|

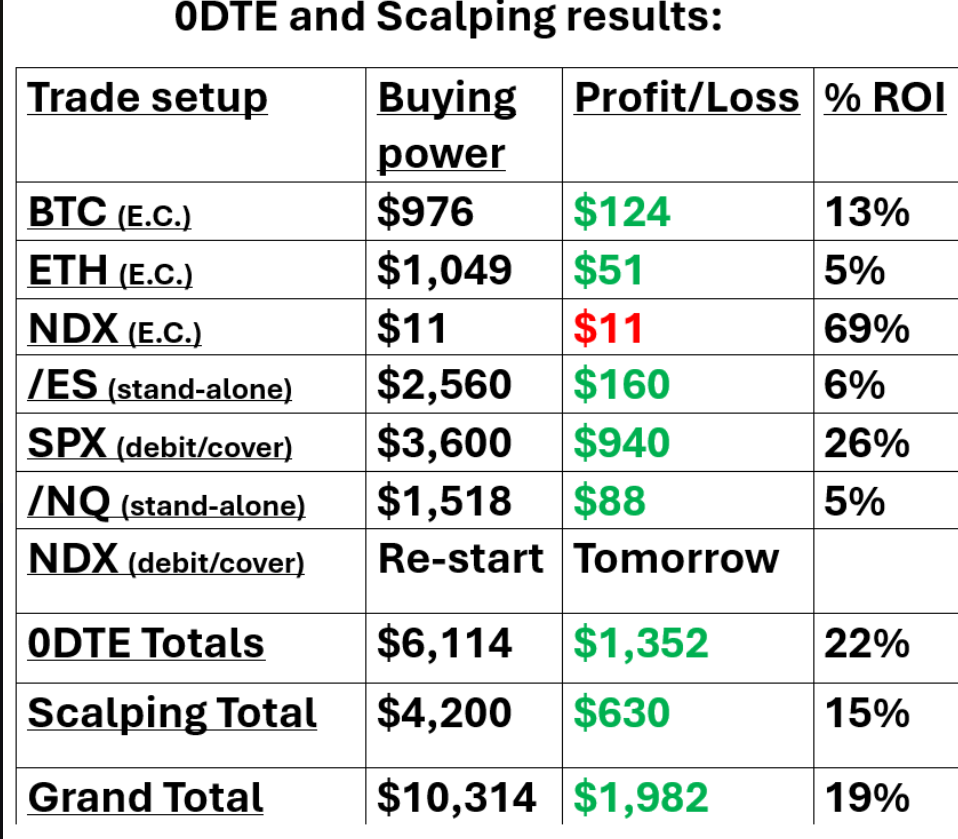

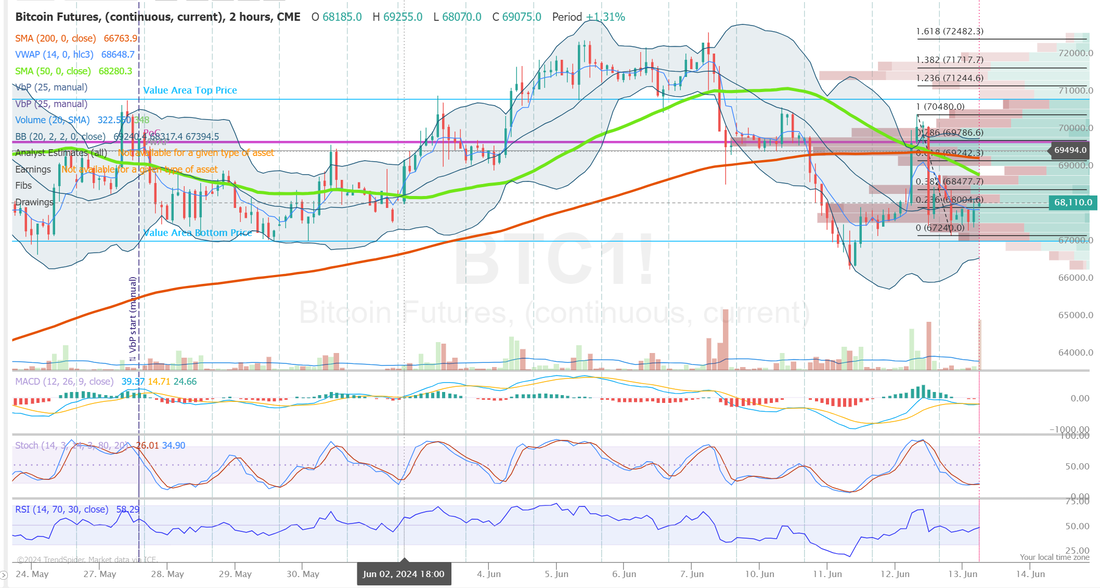

Welcome back traders! Yesterday was an interesting one for sure. My results ended up being just fine but still less than I had hoped for, to be frank. We always look forward to FOMC days when Powell gives testimony. While some traders just take the day off, we love the opportunity the expected volatility brings but yesterdays session was different. We had the added catalyst of CPI numbers and while the market loved the cooling print we got, that pretty much made up the whole days move, with Powell having very little impact. This took away the great scalping opportunity I thought we might get and also didn't allow us to commit as much capital to our 0DTE's as usual. Still a good day. Just below expectations. Markets are back to bullish! This likely means I'll need to stop loss my short VTI swing trade. Not much bearishness here. The big, last remaining bearish warning I can see is the (fairly large) divergence in the market that I noted in yesterdays blog. Today's trade docket is focused on generating some income with Scalping and our 0DTE's (possibly seven) and de-risking a couple other trades as well as creating some more efficent use of BP in our PM NVDA trade.: /HQ, VTI, /MNQ, BA, DIA, FSLR, NVDA, SMCI, 0DTE's. My lean today is bullish. I may or may not cover our bullish SPX debit 0DTE, depending on how much strength we get today. The Labor Department’s report on Wednesday showed consumer prices were unchanged on a monthly basis in May, marking the first flat reading since October 2023. On an annual basis, headline inflation unexpectedly eased to +3.3% in May from +3.4% in April, against expectations of no change at +3.4%. In addition, the core CPI, which excludes volatile food and fuel prices, eased to a 3-year low of +3.4% y/y in May, compared with +3.5% y/y expected and +3.6% y/y in April. Meanwhile, U.S. rate futures have priced in an 8.3% chance of a 25 basis point rate cut at the next central bank meeting in July and a 56.7% chance of a 25 basis point rate cut at the September FOMC meeting. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its Q2 earnings results today. Today, all eyes are focused on the U.S. Producer Price Index in a couple of hours. Economists, on average, forecast that the U.S. May PPI will stand at +0.1% m/m and +2.5% y/y, compared to the previous figures of +0.5% m/m and +2.2% y/y. The U.S. Core PPI will also be closely watched today. Economists expect May’s figures to be +0.3% m/m and +2.4% y/y, compared to the previous numbers of +0.5% m/m and +2.4% y/y. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 225K, compared to last week’s number of 229K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.316%, up +0.54%. Intra-day levels: /ES; 5440/5447/5455/5466 to the upside and 5426/5418/5402/5386 to the downside. /NQ; 19669/19734/19783/20000 to the upside. 19576/19516/19459/19409 to the downside. Bitcoin; Still having trouble gaining traction. 69,225 resistance. 67,100 support. Have a great day today. Thanks to all our members who traded FOMC with me yesterday. It was a fun, interesting day.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |