|

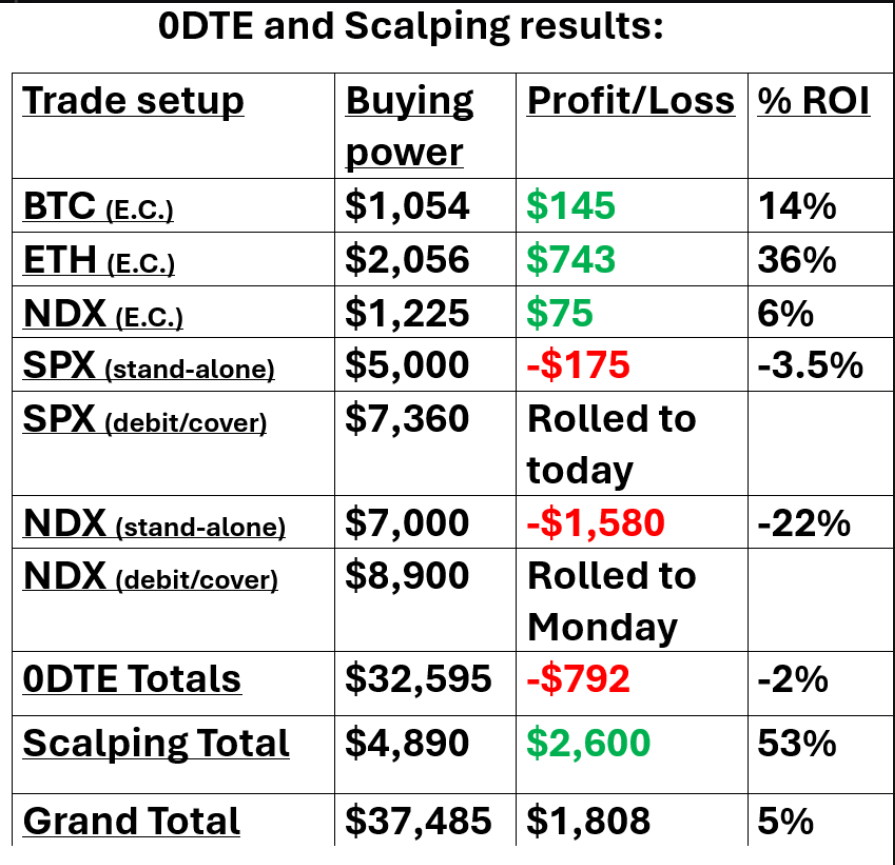

Yesterday was a mixed bag for me with most of our expiring trades working well but we needed to roll a couple of our 0DTE's. I finally had a good day scalping which was nice. It seems like its been forever that we got some good price action and we caught some good reversals throughout the day. Our Event contract 0DTES were a big help with ETH bringing in a 36% return. Our SPX stand alone was so close to profits but just couldn't hold it into the close. Our SPX debit roll could be a huge payoff today with approx. $4,500 of profit but it didn't cash flow for us yesterday. The NDX got run over and we booked a loss on the stand alone and are continuing to work the debit cover. Let's look at the markets: Going into yesterday we were on a seven day winning streak. That usually doesn't last and as expected, we got a reversal yesterday. The DOW however had one of its strongest days in a while. It now joins the SPY an QQQ above their 50DMA. The lowly IWM is the remaining laggard. We didn't get an overnight Vampire trade on yesterday and that was primarily because the premium was lacking. That particular trade setup is very similar in nature to our Theta fairy which also has been scarce lately. One of our trading room members mentioned the one day VIX which is a good indication of where we are at volatility wise. While you can see it spiked yesterday, it really needs to be closer to 17 to get the premium we need for both of those trades. Lately it's been closer to 10! In yesterday’s trading session, Wall Street’s major indices ended mixed. Jabil (JBL) slumped over -11% and was the top percentage loser on the S&P 500 after the company cut its full-year revenue guidance. Also, Qualcomm (QCOM) slid more than -5% after the Wall Street Journal reported that Samsung’s new AI laptops faced operational issues with Windows 11 and the Qualcomm processor. In addition, Trump Media & Technology Group Corp. (DJT) tumbled over -14% following the SEC’s declaration that the company’s April S-1 registration statement had become effective. On the bullish side, Gilead Sciences (GILD) climbed more than +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing that a Phase 3 PURPOSE 1 trial of its experimental therapy, lenacapavir, demonstrated 100% efficacy in the prevention of HIV in cisgender women. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -5K to 238K, compared with the 235K expected. Also, U.S. May housing starts unexpectedly fell -5.5% m/m to a 4-year low of 1.277M, well below the 1.370M consensus, while U.S. building permits unexpectedly fell -3.8% m/m to an almost 4-year low of 1.386M in May, weaker than expectations of 1.450M. In addition, the U.S. June Philadelphia Fed manufacturing index unexpectedly fell to a 5-month low of 1.3, weaker than expectations of 4.8. Minneapolis Fed President Neel Kashkari said Thursday that it would take a year or two to bring inflation back to 2%, given that wage growth might still be too high, suggesting interest rates could remain higher for longer. Also, Richmond Fed President Thomas Barkin stated that he requires additional clarity on the trajectory of inflation before cutting interest rates. “My personal view is let’s get more conviction before moving,” Barkin said. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 59.5% probability of a 25 basis point rate cut at the September meeting. Meanwhile, Wall Street is preparing for a quarterly event known as triple witching, during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. About $5.5 trillion of options are set to expire today. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the June Manufacturing PMI will come in at 51.0, compared to the previous value of 51.3. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 54.8 in May. Economists foresee the preliminary June figure to be 53.4. U.S. Existing Home Sales data will come in today. Economists foresee this figure to stand at 4.08M in May, compared to the previous number of 4.14M. The U.S. Conference Board Leading Index will be reported today as well. Economists expect May’s figure to be -0.4% m/m, compared to the previous figure of -0.6% m/m. Our trade docket today is full of expirations so some of these with a question mark may expire fully profitable on their own. /MCL?, /ZC, /ZN?, CCL?, DIA?, GLD?, IWM?, LULU, MSTR, ODTE's, NVDA, ORCL?, PYPL?, QQQ?, SHOP, SMCI?, SPY?, TSLA?, UPST?, VTI?, WYNN. Intra-day levels for me: /ES; 5540/5548/5555/5566 to the upside. 5518/5506/5495/5481 to the downside. /NQ; 20094/20181/20250/20337 to the upside. 19940/19853/19787/19694 to the downside. Bitcoin; Continues to weaken. 65,934 is resistance. 62,409 is new support. My bias for today is slightly bullish. Futures are still down and PMI is still to come so that may all change but I think we get a slight rebound from yesterday. Have a great weekend folks. See you all Monday.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |