|

Good Wednesday to you all! Yesterday was an o.k. day for me with a mixed bag of trades. Both our standard SPX/NDX 0DTE's made money on the day but involved small call side rolls to today. Those will be our first priority to work today. The event contract 0DTE lost. We have three earnings trades we will be looking to book profits on this morning with WOOF, ZIM and DLTR. CPI hit yesterday and as expected, it was a market mover. It moved bonds. It moved gold. It moved equities. The moves were interesting. Not just because we have positons in all of those but rather the divergence. Inflation came in hot, which you would think would hurt equites. Nope. Markets pushed higher. The general consensus in the June rate cut target for the FED is still in place. Bonds tanked and rates rose. That made sense. Our bond ladder absorbed the move well. Gold got knocked down. That certainly helped our Gold ladder but it also shows that Gold isn't the best hedge against inflation. Its worth noting its also been on an extended, bullish run and may have simply been due a retrace. Our trade docket for today: We'll look to book profits on our three earnings trades of DLTR, WOOF, ZIM. We are in a position to get some buying power back in our DIA and GLD ladders. DELL, FSLR, IWM, META, NDX/SPX/Event contract 0DTE's, NVDA, PFE, PYPL? QQQ are also on the docket. We may have a couple new earnings trades as well. Futures are flat this morning after yesterdays CPI catalyst. “Inflation came in a little hot, but the bulls aren’t ready to throw in the towel yet. Investors remain optimistic that shelter costs will come down. We still have three more reports before that key Fed meeting in June to confirm or reverse that hope,” said David Russell, a global head of market strategy at TradeStation. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data due later in the day. Economists estimate this figure to be 0.900M, compared to last week’s value of 1.367M. We are mostly all in on our oil ladder positioning but have the buying power to adjust should we need to. Oil is one of our main focal points on Weds. Wednesday 13th March 10:30 ET Weekly EIA Crude Oil Inventories The Weekly Energy Information Administration Crude Oil Inventories report provides data on the change in the number of barrels of crude oil held in inventory by commercial firms in the United States over the past week. It is an indicator for assessing supply and demand dynamics in the oil market and can influence crude oil prices. What to Expect A larger-than-expected increase in inventories suggests oversupply conditions, potentially putting downward pressure on oil prices, while a larger-than-expected decrease indicates tightening supply conditions, which could lead to higher prices. Tomorrow we get PPI so inflation continues to be the main topic at hand. As far as price action, we continue to bang our heads against the ATH levels on most of the major indices: The technical picture is decidedly bullish If you look at the overall heat map for the past weeks price action, you'll see mostly green save BA and TSLA. BA couldn't possible get more bad news. Everyday its something with them. Now, apparently whistle blowers are dying? TSLA is a different story. Analysts are predicting a 35% downside in the stock. The EV market is not healthly. Bitcoin (and most crypto) continue to push higher. I'm most interested now in Etherium and its potential to get a spot EFT listed on the exchange. It seems inevitable. Will it get the same pop BTC got? We'll see. Again, I maintain my longs in BTC, ETH, and DOT. Intra-day levels for me: /ES; 5184/5211/5237/5241 to the upside. 5167/5156/5150/5139 to the downside /NQ; 18257/18335/18448/18603 to the upside. 18134/18050/17992/17927 to the downside. My general lean to day is slightly neutral.

0 Comments

We had quite a busy day yesterday. 28 total trades taken in our live trading room. There is always something for everyone and every type of trader. Shorts, Longs, Earnings trades, All kinds of different 0DTE setups, Commodities, Bonds and even a return of the Theta Fairy!...you name it. My net liq had a good day up $3,450 with our event contract 0DTE pulling its weight with our best 0DTE of the year 54% ROI. Unfortunately I didn't get a full fill but thats how is goes sometimes. We don't want to chase entries. Today is another day. We have CPI today as the pre-planned news catalyst. CPI can be a bigger driver than FOMC so I don't plan out levels for today. We'll trade small and trade soley what we see. Tuesday 12th March 08:30 ET US CPI for February The US Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a basket of goods and services. It tracks price movements from the perspective of the consumer and is a key indicator of inflation. The CPI is divided into various categories such as food, energy, housing, transportation, and medical care, providing insights into price trends across different sectors of the economy. Changes in the CPI can impact consumers’ purchasing power, cost of living adjustments, and monetary policy decisions made by central banks. What to Expect Markets are paying attention to inflation reports. Higher-than-expected inflation could cause markets to push back on Fed rate cut bets, which could cause weakness in US stocks, and strength in the dollar. The reverse is also true, lower-than-expected inflation, would likely cause the markets to bring forward rate-cut bets, which would cause strength in US stocks and weakness in the dollar. Societe Generale noted that they view the lingering, sticky price issue as primarily concentrated in the rent component. The PCE-deflator, which is less reliant on rent, has exhibited greater moderation. If CPI rents can moderate, the Fed should be more willing to cut. It you'd like to brush up on CPI and why its such a market mover go here: https://features.financialjuice.com/2024/03/11/us-cpi-prep-2/ I added a section to the website detailing my approach to daytrading. This will give you context into how we operate in our live trading room. Hopefully they can be of help to you. Go to the "more" tab and click on "my level to level approach". The trade docket for today is light. We are looking to book profits on Theta Fairy, ASAN, CASY, ORCL. New trades on DELL and our three 0DTE setups with SPX/NDX/Event contracts. We will also be spending today in our live scalping room. Come watch us work towards $50,000 profit. Trade small today and don't chase is my advice for today. Best of luck to all you traders out there.

Welcome back traders! As we start a new week I'm always reminded the each week provides new opportunities. No matter how your past week went, today we start it all over again. I had a great weekend riding my dirt bike and rock crawling in the jeep with the family. My wifes birthday is the 9th and mine was the 10th so it was a double celebration. Thanks to all who wished us a happy birthday. Last week was a strong one for us with most of us in the trading room having a nice bump in our net liq but Friday was a big turning point. I run a model portfolio of 20-30 positions so at any given time, no matter what the market is doing I always seem to have a few "hot spots" or trades that are giving be trouble. Lately those have been MSTR and NVDA. We've continued to work them both and our patience was rewarded Friday with some decents sized capital gains realized. Both trades look great right now! One aspect of dynamically trading is, you've got to judge the success or failure of a trade once its DONE. I put a video up last year on our two worst trades. Oil and Bonds. The comments were expected. "You should cut and run". You will get buried in those horrible trades", "Cut your losses now, those are bad setups" etc. Not only did both those trades turn around for us but they ened up bringing in nice profits. MSTR and NVDA are on that same path. It's interesting (but predictable) that the internet trolls love to point out when a setup isn't working but when we turn it into a nice profit they fall silent. I'll repeat...if you are using stop losses as your risk management approach thats great. Its easy to judge the result, but if you dynamic trade as we do, don't judge the trade until its done. Both MSTR and NVDA look set to bring in more profits for us this week. Markets continue to look strong (close to ATH's) but toppy. Fridays slide plus this mornings slight red on the futures was enough to give us a very slight sell signal. Is this enough to signal a change of direction? No. Not even close. We would need a much more sustained (maybe three days in a row) selling pressure and more important, we'd need to break below some of the substantial support levels that have been established. Right now this market looks tired but it's still a tired bull. I.V. on the SPX is up to 17% this week with a 1.3% expected move. That's a HUGE improvement for us as mainly credit traders. This may give us the ability to get some Theta Fairy trades working again. The QQQ's with their 1.9% expected move and 23% I.V. continue to provide us better setups. The fear and greed index is about where you would expect it to be with this sustained bull run. The heat map from last weeks price action shows a mixed bag with the market leaders starting to lag. Like I said, this bull market looks tired but, it's still a bull market. Most of the market internals are still healthy. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls climbed by 275K jobs last month, topping analyst expectations of 198K and increasing from the 229K (revised from 353K) jobs added in January. Also, the U.S. February unemployment rate unexpectedly rose to a 2-year high of 3.9%, weaker than expectations of no change at 3.7%. In addition, U.S. average hourly earnings came in at +0.1% m/m and +4.3% y/y in February, weaker than expectations of +0.2% m/m and +4.4% y/y. “The report didn’t necessarily amount to an ‘all-clear’ signal for the Fed, but there also didn’t appear to be anything in it that would derail its plan to cut rates,” said Chris Larkin at E*Trade from Morgan Stanley. Chicago Fed President Austan Goolsbee stated on Friday that he anticipates policymakers will reduce interest rates this year as inflation continues to cool. “As inflation comes down, we would be moving toward less restrictiveness over the course of the year,” Goolsbee said in an interview on Fox News. Meanwhile, U.S. rate futures have priced in a 3.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month and a 24.4% probability of a 25 basis point rate cut at the May FOMC meeting. Our earnings trades have really produced for us the last few weeks. We've still got some potential opportunities coming up for us this week: On the earnings front, notable companies like Oracle (ORCL), Dollar Tree (DLTR), Lennar (LEN), Adobe (ADBE), Dollar General (DG), Ulta Beauty (ULTA), Dick’s Sporting Goods (DKS), and Jabil Circuit (JBL) are slated to release their quarterly results this week. In Friday’s trading session, Wall Street’s major averages ended lower. Marvell Technology Inc (MRVL) tumbled over -11% and was the top percentage loser on the Nasdaq 100 after the specialty semiconductor company issued disappointing Q1 guidance. Also, Costco Wholesale Corp (COST) plunged more than -7% and was the top percentage loser on the S&P 500 after the big box retailer reported weaker-than-expected Q2 revenue. Both of these trades cash flowed well for us. The market is awaiting more inflation data this week with today largely empty of pre-planned news catalysts: On the economic data front, the U.S. consumer inflation report for February will be the main highlight in the coming week. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. Core CPI, Retail Sales, Core Retail Sales, PPI, Core PPI, Initial Jobless Claims, Crude Oil Inventories, Business Inventories, Export Price Index, Import Price Index, NY Empire State Manufacturing Index, Industrial Production, Manufacturing Production, and Michigan Consumer Sentiment (preliminary). Despite making new weekly highs and breaking for the first time above the monthly trendline connecting the 2000 and 2021 highs, the SPY ended the week slightly lower, at $511.72 (-0.21%). The monthly RSI is notable in that it is still well below an overbought reading. Much like the SPY, the QQQ is also flirting with its monthly trendline that connects the 2000 and 2021 highs. Closing the week at $439.02 (-1.48%), this index is currently presenting a bit of a concerning look on the monthly timeframe, but there are still several weeks for the candle to develop. We have three potential earnings trades for today: Our trade docket for today is full. ORCL, CASY, ASAN earnings trades. /ZN, DIA, /MCL, GLD ladder trades. DELL, GOOG, META, MSTR, NVDA, SBUX, PYPL, PLTR, WYNN, FSLR, SMCI, VKTX. Our daily SPX/NDX/Event contract 0DTE's. SPY/QQQ 4DTE trades and last but not least AAPL. We'll also check in our the Wheat setup. I think its getting close to an entry point. Intra-day levels for me today: /ES; 5127/5152/5168/5193* (key level. ATH) to the upside. 5109/5096/5086* (key support level)/5061 to the downside. /NQ; 18111/18188/18237/18313 to the upsdie. 17930/17876/17793/17714 to the downside. News catalysts for the week: Tuesday 12th March 08:30 ET US CPI for February The US Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a basket of goods and services. It tracks price movements from the perspective of the consumer and is a key indicator of inflation. The CPI is divided into various categories such as food, energy, housing, transportation, and medical care, providing insights into price trends across different sectors of the economy. Changes in the CPI can impact consumers’ purchasing power, cost of living adjustments, and monetary policy decisions made by central banks. What to Expect Markets are paying attention to inflation reports. Higher-than-expected inflation could cause markets to push back on Fed rate cut bets, which could cause weakness in US stocks, and strength in the dollar. The reverse is also true, lower-than-expected inflation, would likely cause the markets to bring forward rate-cut bets, which would cause strength in US stocks and weakness in the dollar. Wednesday 13th March 10:30 ET Weekly EIA Crude Oil Inventories The Weekly Energy Information Administration Crude Oil Inventories report provides data on the change in the number of barrels of crude oil held in inventory by commercial firms in the United States over the past week. It is an indicator for assessing supply and demand dynamics in the oil market and can influence crude oil prices. What to Expect A larger-than-expected increase in inventories suggests oversupply conditions, potentially putting downward pressure on oil prices, while a larger-than-expected decrease indicates tightening supply conditions, which could lead to higher prices. Thursday 14th March 08:30 ET US PPI for February The US Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. It tracks price movements from the perspective of the seller and is an important indicator of inflationary pressures in the economy. The PPI is calculated for various stages of production, including finished goods, intermediate goods, and crude goods, providing insights into price trends at different levels of the supply chain. Changes in the PPI can influence the decisions of businesses regarding pricing strategies, production levels, and investment, and can also impact consumer prices (CPI), wages, and monetary policy decisions, making it, in some ways, a leading indicator of inflation. What to Expect Inflation is closely watched by the markets. Higher than expected inflation could prompt the markets to push back on bets for rate cuts this year, which would cause weakness in US stocks, and strength in the dollar. The inverse is also true. If inflation comes in lower, this could mean that the Fed is getting closer to their inflation target, which could cause markets to ramp up bets for rate cuts this year, which would cause strength in US stocks, and weakness in the dollar. Weekly US Initial & Continued Jobless Claims Weekly US Initial Jobless Claims and Continued Jobless Claims are key economic indicators that provide insights into the labor market’s health. Initial Jobless Claims refer to the number of individuals who file for unemployment benefits for the first time during a given week. This metric helps gauge the rate of layoffs and indicates the labor market’s immediate health. A lower number of initial claims suggests a stronger job market, while a higher number may indicate economic weakness. Continued Jobless Claims, on the other hand, represent the number of individuals who continue to receive unemployment benefits after their initial claim. This figure reflects the ongoing level of unemployment and can indicate the persistence of joblessness in the economy. What to Expect As this release is coming out at the same time as the US PPI, it is likely to be overshadowed by this. Nonetheless, higher-than-expected Jobless Claims indicate higher unemployment, which is often seen by the markets as a downside risk to inflation. This could cause strength in US stocks and weakness in the dollar, as it could cause traders to push forward their bets for Fed rate cuts. Friday 15th 10:00 ET The University of Michigan Sentiment March Prelim The University of Michigan Consumer Sentiment Index is a monthly survey that measures the confidence and optimism of US consumers about the economy. It provides insight into consumers’ perceptions of current economic conditions and their expectations for the future. The index is based on surveys conducted with a representative sample of households regarding their views on personal finances, business conditions, and buying intentions. High consumer sentiment generally indicates optimism about economic prospects, which can translate into increased consumer spending and economic growth. Conversely, low consumer sentiment may suggest pessimism and potential retrenchment in spending, which could dampen economic activity. The University of Michigan sentiment report also contains expectations for both 1 and 5-year ahead inflation expectations, which the markets pay attention to. What to Expect High sentiment would indicate that consumers are doing well in the face of high interest rates, and have general optimism over economic conditions, which could increase the chances for a soft landing for the economy. However, if consumer sentiment is much higher, this could be an upside inflation risk, as it could underline higher consumer spending. Having said this, the markets are more likely to react to any meaningful deviations in inflation expectations. Higher 1 and/or 5-year-ahead inflation expectations could cause markets to pull back on bets for Fed rate cuts this year, which would cause weakness in US stocks, and strength in the dollar. My lean today is neutral to slightly bearish.

Happy Friday to you all! Yesterdays trades went well for me yesterday with some good income coming in to the account. NVDA and MSTR continue to give me fits but I'll work them again today. The plan is to de-risk them a little. Drop buying power and build some inner safety legs to maximize income. We had all four of our 0DTE's hit for a profit yesterday. SPX yielded about 8% return. NDX was about 1.2% return after the roll was factored in and our two event contracts yielded 5% and 10% return respectively. A couple interesting, new ETF's came on the market yesterday. Roundhill investments issued the XDTE and QDTE that sell 0DTE options on the SPX and NDX indices. Keep an eye on them. The news catalyst for today in NFP: Friday 8th March 08:30 ET US Employment Situation for February US Nonfarm Payrolls US Nonfarm Payrolls, commonly referred to as NFP, is a key economic indicator published by the Bureau of Labor Statistics on a monthly basis. It represents the total number of paid workers in the US, excluding farm employees, government workers, and non-profit organization employees. The NFP report provides insights into the overall health of the labor market, reflecting changes in employment levels. The data is closely watched by policymakers, economists, and investors for its impact on financial markets and economic policy decisions. US Unemployment Rate The US Unemployment Rate is a widely tracked economic indicator that measures the percentage of the labor force that is unemployed and actively seeking employment. It is calculated by dividing the number of unemployed individuals by the total labor force. The Unemployment Rate can differ from the Nonfarm Payrolls data due to differences in their definitions and methods of measurement. While NFP represents the total number of paid workers in the US, excluding certain categories like farm and government employees, the Unemployment Rate considers the percentage of the labor force that is actively seeking but unable to find employment. US Average Earnings YoY US Average Earnings Year-over-Year is an economic indicator that measures the annual percentage change in the average earnings of all non-farm employees in the United States. This data is typically derived from the monthly employment reports released by the US Bureau of Labor Statistics. Average earnings include wages and salaries, and the YoY comparison helps assess the rate of change in workers’ compensation over a one-year period. Positive growth in Average Earnings YoY is indicative of increasing income levels, while negative growth suggests a decline in average earnings. Policymakers, economists, and investors monitor this indicator for insights into wage trends and their implications for consumer spending and inflation. What to Expect US NFP is the most closely watched employment indicator by traders and policymakers alike. A higher-than-expected read indicates that employment is not slowing down, which poses an upside risk to inflation. This could cause policymakers to keep interest rates higher for longer. This repricing of the future of US monetary policy could be likely to cause weakness in US stocks, and strength in the dollar. The inverse could also be the case. Having said this, participants will also be looking at the average earnings data to see if increased wages are also causing potential upside inflation risks. In comments from Powell and other FOMC officials, they have also noted a refocus back onto the ‘dual mandate’, (which includes employment), so while a slight cooling in the employment situation may be seen as reinforcing dovish Fed bets, too much could go against the other element of the Fed’s dual mandate, and increase recession fears. Unicredit notes that the labor market remains tight, and the unemployment rate is unlikely to rise in a sustained way until monthly payroll gains fall below the around 100k needed to absorb population growth. Consistent with this, initial jobless claims remain low. Most of the indices are hanging around their all time highs. Our trade docket for today is typical of most Fridays. We'll be looking to books profits where we can. De-risk and position for next week. It looks like we should have take profit orders right out of the trading gate on all three or our earnings trades from yesterday: COST, DOCU, MRVL, MSTR, SPX/NDX/Event contract 0DTE's, NVDA, PLTR?, QQQ/SPY?, RIVN, RUM, SMCI, VKTX? Intra-day levels for me: /ES; 5157/5168/5174/5187 to the upside. 5140/5131/5119/5105 to the downside. /NQ; 18270/18330/18357/18382 to the upside. 18250/18185/18137/18081 to the downside. My lean is neutral today: Have a great weekend. Get refreshed. We still have a lot of potential earnings setups for next week to look at.

Good Thursday to you all! I mentioned yesterday how frustrating my Tuesday was. Most of my trades worked fine but my net liq suffered. Well, yesterday those same positions "fixed" themselves and my net liq came roaring back. It got me thinking about my favorite hobby outside of trading...racing dirt bikes. Good racers don't try to control every movement. They let the bike "dance" underneath them. It's tough to see your net liq down $7,000 and say, "well, all my trades look o.k.". Prices ebb and flow. Just make sure you've got setups you can manage. We had another amazing day yesterday with our 0DTE setups. We booked a substantial (well above avg.) profit on our SPX trade and brought in some nice green on the NDX but it was....once again, our Event Contract 0DTE that performed the best. $1,400 profit on $13,200 of capital. These continue to be more and more enticing as we, as traders continue to better understand them and refine our trading of them. Our trade docket for today: DIA, GLD, META, MSTR, SPX/NDX/Event contract 0DTE's, NVDA, PLTR, SMCI with MRVL, DOCU and COST as potential earnings plays. We have jobless claims out today as well and a continuation of Powells speech from yesterday. Thursday 7th March 08:30 ET US Trade Balance for January The US Trade Balance for January is an economic indicator that measures the difference between the value of the goods and services exported by the United States and the value of goods and services imported into the country during that month. A positive trade balance indicates that exports exceed imports, which can contribute positively to economic growth and employment. Conversely, a negative trade balance, or trade deficit, means that imports exceed exports, which can put downward pressure on economic growth and employment. The US Trade Balance provides insights into the country’s international trade dynamics and its impact on the overall economy. What to Expect As a major importer of goods, the US has been in a trade deficit since 1975. While unlikely to move the markets, a smaller than expected trade deficit would indicate higher growth in the US, which could be seen as an upside inflation risk if it is considerably smaller than expected, or, if it is only marginally smaller, could ease recession fears. US Weekly Initial & Continued Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates, however, FOMC officials have mentioned that they do see a higher unemployment rate being in line with their goal back to 2% inflation. This means that Jobless Claims coming in higher than expected, suggesting higher unemployment, would be likely to be read by the Fed as good news for inflation’s return to target. This scenario could cause US stocks to strengthen and the dollar to weaken. Feds Mester is also speaking and we have Nat gas inventory numbers as well. We pulled our weekly profit on our Oil ladder yesterday in preparation for a new set of ladders. I don't believe we will be adjusting our Nat gas trade today but you never know with the "widow maker". Once again the small sell signal only lasted a day then right back to neutral and today, right back to buy: Markets look "toppy" and "frothy" at these ATH's. Yesterdays price action was very unpredictable with alternating buy/sell algos getting triggered throughout the day. Futures are up this morning and it looks like we want to go higher at the open. Some pre-market activity: Pre-Market U.S. Stock Movers Victoria’s Secret & Co (VSCO) plummeted about -31% in pre-market trading after the lingerie retailer warned of potential losses in Q1 and issued weaker-than-expected FY24 revenue guidance. OneSpan Inc (OSPN) soared over +32% in pre-market trading after the company reported upbeat Q4 results and offered a solid FY24 outlook. Yext Inc (YEXT) climbed more than +17% in pre-market trading after the company reported better-than-expected Q4 results and gave an above-consensus FY25 adjusted EPS forecast. Rivian Automotive Inc (RIVN) gained over +1% in pre-market trading after Jefferies initiated coverage of the stock with a Buy rating and a $16 price target. Micron Technology Inc (MU) rose more than +3% in pre-market trading after Stifel upgraded the stock to Buy from Hold with a price target of $120. Edwards Lifesciences Corp (EW) advanced over +1% in pre-market trading after BofA upgraded the stock to Buy from Neutral. My lean for today: Intra-day levels for me:

/ES; 5134/5141/5147/5157 to the upside. 5118/5107/5090* (key support level)/5079 to the downside. /NQ; 18170/18253/18329/18375 to the upside. 18090/18044/17963/17906 to the downside. Good Wednesday to you all! Yesterday was a strange one for me. We have an approach of judging our results via the change in our net liq. We call is "Gestalt". We could do 10 trades in a day and have losses on 9 of the 10 but, if our net liq is up, we call it a win. Yesterday was a pretty successful day for me. All three of my 0DTE's made money. Scalping is a, yet to be determined as I rolled some long QQQ calls into today. Overall it was a pretty solid effort but, it wasn't reflected in my net liq which went down. I have two big positions in NVDA and MSTR that both look o.k. but simply hurt me yesterday in the P/L dept. Tenative trade docket for today: CRWD, CVNA, DELL, GCT?, SMCI, DWAC?, GLD?, IWM, META, MSTR, NVDA, ORCL?, SPX/NDX/Event contract 0DTE's, VKTX, XBI?, ZM, JD? Other than booking profit on our CRWD earnings setup, which looks great pre-market and possibly a post earnings play on JD, we have no earnings plays for today. Tomorrow ramps up with MRVL, DOCU and COST. Once again, I'll plead with you to take a look at event contracts as a way to build "edge" into your 0DTE trading. We had another profitable day yesterday on a setup that, once again, I was wrong on. I don't think I've been right on my calls on the last seven of these setups! It hasn't mattered as they continue to perform and every one has made us money. If you need help getting started with them, just hit me up. Its no cost to get started and you can build your first trade with less than you would spend going out for dinner. Use the link below to open an account, for free at Kalshi. The #1 source for event contracts in the U.S. Markets sold off yesterday and it presents the same question as the last umteenth (is that a word?) times...is this signaling a change of direction and market bias or is it just another "buy the dip" opportunity. It certainly looks like a "buy the dip" opportunity to me (thats why I rolled our long QQQ options to today). We briefly dipped, technically into a sell mode signal, which lasted for a whole couple of hours! As we start this morning we are now back to neutral rating. The damage done yesterday was largely contained to Tech and Healthcare. The A/D line wasn't a bearish as the NDX seemed to imply. Bitcoin continues its charge higher. Looking for new ATH levels. Gold is also flirting with ATH. Keep an eye on Gold. We trade a Gold ladder strategy and premiums are starting to pump. Expected moves in the SPX have jumped about 30% for the next weeks trading window. Yesterdays retrace basically wiped out all of the gains from the last week of trading. We are starting to see some divergence in the big cap weighted underlyings that have been pushing us higher. Look at the 2hr. charts of AAPL and MSFT. Intra-day levels for me: /ES; 5121/5131/5158* (key level. yesterdays high)/5179 to the upside. 5099/5085/5063* (key level. yesterdays low)/5039 to the downside. /NQ; 18163/18261/18372* (key level. yesterdays high)/18439 to the upside. 18038/17963/17880/17827* (key level. Yesterdays low) to the downside. We've got several economic reports out today that could be market movers: Wednesday 6th March 08:15 ET US ADP Employment Change for February The ADP Employment Change compiled by the ADP Research Institute utilizes actual payroll data from a diverse array of private-sector employers to gauge changes in employment levels. Excluding government and farm employment, the ADP figures provide insights into the dynamics of the private labor market, covering small, medium, and large businesses. What to Expect While the Fed does wish to uphold its dual mandate of 2% inflation with maximum job growth, an overly hot reading may have negative implications for the future of inflation. This could send the dollar up and stocks down. 09:45 ET BoC Rate Decision The Bank of Canada Interest Rate Decision is the main monetary policy tool where the Bank of Canada’s Governing Council determines the official interest rate for the Canadian economy. This rate, known as the overnight rate, influences short-term interest rates and serves as a key benchmark for borrowing costs in the country. What to Expect The Bank of Canada uses this rate to achieve its inflation target and support overall economic goals. Changes in the interest rate can impact consumer spending, business investments, and inflation. It is widely expected that the BoC will leave rates unchanged at 5%. If realized, attention will turn to the subsequent BoC rate statement for any clues on the future path of BoC interest rates. Any mention of more rate cuts this year than are already priced in by the markets could prompt strength in Canadian stocks and weakness in the Canadian dollar. However, hawkish remarks implying fewer interest rate cuts than are currently priced this year could result in the opposite. 10:00 ET US JOLTS Job Openings for January The US Job Openings and Labor Turnover Survey (JOLTS) provides monthly data on job openings, hires, separations, and other labor market dynamics in the United States. It offers insights into the demand for labor and the overall health of the job market. Job openings represent unfilled positions that are actively being recruited for by employers. Analyzing JOLTS data helps assess trends in job creation, labor market tightness, and worker mobility, providing valuable information for understanding the dynamics of the US labor market. The JOLTS data is the oldest bit of employment data this week, representing the month of January, while ADP and Nonfarm Payrolls reports represent the month of February. Having said that, with employment a key piece of the Fed’s monetary policy puzzle, markets will still monitor this. What to Expect If JOLTS comes in higher than expected, that indicates there are a larger number of job openings, which means that there is demand on the corporate side to hire more staff. This can be seen as an upside inflation risk, and a threat to the Fed’s 2% inflation target, as higher demand for staff indicates corporations are not being affected as the Fed would like by tight monetary policy. This could cause strength in the dollar and weakness in US stocks. “The series has been very volatile, perhaps reflecting low survey response rates,” Unicredit notes. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report assesses supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant buildup in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. 14:00 ET Fed’s Beige Book The Federal Reserve’s Beige Book, formally known as the Summary of Commentary on Current Economic Conditions, is a report published eight times a year. It provides anecdotal information on current economic conditions in each of the 12 Federal Reserve districts, based on interviews with business contacts, economists, market experts, and other sources. The Beige Book serves as a qualitative assessment of the economy, offering insights into trends in various sectors such as manufacturing, retail, real estate, and agriculture. What to Expect The Beige Book is extremely unlikely to move the markets, as the data is anecdotal; however, it can still provide some important context to the affects of the Fed’s monetary policy on real people’s businesses in a more tangible way. Maybe more important. We have Powell speaking at 10:00 EST and FED's Daly and Kashkan are speaing a little later. There seems to be a lot of focus on Powells speech today. We'll be watching oil inventory results and how that effects our oil ladder setup. My overall lean for the day: Have a great day. Trade small...trade often.

Yesterday was a little bit of a mixed bag for me. 90% of the model portfolio did its job and our 0DTE's worked well, NVDA continues to give us fits. The event contract was the big winner. . What's interesting is that I was wrong on the trade. The SP500 did NOT finish green on the day but we still made a nice profit. There is edge in these trades if you can manage them well. Atlanta Fed President Raphael Bostic said on Monday that he expects the Fed’s first interest-rate cut, scheduled for the third quarter as per his forecast, will be followed by a pause in the subsequent meeting to evaluate the impact of the policy adjustment on the economy. “If Bostic wants one cut then a pause, you can’t help but wonder if the Fed is wavering on three cuts. The data is doing the talking and it’s really not screaming for the Fed to cut rates,” said Societe Generale strategist Kenneth Broux. U.S. rate futures have priced in a 3.0% chance of a 25 basis point rate cut at the next FOMC meeting in March and a 19.8% probability of a 25 basis point rate cut at the May FOMC meeting. Meanwhile, Fed Chair Jerome Powell is set to appear before Congress for his semiannual testimony on Wednesday and Thursday, where he is anticipated to reaffirm his stance that there’s no urgency to lower interest rates. On the earnings front, notable companies like CrowdStrike Holdings (CRWD), Target (TGT), Ross Stores (ROST), NIO (NIO), Box (BOX), and Nordstrom (JWN) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. ISM Non-Manufacturing PMI in a couple of hours. Economists, on average, forecast that the February ISM Non-Manufacturing PMI will come in at 53.0, compared to the previous value of 53.4. Feds Barr is speaking today as well. Futures continue to retreat from ATH's. But on a bigger time frame the trend is still up. Trade docket for today: GCT, MSTR, NDX/SPX/Event contract 0DTE's, NVDA, PFE, QQQ/SPY 4DTE, SMCI, CRWD. Intra-day levels for me: /ES; 5126/5135/5149* (key level. major resistance level from yesterday)/5187* (key level. high of the day yesterday) to the upside. 5112* (key level. below is a pocket of potential downside)/5102/5019/5074 to the downside. /NQ; 18245/18274/18297/18342 to the upside. 18113/18087/18031* (key level. downside pocket below this) 18000 to the downside. Most actives from yesterday: Good morning traders! Welcome to a new week of opportunities. Well...if last Thursday was picture perfect for us, with everything we touched working, Friday was the opposite. Nothing I touched seemed to work well on Friday save for one or our four 0DTE's. It wasn't enough to help my net liq.

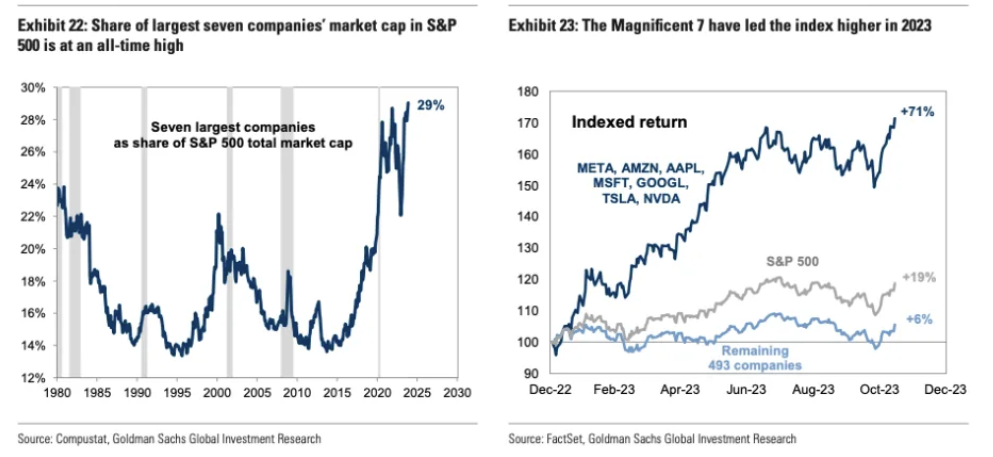

Charts continue to point up on all the major indices: Here's a full list of the planned news items that could be market moving catalysts: Tuesday 5th March 09:45 ET US S&P Services PMI February Prelim The US S&P Services Purchasing Managers’ Index evaluates the health of the services sector in the United States. Through surveys conducted among purchasing managers in diverse industries, such as finance, healthcare, and retail, the PMI assesses key factors like employment, new orders, and business activity. As a diffusion index, a PMI score above 50 indicates expansion in the sector, reflecting positive economic activity, while a score below 50 suggests contraction. What to Expect Markets have been reacting positively to lower Services PMI data, as seen in the last release. This is most likely due to the services sector getting closer to contraction, which may aid in taming inflation. The service sector is also an area where the Fed has said they need to see some more cooling. 10:00 ET US ISM Service PMI for February The US Institute for Supply Management Services Purchasing Managers’ Index, like the S&P Services PMI, measures the health of the services sector. Similar to other PMI indicators, a reading above 50 indicates expansion in the services sector, while a reading below 50 suggests contraction. What to Expect Markets have been reacting positively to lower Services PMI data, as seen in the last release. This is most likely due to the services sector getting closer to contraction, which may aid in taming inflation. The service sector is also an area where the Fed has said they need to see some more cooling. Therefore a lower-than-expected reading may result in US stock strength and Dollar weakness. US Durable Goods January Final Durable goods refers to goods that have a lifespan extending over three years. In the United States, the Census Bureau publishes a monthly report called the “Durable Goods Orders” report. This report tracks the new orders placed with domestic manufacturers for delivery of factory hard goods, such as refrigerators, cars, and industrial machinery, which are expected to last three years or more. The data in this report is a key economic indicator as it provides insight into the health of the manufacturing sector and overall economic activity. What to Expect US Durable Goods is currently nearing a good place, this could mean any shock deviations from forecast could be negative for stocks and the dollar, as any extreme weakness could foreshadow the manufacturing sector going into free fall. A much higher reading may show overheating in the sector. Wednesday 6th March 08:15 ET US ADP Employment Change for February The ADP Employment Change compiled by the ADP Research Institute utilizes actual payroll data from a diverse array of private-sector employers to gauge changes in employment levels. Excluding government and farm employment, the ADP figures provide insights into the dynamics of the private labor market, covering small, medium, and large businesses. What to Expect While the Fed does wish to uphold its dual mandate of 2% inflation with maximum job growth, an overly hot reading may have negative implications for the future of inflation. This could send the dollar up and stocks down. 09:45 ET BoC Rate Decision The Bank of Canada Interest Rate Decision is the main monetary policy tool where the Bank of Canada’s Governing Council determines the official interest rate for the Canadian economy. This rate, known as the overnight rate, influences short-term interest rates and serves as a key benchmark for borrowing costs in the country. What to Expect The Bank of Canada uses this rate to achieve its inflation target and support overall economic goals. Changes in the interest rate can impact consumer spending, business investments, and inflation. It is widely expected that the BoC will leave rates unchanged at 5%. If realized, attention will turn to the subsequent BoC rate statement for any clues on the future path of BoC interest rates. Any mention of more rate cuts this year than are already priced in by the markets could prompt strength in Canadian stocks and weakness in the Canadian dollar. However, hawkish remarks implying fewer interest rate cuts than are currently priced this year could result in the opposite. 10:00 ET US JOLTS Job Openings for January The US Job Openings and Labor Turnover Survey (JOLTS) provides monthly data on job openings, hires, separations, and other labor market dynamics in the United States. It offers insights into the demand for labor and the overall health of the job market. Job openings represent unfilled positions that are actively being recruited for by employers. Analyzing JOLTS data helps assess trends in job creation, labor market tightness, and worker mobility, providing valuable information for understanding the dynamics of the US labor market. The JOLTS data is the oldest bit of employment data this week, representing the month of January, while ADP and Nonfarm Payrolls reports represent the month of February. Having said that, with employment a key piece of the Fed’s monetary policy puzzle, markets will still monitor this. What to Expect If JOLTS comes in higher than expected, that indicates there are a larger number of job openings, which means that there is demand on the corporate side to hire more staff. This can be seen as an upside inflation risk, and a threat to the Fed’s 2% inflation target, as higher demand for staff indicates corporations are not being affected as the Fed would like by tight monetary policy. This could cause strength in the dollar and weakness in US stocks. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report assesses supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant buildup in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. 14:00 ET Fed’s Beige Book The Federal Reserve’s Beige Book, formally known as the Summary of Commentary on Current Economic Conditions, is a report published eight times a year. It provides anecdotal information on current economic conditions in each of the 12 Federal Reserve districts, based on interviews with business contacts, economists, market experts, and other sources. The Beige Book serves as a qualitative assessment of the economy, offering insights into trends in various sectors such as manufacturing, retail, real estate, and agriculture. What to Expect The Beige Book is extremely unlikely to move the markets, as the data is anecdotal; however, it can still provide some important context to the affects of the Fed’s monetary policy on real people’s businesses in a more tangible way. Thursday 7th March 08:30 ET US Trade Balance for January The US Trade Balance for January is an economic indicator that measures the difference between the value of the goods and services exported by the United States and the value of goods and services imported into the country during that month. A positive trade balance indicates that exports exceed imports, which can contribute positively to economic growth and employment. Conversely, a negative trade balance, or trade deficit, means that imports exceed exports, which can put downward pressure on economic growth and employment. The US Trade Balance provides insights into the country’s international trade dynamics and its impact on the overall economy. What to Expect As a major importer of goods, the US has been in a trade deficit since 1975. While unlikely to move the markets, a smaller than expected trade deficit would indicate higher growth in the US, which could be seen as an upside inflation risk if it is considerably smaller than expected, or, if it is only marginally smaller, could ease recession fears. US Weekly Initial & Continued Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates, however, FOMC officials have mentioned that they do see a higher unemployment rate being in line with their goal back to 2% inflation. This means that Jobless Claims coming in higher than expected, suggesting higher unemployment, would be likely to be read by the Fed as good news for inflation’s return to target. This scenario could cause US stocks to strengthen and the dollar to weaken. Friday 8th March 08:30 ET US Employment Situation for February US Nonfarm Payrolls US Nonfarm Payrolls, commonly referred to as NFP, is a key economic indicator published by the Bureau of Labor Statistics on a monthly basis. It represents the total number of paid workers in the US, excluding farm employees, government workers, and non-profit organization employees. The NFP report provides insights into the overall health of the labor market, reflecting changes in employment levels. The data is closely watched by policymakers, economists, and investors for its impact on financial markets and economic policy decisions. US Unemployment Rate The US Unemployment Rate is a widely tracked economic indicator that measures the percentage of the labor force that is unemployed and actively seeking employment. It is calculated by dividing the number of unemployed individuals by the total labor force. The Unemployment Rate can differ from the Nonfarm Payrolls data due to differences in their definitions and methods of measurement. While NFP represents the total number of paid workers in the US, excluding certain categories like farm and government employees, the Unemployment Rate considers the percentage of the labor force that is actively seeking but unable to find employment. US Average Earnings YoY US Average Earnings Year-over-Year is an economic indicator that measures the annual percentage change in the average earnings of all non-farm employees in the United States. This data is typically derived from the monthly employment reports released by the US Bureau of Labor Statistics. Average earnings include wages and salaries, and the YoY comparison helps assess the rate of change in workers’ compensation over a one-year period. Positive growth in Average Earnings YoY is indicative of increasing income levels, while negative growth suggests a decline in average earnings. Policymakers, economists, and investors monitor this indicator for insights into wage trends and their implications for consumer spending and inflation. What to Expect US NFP is the most closely watched employment indicator by traders and policymakers alike. A higher-than-expected read indicates that employment is not slowing down, which poses an upside risk to inflation. This could cause policymakers to keep interest rates higher for longer. This repricing of the future of US monetary policy could be likely to cause weakness in US stocks, and strength in the dollar. The inverse could also be the case. Having said this, participants will also be looking at the average earnings data to see if increased wages are also causing potential upside inflation risks. In comments from Powell and other FOMC officials, they have also noted a refocus back onto the ‘dual mandate’, (which includes employment), so while a slight cooling in the employment situation may be seen as reinforcing dovish Fed bets, too much could go against the other element of the Fed’s dual mandate, and increase recession fears. On the earnings front, notable companies like CrowdStrike Holdings (CRWD), Target (TGT), Ross Stores (ROST), Broadcom (AVGO), Costco (COST), Kroger (KR), MongoDB (MDB), DocuSign (DOCU), NIO Inc. (NIO), and Gap (GPS) are slated to release their quarterly results this week. Here are 5 things to watch this week in the Market. Earnings Still in the public eye are earnings, and while many of the big movers are behind us, we still have some to watch this week. Tuesday before the open Target (TGT) reports and similar to Walmart this name could be a view of things to come. If their foot traffic is decreasing and average purchases have decreased it could be an indicator that the economy is as rosy as some of the numbers say. Broadcom (AVGO) and Costco (COST) report on Thursday after hours and these are important for different reasons. Broadcom recently bought VMware but has promised to hike prices, sometimes by up to 10x the current rate. This could be a huge mistake as many places are looking to push towards open source, or it could end up being a huge benefit like Netflix (NFLX) when they implemented account restrictions. Costco's earnings will be more in the vein of Target in that foot traffic and sales numbers could be important information, especially given the size of their demographic reach. ISM Service PMI On Tuesday we have ISM services PMI which is an indicator of industry expansion or contraction. The last several releases have all been over 50, which indicates expansion but just barely. Given all of the concerns about the economy lately, if this comes in as a miss or under 50, we could see the market start to sell. If this comes in at expectations or over we could see the market start to rally. JOLTS Job Openings The Job openings number is out at 10 am on Wednesday and could provide some short-term volatility to the market. Jobs are often seen as a leading economic indicator so watching how many openings there are could be a further clue about economic health. Also important is to watch for any previous month's revisions that might change the previous outlook on the market. Powell Testifying We have Powell testifying at the Semi-Annual Monetary Policy Report in the House this week as well. He will Speak on Wednesday and Thursday starting at 10 am Eastern. While its unlikely he will say anything incredibly profound during the testimony, he is still the lead Central Banker for the country and what he says about the economic status of the country and his plan for rates could provide some volatility in the market. Non-Farm Payroll Non-farm Employment Change or Non-farm Payrolls for short is due out Friday at 8:30. This is usually regarded as a solid temperature gauge for how the workforce is doing. We are expected to come in 190K jobs but if the last few months are any indication we could be in for a huge beat. The last few times we have beat the market went on to really rally during the day so it's possible this time is no different. The other thing to watch for is if any revisions are made to last month's numbers, as it could be that things aren’t as healthy as they seemed on the surface. There are a couple of areas of interest to me in this market. #1. Is Bitcoin. During bitcoins life its only spent 0.81% of its time above 61,000. Its now 65,000 Even if your not a "crypto guy/gal" its important because its affecting a lot of underlying equites that have bitcoin exposure, I.E. MSTR. #2. SMCI. Add the words "Artificial Intelligence" to any stock and it gets interesting in this market. We had a very successful SMCI trade last week but this is a wild one to trade. Up another 15% pre-market. Keep and eye on this one. Set to join the SP500 it could stil have legs in this monster move. #3. Is NVDA. It's important to note that while this market seems bullet proof and "just goes up", the "Magnificent seven" now comprises 30% of the SP500 market cap! NVDA is the biggest component. It's pretty clear now that, as these seven stocks go, so goes the market. Todays trade docket consists of: All four of our ladder trades, OIl, Bonds, Gold, DIA. SPY/QQQ 4DTE's, DELL, GCT, GOOG, IWM, META, NDX/SPX/Event contract 0DTE's, NVDA, SBUX and possible a few more as the day develops.

Intra-day levels for me: /ES; 5149* (key level its been hitting overnight)/ 5156/ (above 5156 there isn't enough data to venture a level.) 5126/5111/5101/5087 to the downside. /NQ; 18370* (key level or resistance)/18445/18537/18600 to the upside. 18289/18240/18161/18024* (key level) to the downside. Futures are flat this morning as I type this. Good luck on your trading day! Welcome to the month of March! Feb. was a solid month for us even though it seemed like we had to fight for it more than we wanted. Yesterday continued a nice string of wins for us this week. Firstly, we've done 87 earnings trades (not really, but it feels like it) and had a very fortunate run of success with those. We have DELL, ESTC, ZC, SOUN all expiring today and they all look good although DELL may benefit from a roll. We had three 0DTE's yesterday that all went out at max gains. I had $11,500 total capital committed and generated $1,533 in total profits. Scalping did its job for us yesterday with an $1,173 profit. My net liq was up a healthy $7,255 at the close. Futures this morning are pushing us right back to the buy zone. It seems that every time we get a neutral or sell rating technically, its because we have a lack of buyers, not because sellers are in control. PMI will be the big news catalyst for today. We also have Fed's Barkin Speaking before the open Friday 1st March 09:45 ET US S&P Manufacturing PMI February Final The US S&P Manufacturing Purchasing Managers’ Index is an economic indicator that measures the performance of the manufacturing sector. It provides insight into factors such as new orders, production levels, employment, supplier deliveries, and inventory levels. As a diffusion index, a reading above 50 indicates expansion in the sector, while a reading below 50 suggests contraction. The S&P Manufacturing PMI is based on a survey of purchasing managers in the manufacturing industry. What to Expect The markets still seem to think that ‘good news is bad news’ with this report, though it has less weight than its counterpart (The ISM Manufacturing PMI, detailed below) Nonetheless, this means that if the manufacturing PMI comes in above expectations, especially in expansionary territory (50+), then stocks are likely to weaken, and the dollar is likely to strengthen. This is because it is seen as an upside inflation risk, as it indicates there is still strong demand for manufactured goods, despite high interest rates. Morgan Stanley note that the 0.8 point rise in the S&P manufacturing index to 51.5 in February (P) was broad-based, with increases in indexes of output, new orders, and employment from levels already above 50, along with improved supplier deliveries. The overall index was at its highest since September 2022. 10:00 ET US ISM Manufacturing PMI for February The US ISM Manufacturing Purchasing Managers’ Index measures the economic activity and sentiment of manufacturing sector managers. It assesses factors like new orders, production, employment, supplier deliveries, and inventories. The index is compiled from a survey of purchasing managers as a diffusion index, with a reading above 50 indicating expansion and below 50 indicating contraction. The US S&P Manufacturing PMI also measures manufacturing sector activity but uses a different methodology and survey structure. While both PMIs aim to gauge the health of the manufacturing sector, they may differ in their coverage, sample size, and methodology, leading to variations in the reported figures. What to Expect The markets still seem to think that ‘good news is bad news’ with this report. This means that if the manufacturing PMI comes in above expectations, especially in expansionary territory (50+), then stocks are likely to weaken, and the dollar is likely to strengthen. This is because it is seen as an upside inflation risk, as it indicates there is still strong demand for manufactured goods, despite high interest rates. “The sector faces ongoing headwinds from high-interest rates, heightened economic uncertainty and expenditure switching towards services.” Unicredit noted. “Supply-chain disruption in the Red Sea may show up as a lengthening of suppliers’ delivery times and higher input price pressures.” Societe Generale noted that they look for a decline in the orders component, offset by gains throughout the other components. University of Michigan Sentiment February Final The University of Michigan Consumer Sentiment Index, often referred to as the Consumer Sentiment Index or just Consumer Sentiment, is a widely followed economic indicator that measures the confidence of American consumers in the state of the economy. It is based on a survey conducted by the University of Michigan, which gathers data on consumers’ attitudes and expectations regarding their personal finances, business conditions, and overall economic outlook. The index is released monthly and is considered a leading indicator of consumer spending, as confident consumers are more likely to spend money on goods and services, driving economic growth. What to Expect Consumer sentiment is closely watched by markets to assess consumer resilience in a high-interest-rate environment. Elevated sentiment may suggest strong demand, potentially leading to inflationary pressures, but it could also signal consumer resilience, reducing recession fears. In this release, the market focus is on the 1 & 5-year inflation expectations accompanying the sentiment data. Higher inflation expectations may delay Fed rate cuts, affecting US stocks negatively and strengthening the dollar. “Moderate numbers from the Fed’s preferred inflation gauge may lower temperatures after ‘hot’ CPI and PPI readings a couple of weeks ago. While rate cuts are still unlikely until the second half of the year,” said Chris Larkin, managing director for trading and investing at E*Trade from Morgan Stanley. Atlanta Fed President Raphael Bostic said Thursday that if the economy evolves as he expects, it will likely be appropriate for the U.S. central bank to begin interest rate cuts in the summer. Also, San Francisco Fed President Mary Daly said that policymakers stand prepared to reduce interest rates as needed but stressed that there’s currently no immediate need for cuts given the robustness of the economy. In addition, Cleveland Fed President Loretta Mester said Thursday’s inflation data indicated that central bank officials have more work to do to cool price pressures, but she maintained her expectation that the Fed will implement three interest rate cuts this year. Meanwhile, U.S. rate futures have priced in a 3.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting and a 25.2% chance of a 25 basis point rate cut at the May FOMC meeting. Our bond ladder looks to come in, spot on for the week with about $550 dollars of cash flow. $2,000/mon. in cashflow is the goal. Markets overall look pretty healthy here: We continue to consolidate around the ATH's on most indices: Intra-day levels for me:

/ES; 5103/5116* (key level. yesterdays high)/5127/5138 to the upside. 5094/5082/5071/5059*(key level. low of day yesterday) to the downside. /NQ; 18162* (key level. yesterdays high)/18273/18376/18557 to the upside. 18035/17954/17897/17850* (key level. Yesterdays low) to the downside. Trade docket today: /MNQ, KODK?, /MCL, /ZN?, GOOG, IWM, META, SPX/NDX/Event contract 0DTE's, SPY/QQQ, NVDA, DELL, ESTC, ZC, SOUN, WYNN?, /ZC?, /ZW?, FSR, DWAC, VKTX, PLUG? Have a great weekend all! |

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |