|

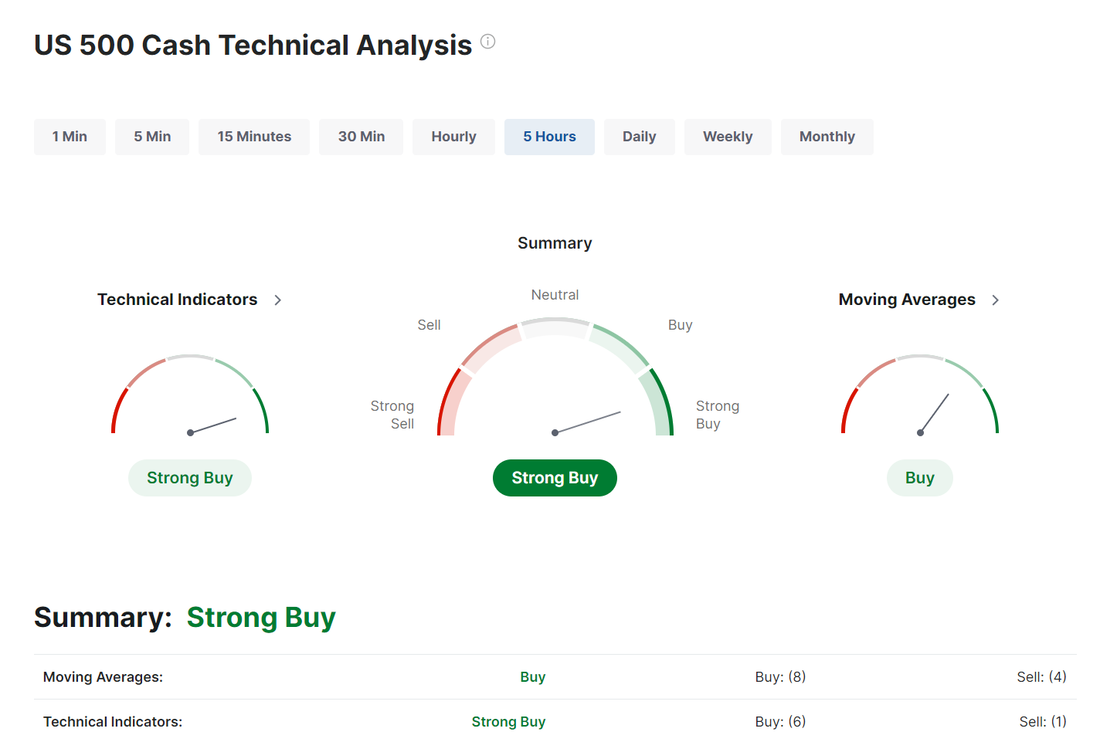

Welcome back traders! Yesterday was the day I wish we had everyday. Nothing amazing. No big surprises. Net liq didn't bounce around too much. I ended up the day $1,562 increase in Net liq. We got all four 0DTE's working well. Bitcoin hit for 7% ROI. NDX hit for 14% ROI. SPX hit for 8% ROI and E.C. NDX hit for 2% ROI. All told just under 12k of capital commited to make almost $1,500 profit. Let's take a look at the markets; The bullish trend continues but when will the market start moving again? We continue to camp out at these ATH levels. Will NVDA earnings today, after the close be the catalyst we are looking for? I'm sure it will have some effect. NVDA is a huge part of the overall indices cap weighting. This is a company that has added one trillion dollars to its market cap just this year. We have done about the best job I know how to with the structure below: We'll know tomorrow morning how well (or poorly) we did. Governor Christopher Waller said Tuesday that he needs to see several more favorable inflation reports before considering interest-rate cuts, adding that keeping rates steady for “three or four” months won’t harm the economy. “In the absence of a significant weakening in the labor market, I need to see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy,” Waller said. In a discussion following his prepared remarks, he added that he expects the next move in borrowing costs will be downward. Also, Atlanta Fed President Raphael Bostic stated that the central bank will be in a position to begin cutting interest rates “by the end of the year,” though he does not anticipate this happening before the fourth quarter. In addition, Fed Vice Chair for Supervision Michael Barr reiterated that officials should keep interest rates steady for a longer duration than previously anticipated to effectively cool inflation. Finally, Cleveland Fed President Loretta Mester stated her preference for observing “a few more months of inflation data that looks like it’s coming down” before cutting interest rates. Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at the next central bank meeting in June and an 18.3% probability of a 25 basis point rate cut at the July FOMC meeting. On the earnings front, major companies like Nvidia (NVDA), TJX Companies (TJX), Analog Devices (ADI), Target (TGT), and Snowflake (SNOW) are slated to release their quarterly results today. Today, investors will also closely monitor the publication of the Federal Reserve’s minutes from the April 30-May 1 meeting to gauge how close the central bank is to lowering borrowing costs. On the economic data front, investors will focus on U.S. Existing Home Sales data due later in the day. Economists, on average, forecast that April Existing Home Sales will stand at 4.21M, compared to the previous value of 4.19M. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.400M, compared to last week’s figure of -2.508M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.437%, up +0.53%. Here are the timestamps for each potential, market moving news item. Docket 10:00 ET US Existing Home Sales Median Forecast: 4.22M | Prior: 4.19M | Range: 4.3M / 4.08M 10:30 ET Weekly EIA Crude Oil Inventories Median Forecast: -2M | Prior: -2.508M | Range: 1M / -3.084M 13:00 ET The US Sells $16 Bln in 20-Year Bonds at Auction 14:00 ET FOMC Meeting Minutes My lean today is neutral. I think we continue to stall here, in anticipation of NVDA results after the bell. Trade docket today: FSLR, SPX/NDS/E.C. NDX/Bitcoin 0DTE's, TOL, PANW, EWW, XME, XRJ, VFS, UPST, SNOW, ELF. Intra-day levels for me: /ES; Very tight range today. 5339/5343/5349/5352 to the upside. 5332* (50 period moving avg. on 2 hr. chart)/5329* (PoC. This may be where we place a butterfly today)/5322/5316 to the downside. /NQ levels: 18824/18866/18888/18907 to the upside. 18768/18707/18678 to the downside. Bitcoin; 74417 is resistance. 65858 is support Lets have a great day! I'm sure I won't be the only one glued to the screen after the close. Let's see what NVDA does and how that effects the indices going into tomorrows open.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |