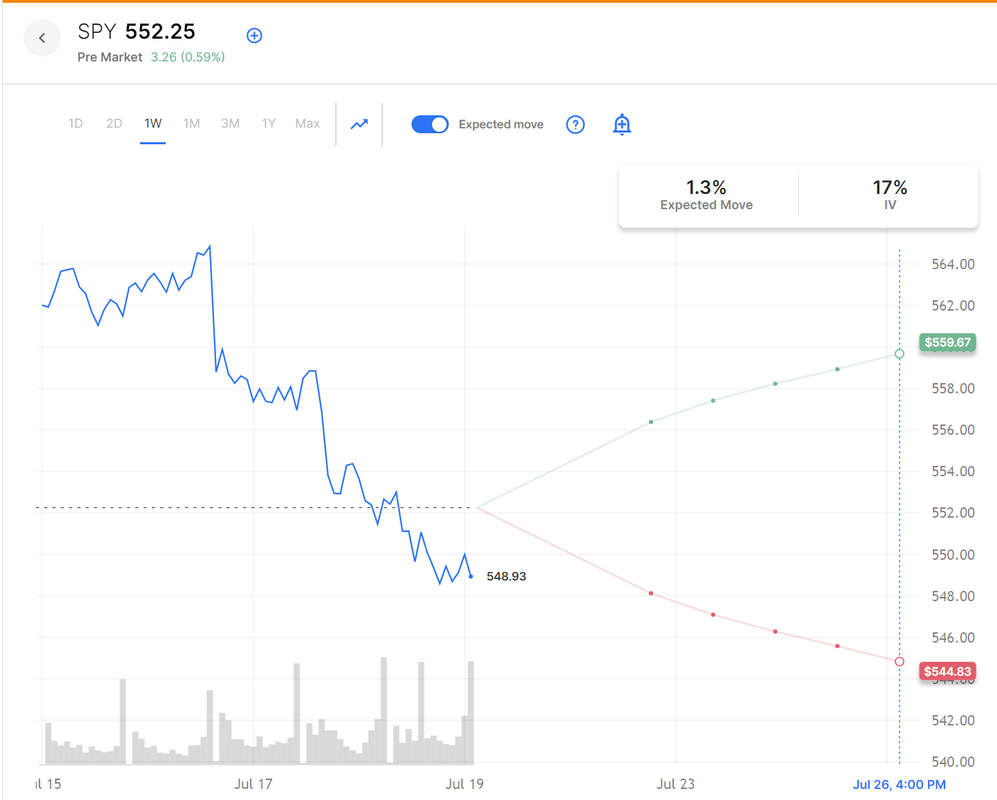

We’re now seven sessions into this rotation. Will small caps dig in and continue higher or was this just a flash in the pan? Let’s get into the charts and see how things are looking. After finding nearly perfect resistance at the 1.618 golden Fibonacci extension last week, the SPY reversed sharply lower to find itself at the bottom of the ascending channel, closing the week at $548.99 (-1.96%). A weekly bearish engulfing candle suggests the possibility of further downside, which is supported by the price closing below the daily 8/21 EMA cloud. The pain continued for the QQQ this week, which closed at $475.24 (-3.96%). With the price breaking down below the ascending channel and a seemingly imminent bearish 8/21 EMA cross on the horizon, the area of low volume looks primed for an eventual test. The rotation into small caps continued this week, gaining over 6% before a strong reversal on Wednesday. Despite this, the IWM closed higher for the second week in a row at $216.84 (+1.74%), but put in a concerning Shooting Star weekly candle as the price fell back into the ascending channel. Bulls will be looking for the 8/21 EMA cloud to act as support next week. A lot of the weakness in the overall indices can be traced to the semi's which just plain got beat up last week Here's a snapshot of the economic calendar for this week. Thurs. and Fri. are the days I'm targeting for this weeks biggest trade docket. September S&P 500 E-Mini futures (ESU24) are up +0.47%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.59% this morning as investors looked past Joe Biden’s exit from his presidential reelection campaign and awaited a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” companies Tesla and Alphabet, as well as the release of the Fed’s preferred inflation gauge later in the week. U.S. President Joe Biden ended his reelection campaign on Sunday and endorsed Vice President Kamala Harris as the Democratic nominee. In a post on X, Biden said that he will stay in his role as President and Commander in Chief until his term ends in January 2025 and will address the nation later this week. “It has been the greatest honor of my life to serve as your President. And while it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term,” Biden wrote. The move was widely anticipated following Biden’s poor debate performance in June and amid polls indicating a growing likelihood of an election win by former President Donald Trump in November. In Friday’s trading session, Wall Street’s major averages closed in the red, with the benchmark S&P 500 dropping to a 2-1/2 week low and the tech-heavy Nasdaq 100 falling to a 3-1/2 week low. CrowdStrike Holdings (CRWD) plunged over -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 after a botched upgrade of its cybersecurity software brought down Microsoft’s systems and triggered a global IT outage. Also, chip stocks lost ground, with Intel (INTC) sliding more than -5%, ON Semiconductor (ON) dropping over -3%, and Nvidia (NVDA) falling more than -2%. In addition, Travelers Cos. (TRV) slumped over -7% and was the top percentage loser on the Dow after reporting weaker-than-expected Q2 revenue. On the bullish side, Intuitive Surgical (ISRG) surged more than +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company reported better-than-expected Q2 results. Also, Starbucks (SBUX) climbed over +6% following a report from the Wall Street Journal that activist investor Elliott Management has built a “sizeable” stake in the coffee chain. Second-quarter earnings season kicks into high gear this week, with investors awaiting fresh reports from major companies such as Tesla (TSLA), Alphabet (GOOGL), IBM (IBM), AT&T (T), Verizon (VZ), Comcast (CMCSA), ServiceNow (NOW), Texas Instruments (TXN), NXP Semiconductors N.V. (NXPI), Spotify Technology S.A. (SPOT), General Motors (GM), Ford (F), AbbVie (ABBV), Bristol-Myers Squibb Company (BMY), Visa (V), 3M Company (MMM), Coca-Cola (KO), Lockheed Martin (LMT), American Airlines Group (AAL), and United Parcel Service (UPS). On the economic data front, the June reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, market participants will be monitoring a spate of other economic data releases, including the U.S. GDP (preliminary), S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Existing Home Sales, Richmond Manufacturing Index, Building Permits, Goods Trade Balance, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Personal Income, Personal Spending, and Michigan Consumer Sentiment. Federal Reserve officials are in a blackout period before the Federal Open Market Committee meeting at the end of July, so they are prohibited from making public comments this week. Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 91.7% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.236%, down -0.07% Let's take a look at I.V. and expected moves this week. We have a 1.3% expected move on the SPY with 17% I.V. Guess what? That's plenty to work with!!!! We've been waiting for this. With about 30% more IV we are finally back to a decent risk/reward ratio on credit trades. The QQQ's are even better. My bias today is back to bullish. Futures are up strong. We don't have any large economic or earnings results to drive us today. The market seems to like the Biden news. Trade docket for today: /ES, /MNQ, /NG, CRWD, GLD, IWM, LEVI, NVDA, SPY/QQQ 4DTE, All seven 0DTE's. I'm looking to get back to our normal weekly schedule of credit strangles and ladder setups Weds. or Thurs. of this week. Scalping should hold some better potential for us Thurs and Friday as well. Intra-day levels for me: /ES; 5594/5605/5615* (200 period M.A.)/5638*(PoC on 2hr. chart) to the upside. 5568/5557/5540/5522 to the downside. /NQ; 19976/20103*(big resistance area)/20183 to the upside. 19853/19783/19650*(large drop space below this) to the downside. Bitcoin. I swung big on the bitcoin 0DTE on Friday with a 38% ROI trade. It was close but close doesn't count. After a nice run late Friday and over the weekend Bitcoin looks stalled here to start the week. Resistance is now 68,717. We are slowly working our way back to the ATH's. Support is 66,666. Yes I know. I don't like the number either! Let's have a great day today and a great week. I think the market has given us all the tools we need for us to have a successful result.

Welcome to Friday traders! The gateway to the weekend! We had a pretty good day yesterday and our Event Contract 0DTE's contributed a bunch. Here's our results. A couple on notes on our trades: We had a very quick, post-earnings take profit on TSM. We also have NFLX and ISRG earnings trades that we should get a profitable exit this morning at the open. We restarted our /MNQ ratio setup last night. I anticipate this to be a near daily setup now with the goal of bringing in $100 a day per contract traded. We'll go into more detail on that setup in todays zoom. We also got a Theta Fairy working and I want to discuss how we can get that back to a more full time trade today. We had two 0DTE's on BTC and two on ETH yesterday. As you know, we strive to make at least $1,000 a day on our 0DTE's and with just $3,200 of buying power the crypto 0DTE's brought in almost $400 of that goal. If you're not trading event contracts you're missing out on some opportunites to create edge and its the best way I know of to day trade crypto. You can get the platfrom setup for free and trade with as little as $20 dollars. Check it out. Let's take a look at the markets. With yesterdays sell off we flip back to a more decisive sell rating on the technicals. A couple of interesting notes; S&P 500 was down more than 1%. What was telling was the breadth. Is this the strongest market ever? The S&P 500 has hit 37 all-time highs this year, the most since 2021. The index has already seen more new records than in every year since 2016, except for 2017 and 2021. It is on pace to hit the 3rd most all-time highs in history, only behind 2021 and 1995 which saw 70 and 77 records. Overall, the S&P 500 is up ~17% year-to-date which marks the 12th best start to a year in the entire stock market history. Will the market hit over 70 new highs this year? $VIX overbought on daily RSI. VIX rarely stays overbought long... The past four times this has happened, it's marked multi-month tops for the VIX. Here's a snapshot of the major indices we trade. Of note yesterday was the fact that the parabolicly bullish IWM and DIA also joined in on the sell off. Futures are slightly up to mixed as I type. I've got a long QQQ scalp on that I carried over from yesterday that could use some more bullishness. Computer systems failed worldwide on Friday, disrupting services at airlines, banks, and the London Stock Exchange after a widely used cybersecurity program crashed and Microsoft separately reported issues with its cloud services. CrowdStrike Holdings alerted customers on Friday that its Falcon Sensor threat-monitoring product was causing crashes in Microsoft’s Windows operating system. At the same time, it was unclear what caused the issues, which coincided with disruptions in Microsoft’s Azure cloud and 365 services. In yesterday’s trading session, Wall Street’s major indexes ended lower. Domino’s Pizza (DPZ) tumbled over -13% and was the top percentage loser on the S&P 500 after the world’s largest pizza company reported weaker-than-expected Q2 total domestic comparable sales growth and suspended its target of opening more than 1,100 global net stores. Also, mega-cap technology stocks lost ground, with Amazon.com (AMZN) and Apple (AAPL) falling more than -2%. In addition, Elevance Health (ELV) slid over -3% after Bank of America Global Research downgraded the stock to Neutral from Buy. On the bullish side, D.R. Horton (DHI) surged more than +10% and was the top percentage gainer on the S&P 500 after the homebuilder reported upbeat Q3 results and announced a new $4.0 billion stock buyback program. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose +20K to 243K, compared with the 229K expected. Also, the U.S. July Philadelphia Fed manufacturing index rose to 13.9, stronger than expectations of 2.7. In addition, the Conference Board’s leading economic index for the U.S. fell -0.2% m/m in June, better than expectations of -0.3% m/m. “The Fed asked to see more evidence of a cooling economy, and for the most part, they’ve gotten it,” said Chris Larkin at E*Trade from Morgan Stanley. “Add [Thursday’s] weekly jobless claims to the list of rate-cut-friendly data points. The path to September remains open.” Chicago Fed President Austan Goolsbee said on Thursday that the Fed may need to cut interest rates soon to prevent a sharper deterioration in the labor market, which has cooled in recent months. While the Fed’s battle against inflation continues, several months of improving data have reassured him that officials are on course to reduce inflation to their 2% target, Goolsbee said. Also, San Francisco Fed President Mary Daly stated that some recent inflation data has been “really good,” but the Fed has not yet attained price stability. “We’re not there yet,” Daly said. “We don’t have price stability right now and we need to be very confident that we’re on a sustainable path to achieve it.” Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at the July FOMC meeting and a 95.3% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies like American Express (AXP), Schlumberger (SLB), Travelers (TRV), Halliburton (HAL), and Regions Financial (RF) are set to report their quarterly figures today. The U.S. economic data slate is empty on Friday. However, investors will likely focus on speeches from New York Fed President John Williams and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.192%, up +0.12%. My bias today is slightly bullish IF, and it's a big if, the markets can shake off the big computer snafu from overnight. One of the trades we are looking at today is CRWD. Our trade docket today: DELL, DJT, FSLR, ISRG, Theta fairy, /MNQ, IWM, LEVI, NFLX, NVDA, CRWD, 0DTE's. Intra-day levels for me: /ES; 5605/5613*(200 period M.A.)/5628/5642*(PoC) to the upside. 5592/5579/5570 to the downside. Below 5570 we could get some heavy bearish action. /NQ; 19968/20000*(PoC)/20082/20173 to the upside. 19888/19846/19805/19754 to the downside. Below 19754 could be very bearish. Bitcoin; 65,373 resistance. 63,623 support. Unless we get some movement today it may be tough to get a setup on the cryptos. Let's have another profitable day and I hope you all have a safe and enjoyable weekend!

Welcome back traders! We had an O.K. day yesterday. I came close to a full profit on my NDX debit 0DTE but ended up rolling the put side at the last minute at a debit so I'll need to work that today. It was really scalping that hurt me the most. Apparently its not profitable to be bullish in a bearish price action. I'll try to be better today. Here's our results. Let's take a look at the markets. Technicals have moved to bearish after yesterdays price action. Technicals are tenuous enough that any decent sized move today could swing it either way. Another down day could break us below some substantive support and be very bearish. A decent sized up day and we could be right back to bullish. Our short on the IWM yesterday via the micro futures worked like a charm. It and the DIA certainly seem overstretched here. September S&P 500 E-Mini futures (ESU24) are up +0.18%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.41% this morning, signaling a partial rebound from yesterday’s slump as an upbeat earnings report from Taiwan’s TSMC helped restore sentiment in the tech sector, while investors awaited a new round of U.S. economic data, remarks from Federal Reserve officials, as well as corporate earnings reports, with the spotlight on results from streaming giant Netflix. In yesterday’s trading session, Wall Street’s major indices closed mixed. Spirit Airlines (SAVE) plunged over -10% after the carrier lowered its Q2 revenue guidance. Also, chip stocks declined due to concerns about tighter U.S. restrictions on chip sales to China, with ASML Holding NV (ASML) slumping more than -12% to lead losers in the Nasdaq 100, Advanced Micro Devices (AMD) sliding over -10%, and Nvidia (NVDA) falling more than -6%. In addition, Five Below (FIVE) tumbled over -25% after the discount retailer provided downbeat Q2 guidance and announced the resignation of Joel Anderson from his roles as President and CEO. On the bullish side, Johnson & Johnson (JNJ) rose more than +3% after the pharmaceutical giant reported better-than-expected Q2 results. Economic data on Wednesday showed that U.S. industrial production climbed +0.6% m/m in June, stronger than expectations of +0.3% m/m. Also, U.S. June housing starts rose +3.0% m/m to 1.353M, stronger than expectations of 1.300M, while U.S. building permits rose +3.4% m/m to 1.446M in June, stronger than expectations of 1.400M. In addition, U.S. June manufacturing production rose +0.4% m/m, stronger than expectations of +0.2% m/m. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that the U.S. economy expanded at a modest pace heading into the third quarter, with several regions reporting flat or declining activity. The report also highlighted modest overall price increases, alongside slight growth in employment. Consumer spending was little changed. Nearly every district “mentioned retailers discounting items or price-sensitive consumers only purchasing essentials, trading down in quality, buying fewer items, or shopping around for the best deals,” the report said. Looking forward, businesses anticipated the slowing to persist. “Expectations for the future of the economy were for slower growth over the next six months due to uncertainty around the upcoming election, domestic policy, geopolitical conflict, and inflation,” according to the Beige Book. Fed Governor Christopher Waller said on Wednesday that the economy is nearing a point where the central bank can cut interest rates but noted he’d like to see a “bit more evidence” that inflation is on a sustained downward path. “While I don’t believe we have reached our final destination, I do believe we are getting closer to the time when a cut in the policy rate is warranted,” Waller said. Also, New York Fed President John Williams remarked that inflation data in recent months has been encouraging, but he requires more evidence in the upcoming months to gain the confidence needed to reduce borrowing costs. In addition, Richmond Fed President Thomas Barkin stated that the Fed requires more evidence that the disinflation process is sustained before cutting interest rates. U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 91.7% chance of a 25 basis point rate cut at the September meeting. Second-quarter earnings season gathers steam, and investors await new reports from notable companies today, including Netflix (NFLX), Abbott Laboratories (ABT), Blackstone (BX), Intuitive Surgical (ISRG), Marsh & McLennan Companies (MMC), Cintas (CTAS), DR Horton (DHI), Domino’s Pizza (DPZ), and KeyCorp (KEY). On the economic data front, all eyes are focused on the U.S. Philadelphia Fed manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the July Philadelphia Fed manufacturing index will arrive at 2.7, compared to last month’s value of 1.3. Also, investors will focus on U.S. Initial Jobless Claims data. Economists estimate this figure to stand at 229K, compared to last week’s number of 222K. The U.S. Conference Board Leading Index will be reported today as well. Economists expect June’s figure to be -0.3% m/m, compared to the previous number of -0.5% m/m. In addition, market participants will be anticipating speeches from Dallas Fed President Lorie Logan, San Francisco Fed President Mary Daly, and Fed Governor Michelle Bowman. Our trade docket for today: /MNQ, DPX, NVDA, UAL, TSM, NFLX, ISRG, PPG, HAL, 0DTE's. My bias today is neutral. Futures are showing weakness in the IWM and DIA which are very overstretched and strength in the SPX and NDX. Techs and Semis are coming back this morning. I think it all balances out to a lot of nothing. Intra-day levels for me: /ES; 5652/5680/5701/5720*(key level. above here we break to new ATH) to the upside. 5637* (key level. This may be the most important level of the day. PoC and a huge magnet)/518/5609* (key level. 200 period M.A.)/5599 to the downside. /NQ; 20139/20238/20341/20418 to the upside. 20019/19995/19969/19889 to the downside. Bitcoin; While we had success with both our crypto 0DTE's yesterday it wasn't a great setup and we had very little capitial committed. Today may be more of the same. Bitcoin continues to consolidate in preparation of its next big directional move. 66,300 is resistance and 64,179 is support. Lot's of earning plays today. I'll see you all in the trading room!

Welcome to the jungle. The rotation out of techs continues this morning. We've been setting up for this for weeks now. Some of our members patience was being tested but the payoff seems near. Our results yesterday were perfect. When I say perfect I mean everything we touched hit for a full profit. I'm humble enough to always say that when those rare days occur it's luck. That's just not how trading works. In fact, one of the biggest challenges I see with new traders is the idea that if they get good enough, somehow, they will be able to avoid losses. Losses are a part of the game and will ALWAYS happen. All we can do as traders in put our selves in the best position we can. Here's our results from yesterday. A couple quick notes on the above matrix. These are JUST our day trades. We work 15-30 other weekly trades. I'm also going to add our /MNQ futures trade to this matrix starting today. We are currently short with a put cover that we are rolling each day. I have four short /MNQ contracts using about $9,000 in buying power and generating about $120 a day in cash flow. This hedge can be long or short, depending on my market bias but obviously right now, with the markets bouncing around all time highs, I'm short. Also a quick note, once again, about the importance of having multiple irons in the fire. Scalping has been a huge help to us. Today looks to be another nice opportunity. Our event contract 0DTE's have been amazing. Sure we only had $18.50 in the NDX yesterday but 370% ROI is not a bad risk/reward! Finally, I will say this again. I don't know of another place where you can go to find seven 0DTE opportunities a day! Combine that with our track record this year of an annualized return of $400,000 dollars on about $35,000 of capital. Here's our results YTD of our documented SPX/NDX combos. Almost $160,000 profit on NDX and almost $60,000 profit on the SPX. Add in about $8,000 of profit on our Event contract 0DTEs and the fact that I don't know of another place that offers up daily 0DTE opportunities on both Bitcoin and Etherium and I feel comfortable saying, we're doing pretty good. On to the markets. Gold has broken out to a new ATH. This is bearish for equities. 1. Tech stocks are falling like we are entering a bear market 2. Small cap stocks are rising like the bull market just began 3. Gold prices are rising like we are entering a recession 4. Bond prices are falling like the economy is strong 5. Oil prices are falling like rate cuts are cancelled 6. The S&P 500 is rising like rate cuts already began This is a very confused market! September S&P 500 E-Mini futures (ESU24) are down -0.79%, and September Nasdaq 100 E-Mini futures (NQU24) are down -1.22% this morning as concerns over stricter U.S. restrictions on Chinese trade and semiconductor technology weighed on sentiment, while investors awaited a fresh batch of U.S. economic data and the next round of corporate earnings. Bloomberg News reported on Wednesday that the Biden administration has informed allies that it is contemplating deploying the most stringent trade measures possible if companies like Tokyo Electron and ASML Holding persist in providing China with access to advanced semiconductor technology. Seeking leverage with allies, the U.S. is considering whether to implement a measure known as the foreign direct product rule, which allows the country to impose controls on foreign-made products using even the smallest amount of American technology, according to the report. The U.S. is presenting this idea to officials in Tokyo and the Hague as a scenario that is becoming increasingly probable if these countries do not strengthen their own measures against China. In yesterday’s trading session, Wall Street’s major indexes ended in the green, with the benchmark S&P 500 and blue-chip Dow notching new all-time highs. Match Group (MTCH) climbed over +7% after activist investor Starboard Value disclosed a stake of around 6.6% in the dating app company and advocated for a turnaround or potential sale. Also, UnitedHealth Group (UNH) advanced more than +6% and was the top percentage gainer on the Dow after the insurer reported upbeat Q2 results and backed its full-year adjusted EPS guidance. In addition, Bank of America (BAC) rose over +5% after the number two U.S. lender reported better-than-expected Q2 net interest income and provided an above-consensus Q4 net interest income forecast. On the bearish side, Charles Schwab (SCHW) plunged more than -10% and was the top percentage loser on the S&P 500 after reporting fewer-than-expected new brokerage accounts in Q2. Economic data on Tuesday showed that U.S. retail sales were unchanged m/m in June, stronger than expectations of -0.3% m/m, while May’s reading of +0.1% m/m was revised upward to +0.3% m/m. Also, U.S. June core retail sales, which exclude motor vehicles and parts, rose +0.4% m/m, stronger than expectations of +0.1% m/m. In addition, the U.S. import price index was unchanged m/m in June, weaker than expectations of +0.2% m/m. Meanwhile, U.S. rate futures have priced in a 6.7% chance of a 25 basis point rate cut at the next central bank meeting in July and a 93.3% chance of a 25 basis point rate cut at the September FOMC meeting. Second-quarter earnings season is gathering pace, with investors awaiting fresh reports from notable companies today, including Johnson & Johnson (JNJ), Elevance Health (ELV), Prologis (PLD), U.S. Bancorp (USB), Kinder Morgan (KMI), United Airlines (UAL), and Ally Financial (ALLY). On the economic data front, investors will focus on U.S. Industrial Production data, set to be released in a couple of hours. Economists, on average, forecast that June Industrial Production will arrive at +0.3% m/m, compared to the previous figure of +0.9% m/m. The U.S. Building Permits (preliminary) and Housing Starts data for June will be reported today. Economists forecast Building Permits to be 1.400M and Housing Starts to be 1.300M, compared to the previous numbers of 1.399M and 1.277M, respectively. U.S. Crude Oil Inventories data will come in today as well. Economists estimate this figure to be -0.900M, compared to last week’s value of -3.443M. In addition, market participants will be looking toward speeches from Richmond Fed President Thomas Barkin and Fed Governor Christopher Waller. Later today, the Federal Reserve will release its Beige Book survey of regional business contacts, which includes anecdotes and commentary on business conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.159%, down -0.07%. With the slide in futures this morning we are back to Neutral technical rating I've been taling about the laggard indices of the IWM and DIA for a long, long time. I said that this divergence won't last. It never does. Either the SPX and NDX will come down or the IWM and DIA will come up. It looks like it's the latter. Talk about parabolic moves! We are currently short the NDX via an /MNQ futures position. I'm looking today to take a possible short in /M2K. Bollinger bands and Keltner channels are blown through. Move is wayyyyyy beyond Avg. True range. Stoc and RSI are pinned at overbought. Trade docket for today: /MNQ, DELL, DIA, FSLR, NEM/GLD combo, NVDA. We have CCI, DFS, UAL, BX, NDK, DPZ as all potential earnings plays and the /M2K short,cover trade. Of course we'll be looking to work our seven 0DTE opportunites. Our SPX debit is already set for a $500 profit at the open. I'll also look to get our VTI monthly swing trade on. My bias for today is bearish. We have had so much success with our VTI monthly swing trade. 2-4% a month profit. Easy peasy setup. Doesn't need a lot of monitoring. Just a really, really great trade. We haven't gotten a clear signal this month to get one in place! Today is the day. We'll be lucky to make 1.5% this go around but...it's only a three day trade! Intra-day levels for me: /ES; 5672/5683/5691/5702 are resistance levels to the upside. 5655/5639* (key level! PoC on 2hr. chart)/5613/5595*(key level! below here is "look out below".) /NQ; The index looks weak. We are below PoC. Below 50 period moving avg. on 2hr. chart and now, breaking below 200 period moving avg. 20419/20515/20593/20633* (key level. PoC on 2 hr. chart) are resistance levels. Bulls need to reclaim the 20633 level to keep the uptrend in place. 20234/20205/20116/20005 to the downside. Bitcoin; It looks like the near term bottom is in on BTC. 65,945/66318 are new resistance levels and 64,049/63,489 are support. Let's have a great day folks! Who knows what the market will do today? Who know how our trades will turn out? There are no guarantees in trading but....I'm confident that today, just like most days, our trading system will offer us the ability and opportunity to make more than $1,000 dollars today. Just like it does almost every day. Will we succeed? Check back tomorrow! We don't know right now but...the opportunity is there for us with the systems we've created. For that, I'm grateful.

Welcome back traders. I'm back from the mountains and lake. It was a nice break but I can't help but think of the scalping opportunities I missed on Fri. and Mon. That price action has been amazing. We'll be back in full swing today with our scalping program. We had a good day yesterday, although I had about 35% of the normal amount of capital committed. That was partially because some positions ran too fast but also deliberate. The swings going into the close have been dramatic. We'll look today to get earlier exits on our 0DTE's to avoid nail biting it into the close. Technicals are still pointing upwards. The IWM appears to be going parabolic. In yesterday’s trading session, Wall Street’s main stock indexes closed higher, with the benchmark S&P 500 and blue-chip Dow posting new record highs. Trump Media & Technology Group (DJT) soared over +31% after a failed assassination attempt on former President Donald Trump on Saturday evening potentially boosted his chances of winning the presidential election in November. Also, Apple (AAPL) closed up more than +1% at a record high after Morgan Stanley named the stock as a “Top Pick” with a price target of $273. In addition, Goldman Sachs (GS) gained over +2% as upbeat Q2 results overshadowed plans to moderate the pace of buybacks. On the bearish side, Macy’s (M) tumbled more than -11% after the department store chain announced that it had ended buyout discussions with Arkhouse Management and Brigade Capital Management. Economic data on Monday showed that the Empire State manufacturing index fell to -6.60 in July, weaker than expectations of -5.50. Federal Reserve Chair Jerome Powell said in an interview on Monday that second-quarter economic data has given policymakers greater confidence that inflation is trending towards the central bank’s 2% target, potentially setting the stage for near-term interest rate cuts. Powell also remarked that the labor market has shifted into better balance and that monetary lags imply the Fed can take action before achieving the 2% inflation target. At the same time, the Fed chief made clear that he would not send “any signals” regarding the timing of rate cuts. Separately, San Francisco Fed President Mary Daly remarked that inflation is decreasing in a manner that boosts confidence it is moving towards 2%. “Inflation is coming down and it’s doing so in a way that confidence is growing that we’re getting nearer a sustainable pace of getting inflation back down to 2%,” Daly said. Meanwhile, U.S. rate futures have priced in an 8.6% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 99.4% probability of at least a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like UnitedHealth (UNH), Bank of America (BAC), Morgan Stanley (MS), PNC Financial (PNC), and JB Hunt Transport (JBHT) are set to report their quarterly figures today. On the economic data front, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that June Retail Sales will stand at -0.3% m/m, compared to last month’s figure of +0.1% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at -0.1% m/m in May. Economists foresee the June figure to be +0.1% m/m. The U.S. Import Price Index for June will be reported today. Economists anticipate the import price index to be +0.2% m/m, compared to the previous figure of -0.4% m/m. U.S. Business Inventories data will come in today as well. Economists foresee this figure to arrive at +0.4% m/m in May, compared to the previous number of +0.3% m/m. In addition, market participants will be anticipating a speech from Fed Governor Adriana Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.176%, down -1.26%. In spite of all the bullish leanings my bias today is more neutral. I think the selling pressure we've been getting going into the close the last couple of trading sessions is trying to tell us something. Futures are up as I type but that can change quickly, as we've seen lately. Trade docket for today is fairly loaded up. IBKR, JNJ and UAL potential earnings setups. /ZC, DELL, DJT, FSLR, GLD/NEM, IWM, UPST, BA?, NVDA and our seven potential 0DTE's. Intra-day levels for me: /ES; 5695/5710/5718 are resistance levels to the upside. 5681/5638/5636 are support levels to the downside with 5636 being the key PoC level. A drop below that would put me more bearish. /NQ; The Nasdaq is a tad weaker than SP500. 20696/20799/20888 are key resistance levels with 20888 being key. A push above that would be very bullish. 20631/20539/20444 are support levels to the downside with 20631 key. It's a pretty substantive PoC and as I type its right were we are sitting. Bulls need to hold this level. Bitcoin; Both our crypto 0DTE's from yesterday we nice wins for us. This bullish change of direction looks like it may have legs. Germany (we assume) has ended it's selling an Bitcoin ETF's are seeing heavy inflows compared to the outflows of the past month. 65,945 is new resistance and 60,591 is new support. Let's have a great day folks. Premiums are still low but if the price action today is anything like our last two sessions, we should be able to find opportunities.

Welcome back to the new week traders! The last few days have served notice, once again, that if you don’t like what’s happening just wait. It will change. Thurs. and Fri. saw us finally getting some movement in the market. The weekend say the assassination attempt against former Pres. Trump. It servers notice that we should always expect the unexpected. It’s also my wish that we, as human beings, may unite in the sanctity of life. Our ability to peacefully disagree is something we should all strive for. My heart goes out to the innocents that were wounded and killed. Let's take a look at where we are in the markets to start off the week. Technicals have swung us back into bullish mode. September S&P 500 E-Mini futures (ESU24) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.52% this morning as investors increased their bets on Donald Trump winning the U.S. presidential election following an assassination attempt, with the focus shifting to Wall Street’s earnings season, key economic data releases, as well as comments from Federal Reserve Chair Jerome Powell and other Fed officials. Donald Trump was shot in the ear during a Saturday campaign rally, an attack that left the Republican presidential candidate’s face streaked with blood. His security agents swiftly surrounded him, but he soon emerged, pumping his fist in the air and mouthing the words “Fight! Fight! Fight!” The Republican National Convention begins on Monday and continues through Thursday when presidential candidate Donald Trump will give remarks, marking his first public appearance since the attempted assassination. The dollar rose while longer-maturity bonds fell on Monday as investors anticipated that Trump’s return to the White House would lead to relaxed fiscal policy and increased trade tariffs. In Friday’s trading session, Wall Street’s major averages ended in the green, with the benchmark S&P 500 and blue-chip Dow notching new record highs. Bank of New York Mellon (BK) climbed over +5% after reporting better-than-expected Q2 net interest income. Also, chip stocks gained ground, with ARM Holdings (ARM) rising more than +4% to lead gainers in the Nasdaq 100 and Intel (INTC) advancing nearly +3% to lead gainers in the Dow. In addition, Carvana (CVNA) closed up over +4% after BTIG initiated coverage of the stock with a Buy rating and a $155 price target. On the bearish side, Wells Fargo (WFC) slumped about -6% and was the top percentage loser on the S&P 500 as the lender’s Q2 results were impacted by higher-than-expected costs. Economic data on Friday showed the U.S. June producer price index for final demand rose +0.2% m/m and +2.6% y/y, stronger than expectations of +0.1% m/m and +2.3% y/y. Also, the U.S. core PPI, which excludes food and energy, increased +3.0% y/y in June, higher than the +2.5% y/y consensus and accelerating from the +2.6% y/y pace in May (revised from +2.3% y/y). However, categories used in calculating the Fed’s preferred inflation measure, the core personal consumption expenditures price index, were not so dire. Finally, the University of Michigan’s U.S. consumer sentiment index unexpectedly fell to an 8-month low of 66.0 in July, weaker than expectations of 68.5. At the same time, the University of Michigan’s July year-ahead inflation expectations eased to 2.9% from 3.0% in June, in line with expectations, while 5-year implied inflation expectations eased to 2.9%, better than expectations of no change at 3.0%. “We continue to expect the Fed to join the global rate-cutting cycle in September, with 50 basis points of easing this year,” said Mark Haefele at UBS Global Wealth Management. U.S. rate futures have priced in a 4.7% probability of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month and a 91.7% chance of a 25 basis point rate cut at September’s policy meeting. Earnings season picks up steam this week, with results expected from several more big banks, including Goldman Sachs (GS), Bank of America (BAC), and Morgan Stanley (MS). Also, notable companies, including Netflix (NFLX), UnitedHealth (UNH), Johnson & Johnson (JNJ), Blackrock (BLK), Progressive (PGR), Kinder Morgan (KMI), Alcoa (AA), U.S. Bancorp (USB), United Airlines (UAL), Ally Financial (ALLY), Abbott Laboratories (ABT), Domino’s Pizza (DPZ), Schlumberger (SLB), American Express (AXP), Halliburton (HAL), and Travelers (TRV), are slated to post quarterly updates this week. In addition, investors will be monitoring a spate of economic data releases this week, including U.S. Retail Sales, Core Retail Sales, Export Price Index, Import Price Index, Business Inventories, Building Permits (preliminary), Housing Starts, Industrial Production, Manufacturing Production, Crude Oil Inventories, Initial Jobless Claims, Philadelphia Fed Manufacturing Index, and Leading Index. Meanwhile, Fed Chair Jerome Powell is scheduled to participate in an interview hosted by the Economic Club of Washington later in the day. A host of other Fed officials will also be making appearances throughout the week, including Daly, Kugler, Barkin, Waller, Logan, Bowman, Williams, and Bostic. Today, investors will likely focus on the U.S. NY Empire State manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the July NY Empire State manufacturing index will arrive at -5.50, compared to the previous value of -6.00. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.206%, up +0.50%. The attempt on Trump is political but it also affects markets. The dollar. The indices and, of course, DJT. We hold a short position in that which we've been cash flowing. It looks to hurt us today with this massive shift in opinion. It will be interesting to see if this shift in public opinion will look into the election. Finally! We've been talking about the lagging indices, namely the IWM and DIA. They aren't lagging anymore. The Dow has now found some legs and the IWM has woken up! After a few months of outflows, there is now a focused inflow of captial into the Small caps. Let's take a look at I.V. and the expected moves for the week. For all the movement we've had over the last three trading sessions, our I.V. is still in the tank. It looks like, only a decisive downward move will help this. That rotation was pretty clear on Fridays session. Market internals are pretty strong. Friday's performance was strong in all sectors with weakness only showing up in META and some reporting bank stocks. My bias and lean today is bullish. The order flow is pretty heavily slanted that way. Trade docket for today: We'll start with five 0DTE's today. An SPX stand alone. We already have a call side started there. An NDX "debit type" which will build on our already existing bullish BWB. An Event contract NDX, BTC and ETH. We'll also restart all our ladder trades today with Oil, Bonds, DIA and Gold. I'll hold off until tomorrow for our other weekly standard setups to see if we can get some more I.V. into the option pricing. Intra-day levels for me: /ES; Futures came alive on Friday and are continuing this morning. There are a couple key levels for me today. 5688, which is right were we are as I type is a key level. It puts us right back to ATH's and more importantly, right back to the level that we rose to on Friday before retracing. 5707 is a key level for bulls. A break above that and its all bullish. Below 5654 and we may be able to start a retrace lower. /NQ; 20627 (right where we are at as I type) is a critical PoC level. 20740 is the first resistance then comes 20939. Above that we are back to marking ATH's. 20487 is the first support level and then 20391. Bitcoin: Guess what woke up with the Trump shooting? BTC! A $5,0000+ dollar move to the upside. Resistance is now 64,226 with support at 61,855. It will be interesting to see what type of trade we can find here today. Let's have a great week folks!

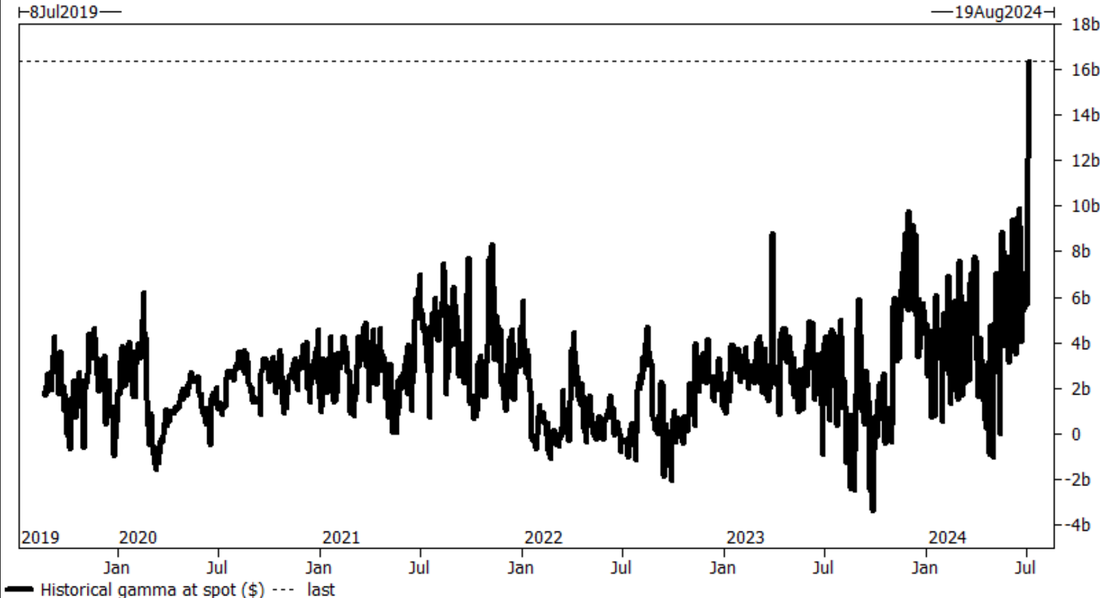

What a day yesterday. I'm always surprised more traders don't use technicals more. They never tell us when an event will happen but they sure give us clues as to what the next move may be. We've been talking here for two weeks about Stocastics being overbought. RSI pinned to the upside. Keltner and Bollinger bands being pressed to the upside etc. I saw a lot of chatter yesterday by traders who were just plain surprised that the market took a dump. I on the other hand was surprised it just kept going up. Well, we got what we asked for yesterday. Weds. I complained all day about horrible vol and I.V. That certainly wasn't the case yesterday. It was a perfect day for traders. We had a good day. It could have been much, much better but I try to never complain when we are making money. Here's our results for the day. Heading into today's session we are back to a technical neutral rating. Futures are mostly flat. In yesterday’s trading session, Wall Street’s major indexes closed mixed, with the tech-heavy Nasdaq 100 dropping to a 1-week low. Tesla (TSLA) slumped over -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Bloomberg News reported that the company was delaying its planned robotaxi event by about two months to October. Also, Delta Air Lines (DAL) slid about -4% after the top U.S. carrier posted downbeat Q2 results and provided below-consensus Q3 adjusted EPS guidance. In addition, chip stocks retreated, with Nvidia (NVDA) falling more than -5% and Intel (INTC) dropping nearly -4% to lead losers in the Dow. On the bullish side, WD-40 (WDFC) gained over +4% after the company reported better-than-expected Q3 results. The Labor Department’s report on Thursday showed consumer prices edged down -0.1% m/m in June, lower than the predicted figure of +0.1% m/m. On an annual basis, headline inflation eased to +3.0% in June from +3.3% in May, better than expectations of +3.1%. In addition, the core CPI, which excludes volatile food and fuel prices, eased to a 3-year low of +3.3% y/y in June, better than expectations of no change at +3.4% y/y. At the same time, the number of Americans filing for initial jobless claims in the past week fell -17K to a 6-week low of 222K, stronger than expectations of 236K. Chicago Fed President Austan Goolsbee described the latest inflation data on Thursday as “excellent,” stating that the figures provided the evidence he has been waiting for to be confident that the central bank is on track to achieve its 2% goal. Also, San Francisco Fed President Mary Daly said, “With the information we have received to date, which include data on employment, inflation, GDP growth, and the outlook for the economy, I see it as likely that some policy adjustment will be warranted.” At the same time, St. Louis Fed President Alberto Musalem stated that the June CPI report indicated “encouraging further progress towards lower inflation,” but he would like additional evidence of easing price pressures. “We’ll see you September! Better-than-expected inflation readings in many key sectors should allow the Fed to start talking about adjusting policy in July - and potentially allow the Fed to act in September,” said George Mateyo at Key Wealth. “That said, we still see the Fed wanting to gain further confidence before cutting aggressively unless stress materializes in the labor market.” U.S. rate futures have priced in a 6.7% chance of a 25 basis point rate cut at the next FOMC meeting in July and an 86.4% probability of a 25 basis point rate cut at the September FOMC meeting. Meanwhile, the second-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C), slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. Producer Price Index, set to be released in a couple of hours. Economists, on average, forecast that the U.S. June PPI will stand at +0.1% m/m and +2.3% y/y, compared to the previous figures of -0.2% m/m and +2.2% y/y. The U.S. Core PPI will also be closely watched today. Economists expect June’s figures to be +0.2% m/m and +2.5% y/y, compared to the previous numbers of 0.0% m/m and +2.3% y/y. The U.S. Michigan Consumer Sentiment preliminary reading will be reported today as well. Economists estimate this figure to arrive at 68.5 in July, compared to 68.2 in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.222%, up +0.77%. With PPI out this morning I once agian have no bias for the day and won't look at levels. As you saw yesterday it's best to just trade what we see as the day develops and not have any preconcieved Ideas. Dealer gamma exposure (GEX) skyrocketed 250% this week to $16B, the highest on record. High dealer gamma means dealers are net long options. Large gamma spikes like this typically precede significant upward momentum, which creates the environment necessary for a violent reversal Gamma Exposure (GEX) is telling us we're about to enter the final blow off top. In this phase there is almost always increased speculation in micro caps & derivatives as the top performing stocks begin selling off. Looks like a rotation out of Tech into REITs & Utilities could be underway after yesterday’s CPI print… I've also been saying for a month now that the divergence between the SPY and QQQ's continually hitting new ATH's and the IWM and DIA staying weak would resolve. That appears to be happening with strength in the DIA and IWM and the SPY and QQQ's weakening. We haven't been able to get one of our VTI swing trades working yet this month but it looks like we may be getting closer to a short setup Our trade docket today will be primarily focused on our 0DTE's. No zoom feed today. I'm up at our cabin with the family and the boat that, I'm sure we have some mechanical malfunction (it always does) and the internet is poor. I'll also skip scalping. It certainly saved us yesterday.

Have a great weekend all! Remember for today...just trade what you see. No bias. Holy smokes! We had a really nice day yesterday...I am frankly amazed. I truely have not see a day like this in the past five years of running this trading room. Low vol. and I.V. just absolutely in the tank! Credit trades have horrible risk/reward ratios right now. Fine. Let's flip to debit trades. That's not much easier. All our indicators are bullish. The market is bullish, but do you really want to go long here at this level? How about bearish? We certainly seem overstretched to the upside but...no real sell or reversal signals yet either. Tough, tough market. We get CPI this morning. Maybe that will juice the premiums a bit. Here's our results from yesterday. Federal Reserve Chair Jerome Powell told House lawmakers on Wednesday that he perceives inflation to be diminishing, though he remains uncertain whether price increases are sustainably slowing toward the Fed’s 2% target. Also, Powell stated the Fed doesn’t require inflation to drop below 2% before reducing rates, while noting that officials still have more work to do. In addition, the Fed chief remarked that the labor market has cooled “pretty significantly.” “Markets remain remarkably calm despite the flood of data this week, including Fed Chair Powell’s testimony, CPI/PPI reports, and the beginning of earnings season,” said Mark Hackett at Nationwide. “This could be challenged by the CPI reading.” Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at the July FOMC meeting and a 68.1% probability of a 25 basis point rate cut at the September meeting. Today, all eyes are focused on the U.S. consumer inflation report, set to be released in a couple of hours. Economists, on average, forecast that the U.S. June CPI will arrive at +0.1% m/m and +3.1% y/y, compared to the previous numbers of 0.0% m/m and +3.3% y/y. The U.S. Core CPI data will also be closely watched today. Economists anticipate the Core CPI to be +0.2% m/m and +3.4% y/y in June, compared to the previous figures of +0.2% m/m and +3.4% y/y. According to a survey by 22V Research, 55% of investors anticipate a “risk-on” market reaction to the CPI report, while 16% foresee a “risk-off” response, and 29% expect a “mixed/negligible” response. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 236K, compared to last week’s number of 238K. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. On the earnings front, PepsiCo (PEP) and Delta Air Lines (DAL) are slated to report their Q2 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.277%, down -0.02%. Pre-CPI release the technicals are all still bullish. I don't have any real directional bias this morning as CPI will likely be the catalyst that drives the price action today. All the major indicies look very bullish here. However, RSI is above 80 and we are pushing on the upper Bollinger band. We look overstreched. It's also interesting the most fund managers are pretty much "all in" at this point. That's bearish. It's also worth noting, the Hindenburg Omen triggered yesterday. Not aware of it? Google it! I'm not looking at intra-day levels today as CPI should serve as the catalyst for the day.

Our trade docket for today is simply to book profits where we can. Free up some cash and focus on 0DTE's. This market simply isn't rewarding us for taking other risks. Welcome to midweek!. We had a decent day yesterday. It would be nice if I could catch a trend runner in my scalping efforts but today is another day. We have a small long call position on the QQQ's that we carried over from yesterday which looks good pre-market. We got a jump on our ETH and BTC crypto 0DTE's last night with some pretty nice setups that look to cash flow for us today. Speaking of crypto, something to keep an eye on is the rainbow chart analysis. Here's an overview for you; There has been no small amount of uncertainty surrounding Bitcoin (BTC) for approximately a month. After a significant climb in the initial months of 2024 and a new all-time high (ATH) just above $73,000 in March, the world’s premier cryptocurrency found itself in a strong downtrend in June and early July. While the decline is widely considered to be at least partially driven by a convergence of events – including the German government’s plans to offload seized BTC and the long-awaited repayments by the collapsed crypto exchange Mt. Gox – the fact that Bitcoin has crashed through multiple support zones has left many investors wary. Though BTC remains 32.44% in the green in the year-to-date (YTD) chart, it has fallen nearly 20% in the last 30 days of trading and is 23.09% below its yearly – and all-time – highs. By July 8, the cryptocurrency appears to have settled in the range between just below $54,500 and just above $56,000 – levels not seen since February – with little certainty about whether the next move will take it higher or lower. Bitcoin price today, at press time, stands at $56,147. BTC YTD price chart. Source: FInboldIn this climate of fear and uncertainty, the Bitcoin Rainbow Chart – a tool that utilizes a logarithmic growth curve and describes investor sentiment at various price levels – can offer valuable insights into what the coin’s next move in the crypto market may be. The 2024 Bitcoin Rainbow chartThe Bitcoin Rainbow Chart is divided into nine color-coded zones, each representing a certain price range and the associated market sentiment. These range from ‘Bitcoin is dead’ – lows that indicate that severe bearish sentiment prevails – to ‘Maximum Bubble Territory’ – highs that are so high that the cryptocurrency’s price is likely to plummet. According to the chart, the recent downtrend brought Bitcoin to the border between ‘Accumulate’ – levels that indicate it is a good time to purchase more of the coin – and ‘Still cheap’ – another zone predicted to be well below BTC’s forthcoming highs. Bitcoin Rainbow chart predicts Bitcoin ranges for end of 2024In addition to presenting Bitcoin’s historical performance and placing it in a market sentiment context, the Rainbow Chart also offers some insights into the likely future prices of the world’s premier cryptocurrency. According to the tool, should BTC find itself below $37,417.75 in late December, it would mean that the current bull cycle is likely at an end and that the winds of the crypto winter are again blowing strong. On the other hand, trading above $186,667.72 would hint that Bitcoin has become a bubble, while sustained closes above $244,473.74 would all but guarantee it, meaning that a major correction is almost certainly imminent. Bitcoin Rainbow chart zones for late 2024. Source: BlockhainCenterEslewhere, the Rainbow chart indicates that BTC would be the most stable at the end of 2024 if it remains between $85,730.33 and $112,983.27 – the ‘HODL’ range – and relatively stable, though investors would do well to keep a lookout for the range between $112,983.27 and $144,774.1 – the ‘Is this a bubble?’ range. Finally, the tool strongly suggests that an investor would be right to buy Bitcoin near the end of 2024 if it trades in the zone between $50,768.84 and $65,962.8 as it marks the area as ‘Accumulate’ though prices up to $85,730.33 would still be considered relatively cheap. In prepared remarks for a Senate hearing Tuesday, Fed Chair Jerome Powell said that “more good data” would bolster confidence that inflation is moving down toward the Fed’s 2% target, noting that recent readings indicate “modest further progress” on prices. Also, Powell remarked that lowering rates too soon or too much could harm inflation progress. In addition, the Fed chief described the labor market as “strong, but not overheated” and noted that the central bank’s restrictive stance is effectively balancing supply and demand. “Powell keeps the ship steady. Chair Powell’s prepared testimony struck a balanced tone,” said Peter Williams at 22V Research. “September remains modal, if notably more tentative than priced currently. But with the Fed balancing risks, upside surprises to labor market or inflation data could delay the first cut.” U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at the next central bank meeting in July and a 70.0% chance of a 25 basis point rate cut at September’s policy meeting. Today, investors will closely monitor Federal Reserve Chair Jerome Powell’s semi-annual monetary policy testimony before the House Financial Services Committee. Also, market participants will be looking toward speeches from Chicago Fed President Austan Goolsbee, Fed Governor Michelle Bowman, and Fed Governor Lisa Cook. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data, set to be released in a couple of hours. Economists estimate this figure to be 0.700M, compared to last week’s value of -12.157M. U.S. Wholesale Inventories data will be reported today as well. Economists expect May’s figure to be +0.6% m/m, compared to +0.1% m/m in April. Meanwhile, the focus remains on the June reading of the U.S. Consumer Price Index, scheduled for release on Thursday, which is expected to show a decline in inflation to +3.1% y/y from +3.3% y/y in May. Second-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) set to report their quarterly results. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.286%, down -0.28%. Markets remain bullish. I know I seem like a broken record, repeating myself daily but...this divergence in the market is not a bullish indicator of things to come. Add to the the fact that $SPY Today was the lowest volume day since Dec. 24th 2019 (half day before Christmas). $SPY Today was the lowest volume day for a full day ever? Crazy. SPX 30 day realized volatility making new 4-year low of 5.7%. So the VRP, the implied realized volatility spread, is 4.5% (96th percentile). The VIX1D is in the tank! This is not a favorable enviroment for option sellers. We are 50% off where I.V. should be for optimal selling setups! 50%!!!!! I honestly can't remember the last time I've seen this. For us, as option sellers it simply means we trade smaller and get more selective in the trades we do take. Trade docket for today; FSLR, LEVI, NVDA, ORCL, TSLA, 0DTE's My lean for today is slightly bullish. Intra-day levels for me: /ES; 5645/5650/5657/5668 to the upside. 5639/5635/5628/5622 to the downside. Note; Tight consolidation ranges like this always happen prior to a big expansion. /NQ; 20774/20833/20846 to the upside. 20679/20621/20520 to the downside. Bitcoin; 59,745/60,602 are resistance levels. 57,772/57,201 are support. We've had five days now of slightly bullish price action. The German government still has some more planned selling to do but we may be seeing signs of selling abating. Let's have a great day folks. If you're an option seller be cautious. I'm looking to more asymmetric setups. Chicken Iron condors, Broken wing butterflies, Iron butterflies etc.

|

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |