|

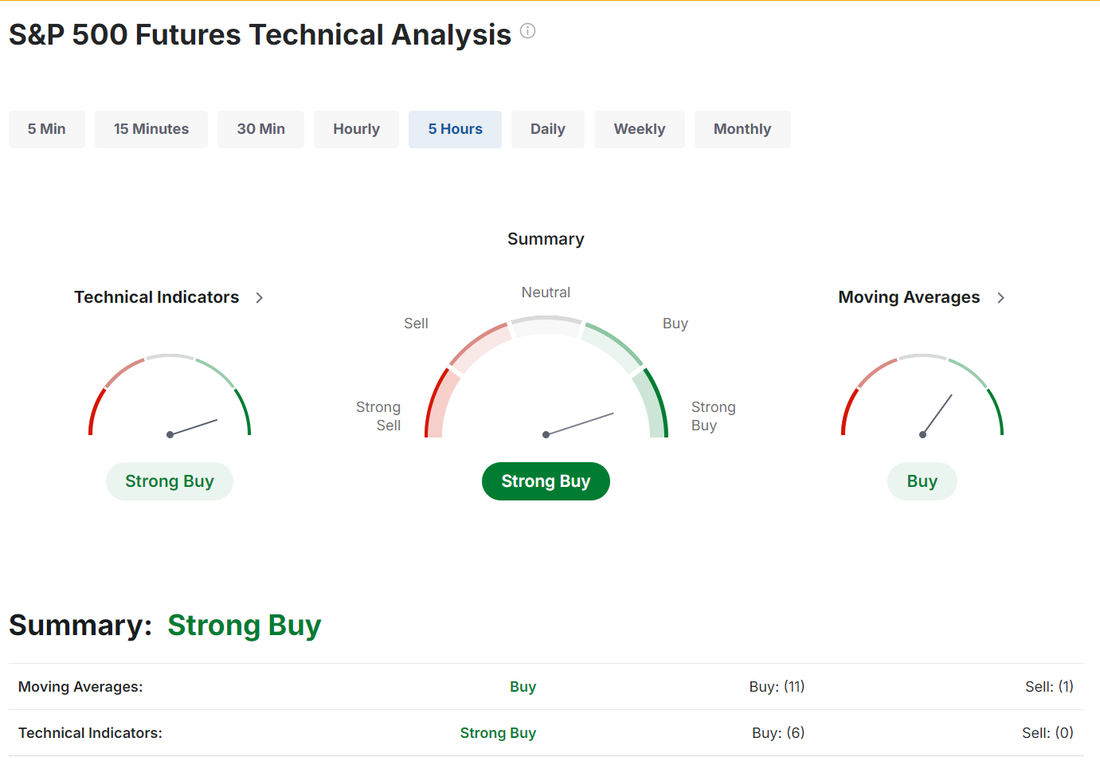

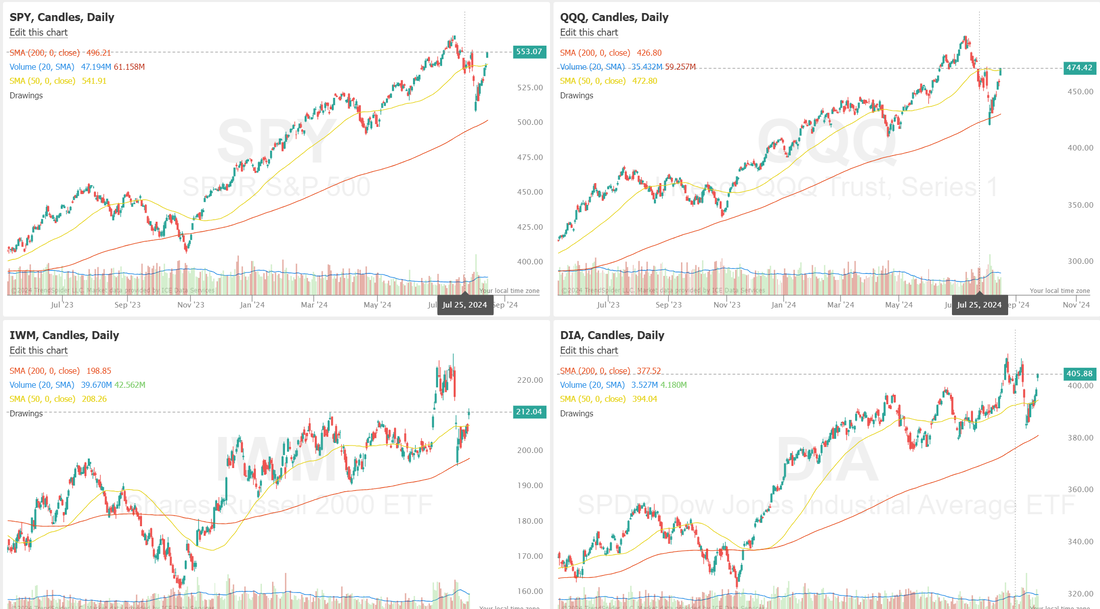

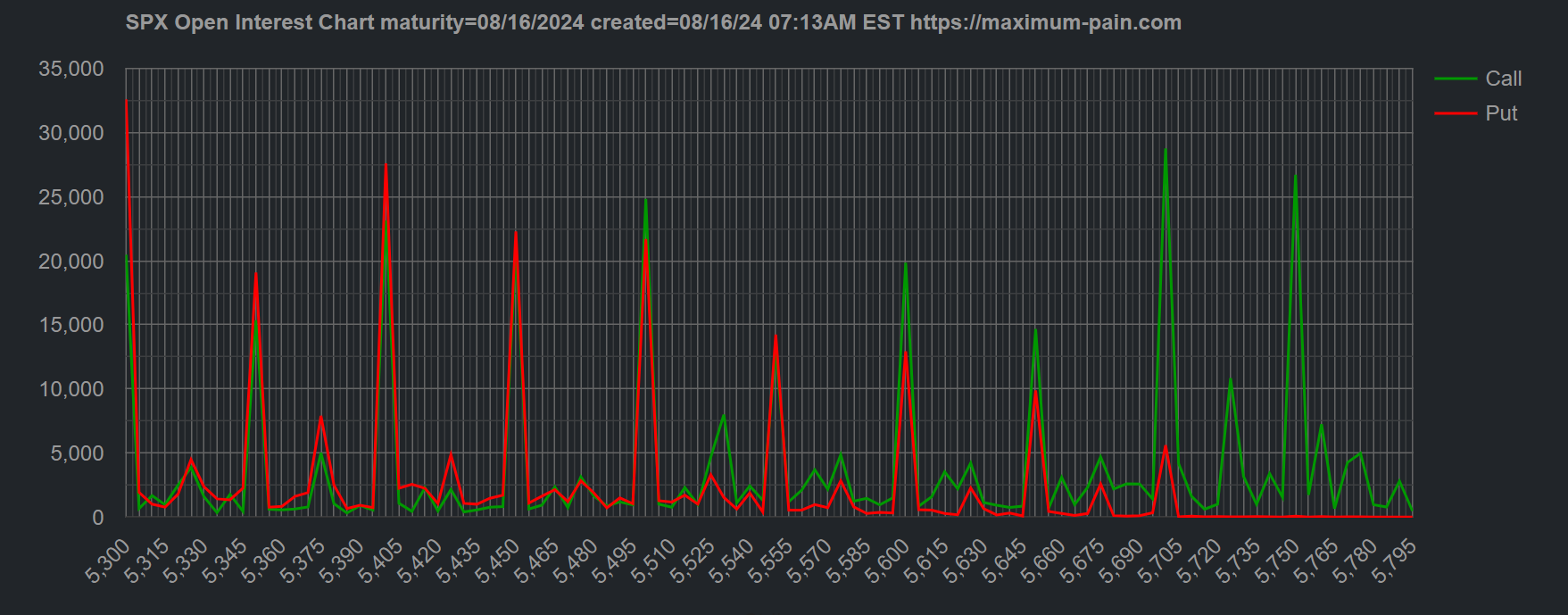

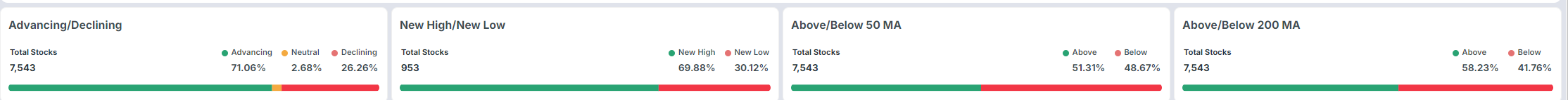

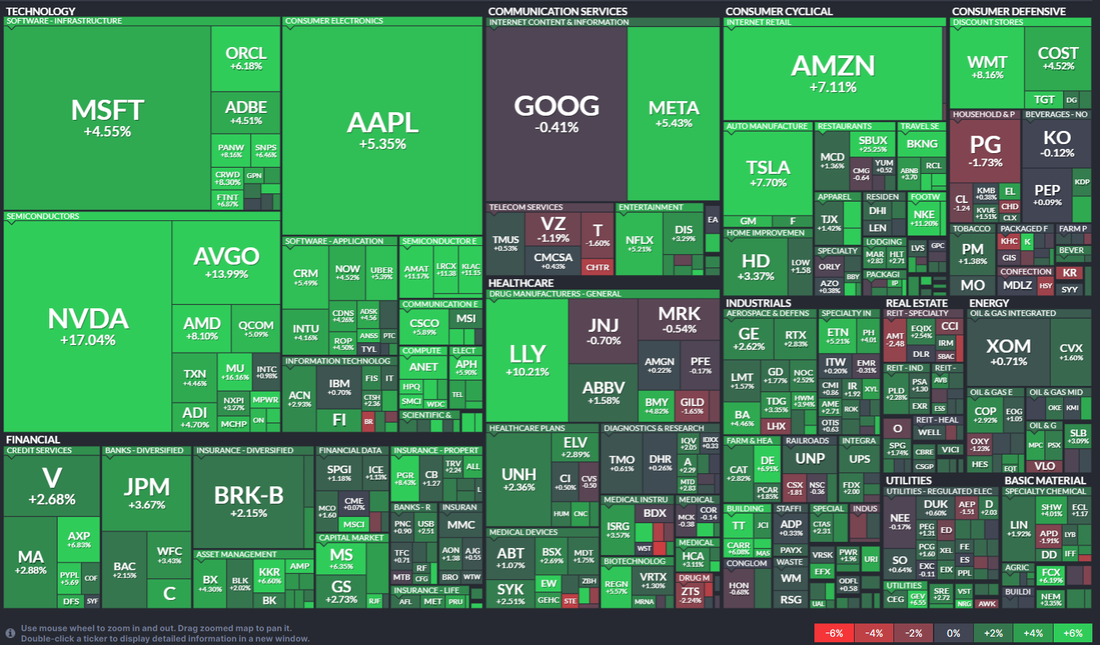

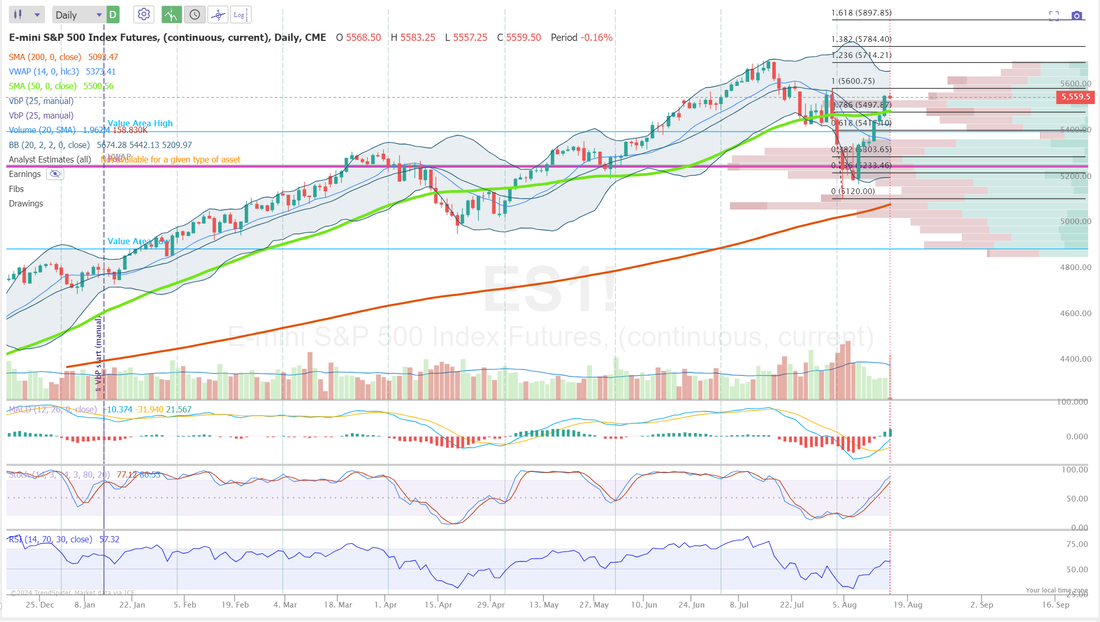

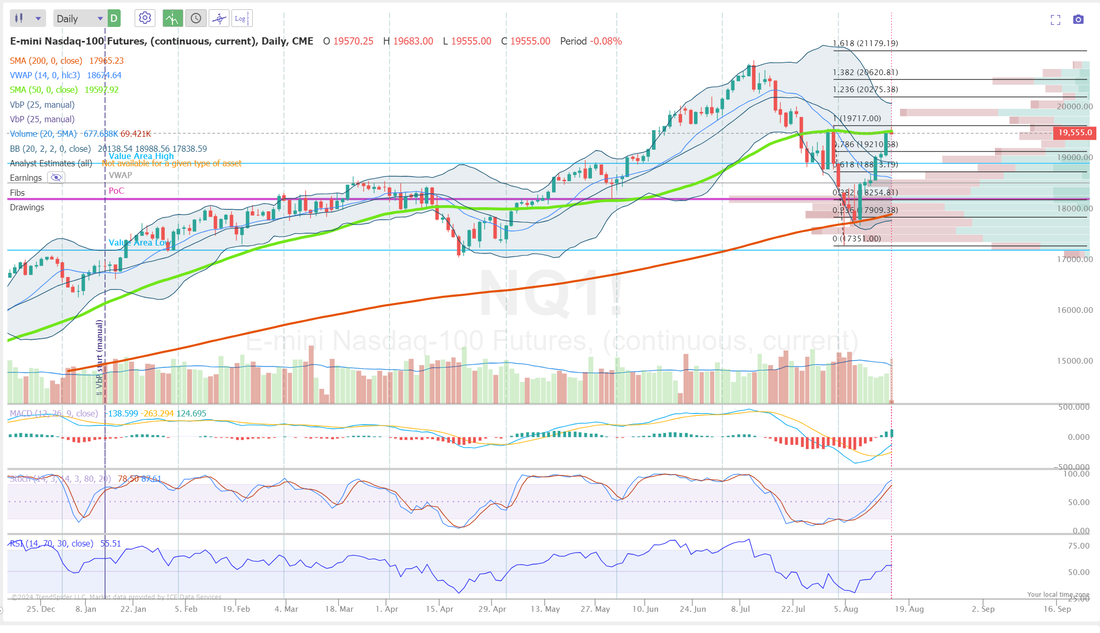

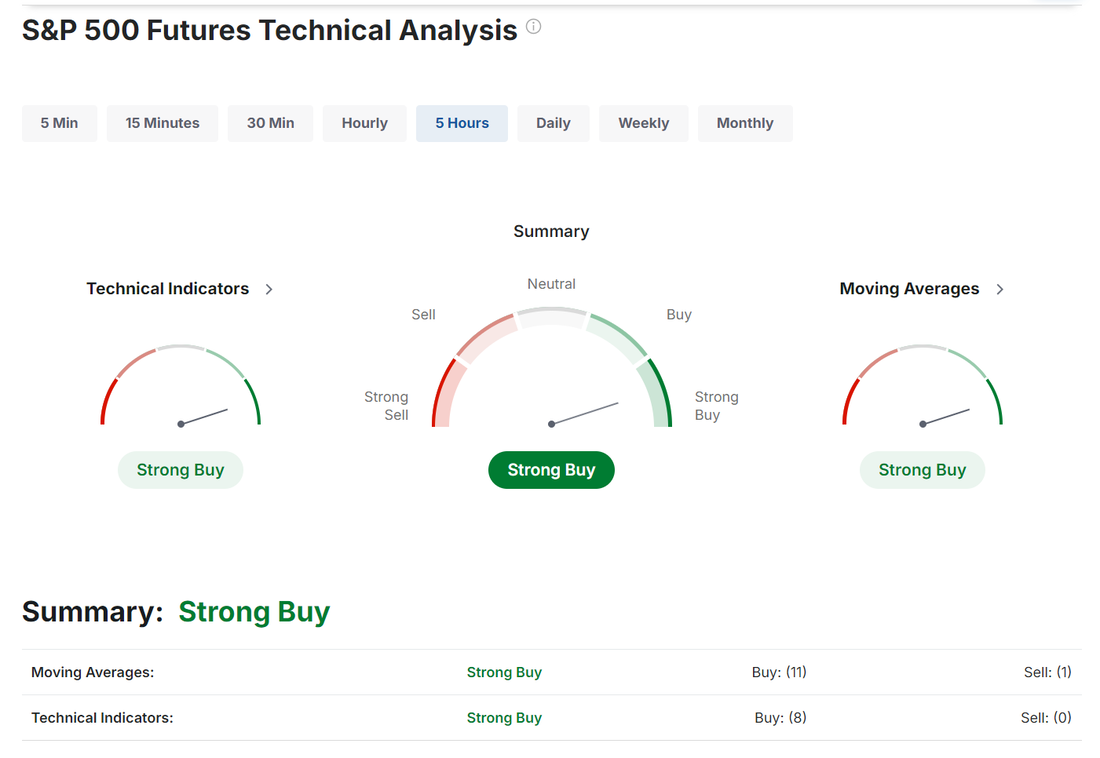

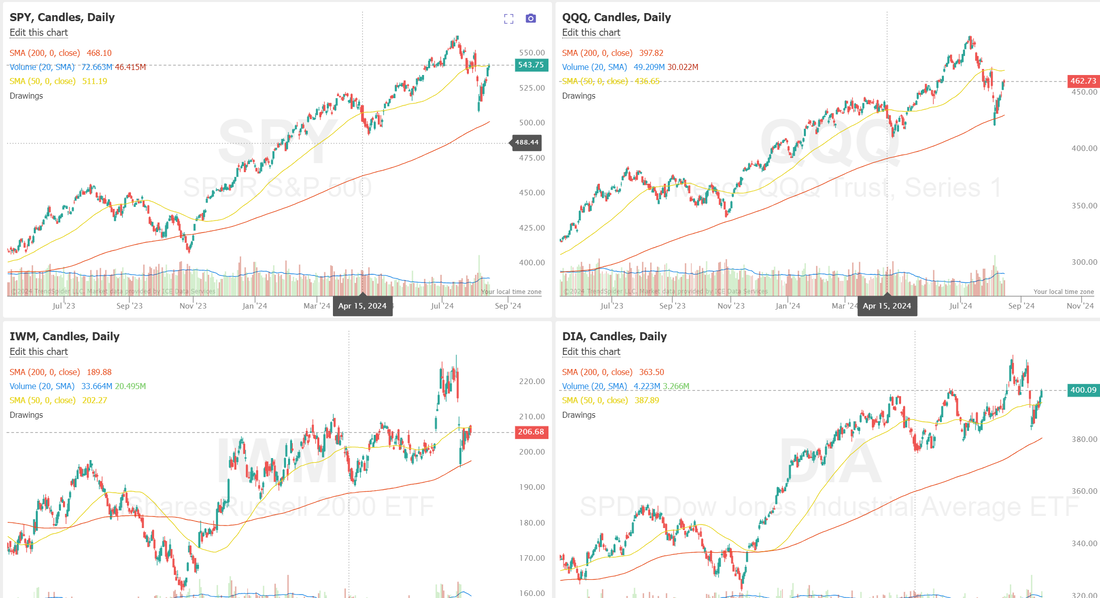

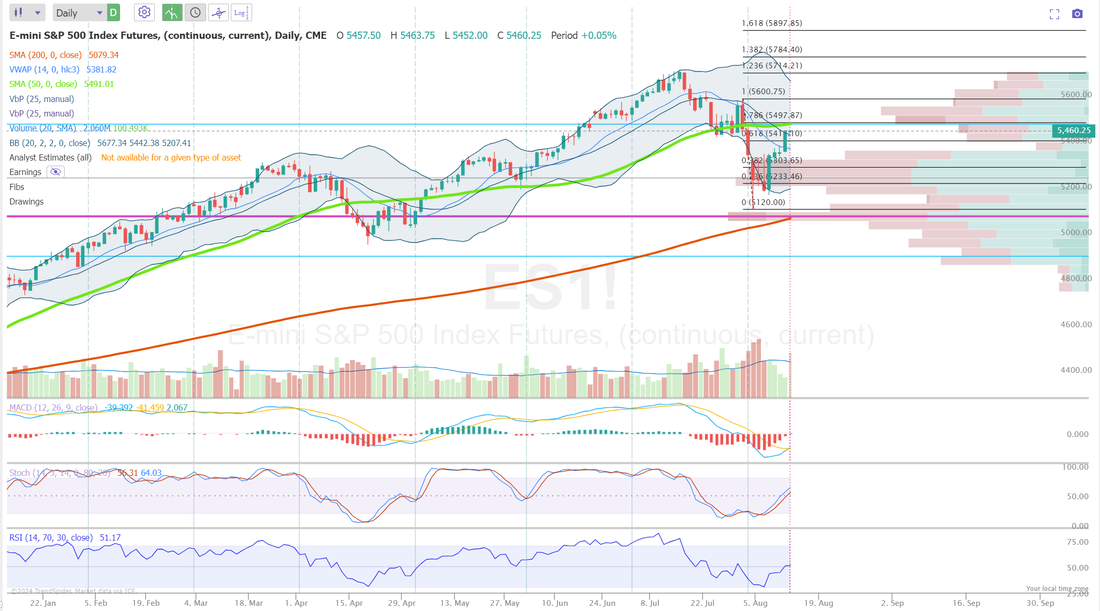

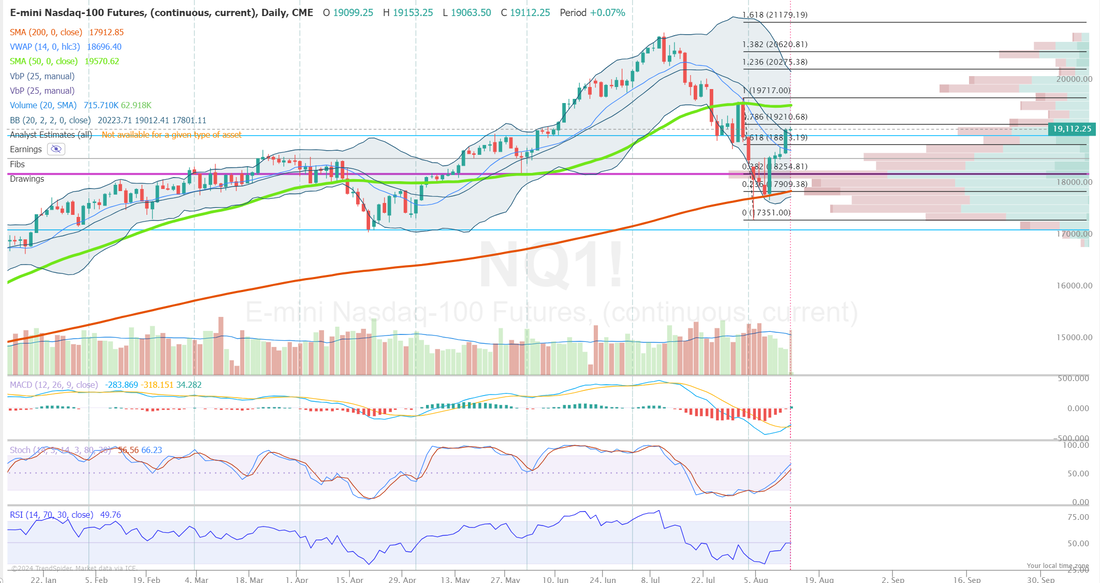

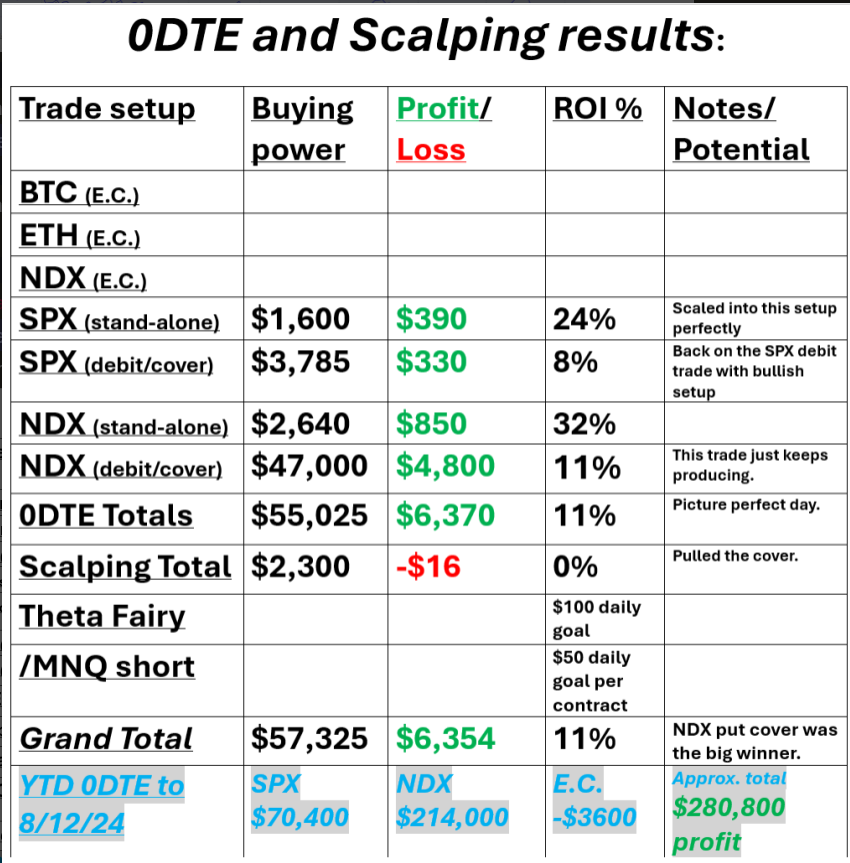

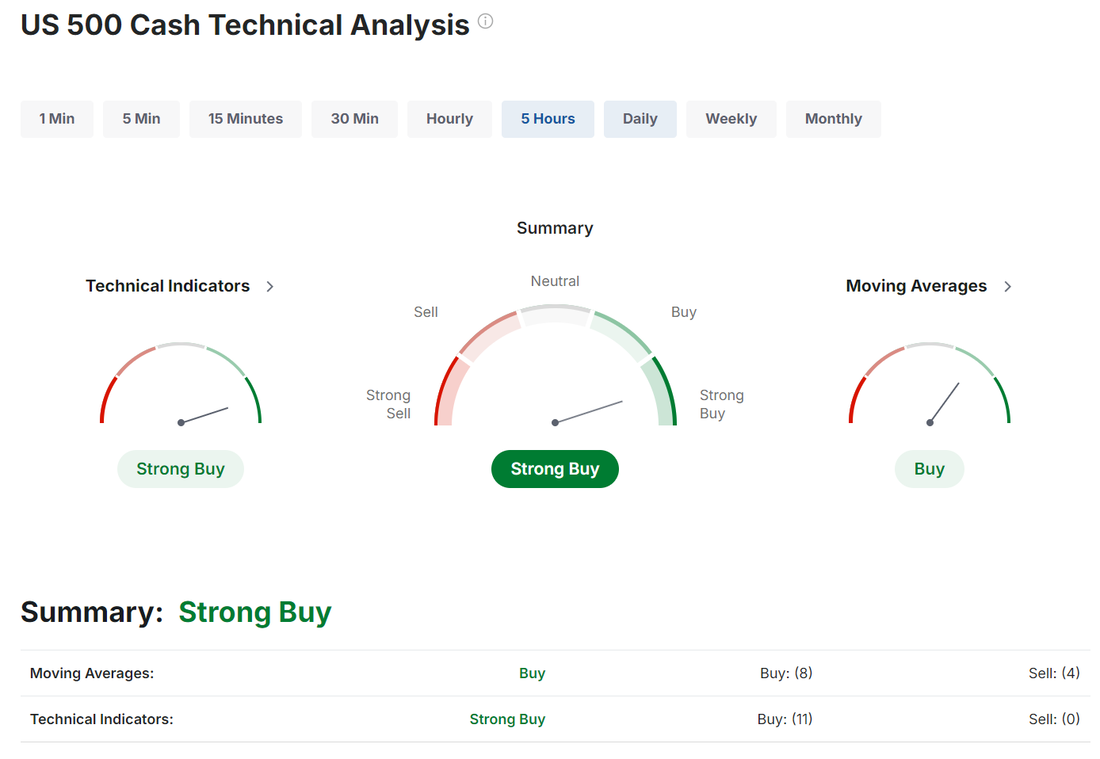

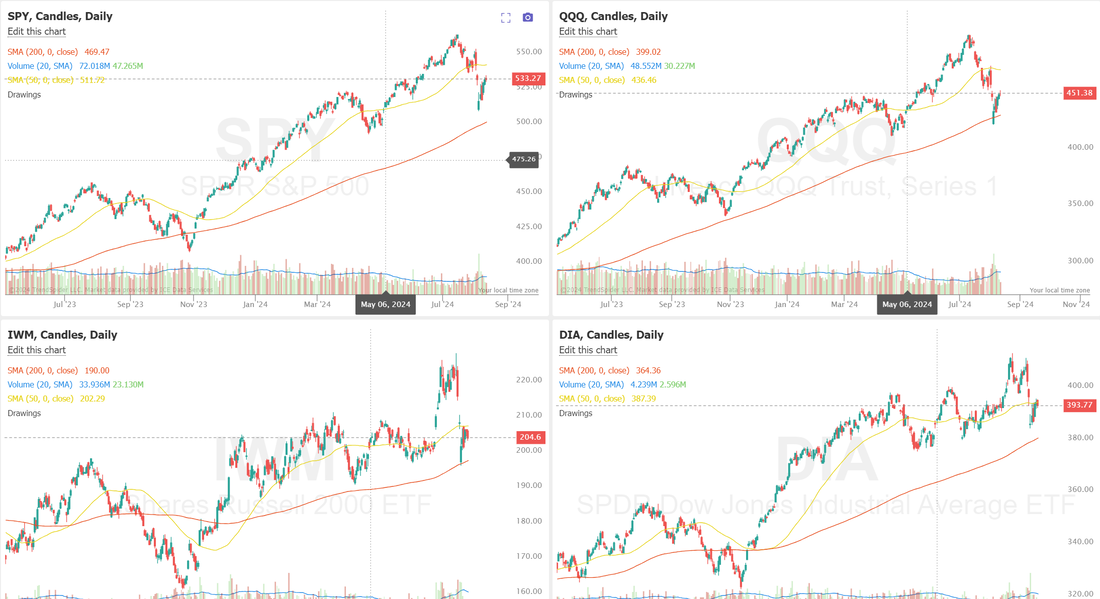

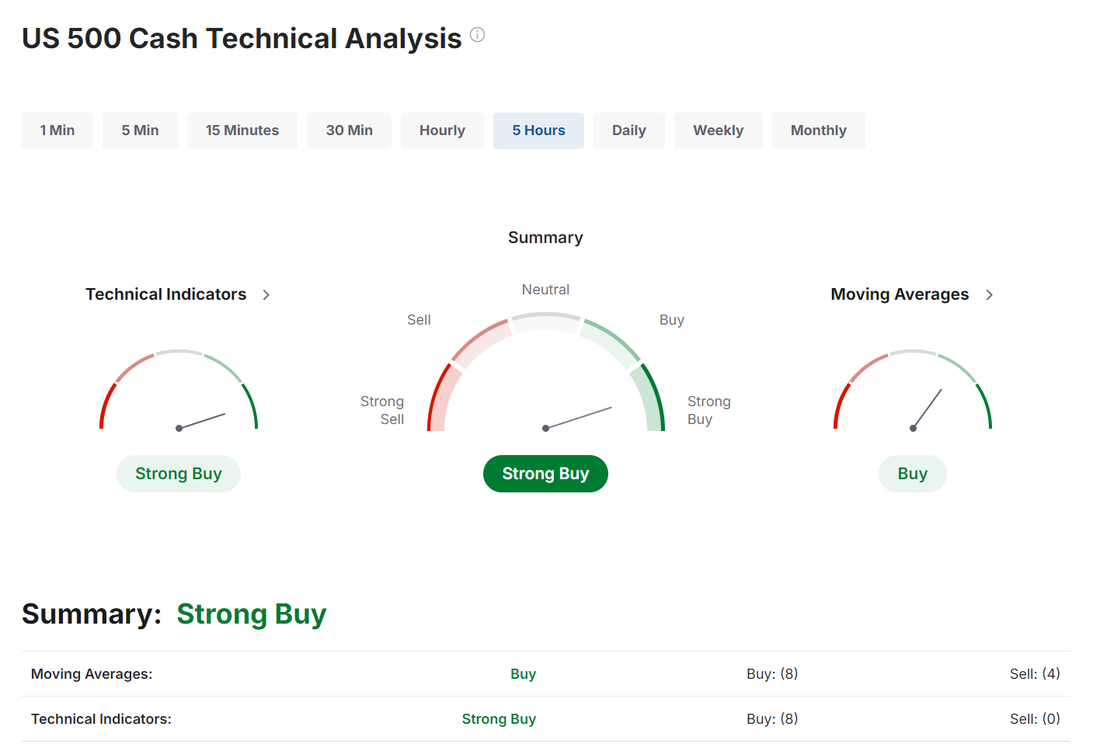

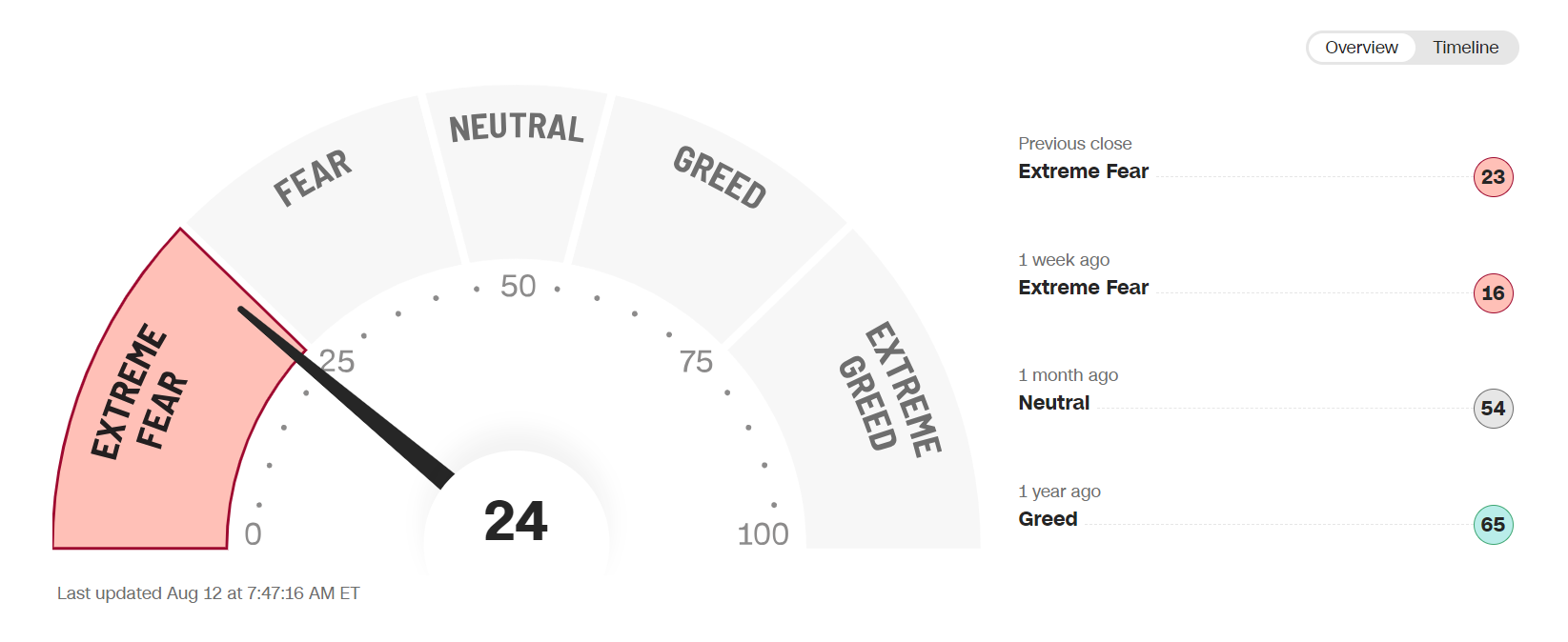

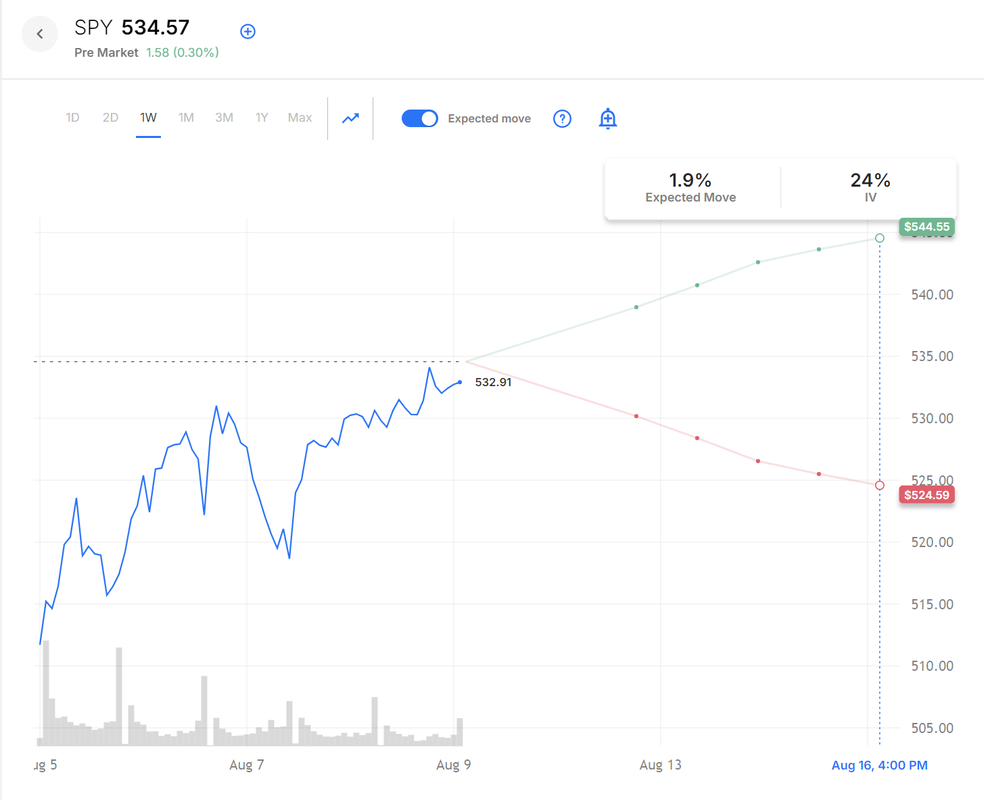

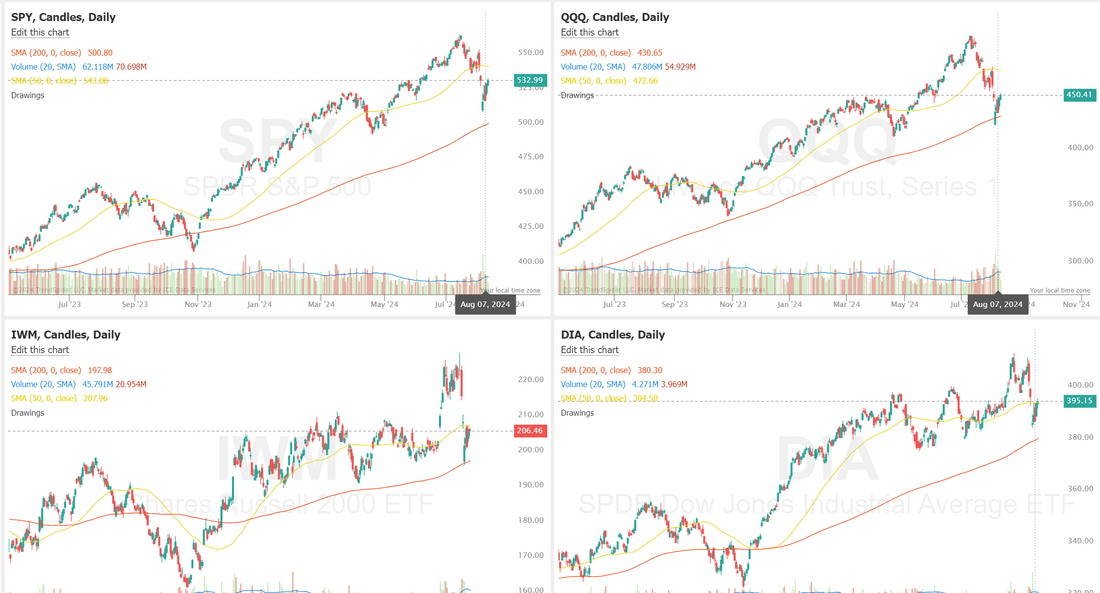

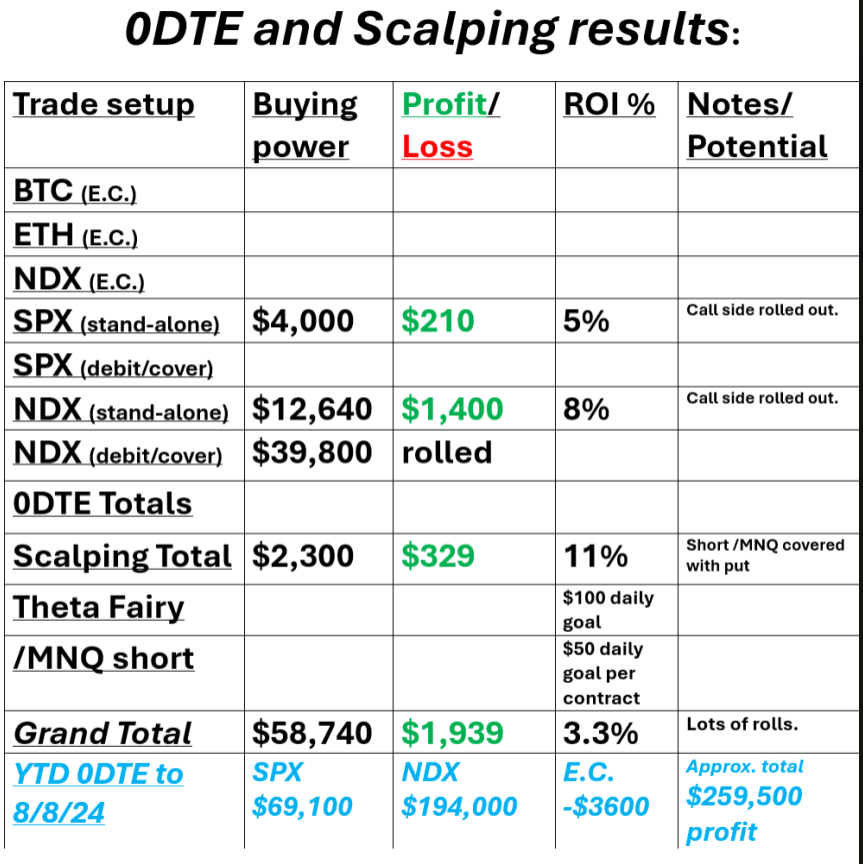

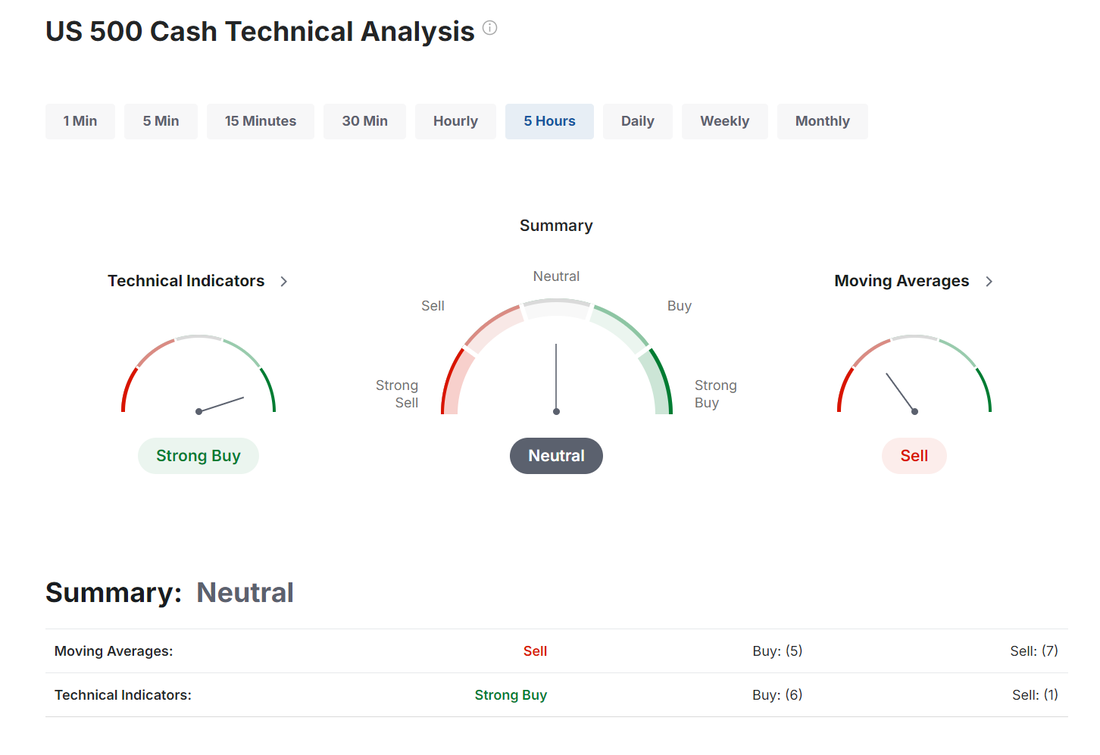

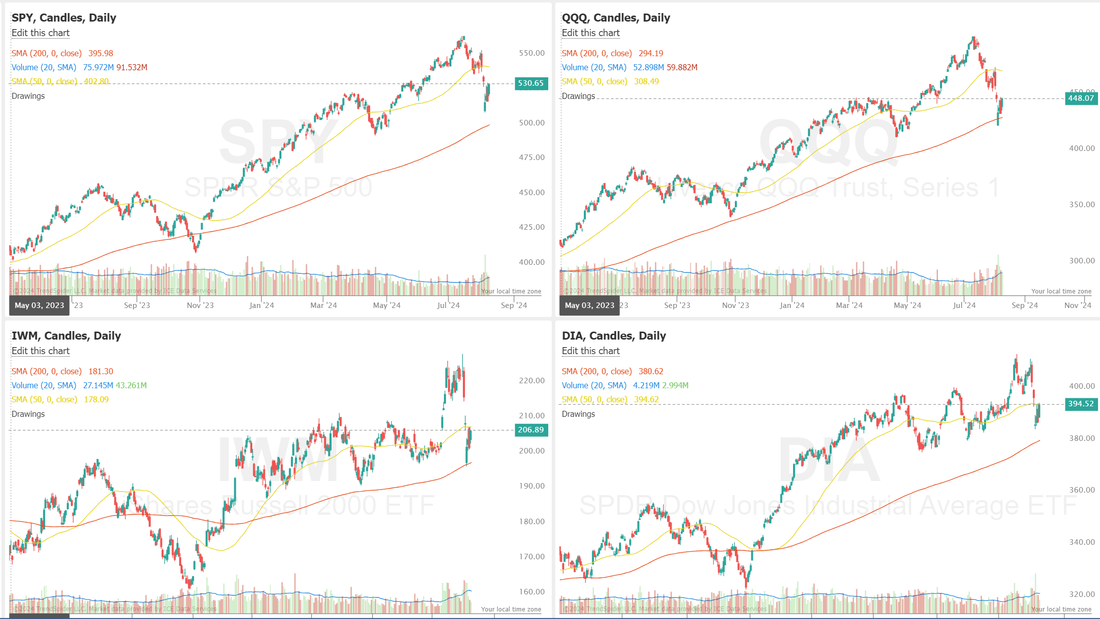

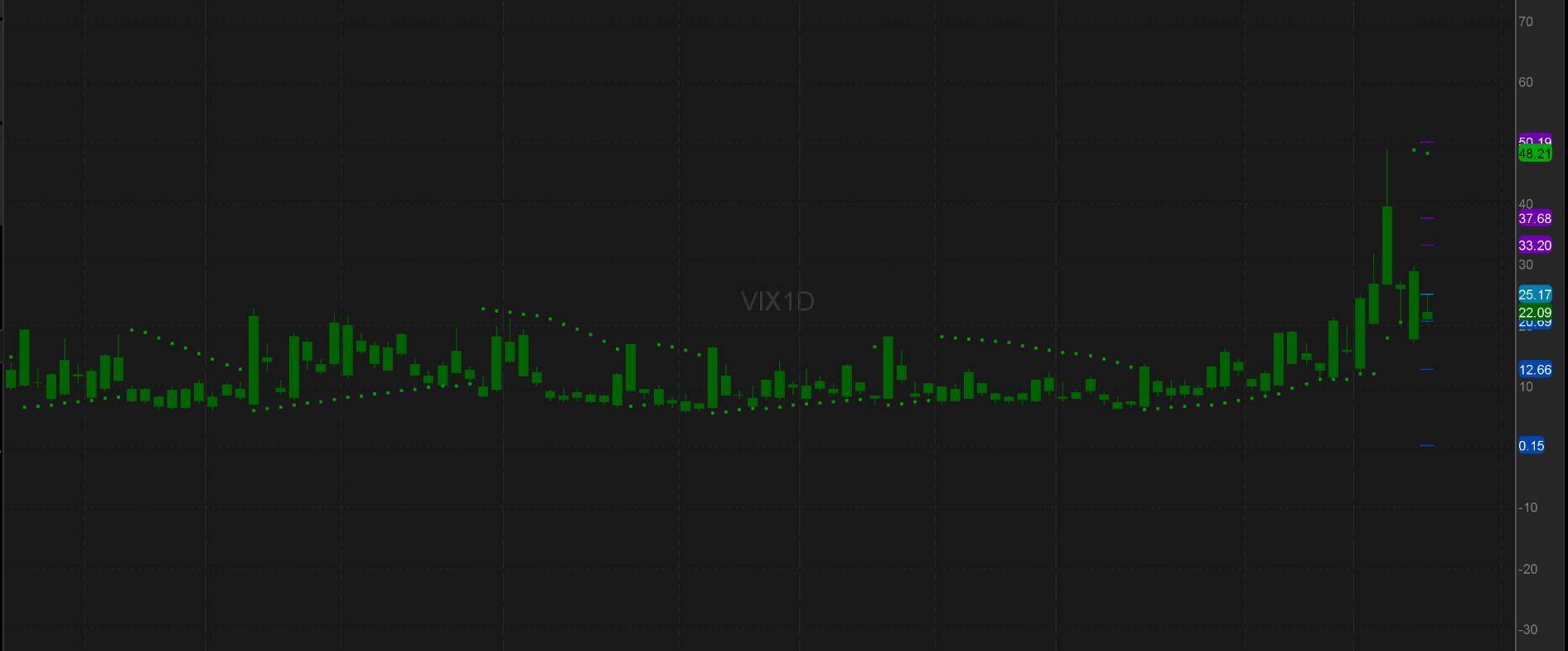

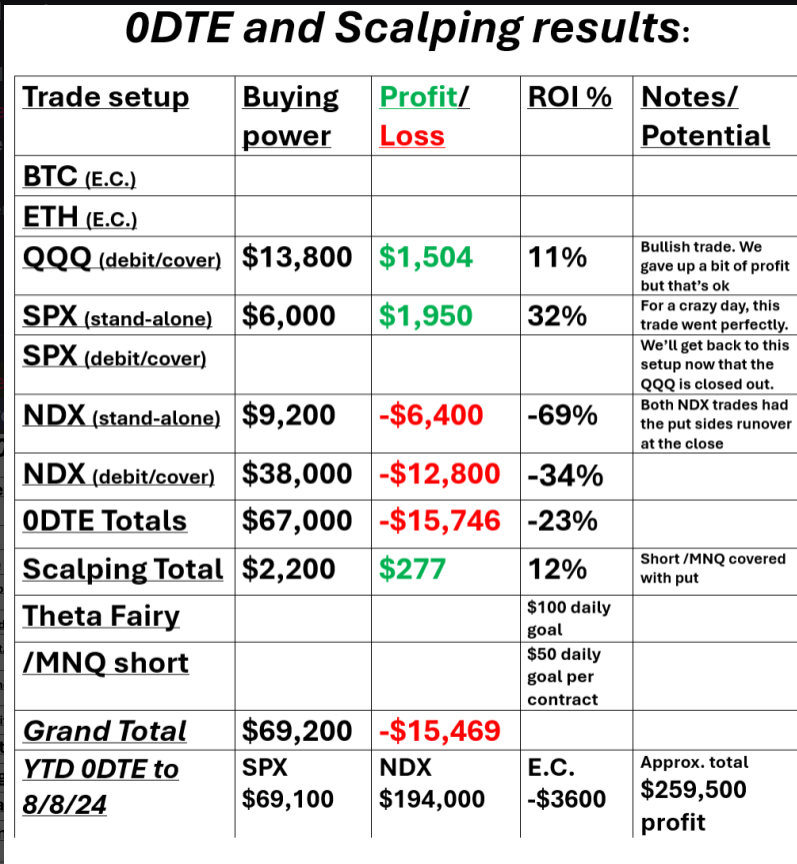

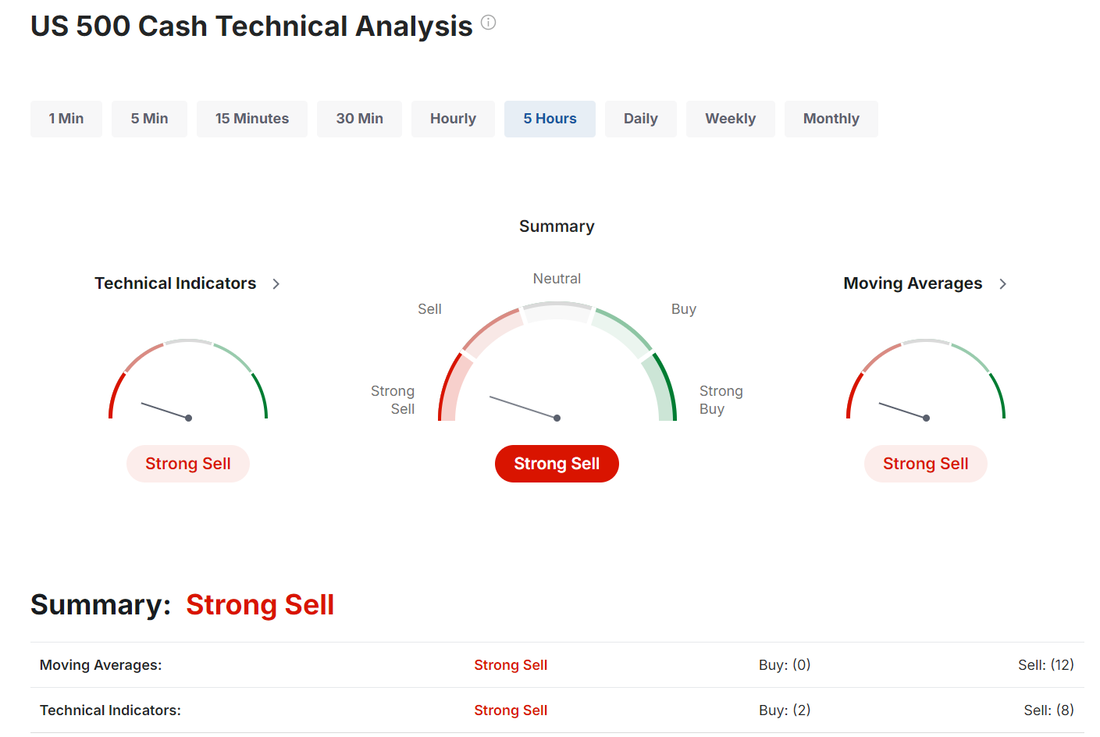

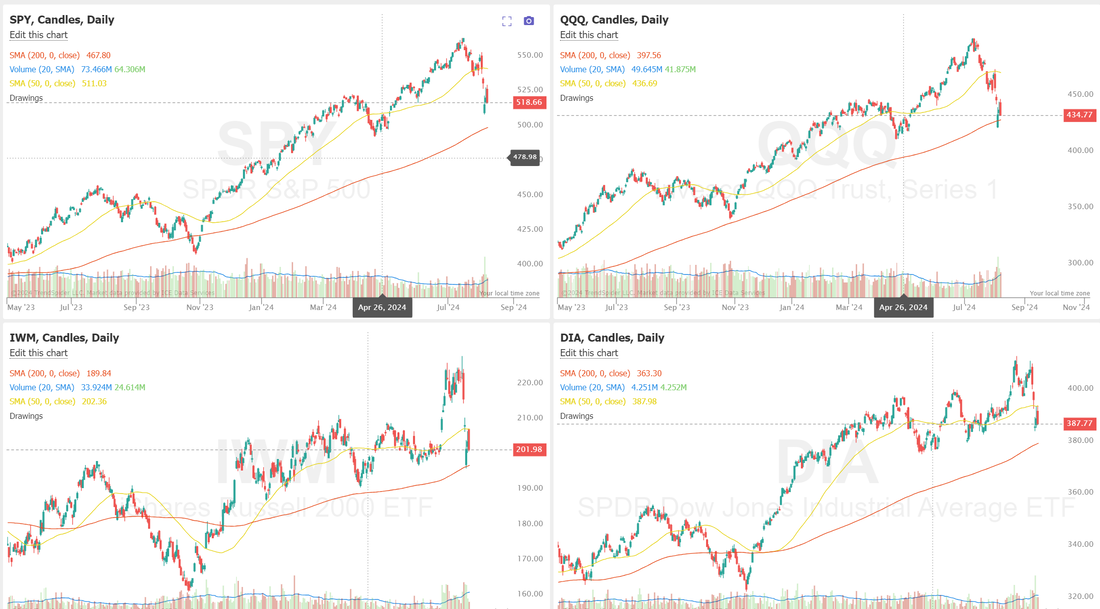

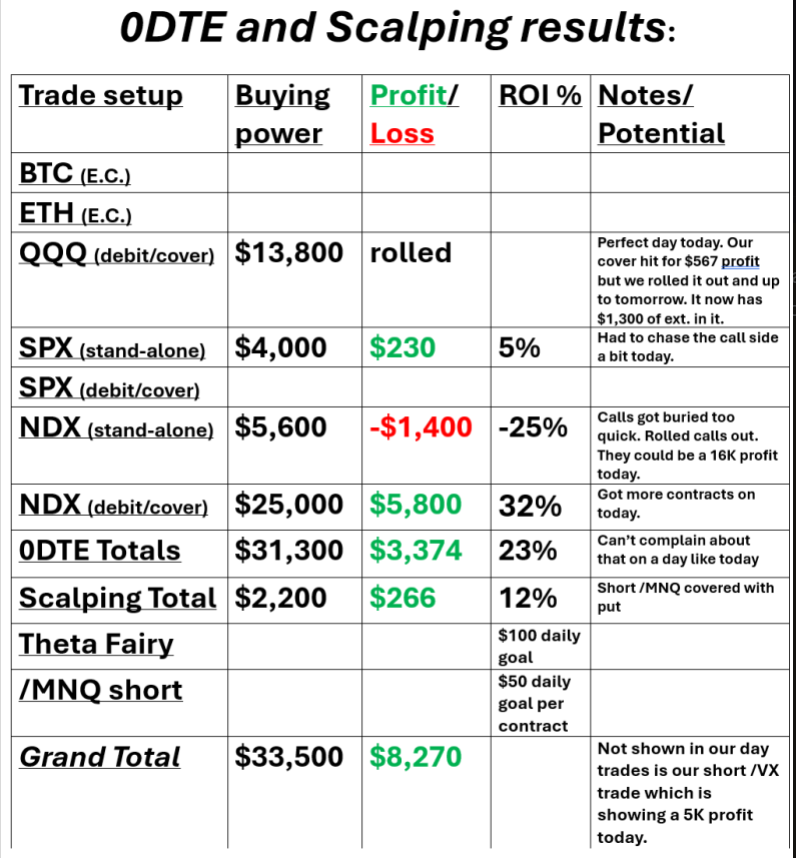

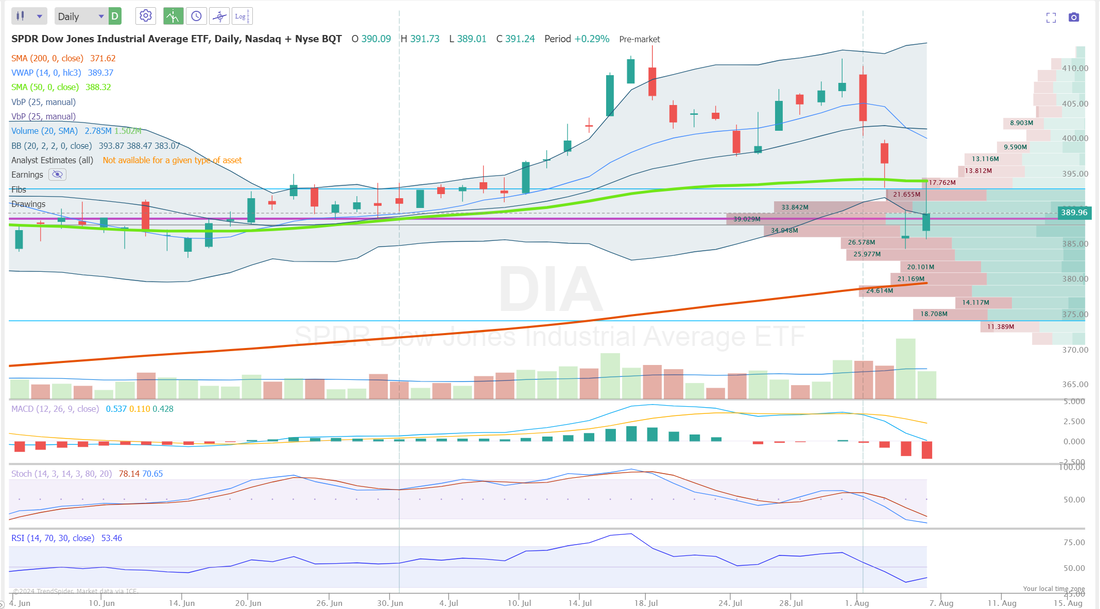

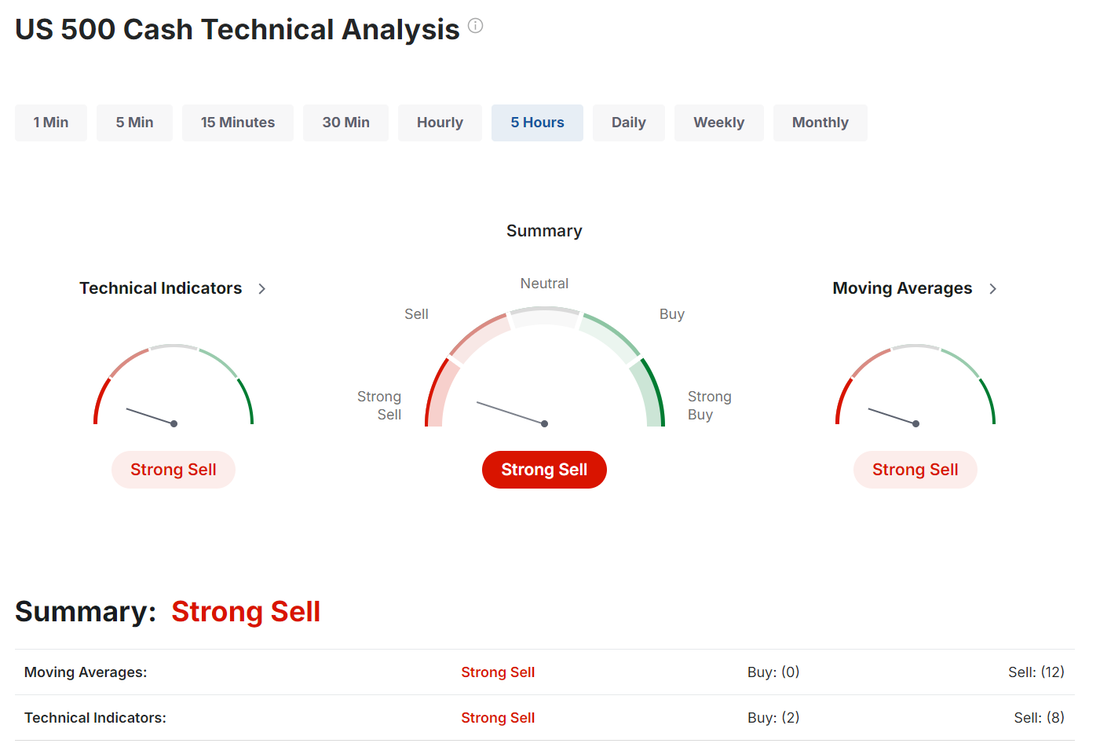

Welcome back to a new week of trading! One of the things I love about trading is that, for good or bad, no matter how your week went, it all starts over again today! Last Thursday was amazing for us. We crossed over $300,000 in YTD profits on our 0DTE's and our 31% gain on the day was a record as well. That being said, Friday was really a better day for us. Pretty mellow. We had an SPX rolled call side to deal with and with the Vampire trade that also means we didn't have any NDX 0DTE options to works with. Big up days are great but they usually come with more buying power and more stress. Our Friday effort didn't quite hit our $1,000/day goal but it was close and if we can do that consistenty that's all we need to justify our time and effort here. Let's take a look at our results from Friday. We are slowly getting back into our "normal" setups. This Weds. we'll be back on the QQQ's for Scalping, in addition to our new /MNQ addition. This will mean I'm committing more capital to the scalping effort. We'll also get back to our Event contracts as the setups are starting to look a little better. There's also a good chance we can get a Theta fairy on tonight! Let's look at the markets for this week. We had the best week of the year last week! Buy mode is clinging on. It's tenious but...bullish is bullish. You can see how explosive the bullish retrace was on all the major indices last week. It's also brought us up to another level of consolidation. Let's take a look at the I.V. and expected moves this week: We look to be starting the week in a "sweet spot". I.V. isn't elevated but it's not in the dumps either. It could be a good week for our 4DTE SPY/QQQ setups. Oh what a difference a few days make. Our shorting of the VIX was such a great trade and one of my favorites. Unfortunately, those setups don't come along very often. VIX is back to a normal range. September S&P 500 E-Mini futures (ESU24) are down -0.02%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.21% this morning as investors looked ahead to the release of the minutes of the Federal Reserve’s latest policy meeting, Fed Chair Jerome Powell’s speech at Jackson Hole, and earnings reports from a diverse group of prominent companies. In Friday’s trading session, Wall Street’s major averages ended in the green, with the benchmark S&P 500 and blue-chip Dow rising to 2-week highs and the tech-heavy Nasdaq 100 climbing to a 3-week high. H&R Block (HRB) surged over +12% after the tax preparation company reported upbeat Q4 results, provided an above-consensus FY25 forecast, and announced a new $1.5 billion share repurchase program. Also, Coherent (COHR) climbed more than +7% after the company reported better-than-expected Q4 results and issued solid Q1 revenue guidance. In addition, Fox Corp. (FOXA) gained over +1% after Wells Fargo double-upgraded the stock to Overweight from Underweight with a price target of $46. On the bearish side, Applied Materials (AMAT) fell more than -1% after giving an in-line Q4 net sales forecast that disappointed investors looking for a bigger payoff from AI spending. Economic data on Friday showed that the University of Michigan’s U.S. consumer sentiment index stood at 67.8 in August, stronger than expectations of 66.7. At the same time, U.S. July housing starts fell -6.8% m/m to a 4-year low of 1.238M, weaker than expectations of 1.340M. In addition, U.S. building permits, a proxy for future construction, fell -4.0% m/m to a 4-year low of 1.396M in July, weaker than expectations of 1.430M. Chicago Fed President Austan Goolsbee supported rate cuts on Friday after noting that the U.S. labor market and some leading economic indicators are showing warning signs and expressing concerns that unemployment will continue to increase. Goolsbee stated that the speed of transmission of lower rates would “depend on many factors” and indicated his support for a “gradual” rather than rapid pace of rate cuts. U.S. rate futures have priced in a 71.5% chance of a 25 basis point rate cut and a 28.5% chance of a 50 basis point rate cut at September’s monetary policy meeting. In other news, Goldman Sachs over the weekend reduced the probability of a U.S. recession in the next year to 20% from 25%, citing last week’s healthy economic data. Meanwhile, Fed Chair Jerome Powell is scheduled to deliver the keynote address at the central bank’s annual economic symposium in Jackson Hole, Wyoming, on Friday. Market participants will be keenly focused on what he indicates about the pace and timing of rate cuts in the coming months. Earlier in the week, Fed Governor Christopher Waller, Fed Vice Chair for Supervision Michael Barr, and Atlanta Fed President Raphael Bostic will be making appearances. “We look for Powell to signal that given recent progress, the Fed is likely to ease policy next month - without fully committing to the size of the rate cut. We expect a 25 basis-point reduction,” according to TD Securities’ strategists. Investors will also be monitoring a spate of economic data releases this week, including the U.S. S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Crude Oil Inventories, Initial Jobless Claims, Existing Home Sales, Building Permits, and New Home Sales. Retailers Lowe’s (LOW), Target (TGT), TJX (TJX), and Ross Stores (ROST), along with notable tech players such as Zoom Video (ZM), Snowflake (SNOW), Palo Alto Networks (PANW), Workday (WDAY), and Analog Devices (ADI), are among the prominent companies set to release their quarterly results this week. In addition, market participants will pay close attention to the publication of the Federal Reserve’s minutes from the July meeting on Wednesday, during which Fed Chair Jerome Powell acknowledged progress on inflation and left the door open for a rate cut in September. Today, investors will focus on the U.S. Conference Board Leading Index, set to be released in a couple of hours. Economists expect July’s figure to be -0.4% m/m, compared to the previous number of -0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.868%, down -0.70%. We don't have any really big news catalysts today so I'm leaning to a neutral to slightly bullish day today, After the massive push last week I think we are due for a pause. Trade docket for today: /MNQ scalping. /ZN, DELL, DIA, GLD, DJT?, IWM, NVDA, PLTR, PYPL, SHOP, SPY/QQQ 4DTE's, 0DTE's. PANW, LOW, MDT potential earnings setups. Open interest. You can see a big target on the 5630 SPX level. Let's take a look at some key, intr-day 0DTE levels for me today. /ES; From a bigger perspective their is a 100 point trading zone right now on the /ES. 5603 is a clear resistance zone that we broke through in July and hit again in Aug. 5503 is the 50DMA (green line) and could provide support in a drawdown. Intra-day on the 2 hr. chart shows we've been coiled up since last Thurs. in a very tight range. A break above 5593 or below 5558 might get us moving again. /NQ; The Nasdaq continues to be a tad weaker than the SP500. It's been clinging to it's 50DMA for a few trading sessions now. On an intra-day basis we would need to push above 19688 or drop below 19463 to get a new directional move going. Let's have a great day folks! There's a lot worse ways we could be out there slogging away, trying to make a living! Enjoy the process.

0 Comments

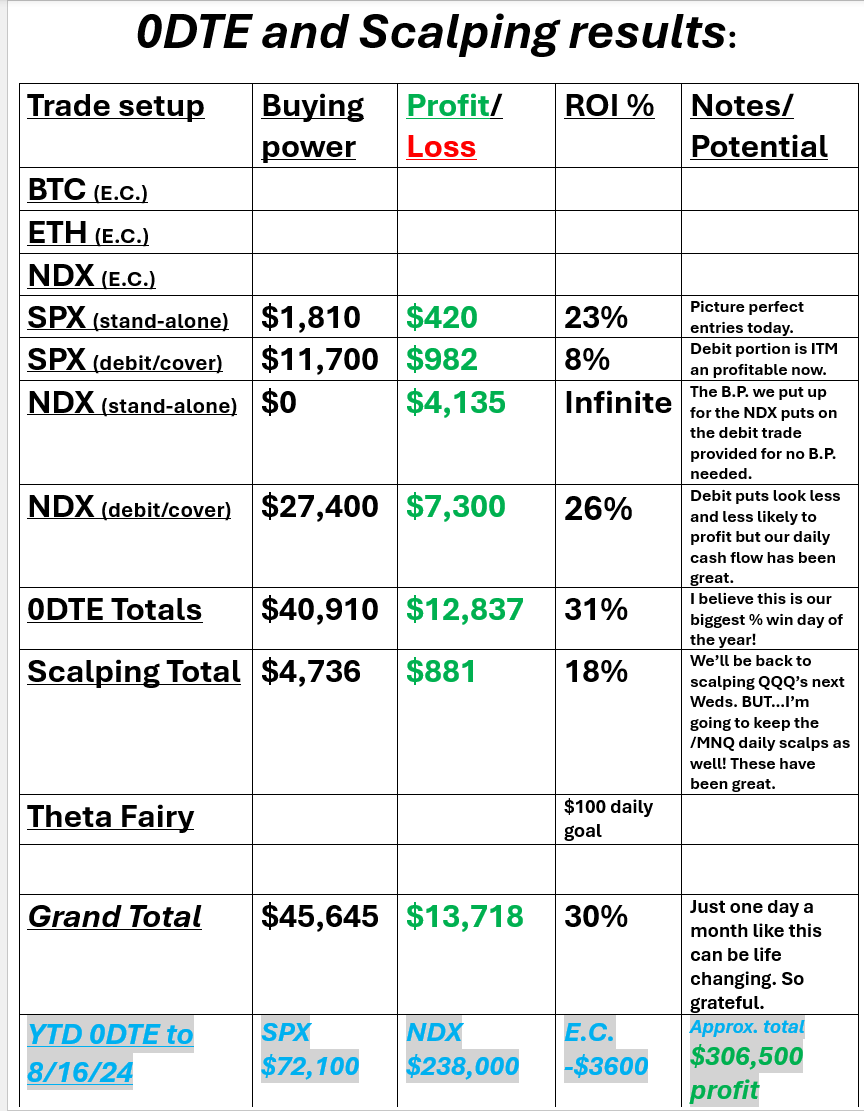

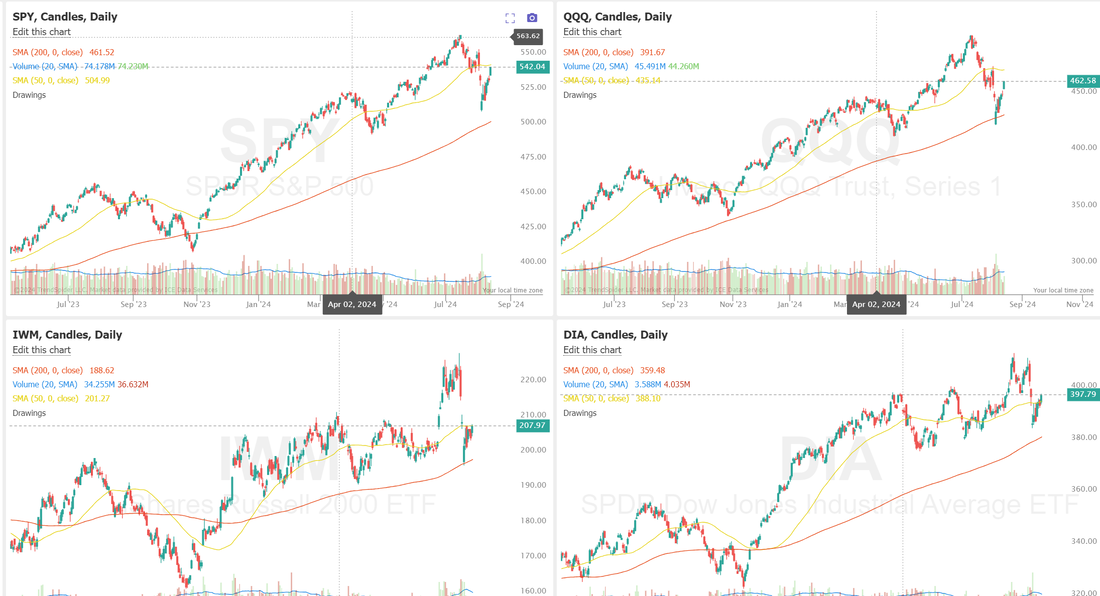

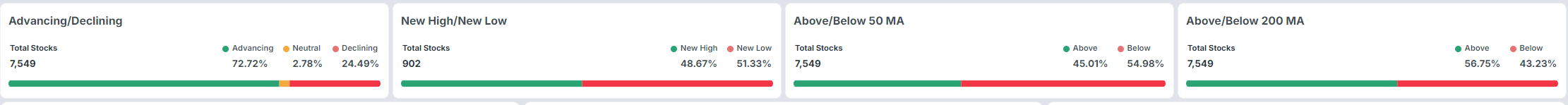

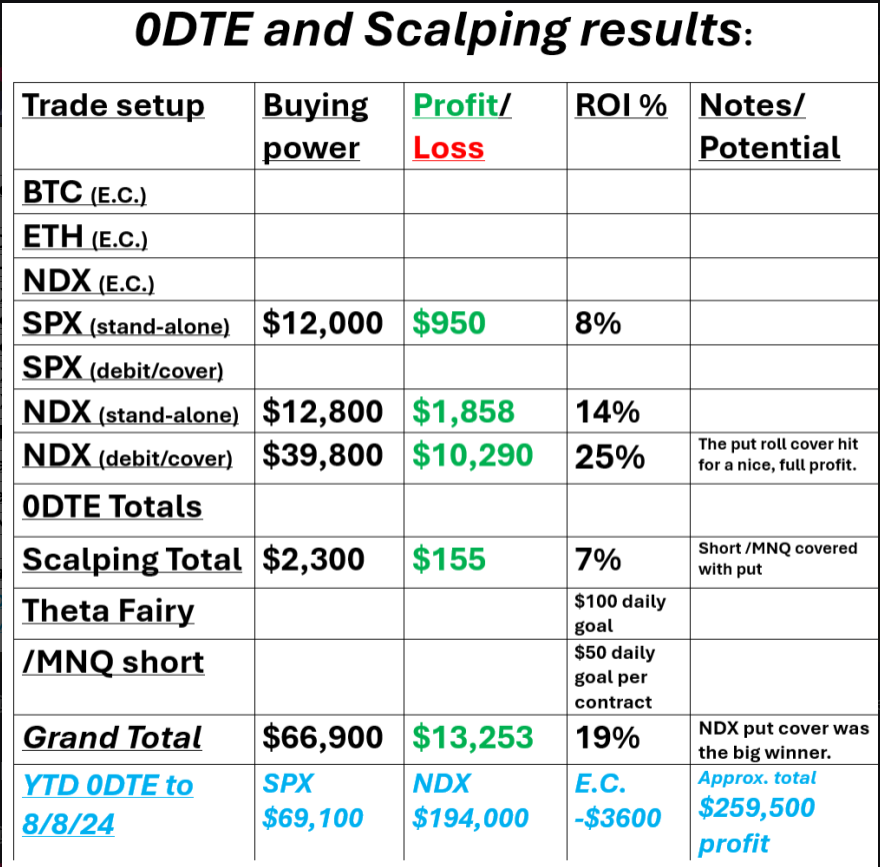

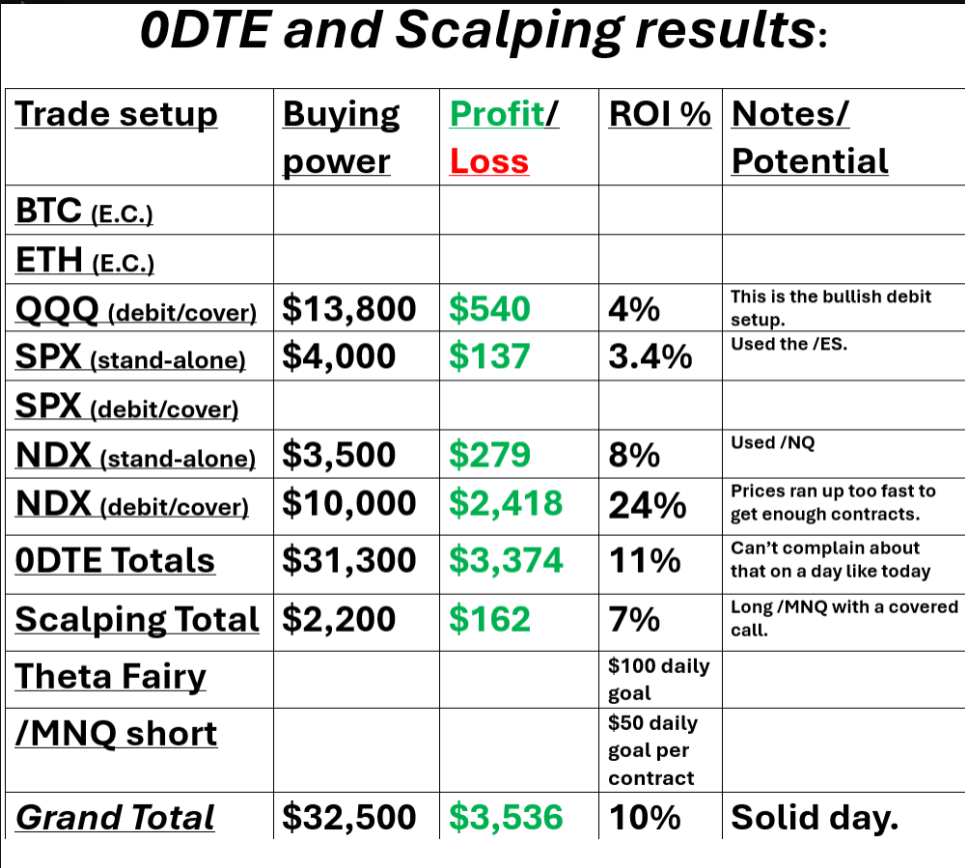

Weclome to Friday traders! The last trading day of the week. Our focus on Fridays is #1. Book any open profits. #2. De-risk the account. #3. Bring our buying power back in so we can be ready to do it all over again next week. Yesterday wasn't good for us...it was stellar. Just stellar. I believe it was the highest percentage gain we've had all year. We've had days where the dollar profit was greater but not the percentage gain. 31% in a day might be a record for us. It also pushes us up over $300,000 dollars in documented profits on our 0DTE's for the year. These can be life changing results but...sadly they are not enough. I just had a new member in our trading room cancel his membership. Sometimes people are looking for something other than just making money. I'm going to write up some thoughts on that in our trading room today. Hopefully it can help each of you set goals with your trading that better align with what you really want out of life. Never the less...I simply couldn't be happier with our results. NOTE: No live zoom feeds until next Weds. I'm out visiting the in-laws in Washington. Let's take a look at the markets. The buy signals continue to hold. We've blasted up above the key levels of the 50DMA on all the indices we trade. One of our trading members asked yesterday about premium skew and where the most activity is. Here's a snapshot of the largest open interest levels currently. Most of our internal metrics look healthly This week has been a good, solid one for the bulls. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500, blue-chip Dow, and tech-heavy Nasdaq 100 notching 2-week highs. Ulta Beauty (ULTA) surged over +11% and was the top percentage gainer on the S&P 500 after a 13F filing revealed that Warren Buffett’s Berkshire Hathaway purchased approximately 690,000 shares of the company, valued at around $266 million, during the second quarter. Also, Cisco Systems (CSCO) climbed more than +6% and was the top percentage gainer on the Dow after the company posted upbeat Q4 results, provided solid Q1 guidance, and announced plans to cut its global workforce by about 7%. In addition, Walmart (WMT) gained over +6% after the retail giant reported stronger-than-expected Q2 results and raised its FY25 guidance. On the bearish side, Dillard’s (DDS) plunged more than -10% after reporting weaker-than-expected Q2 results. Economic data on Thursday showed that U.S. retail sales climbed +1.0% m/m in July, stronger than expectations of +0.4% m/m and the biggest increase in 1-1/2 years, while U.S. core retail sales, which exclude motor vehicles and parts, rose +0.4% m/m in July, beating the +0.1% m/m consensus. Also, the U.S. August Philadelphia Fed manufacturing index fell to a 7-month low of -7.0, weaker than expectations of 5.4. In addition, U.S. industrial production slumped -0.6% m/m in July, weaker than expectations of -0.3% m/m, while U.S. July manufacturing production fell -0.3% m/m, weaker than expectations of -0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -7K to a 5-week low of 227K, less than the 236K consensus. “We’re back to an environment where good news is good news and bad news is bad news,” said Bret Kenwell at eToro. “Investors and consumers want inflation to go lower - but not at the expense of the economy. [Thursday’s] stronger-than-expected retail sales figure quiets some of the fears the U.S. may be slipping into a recession.” Atlanta Fed President Raphael Bostic told the Financial Times in an interview released on Thursday that he is open to an interest rate cut in September, noting that the Fed cannot “afford to be late” in easing monetary policy. “I’m open to something happening in terms of us moving before the fourth quarter,” Bostic told the newspaper. Also, St. Louis Fed President Alberto Musalem stated that he believes the time is approaching when it will be appropriate for the central bank to lower interest rates. “From my perspective, the risk to both sides of the mandate seems more balanced. Accordingly, the time may be nearing when an adjustment to a moderately restrictive policy may be appropriate as we approach future meetings,” Musalem said. Meanwhile, U.S. rate futures have priced in a 72.5% chance of a 25 basis point rate cut and a 27.5% probability of a 50 basis point rate cut at the next FOMC meeting in September. Today, all eyes are focused on the preliminary reading of the U.S. Michigan Consumer Sentiment Index, set to be released in a couple of hours. Economists, on average, forecast that the Michigan consumer sentiment index will come in at 66.7 in August, compared to last month’s value of 66.4. The U.S. Building Permits (preliminary) and Housing Starts data for July will also be reported today. Economists forecast Building Permits to be 1.430M and Housing Starts to be 1.340M, compared to the previous numbers of 1.454M and 1.353M, respectively. In addition, market participants will be anticipating a speech from Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.913%, down -0.54%. My bias today is slightly bearish. We've had a big run this week. Probably time to pause or give a little back. Trade docket for today could be busy. Many of these positions expire today and may do so on their own. We still list them. /MNQ scalping, /MCL, /NG, /ZC, /ZN, AMAT, BABA, DELL, F, GLD, IWM, META, NVDA, ORCL, PLTR, PYPL, SHOP, UPST, WYNN, 0DTE's. Let's take a look at a couple key levels for our 0DTE's today. /ES; The /ES is a little more healthy than the /NQ. Solidly above the 50DMA. 5600 is first upside target with 5716 the next. 5497 is the first downside target and corresponds to the 50DMA. 5426 would be the next target is we can break below the 50DMA. /NQ: That green line is key. 50DMA. 19589. Bulls need to continue to push through that level to maintain momentum. Above that is 19700 which is also heavy resistance. 19204 is first downside target then all the way down to 18985. There appears to be more downside than upside today. Let's have a great finish to a great week today! I hope you all have a great weekend.

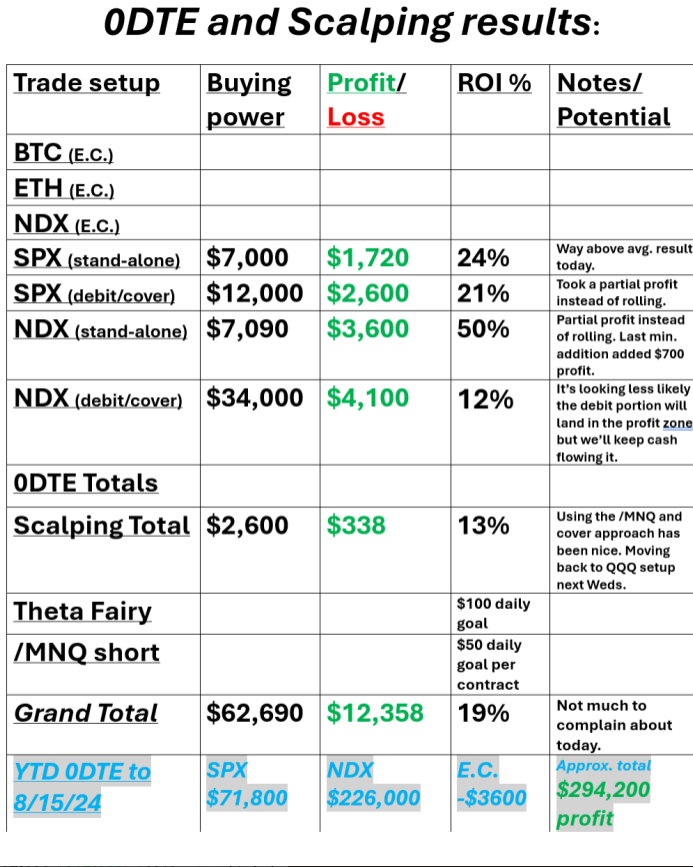

Welcome back traders. We had a solid day yesterday even though my prediction of a "trend" day couldn't have been more wrong. It was another day of ups and downs but the range was pretty confined and we were able to scale fairly well. We left some money on the table by closing a few legs down at way less than full profit capture but, nevertheless, it was a great day. Our results are below: One item of note. Our NDX put debit setup still has 11 days before expiration and while it's been a great cash flow machine, it's looking less likely it will hit for a profit. We only show realized gains and losses on the matrix above. It would be a 24K loss if that debit doesn't land in the profit zone and once that's realized (either profit or loss) I'll post it, however, our YTD 0DTE profit DOES reflect the current unrealized loss on that position. I'm just proud of our 0DTE results. I don't know if we'll be able to get to our $300,000 profit target by the end of this month IF the NDX debit doesn't hit but we'll certainly try! Let's take a look at the markets: Buy signals continue to hold tight. September S&P 500 E-Mini futures (ESU24) are up +0.01%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.15% this morning as investors awaited a flurry of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from retail giant Walmart. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the benchmark S&P 500, blue-chip Dow, and tech-heavy Nasdaq 100 posting 1-1/2 week highs. Kellanova (K) climbed over +7% and was the top percentage gainer on the S&P 500 after Mars agreed to acquire the company for $83.50 a share in a deal valued at about $36 billion. Also, Cardinal Health (CAH) gained more than +3% after the company posted upbeat Q4 results and boosted its FY25 adjusted EPS guidance. In addition, Illumina (ILMN) rose over +2% after TD Cowen upgraded the stock to Buy from Hold with a price target of $144. On the bearish side, Alphabet (GOOGL) fell more than -2% after Bloomberg News reported that the U.S. Department of Justice is considering several options to break up Google following a landmark court ruling that the company monopolized the online search market. The Labor Department’s report on Wednesday showed consumer prices increased +0.2% m/m in July, in line with expectations. On an annual basis, headline inflation eased to +2.9% in July from +3.0% in June, better than expectations of no change at +3.0% and the smallest year-over-year increase since March 2021. In addition, the core CPI, which excludes volatile food and fuel prices, eased to +3.2% y/y in July from +3.3% y/y in June, in line with expectations and the smallest annual increase in 3-1/4 years. “It may not have been as cool as [Tuesday’s] PPI, but [Wednesday’s] as-expected CPI likely will not rock the boat,” said Chris Larkin at E*Trade from Morgan Stanley. “Now the primary question is whether the Fed will cut rates by 25 or 50 basis points next month. If most of the data over the next five weeks points to a slowing economy, the Fed may cut more aggressively.” Atlanta Fed President Raphael Bostic told the Financial Times in an interview released on Thursday that he is open to a rate cut in September, noting that the central bank cannot “afford to be late” in easing monetary policy. “I’m open to something happening in terms of us moving before the fourth quarter,” Bostic told the newspaper. Meanwhile, U.S. rate futures have priced in a 64.5% chance of a 25 basis point rate cut and a 35.5% probability of a 50 basis point rate cut at the next FOMC meeting in September. On the earnings front, notable companies like Walmart (WMT), Applied Materials (AMAT), Deere (DE), and Tapestry (TPR) are slated to release their quarterly results today. On the economic data front, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that July Retail Sales will stand at +0.4% m/m, compared to the June figure of 0.0% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.4% m/m in June. Economists foresee the July figure to be +0.1% m/m. The U.S. Philadelphia Fed Manufacturing Index will be reported today. Economists foresee this figure to stand at 5.4 in August, compared to the previous value of 13.9. U.S. Industrial Production and Manufacturing Production data will be closely monitored today. Economists forecast July Industrial Production to be at -0.3% m/m and July Manufacturing Production to stand at -0.2% m/m, compared to the June numbers of +0.6% m/m and +0.4% m/m, respectively. U.S. Export and Import Price Indexes for July will come in today. Economists anticipate the export price index to be 0.0% m/m and the import price index to be -0.1% m/m, compared to the previous figures of -0.5% m/m and 0.0% m/m, respectively. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 236K, compared to last week’s value of 233K. In addition, market participants will be looking toward speeches from St. Louis Fed President Alberto Musalem and Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.850%, up +0.63%. Some important levels were hit yesterday. The SPY, DIA and IWM all held above their 50DMA. QQQ's are still the weakest. Retail sales, Jobless claims and Industrial production should be the news catalysts today. Assuming they don't rock the boat I'm starting the day with a bullish bias. Our trade docket for today: BABA, AMAT, /MCL, /ZN, DELL, DJT, DIA, FSLR, NEM, IWM, /MNQ scalp, 0DTE's. Let's take a look at a couple key levels for me today; /ES; Very tight range pattern today. 5491 and 5520 are the next two resistance levels bulls need to break through. 5469 and 5452 are the support areas. /NQ; We find a similar pattern in the Nasdaq. 19208 is the first resistance. 19310 is the next. 19049 is first support. 18942 is the next. Let's have a great day folks!

Welcome to Weds. and CPI day for those of you that celebrate it! Yesterday we got PPI and the market loved the soft numbers. We broke through some critical resistance. Today could give us a definitive directional change. The main (only?) question today is, does CPI confirm the soft PPI numbers or contradict? It should be the driver for today. We had a decent day yesterday. Our SPX debit call cover and NDX stand alone 0DTES have positions we've rolled to today so we'll really see the results of our full effort yesterday in todays closing numbers. Here's how our trades went yesterday. The big push up hurt our NDX put debit spread but that is as of yet, unrealized as a gain or loss. We've got 12 more days to work that setup. Let's take a look at the markets. We finally have some movement off of strong consolidation zones. Buy mode was achieved. From a technical perspective we broke through some key levels of resistance. However, you can see that it's just brought us back to the next resistance levels. The market certainly looks much more healthy. What led us down (tech) is also what's leading us back up. This past week has been strong across all sectors. The QQQ's are pricing in a 1.3% potential move today. CPI is a big market driver. September S&P 500 E-Mini futures (ESU24) are up +0.02%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.09% this morning as market participants held back from making any big bets ahead of the release of the U.S. consumer inflation report. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching 1-1/2 week highs and the blue-chip Dow posting a 1-week high. Starbucks (SBUX) soared over +24% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after naming Chipotle Mexican Grill’s Brian Niccol as its next CEO effective September 9th, succeeding Laxman Narasimhan, who is stepping down as CEO effective immediately. Also, chip stocks gained ground, with Nvidia (NVDA) advancing more than +6% and Intel (INTC) rising over +5% to lead gainers in the Dow. In addition, Dell Technologies (DELL) climbed more than +4% after Barclays upgraded the stock to Equal Weight from Underweight. On the bearish side, Chipotle Mexican Grill (CMG) slumped over -7% and was the top percentage loser on the S&P 500 after CEO Brian Niccol departed the company to take up the role of CEO at Starbucks. Economic data on Tuesday showed the U.S. July producer price index for final demand rose +0.1% m/m and +2.2% y/y, better than expectations of +0.2% m/m and +2.3% y/y. Also, the U.S. core PPI, which excludes food and energy prices, increased +2.4% y/y in July, less than the +2.7% y/y consensus and cooling from the +3.0% y/y pace in June. “Muted PPI is more good data,” said Paul Ashworth at Capital Economics. “It is nevertheless consistent with the Fed’s preferred core PCE prices measure increasing at a below 2% annualized pace.” Atlanta Fed President Raphael Bostic stated Tuesday that he is seeking “a little more data” before endorsing a reduction in interest rates. “We want to be absolutely sure,” Bostic said. “It would be really bad if we started cutting rates and then had to turn around and raise them again.” Meanwhile, U.S. rate futures have priced in a 49.5% chance of a 25 basis point rate cut and a 50.5% chance of a 50 basis point rate cut at the next central bank meeting in September. On the earnings front, notable companies like Cisco Systems (CSCO), Cardinal Health (CAH), and Brinker International (EAT) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. consumer inflation report, set to be released in a couple of hours. Economists, on average, forecast that the U.S. July CPI will arrive at +0.2% m/m and +3.0% y/y, compared to the previous numbers of -0.1% m/m and +3.0% y/y. The U.S. Core CPI will also be closely watched today. Economists anticipate the Core CPI to be +0.2% m/m and +3.2% y/y in July, compared to the previous figures of +0.1% m/m and +3.3% y/y. A survey conducted by 22V Research revealed that 52% of investors anticipate the market reaction to the consumer inflation report will be “risk-on.” U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.900M, compared to last week’s value of -3.728M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.855%, down -0.05%. No bias or lean for me today. I'm sure our price action will be data driven off the CPI result. However the data is percieved by the market, I think we have a good chance for a trend day. Trade with the trade today, that's my goal. Let's look at the new, key levels for me today. /ES; /NQ: Some key levels for me today: 19601 to the upside is the first big target. This is the 50DMA. 18546 is the first downside target with 18249 the next level down. Again...lots of potential movement lined up for today. Trade docket for today: DDD?, CSCO, /MCL, /MNQ scalping, /NG, CRM?, DELL, DJT, FSLR, IWM?, NVDA?, UPST, NU, XP, 0DTE's. Have a great day folks. CPI is out shortly!

Welcome back traders. We had a near, picture perfect day yesterday. In the trading room we talked about how some days, whatever you do it doesn't work and somedays everything just flows. Take a look at our results below. We continue to grow our profits on our 0DTE setups. We'll need the help of the NDX debit setup to get us over the $300,000 profit mark. We should know more on that after PPI and CPI this week. Let's take a look at the markets. Buy mode just holding on. We continue to be stuck in major consolidation zones. Yesterdays price action didn't really alter that. September S&P 500 E-Mini futures (ESU24) are trending up +0.11% this morning as investors awaited crucial U.S. producer inflation data, comments from a Federal Reserve official, and an earnings report from home improvement chain Home Depot. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. KeyCorp (KEY) climbed over +9% and was the top percentage gainer on the S&P 500 after Scotiabank announced plans to buy a 14.9% pre-forma stake for a minority investment of about $2.8 billion through the issuance of common shares at a price of $17.17 per share. Also, Monday.com (MNDY) advanced more than +14% after the company posted upbeat Q2 results and raised its full-year revenue guidance. In addition, Starbucks (SBUX) gained over +2% after the Wall Street Journal reported that activist investor Starboard Value had built a stake in the coffee giant. On the bearish side, B. Riley Financial (RILY) plummeted nearly -52% after the company suspended its quarterly dividend and said it expects a Q2 loss between $435 million and $475 million. “This skittish sentiment will likely persist until investors see more evidence that the economy isn’t slowing into a recession and indications from the Fed that it will act aggressively, if necessary,” said Jason Draho at UBS Global Wealth Management. Meanwhile, U.S. rate futures have priced in a 50.5% probability of a 25 basis point rate cut and a 49.5% chance of a 50 basis point rate cut at the September FOMC meeting. On the earnings front, home improvement chain Home Depot (HD) is set to report its Q2 earnings results today. Today, all eyes are focused on the U.S. Producer Price Index, set to be released in a couple of hours. Economists, on average, forecast that the U.S. July PPI will stand at +0.2% m/m and +2.3% y/y, compared to the previous figures of +0.2% m/m and +2.6% y/y. The U.S. Core PPI will also be closely watched today. Economists expect July’s figures to be +0.2% m/m and +2.7% y/y, compared to the previous numbers of +0.4% m/m and +3.0% y/y. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.920%, up +0.26%. No lean or bias for me today. PPI should be the catalyst and we also have FED Bostic speaking. Trade docket for today: NU and XP earnings setups. CCL, FSLR, META additions to current setups. /MNQ scalp, 0DTES. We have skipped the E.C. 0DTE's this past week as the edge just wasn't there but they look more enticing now. I'd imagine we'll be back on them next week. As mentioned, I think PPI an Bostic speaking should be our two potentially market moving catalysts for today so let's look at a coupld key levels in the /ES and /NQ. /ES; On the upside we have 5403. This is the current resistance. Above that we have the 200 period M.A. (red line) on the 2hr. chart. Support is at 5359 and then down to 5332 (green line) which is the 50 period M.A. A breakout above or below these levels could get us back to moving more directionally. /NQ: 18829 is the first resistance level with 18948 being the next (red line) as the 200 period M.A. 18627 is the first support and 18536 takes us down to the PoC (purple line). Again, a break out above of below these levels could initiate some directional movement. Use the converter to easily convert futures to SPY/QQQ or SPX/NDX: Now we just await the PPI numbers. Have a great day folks. Let's see if we can keep the momentum going.

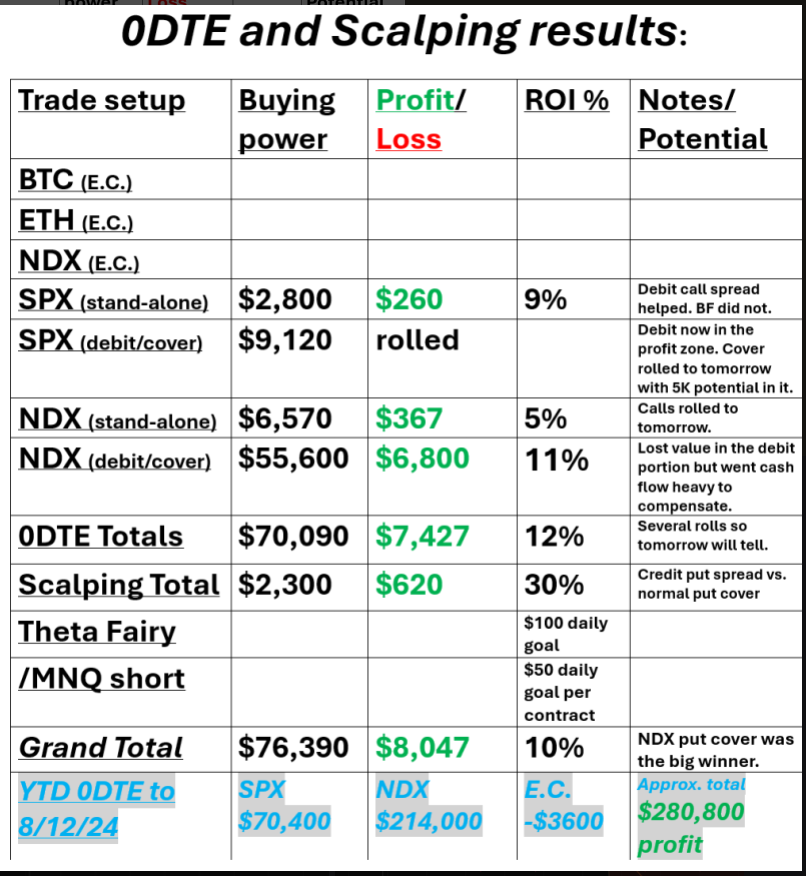

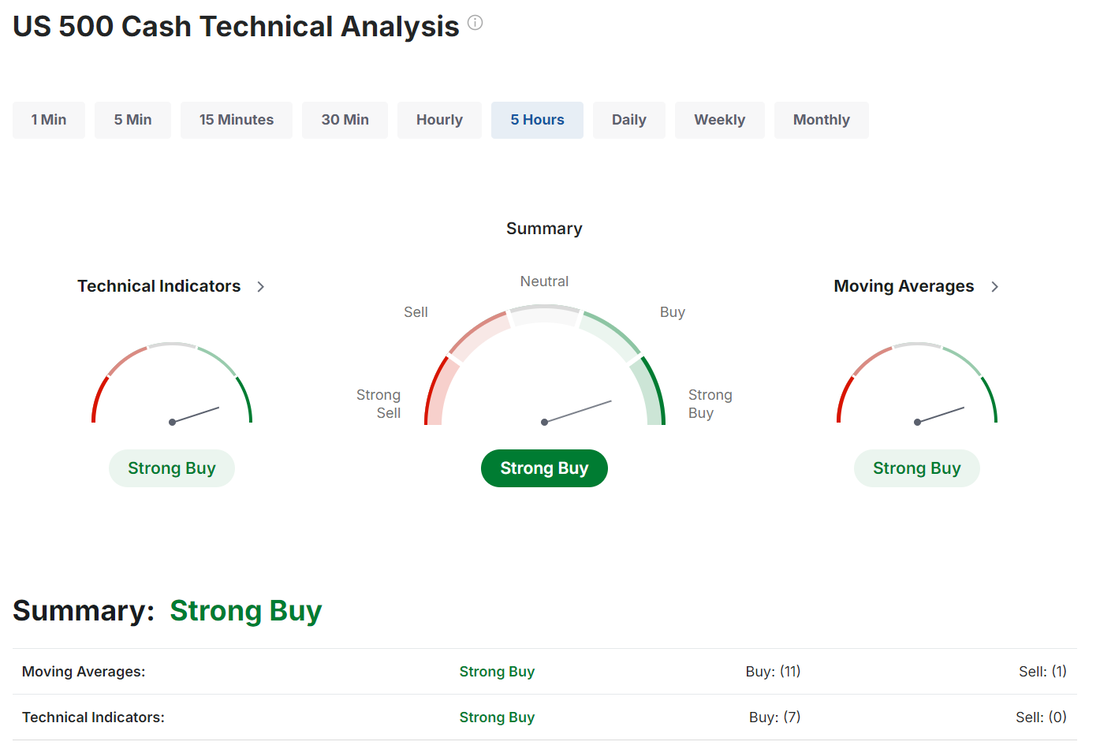

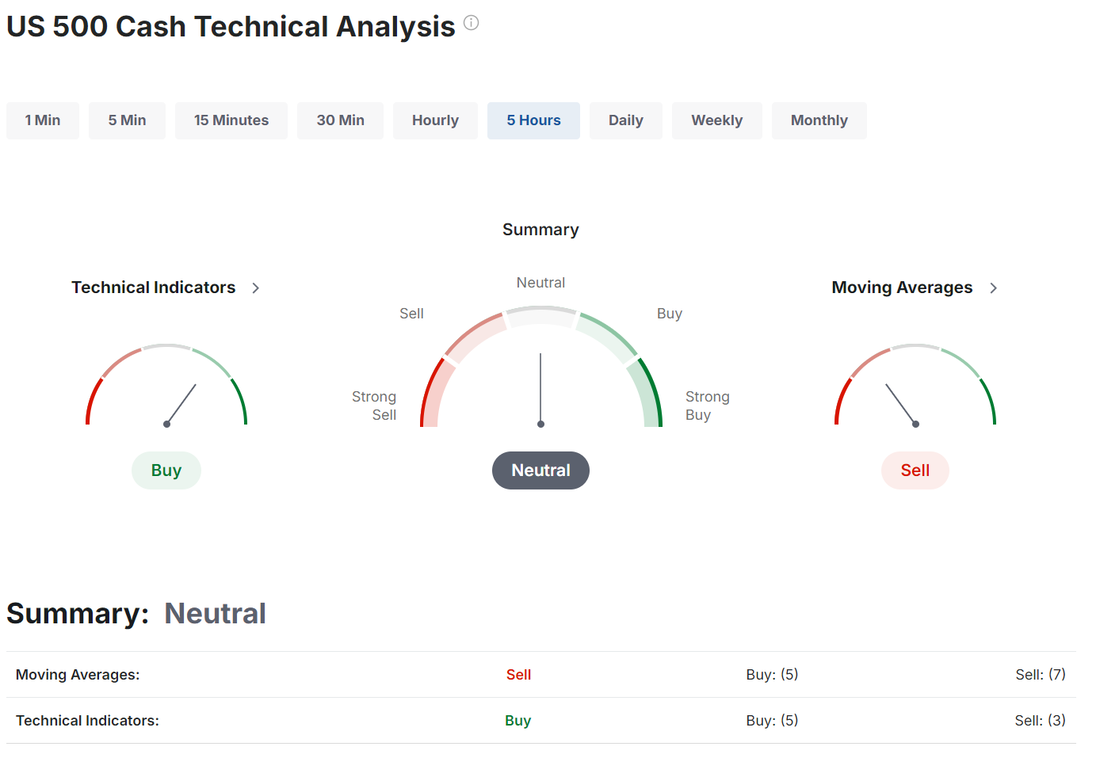

Welcome back traders. We had a nice finish to the week last Friday with our NDX debit 0DTE cover hitting for a full profit. Here's our results. I has set an aggressive goal to see if we could get to $300,000 of total profit on our 0DTE's by the end of the month. That's a lot but if we can get the NDX debit to finish in the profit zone we should be close. We've got CPI this week. I believe that will cement our near term direction, either up or down. We've got two weeks to continue to work this I.V. has fallen back into its more normal range. Take a look at the VIX1D. Technicals are flashing a moderate buy signal. The fear and greed index is flashing buy signals as well Let's take a look at the expected moves for the SPY and QQQ this week. This past week we saw a rotation out of the defensive sectors and back into the "risk on" stocks. September S&P 500 E-Mini futures (ESU24) are up +0.10%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.21% this morning as investors looked ahead to the release of U.S. inflation data, quarterly earnings reports from retail heavyweights, and remarks from Federal Reserve officials. In Friday’s trading session, Wall Street’s major averages closed higher. Akamai Technologies (AKAM) climbed over +10% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results. Also, Trade Desk (TTD) surged more than +12% and was the top percentage gainer on the Nasdaq 100 after the company reported strong Q2 results and provided above-consensus Q3 revenue and adjusted EBITDA guidance. In addition, Expedia (EXPE) gained over +10% after the online travel company reported better-than-expected Q2 results. On the bearish side, Insulet (PODD) slumped more than -8% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q2 adjusted EPS. Also, Intel (INTC) slid over -3% and was the top percentage loser on the Dow and Nasdaq 100 after Moody’s Ratings downgraded Intel’s senior unsecured debt rating to Baa1 from A3 and revised its outlook to negative from stable. “Even if that nerve-racking event is over, we learned how sensitive markets now are to cooler US economic data, how broad-reaching the impact of the yen carry trade can be, and how conditioned investors are to expect rate cuts as the salve for every scrape,” said Liz Young Thomas at SoFi. Boston Fed President Susan Collins stated in an interview with the Providence Journal on Friday that the U.S. central bank might start lowering interest rates soon if inflation maintains its downward trajectory amid a robust labor market. “If the data continue the way that I expect, I do believe that it will be appropriate soon to begin adjusting policy and easing how restrictive the policy is,” Collins said. “My outlook is for continued gradual reduction back to our 2% target amid a healthy labor market.” At the same time, Fed Governor Michelle Bowman said Saturday that she continues to see upside risks for inflation and continued strength in the labor market. “The progress in lowering inflation during May and June is a welcome development, but inflation is still uncomfortably above the committee’s 2% goal,” Bowman said. “I will remain cautious in my approach to considering adjustments to the current stance of policy.” Meanwhile, U.S. rate futures have priced in a 51.5% chance of a 25 basis point rate cut and a 48.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. Second-quarter earnings season winds down, but several notable companies are due to report this week, including Walmart (WMT), Home Depot (HD), Cisco (CSCO), Barrick Gold (GOLD), Deere (DE), Applied Materials (AMAT), and Sun Life Financial (SLF). On the economic data front, the U.S. consumer inflation report for July will be the main highlight in the coming week. Also, market participants will be monitoring a spate of other economic data releases, including the U.S. Core CPI, PPI, Core PPI, Retail Sales, Core Retail Sales, Crude Oil Inventories, Export Price Index, Import Price Index, Initial Jobless Claims, NY Empire State Manufacturing Index, Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Building Permits (preliminary), Housing Starts, and Michigan Consumer Sentiment Index (preliminary). In addition, Atlanta Fed President Raphael Bostic, St. Louis Fed President Alberto Musalem, Philadelphia Fed President Patrick Harker, and Chicago Fed President Austan Goolsbee will be making appearances this week. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.953%, up +0.23%. Price action, while being very active, has simply taken most of the indices back to previous consolidation zones. We are still waiting for a new trend to develop. Let's take a look at some key levels for our 0DTE entries today. /ES: 5402 is the first key resistance level. 5440 is the 200 period M.A. on a 2 hr. chart. Above that sits the PoC. Those are some (usually) stiff resistance areas. 5363 is first support and 5322 is the next. /NQ; There are a couple key levels I'm watching. 18772 is first resistance. If we can break above that we could have clear sailing all the way up to 19025 which is the 200 Period M.A. on the 2 hr. chart. On the downside, the first target is 18569. Below that is the 50 period M.A. on the 2 hr. chart. 18401. My lean today is bullish. I'm going to simply fall in line with the technicals today. Our trade docket for today: Scalping with /MNQ. ETH crypto add. FSLR, WYNN, UPST, ORCL, IWM, CCL, NVDA, PLTR, PYPL, SHOP, META?, Bonds, Oil, Gold, DIA ladders. 0DTE's. We are back to a more "normal" Monday trading day. PPI and CPI should be the big catalyst's this week so keep an eye on them.

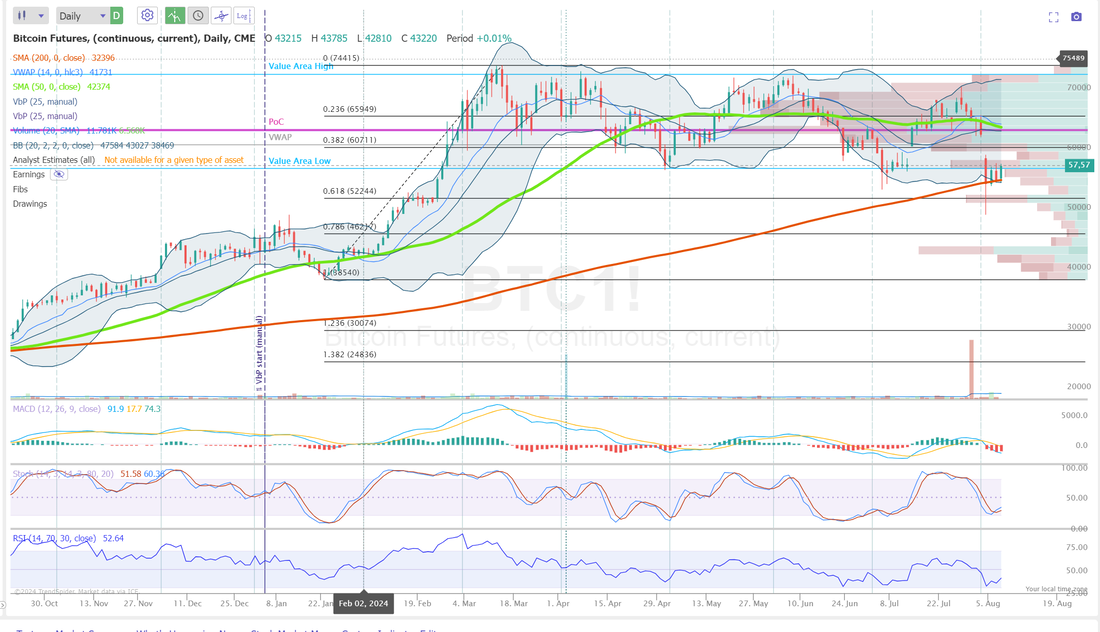

Have a great day folks! Welcome back folks! Last trading day of the week! We don't have much planned news items today to act as catalysts. Futures are flat to slightly down as I type. I didn't have the greatest of days yesterday but I made the most of what I had. Here's my results below: Yesterdays rebound was enough to move us off of a neutral rating but this "buy" signal is pretty darn weak. Futures aren't telling us much. They've been up and down overnight. Up this morning and now slightly red so, who knows for today? Essentially yesterdays rally just brought us back to previous consolidation zones. September S&P 500 E-Mini futures (ESU24) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.42% this morning, building on yesterday’s sharp gains after U.S. labor market data helped alleviate concerns about a significant economic slowdown, while investors awaited a new batch of U.S. economic data due next week to reinforce signs of resilience in the world’s largest economy. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Parker-Hannifin (PH) surged over +10% after the company posted upbeat Q4 results and provided a strong FY25 adjusted EPS forecast. Also, chip stocks gained ground, with Arm (ARM) climbing more than +10% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) rising over +8%. In addition, Eli Lilly (LLY) advanced more than +9% after the drugmaker reported stronger-than-expected Q2 results and raised its full-year guidance. On the bearish side, McKesson (MCK) plunged over -11% and was the top percentage loser on the S&P 500 after the drug distributor reported weaker-than-expected Q1 revenue. Also, Monster Beverage (MNST) slumped more than -10% and was the top percentage loser on the Nasdaq 100 after reporting weaker-than-expected Q2 results and warning of declining demand. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell by -17K to 233K, less than the 241K consensus and down from 250K in the prior week (revised from 249K). Also, U.S. wholesale inventories increased by +0.2% m/m in June, in line with expectations. “[Thursday’s] jobless claims data may ease some of the concerns raised by last week’s soft jobs report,” said Chris Larkin at E*Trade from Morgan Stanley. “But with inflation data due out next week and the stock market still working through its biggest pullback of the year, it’s unclear how much this will move the sentiment needle.” Kansas City Fed President Jeffrey Schmid indicated Thursday that he is not prepared to endorse a reduction in interest rates with inflation above target and the labor market remaining healthy, albeit showing some signs of cooling. “We are close, but we are still not quite there,” Schmid said. U.S. rate futures have priced in a 45.5% probability of a 25 basis point rate cut and a 54.5% chance of a 50 basis point rate cut at September’s policy meeting. Note: The market is pricing in a greater chance of a 50 basis cut over a 25 basis cut. I really think it's going to be dissapointed here! The U.S. economic data slate is empty on Friday. Meanwhile, attention will now shift to the U.S. consumer price inflation report and retail sales figures for July, scheduled for release next week, with investors looking for signs of a soft landing. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.959%, down -0.96%. My bias today is bearish. No news catalysts today. Back to substantive resistance zones. I just don't see the catalysts in place to continue yesterdays push up. Our trade docket for today is light as it is most Fridays. I'll continue to work our scalps using the /MNQ. DELL, NVDA and of course, our 0DTE's. Volatility is starting to come back down to normal levels. I think we'll have a good shot at returning to our normal schedule of trading next week. Let's take a look at a couple key levels on the indices: /ES; Looking at the daily chart, there are two key levels for me. 5414 to the upside. 5305 to the downside. Between here is just meaningless chop to me. Above 5414 could signal a bullish breakout and below 5305 could lead to substantial downside. /NQ; The two key levels for me are 18788 resistence and 18300 support. Between these levels is not significant to me. Above 18788 could signal a bullish breakout. Below 18300 could provide above average downside potential. Bitcoin; BTC had a monster, 6,000 point pop yesterday. That 200DMA held (and I should have believed in it more and gone long) 63,600 is the next upward target. We did get long a super small ETH position in our trading room. Let's have a good day folks. It's always nice to go into the weekend, happy with your results. We've got a lot of rolled calls today that look good now but it's a long time before expiration!

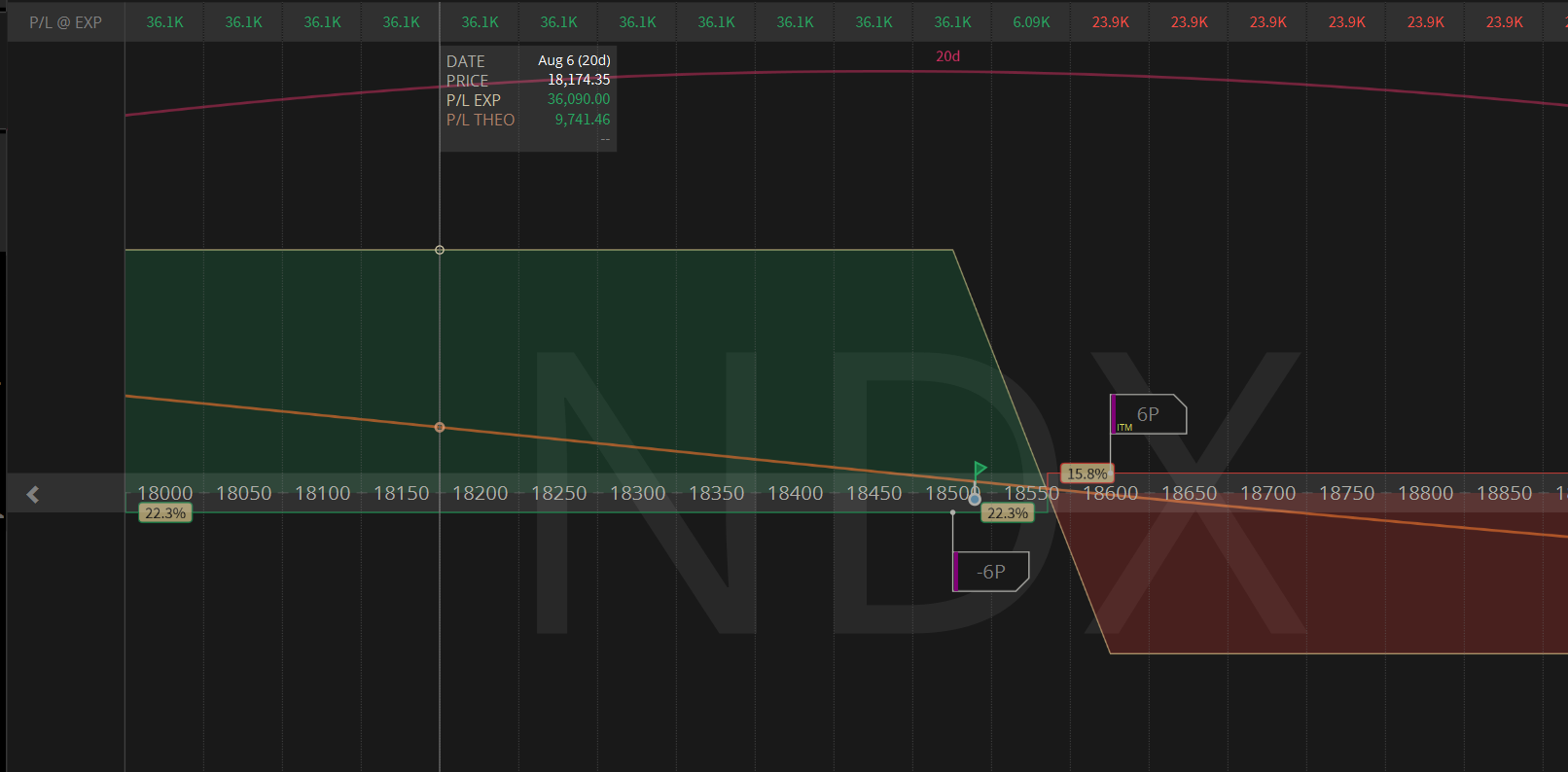

Welcome back to Thursdays trading session! Yesterday was a losing day for me but I fought it right down to the wire. You'll see my capital allocation was almost double a normal day. We've got Jobless claims today which should be our driver today so I won't pick a bias today. Let's just trade what we see. I also think I'll wait a bit longer into the day to start our 0DTE setups. Heavens knows we aren't lacking for premium right now so I think giving up a couple hours of Theta for the greater transparency makes sense. It certainly would have helped me yesterday. Here's a look at my results. A couple of notes. I've added a running tally of our 0DTE results YTD into the P/L matrix. I'll update this about once a week. Also, we've still got 18 days to go in our NDX put debit cover 0DTE. There is $36,000 of profit potential in that setup so we'll need to keep working the covers (even though they didn't work yesterday) to try to bring that trade home. As you can see, we've got almost $16,000 of unrealized profits in the NDX debit 0DTE with 20K still left of ext. Getting that 20K into our pockets would be helpful after yesterdays loss. Also, yesterdays result is another good lesson in the importance of consistency. At the end of the day I was pleased to "only" be down what I was. It could have been much worse but...we also started the day with approx. 16K of profit potential so it really was a 30K swing in net liq. That's a dangerous game to play, the woulda, coulda, shoulda but, it's point is still valid. Let's take a look at the markets. No surprise, we swing back to sell mode after yesterdays give back. The "buy the dip" appears to now be "sell the rip". Any push up gets knocked back down. Good news...bad news. The good news is all the indices we trade are still firmly above their 200DMA. The bad news? They are also all below their 50DMA now. Most of the market internals still look weak September S&P 500 E-Mini futures (ESU24) are down -0.10%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.03% this morning as market participants geared up for U.S. weekly jobless claims data and the next round of quarterly results while also awaiting remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indices closed lower. Super Micro Computer (SMCI) tumbled over -20% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the artificial intelligence server company reported weaker-than-expected Q4 adjusted EPS. Also, Airbnb (ABNB) plunged more than -13% after the company reported mixed Q2 results, issued below-consensus Q3 revenue guidance, and warned of slowing demand from U.S. vacationers. In addition, Charles River Laboratories (CRL) slumped over -12% after lowering its FY24 guidance. On the bullish side, Fortinet (FTNT) surged more than +25% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the cybersecurity firm posted upbeat Q2 results, offered solid Q3 guidance, and lifted its full-year revenue forecast. Also, Axon Enterprise (AXON) advanced over +18% after the company reported better-than-expected Q2 results and raised its FY24 revenue guidance. Economic data on Wednesday showed that U.S. consumer credit increased by +$8.93B in June, weaker than expectations of +$9.80B. Meanwhile, U.S. rate futures have priced in a 27.5% chance of a 25 basis point rate cut and a 72.5% probability of a 50 basis point rate cut at the September FOMC meeting. On the earnings front, notable companies like Eli Lilly (LLY), Gilead Sciences (GILD), Datadog (DDOG), Expedia (EXPE), The Trade Desk (TTD), Take-Two Interactive (TTWO), Paramount Global (PARA), and Capri Holdings (CPRI) are slated to release their quarterly results today. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, set to be released in a couple of hours. Economists estimate this figure to come in at 241K, compared to last week’s number of 249K. U.S. Wholesale Inventories data will be reported today as well. Economists expect June’s figure to be +0.2% m/m, compared to +0.6% m/m in May. In addition, market participants will be looking toward a speech from Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.913%, down -1.34%. Lets take a look at some key levels on the indices starting with the /ES. 5272 is the first bullish target. That's the PoC (purple line). 5118 is the next support level down. A break of either of these zones could free up some big additional movement. On the /NQ; 19584 is the 50DMA and the primary target for bulls. 17890 is a critical support fib line. We are just above that as I type. The next level down would be the 200DMA. Below that? Look out. BTC: The absolute key level for bitcoin is that red line. The 200DMA. It's been support now for four trading days straight. We haven't traded BTC all week although we are dollar cost averaging into a long ETH setup in our trading room. Our trade docket for today: DELL, DIA ( I got assigned long shares here so I'll be unwinding that today), IWM (I also got assigned long shares here. I'll be unwinding that. Note: We have traded this IWM setup every week for 5+ years. This will be the first recorded loss we've taken. Perfect records never last but it was a nice run.),NVDA, Scalping /MNQ, ODTE's on SPX debit. SPX stand alone, NDX debit, NDX stand alone. Good luck out there today folks. Step one, I believe, is to see what jobless claims does to the futures. Then...be patient. I don't think there is any need to rush into postions today.

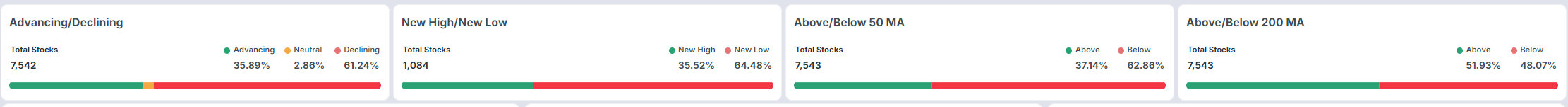

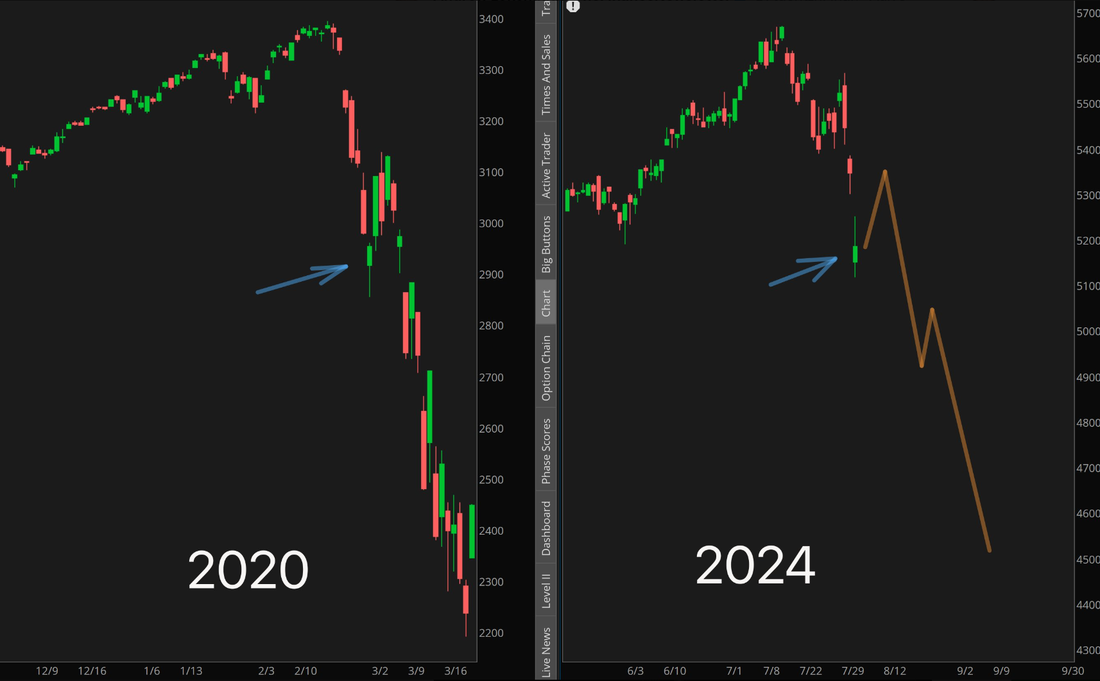

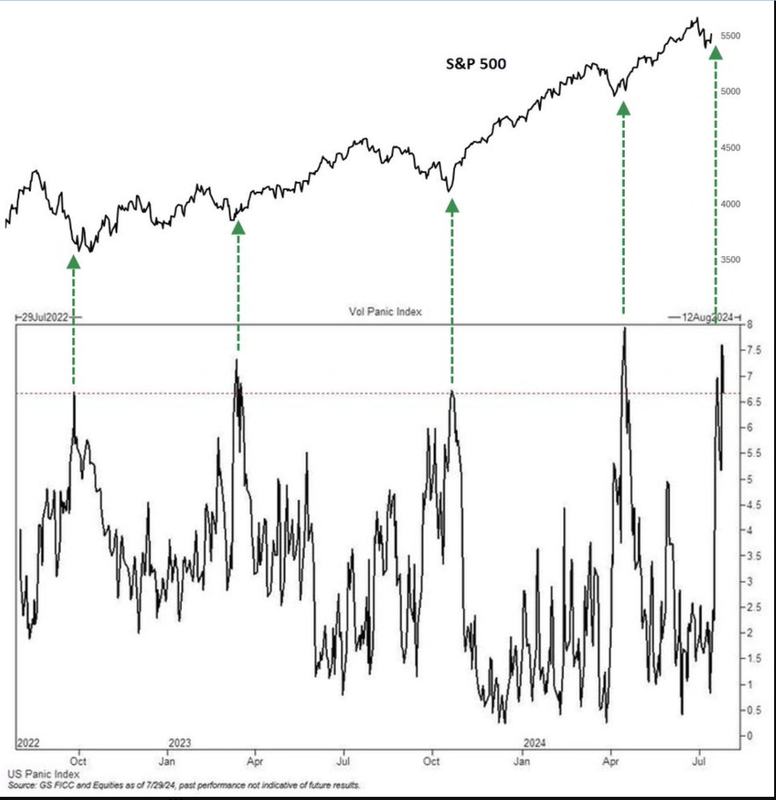

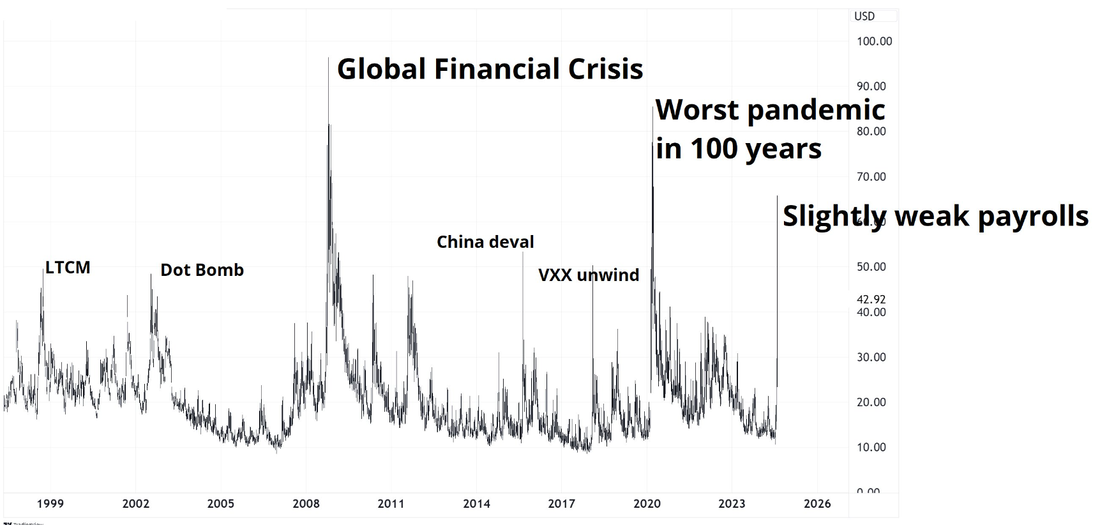

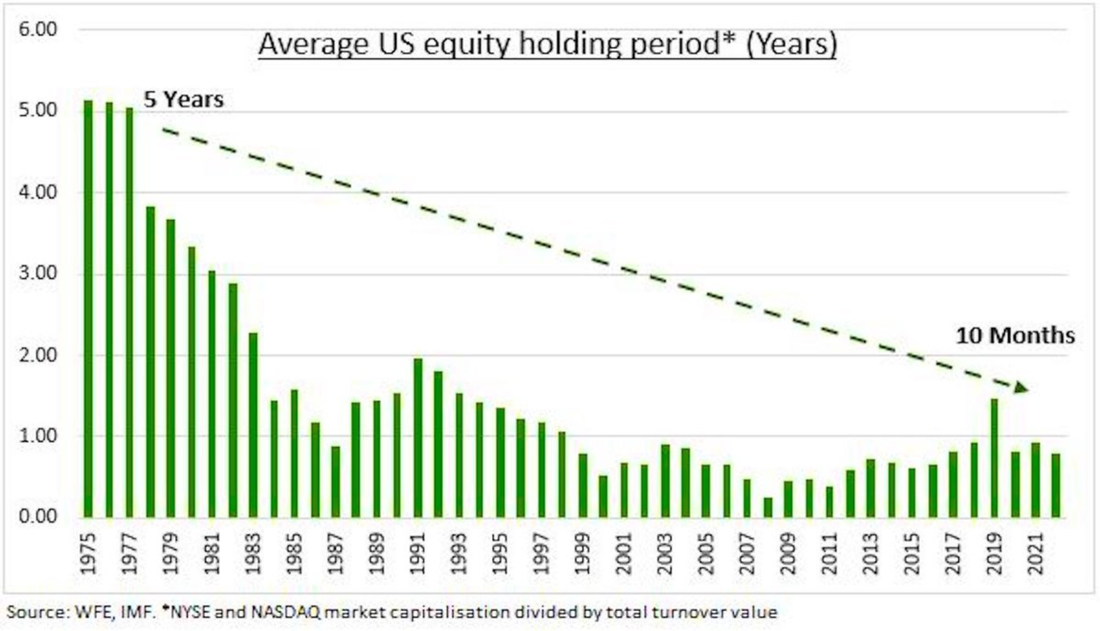

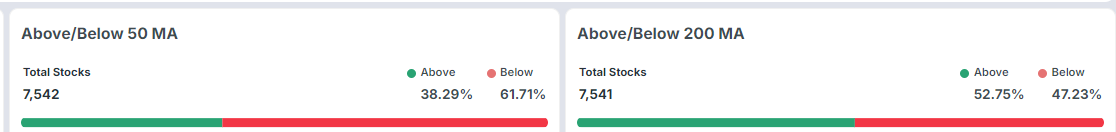

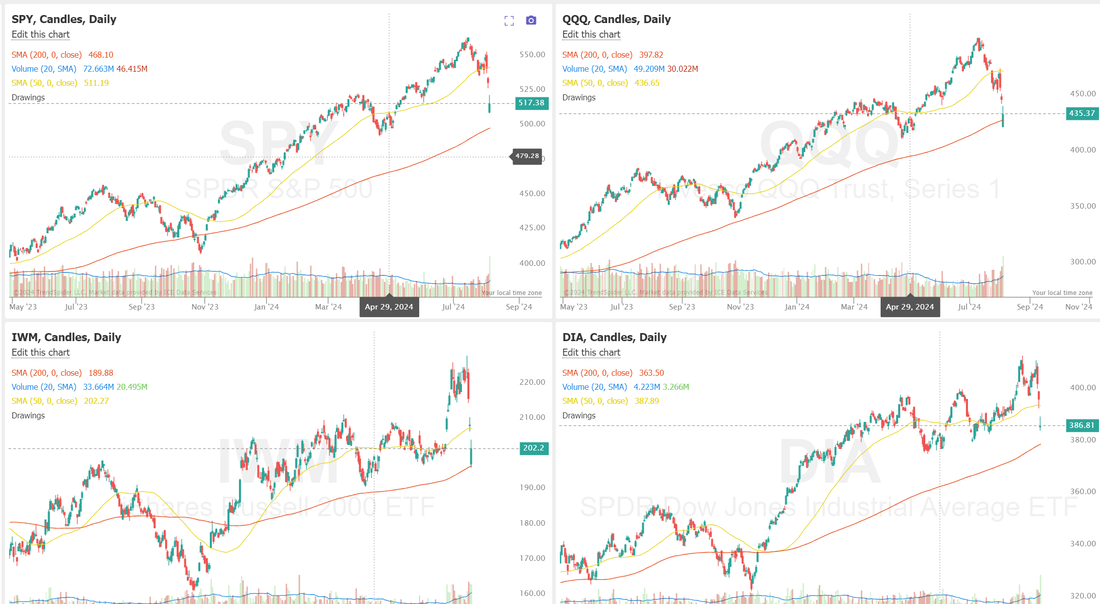

Welcome back traders! Yesterday was another solid day for us as we've stuck to our super focused approach that we took on mid last week. Every day we have members in the trading room asking, "what about this trade, what about this trade?" Nope. We've stuck to a very focused approach. Eskewed a lot of our normal weekly trades and wouldn't you know it, every day of this downturn has been nicely profitable for us. Last Fridays was huge. Scoring a $7,500 profit on one setup, which is nice, but we've done that before. That's not new. What was special was the $390 of total risk we took to garner that win. Yesterday we banked a 100% profit on our short VIX trade. Turning $5,600 into over $11,000. Our NDX stand alone 0DTE that we rolled to today has $16,000 of potential profit in it. Today could be a big one. Here's how our 0DTE trades went yesterday. With over $250,000 dollars of documented profits from our 0DTE trades, I'm just absolutely floored. I couldn't ask for any better results than this. Let's do our best to keep it going. Let's take a look at whats happening in the markets. In 2020 the stock market crashed 35% In 2008 the stock market crashed 55% In 1987 the stock market crashed 35% In 1973 the stock market crashed 50% In 1929 the stock market crashed 90% What's the take away? #1. Markets ALWAYS crash! They always have and they always will. It's how it works folks. People were asking, "what's wrong?" "what happened?" Nothing! It's how it works folks. This is why we ALWAYS have negative delta, bearish positions on! #2. Guess what happened after all those crashes? The market went on to hit a new all time high! That's also how it works! Takeaway: Don't get bogged down in all the daily movements. Just trade what you see and always have crash protection in place. It certainly served us well. Futures are up nicely as I type. Technicals are not quite back to bullish but they are trying. Does this mean we are out of the danger zone? Ah....let's not make that call quite yet. In bear markets we have huge one or two day short covering rallys. In bull markets we have one or two day selloffs. It doesn't neccessarily me a change of direction. Take a look at a few potential outcomes here. I'm not saying this is where we are going. Just be aware. The Goldman Panic Index is flashing panic. Past times were close to fairly major lows fwiw. It's not just jobs. The unwinding of the Yen carry trade has also done a lot of damage. You know what else is affecting the markets and adding to volatility? Apparently everyone is a day trader now! Long term "buy and hold" is becoming less and less of a thing. One last thing I'll add. US MANUFACTURING SECTOR HAS BEEN IN RECESSION FOR 22 MONTHS, THE LONGEST PERIOD SINCE 1990s We have to keep in mind, however, that manufacturing accounts for only 10% of US GDP. On the other hand, the services sector reflects ~70% of the US GDP Here's some key areas I'm looking at on the SPY, QQQ, IWM, DIA. SPY is not flashing a buy or sell signal today. My two key levels are the purple line on the downside which is the PoC (Point of control) 515.74 and the teal line up above which is the next big resistance level. We almost got there yesterday before selling off into the close. That's 533.61. Between here is just chop. QQQ has been beat up more than SPY. The one main bullish note you can make is that it has recaptured it's 200DMA (red line). That's no small feat. I'd like to see it break above it's PoC of 440.53. The next resistance is the blue line at 460. The QQQ's have a lot of damage to unwind. Holding above that 200DMA is key. IWM has given me flashbacks of Mister Toads wild ride at the local amusement park. What goes parabolic usually retraces and that's certainly been the case here. We went straight up and then straight down and guess what? We landed right back where we were for most of June and July. That purple line is the PoC. It's, as Happy Gilmore likes to say, "it's home". I expect less volatility with IWM now. DIA has has a very similar trajectory as IWM. Going near parabolic to the upside then summarily giving it all back. It too is now hovering just above its PoC and back to where it just hung out most of the last two months. We are sticking to our plan for our trade docket today. We do have some adjustments potentially to /ZC, /NG, CRM, DELL, DIA, DJT, F, IWM, LEVI. A new setup on NVDA. Continued scalping using the /MNQ. Four 0DTE's. SPX stand alone. QQQ bullish debt. NDX bearish debit. NDX stand alone. This should be plenty to keep us busy today. My bias today: Slightly bullish. In spite of the late day give back yesterday. The price action was mostly bullish and futures are up as I type. The markets trying to stabilize and rebound. Can it? Well...we'll know in about 7 hours! Tech, for the first time in a while, actually participated in the rebound yesterday. We still need a larger portion of stocks to be above their 50/200DMA's. Have a good day. We've got some monster potential today. That's all we can ask. Now it's up to us to make it happen.

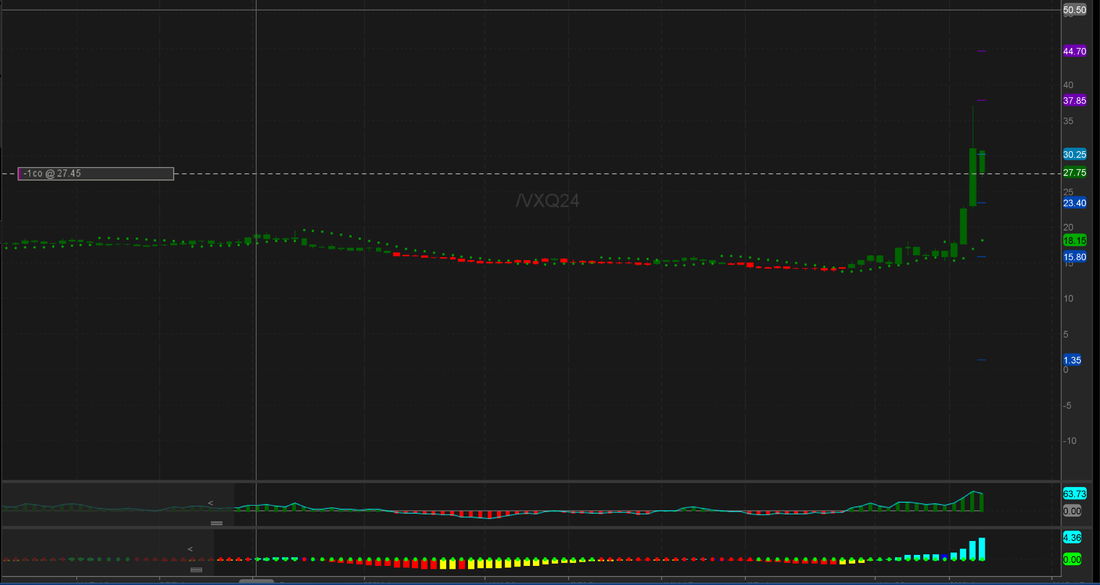

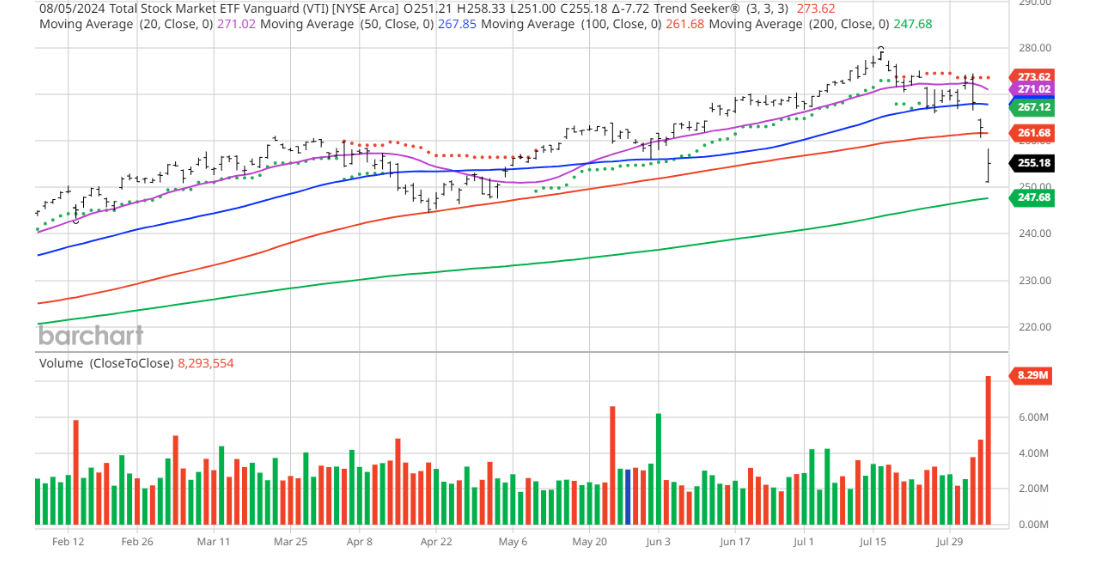

Another day. Another 500 point slide in the NDX! We've been so well posiitoned for this slide that it's actually been a drag on our portfolio over the last month as the market pushed to new highs. No longer. We have scored big on these downturns. Yesterday was a tad bit disappointing to me as the NDX ran back up too quick and I couldn't get enough buying power put to use but....you never know what to expect on days like this so having a bunch of dry powder makes sense. Here's a look at our days results. September S&P 500 E-Mini futures (ESU24) are up +0.55%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.56% this morning, signaling a partial rebound from yesterday’s dramatic selloff as a hotter-than-expected ISM services report and comments from Federal Reserve officials eased fears of a recession, while investors looked ahead to a fresh batch of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes closed lower, with the benchmark S&P 500 and tech-heavy Nasdaq 100 falling to 3-month lows and the blue-chip Dow dropping to a 7-week low. Nvidia (NVDA) slumped over -6% after The Information reported that the company’s upcoming artificial intelligence chips will be delayed by three months or more due to design flaws. Also, megacap technology stocks lost ground, with Amazon.com (AMZN) sliding more than -4% and Microsoft (MSFT) falling over -3%. In addition, Apple (AAPL) dropped more than -4% after Berkshire Hathaway reduced its stake in the iPhone maker by nearly 50% in the second quarter. On the bullish side, Kellanova (K) surged over +16% and was the top percentage gainer on the S&P 500 after Reuters reported that candy giant Mars was exploring an acquisition of the company. Economic data on Monday showed that the U.S. ISM services index rose to 51.4 in July, stronger than expectations of 51.0. At the same time, the U.S. S&P Global services PMI unexpectedly fell to 55.0 in July’s final estimate from the mid-month reading of 56.0 and 55.3 in June. Chicago Fed President Austan Goolsbee reiterated on Monday that the central bank’s role is not to react to one month of weaker labor data, adding that markets are much more volatile than Fed actions. Goolsbee noted that there are cautionary signs, such as the increase in consumer delinquencies, but economic growth continues at a “fairly steady level.” “As you see jobs numbers come in weaker than expected but not looking yet like recession, I do think you want to be forward-looking of where the economy is headed for making the decisions,” Goolsbee said. Separately, San Francisco Fed President Mary Daly stated that the labor market is softening and indicated the Fed should start reducing interest rates in the upcoming quarters, yet she refrained from concluding that the labor market has begun to weaken significantly. “We have now confirmed that the labor market is slowing, and it is extremely important that we not let it slow so much that it tips itself into a downturn,” she said. Daly stressed that the timing and magnitude of rate cuts will “depend a lot on the incoming information.” Meanwhile, U.S. rate futures have priced in a 22.5% chance of a 25 basis point rate cut and a 77.5% chance of a 50 basis point rate cut at the next FOMC meeting in September. In other news, the Federal Reserve’s Senior Loan Officer Opinion Survey, released on Monday, showed that a smaller share of U.S. banks reported tighter credit standards in the second quarter. The net share of U.S. banks that tightened standards on commercial and industrial loans for mid-sized and large businesses dropped to 7.9%, the lowest since 2022, down from 15.6% in the previous report. Banks generally tightened lending standards for consumers, particularly for subprime credit card and subprime auto loans, the Fed said. Second-quarter earnings season continues in full flow, with investors awaiting fresh reports from notable companies today, including Amgen (AMGN), Caterpillar (CAT), Uber Technologies (UBER), Airbnb (ABNB), Duke Energy (DUK), and Super Micro Computer (SMCI). On the economic data front, investors will likely focus on U.S. Trade Balance data, set to be released in a couple of hours. Economists foresee this figure to stand at -$72.50B in June, compared to the previous figure of -$75.10B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.833%, up +1.41%. Sell signals abound right now. More important, the IWM and QQQ's are threatening to break below their 200DMA. That would be very bearish. My bias today is neutral. Futures are up and we may get (probably will get) more big swings today but I think the panic selling is over yet buyers are not excited to come rushing in. For our trade docket today we are going to continue what has been so successful for us over the last three trading days of chaos. I'll continue to scalp with the /MNQ futures and covers. I may take advantage of the potential pop on the open with NVDA to close it and reset it later this week. I'm going to work a cover on the bullish QQQ debit/0DTE. A cover on the bearish NDX debit/0DTE and a stand alone NDX as well as a stand alone SPX 0DTE. Once price action calms down we'll return to our normally scheduled trading. I did put on a short VIX position yesterday. This is a $5,600 position and it's completely directional. There are no options on it. I believe we retrace back down to the $20 dollar range. That would be an approx. $7,0000 dollar profit. Shorting spiked I.V. has always been a huge success for me. Unfortunately we don't get spikes like this very often. We have a great trade called the VTI swing trade. We didn't get one on this last month because the sell signal hit so quickly but I like to use the VTI to gauge overall market health. You can see that not only are we in full sell mode but it's happening on increasing red volume. Intra-day levels: /ES; Just a couple key levels for me today. 5306 is first big resistance and the 5398 which is 50 period M.A. on the 2 hr. chart. 5190 is the key support level. Below that we open up a lot more downside. /NQ; 18,441 is first resistance. 18711 is 50 period M.A. Bulls need to clear that level. 18023 is first support with 17582 next. Below that is more downside. Bitcoin; BTC has gotten pretty hammered, in case you hadn't heard. It's sitting right now on its 200DMA. I'm going to let this one sort itself out before doing more trades on it. We've had some really good days lately as the market churns and drops. We'll stick to what's been working for us and focus mainly on our 0DTE's today. Stay sharp folks.

|

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |