|

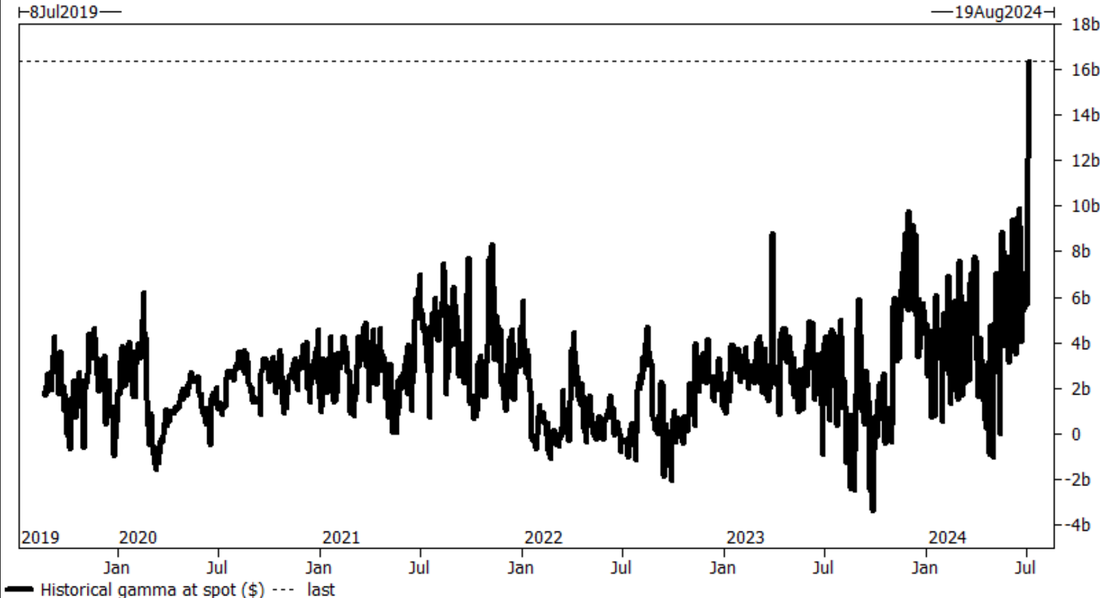

What a day yesterday. I'm always surprised more traders don't use technicals more. They never tell us when an event will happen but they sure give us clues as to what the next move may be. We've been talking here for two weeks about Stocastics being overbought. RSI pinned to the upside. Keltner and Bollinger bands being pressed to the upside etc. I saw a lot of chatter yesterday by traders who were just plain surprised that the market took a dump. I on the other hand was surprised it just kept going up. Well, we got what we asked for yesterday. Weds. I complained all day about horrible vol and I.V. That certainly wasn't the case yesterday. It was a perfect day for traders. We had a good day. It could have been much, much better but I try to never complain when we are making money. Here's our results for the day. Heading into today's session we are back to a technical neutral rating. Futures are mostly flat. In yesterday’s trading session, Wall Street’s major indexes closed mixed, with the tech-heavy Nasdaq 100 dropping to a 1-week low. Tesla (TSLA) slumped over -8% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Bloomberg News reported that the company was delaying its planned robotaxi event by about two months to October. Also, Delta Air Lines (DAL) slid about -4% after the top U.S. carrier posted downbeat Q2 results and provided below-consensus Q3 adjusted EPS guidance. In addition, chip stocks retreated, with Nvidia (NVDA) falling more than -5% and Intel (INTC) dropping nearly -4% to lead losers in the Dow. On the bullish side, WD-40 (WDFC) gained over +4% after the company reported better-than-expected Q3 results. The Labor Department’s report on Thursday showed consumer prices edged down -0.1% m/m in June, lower than the predicted figure of +0.1% m/m. On an annual basis, headline inflation eased to +3.0% in June from +3.3% in May, better than expectations of +3.1%. In addition, the core CPI, which excludes volatile food and fuel prices, eased to a 3-year low of +3.3% y/y in June, better than expectations of no change at +3.4% y/y. At the same time, the number of Americans filing for initial jobless claims in the past week fell -17K to a 6-week low of 222K, stronger than expectations of 236K. Chicago Fed President Austan Goolsbee described the latest inflation data on Thursday as “excellent,” stating that the figures provided the evidence he has been waiting for to be confident that the central bank is on track to achieve its 2% goal. Also, San Francisco Fed President Mary Daly said, “With the information we have received to date, which include data on employment, inflation, GDP growth, and the outlook for the economy, I see it as likely that some policy adjustment will be warranted.” At the same time, St. Louis Fed President Alberto Musalem stated that the June CPI report indicated “encouraging further progress towards lower inflation,” but he would like additional evidence of easing price pressures. “We’ll see you September! Better-than-expected inflation readings in many key sectors should allow the Fed to start talking about adjusting policy in July - and potentially allow the Fed to act in September,” said George Mateyo at Key Wealth. “That said, we still see the Fed wanting to gain further confidence before cutting aggressively unless stress materializes in the labor market.” U.S. rate futures have priced in a 6.7% chance of a 25 basis point rate cut at the next FOMC meeting in July and an 86.4% probability of a 25 basis point rate cut at the September FOMC meeting. Meanwhile, the second-quarter corporate earnings season gets underway, with some of the biggest U.S. banks, including JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C), slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. Producer Price Index, set to be released in a couple of hours. Economists, on average, forecast that the U.S. June PPI will stand at +0.1% m/m and +2.3% y/y, compared to the previous figures of -0.2% m/m and +2.2% y/y. The U.S. Core PPI will also be closely watched today. Economists expect June’s figures to be +0.2% m/m and +2.5% y/y, compared to the previous numbers of 0.0% m/m and +2.3% y/y. The U.S. Michigan Consumer Sentiment preliminary reading will be reported today as well. Economists estimate this figure to arrive at 68.5 in July, compared to 68.2 in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.222%, up +0.77%. With PPI out this morning I once agian have no bias for the day and won't look at levels. As you saw yesterday it's best to just trade what we see as the day develops and not have any preconcieved Ideas. Dealer gamma exposure (GEX) skyrocketed 250% this week to $16B, the highest on record. High dealer gamma means dealers are net long options. Large gamma spikes like this typically precede significant upward momentum, which creates the environment necessary for a violent reversal Gamma Exposure (GEX) is telling us we're about to enter the final blow off top. In this phase there is almost always increased speculation in micro caps & derivatives as the top performing stocks begin selling off. Looks like a rotation out of Tech into REITs & Utilities could be underway after yesterday’s CPI print… I've also been saying for a month now that the divergence between the SPY and QQQ's continually hitting new ATH's and the IWM and DIA staying weak would resolve. That appears to be happening with strength in the DIA and IWM and the SPY and QQQ's weakening. We haven't been able to get one of our VTI swing trades working yet this month but it looks like we may be getting closer to a short setup Our trade docket today will be primarily focused on our 0DTE's. No zoom feed today. I'm up at our cabin with the family and the boat that, I'm sure we have some mechanical malfunction (it always does) and the internet is poor. I'll also skip scalping. It certainly saved us yesterday.

Have a great weekend all! Remember for today...just trade what you see. No bias.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |