|

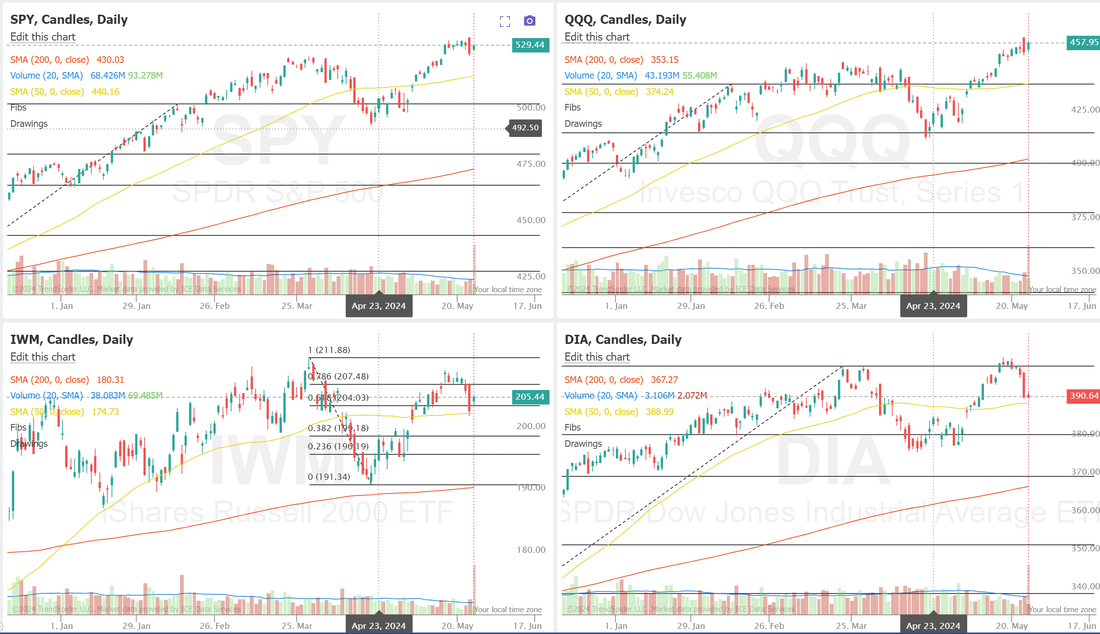

Welcome back traders! I hope everyone had a memorable Memorial day holiday. Our trading went well on Friday even with my shortened trading session as I went to catch a plane. We were still able to get two 0DTE's working with a successful SPX and NDX trade. With the shortened week this week our zoom feed will be in the scalping room today. Let's take a look at where the markets are to start this shortened trading week. Most of our indicators are flashing buy. It wasn't a resounding success last week as thte Energy/Healthcare/Financial sectors lagged while the Tech sector soared with NVDA leading the way. The SPY broke its four-week green streak, closing slightly lower at $529.51 (–0.002%), and nearly even with last week’s close. While Thursday’s selloff found the price testing the March highs, they appear to be acting as strong support for now. With a little help from NVDA earnings, the QQQ regained its place as the strongest of the three indexes this week, closing at $457.95 (+1.37%). Despite a nasty selloff on Thursday, support was found at the 8 EMA, and the price managed to stay above the March highs, as well. Small caps were again the underperformer this week, closing at $205.44 (-1.27%). IWM tested the top of the range on Monday but was immediately rejected. By week’s end, a powerful close below the 8 EMA coincided with a bearish MACD cross, suggesting the possibility of a short-term trend reversal. We aren't substantially different than where we've been for a while Volatility and expected moves are down in the dumps, once again. With SPY below 1% and QQQ below 1.3%. Our trade docket for today: Scalping, /ZN, BA, CVS, DELL, DIA, DIS, FSLR, GLD, IWM, NDX/SPX/E.C.NDX/Bitcoin, NVDA, PYPL, SMCI. My lean is bullish today. n this holiday-shortened week, the April reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (second estimate), Richmond Manufacturing Index, Goods Trade Balance, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Crude Oil Inventories, Personal Income, Personal Spending, and Chicago PMI. Several notable companies like Salesforce (CRM), Dick’s Sporting Goods (DKS), Chewy (CHWY), HP Inc. (HPQ), C3.ai (AI), Best Buy (BBY), Dollar General (DG), Foot Locker (FL), Costco (COST), Gap (GPS), Marvell (MRVL), Dell (DELL), and Nordstrom (JWN) are slated to release their quarterly results this week. In addition, several Fed officials will be making appearances this week, including Cook, Daly, Williams, Bostic, and Logan. In other news, UBS Global Research adjusted its year-end target for the benchmark S&P 500 index on Tuesday, raising it to 5,600 from the previous estimate of 5,400, representing the most optimistic forecast among major brokerages. Today, all eyes are focused on the U.S. CB Consumer Confidence Index in a couple of hours. Economists, on average, forecast that the May CB Consumer Confidence index will stand at 96.0, compared to the previous figure of 97.0. My intra-day levels: /ES; 5333/5339/5351/5367 to the upside. 5323/5314/5305/5298 to the dowside. /NQ; 18950/18969/19022/19042 to the upside. 18896/18867/18842/18812 to the downside. Bitcoin; 74,285 is resistance and 65856 is support. Lets have a great week folks!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |