|

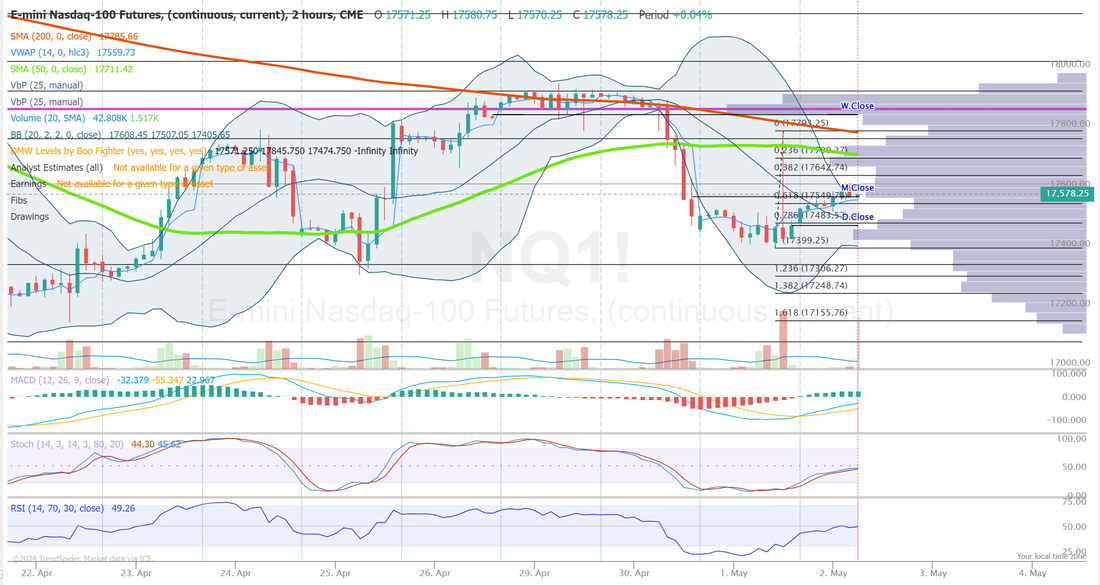

What a day yesterday! FOMC rarely disappoints when it comes to movement. One of the most difficult traits for a trader to develop is patience, discipline and the skill set of "sitting on your hands". We try to exercise all of those every day but especially on FOMC type days. Our day was made slightly more challenging in that we were starting the day with two rolled 0DTE positions. One in NDX and one in SPX. With some nice overlays we were able to bring both into a nice profit on the day. Our DASH and CVNA earnings trades also look set for some nice take profits at the open this morning. We'll have two more earnings setups today with AAPL and COIN. The biggest pain in my side right now is my SBUX position. It's really gotten beat up after earnings. I may be delusional but if you take a bigger view of 10 yr. earnings it still seems like its headed in the right direction but regardless, I'll need to pick up the cash flow component if this trade is going to make it into the green. ~33% of all S&P 500 stock trades are now executed in the last 10 minutes of the trading session. This is up from ~27% in 2021 and has been steadily increasing over the last few months. The entire trading session lasts for 390 minutes, but ONE THIRD of all trades are done in the last 10. Interestingly, assets of passive equity funds such as ETFs have risen to nearly $12 trillion in the US, according to Bloomberg. These funds usually execute their trades near the end of a trading session. This explains the significant spike in volatility at the end of the day. Futures look to rebound this morning, post FOMC but the technicals are still bearish Indices are at key levels today. This can either be a launching pad for higher movement or the cliff that we fall off of. Our trade docket for today: SMCI, /MCL, /ZN, BA, CVNA, CVS, DASH, DIA, GLD, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, ORCL?, XBI, AAPL and COIN. My lean today is neutral, even with futures up as I type. Intra-day levels for me: /ES; 5092/5105*(PoC. Could be an interesting butterfly level)/5115/5127 to the upside. 5071/5056/5046/5037 to the downside. /NQ: 17640/17701/17713/17793 to the upside. 17552/17483/17402/17345 to the downside. Bitcoin; 66134 is the first major resistance and 52116 is the next major support. Good luck and good trading folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |