|

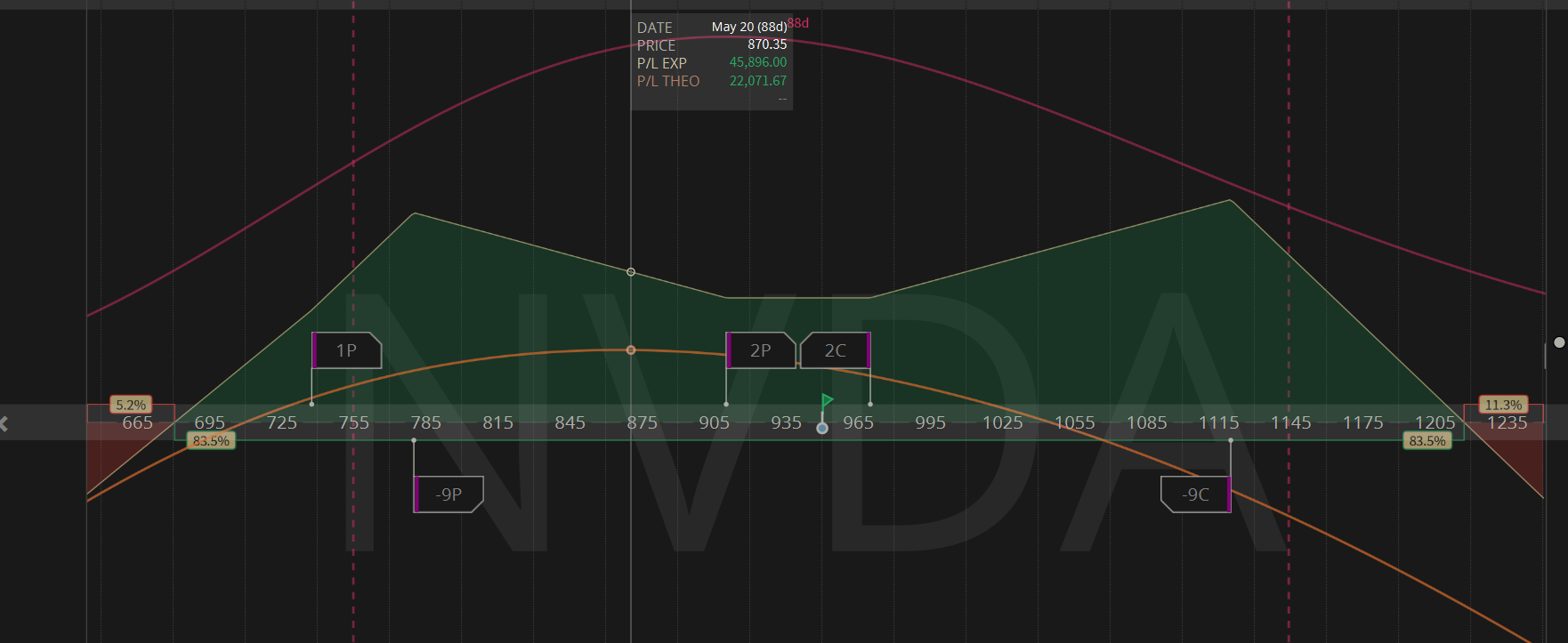

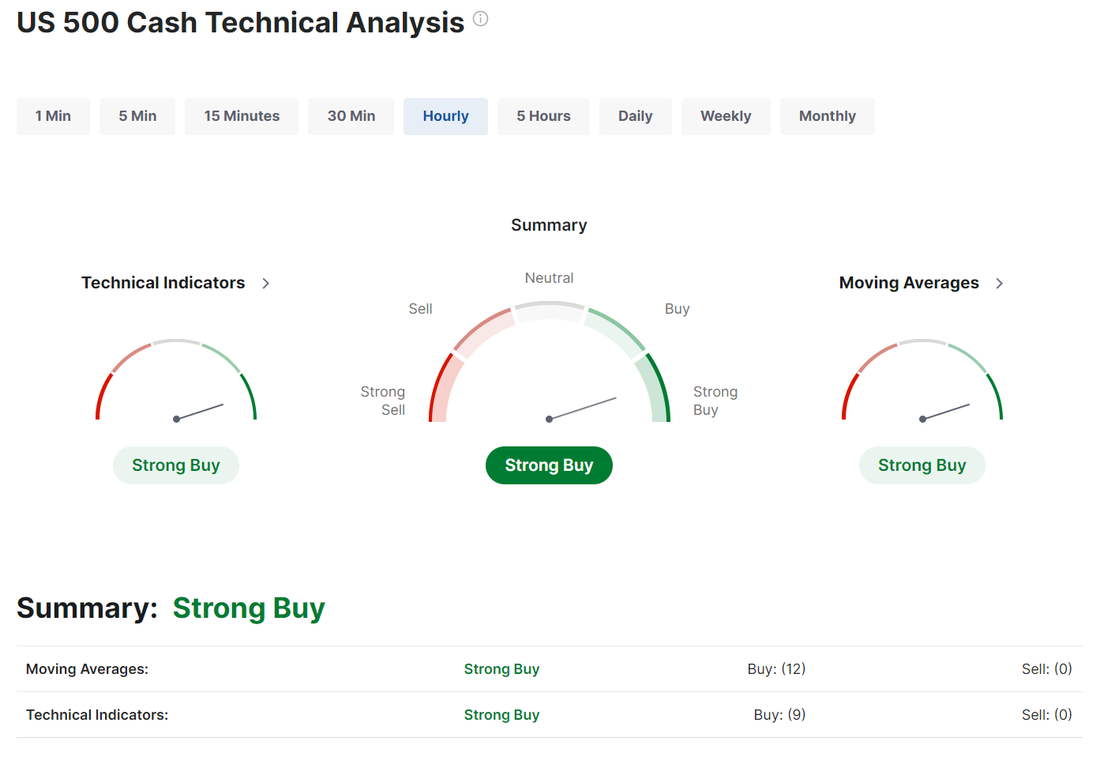

Good Thursday to you all! Yesterday was fairly uneventful for us as we anticipated the NVDA results. The stock is currently up 67 points pre-market. Our setup continues to look solid. Our 0DTE's were "mostly" successful. We didn't get an E.C. NDX one on but our Etherium 0DTE cash flowed as well as our NDX which hit for $2,400 of profit. We needed to roll the put side of the SPX to today but with the pre-market up 35 points it looks to be profitable today. Jobless claims and PMI are the main news catalysts for today: June Nasdaq 100 E-Mini futures (NQM24) are trending up +1.01% this morning as forecast-beating quarterly results and sales forecast from Nvidia boosted sentiment, with investors bracing for U.S. business activity data. Nvidia (NVDA) climbed over +6% in pre-market trading after the semiconductor giant reported stronger-than-expected Q1 results and provided above-consensus Q2 revenue guidance. The company also boosted its quarterly dividend by about 150% to $0.10 a share and announced a 10-for-1 stock split, effective June 7th. Yesterday, the minutes of the Federal Open Market Committee’s April 30-May 1 meeting revealed that Federal Reserve officials became increasingly worried about inflation. Policymakers noted that “recent data had not increased their confidence in progress toward 2 percent and, accordingly, had suggested that the disinflation process would likely take longer than previously thought.” Also, the minutes showed that “various participants” discussed a willingness to raise rates if inflation did not continue its downward trajectory toward the 2% goal. “Although monetary policy was seen as restrictive, many participants commented on their uncertainty about the degree of restrictiveness,” according to the FOMC minutes released on Wednesday. “Hawkish surprise (kind of) from the Fed minutes. The investing world will have to wait at least another month to hear anything about rate cuts - but the kicker in this report was the willingness of some participants to restrict policy further,” said Alex McGrath at NorthEnd Private Wealth. In yesterday’s trading session, Wall Street’s major indices closed lower. Target (TGT) plunged about -8% and was the top percentage loser on the S&P 500 after the retail giant reported weaker-than-expected Q1 adjusted EPS and expressed caution regarding discretionary spending in the coming months. Also, Lululemon Athletica (LULU) slid more than -7% and was the top percentage loser on the Nasdaq 100 after announcing the departure of its chief product officer, Sun Choe, and plans to revamp its product and brand teams. In addition, ViaSat (VSAT) tumbled over -16% after the company posted a surprise Q4 loss and said it expects “roughly flat” year-over-year revenue growth in fiscal 2025. On the bullish side, Analog Devices (ADI) surged more than +10% after the analog chip supplier reported upbeat Q2 results and offered above-consensus Q3 guidance. Economic data on Wednesday showed that U.S. existing home sales unexpectedly fell -1.9% m/m to 4.14M in April, weaker than expectations of 4.21M. Meanwhile, U.S. rate futures have priced in a 4.2% chance of a 25 basis point rate cut at the next FOMC meeting in June and a 17.4% probability of a 25 basis point rate cut at July’s policy meeting. On the earnings front, notable companies like Intuit (INTU), Medtronic (MDT), Ralph Lauren (RL), Ross Stores (ROST), and Workday (WDAY) are set to report their quarterly earnings today. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading in a couple of hours. Economists, on average, forecast that the May Manufacturing PMI will come in at 50.0, compared to the previous value of 50.0. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 51.3 in April. Economists foresee the preliminary May figure to be 51.2. U.S. New Home Sales data will be reported today. Economists foresee this figure to stand at 677K in April, compared to the previous number of 693K. The U.S. Building Permits data will come in today. Economists expect April’s figure to be 1.440M, compared to 1.485M in March. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 220K, compared to last week’s value of 222K. In addition, market participants will be anticipating a speech from Federal Reserve Bank of Atlanta President Raphael Bostic. The markets are in a solid buy mode now having cleared the 50DMA and pushing higher today with tech leading the way. Our trade docket for today: /HG, /MCL, DIA, FSLR, SPX/NDX/E.C. NDX/Bitcoin or Etherium 0DTE's, NVDA? PLTR?, SPY/QQQ? SMCI, INTU, ROST. My lean today is bullish: Intra-day levels for me: I'm focused on more substantive, larger levels today. /ES; 5420/5472 to the upside. 5256/5192 to the downside. /NQ; 19073/19327 to the upside. 18691/18360 to the downside. I believe ETH will give us a better risk/reward today vs. BTC. ETH; 4070 is near term upside resistance and 3666 is downside support. Have a great day folks! I'm headed to NYC tomorrow with the family for a freinds daughters reception so tomorrow will be a shortened zoom session but we'll still have time to get everything done.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |