|

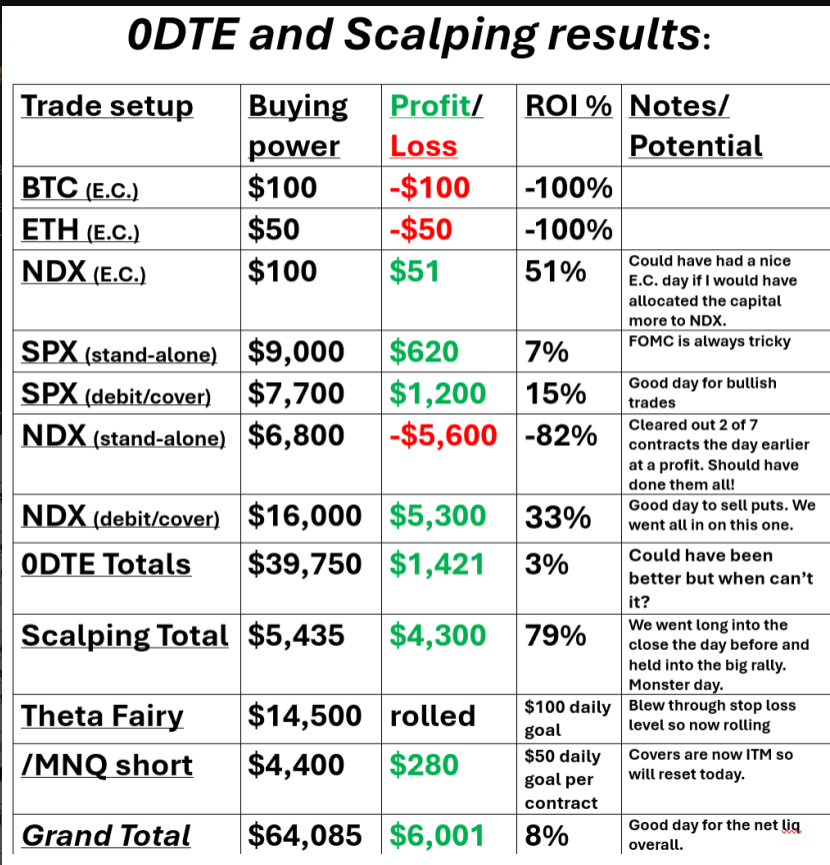

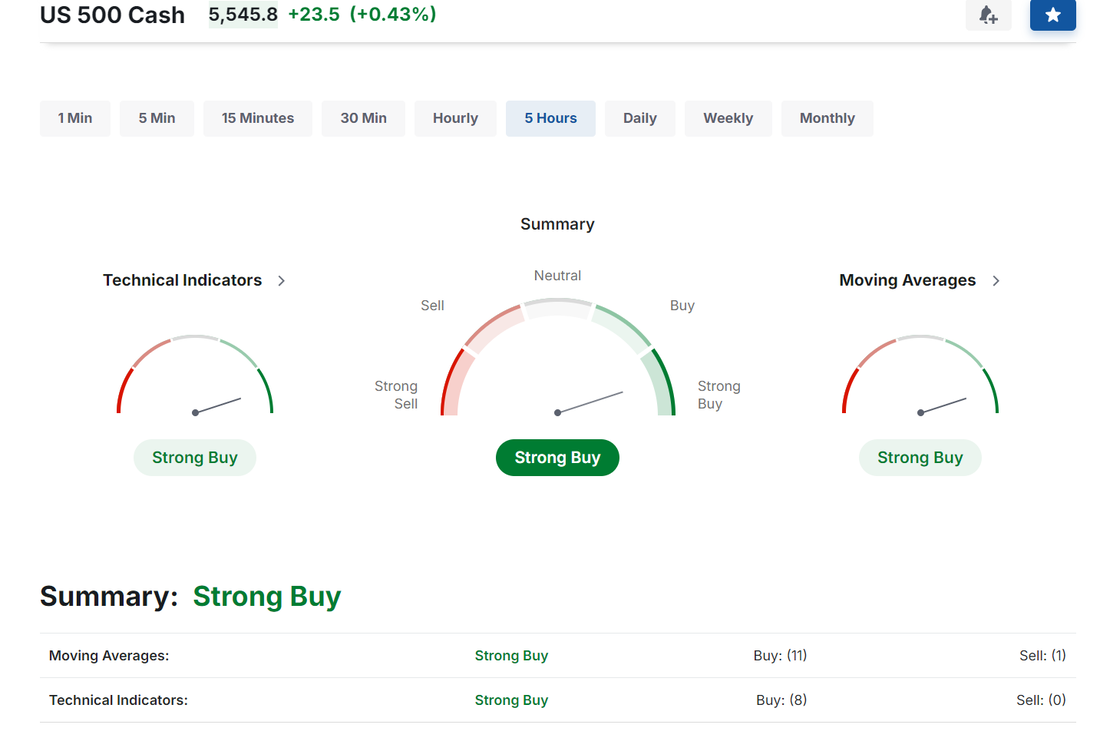

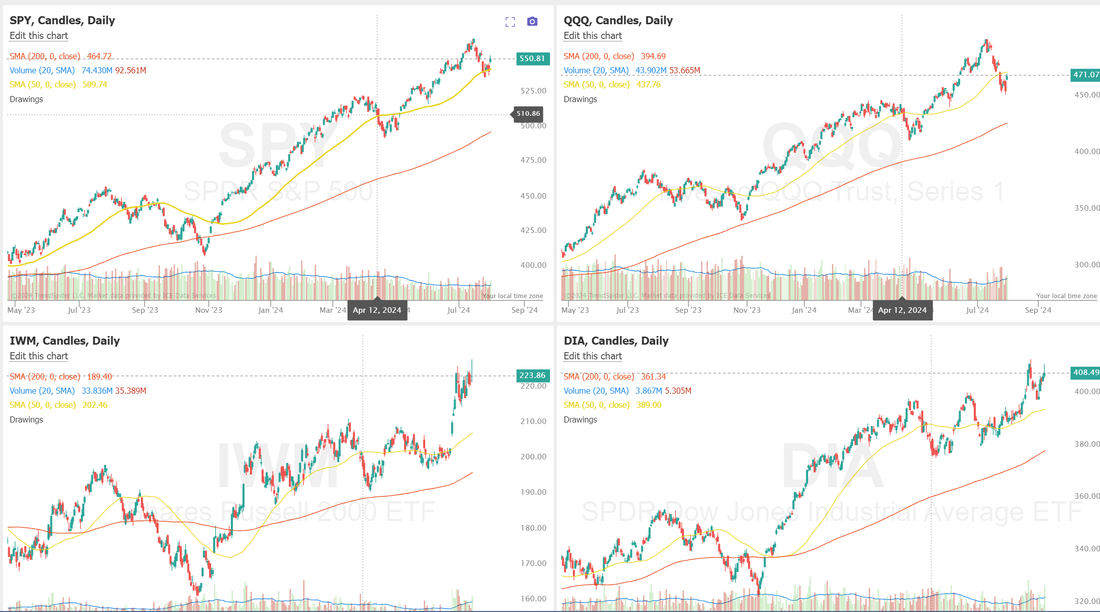

Welcome back! FOMC has come and gone and it didn't disappoint. I'm getting a late start so todays blog will be short. Here's a look at our results from yesterday. September Nasdaq 100 E-Mini futures (NQU24) are up +0.36% this morning as strong quarterly results from Meta Platforms and dovish comments from Federal Reserve Chair Jerome Powell boosted sentiment, while investors awaited a new round of U.S. economic data and earnings reports. Meta Platforms (META) climbed over +6% in pre-market trading after the company reported stronger-than-expected Q2 results and issued solid Q3 revenue guidance. As widely expected, yesterday the Federal Reserve kept the federal funds rate in a range of 5.25% to 5.50%, a level it has held since last July. At the same time, policymakers made several changes to the language of a statement issued after their two-day meeting. The committee altered its language to state it is “attentive to the risks to both sides of its dual mandate,” moving away from previous wording that concentrated solely on inflation risks. The Fed also adjusted its language to note that price pressures remain “somewhat” elevated and to acknowledge “some further progress” toward its inflation goal, a change from “modest further progress” in the previous statement. In addition, Fed Chair Jerome Powell stated at his post-monetary policy decision press conference that a rate cut “could be on the table as soon as September” if inflation continues to move toward the central bank’s 2% target. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching 1-week highs and the blue-chip Dow posting a 1-1/2 week high. Nvidia (NVDA) surged over +12% and was the top percentage gainer on the Nasdaq 100 after Morgan Stanley named the chip giant a top U.S. chip stock pick following the stock’s recent selloff. Also, Advanced Micro Devices (AMD) gained more than +4% after the semiconductor company reported stronger-than-expected Q2 results, offered a solid Q3 revenue forecast, and boosted its full-year guidance for artificial intelligence chip sales. In addition, Match Group (MTCH) climbed over +13% after the company reported better-than-expected Q2 revenue and announced plans to cut about 6% of its staff. On the bearish side, Humana (HUM) plunged more than -10% and was the top percentage loser on the S&P 500 after the health insurer cut its full-year GAAP EPS guidance and warned of higher hospital admissions. The ADP National Employment report on Wednesday showed private payrolls rose by 122K jobs in July, significantly lower than the consensus figure of 147K. Also, the U.S. employment cost index, a key gauge of U.S. labor costs, rose +0.9% q/q in the second quarter, weaker than expectations of +1.0% q/q. In addition, the U.S. July Chicago PMI fell to 45.3, a smaller decline than expectations of 44.8. Finally, U.S. pending home sales rose +4.8% m/m in June, stronger than expectations of +1.4% m/m and the biggest increase in 6 months. Second-quarter corporate earnings season continues in full flow, with investors awaiting new reports today from notable companies such as Amazon (AMZN), Apple (AAPL), Intel (INTC), Block (SQ), DoorDash (DASH), Cigna (CI), ConocoPhillips (COP), Roblox (RBLX), and DraftKings (DKNG). On the economic data front, all eyes are focused on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the July ISM Manufacturing PMI will arrive at 48.8, compared to last month’s figure of 48.5. Also, investors will likely focus on the U.S. S&P Global Manufacturing PMI, which stood at 51.6 in June. Economists foresee the July figure to be 49.5. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q2 Unit Labor Costs to be at +1.8% q/q and Q2 Nonfarm Productivity to stand at +1.7% q/q, compared to the first-quarter numbers of +4.0% q/q and +0.2% q/q, respectively. U.S. Construction Spending data will be reported today. Economists foresee this figure to stand at +0.2% m/m in June, compared to the previous number of -0.1% m/m. U.S. Initial Jobless Claims data will come in today as well. Economists estimate this figure to be 236K, compared to last week’s value of 235K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.055%, down -1.22%. Market technicals are bullish Most indices have easily cleared their respective 50DMA's save for the QQQ's which look to do so today. Trade docket for today: /ES, /MCL, /MNQ, /ZN, CRM, CVNA, DJT, EBAY, IWM, META, MGM, MRK, NVDA, QCOM, QQQ. 0DTE's (I'll be using futures today for our covers and going a little heaver on position size. This will allow me greater control if we need adjustments outside of the cash market time frame). No scalping for me today and tomorrow. I'll be in and out too much to monitor but I'll be running the zoom feed for you all. My bias today: I'm not sure! I don't really have one. Clearly yesterday was bullish. Technicals are bullish and futures are up as I type. I wouldn't be surprised if we took a breather and consolidated today. I certainly wouldn't be surprised if the bullish trend continued and I wouldn't be surprised if we gave back a bit of those monster gains from yesterday. I'll just remain neutral and patient and trade what I see today. Intra-day levels: /ES; 5595* (key level. this was a heavy resistance yesterday)/5606/5631* (key level. high of the day yesterday) to the upside. 5558/5533/5508* (key level. PoC) to the downside. /NQ; Two key levels for me today. 19,724 is resistance and high of the day yesterday. 19487 is support and weakness could come below that. Bitcoin: BTC fell apart late in the day yesterday and ruined my crypto 0DTE's. I'm watching 63,949 level of support (red line) If we can hold that for a few hours into the trading day that my be my signal for a bullish entry on the 0DTE. I hope you all have a great day today. Premium is down a tad today after that monster rally but it's still good. Let's make it happen.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |