|

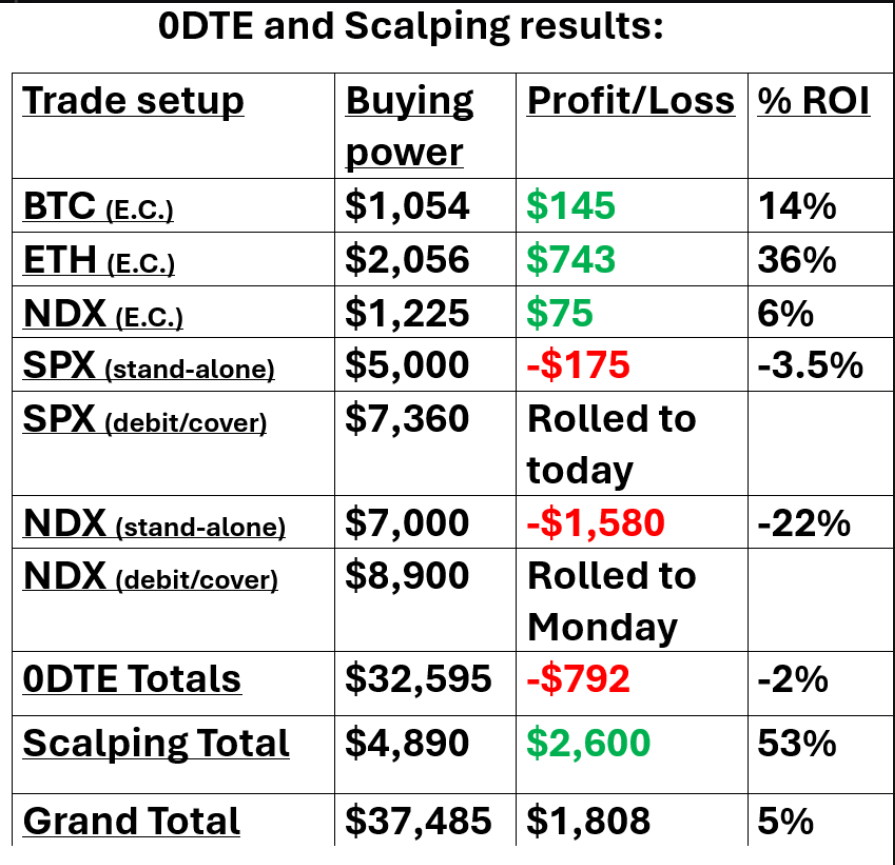

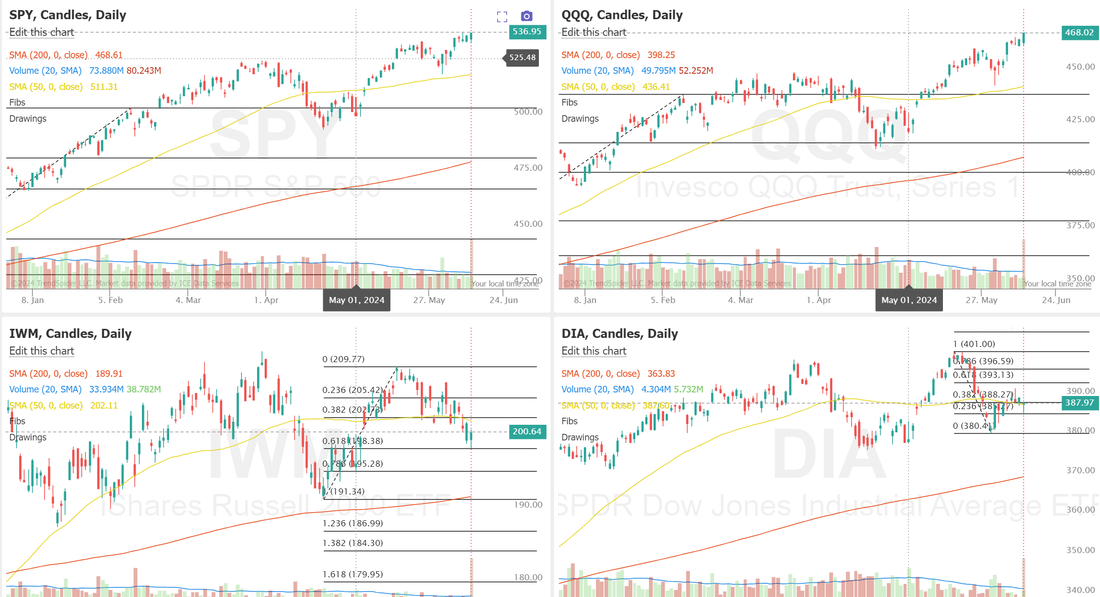

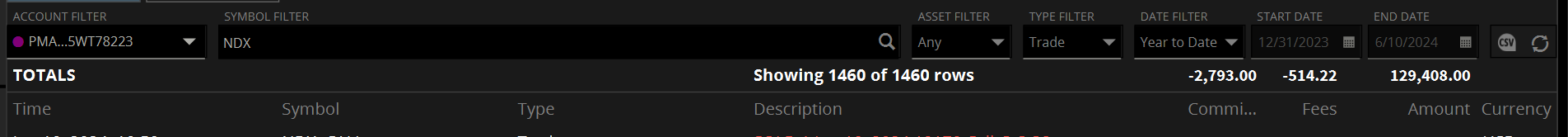

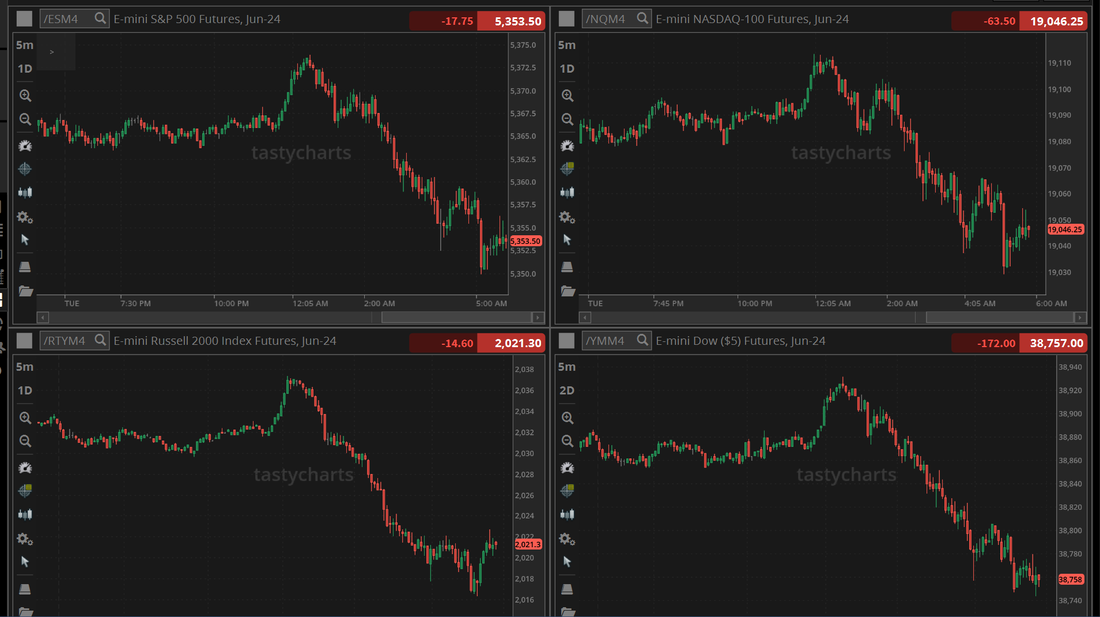

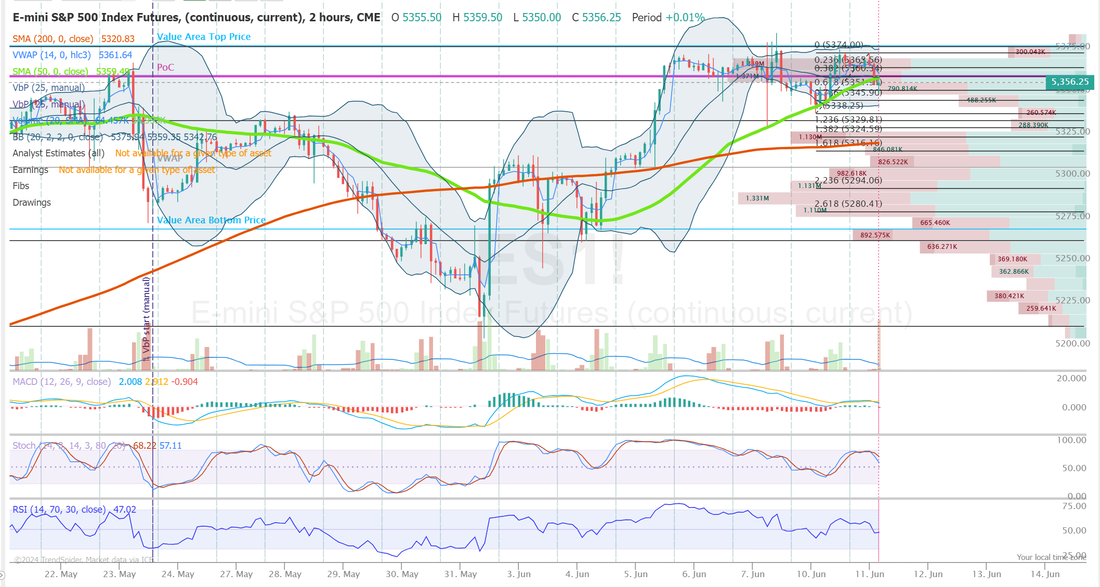

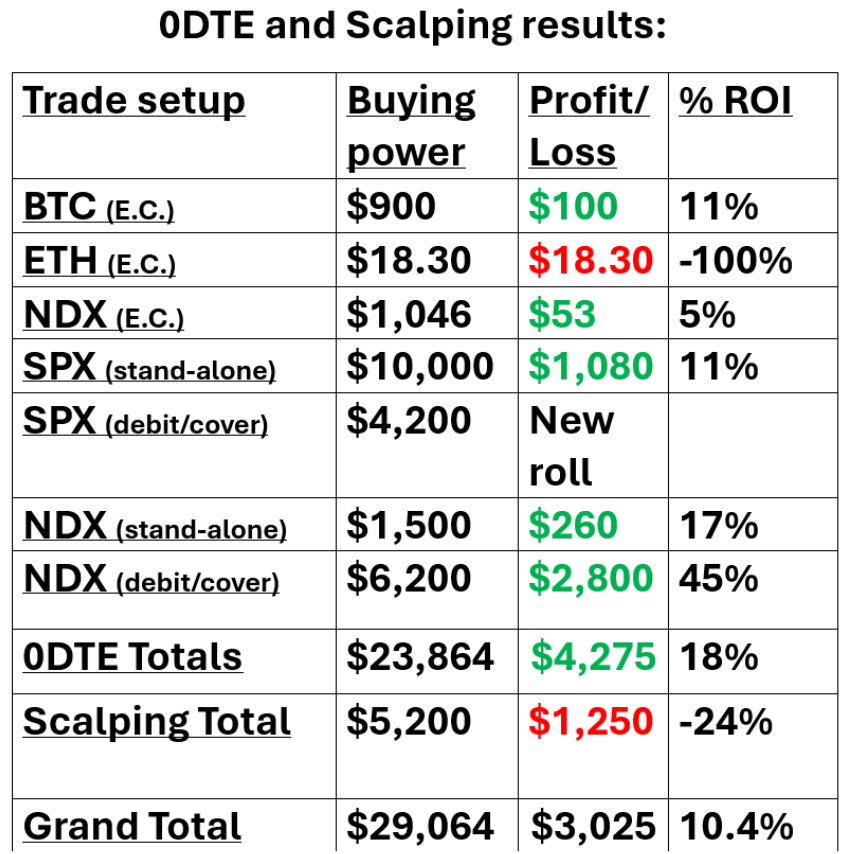

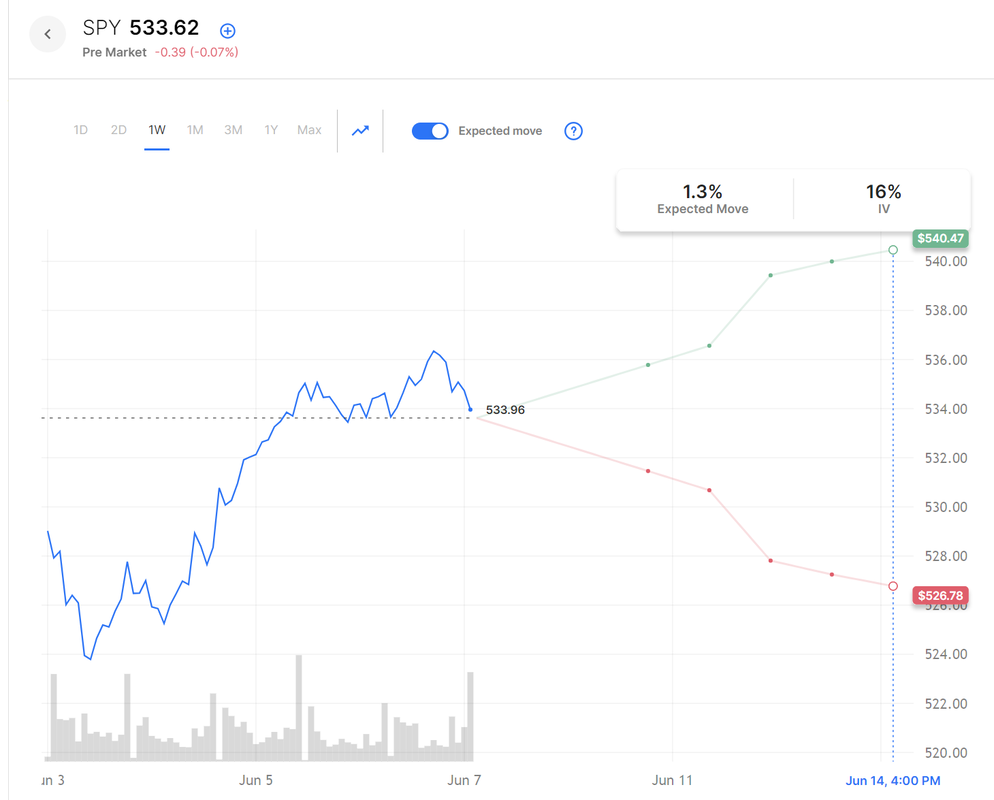

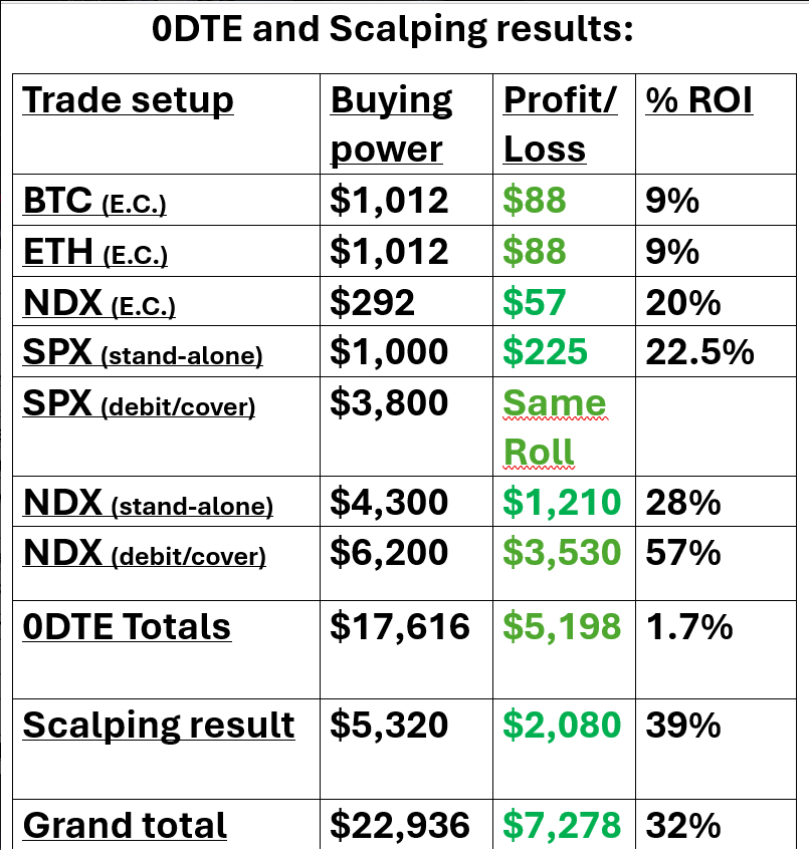

Yesterday was a mixed bag for me with most of our expiring trades working well but we needed to roll a couple of our 0DTE's. I finally had a good day scalping which was nice. It seems like its been forever that we got some good price action and we caught some good reversals throughout the day. Our Event contract 0DTES were a big help with ETH bringing in a 36% return. Our SPX stand alone was so close to profits but just couldn't hold it into the close. Our SPX debit roll could be a huge payoff today with approx. $4,500 of profit but it didn't cash flow for us yesterday. The NDX got run over and we booked a loss on the stand alone and are continuing to work the debit cover. Let's look at the markets: Going into yesterday we were on a seven day winning streak. That usually doesn't last and as expected, we got a reversal yesterday. The DOW however had one of its strongest days in a while. It now joins the SPY an QQQ above their 50DMA. The lowly IWM is the remaining laggard. We didn't get an overnight Vampire trade on yesterday and that was primarily because the premium was lacking. That particular trade setup is very similar in nature to our Theta fairy which also has been scarce lately. One of our trading room members mentioned the one day VIX which is a good indication of where we are at volatility wise. While you can see it spiked yesterday, it really needs to be closer to 17 to get the premium we need for both of those trades. Lately it's been closer to 10! In yesterday’s trading session, Wall Street’s major indices ended mixed. Jabil (JBL) slumped over -11% and was the top percentage loser on the S&P 500 after the company cut its full-year revenue guidance. Also, Qualcomm (QCOM) slid more than -5% after the Wall Street Journal reported that Samsung’s new AI laptops faced operational issues with Windows 11 and the Qualcomm processor. In addition, Trump Media & Technology Group Corp. (DJT) tumbled over -14% following the SEC’s declaration that the company’s April S-1 registration statement had become effective. On the bullish side, Gilead Sciences (GILD) climbed more than +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing that a Phase 3 PURPOSE 1 trial of its experimental therapy, lenacapavir, demonstrated 100% efficacy in the prevention of HIV in cisgender women. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -5K to 238K, compared with the 235K expected. Also, U.S. May housing starts unexpectedly fell -5.5% m/m to a 4-year low of 1.277M, well below the 1.370M consensus, while U.S. building permits unexpectedly fell -3.8% m/m to an almost 4-year low of 1.386M in May, weaker than expectations of 1.450M. In addition, the U.S. June Philadelphia Fed manufacturing index unexpectedly fell to a 5-month low of 1.3, weaker than expectations of 4.8. Minneapolis Fed President Neel Kashkari said Thursday that it would take a year or two to bring inflation back to 2%, given that wage growth might still be too high, suggesting interest rates could remain higher for longer. Also, Richmond Fed President Thomas Barkin stated that he requires additional clarity on the trajectory of inflation before cutting interest rates. “My personal view is let’s get more conviction before moving,” Barkin said. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 59.5% probability of a 25 basis point rate cut at the September meeting. Meanwhile, Wall Street is preparing for a quarterly event known as triple witching, during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. About $5.5 trillion of options are set to expire today. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the June Manufacturing PMI will come in at 51.0, compared to the previous value of 51.3. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 54.8 in May. Economists foresee the preliminary June figure to be 53.4. U.S. Existing Home Sales data will come in today. Economists foresee this figure to stand at 4.08M in May, compared to the previous number of 4.14M. The U.S. Conference Board Leading Index will be reported today as well. Economists expect May’s figure to be -0.4% m/m, compared to the previous figure of -0.6% m/m. Our trade docket today is full of expirations so some of these with a question mark may expire fully profitable on their own. /MCL?, /ZC, /ZN?, CCL?, DIA?, GLD?, IWM?, LULU, MSTR, ODTE's, NVDA, ORCL?, PYPL?, QQQ?, SHOP, SMCI?, SPY?, TSLA?, UPST?, VTI?, WYNN. Intra-day levels for me: /ES; 5540/5548/5555/5566 to the upside. 5518/5506/5495/5481 to the downside. /NQ; 20094/20181/20250/20337 to the upside. 19940/19853/19787/19694 to the downside. Bitcoin; Continues to weaken. 65,934 is resistance. 62,409 is new support. My bias for today is slightly bullish. Futures are still down and PMI is still to come so that may all change but I think we get a slight rebound from yesterday. Have a great weekend folks. See you all Monday.

0 Comments

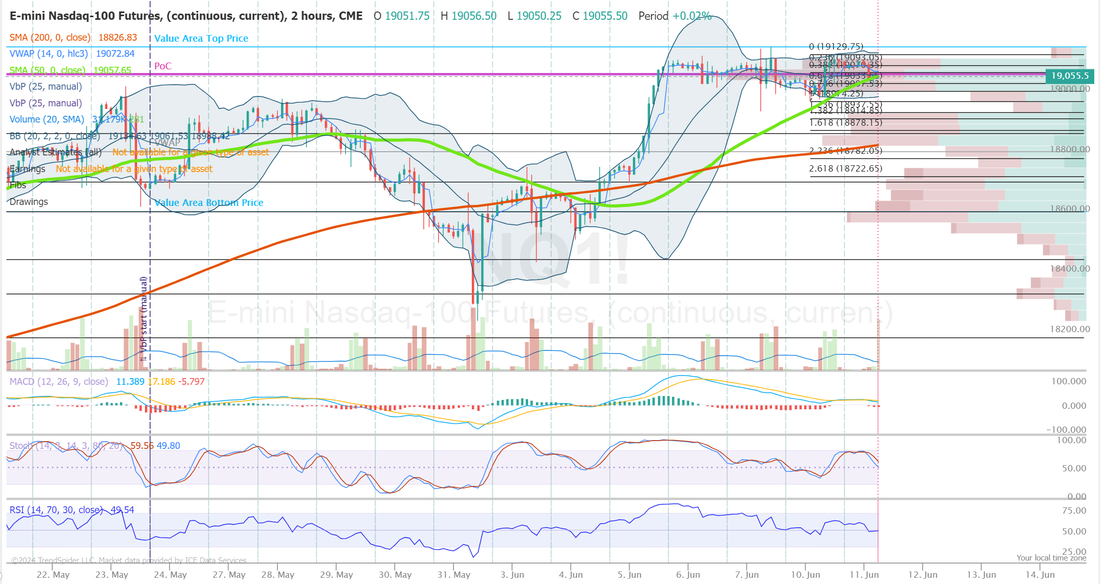

Welcome back traders! I hope everyone had a nice break yesterday. It feels a little strange to have a mid-week break but I got some stuff done so it was useful. Our trading on Tues. went well. Although I continue to lag in my scalping results. Let's take a look at the markets: In Tuesday’s trading session, Wall Street’s main stock indexes closed higher, with the benchmark S&P 500 posting a new all-time high. Nvidia (NVDA) gained over +3% after Rosenblatt Securities raised its price target on the stock to $200 from $140. Also, Micron Technology (MU) advanced more than +3% after Bank of America added the stock to its “U.S. 1 List.” In addition, Silk Road Medical (SILK) surged over +24% after Boston Scientific entered into a definitive agreement to acquire the company for about $1.16 billion, or $27.50 a share. On the bearish side, Lennar Corporation (LEN) slumped about -5% after the homebuilder provided weaker-than-expected Q3 new orders and home deliveries guidance. Economic data on Tuesday showed that U.S. retail sales edged up +0.1% m/m in May, weaker than expectations of +0.3% m/m, while April’s reading of unchanged m/m was revised downward to -0.2% m/m. Also, U.S. May core retail sales unexpectedly fell -0.1% m/m, weaker than expectations of +0.2% m/m. At the same time, U.S. industrial production climbed +0.9% m/m in May, stronger than expectations of +0.3% m/m. In addition, U.S. May manufacturing production advanced +0.9% m/m, stronger than expectations of +0.3% m/m. New York Fed President John Williams stated on Tuesday that the U.S. economy is “moving in the right direction” but stressed that decisions on the timing or extent of policy easing this year would hinge on incoming economic data. Also, Fed Governor Adriana Kugler indicated it would likely be suitable for the central bank to reduce rates “sometime later this year” if economic conditions evolve as she expects. In addition, Dallas Fed President Lorie Logan said, “From a monetary policy perspective, we’re in a good position; we’re in a flexible position to watch the data and be patient. We’re going to need to see several months of that data to really have confidence in our outlook that we’re headed to 2% on inflation.” At the same time, St. Louis Fed President Alberto Musalem said U.S. interest rate cuts could be delayed for some time, indicating it’s more likely to take “quarters” rather than months to see data supporting a reduction. Also, Boston Fed President Susan Collins said, “It is too soon to determine whether inflation is durably on a path back to the 2% target, and this process may just take more time than previously thought.” Finally, Richmond Fed President Thomas Barkin described recent U.S. inflation figures as “very encouraging,” but emphasized the need for continued progress toward the Fed’s 2% goal. Meanwhile, U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next FOMC meeting in July and a 57.9% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies like Accenture (ACN), Kroger (KR), Darden Restaurants (DRI), Jabil (JBL), and Winnebago (WGO) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. Philadelphia Fed manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the June Philadelphia Fed manufacturing index will stand at 4.8, compared to the previous value of 4.5. Also, investors will focus on U.S. Initial Jobless Claims data. Economists estimate this figure to arrive at 235K, compared to last week’s number of 242K. The U.S. Building Permits (preliminary) and Housing Starts data for May will be reported today. Economists forecast Building Permits to be 1.450M and Housing Starts to be 1.370M, compared to the previous numbers of 1.440M and 1.360M, respectively. Technically we are still holding onto the bullish bias. With the SPY and QQQ holding at these ATH's and the DIA and IWM still trying to get back above their respective 50DMA levels. My market bias for today is neutral. Technicals are all bullish but we've been on a very long, seven day, sustained run to the upside in the SPX. We are due for a pause. Trade docket for today: /ZC, KBH, All 0DTE's, NVDA, ORCL, PLTR, SMCI, SPCE, LULU, VTI, SPY/QQQ Intra-day levels for me: /ES; 5513/5518/5528/5532 to the upside. 5501/5491/5482/5473 to the downside. /NQ; 20040/20094/20153/20209 to the upside. 19946/19903/19849/19795 to the downside. Bitcoin; Resistance 67495. Support 64771. Let's have a great day!

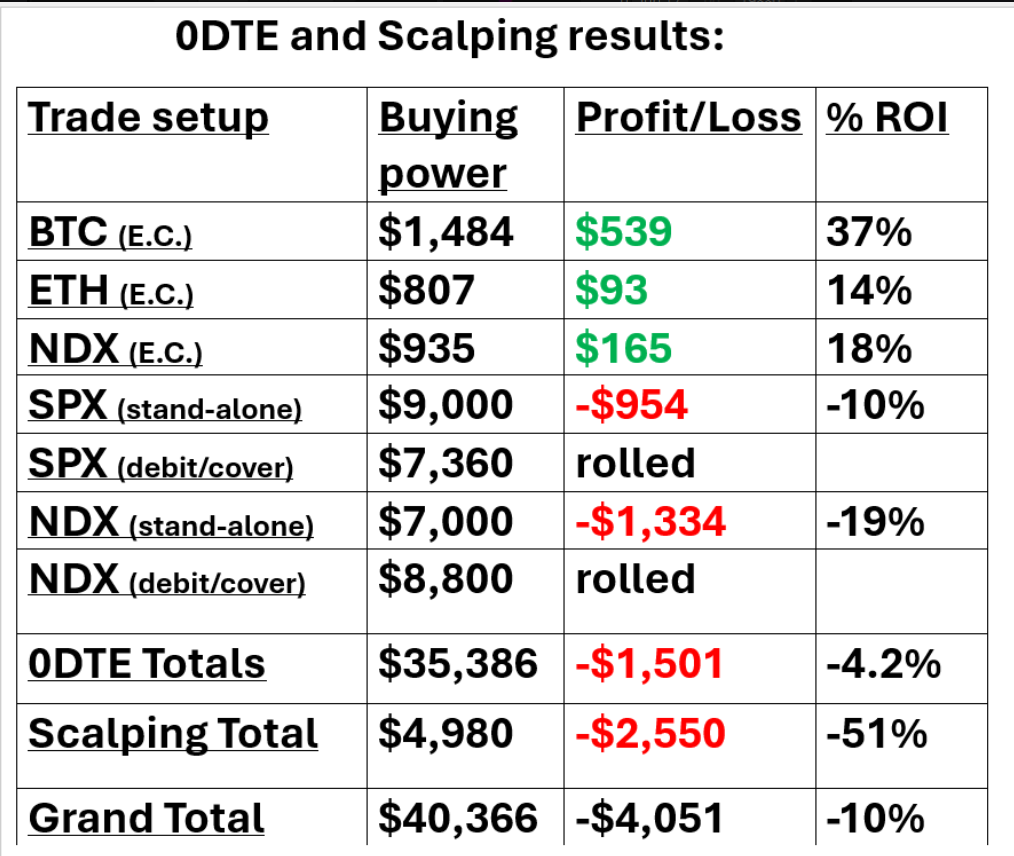

Good morning traders. The market is closed tomorrow so with a shortened week already ahead of us, I didn't get the best of starts yesterday. Let's see if I can get a better result today. My bias lean yesterday of neutral couldn't have been more off. We had a bullish trending day pretty much all day. Pushing the SPY and QQQ to new highs and even the lowly IWM and DIA are trying to push above their 50DMA's. Economic data on Monday showed that the U.S. Empire State manufacturing index rose to a 4-month high of -6.00 in June, stronger than expectations of -12.50. Philadelphia Fed President Patrick Harker said on Monday that he views one interest-rate cut as appropriate for this year according to his current forecast. Harker noted that a recent report showing a cooling of consumer prices in May was “very welcome,” yet emphasized that policymakers require more evidence to be assured that inflation is moving toward the central bank’s 2% goal. “If all of it happens to be as forecasted, I think one rate cut would be appropriate by year’s end,” Harker said. “Indeed, I see two cuts, or none, for this year as quite possible if the data break one way or another. So, again, we will remain data dependent.” Meanwhile, U.S. rate futures have priced in an 8.3% chance of a 25 basis point rate cut at the July FOMC meeting and a 55.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. Today, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that May Retail Sales will stand at +0.3% m/m, compared to the previous number of 0.0% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.2% m/m in April. Economists foresee the May figure to be +0.2% m/m. U.S. Industrial Production data will be reported today. Economists expect May’s figure to be +0.3% m/m, compared to the previous number of 0.0% m/m. U.S. Manufacturing Production data will come in today. Economists forecast this figure to stand at +0.3% m/m in May, compared to the previous figure of -0.3% m/m. U.S. Business Inventories data will be reported today as well. Economists foresee this figure to come in at +0.3% m/m in April, compared to the previous number of -0.1% m/m. In addition, market participants will be looking toward a batch of speeches from Fed officials Barkin, Collins, Logan, Kugler, Musalem, and Goolsbee. The U.S. stock markets will be closed on Wednesday for observance of the Juneteenth National Independence Day federal holiday. Trade docket for today: /MCL?, /ZN, DELL, DIA, DJT, FSLR, 0DTE's, NVDA, ORCL, PLTR SPY/QQQ. My lean today is neutral to slightly bullish : Intra-day levels for me: /ES; 5494/5502/5520/5528 to the upside. 5467/5452/5439/5424 to the downside. /NQ; 19978/20044/20119/20180 to the upside. 19899/19855/19771/19709 to the downside. Bitcoin; Weakness continues with 67504 resistance and 64690 the new support. Let's see if we can get some better results today folks!

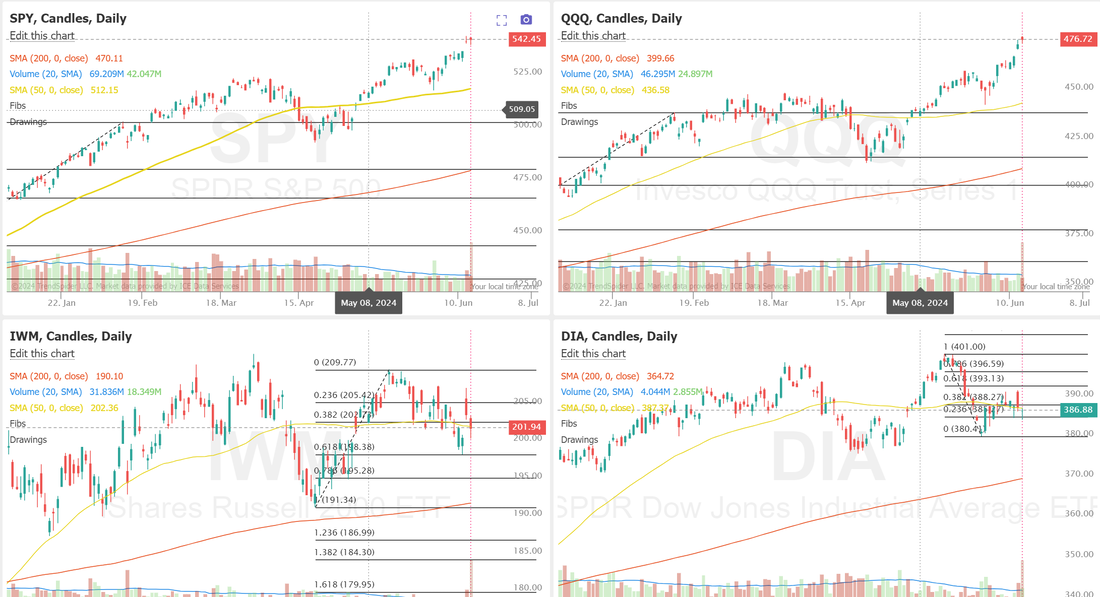

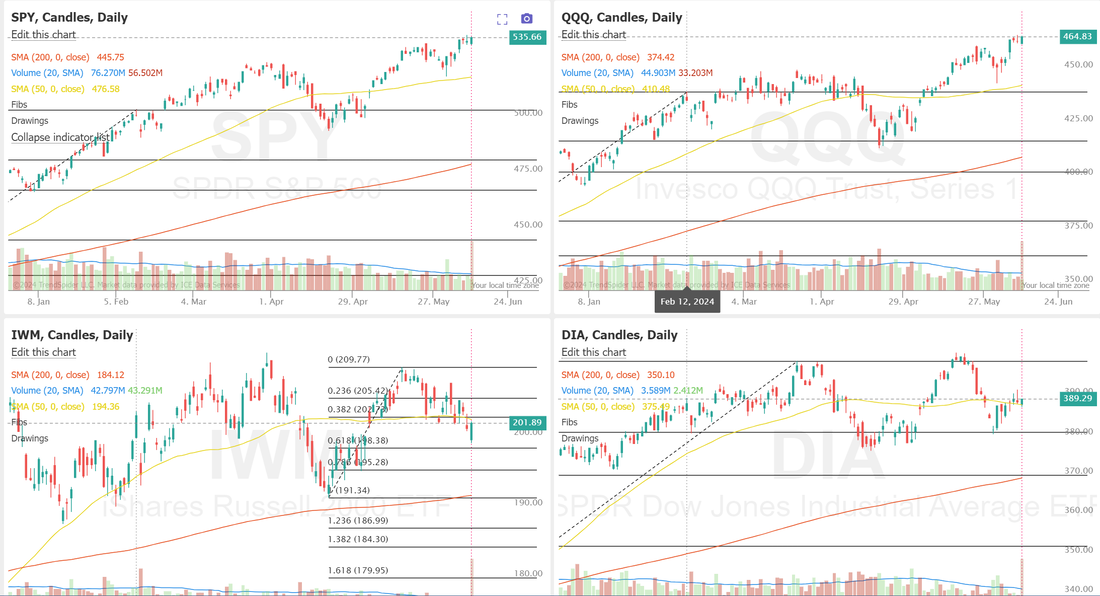

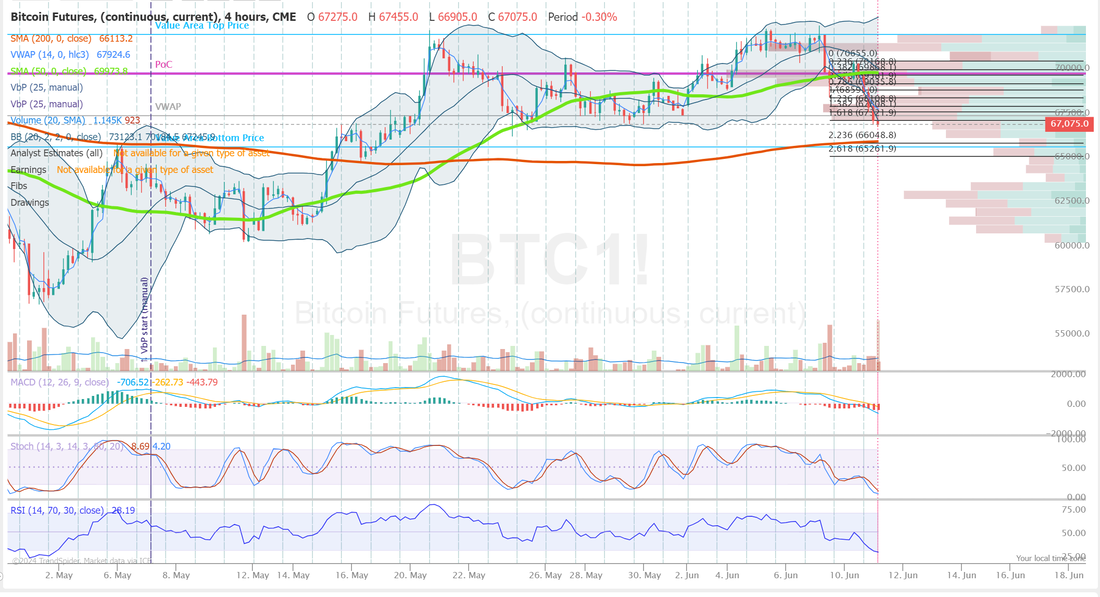

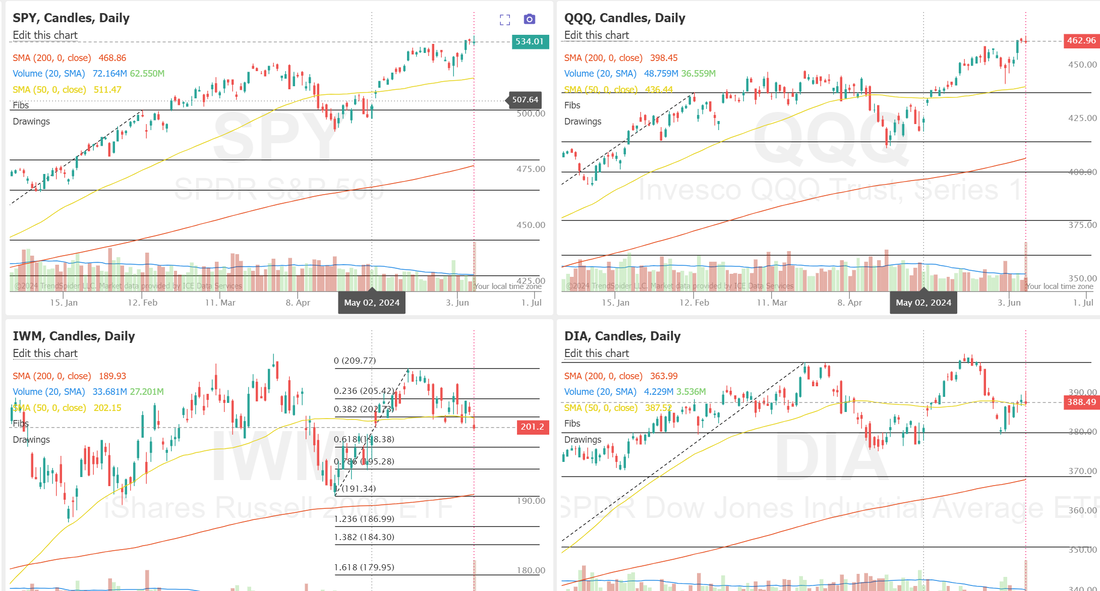

Good morning traders! Welcome back to a shortened trading week with June19th off. We finished off the week strong with solid 0DTE results once again. Let's look at the markets as we start off the trading today: Buy signals are still holding: We start the week with the same divergence as last with the IWM and DIA still down below their 50DMA and the SPY and QQQ sitting near ATH's. After a powerful gap-up on Wednesday, the SPY stayed strong into the weekend, holding the gap and closing at $542.78 (+1.64%). The price now sits right below the 1.618 golden Fibonacci extension from the March highs, a key level to gain for a continuation move in the weeks to come. The QQQ was in a league of its own this week, closing well above the 1.618 golden Fibonacci extension at $479.19 (+3.51%). With AAPL leading the charge off the heels of its blockbuster WWDC event, this index is now showing its highest RSI reading since December 2023. IWM continued their doldrums this week, filling Wednesday’s gap up and closing nearly at the lows of the week at $198.73 (-1.22%). On Friday, the price also failed below the year-to-date anchored VWAP, which means the average buyer in 2024 is now underwater. If previous losses of this level are any indication, we could be stuck below it for a few weeks. Expected moves for the week: Trade docket for today: /ZN, CCL, DELL< DIA, NVDA, PFE, 0DTE's, SPY/QQQ 4DTE Economic data on Friday showed that the University of Michigan’s U.S. consumer sentiment index unexpectedly fell to a 7-month low of 65.6 in June, weaker than expectations of 72.1. Also, the University of Michigan’s June year-ahead inflation expectations were unchanged from May at 3.3%, above expectations of a decline to 3.2%, while 5-year implied inflation expectations rose to a 7-month high of 3.1%, higher than expectations of no change at 3.0%. At the same time, the U.S. import and export price indexes for May unexpectedly fell to -0.4% m/m and -0.6% m/m, respectively. “[Friday’s] softer-than-expected reading puts consumer sentiment at roughly the midpoint of where it has been over the past two years. The growth in prices may be coming down, but prices are not and that is weighing on households, particularly those in the middle most apt to feel the squeeze,” Wells Fargo’s Tim Quinlan said. Cleveland Fed President Loretta Mester stated Friday that she continues to view inflation risks as tilted to the upside despite the latest softer-than-expected inflation figures. The Cleveland Fed chief also said that the median projection of policymakers’ latest forecasts, which indicated only one interest-rate cut this year, aligns closely with her own outlook for the economy. Also, Minneapolis Fed President Neel Kashkari said Sunday that the central bank can take its time and monitor incoming data before initiating interest rate cuts. “We need to see more evidence to convince us that inflation is well on our way back down to 2%,” Kashkari said on CBS’s Face the Nation. U.S. rate futures have priced in an 11.4% chance of a 25 basis point rate cut at the next central bank meeting in July and a 60.0% chance of a 25 basis point rate cut at the September FOMC meeting. In other news, Goldman Sachs strategists raised their year-end target for the S&P 500 index to 5,600 from 5,200 on Friday, citing “milder-than-average negative earnings revisions and a higher fair value P/E multiple.” In the coming week, investors will be monitoring a spate of economic data releases, including U.S. Retail Sales, Core Retail Sales, Industrial Production, Manufacturing Production, Business Inventories, Philadelphia Fed Manufacturing Index, Building Permits (preliminary), Housing Starts, Current Account, Initial Jobless Claims, Crude Oil Inventories, S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Existing Home Sales, and Leading Index. In addition, a slew of Fed officials will be making appearances throughout the week, including Williams, Harker, Cook, Barkin, Logan, Kugler, Kashkari, Daly, and Goolsbee. Meanwhile, the U.S. stock markets will be closed on Wednesday for observance of the Juneteenth National Independence Day federal holiday. My market bias for today is neutral. With the SPY/QQQ sitting at ATH's and the IWM/DIA lagging below their 50DMA we'll need a catalyst of some sort to get more movement. Intra0day levels: /ES; 5444/5449/5459/5466 to the upside. 5432/5426/5416/5407 to the downside. /NQ; 19749/19789/19857/20000 to the upside. 19689/19654/19595/19504 to the downside. Bitcoin: 67213 resistance. 65143 support. Let's have another great week!

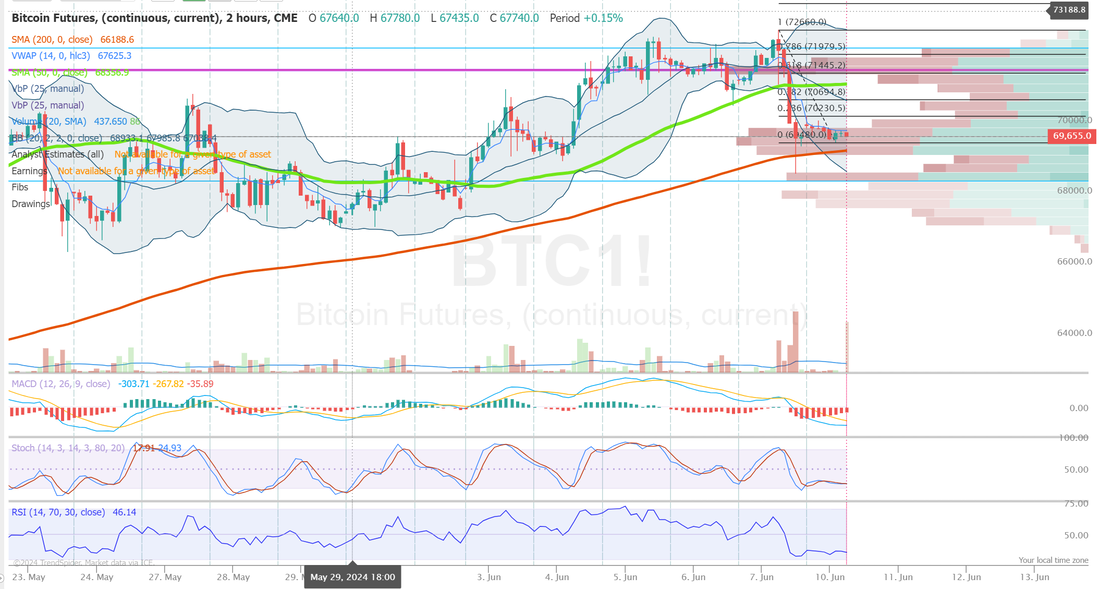

Welcome to Friday folks! Yesterday ended up being just o.k. for me. We had the BTC 0DTE that couldn't have been closer to profits but just missed. That plus a poor scalping result and not getting enough capital into the other 0DTE's hurt my overall result. Still...green in green and not every every is a home run day. The markets are still flashing buy. But, there's a widening cavern bettween the NDX and SPX which are holding at ATH's and the IWM and DIA which are still lagging below their 50DMA. Futures are weak in the pre-market. Our trade docket for today is heavy and a little different from most Fridays where we are normally just de-risking positions and getting buying power in place for next week. We finally have some premium to work with and so it's important to get back to our normal business plan: /MCL, /HG, /ZN, GLD, DIA, ORCL, IWM, CRM, PYPL, SHOP, WYNN, ADBE, RH, BA, DELL, 0DTE's, NVDA, SMCI, XBI, PLTR. My bias today is neutral. We've got bullish technicals with lower futures and the IWM/DIA continue to drag on the SPY/QQQ. Intra-day levels for me: /ES; 5425/5433/5442/5451 to the upside. 5406/5398/5384/5377 to the downside. /NQ; 19620/19655/19693/19783 to the upside. 19525/19469/19420/19352 to the downside. Bitcoin; 69770 resistance/ 66379 support Let's have a good day folks and have a great weekend!

Welcome back traders! Yesterday was an interesting one for sure. My results ended up being just fine but still less than I had hoped for, to be frank. We always look forward to FOMC days when Powell gives testimony. While some traders just take the day off, we love the opportunity the expected volatility brings but yesterdays session was different. We had the added catalyst of CPI numbers and while the market loved the cooling print we got, that pretty much made up the whole days move, with Powell having very little impact. This took away the great scalping opportunity I thought we might get and also didn't allow us to commit as much capital to our 0DTE's as usual. Still a good day. Just below expectations. Markets are back to bullish! This likely means I'll need to stop loss my short VTI swing trade. Not much bearishness here. The big, last remaining bearish warning I can see is the (fairly large) divergence in the market that I noted in yesterdays blog. Today's trade docket is focused on generating some income with Scalping and our 0DTE's (possibly seven) and de-risking a couple other trades as well as creating some more efficent use of BP in our PM NVDA trade.: /HQ, VTI, /MNQ, BA, DIA, FSLR, NVDA, SMCI, 0DTE's. My lean today is bullish. I may or may not cover our bullish SPX debit 0DTE, depending on how much strength we get today. The Labor Department’s report on Wednesday showed consumer prices were unchanged on a monthly basis in May, marking the first flat reading since October 2023. On an annual basis, headline inflation unexpectedly eased to +3.3% in May from +3.4% in April, against expectations of no change at +3.4%. In addition, the core CPI, which excludes volatile food and fuel prices, eased to a 3-year low of +3.4% y/y in May, compared with +3.5% y/y expected and +3.6% y/y in April. Meanwhile, U.S. rate futures have priced in an 8.3% chance of a 25 basis point rate cut at the next central bank meeting in July and a 56.7% chance of a 25 basis point rate cut at the September FOMC meeting. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its Q2 earnings results today. Today, all eyes are focused on the U.S. Producer Price Index in a couple of hours. Economists, on average, forecast that the U.S. May PPI will stand at +0.1% m/m and +2.5% y/y, compared to the previous figures of +0.5% m/m and +2.2% y/y. The U.S. Core PPI will also be closely watched today. Economists expect May’s figures to be +0.3% m/m and +2.4% y/y, compared to the previous numbers of +0.5% m/m and +2.4% y/y. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 225K, compared to last week’s number of 229K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.316%, up +0.54%. Intra-day levels: /ES; 5440/5447/5455/5466 to the upside and 5426/5418/5402/5386 to the downside. /NQ; 19669/19734/19783/20000 to the upside. 19576/19516/19459/19409 to the downside. Bitcoin; Still having trouble gaining traction. 69,225 resistance. 67,100 support. Have a great day today. Thanks to all our members who traded FOMC with me yesterday. It was a fun, interesting day.

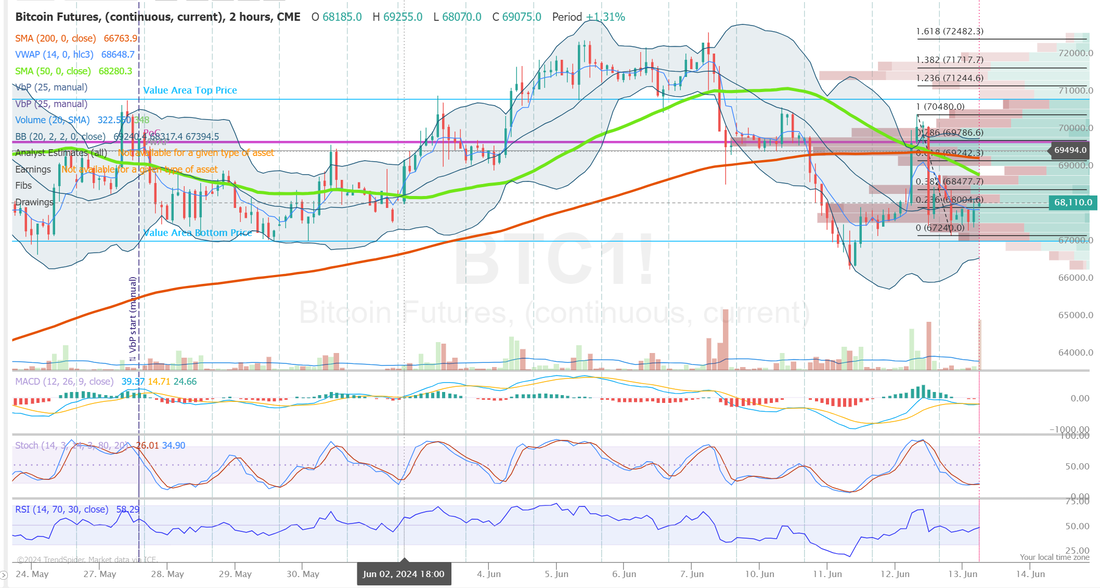

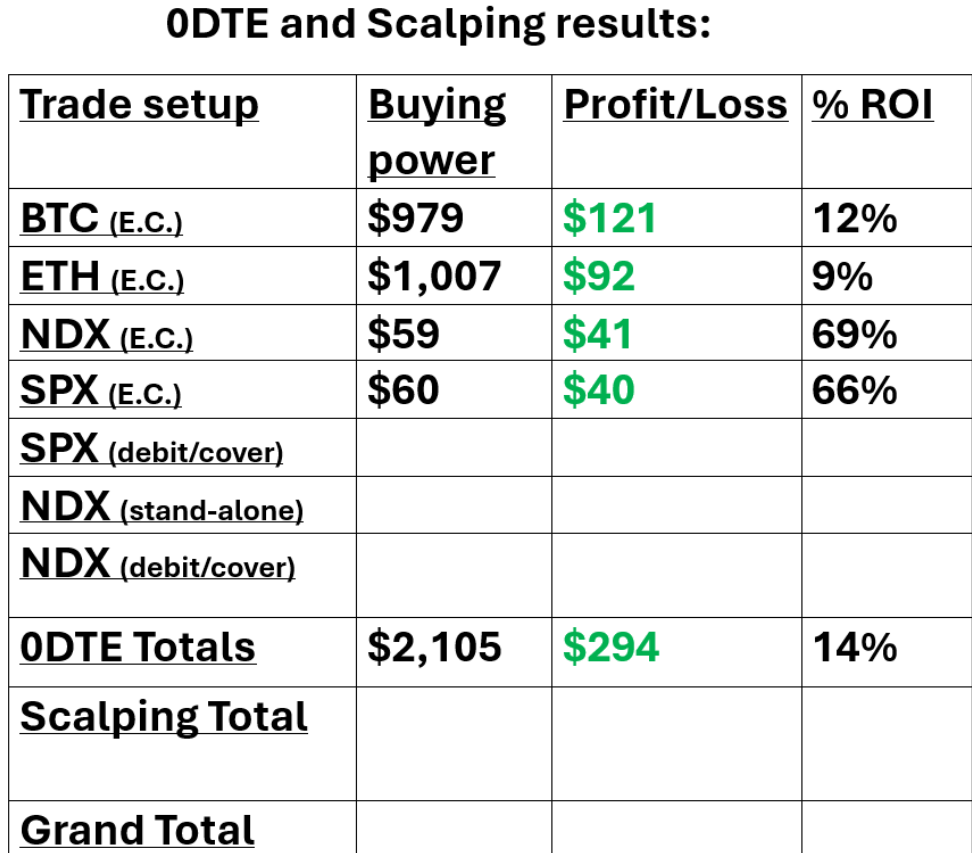

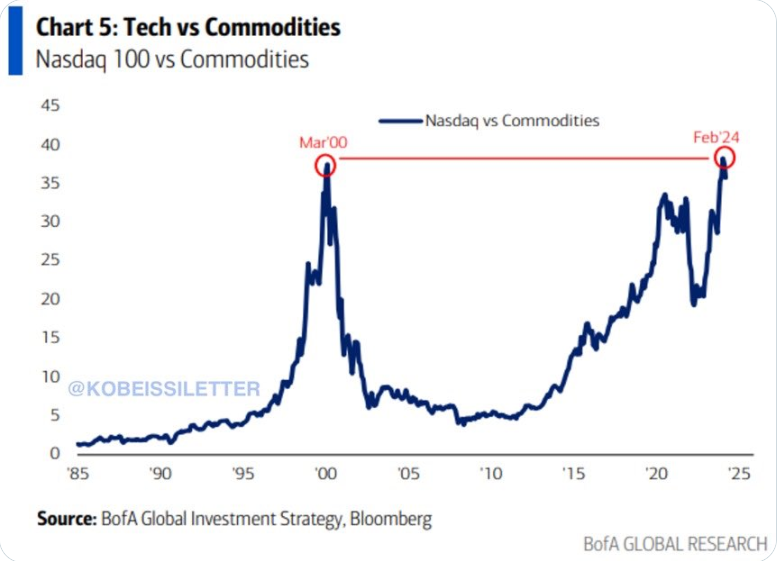

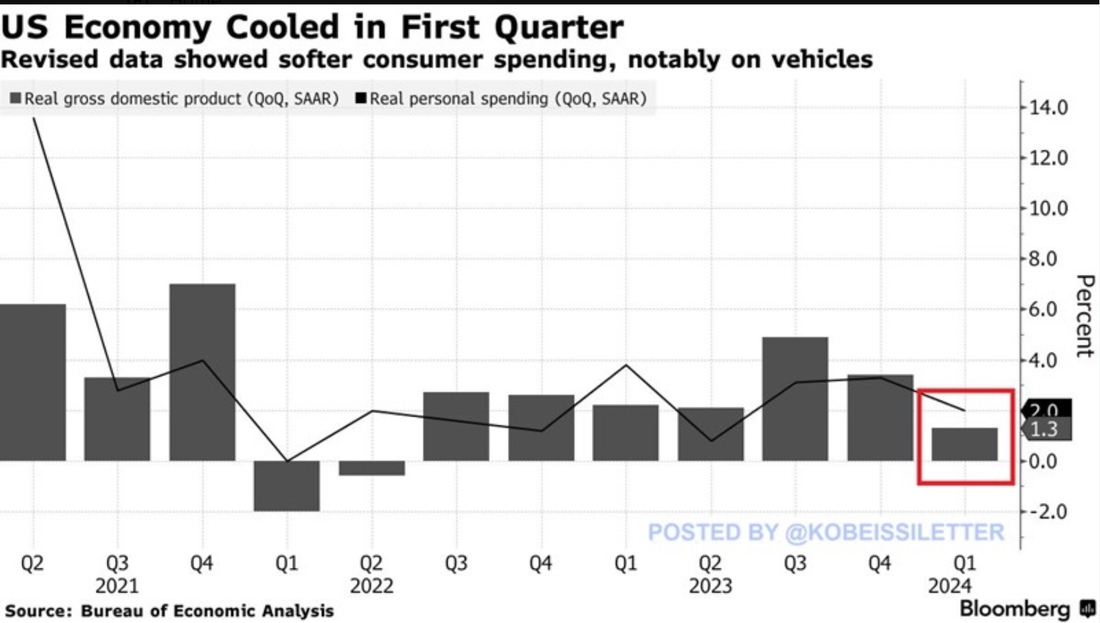

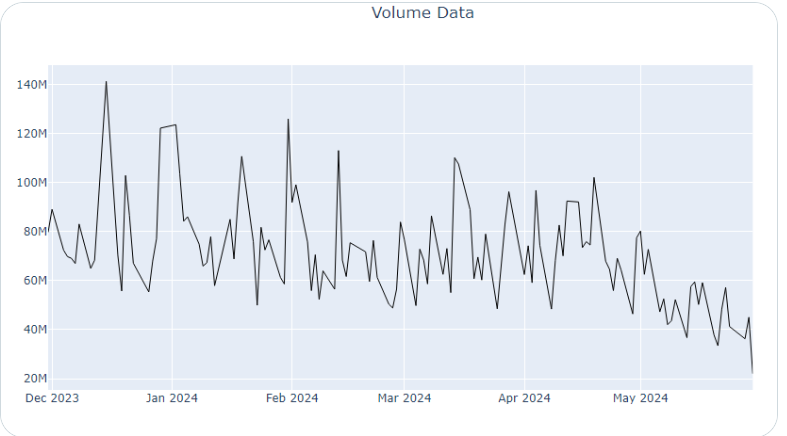

Good CPI/FOMC day my friends! Well, yesterday was either amazing for us, considering our platforms were down most of the day or, it was basically a day off. Just depends on how you look at it. TOS/Schwab was down most of the day and I was having execution issues on Tasty for scalping so this is the sum total of what we did yesterday: We were able to get four 0DTE's working with our Kalshi event contract broker. A 14% ROI and almost $300 profit is better than a poke in the eye with a sharp stick...all things considered. Today however? Well, this should be a different day. No charts. No levels. No lean bias for me today. We have a unique, dual-fold catalyst today with CPI inflation numbers our pre-market and then FOMC and Powell to finish off the day. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. With the Fed widely anticipated to hold borrowing costs at a two-decade high for a seventh straight meeting, the focus will shift to policymakers’ quarterly rate projections, known as the “dot plot,” and Chair Jerome Powell’s post-decision press conference. According to the median estimate in a Bloomberg survey, a 41% plurality of economists anticipate the Fed signaling two cuts in the closely watched “dot plot,” while an equal number expect the forecasts to indicate just one or no cuts at all. “We expect Fed Chair Powell and company to maintain a position that stresses potential rate cuts remain contingent on the committee seeing further progress made on bringing down price pressures,” said Anthony Saglimbene at Ameriprise. U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting and a 48.3% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, California-based semiconductor giant Broadcom (AVGO) is slated to report its Q2 earnings results today. On the economic data front, investors will direct their attention to the U.S. consumer inflation report. Economists, on average, forecast that the U.S. May CPI will come in at +0.1% m/m and +3.4% y/y, compared to the previous numbers of +0.3% m/m and +3.4% y/y. The U.S. Core CPI data will also be closely watched today. Economists anticipate the Core CPI to be +0.3% m/m and +3.5% y/y in May, compared to the previous figures of +0.3% m/m and +3.6% y/y. What will the market do today? It's interesting that while the SPY is hitting new ATH's the internals are weakening. Maybe the ultimate pairs trade is short tech and long commodities? Has stagflation been confirmed? Second reading of US Q1 2024 GDP just fell to 1.3%, below the initially reported growth of 1.6% last month. This is ~60% less than the 3.4% growth seen in Q4 2023. This downward GDP revision primarily reflected slower consumer spending of -2.0%, down from previously reported +2.5% expansion. Meanwhile, the Core PCE Price Index hit 3.6%, up sharply from its 2.0% reading in Q4 2023. A weakening economy with rising inflation is the worst outcome for the Fed. Is the Fed trapped? One thing is for sure. Volume data on SPY has been absolutely horrible! The SPY and QQQ look priced for perfection and the IWM and DIA look like they could roll over and die. Somethings got to give here and today may very well do that day. With no levels or bias today, here's our trade plan and docket: We've cleared out a lot of "closet space" yesterday and have plenty of dry powder to work today. Our approach won't be much different today than it is every FOMC/Powell day. We have the SPX debit 0DTE still working. I'll cover that this morning with a smaller position. We'll also put a very small, very asymmetrical 0DTE on the SPX as a stand alone with the goal of getting an early exit before FOMC. We are also looking to get a Theta fairy on before CPI comes out. Then...we just sit on our hands for most of the day. 20 minutes into Powells testimony we'll start hitting our trades and we have a bunch! All our ladder trades. Bonds/Oil/DIA/GLD. All our credit strangles FSLR, WYNN, ORCL, CRM, PLTR, PYPL, SHOP. Earnings plays on AVGO and PLAY. All seven 0DTE's. Our SPY/QQQ 4DTE's. Its going to be a hectic end of the day. Trade to trade well today my friends. See you all in the live zoom!

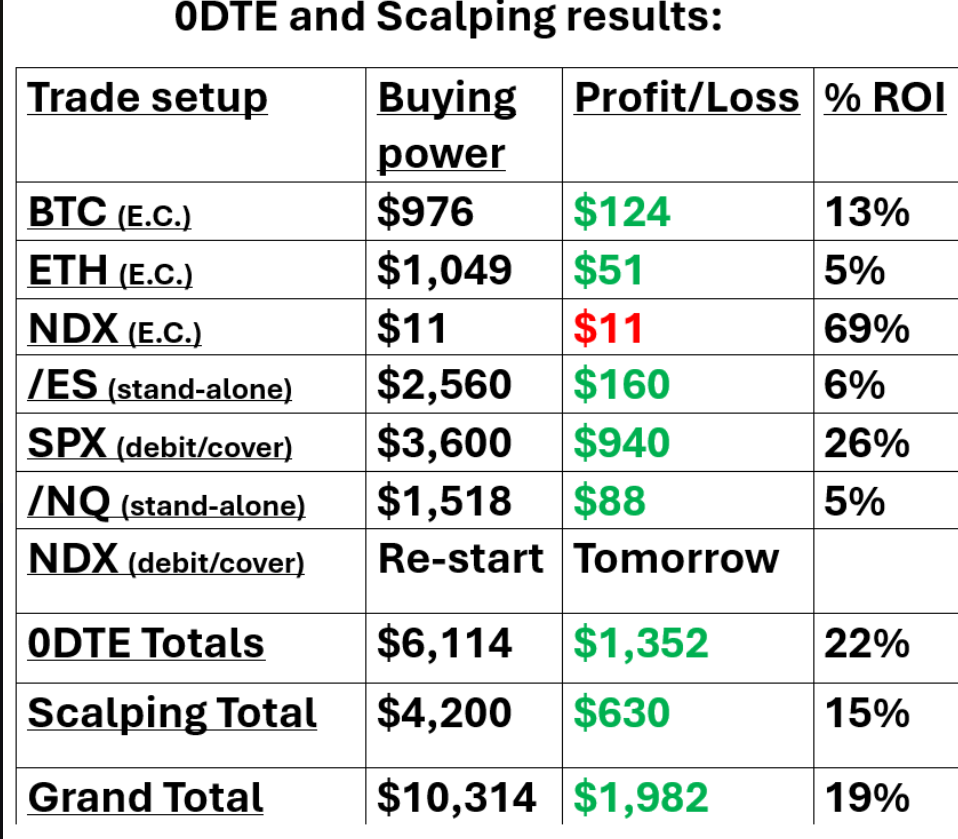

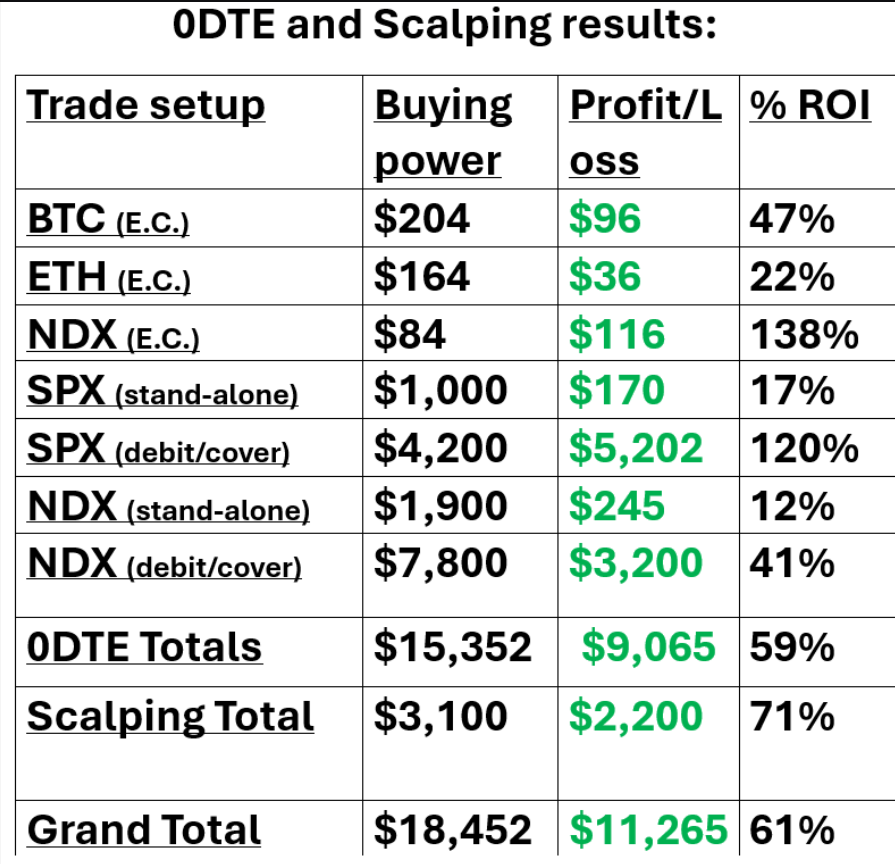

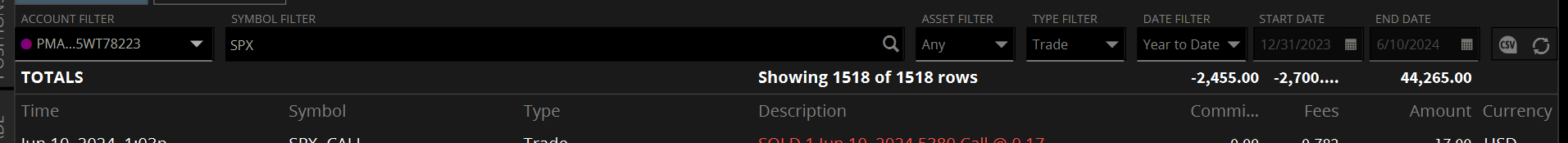

Welcome back folks. What an absolute fantastic, picture perfect day for us yesterday. I can't even express how far ahead of our pro-forma goals we are. This is just fantastic. Here's a quick snap shot of our seven 0DTE's and scalping from yesterday: That outsized gain on our SPX debit setup has been building since last Thursday , with two rolls but finally realized and booked the proift yesterday. We've talked about the potential for us to make as much as $500,000 dollars profit this year from all seven of our daily possible 0DTE setups and our now daily effort with scalping. It seems almost fantastical and well, a pipe dream, to be honest, but guess what? That pretty close to what we are on pace for. If our numbers hold through the first six months of this year we will be very close to $200,000 documeted profits on our 0DTE's. Our four standard SPX/NDX setups are close to $170,000 pure profit now and our three Event contract 0DTE's have added another approx. $6,000 of profit. With some good fortune, we could finish the month off very close that that $200,000 goal. Our scalping is continuing to produce results above expectations. Moving to five days a week we've reset our income target to $100,000 for a 12 month period vs. the $50,000 target we had with just two days a week effort. I know there are some amazing traders out there but I have to believe that these results put us up against the very best of the best. I'm extremely proud of what we've accomplished and I'm always thrilled when our members express how grateful they are to have found us. This is a special community of solid people. I appreciate all of you who contribute to the programs success. If you would like a free peek at how we are achieving this come hang out for a week at no -charge and see what we do. If you're just interested in scalping and don't want to trade full time and are happy with the potential for an extra $100,000 a year in income go here: Lets take a look at the markets: Markets continue to stall here. Most likely awaiting the dual catalyst of CPI/FOMC Weds. Futures are down as we speak The Federal Reserve kicks off its two-day meeting later in the day, with investors widely anticipating the U.S. central bank to hold borrowing costs steady on Wednesday for the seventh consecutive gathering. Investor attention will center on the Fed’s new “dot plot” in its Summary of Economic Projections, which displays Federal Open Market Committee member projections regarding the trajectory of interest rates. Market participants will also pay close attention to Fed Chair Jerome Powell’s post-decision press conference for hints about when the Fed might cut interest rates. Meanwhile, a 41% plurality of economists anticipate the Fed signaling two cuts in the closely watched “dot plot,” while an equal number expect the forecasts to indicate just one or no cuts at all, according to the median estimate in a Bloomberg survey. Investor focus also rests on the May reading of the U.S. Consumer Price Index, set for release on Wednesday, which is expected to show that headline inflation remained steady from April at +3.4% y/y. At the same time, U.S. May underlying inflation is expected to ease slightly to +3.5% y/y from +3.6% y/y in April. “The interest-rate guessing game goes on,” said Chris Larkin at E*Trade from Morgan Stanley. “Even the friendliest inflation numbers probably won’t push the Fed to act any sooner than September.” U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 50.0% chance of a 25 basis point rate cut at the September meeting. On the earnings front, Texas-based software giant Oracle (ORCL) is scheduled to report its Q4 earnings results today. The U.S. economic data slate is mainly empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.433%, down -0.85%. Our trade docket for today is stlll light until we get past Powells testimony. /HG, DELL, DIS, DJT, FSLR, all 7 0DTE's, SMCI, ORCL, GME. My bias today is bearish, once again. Until we get past Powells testimony on Weds. there isn't much insentive for bulls to stick there necks out. Intra-day levels for me: /ES; 5365/5373/5383/5398 to the upside. 5352/5344/5332/5325 to the downside. /NQ; 19090/19132/19155/19226 to the upside. 19033/18975/18934/18876 to the downside. Bitcoin; Bitcoin got hammered overnight. 69768 is resistance and 66073 is now new support. Be safe out there today folks and save up some buying power for Weds. It should be a doozy.

Welcome back traders. I hope you all had a great weekend. We had a nice finish to our week with Fridays results. It seems like a stretch, and everything would need to stay on track with no big drawdowns but... we are on track for almost $400,000 of income this year annualized out on our scalping/0DTE's. To say I'm thrilled with our results is an understatement. We've got a potential big payoff awaiting us today in our SPX rolled cover. It could be a nice start to the week. Lets take a look at the markets and price action; Firstly, some key items to watch. Roaring Kitty, the GME trader is back! If you haven't been following this saga and GME's price swings you owe it to yourself. This is better than an action flick and you don't have to pay to watch. I'm sitting on the sidelines for now but we've had great success shorting GME and AMC for that matter on these big pops to the upside. NVDA's 10 for 1 split is active today. While a split has no actual effect on a stocks fundamentals it should help us tremendously to continue our slow march to the exits on this trade. It will be much easier to reduce buying power now. Our trade continues to look good but it also continues to get pushed out in time....someday. Thursday we get the big vote result on Elon's pay package at TESLA. This could be a market mover for the stock. Of Course, we also have a potential monster of a day coming Weds. with BOTH CPI and FOMC in the same day! We may have a shot at some more Theta fairy setups this week. After several days retesting the March highs, the SPY managed to find its footing and push higher, closing the week at $534.01 (+1.26%). Additionally, MACD is back in positive territory, turning up and showing the beginnings of a bullish cross. Much like the SPY, the QQQ found clear support at the March highs and rallied to make new all-time highs on Friday and close the week at $462.96 (+2.72%). Additionally, a clear bullish cross up is visualized on MACD, a sign that this move could just be getting started. The doldrums returned for the small caps, which closed at $201.20 (-2.47%) this week after failing to push out of the handle. Despite last week’s relative strength, IWM has struggled since the bearish MACD cross in late May. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls climbed by 272K jobs last month, well above the 182K consensus. At the same time, the U.S. May unemployment rate unexpectedly rose to 4.0%, weaker than expectations of no change at 3.9%. Also, U.S. average hourly earnings came in at +0.4% m/m and +4.1% y/y in May, stronger than expectations of +0.3% m/m and +3.9% y/y. Finally, U.S. April consumer credit rose +$6.40B, weaker than expectations of +$9.30B. “[Friday’s] jobs report may lower rate-cut expectations,” said Bret Kenwell at eToro. “But at the end of the day, a strong labor market is hardly a bad thing - especially for an economy that’s so dependent on consumer spending.” The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Reserve is anticipated to hold interest rates steady for the seventh straight meeting on Wednesday, shifting investor focus to the central bank’s quarterly “dot plot” in its Summary of Economic Projections, which displays Federal Open Market Committee member projections regarding the trajectory of interest rates. The updated “dot plot” is likely to indicate two 25-basis point cuts this year, down from three cuts projected in March. Meanwhile, U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the July FOMC meeting and a 43.4% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the economic data front, the U.S. consumer inflation report for May will be the main highlight. Also, market participants will be monitoring other economic data releases this week, including the U.S. Core CPI, PPI, Core PPI, Crude Oil Inventories, Initial Jobless Claims, Export Price Index, Import Price Index, and Michigan Consumer Sentiment Index (preliminary). On the earnings front, major companies like Adobe (ADBE), Oracle (ORCL), and Broadcom (AVGO) are set to report their quarterly figures this week. In addition, several Fed officials will be making appearances this week, including Williams, Goolsbee, and Cook. The U.S. economic data slate is mainly empty on Monday. I.V. for this week is MUCH better than last week, thanks to CPI and FOMC. I'll go over out trade docket today in our live zoom feed. It's hard to say what we can do today until we get a market open because our buying power is artifically inflated right now with the NVDA split. Once that balances out we'll know how much BP we have to work with. My bias to start off the week is bearish. I think the current FED trend of continuing to push of rate cuts continues this week. The divergence in the major indices we trade continues with the SPY and QQQ holding near highs and the IWM and DOW still stuck under their 50DMA. Intra-day levels for me: /ES; 5366/5375/5386/5396 to the upside. 5349/5338/5318/5303 to the downside. /NQ; 19043/19086/19115/19155 to the upside. 18973/18939/18863/18843 to the downside. Bitcoin: We continue to trade in a very tight range. Look for a break out soon. Resistance is 72,660. Support is 68,406. Have a great day folks. See you in the trading room shortly.

Welcome back to Friday! We had a picture perfect day yesterday. It's rare but everyone once in a while everything clicks at the same time. A: We got all seven of our possible 0DTE's working. B: They all hit for a profit. C: They all went out at max. gains. In addition to our 0DTE's we had an above avg. result with our scalping. Sentiment A global equity rally faltered ahead of key US jobs data, which could cement bets on when the Federal Reserve will begin to ease monetary policy. While traders were wary of placing large bets this morning, global stocks are poised to end a two-week losing streak. Rate-cut expectations have risen in the last week, boosted by a slew of weaker-than-expected US data, as well as easing by the Bank of Canada and the European Central Bank. Docket 08:30 ET US Employment Situation for May Nonfarm Payrolls – Median Forecast: 185k | Prior: 175k | Range: 258k / 120k Unemployment Rate – Median Forecast: 3.9% | Prior: 3.9% | Range: 4% / 3.8% Average Earning YoY – Median Forecast: 3.9% | Prior: 3.9% | Range: 4% / 3.8% Trade docket for today: 0DTE's, Scalping, , DOCU. My software is down this morning so no chart action to share. This will be short and sweet. Our goal today is to de-risk and get capital back for next Monday.

I hope you all have a good weekend. |

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |