|

Welcome back traders! We had a solid day yesterday. Premiums are still in the basement and our debit set ups look less appealing with our 0DTE's but we still managed to get a nicely profitable day. Yesterday was more of the same. Strength in the SPX and NDX (hitting new ATH's) and weakness in IWM and DIA. The total market index EFT, VTI seems overstretched and stalling. More interesting to me continues to be the divergence between the SPY and RSP. This wide of a divergence can't last forever. They will eventually converge. Whether that means SPY pulling RSP up or RSP pulling SPY down. It's usually the later. Our trade docket for today: /MCL, DELL, NVDA, 0DTE's, Scalping. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 posting new record highs. Corning (GLW) surged about +12% and was the top percentage gainer on the S&P 500 after the glass and advanced optics maker raised its Q2 core sales guidance. Also, chip stocks gained ground, with Intel (INTC) climbing over +6% to lead gainers in the Dow and Nasdaq 100 and Advanced Micro Devices (AMD) rising nearly +4%. In addition, Morphic Holding (MORF) soared more than +75% after Eli Lilly agreed to buy the U.S. gut drug maker in a deal valued at $3.2 billion. On the bearish side, Nike (NKE) fell over -3% and was the top percentage loser on the Dow following Jim Cramer’s remarks that the company’s latest conference call was a “call of despair” and that he “can’t find anything going right for the company.” Economic data on Monday showed that U.S. consumer credit increased by +$11.35B in May, stronger than expectations of +$10.70B and the largest increase in 4 months. Meanwhile, Oppenheimer’s John Stoltzfus, chief investment strategist in the firm’s asset-management business, increased his year-end target for the S&P 500 to 5,900 from 5,500 on Monday, citing a strong earnings outlook and a resilient economy that could support even higher valuations. “S&P 500 earnings results over the most recent reporting seasons and economic data that has provided evidence of resilience remain at the core of our bullish outlook for stocks,” Stoltzfus noted. Today, market participants will closely monitor Fed Chair Jerome Powell’s semi-annual monetary policy testimony before the Senate Banking Committee. Powell faces pressure from lawmakers increasingly eager for interest rate cuts and others dissatisfied with the central bank’s recent plan to raise capital requirements for Wall Street lenders. Also, investors will likely focus on speeches from Fed Vice Chair for Supervision Michael Barr and Fed Governor Michelle Bowman, due later in the day. Aside from Powell’s testimony, the U.S. consumer inflation report for June, scheduled for release on Thursday, will be a highlight. Market participants anticipate the latest report to show annual headline inflation easing to 3.1% in June from 3.3% in May. “While the CPI release will be key, we will be looking for signs from Powell that the Fed is edging closer to a decision to cash in its chips and move in September provided ongoing inflation news broadly confirms that the run-rate has stepped back down,” said Krishna Guha at Evercore. U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 73.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. Second-quarter corporate earnings season begins in earnest on Friday, with major banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) set to report their quarterly figures. According to data compiled by Bloomberg, expectations for 12-month forward earnings are at an all-time high. The U.S. economic data slate is largely empty on Tuesday. My bias today is more neutral. Intra-day levels for me: /ES; 5640 is THE key resistance level for me. We have been banging our head on that all night long. If we can break above that (we are close) then we set a new ATH and the bulls continue to run. It's a big and important level. 5633 is first support and 5625 is big. Below that we may have some downside. /NQ; We have the same setup happening here. 20,745 is resistance. We are close. If we break above and hold thats a new ATH and the bulls continue to run. Support is 20,662 with 20,605 the next level down. Below that we may have some room to retrace. Bitcoin: BTC is actually holding its own considering the mass liquidations by Mt. Gox and now the German government dumping $900 million dollars worth or crypto yesterday. Bitcoin has been under tremendous selling pressure the last few weeks. 58,985 and 60,135 are resistance. 55891 and 54823 are support. Let's have another good day out there folks. Remember, you don't need to swing for the fences or hit home runs. If we can make $1,000 dollars today that's a tremendous victory.

0 Comments

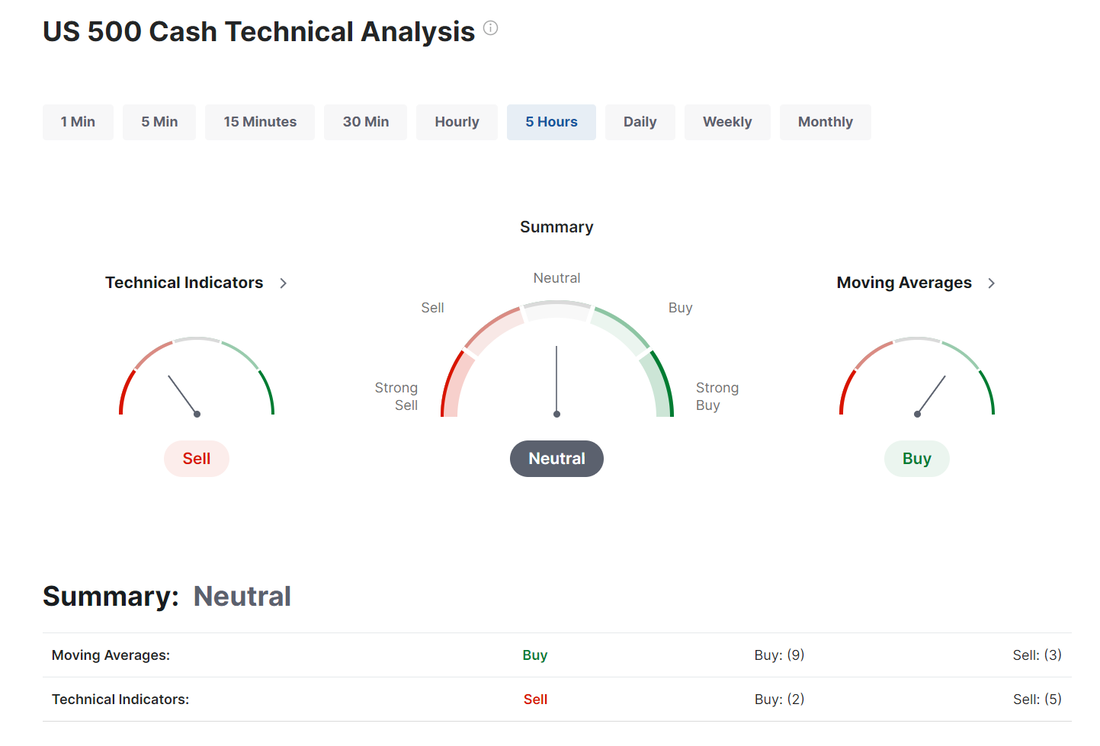

Good morning traders! Welcome back to a full week of trading action. I hope everyone had a nice 4th and a great weekend. It's time to get back to the action. Markets are still flashing buy. I took a bearish stance on both Weds. and Fri. and I was wrong! Technicals continue to point up. We cleared some pretty important resistance zones on the SPY and QQQ Friday. The IWM and DIA continue to languish. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose by 206K jobs last month, surpassing the 191K consensus but at a slower pace than the 218K recorded in May, which was revised down from 272K. Also, the U.S. June unemployment rate unexpectedly rose to a 2-1/2 year high of 4.1%, weaker than expectations of no change at 4.0%. In addition, U.S. average hourly earnings came in at +0.3% m/m and +3.9% y/y in June, in line with expectations. “Get on with it. [Friday’s] employment report ought to firm up expectations of a September rate cut. Economic conditions are cooling and that makes the trade-offs different for the Fed,” said Neil Dutta at Renaissance Macro Research. Meanwhile, New York Fed President John Williams said Friday that although inflation has recently moderated toward the central bank’s 2% target, policymakers are still some way off from reaching their goal. “Inflation is now around 2-1/2%, so we have seen significant progress in bringing it down. But we still have a way to go to reach our 2% target on a sustained basis,” Williams said. “We are committed to getting the job done.” U.S. rate futures have priced in a 6.7% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month and a 69.0% probability of a 25 basis point rate cut at the September FOMC meeting. Second-quarter earnings season kicks off this week, with big banks such as JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) set to release their earnings reports on Friday. PepsiCo (PEP) and Delta Air Lines (DAL) are among other major names scheduled to deliver quarterly updates during the week. On the economic data front, the U.S. consumer inflation report for June will be the main highlight. Also, market participants will be monitoring other economic data releases this week, including the U.S. Core CPI, PPI, Core PPI, Crude Oil Inventories, Wholesale Inventories, Initial Jobless Claims, and Michigan Consumer Sentiment Index (preliminary). In addition, investors will focus on Fed Chair Jerome Powell’s semi-annual monetary policy testimony on Capitol Hill. Mr. Powell will testify before the Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday. Powell is expected to tell lawmakers that Fed officials need more evidence of slowing inflation before considering interest rate cuts, despite mounting evidence of softer growth and employment. Fed Vice Chair for Supervision Michael S. Barr, Fed Governor Michelle Bowman, Chicago Fed President Austan Goolsbee, Fed Governor Lisa Cook, and Atlanta Fed President Raphael Bostic are also scheduled to speak this week. Today, investors will likely focus on U.S. Consumer Credit data. Economists, on average, forecast that May Consumer Credit will stand at $10.70B, compared to the previous value of $6.40B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.310%, up +0.86%. Let's take a look at the expected moves for this week in the SPY/QQQ. Not much difference than last week. We continue to be about 20%-30% lower on I.V. than we would like. The 1 day VIX reading continues to sit in the basement. This likely means more debit trades for us this week. My lean is bullish today. Its hard to be anything but with the substantive resistance levels that were broken on Friday. Our trade docket for today. /MNQ?, /ZC, /ZN, /MCL, DELL?, DIA, FSLR, NVDA, ORCL, CCL?, WYNN, ODTE's, SPY/QQQ 4DTE, Scalping The fear and greed index is also close to neutral. No clear reading here. One quick note for the upcoming trading sessions. This Thursday, after the close we're headed up to our cabin at East Canyon until Monday evening. I'll be trading with you in the live trading room on Friday and Monday but no zooms as the connection is weak there. Also no scalping for me on those two days. Intra-day levels for me: /ES; I have two key support/resistance levels today. 5627 is the first important resistance level. The next is 5631. If both those clear and hold its more bullishness (IMHO). Likewise, 5616 and 5610 to the downside. If we can retrace back below those two levels and hold then we might get a setup for some downside action. /NQ; Same situation for the Nasdaq. 20637 and 20689 are the next resistance levels. If we can break above those the bullishness should continue. Below 20579 and 20537 we could get a retrace. Bitcoin; Mt. Gox payments are set to start getting disbursed. This means a lot of potential liquidation is coming. I do think after this we start to see a bottom. Heavens knows BTC has been beat up a lot lately. 54,592 is the current key support level. We've formed a double bottom there. 58519 is current resistance. One last push on my bearish concerns.

Market internals continue to break down while the index itself continues to charge higher. This never lasts. At some point the overall internals will rise which could trigger a massive upside or, the techs that are driving the index higher reverse and fall in line with the overall market, in which case we could get a decent sized pullback.

Be picky this week with your credit trades folks You're not getting paid very well for them. Good morning traders! Welcome back after the holiday. I hope everyone had a nice break from the action and are refreshed! We didn't make many trades and no 0DTE's on Weds. shortened session. Let's get into it and take a look at the markets. Technicals are still holding on the buy signal. We've got the SPY and QQQ back to new ATH's. Is this the start of a new bull leg? Meanwhile the IWM and DIA continue to not participate. The IWM just can't seem to break above the 50DMA and the DIA is treading water. Let's take a look at the news for today: September S&P 500 E-Mini futures (ESU24) are up +0.04%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.11% this morning as trading resumed after the Independence Day holiday, with market participants bracing for the all-important U.S. payrolls reading due later in the day. The minutes of the Federal Open Market Committee’s June 11-12 meeting, released Wednesday, showed that officials didn’t deem it appropriate to lower borrowing costs “until additional information had emerged to give them greater confidence that inflation” is on track to their 2% goal. Officials pointed to inflation progress evidenced by smaller monthly gains in the core personal consumption expenditures price index and May consumer price data released hours before the rate decision. While “some” participants emphasized the need for patience, “several” officials highlighted that further weakening in demand could lead to a larger increase in unemployment. At the same time, the minutes showed that several policymakers remained ready to raise interest rates if inflation remained elevated. “Participants noted the uncertainty associated with the economic outlook and with how long it would be appropriate to maintain a restrictive policy stance,” according to the FOMC minutes. In Wednesday’s holiday-shortened trading session, Wall Street’s main stock indexes ended mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching new record highs. Paramount Global (PARA) surged nearly +7% and was the top percentage gainer on the S&P 500 after the Wall Street Journal reported that Skydance Media had reached a preliminary agreement to buy National Amusements and merge with Paramount. Also, Tesla (TSLA) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Bank of America Global Research raised its price target on the stock to $260 from $220. In addition, chip stocks advanced following a sharp decline in bond yields, with Nvidia (NVDA) and Broadcom (AVGO) rising over +4%. On the bearish side, Simulations Plus (SLP) tumbled more than -14% after the company suspended its quarterly cash dividend and cut its full-year EPS guidance. The ADP National Employment report on Wednesday showed private payrolls rose by 150K jobs in June, weaker than expectations of 163K. Also, the U.S. June ISM services index fell to 48.8, weaker than expectations of 52.6 and the steepest pace of contraction in 4 years. In addition, U.S. factory orders unexpectedly fell -0.5% m/m in May, weaker than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week rose +4K to 238K, compared with 234K expected. “With the ISM services falling to 48.8, the weakest since the pandemic and job claims deteriorating, ultimately the negative data is being seen as positive for markets,” said Justin Onuekwusi, chief investment officer at St James Place. “It feels like September is the date everyone is now looking at.” Meanwhile, U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the next FOMC meeting in July and a 68.1% chance of a 25 basis point rate cut at September’s policy meeting. Today, all eyes are focused on U.S. Nonfarm Payrolls data, set to be released in a couple of hours. Economists, on average, forecast that June Nonfarm Payrolls will come in at 191K, compared to the previous value of 272K. A survey conducted by 22V Research revealed varied expectations among investors regarding the market reaction to the jobs report, with 40% predicting a “negligible/mixed” response, 34% expecting “risk-on,” and 26% anticipating “risk-off.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect June’s figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.4% m/m and +4.1% y/y. The U.S. Unemployment Rate will be reported today as well. Economists foresee this figure to remain steady at 4.0% in June. In addition, market participants will be looking toward a speech from New York Fed President John Williams. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.342%, down -0.05%. I have to say, I'm surprised the markets are as strong as they are with FED members now starting to talk about the potential need for a rate HIKE! My bias for today is bearish. My bias for Wed's shortened session was bearish as well. Guess what? I was wrong! NFP today will be what starts our trade flow off so really it could bullish or bearish today depending on what it looks like but I continue to believe that traders don't want to hold a lot of positions over the weekend. Next week, hopefully, we can get back to some normal volume. A look at the VTI tells the tale of the market. Sitting at ATH's but no real trigger signal. Its very hard for me to go bullish or bearish here as we just don't have the signals...yet. One thing we know for sure, consolidation always leads to expansion. We will get directional movement. We just don't know when or in what direction. Trade docket for today: We've been light all week so its time to get back to putting our money to use. /NG, /MCL, /ZN, DIA, FSLR, WYNN, UPST, ORCL, IWM, CCL, NVDA, PLTR, PYPL, SHOP, ODTE's. Let's drill down on the price action levels for me today: /ES: One level for the upside. That's 5600. If the market can break above, and hold 5600 that would be incredibly bullish and set the stage for a possible new bullish leg up. 5573 is the first downside target then 5560 and 5535 which is PoC. If we can break below 5535 that would be very bearish price action. /NQ: 20460 is THE key level for me to the upside. If we can break through that level it would be very bullish. 20382 is the first support level then 20295 and finally 20254. This level is key. If we can break below 20254 I believe we could get some decent downside price action. Bitcoin: Wow! I wasn't following the price action too much yesterday with the day off but I was blown away when I did! That's a big hit the to crypto markets. You can see on the 2hr. chart that once it lost it's PoC (purple line) is went into free fall. 61,000 down to 55,000. The question now is where is support and when will the bottom be put in? My levels for today on BTC: 60588 is now resistance and 52422 is support. This support level goes back to Feb. of this year. It's a substantial one. If that doesn't hold then all bets are off as to how big the downside is. Have a great day folks and a nice, safe weekend coming up!

Good morning traders! Welcome back to a shortened trading session. We aren't taking today off but it will be a light day for us with just a couple of adjustments and no new adds to the portfolio. Shortened days like this don't happen often but I've found the the risk/reward for 0DTE's is not very good. Tomorrow the market is closed so we'll be back Friday to hit it hard. Yesterday was a good day overall. I added another column to our results matrix for notes and potential gains. We've been doing small event contracts setups that are very asymmetric in nature. They usually come in around 200%-800% ROI potential but are very low probability trades. Statistically these types of setups will lose money 90% of the time but one win puts you nicely in green. Our trade docket for this shortened session is small: DIA, FSLR, LEVI. A Labor Department report on Tuesday showed that U.S. JOLTs job openings unexpectedly rose to 8.140M in May, stronger than expectations of 7.960M. Federal Reserve Chair Jerome Powell said Tuesday that recent economic data indicate inflation is returning to a downward trajectory, but stressed that policymakers require additional evidence before reducing interest rates. While Powell refrained from offering any specific guidance on the timing of the first rate cut, he acknowledged that the central bank has made “quite a bit of progress” in lowering inflation. He added that he would like to see that progress continue. “Because the U.S. economy is strong and the labor market is strong, we have the ability to take our time and get this right,” Powell said. “And that’s what we’re planning to do.” U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at the next central bank meeting in July and a 59.9% probability of a 25 basis point rate cut at the September FOMC meeting. Meanwhile, the U.S. stock markets will close early at 1 p.m. Eastern Time today and remain closed on Thursday for the Independence Day holiday. Today, investors will closely monitor the release of the Federal Reserve’s minutes from the June meeting, which may provide further insights into the policymakers’ views on inflation, interest rates, and the economy. On the economic data front, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, set to be released in a couple of hours. Economists, on average, forecast that the June ADP Nonfarm Employment Change will stand at 163K, compared to the previous number of 152K. Also, investors will focus on U.S. Initial Jobless Claims data. Economists estimate this figure to arrive at 234K, compared to last week’s number of 233K. The U.S. ISM Non-Manufacturing PMI and the U.S. S&P Global Services PMI will be closely watched today. Economists forecast the June ISM Non-Manufacturing PMI to stand at 52.6 and the June S&P Global Services PMI to be 55.1, compared to the previous values of 53.8 and 54.8, respectively. U.S. Factory Orders data will come in today. Economists foresee this figure to stand at +0.2% m/m in May, compared to the previous figure of +0.7% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -0.400M, compared to last week’s value of 3.591M. In addition, market participants will be anticipating a speech from New York Fed President John Williams. My bias for today is bearish. Traders have already headed for an extended holiday weekend and volume is low. Most traders I know don't want to be long over the long weekend. We had a strong finish going into the close yesterday but nothing effectively has changed. SPY and QQQ are still stuck at ATH's and the IWM is still struggling to get above its 50DMA while the DIA treads water. Looking at the VTI, which I use to get a broader view of what the "market" is doing, we see the consolidation continue. No real signal here. There are however, some areas for concern. The 10-year note yield is now up over 20 basis points in since Friday's intraday low. That's 20 basis points in a matter of hours without any material news. For the first time in almost 5 weeks, the 10-year note yield is set to break above 4.50%. Bond markets are trading like rate cuts got cancelled and inflation is on the rise. Are bond markets telling us something? This is also of concern. This is quite an unusual setup: while the S&P 500 has moved up, the percentage of S&P 500 stocks above their 50-day moving average has dropped. In the last 4 instances when the % Yield Curve Inversion has gone above 70% and then back to 50%, we saw massive drawdowns for the index. Once again, I'm not predicting a crash. I have no idea when or by how much we reverse but...reversals do happen. No intra-day levels for me today as I'll be skipping any new 0DTE setups.

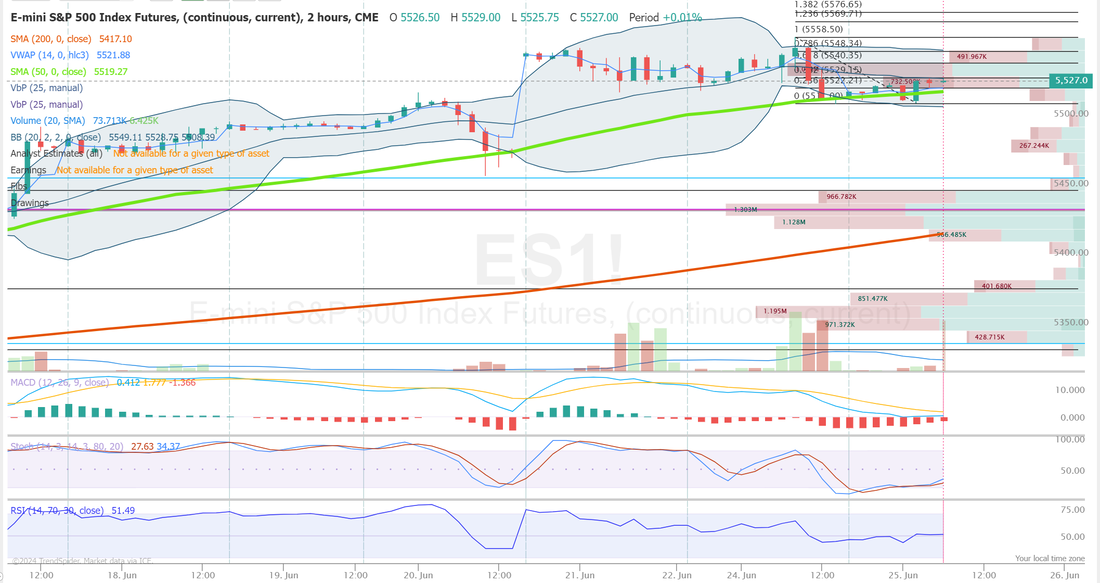

I hope you all have a nice break. Go do something fun and be safe. I'll see you all Friday! Welcome back! We had a decent day yesterday. This is what I consider to be one of the toughest weeks of the year to trade. When I was on Wall Street it was the week that most traders took off. With Weds. being a half day and Thurs. having the market closed, most traders would take Friday off as well. If you hone in on the volume of the SPY you'll see it's about as low as it's been all year. I.V. is off. Volume is down at 67% of avg.. Shortened week. We do have NFP on Friday which may give us some action but otherwise it's generally not a great week for traders. Here's our results from yesterday. We did book a profit early this morning on our Theta fairy of $392 dollars for the two day hold. Almost double what we look to make. This is one area that seems to be working for us. Lets take a look at the markets. Mostly weakness yesterday with the poor IWM slipping back below the 50DMA. Futures this morning are indicating a slight sell signal. This Friday’s nonfarm payrolls report is expected to be a “goldilocks” report, with 200,000 jobs created and a steady 4% unemployment rate. But even a minor deviation from the consensus could be noteworthy. This year, headline payroll gains have been solid, with an average monthly increase of 255,000 jobs. Yet, in that same time, the unemployment rate has risen from 3.7% to 4%. It’s up even more from its post-Covid low point of 3.4% reached in January and April of 2023. The nonfarm payrolls data and the unemployment rate come from two separate government surveys—the payroll survey and the household survey, respectively. While the payroll survey has been showing strong job gains this year, the household survey hasn’t. No jobs have been added this year based on the household survey, compared to 1.5 million for the payroll survey. Divergences in the two sets of data aren’t unusual, and the Bureau of Labor Statistics lays out several reasons why it happens, from sampling error to benchmark revisions to “off-the-books” employment. In general, investors tend to favor the nonfarm payrolls report when gauging the health of the U.S. jobs market. Economic data on Monday showed that the U.S. ISM manufacturing index unexpectedly fell to a 4-month low of 48.5 in June, weaker than expectations of an increase to 49.2. Also, the U.S. June ISM price paid sub-index fell to a 6-month low of 52.1, weaker than expectations of 55.8. In addition, U.S. construction spending unexpectedly fell -0.1% m/m in May, weaker than expectations of +0.3% m/m. At the same time, the U.S. June S&P Global manufacturing PMI increased to 51.6, falling slightly short of the 51.7 expected level. “While manufacturing is contracting, the rest of the economy is in decent shape ... the Fed wants the economy to keep running in low gear near-term. They will see ongoing softness in manufacturing as contributing to their goal of less inflation,” said Bill Adams, chief economist at Comerica Bank. Meanwhile, Fed Chair Jerome Powell is scheduled to participate in a policy panel discussion with European Central Bank President Christine Lagarde at the ECB’s annual forum in Sintra, Portugal, later today, with investors eagerly awaiting to see if he will offer any new insights on interest rates. U.S. rate futures have priced in an 8.8% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 59.9% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, set to be released in a couple of hours. Economists, on average, forecast that the May JOLTs Job Openings will come in at 7.960M, compared to the previous figure of 8.059M. My lean today continues to be bearish to slightly neutral. Look for lots of chop this week. Intra-day levels for me: /ES; 5512/5525/5529 (PoC)/5539 to the upside. 5504/5496/5483/5474 to the downside. /NQ: 20012/20072/20117/20150 to the upside. 19913/19868/19814/19753 to the downside. BTC; There's been some sustained sellling for the last week and a half. The last couple days seems to be forming a bottom. It's doubtful crypto can make a bit upward push without the help of the equity markets. The correlation is too high but it's certainly trying. 65804 resistance. 60646 support. Our trade docket for today is short. We'll focus most of our energy on Friday's trading session. /MCL, /ZN, /NG and all seven 0DTE's/ Scalping/Theta fairy. Have a safe day out there. Remember to let the trades come to you. If it's not there (and it may not be this week) don't force it. Sitting on your hands is a skillset and knowing when not to trade is an important discipline.

Welcome to a new week traders! This is a holiday shortened week with the markets closed Thursday for the 4th of July holiday. Our week ended o.k. on Friday with scalping really pulling its weight. Today's trade docket will be focused on our seven 0DTE setups, using futures. We had the /ES debit cover which expires today. That looks well positioned to start the day and has a good chance of expiring fully profitable on its own. Our /ES stand alone has the put side already in place. It looks good right now but is tight. We'll see how that one progresses today and we may be able to get a call side added. With /NQ we have the debit put cover that we rolled out to Friday. We'll work that today either with more puts with a 0DTE expiration of possibly calls, depending on the price action today. Event contract 0DTE's should be posted in discord in hte next 30 minutes. Lets take a look at the markets. Technicals are flashing a slight bearish lean but its not very strong. Basically, we continue to coil here. Credit to the IWM and DIA though. They are both holding above their respective 50DMA, which has been tough for them. To get a better "overall" view of the markets bias I like to use the VTI. Our swing trade setups on this have been money this year but we don't currently have a setup to initiate a new trade. It certainly looks like it wants to roll over. We are just waiting on a MACD confirmation to enter a potential short swing trade. We don't have much in the way of earnings trades this week. We do have a couple of potential news catalysts in the form of FOMC minutes on Weds. and NFP on Friday. With the holiday shortened week, Friday may be our best opportunity for trade setups. Let's take a look at the weekly expected moves. They are depressing, to say the least, from a credit traders perspective. This means, most likely that we will be looking at more debit trades this week. Agian, Friday may be our best day with NFP to get some movement. Looking at the VIX1D (One day ViX) you can see the problem. A grind higher will make this low I.V. enviroment even worse. We NEED some downward movment to get I.V. back to where we like it. You can see last weeks performance didn't have many standouts. The number of stocks below their 50/200 DMA's is also a concern for the bulls The Fear/Greed index also shows the complacency. The visual of last weeks market doesn't show many sector trends firming up either. My lean for today is of so slightly bullish. In spire of the weak results last week and the lack of strength in the tecnicals, I think the futures pointing up this morning gives us a clue that the market wants to, if nothing else, hold here. In Friday’s trading session, Wall Street’s major averages closed lower. Nike (NKE) tumbled about -20% and was the top percentage loser on the S&P 500 and Dow after the world’s largest sportswear company reported weaker-than-expected Q4 revenue and provided FY25 revenue guidance that fell short of analyst estimates. Also, Kura Sushi USA (KRUS) plunged more than -23% after reporting disappointing preliminary Q3 results and cutting its full-year revenue guidance. In addition, Accolade (ACCD) plummeted over -43% after the company issued below-consensus Q2 and FY25 revenue guidance. On the bullish side, Infinera (INFN) climbed more than +15% after Nokia Oyj agreed to acquire the company in a deal valued at about $2.3 billion. Data from the U.S. Department of Commerce on Friday showed that the U.S. core PCE price index, a key inflation gauge monitored by the Federal Reserve, came in at +0.1% m/m and +2.6% y/y in May, in line with expectations. Also, the U.S. Chicago PMI rose to a 7-month high of 47.4 in June, stronger than expectations of 39.7. In addition, U.S. May personal spending rose +0.2% m/m, weaker than expectations of +0.3% m/m, while U.S. May personal income rose +0.5% m/m, stronger than expectations of +0.4% m/m. Finally, the University of Michigan’s gauge of consumer sentiment was revised upward to 68.2 in June, stronger than expectations of 66.0. “From the market’s perspective, [Friday’s] PCE report was near perfect. The Fed’s favorite inflation indicator not only showed inflation was moving towards the Fed’s inflation target but that the economy was resilient. Consumer spending was on the rise and take-home pay was also up after a couple of sluggish months,” said David Donabedian at CIBC Private Wealth U.S. Richmond Fed President Thomas Barkin remarked on Friday that the battle against inflation has not yet been won, emphasizing that the U.S. economy is expected to stay resilient as long as unemployment stays low and asset valuations remain high. Also, Barkin noted, “Given the remarkable strength we are seeing in the economy,” he is receptive to the notion that the longer-term equilibrium rate balancing supply and demand “has shifted up somewhat” and that policy may not be as restrictive as perceived. U.S. rate futures have priced in a 10.9% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 56.3% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. Meanwhile, the U.S. stock markets will close early at 1 p.m. Eastern Time on Wednesday and remain closed on Thursday for the Independence Day holiday. The highlight of the holiday-shortened week will be the U.S. Nonfarm Payrolls report for June. Also, investors will be eyeing a spate of other economic data releases, including U.S. JOLTs Job Openings, ADP Nonfarm Employment Change, Initial Jobless Claims, S&P Global Composite PMI, S&P Global Services PMI, Factory Orders, ISM Non-Manufacturing PMI, Crude Oil Inventories, Average Hourly Earnings, and Unemployment Rate. Market participants will also be focused on remarks from Fed Chair Jerome Powell, who, along with New York Fed President John Williams, is set to participate in the European Central Bank’s annual forum in Sintra, Portugal this week. In addition, investors will be keeping an eye on the release of the Fed’s minutes from the June meeting on Wednesday, which may provide further insights into the policymakers’ views on inflation, interest rates, and the economy. Today, all eyes are focused on the U.S. ISM Manufacturing PMI, set to be released in a couple of hours. Economists, on average, forecast that the June ISM manufacturing PMI will come in at 49.2, compared to the previous month’s value of 48.7. Also, investors will focus on the U.S. S&P Global Manufacturing PMI, which stood at 51.3 in May. Economists foresee the June figure to be 51.7. U.S. Construction Spending data will be reported today as well. Economists foresee this figure to stand at +0.3% m/m in May, compared to the previous number of -0.1% m/m. Intra-day levels for me: /ES; 5539/5557/5570/5584 to the upside. 5528/5510/5495/5474 to the downside. /NQ; 20044/20137/20193/20272 to the upside. 19903/19820/19738/19675 to the downside. Bitcoin: BTC is trying to build a base here. It hasnt been very successful as of late but keep in mind it is still up over 45% on the year. Support has been 60695 with resistance up at 66000. Let's have a great, shortened trading week folks!

We had another really solid day yesterday. Our re-set NVDA trade has a goal of producing $3,500 a week in income for us. After blowing that number away last week, it looked like this week would be below our goal but yesterdays adjustments brought us to close to $4,000 of potential income for the week. Yesterday was all about asymmetric trade setups. We put a lot of small, low probability but high profit potential trades on. Only one of them hit (SPX chicken Iron condor) but the risk was so small that it ended up being a great success. We had MU report after the close with dissapointing results. This knocked the futures down but we are still holding to a slight bullish bias technically. Once again, yesterdays price action refused to give us any clarity or directional bias. The markets continue to coil here, building kinetic energy and preparing for their next move. It's still unclear when and what direction that will take. If you follow our trades you'll know that one of our all time favorite trades is the Theta fairy. Unfortunately we rarely get enough I.V. to get one on. A quick rule of thumb is we want $7.00+ of credit showing on a one standard deviation stike. As you can see, if are far from that. That, of course, is due to the low market I.V. as measured via the VIX1D. We may have found a work around by replacing the /ES for the /MNQ. It's scalable, unlike the /ES and it has much better I.V.. Look for more Theta fairys in the near future as we switch our efforts to this new underlying. Apex is currently running another of their specials. This is one of the best. Apex Milestone Celebration 80% Off any size Evaluation! One Day To Pass! $35 Resets! Only $40 for the $150k- $250k - $300k Evaluation Account!! Also, if you want to trade crypto with 0DTE setups. Some with 300% daily potential payouts you'll need the Kalshi tradomg platform. It's free. You can trade as little as $10 dollars and it will give you another tool to diversify your trading. Click the link below to get started. We've got some market catalysts incoming this morning. Micron Technology (MU) slumped over -6% in pre-market trading after the memory chipmaker provided Q4 sales guidance that trailed the estimates of some investors, overshadowing its stronger-than-expected Q3 results. In yesterday’s trading session, Wall Street’s main stock indexes closed in the green. FedEx (FDX) surged over +15% and was the top percentage gainer on the S&P 500 after the shipping giant posted upbeat Q4 results, provided a strong 2025 adjusted EPS forecast, and said it would buy back $2.5 billion of its stock over the next year. Also, Apple (AAPL) gained +2% after Rosenblatt Securities upgraded the stock to Buy from Neutral with a price target of $260. In addition, Whirlpool (WHR) climbed over +17% following a report from Reuters that Robert Bosch GmbH is contemplating an offer for the appliance maker. On the bearish side, Moderna (MRNA) plunged about -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 following new data indicating that the efficacy of its RSV vaccine declined significantly in the second year and was inferior to that of rival vaccines. Economic data on Wednesday showed that U.S. new home sales fell -11.3% m/m to a 6-month low of 619K in May, weaker than expectations of 636K. Also, U.S. May Building Permits were revised higher to 1.399M from a preliminary estimate of 1.386M, yet still marked the lowest level since June 2020. The Federal Reserve said on Wednesday that the largest U.S. banks passed the annual stress test, clearing the path for higher shareholder payouts. The results indicated that while large banks would face greater losses compared to the 2023 test, they remain well-positioned to weather a severe recession, according to the central bank. “While the severity of this year’s stress test is similar to last year’s, the test resulted in higher losses because bank balance sheets are somewhat riskier and expenses are higher,” said Fed Vice Chair of Supervision Michael S. Barr. Fed Governor Michelle Bowman on Wednesday reiterated her baseline view that “inflation will decline further with the policy rate held steady,” and she also stated that rate cuts would be “eventually” appropriate if inflation moves sustainably toward 2%. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the July FOMC meeting and a 56.3% probability of a 25 basis point rate cut at September’s policy meeting. Meanwhile, market participants will be keeping an eye on the first U.S. presidential debate of the 2024 election later today, featuring Democratic President Joe Biden and his Republican challenger Donald Trump. On the earnings front, notable companies like Nike (NKE), McCormick (MKC), Walgreens Boots Alliance (WBA), and Acuity Brands (AYI) are slated to release their quarterly results today. On the economic data front, all eyes are on the Commerce Department’s final estimate of gross domestic product, set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP will stand at +1.3% q/q in the first quarter, compared to +3.4% q/q in the fourth quarter. Also, investors will focus on U.S. Durable Goods Orders data, which came in at +0.7% m/m in April. Economists foresee the May figure to be -0.5% m/m. U.S. Core Durable Goods Orders data will be reported today. Economists estimate this figure to come in at +0.2% m/m in May, compared to the previous number of +0.4% m/m. U.S. Pending Home Sales data will come in today. Economists expect May’s figure to be +0.6% m/m, compared to the previous figure of -7.7% m/m. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 236K, compared to last week’s number of 238K. Trade docket for today: NKE, WBA, LEVI, MU, /ZC, /ZN?, DELL, FDX, MSTR?, 0DTE's, PLTR, PYPL, Theta Fairy using /MNQ. My lean for today: Slighty bullish even with the futures down. I think the market shrugs off MU's dissapointing earnings. Of course Jobless claims/ GDP/ Durable goods numbers may change all that. No initial intra-day levels for me yet as we have lots of news catalysts incoming shortly. We'll talk about levels in our live chat room later in the day once we get some price action. Have a great day everyone! Let's see if we can get a repeat of yesterday.

Well, I had a much better day yesterday than Monday! It was really what we strive to call a "normal" day. Most, but not all our trades worked. Nothing crazy big on the win side. Nothing crazy big on the loss side and at the end of the day we made some good money on the overall capital deployed. It sounds strange but I don't really like the $10,000 profit days because that also implies we could have a $20,000 down day. Steady, consistent upward movement is what we desire. Let's take a look at our results. The market continues to keep us waiting for a new trend to follow. We had two days in a row of neutral ratings. Those are incredibly hard days for me to find solid levels to trade. We are back now to a buy rating. Even so. Yesterday was another "mixed bag" day. Yes the SPY and QQQ turned in green days but the IWM struggled and is now back below the 50DMA and the DIA seems to have lost all its recent steam. This is a market that is coiling and looking for its next breakout. I.V. as measured by the VIX1D is still ridiculously low. Anything in the single digits is horrible for option sellers. We'd prefer it closer to 17 than 8. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Carnival (CCL) surged over +8% and was the top percentage gainer on the S&P 500 after the company reported upbeat Q2 results and provided above-consensus Q3 adjusted EBITDA guidance. Also, mega-cap technology stocks gained ground, with Nvidia (NVDA) climbing more than +6% to lead gainers in the Nasdaq 100 and Meta Platforms (META) rising over +2%. In addition, Capri Holdings (CPRI) advanced more than +1% after Wells Fargo upgraded the stock to Overweight from Equal Weight with a price target of $43. On the bearish side, Pool Corp. (POOL) slumped over -8% and was the top percentage loser on the S&P 500 after the company cut its full-year EPS forecast on weaker-than-expected demand. Economic data on Tuesday showed that the U.S. CB consumer confidence index edged down to 100.4 in June, stronger than expectations of 100.0. Also, the U.S. June Richmond Fed manufacturing survey fell to -10, weaker than expectations of -3. In addition, the U.S. S&P/CS HPI Composite - 20 n.s.a. eased to +7.2% y/y in April from +7.5% y/y in March (revised from +7.4% y/y), stronger than expectations of +7.0% y/y. Fed Governor Michelle Bowman stated Tuesday that she sees several upside risks to the inflation outlook and reiterated the necessity of maintaining elevated borrowing costs for an extended period. “We are still not yet at the point where it is appropriate to lower the policy rate,” Bowman said. During a moderated discussion following her speech, the Fed governor stated that she does not foresee any interest rate cuts this year. At the same time, Fed Governor Lisa Cook indicated that she sees it as appropriate to lower interest rates “at some point,” noting her expectation of gradual inflation improvement this year followed by more rapid progress in 2025. “The timing of any such adjustment will depend on how economic data evolve and what they imply for the economic outlook and balance of risks,” Cook said. Meanwhile, U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next FOMC meeting in July and a 57.9% chance of a 25 basis point rate cut at the September FOMC meeting. The focus this week will be on the May reading of the U.S. core personal consumption expenditures price index, the Fed’s first-line inflation gauge, set to be released on Friday. On the earnings front, notable companies like Micron Technology (MU), General Mills (GIS), Paychex (PAYX), Levi Strauss (LEVI), and AeroVironment (AVAV) are set to report their quarterly figures today. On the economic data front, investors will direct their attention to U.S. New Home Sales data, set to be released in a couple of hours. Economists, on average, forecast that May new home sales will come in at 636K, compared to the previous number of 634K. The U.S. Building Permits data will come in today. Economists expect May’s figure to be 1.386M, compared to 1.440M in April. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.600M, compared to last week’s value of -2.547M. Later today, the Federal Reserve will release the results of its annual stress test for the biggest U.S. banks. In spite of the technicals I'm leaning bearish today. FDX earnings pumped the futures initially but they've since lost all that momentum. Trade docket for today: /MCL, /NG, CCL, CRM?, FDX, GIS, GLD/NEM?, ODTE's, NVDA, ORCL?, PAYX, SMCI?, MU, LEVI, SPY/QQQ. Intra-day levels for me: /ES; 5542/5551/5558/5570 to the upside. 5532/5526/5519/5510 to the downside. /NQ; 20067/20085/20172/20223 to the upside. 19946/19915/19863/19808 to the downside. Bitcoin; Slide continues. Resistance now 63,550 and support is 60,357 with 58,423 the next level down if we break 60,357 Lets have another "normal" day today!

Yesterday was one of those days I should have just stayed in bed. I gave back almost 10 days of profits in the last 30 mins. of the day with the selloff. Here's my results. BTC missed a full profit by $7 dollars! SPX went perfect but I didn't have enough leverage in that to offset the selloff in NDX. Scalping helped but again, not enough. My lean yesterday was bearish as I mentioned but I didn't anticipate a selloff like that going into the close. I'll try to get quicker exits today to avoid the power hour all together. Lets look at the markets: We did see some slight rotation with weakness in the SPY and QQQ and strength in the IWM and DIA. This is a reversal from previous sessions. We continue to look for a sell confirmation in the VTI. The market enters today with another neutral rating. That makes it tough to find proper levels when the market is trying to make up its mind. My lean today is more neutral. The strenght in the laggards (IWM, DIA) should help outweight the weakness from the SPY, QQQ. Trade docket for today: /HG, CCL, 0DTE's, NVDA, PFE, FDX, PAYX, GIS. Dovish comments Monday from Chicago Fed President Goolsbee knocked T-note yields lower and supported stocks when he said it might be appropriate for the Fed to start thinking about whether restrictive policy is putting too much pressure on the economy. San Francisco Fed President Daly said if inflation falls more slowly than expected, it would be appropriate for the Fed to hold interest rates higher for longer, but if inflation falls quickly or the labor market cools more than expected, cutting rates would be necessary. The US Jun Dallas Fed manufacturing outlook survey rose +4.3 to -15.1, slightly weaker than expectations of -15.0. The markets are awaiting Friday’s release of the US May core PCE deflator, the Fed’s preferred inflation gauge, to see if price pressures are abating, which could pave the way for the Fed to begin cutting interest rates. The consensus is that the May core PCE deflator eased to +2.6% y/y from +2.8% y/y in April. The markets are discounting the chances for a -25 bp rate cut at 10% for the next FOMC meeting on July 30-31 and 65% for the following meeting on September 17-18. Generally positive Q1 earnings results are supportive of stocks. Q1 earnings are expected to climb +7.1% y/y, well above the pre-earnings season estimate of +3.8%. According to data compiled by Bloomberg Intelligence, about 81% of reporting S&P 500 companies have beaten Q1 earnings estimates. Overseas stock markets Monday settled mixed. The Euro Stoxx 50 rose to a 1-week high and closed up +0.89%. China's Shanghai Composite fell to a 3-3/4 month low and closed down -1.17%. Japan's Nikkei Stock 225 Index climbed to a 1-week high and closed up +0.54%. My intra-day levels: /ES; 5540/5558/5570/5581 to the upside. 5522/5510/5490/5474 to the downside. /NQ; 19861/19949/20009/20085 to the upside. 19809/19724/19685/19638 to the downside. Bitcoin; The weakness continues with support levels tenuous. We are working on a 13 day slide at this point. 65,888 is resistance and 56,782 is new support. Let's see if I can snag some green today after yesterdays red!

Welcome back to a new week of trading! Friday ended up a pretty solid week for us. All told we brought in over $13,000 of profits from our 0DTE's with our event contracts contributing $1,400 and our standard SPX/NDX combos bringing in the rest. We also had some nice success with our SPY/QQQ combo even though it was put on much later in the week than normal. Today is a big day for our NDX as we have $5,000 of extrinsic set for expiration today. Let's take a look at the markets. The SPY made little headway this week, giving back much of its early-week gains and closing at $544.51 (+0.32%). Cautious traders are pointing to a clear overextension away from the 200-day SMA and an overbought RSI reading as reasons to tread lightly. In fact, the last time this index was this far above its 200-day SMA was in May of 2021! This week, QQQ made history, with a daily close above an 80 RSI level for only the 13th time ever. Despite this strength, the week ended on a down note, closing at $480.18 (+0.19%). This index has been running hot and is currently farther away from its 200-day moving average than it’s been in nearly a year, suggesting the possibility for some cooling in the weeks to come. It’s hard to believe, but the small caps were the top gainer this week, closing at $200.35 (+0.82%). That said, is history about to repeat itself? In August of last year, a clear head and shoulders pattern led the way to a break below the 100-day SMA, and a very similar-looking setup appears to be forming now. NVDA, which is a big weekly trade for us, turned lower this week following a large bearish engulfing candle, resembling the March market top that front ran a 22% correction. With weak S&P seasonality on the horizon, prices may stay suppressed. At the same time, CEO Jensen Huang has cashed out over $90M worth of shares since June 15th. Let's take a look at I.V. and potential moves for the week. The 1 day VIX is still dreadfully low in the 8 dollar range. A reading above 15 is the sweet spot for getting Theta fairy setups and also gives us the best risk/reward ratio for our 0DTE's. Expected moves in the market this week: In other words...nothing new or exciting happening on the I.V. front. Not much to work with...again. Economic data on Friday showed that the U.S. S&P Global manufacturing PMI unexpectedly rose to 51.7 in June, stronger than expectations of 51.0. Also, the U.S. June S&P Global services PMI unexpectedly rose to a 2-year high of 55.1, stronger than expectations of 53.4. At the same time, U.S. existing home sales fell -0.7% m/m to a 4-month low of 4.11M in May, compared with the 4.08M consensus. In addition, the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in May, weaker than the expected -0.4% m/m. “Investors should brace for drama. The second half of 2024 is shaping up to be a time of transition and volatility. The decisions that investors make now will be key to navigating this period effectively,” said Solita Marcelli at UBS Global Wealth Management. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next central bank meeting in July and a 60.3% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. In the coming week, the May reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred measure of inflation, will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (third estimate), CB Consumer Confidence Index, S&P/CS HPI Composite - 20 n.s.a., Richmond Manufacturing Index, Building Permits, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Goods Trade Balance, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, Chicago PMI, and Michigan Consumer Sentiment Index. Several notable companies like Nike (NKE), FedEx (FDX), Micron Technology (MU), Walgreens Boots Alliance (WBA), General Mills (GIS), and Carnival (CCL) are slated to release their quarterly results this week. Investors will also gain further insights into the artificial intelligence landscape this week as investor favorite Nvidia hosts its annual shareholder meeting on Wednesday. In addition, several Fed officials will be making appearances throughout the week, including Daly, Cook, Bowman, and Barkin. Meanwhile, investors will be closely watching the first U.K. prime ministerial and U.S. presidential debates scheduled for this week, alongside the first round of voting in the French legislative election scheduled for this weekend. The U.S. economic data slate is mainly empty on Monday. With the pause in the markets Friday we are closer to sell signals than buys as we start the week. One ominous sign that I don't think is getting enough airplay is the huge divergence in the markets. With the SPY and QQQ bouncing around ATH's the overall market is seeing more and more selling. Take a look at the SPY vs. the equal weighted RSP. It's largely been tech and semi's and A.I. driven stocks holding this market up. The rest of the market is struggling. If TSLA and NVDA continue to be weak it could be the catalyst to pull the broader markets down. Our VTI swing trade is flashing a short signal. Add to that the fact that the technicals have swung back to the dreaded neutral rating today. Today could be key for the bulls if they want to hold on to any momentum. We are back to a full week of potential earnings trades with FDX, CCL, MU, PAYX, GIS, LEVI, NKE, WBA all on our potentals list. Our trade docket for today: /NG, /HG, /ZN, CCL, DELL, DIA, ODTE's, GLD, PLTR, IWM, CRM, NVDA, PYPL, SHOP, WYNN, UPST, SPY/QQQ 4DTE, VTI, NVDA. My lean today is bearish. With finishing last week with a week close and the neutral rating technically today as well as the VTI flashing sell I'm leaning to the downside today. Intra-day levels for me: /ES; 5539/5545/5550/5556 to the upside. 5529/5519/5513/5509 to the downside. As you can see, the range is very tight today as is normal on a neutral rated day but there is an open air pocket below support if we start to drop. /NQ; 20009/20091/20188/20248 to the upside. 19990* (key support) 19849/19787/19694 to the downside. Bitcoin: Is back to a critical support level it established in early May. 65,908 is now resistance and 60,694 is critical support. A break below that and there could be some downside potential. Let's have a great day!

|

Archives

November 2024

AuthorScott Stewart likes trading, motocross and spending time with his family. |