|

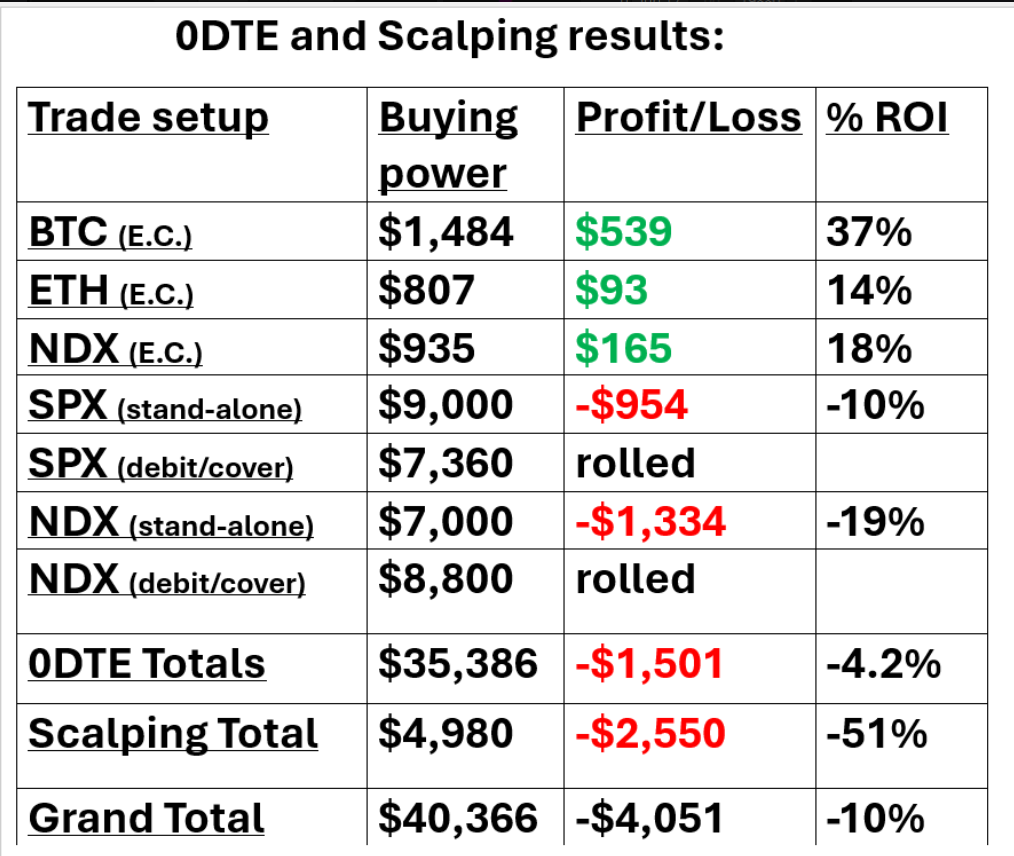

Good morning traders. The market is closed tomorrow so with a shortened week already ahead of us, I didn't get the best of starts yesterday. Let's see if I can get a better result today. My bias lean yesterday of neutral couldn't have been more off. We had a bullish trending day pretty much all day. Pushing the SPY and QQQ to new highs and even the lowly IWM and DIA are trying to push above their 50DMA's. Economic data on Monday showed that the U.S. Empire State manufacturing index rose to a 4-month high of -6.00 in June, stronger than expectations of -12.50. Philadelphia Fed President Patrick Harker said on Monday that he views one interest-rate cut as appropriate for this year according to his current forecast. Harker noted that a recent report showing a cooling of consumer prices in May was “very welcome,” yet emphasized that policymakers require more evidence to be assured that inflation is moving toward the central bank’s 2% goal. “If all of it happens to be as forecasted, I think one rate cut would be appropriate by year’s end,” Harker said. “Indeed, I see two cuts, or none, for this year as quite possible if the data break one way or another. So, again, we will remain data dependent.” Meanwhile, U.S. rate futures have priced in an 8.3% chance of a 25 basis point rate cut at the July FOMC meeting and a 55.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. Today, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that May Retail Sales will stand at +0.3% m/m, compared to the previous number of 0.0% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.2% m/m in April. Economists foresee the May figure to be +0.2% m/m. U.S. Industrial Production data will be reported today. Economists expect May’s figure to be +0.3% m/m, compared to the previous number of 0.0% m/m. U.S. Manufacturing Production data will come in today. Economists forecast this figure to stand at +0.3% m/m in May, compared to the previous figure of -0.3% m/m. U.S. Business Inventories data will be reported today as well. Economists foresee this figure to come in at +0.3% m/m in April, compared to the previous number of -0.1% m/m. In addition, market participants will be looking toward a batch of speeches from Fed officials Barkin, Collins, Logan, Kugler, Musalem, and Goolsbee. The U.S. stock markets will be closed on Wednesday for observance of the Juneteenth National Independence Day federal holiday. Trade docket for today: /MCL?, /ZN, DELL, DIA, DJT, FSLR, 0DTE's, NVDA, ORCL, PLTR SPY/QQQ. My lean today is neutral to slightly bullish : Intra-day levels for me: /ES; 5494/5502/5520/5528 to the upside. 5467/5452/5439/5424 to the downside. /NQ; 19978/20044/20119/20180 to the upside. 19899/19855/19771/19709 to the downside. Bitcoin; Weakness continues with 67504 resistance and 64690 the new support. Let's see if we can get some better results today folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |