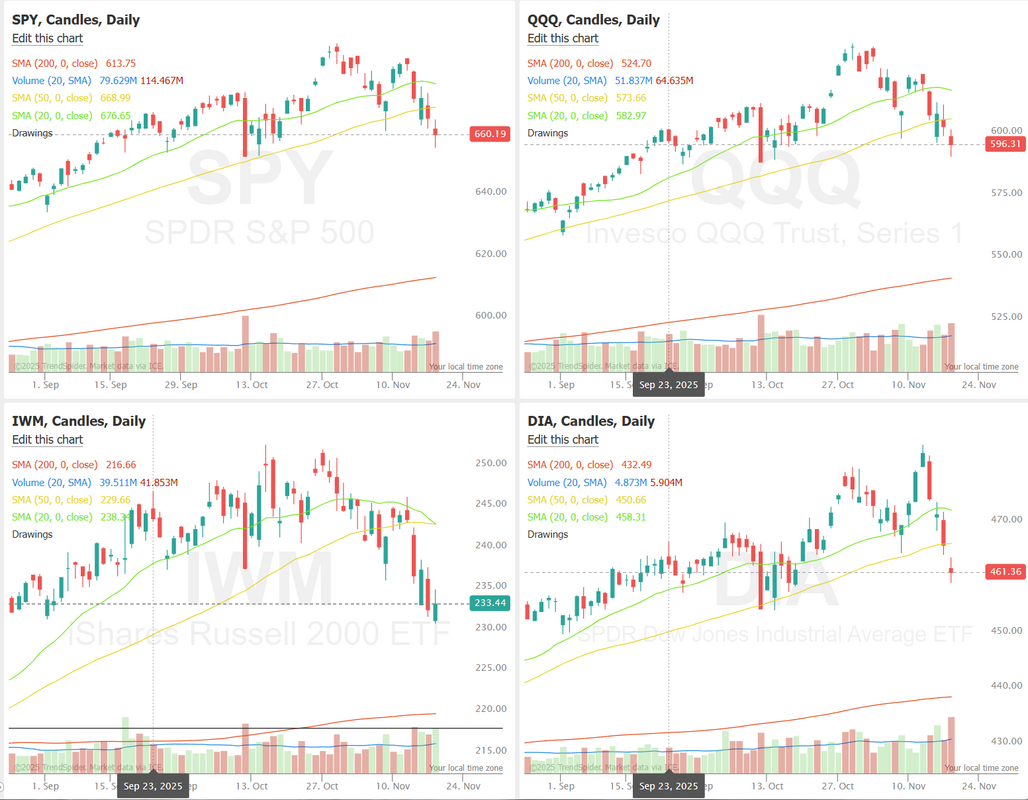

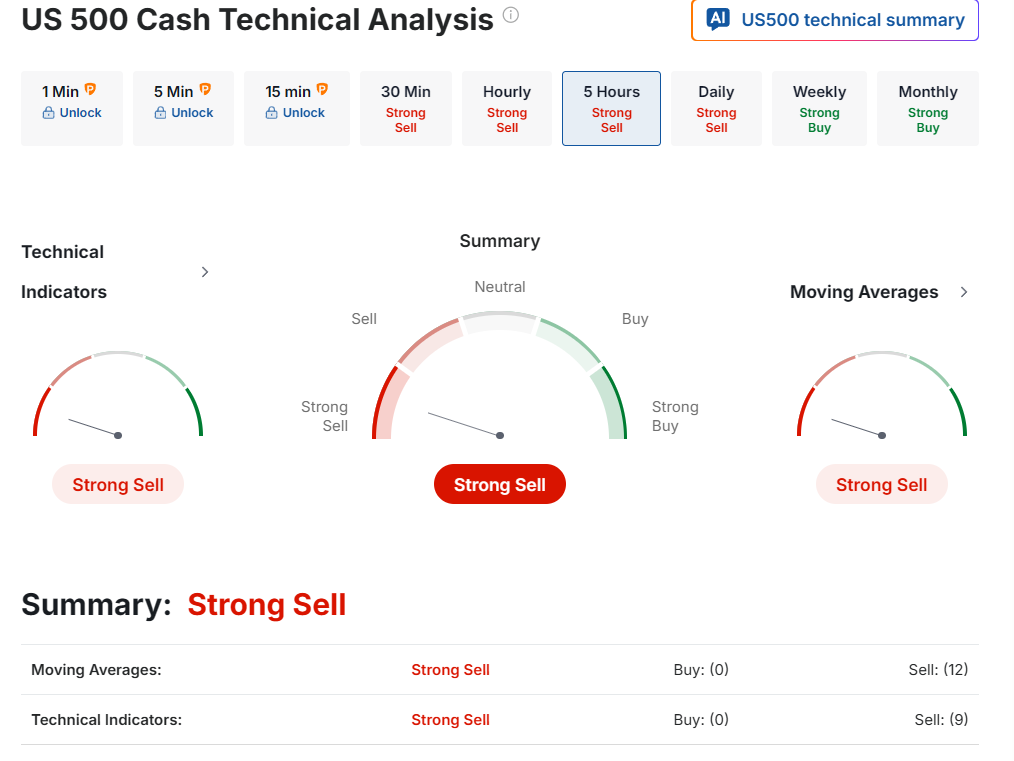

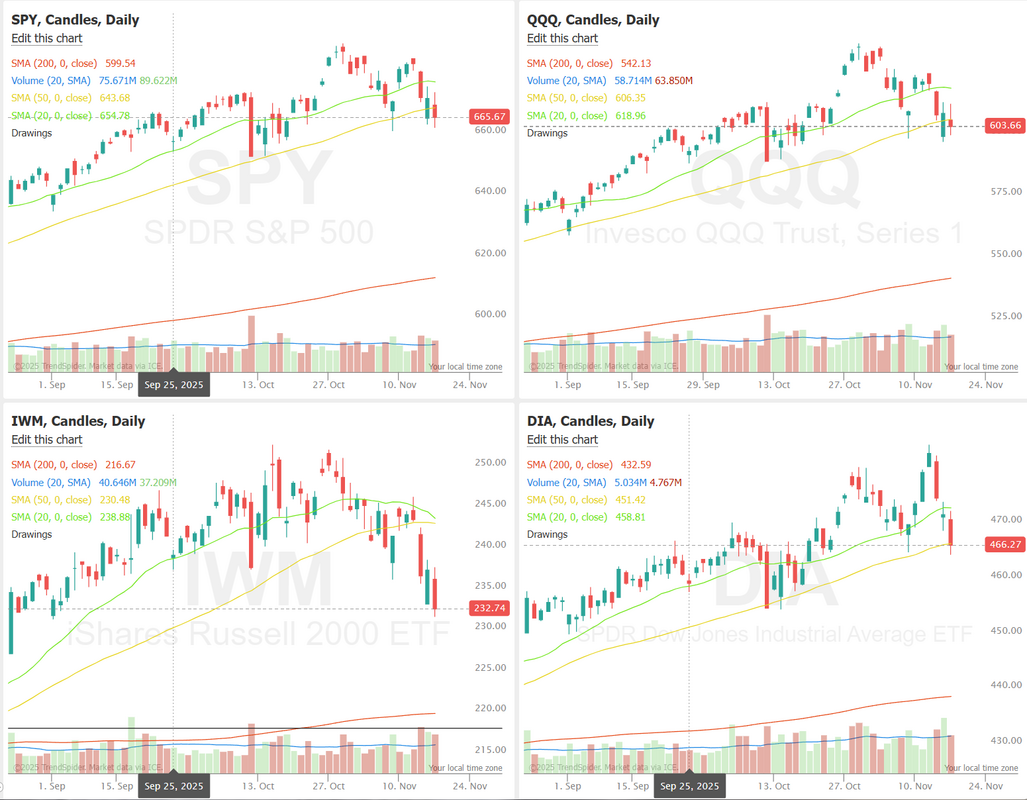

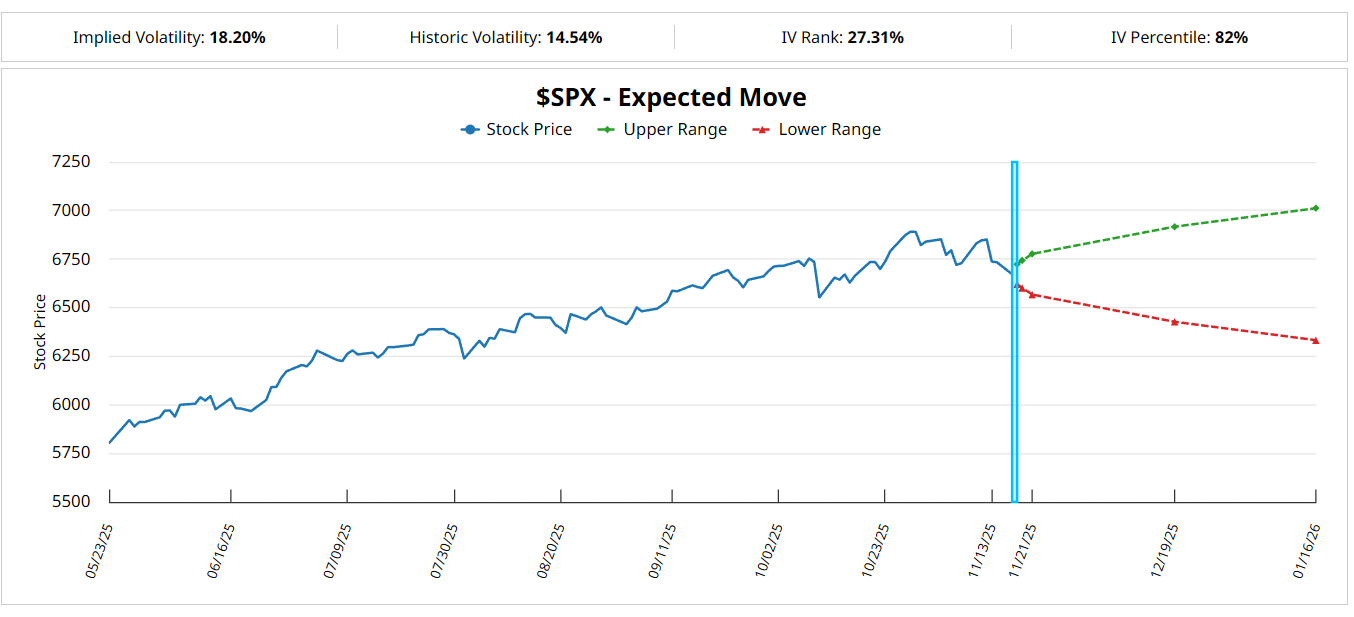

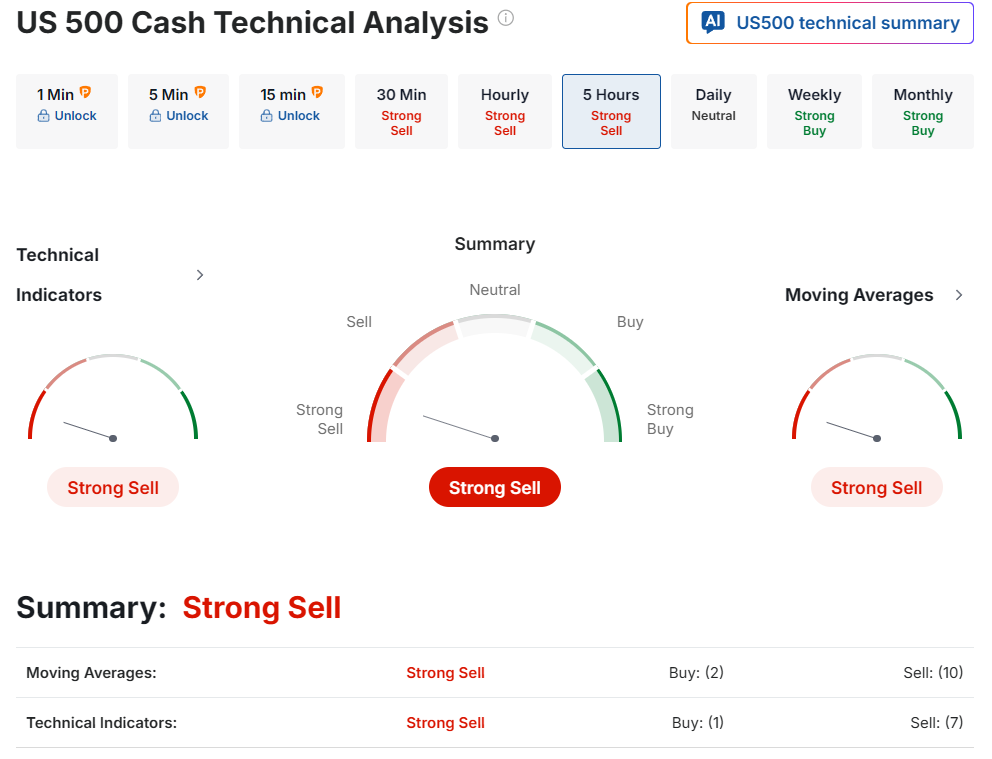

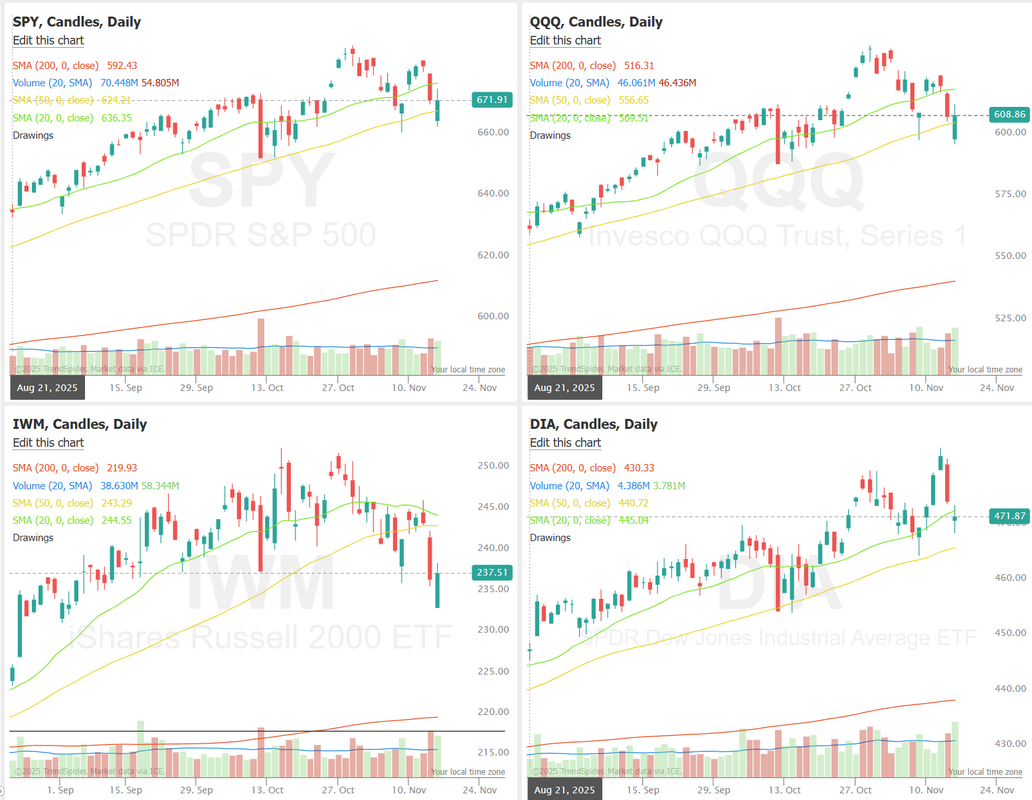

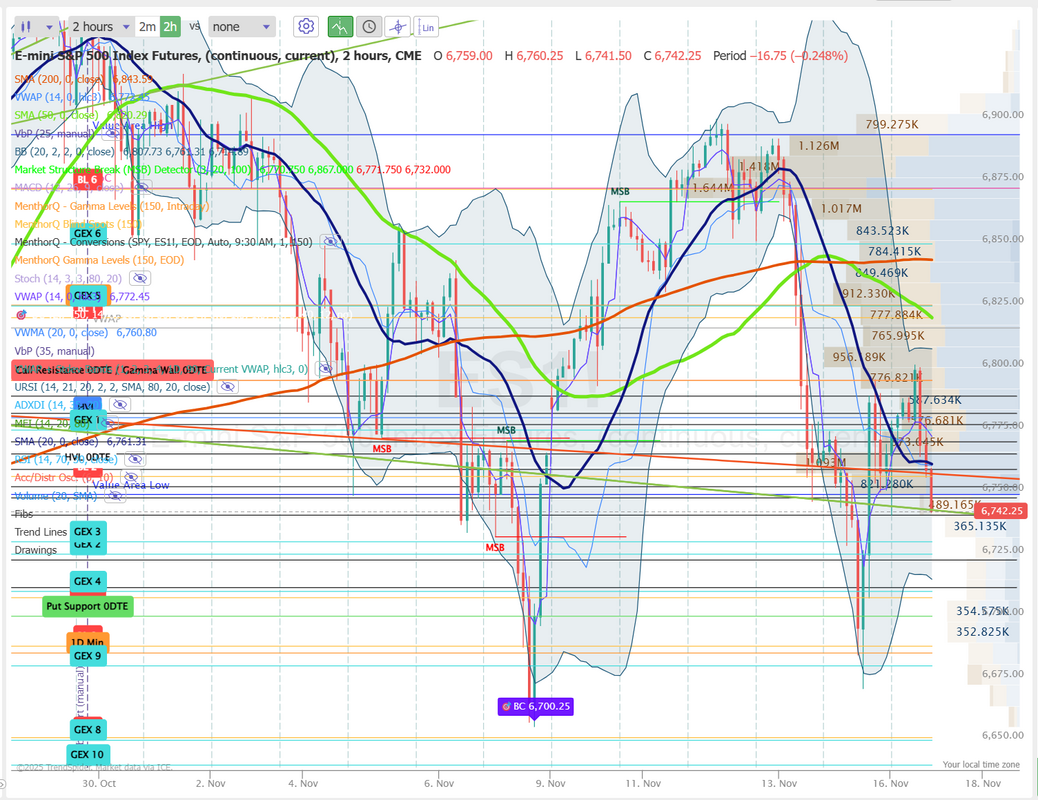

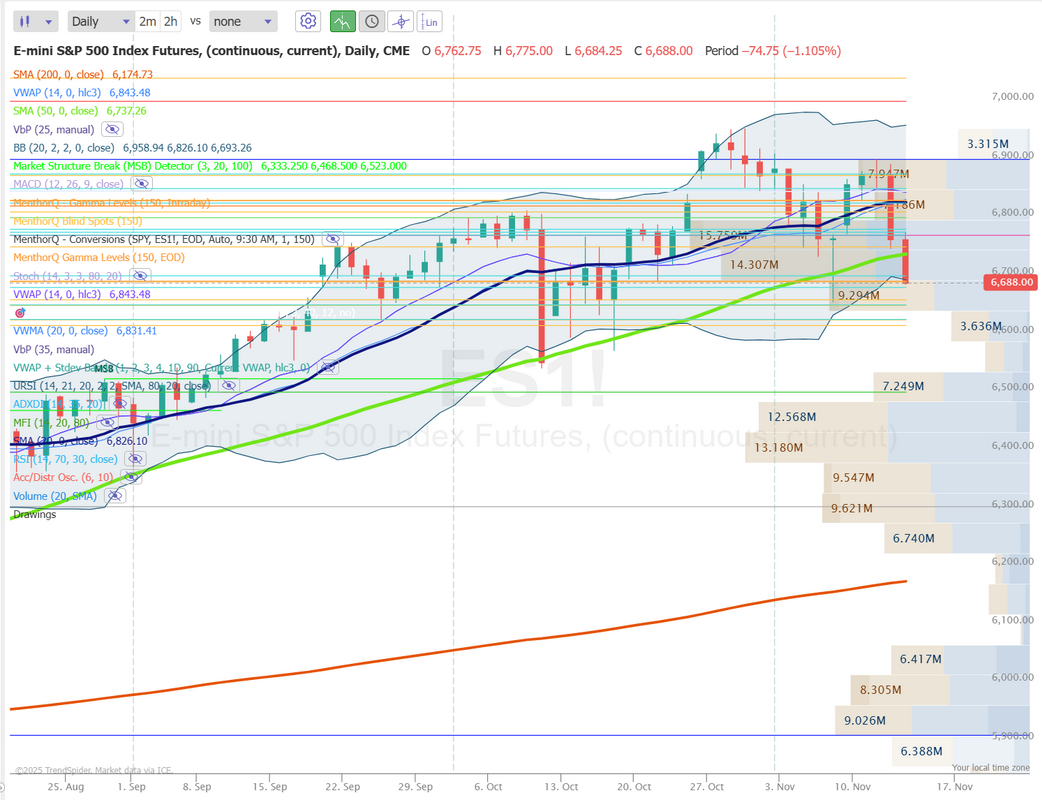

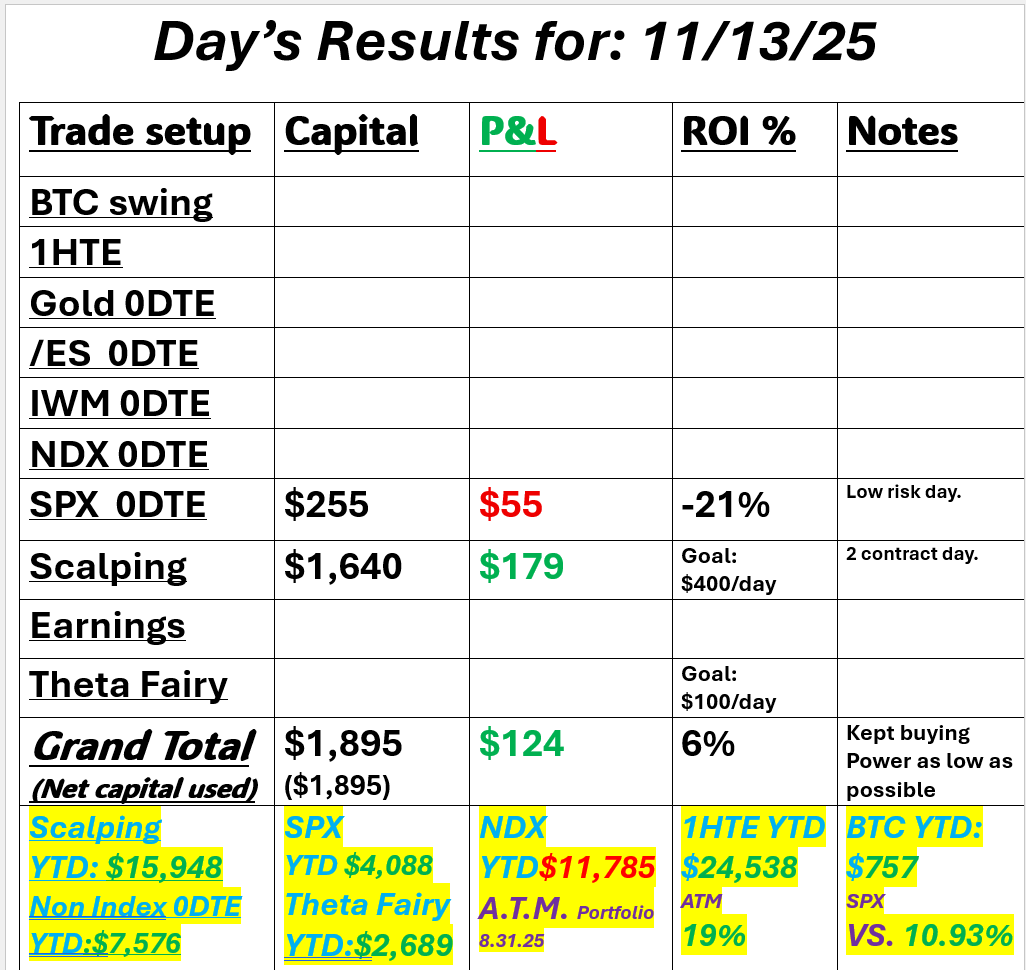

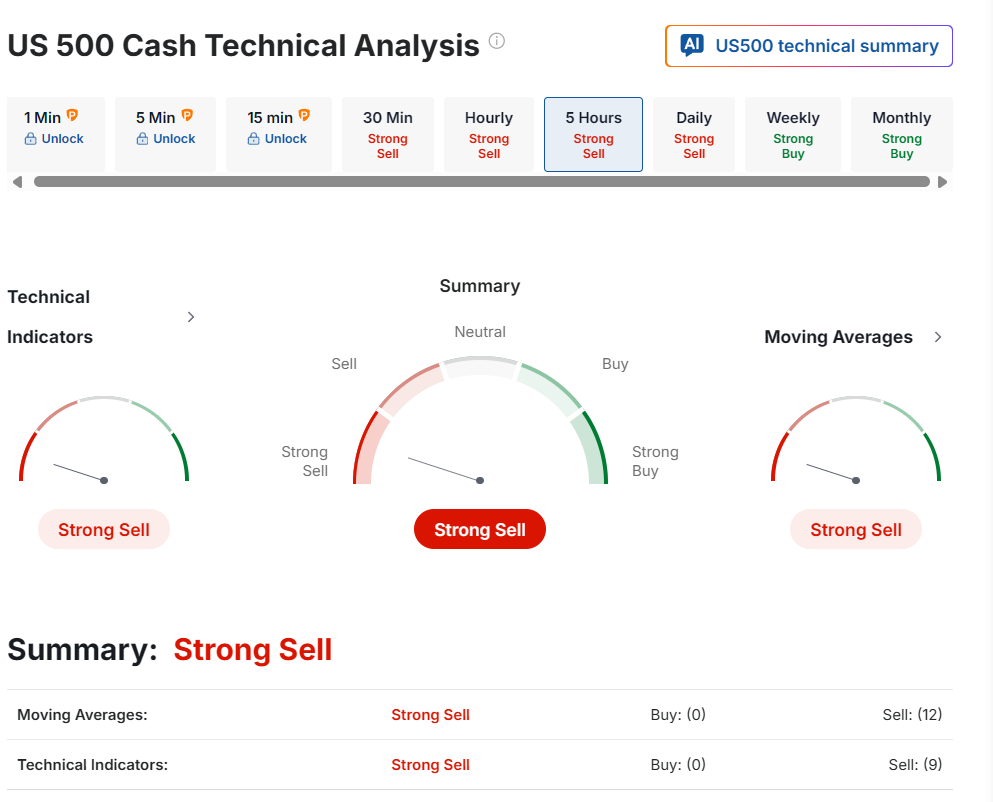

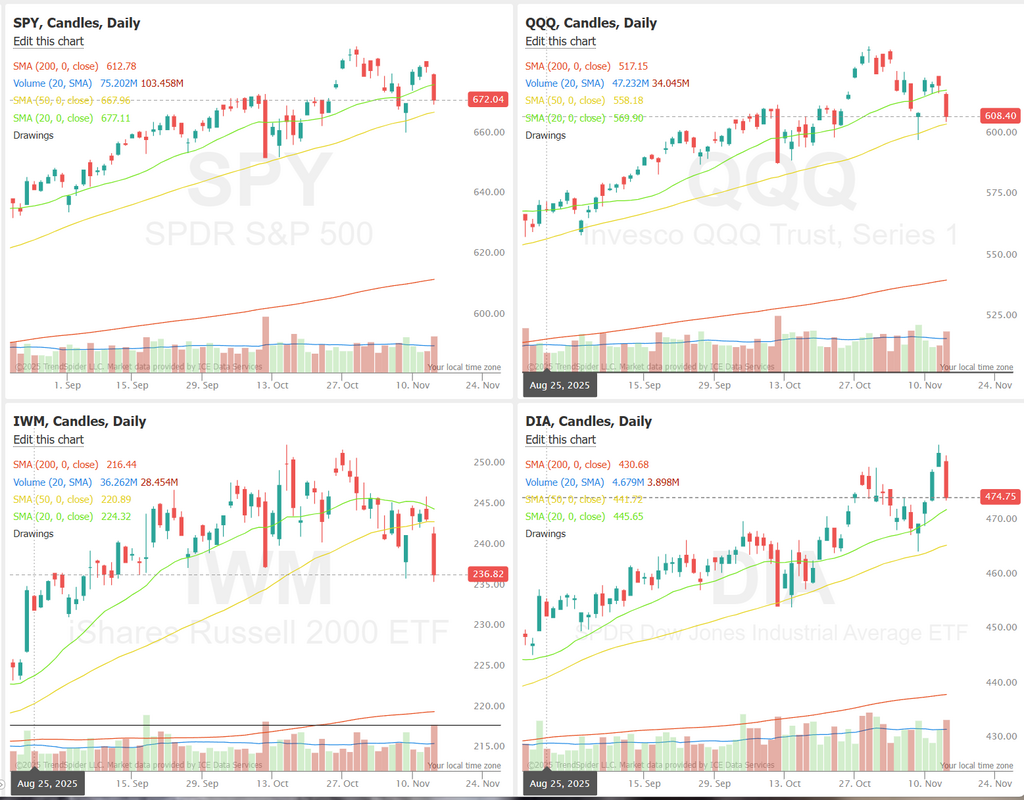

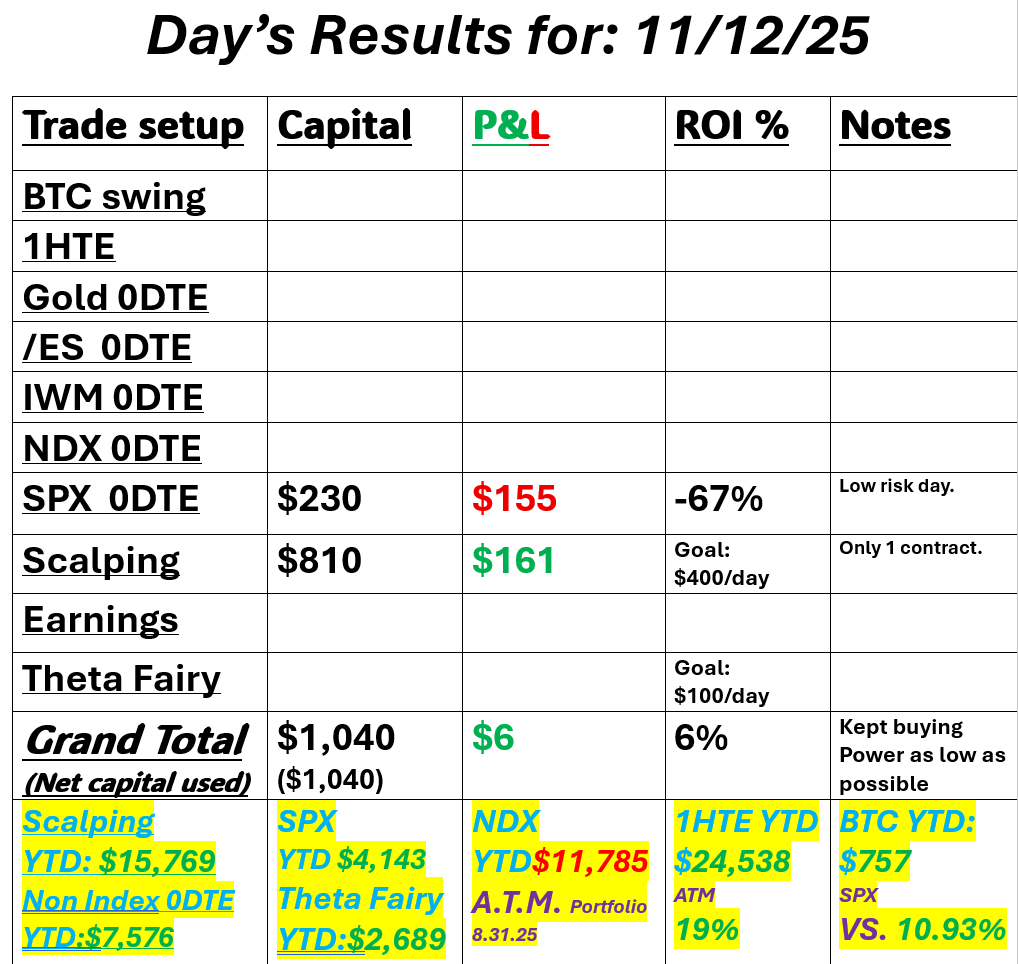

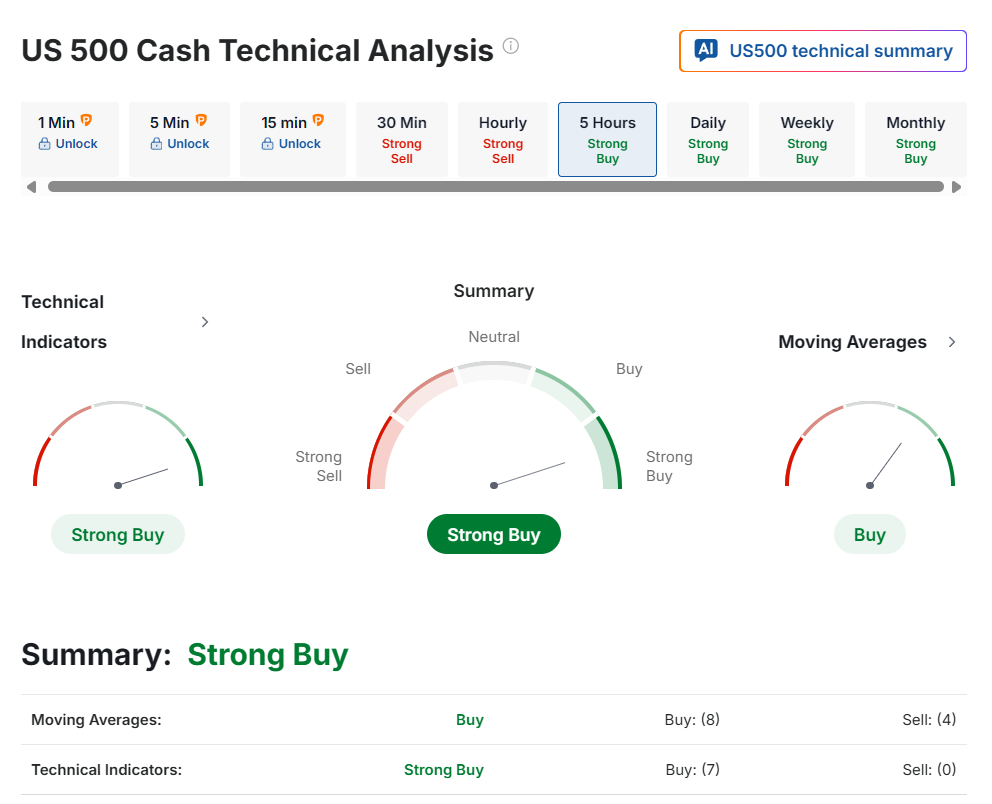

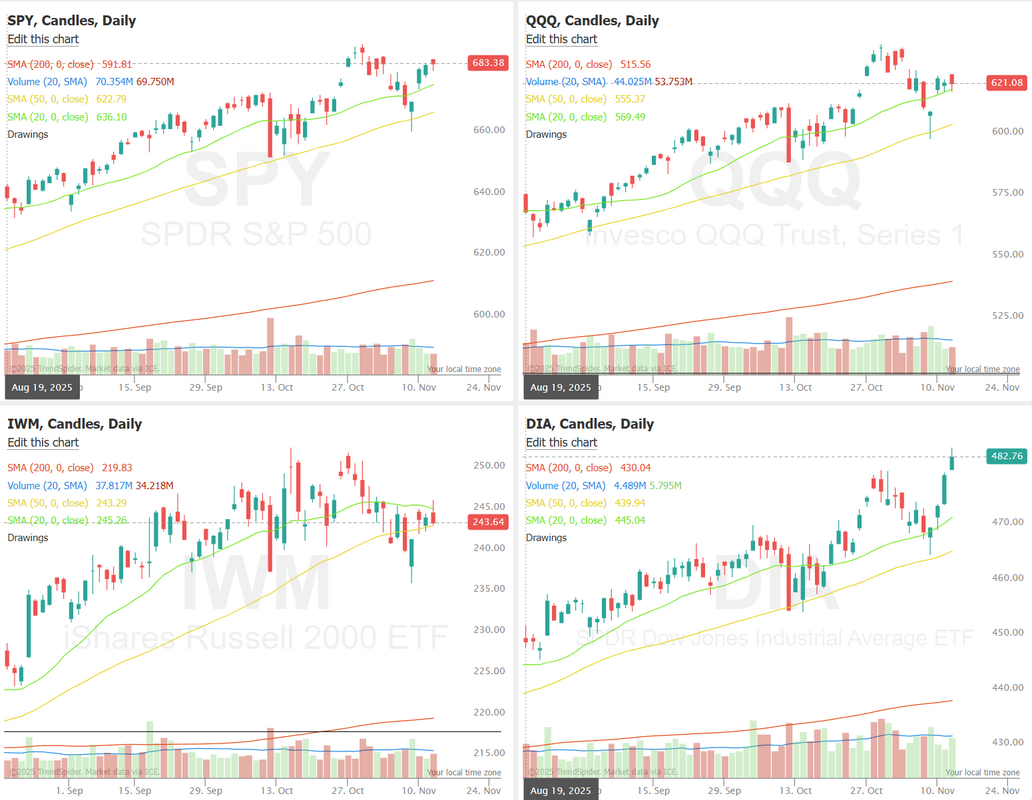

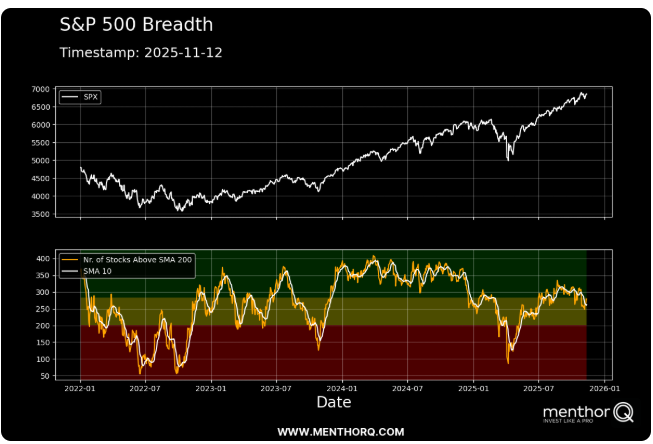

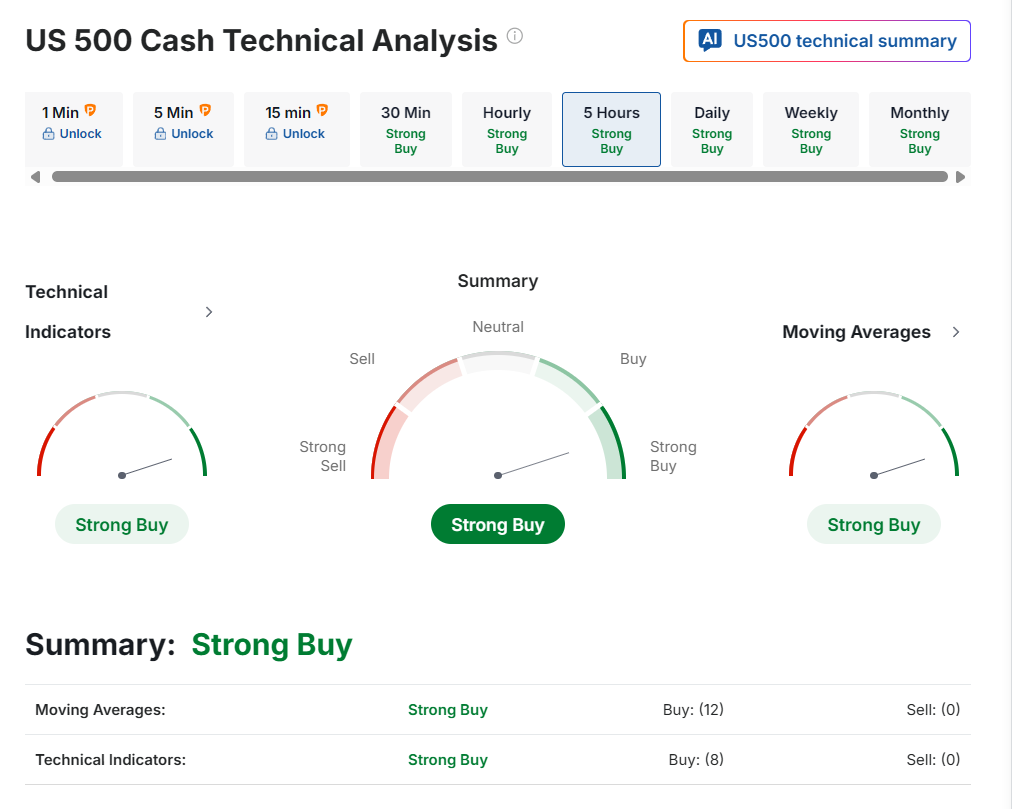

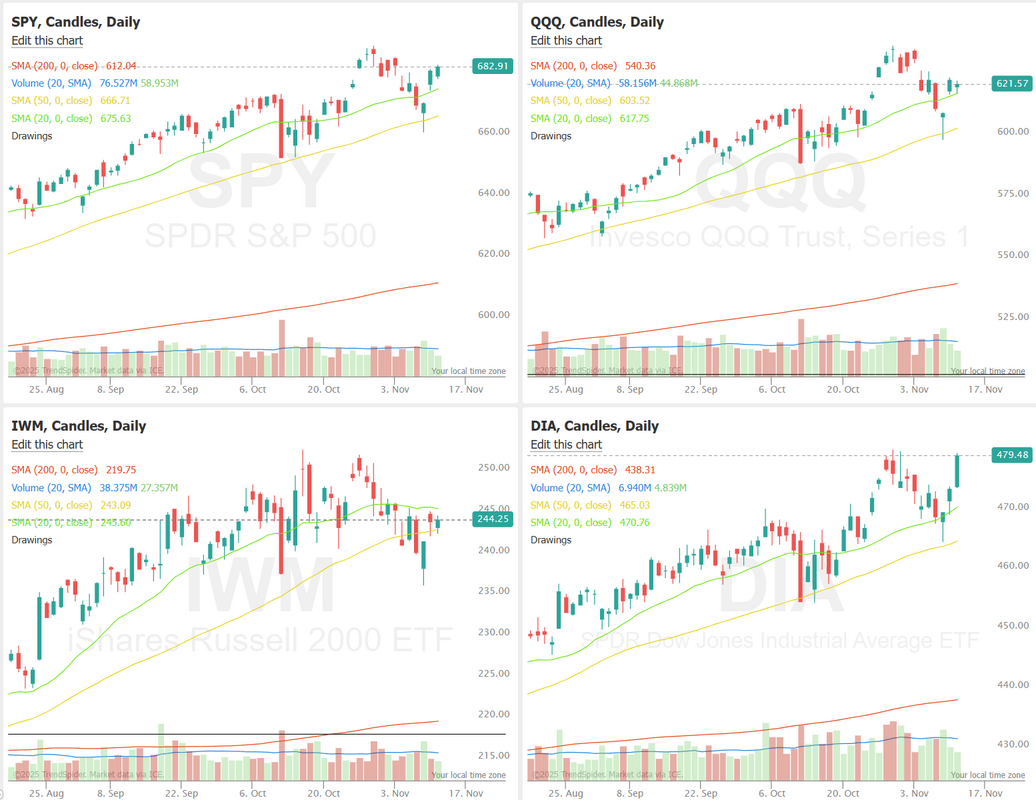

Bulls are trying.Two days of any type of movement does not make a trend, but the bulls are certainly trying here to regain some ground. We had a gap-up day yesterday after a decent green day last Friday. The vaunted 50DMA is now back in play. That's the big focus for today. Can the SPY and QQQ reclaim those respective levels? It's not a particularly easy task to break through (up or down). I went 0-2 yesterday on my SPX 0DTE's. The second one was set to put us in a position to finish green but missed . Close but no cigar. We had a solid training session yesterday on reflexivity. Tomorrow we'll be training on the book Manias, Panics, and Crashes by Charles P. Kindleberger December S&P 500 E-Mini futures (ESZ25) are trending down -0.12% this morning as investors brace for a flood of U.S. economic data, with particular attention on the retail sales report and producer inflation figures, to assess whether optimism about a potential Federal Reserve rate cut in December can hold up. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. The Magnificent Seven stocks advanced, with Tesla (TSLA) and Alphabet (GOOGL) climbing over +6%. Also, semiconductor stocks rallied, with Broadcom (AVGO) surging more than +11% to lead gainers in the S&P 500 and Nasdaq 100, and Micron Technology (MU) rising about +8%. In addition, Inspire Medical Systems (INSP) jumped more than +30% after Stifel and Nephron Research upgraded the stock to Buy from Hold. On the bearish side, Frontline Plc (FRO) slid over -3% after Clarksons Securities downgraded the stock to Neutral from Buy. “I believe the combination of a reset of the equity market and the increased odds of a rate cut in December has propelled stocks higher and put the year-end melt-up back on the table,” said Chris Murphy, Susquehanna International Group’s co-head of derivatives strategy. Fed Governor Christopher Waller said on Monday he’s backing a rate cut in December. “My concern is mainly the labor market, in terms of our dual mandate. So I’m advocating for a rate cut at the next meeting,” Waller said on the Fox Business Network. “You may see more of a meeting-by-meeting approach once you get to January.” San Francisco Fed President Mary Daly told the Wall Street Journal that she supports cutting interest rates next month, saying a sudden weakening in the labor market is both more probable and more difficult to manage than a resurgence in inflation. U.S. rate futures have priced in an 80.9% probability of a 25 basis point rate cut and a 19.1% chance of no rate change at the December FOMC meeting. Today, all eyes are focused on the U.S. Retail Sales report for September, which is set to be released in a couple of hours. The report was originally scheduled for release on October 16th, but was delayed due to the government shutdown. Economists, on average, forecast that Retail Sales will show a +0.4% m/m increase in September following a +0.6% m/m gain in August. Investors will also focus on U.S. Core Retail Sales data, which climbed +0.7% m/m in August. Economists expect the September figure to rise +0.3% m/m. The U.S. Producer Price Index for September will be closely monitored today. The PPI was originally scheduled for release on October 16th, but was delayed due to the shutdown. Notably, the PPI will be one of the final inflation readings the Fed sees before its rate decision in December. Economists forecast that the U.S. September PPI will stand at +0.3% m/m and +2.7% y/y, compared to the August figures of -0.1% m/m and +2.6% y/y. The U.S. Core PPI will also be released today. Economists expect September figures to be +0.2% m/m and +2.7% y/y, compared to August’s numbers of -0.1% m/m and +2.8% y/y. The U.S. Conference Board’s Consumer Confidence Index will come in today. Economists anticipate that the November figure will stand at 93.5, compared to last month’s value of 94.6. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the September figure to ease to +1.4% y/y from +1.6% y/y in August. U.S. Pending Home Sales data will be released today as well. Economists forecast the October figure at +0.5% m/m, compared to the previous figure of 0.0% m/m. Meanwhile, the Commerce Department said on Monday it will release its initial estimate of third-quarter gross domestic product on December 23rd. The agency will not publish third-quarter GDP in its usual sequence of three successive estimates. Instead, there will be only two third-quarter GDP estimates, including the delayed second review of the data set for just before Christmas, and a final estimate that has not yet been scheduled. On the earnings front, notable companies like Analog Devices (ADI), Dell Technologies (DELL), Autodesk (ADSK), Workday (WDAY), Zscaler (ZS), and HP Inc. (HPQ) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.030%, down -0.12%. Let's take a look at the markets: Technicals are back to buy mode. Can bulls keep it going up against the 50DMA? We should find out today. I've talked about the daily stoic a lot in our trading room. This is todays message. I thought I'd pass it along. It's good stuff that can make us all better. My lean or bias today is tentatively bullish. It may be a bit too much to ask that we just push through the 50DMA in one fell swoop but the bulls are trying. The latest SPX momentum score shows a meaningful loss of short-term strength, with the indicator slipping to the lower end of its recent range even as price attempts a modest rebound. This divergence suggests the index is still working through a period of fading follow-through after several weeks of choppy movement. In the near term, traders may want to watch whether the score can recover back above the mid-range (around 3–4), which has historically aligned with steadier upside attempts. Until momentum re-accelerates, the setup still leans toward a cautious, range-bound environment where upside probes may lack conviction and dips could remain vulnerable to retests of recent lows, without this being a forecast or advice. The data backlog is starting to unwind. Tuesday

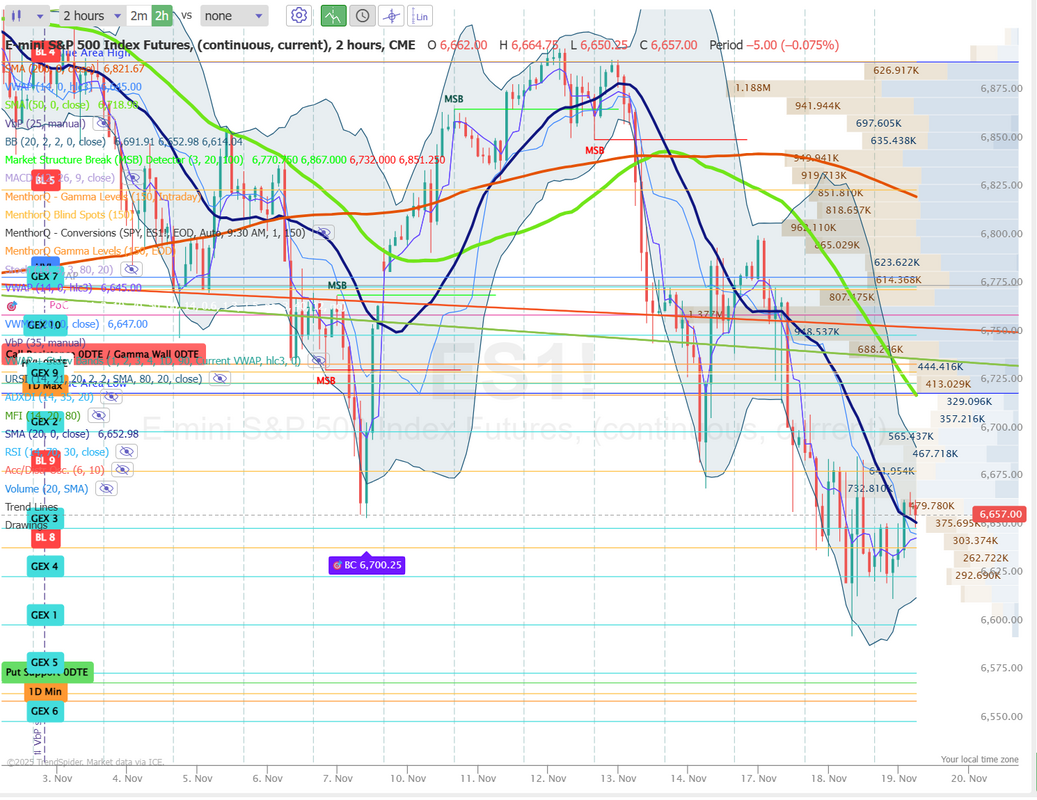

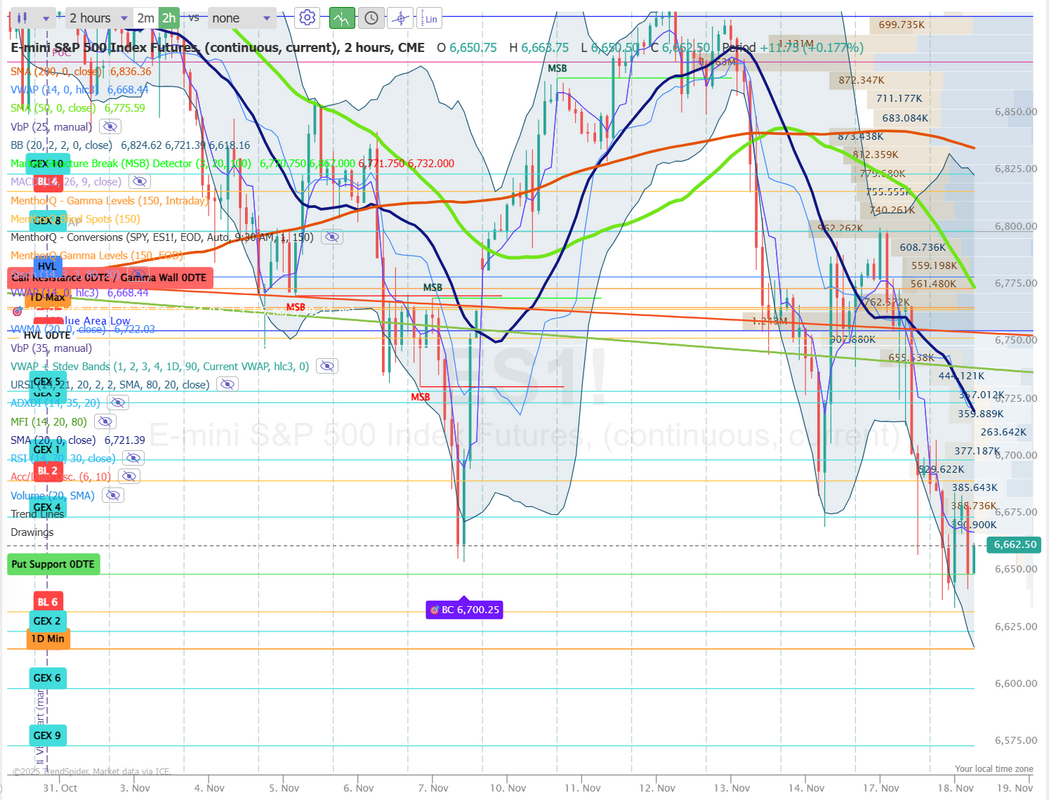

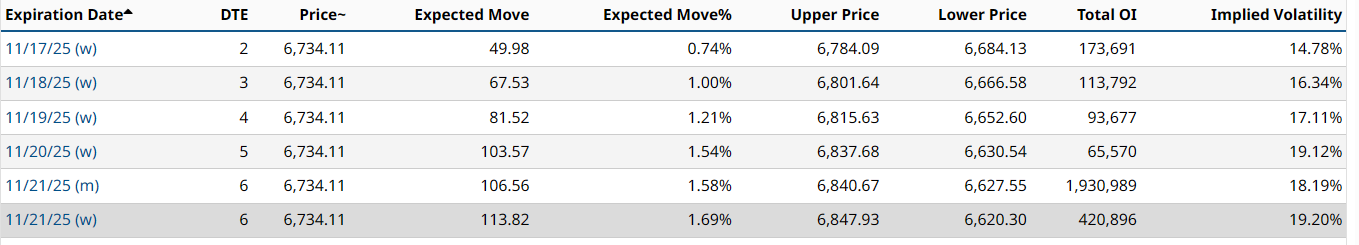

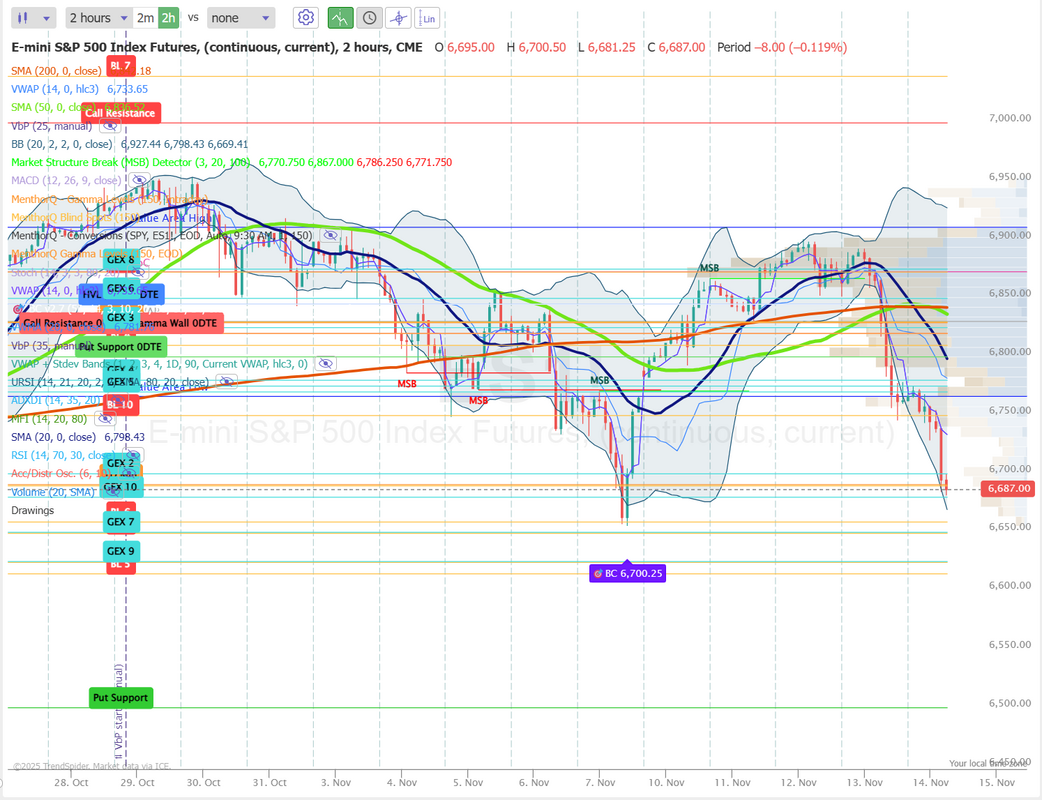

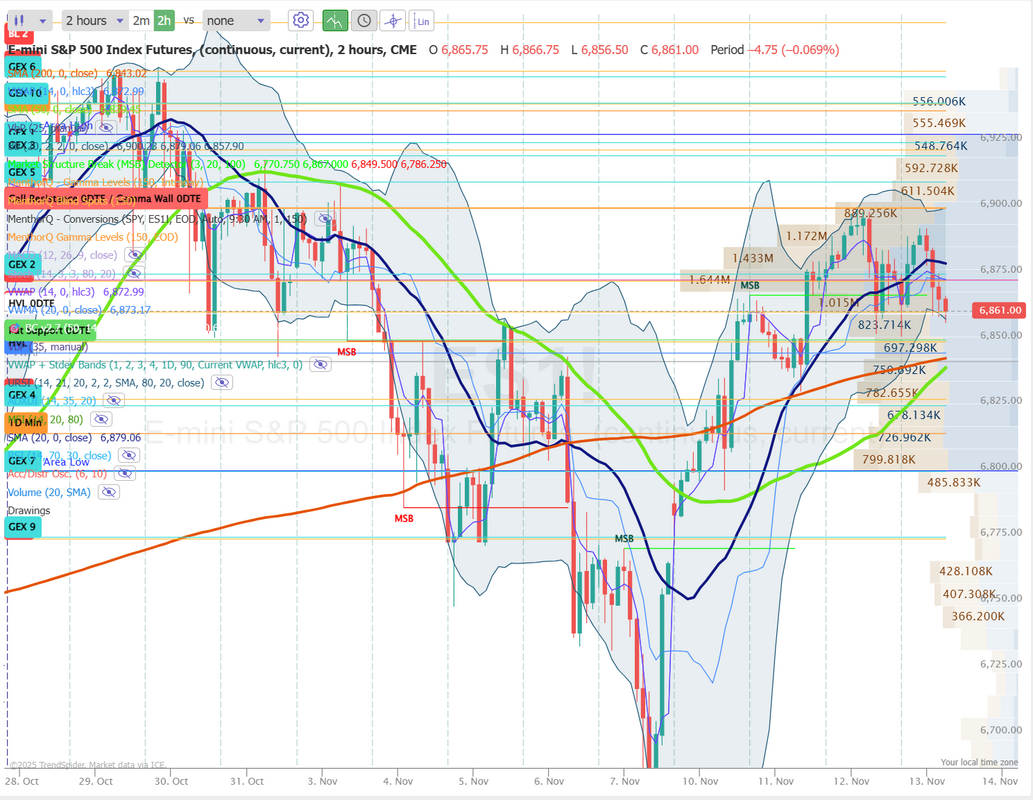

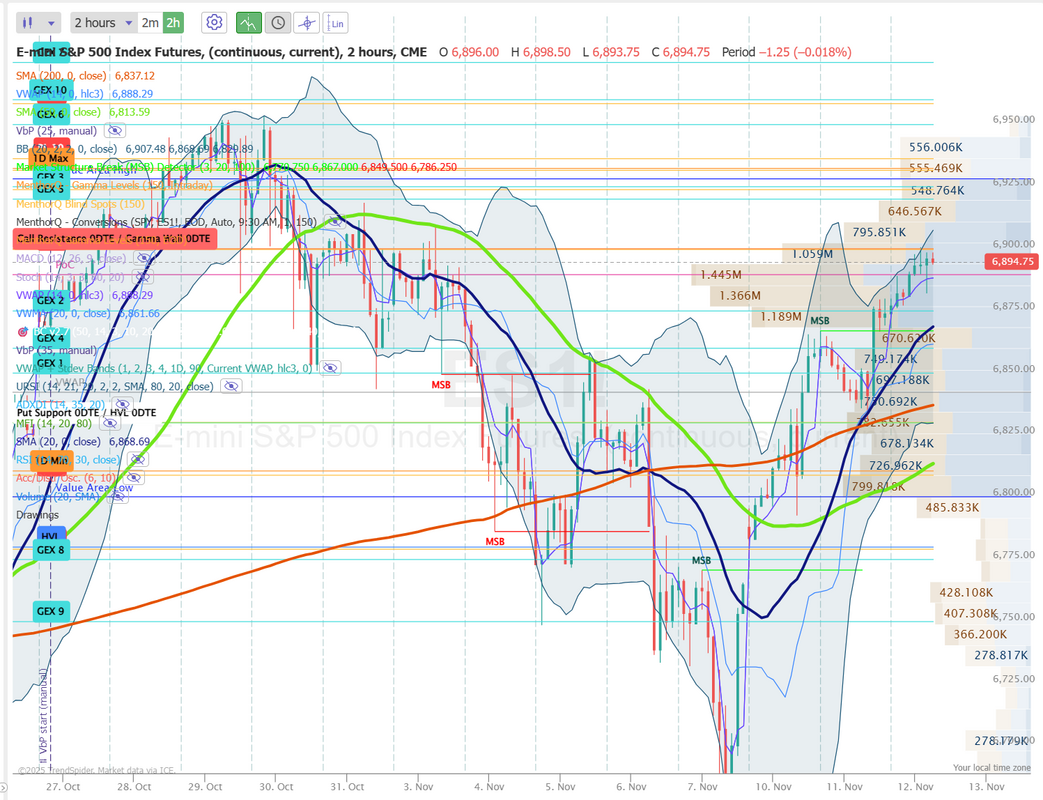

In spite of the last two bullish days there is still plenty of worry out there. That is keeping premium in line. Let's take a look at the intraday /ES levels. 6733, 6750, 6761, 6765* ( 200PMA), 6776, 6790 are resistance levels. 6711, 6699, 6684, 6670, 6654 are support. Let's get back on track today! I'll see you all in the live trading room shortly!

0 Comments

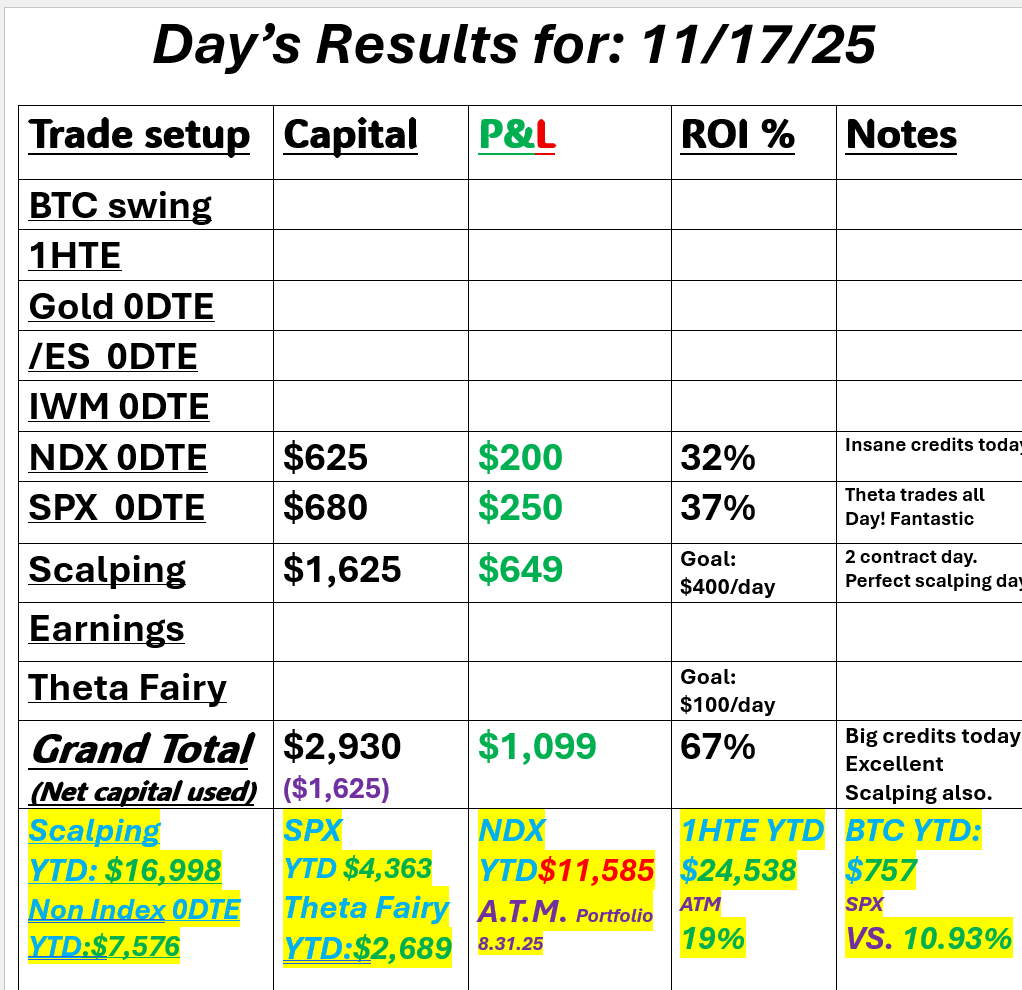

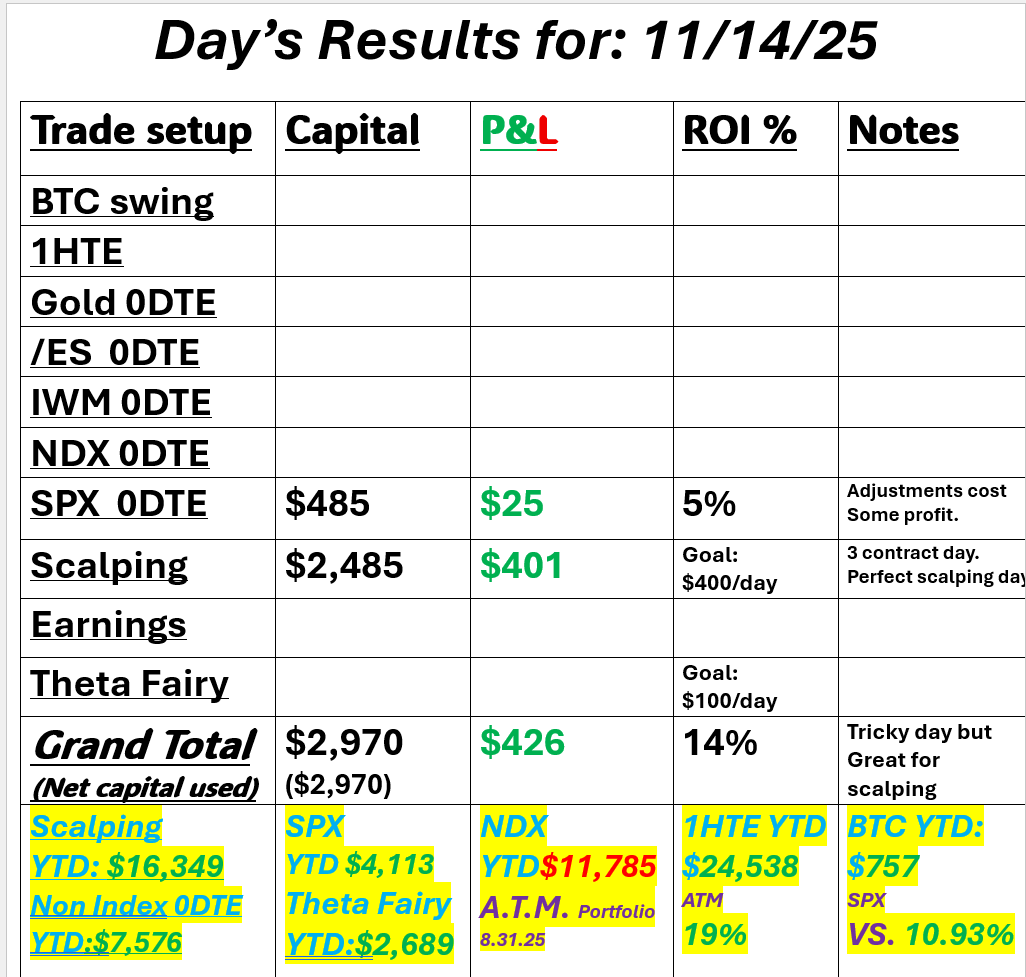

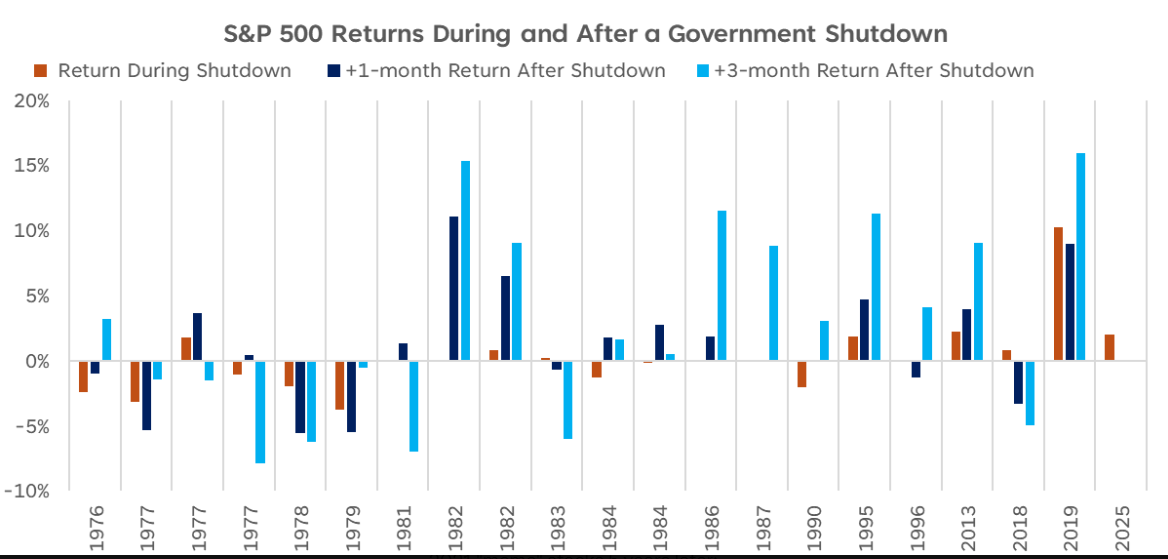

Yea or nay?First of all, welcome back! I hope you all had a great weekend. We are into week two now at the Stewart household with our new foster dog and at nearly 60 years old I'm not sure I know what I'm doing! These shelter dogs come with so much trauma. Some traders lately seem to be experiencing trauma with this crazy market! One big recommendation I will make it to find a community of traders you can be a part of. I'd obviously love to see you in ours but if not, find one that can support you. It's never a great idea to trade alone. We traded small again on Friday, out of caution. On crazy, unpredictable days some traders will choose to simply not participate. I prefer to stay in the game but downsize trade size. It allowed us to pull a profit on the day, albeit small. Here's a look at our day: Let's take a look at the markets: We start this holiday shortened week with a neutral technical rating, thus my title of "Yay or nay?" Are we really starting a verified bearish trend or is this just another "buy the dip" opportunity? It seems like it's too early to tell however I was surprised to see that the current downtrend has now been in place since the top of Oct. 29th for the SPX. This bearish move is almost a month long now. December S&P 500 E-Mini futures (ESZ25) are up +0.19%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.39% this morning as investors gear up for a week of key U.S. economic data amid growing expectations for a Federal Reserve interest rate cut next month. Lower bond yields today are supporting stock index futures. Treasury yields slipped as traders bet that delayed economic reports coming this week would strengthen the case for a Fed rate cut in December. In Friday’s trading session, Wall Street’s major equity averages closed higher. Ross Stores (ROST) climbed over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the off-price retailer posted upbeat Q3 results and raised its full-year earnings guidance. Also, most chip stocks advanced, with GlobalFoundries (GFS) rising more than +5% and ON Semiconductor (ON) gaining over +4%. In addition, Intuit (INTU) rose more than +4% after the maker of TurboTax reported stronger-than-expected FQ1 results. On the bearish side, Veeva Systems (VEEV) slumped over -9% after the cloud software provider reported weaker-than-expected Q3 adjusted gross margin. “It’s hard to call a bottom to the correction, but if the better bets on a December Fed cut come through, we will likely have a material rebound in December,” said Louis Navellier at Navellier & Associates. Economic data released on Friday showed that the U.S. S&P Global manufacturing PMI fell to 51.9 in November, slightly weaker than expectations of 52.0, while the S&P Global services PMI unexpectedly rose to 55.0, stronger than expectations of 54.6. Also, the University of Michigan’s U.S. November consumer sentiment index was revised higher to 51.0, stronger than expectations of 50.6. New York Fed President John Williams said on Friday he sees scope for the central bank to cut interest rates again in the near term as the labor market weakens. At the same time, Boston Fed President Susan Collins signaled that keeping interest rates on hold would be “appropriate for now,” as inflation is likely to remain elevated for some time. In addition, Dallas Fed President Lorie Logan said, “With two rate cuts now in place, I’d find it difficult to cut rates again in December unless there is clear evidence that inflation will fall faster than expected or that the labor market will cool more rapidly.” U.S. rate futures have priced in a 75.5% chance of a 25 basis point rate cut and a 24.5% chance of no rate change at the conclusion of the Fed’s December meeting. As uncertainty around the Fed’s December interest rate decision remains high, investors will continue to scrutinize economic data. In this holiday-shortened week, market watchers will closely monitor the September Retail Sales report, wholesale-focused Producer Price Index, and Durable Goods Orders data. The data were delayed by the recent government shutdown and were originally scheduled for release in October. Other noteworthy data releases include the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., Pending Home Sales, Initial Jobless Claims, the Richmond Fed Manufacturing Index, and the Chicago PMI. Notably, the Bureau of Economic Analysis has rescheduled two releases that were originally set for publication this week after the shutdown, including the second estimate of Q3 gross domestic product and the October PCE Price Index. Investors will also focus on earnings reports from several high-profile names. Prominent companies such as Dell Technologies (DELL), HP Inc. (HPQ), Analog Devices (ADI), Deere & Company (DE), Workday (WDAY), Agilent Technologies (A), Keysight Technologies (KEYS), and Zscaler (ZS) are scheduled to release their quarterly results this week. In addition, the Fed will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Fed districts. The report will likely underscore weakness in employment and activity. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. Meanwhile, the U.S. stock markets will be closed on Thursday in observance of the Thanksgiving Day Holiday. Also, the stock markets will close early on Black Friday, with trading ending at 1 p.m. Eastern Time. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.047%, down -0.39%. Our schedule this week is truncated with the holiday. Mon., Tues., Weds. will be normal Thurs. we are off and Friday we will provide any necessary updates to the ATM portfolio as well as an attempt to grab a quick 0DTE on SPX before the early close. Todays training session comes from George Soros book, "The Alchemy of finance" with a primary focus on his theory or reflexivity. Come join us on our live zoom feed. There is still a large volume profile vacuum directly below current pricing. With any future weakness we could easily see a 150+ point downside move in the SPX SPY closed the week down at $659.03 (-1.92%), as price pressed against the lower Bollinger Band. The Combined RSI Ensemble also printed a green oversold candle as SPY tested its October 10th low. With clear evidence of rotation into safety and major support levels under pressure, buyers will need to show up quickly to prevent this pullback from developing into a deeper trend shift. Tech took the biggest hit last week as QQQ finished in the red at $590.07 (-3.07%). The gap between the fast and slow lines of the ADT (Lower) Indicator is widening quickly, although both still sit above zero, suggesting the broader bullish trend remains intact but is starting to show early signs of weakness. With price testing its October low, traders are watching to see whether this level provides support or if the rotation into safety gains momentum. The SPX long/short volatility barometer continues to drift higher off its late-summer lows, signaling a gradual shift toward a more defensive short-term volatility stance. While the SPX itself has pulled back from recent highs, the barometer’s rise suggests traders are becoming more sensitive to downside swings and may be looking to hedge more actively. In the near term, this uptick in volatility appetite often aligns with choppier price action, especially when the indicator pushes toward the upper end of its recent range. The key to watch now is whether the barometer keeps climbing, which would point to growing demand for long-vol exposure or fades back toward its lows, which would hint at stabilizing sentiment. Volatility is still elevated, in spite of Fridays green day and futures being up this morning. 1.76% implied move on the shortened trading week is well above avg. My lean or bias today: No idea. Bulls fought back Friday and futures are pushing higher as I type but we are still in a very pivotable zone. The neutral technical rating for this morning seems apropos. I don't think we'd be surprised to see a big green (or red) day today. Premium is good so we can let it play out a bit before putting on a trade. Let's take a look at the intraday levels that are key today on /ES. 6675, 6700, 6709, 6723, 6750 are resistance zones. 6650, 6629, 6624, 660, 6594. I look forward to seeing you all in the live trading room shortly. Our training should be a good one and while I'm not sure what scalping will provide us today, I'm sure we'll get an opportunity for a couple good 0DTE entries.

What was that?Well, that was one of the most insane days I've seen in a long time. The biggest intraday swing all year. If you made money yesterday, congrats to you, my friend. It was just wild. I'm not saying that this locks us in for a bear market going forward but these are the types of wild movements we usually get at market tops. I had a losing day yesterday but fortunately I traded small. It's really my only saving grace. Scalping helped out a bunch and that may all play out the same for me today. Trading small and looking for scalping opportunities. Here's a look at my day: Let's take a look at the markets: No surprise. The technicals are leaning to sell mode. This big drop takes us back to where the last big drop took us...Oct. 10th. We didn't have time yesterday in all the chaos to go over our training on investor reflexivity. We'll hit it on Monday but it was ironic on the timing. We are seeing a lot of it in the current markets. My Twitter feed (and yours as well, I imagine) has been filled with individuals talking about how they were going to get rich on the covered call ETF's and Bitcoin and how stupid all of the rest of us were if we weren't "all in". Those posts have disappeared. I've always promoted a hedged approach of having shorts and bearish positions in your portfolio. It seems foolish in good times but it's nice in the bad times. December S&P 500 E-Mini futures (ESZ25) are trending up +0.46% this morning as sentiment improved following dovish comments from a Federal Reserve official. New York Fed President John Williams said on Friday he sees scope for the central bank to cut interest rates again in the near term as the labor market weakens. “I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions,” Williams said. “Therefore, I still see room for a further adjustment in the near term to the target range for the federal funds rate to move the stance of policy closer to the range of neutral, thereby maintaining the balance between the achievement of our two goals.” Investor focus now turns to U.S. business activity data. In yesterday’s trading session, Wall Street’s major indices ended in the red. The Magnificent Seven stocks fell, with Nvidia (NVDA) sliding over -3% and Tesla (TSLA) dropping more than -2%. Also, chip stocks plunged, with Micron Technology (MU) slumping over -10% to lead losers in the Nasdaq 100 and Advanced Micro Devices (AMD) falling more than -7%. In addition, Jacobs Solutions (J) sank over -10% and was the top percentage loser on the S&P 500 after the engineering and consulting firm posted disappointing FQ4 GAAP EPS. On the bullish side, Walmart (WMT) climbed more than +6% and was the top percentage gainer on the S&P 500 and Dow after the world’s largest retailer reported better-than-expected Q3 results and raised its full-year guidance. The U.S. Labor Department’s report on Thursday showed that nonfarm payrolls rose by 119K in September, stronger than expectations of 53K. At the same time, the U.S. unemployment rate unexpectedly ticked up to a nearly 4-year high of 4.4% in September, weaker than expectations of no change at 4.3%. In addition, U.S. September average hourly earnings rose +0.2% m/m and +3.8% y/y, compared to expectations of +0.3% m/m and +3.7% y/y. Finally, the number of Americans filing for initial jobless claims in the past week fell by -8K to 220K, compared with the 227K expected. “September’s payroll numbers may have surprised to the upside, but in terms of the Fed’s December interest rate decision, October is what mattered,” said Ellen Zentner at Morgan Stanley Wealth Management. “With that data now delayed until after the FOMC meeting, the Fed’s rate-cut path has more question marks.” Cleveland Fed President Beth Hammack said on Thursday that cutting interest rates to support the labor market could prolong the period of above-target inflation and heighten financial stability risks. Also, Fed Governor Michael Barr said, “I am concerned that we’re seeing inflation still at around 3% and our target is 2% and we’re committed to getting to that 2% target,” adding that policymakers “need to be careful and cautious now about monetary policy, because we want to make sure that we’re achieving both sides of our mandate.” In addition, Chicago Fed President Austan Goolsbee indicated that he remains apprehensive about approving another rate cut next month. “In the near term, I’m a little uneasy front-loading too many rate cuts and counting on ‘this will be transitory and inflation will go back down,’” Goolsbee said. Meanwhile, U.S. rate futures have priced in a 59.0% probability of no rate change and a 41.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next month. In tariff news, U.S. President Donald Trump signed an executive order on Thursday to remove certain tariffs on specific agricultural products imported from Brazil after November 13th. Today, investors will focus on preliminary U.S. purchasing managers’ surveys, set to be released in a couple of hours. Economists expect the November S&P Global Manufacturing PMI to be 52.0 and the S&P Global Services PMI to be 54.6, compared to the previous values of 52.5 and 54.8, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will also be released today. Economists anticipate that the final November figure will be revised higher to 50.6 from the preliminary reading of 50.3. U.S. Wholesale Inventories data will be released today as well. Economists forecast that the final August figure will be unrevised at -0.2% m/m. In addition, market participants will be looking toward speeches from Fed Vice Chair Philip Jefferson, Fed Governor Michael Barr, New York Fed President John Williams, and Dallas Fed President Lorie Logan. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.057%, down -1.17%. Let's take a deep dive into the market levels. The Nasdaq is back to Oct. 10th levels. It's sitting on the bottom Bollinger band and MACD, Stoch, RSI are all over sold. Almost identical situation with the SPX. Do we bounce here? The setup is certainly there. Futures are climbing as I type. (for what that's worth) Let's look at the intraday levels: There is one key level I'm watching today. 6575. It worked as the support for yesterdays selloff. We are slightly above it as I type. Above this level I would be bullish. Below, bearish. Some days are good to trade small. It saved us from bigger losses yesterday. I think today falls into that camp. I'll see you all in the live trading room shortly. Make sure to tune in to the scalping zoom feed. That might be our go to today.

It's tricky, tricky.We got the old "pump and dump" yesterday, which can be tricky to trade. I'd mentioned in yesterday's blog that while I was bearish on the technicals, there was a clear and present danger of a violent retrace to the upside. We planned our NDX strikes for as much as a 550-point jump! Markets did surge out of the gate but gave it all back by midday, only to push back into the close of business. We were able to catch the waves almost perfectly with our 0DTE's and our Scalps. The Theta fairy once again made an appearance. They are still modified versions, but the premium is solid. Here's a look at our day: Let's take a look at the markets. NVDA did me dirty. We knew the numbers were going to be awesome. The question was, would we get a "buy the rumor, sell the news" reaction like so many times before? I thought yes! I put on a very small $156 bearish setup. Of course, we got a pop instead. Hopefully, we can mitigate it with a credit put spread underneath it and reduce the risk to around $50 bucks. Risking $50 to potentially make almost $600 made sense, but it looks like it will go out as a loser. Let's take a look at the markets. Technicals are getting a big reversal to buy mode, off the NVDA earnings. The bulls tried yesterday but ultimately couldn't do much to reverse the downtrend. Futures this morning are popping and taking us right back to the all important 50DMA. Today should be a big test for both the bulls and bears. Bulls need to get back above the 50DMA and bears still have the momentum and could easily push us back down. Mornings like this are tricky for our 0DTE entries. The /ES is up 80+ points already as I type. I'm not really interested in putting on a long position at this level and so that leaves me waiting around for a retrace to the downside, that may never show up! That means I have no real bias this morning to start the day. December S&P 500 E-Mini futures (ESZ25) are up +1.12%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +1.55% this morning as strong quarterly results and guidance from AI darling Nvidia boosted sentiment. Nvidia (NVDA) rose over +4% in pre-market trading after the chipmaker reported stronger-than-expected Q3 results and provided an upbeat Q4 revenue forecast. Strong results from the AI bellwether helped ease concerns about a potential bubble in the AI sector that had rattled markets in recent weeks. Attention now turns to the delayed September jobs report, which will provide investors with clues on the Federal Reserve’s policy outlook. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. GE Vernova (GEV) climbed over +7% and was among the top percentage gainers on the S&P 500 after the company announced it had secured its first international onshore wind repower upgrade agreement with Taiwan Power Company. Also, chip stocks gained ground, with Applied Materials (AMAT) and Broadcom (AVGO) rising more than +4%. In addition, Constellation Energy (CEG) advanced over +5% and was the top percentage gainer on the Nasdaq 100 after the electricity provider announced that the U.S. Department of Energy had loaned it $1 billion to fund the restart of the nuclear plant at Three Mile Island in Pennsylvania. On the bearish side, Eversource Energy (ES) plunged more than -12% and was the top percentage loser on the S&P 500 after Connecticut regulators rejected its request to sell its subsidiary, Aquarion Water Company. Economic data released on Wednesday showed that the U.S. trade deficit narrowed to -$59.6 billion in August from -$78.2 billion (revised from -$78.3 billion) in July, better than expectations of -$61.3 billion. The minutes of the Federal Open Market Committee’s October 28-29 meeting, released on Wednesday, showed that many Fed officials said it would likely be appropriate to keep interest rates unchanged for the remainder of 2025. “Many participants suggested that, under their economic outlooks, it would likely be appropriate to keep the target range unchanged for the rest of the year,” according to the FOMC minutes. The minutes also showed that “several” officials opposed reducing the Fed’s benchmark rate last month. At the same time, “several participants” said another rate cut “could well be appropriate in December if the economy evolved about as they expected” ahead of the next meeting. “Uncertainty is running high because of the lost data and the unclear impact of tariffs. There’s no consensus at the Fed with policymakers flying blind, but these minutes lean hawkish overall,” said David Russell at TradeStation. U.S. rate futures have priced in a 68.2% chance of no rate change and a 31.8% chance of a 25 basis point rate cut at December’s monetary policy meeting. Today, all eyes are focused on the U.S. monthly payroll report for September, which is set to be released in a couple of hours. The report was originally scheduled for release on October 3rd, but was delayed due to the government shutdown. Economists, on average, forecast that September Nonfarm Payrolls will come in at 53K, compared to the August figure of 22K. Meanwhile, the Bureau of Labor Statistics said on Wednesday it won’t release an October jobs report, but will incorporate the payroll figures into the November reading scheduled after the Fed’s final meeting of 2025. The shutdown prevented the collection and release of the data. That leaves Fed officials without a key piece of economic data ahead of their final meeting of the year. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect the September figures to be +0.3% m/m and +3.7% y/y, the same as in August. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will remain steady at 4.3% in September. The U.S. Philadelphia Fed Manufacturing Index will come in today. Economists anticipate that the Philly Fed manufacturing index will stand at 1.0 in November, compared to last month’s value of -12.8. U.S. Existing Home Sales data will be released today as well. Economists foresee this figure coming in at 4.08 million in October, compared to 4.06 million in September. On the earnings front, retail giant Walmart (WMT), along with notable companies such as Intuit (INTU) and Copart (CPRT), are slated to release their quarterly results today. In addition, market participants will parse comments today from Cleveland Fed President Beth Hammack, Fed Governor Lisa Cook, and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.136%, up +0.07%. The latest SPX MACD breadth chart shows the index still holding its broader uptrend, but the short-term picture has shifted toward caution. The number of S&P 500 stocks flashing MACD buy signals continues to oscillate sharply, and the recent drop below the 10-day SMA suggests breadth momentum has weakened. In the near term, traders may treat any rebound in the breadth line back above the SMA as evidence of improving internal strength, while continued compression or new lows in buy-signal counts could point to further downside pressure. This kind of setup often precedes short, choppy sessions where the index reacts more sensitively to data catalysts and sector rotations so monitoring whether breadth stabilizes or deteriorates further could be key in the coming days. Todays training should be another good one. Today we'll focus on George Soros book, The Alchemy of Finance. Let's take a look at the intraday levels for /ES. I'm going to look for some large, big levels today. With so much movement pre-market, it's a bit tough to get a read on the tighter zones. 6757, 6768, and 6800 are the major resistance levels. 6738, 6707, and 6699 are the major support levels. Let's be patient this morning and let this bullish move play out. It's very possible we may get a bit of a give back later in the day? Remember...sitting on our hands IS a skill set. I'll see you all shorty in the live trading room!

Nivida earnings incomingNVDA earnings are coming in after the close today. The numbers should be awesome. It's not like AI chip and GPU demand has waned. The real question is, how will the market react? Chances are high we get a selloff. Regardless, it will be a driver for futures after hours and likely into tomorrow morning. We'll be looking to add another Theta fairy tonight once we see the reaction. Yesterday was a loss for me but I'd still take the same approach. All our day trades worked out well, even though the SPX needed an adjustment to work. I went bigger than normal on scalping because the movement (or so I thought) was going to be great. It ended up chopping me up most of the day and the internet outage in the early hours hurt. Trading without our tick strike audible order flow was tough and put me in a hole right out of the gate. Here's a look at my day. Let's take a look at the markets: Sell mode is still in place technically. We are now FIRMLY below the 50DMA on all our indices Theta fairy's seem to be back! Premium is rich now. They still need to be modified as a pure strangle is still too low of premium but they seem to be working. We've got another one on this morning that is already above our normal take profit level. We'll look to add another one this late afternoon after we see what NVDA earnings do to the futures. Today is part II of our training on the next four books in our master list. Join in on our live zoom feed. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +0.44% this morning, signaling a modest rebound from a bruising stretch of losses, while investors look ahead to an earnings report from AI darling Nvidia. In yesterday’s trading session, Wall Street’s major indexes ended in the red. Home Depot (HD) slid over -6% and was the top percentage loser on the S&P 500 and Dow after the world’s largest home-improvement retailer reported weaker-than-expected Q3 comparable sales and cut its full-year earnings guidance. Also, chip stocks slumped, with Marvell Technology (MRVL) and Micron Technology (MU) falling more than -5%. In addition, Amazon.com (AMZN) sank more than -4% after Rothschild & Co. Redburn downgraded the stock to Neutral from Buy. On the bullish side, Medtronic Plc (MDT) climbed over +4% and was the top percentage gainer on the S&P 500 after the medical device maker posted upbeat FQ2 results and raised its full-year guidance. Economic data released on Tuesday showed that U.S. factory orders rose +1.4% m/m in August, in line with expectations. Also, data from ADP Research showed that U.S. companies shed an average of 2,500 jobs per week in the four weeks ending November 1st. Richmond Fed President Tom Barkin on Tuesday offered an upbeat outlook on inflation, while indicating the labor market may be softer than the available data suggest. Still, he did not indicate whether he will back another rate cut next month. Meanwhile, U.S. rate futures have priced in a 53.4% chance of no rate change and a 46.6% chance of a 25 basis point rate cut at the December FOMC meeting. Investors are eagerly awaiting Nvidia’s third-quarter earnings report, scheduled for release after the market close. The chipmaker’s earnings reports have been market-moving since May 2023, when it delivered the revenue growth forecast that reverberated globally. Skepticism toward the AI trade is now at its highest level since before Nvidia’s 2023 forecast, putting pressure on the company to deliver with its report. “We expect Nvidia to exceed estimates and provide future earnings and revenue guidance that is higher than investors expect. It’s unlikely that Nvidia has seen any slowdown in demand for its products, even with increased competition, given how early we are in the AI cycle,” said James Demmert at Main Street Research. Retailers such as TJX Companies (TJX), Lowe’s (LOW), and Target (TGT), along with cybersecurity firm Palo Alto Networks (PANW), are also set to report their quarterly figures today. Market watchers will also pay close attention to the publication of the Fed’s minutes from the October 28-29 meeting. The FOMC lowered its benchmark rate last month for the second time this year, though Chair Jerome Powell cautioned that a December reduction is far from a “foregone conclusion.” Since then, a faction of Fed officials has intensified warnings that progress on inflation could slow or stall, casting doubt on the prospects for another rate cut next month and underscoring a widening divide within the central bank. “We expect the minutes to show a deeply divided Fed with concerns over weaker employment picture but sticky inflation,” according to Mohit Kumar, chief economist and strategist for Europe at Jefferies. In addition, market participants will be anticipating speeches from Fed Governor Stephen Miran, Richmond Fed President Tom Barkin, and New York Fed President John Williams. On the economic data front, investors will focus on the August Trade Balance data, set to be released in a couple of hours. The data was originally scheduled for release on October 7th, but was delayed due to the government shutdown. Economists anticipate that the trade deficit will narrow to -$61.3 billion from -$78.3 billion in July. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.9 million barrels, compared to last week’s value of 6.4 million barrels. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.126%, up +0.10%. The SPX has been sliding in recent sessions, and the Volatility Risk Premium has jumped back into elevated territory, sitting near the upper end of its 3-month range. With IV marked as overvalued and VRP pushing above 5%, the options market is pricing in more short-term uncertainty than recent realized volatility supports. In the near term, this kind of setup often coincides with choppier price action as traders recalibrate to the richer volatility environment. The key focus now is whether VRP continues to rise—signal of persistent hedging demand, or quickly mean-reverts, which would hint that the recent volatility spike may be settling. The QQQ 5-day Swing Model is entering a more tactical zone, with price pulling back toward the model’s risk trigger near 575.96, a level that has historically acted as a short-term pivot. The lower band remains well below current pricing, but the recent drop toward mid-range suggests momentum has cooled. With the swing model showing a high historical success rate and the upper band sitting far above at 616.66, the next few sessions may hinge on whether QQQ stabilizes above the risk trigger or continues sliding toward the lower band that has captured most successful rebounds. Short-term traders often watch these inflection zones closely, as moves into or away from risk triggers tend to shape near-term directional bias. Wednesday

My lean or bias this morning is bearish once again. Much like yesterday, we may be a relief rally and futures are up as I type but technicals are bearish and being below the 50DMA you kind of have to go with the flow. Let's take a look at the intraday /ES levels for 0DTE's today. 6679, 6700, 6719 6735* (big gamma wall) are all resistance levels. 6650, 6640* (key support level yesterday), 6625, 6599* (key buying level) are all support levels. I look forward to seeing you all in the live trading room shortly. Our part II training should be another good one.

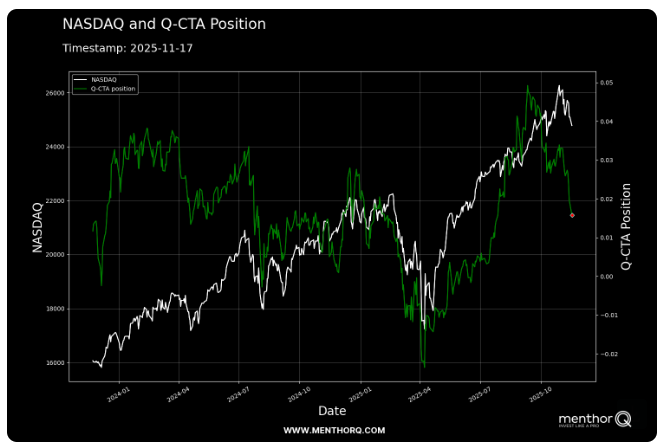

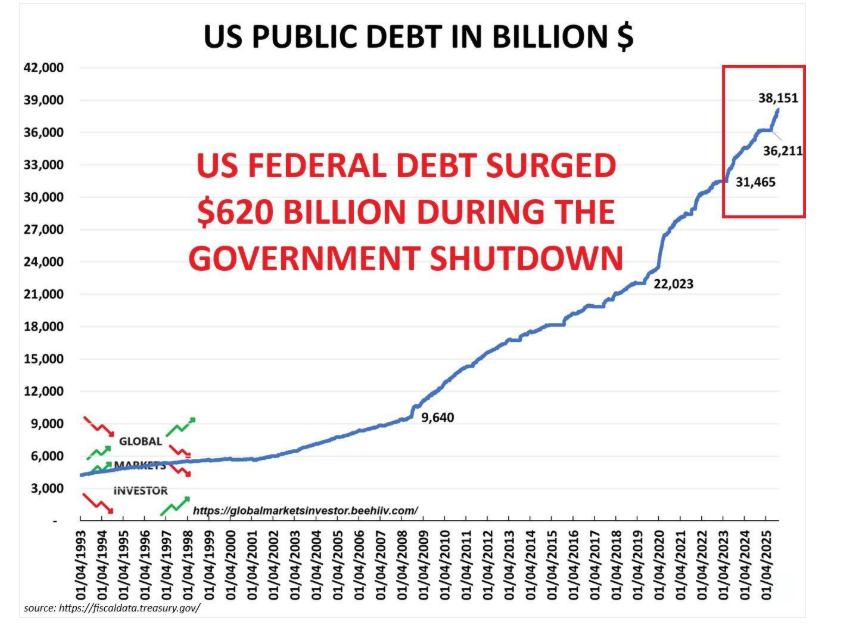

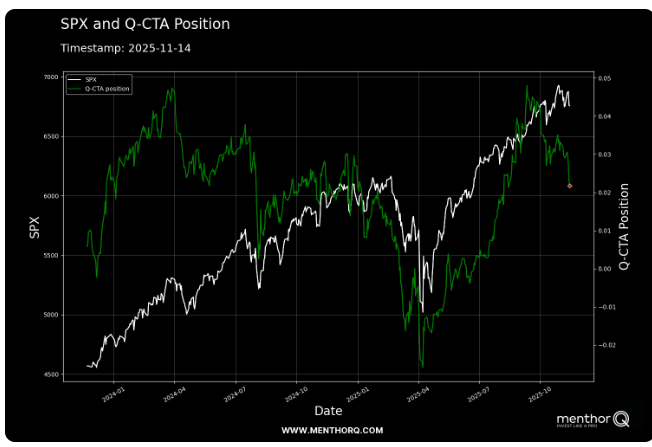

Ugly looking market=Beautiful profitsHow good was yesterday? Down markets are simply the best! It's everything we ask for, but it's more importantly, everything we are prepared for and set up to benefit from. Don't fear the reaper...be the reaper. Sorry, couldn't resist. Premium was just absolutely stellar. This is why we love down markets. It's been a long time since pure Theta trades made this much sense. We also had a solid day yesterday in our Asset allocation portfolio. It's built for days like this. Here's a look at our day yesterday. ATM portfolio was great. It was a scalpers paradise and 0DTE premium was rich. A 67% ROI on our used capital is extremely high without the help of debit trades. Let's take a look at the markets. It's not surprising, that the technicals are pointing bearish. Something very big happened yesterday. We broke below the 50DMA on all the indices we track and trade. This hasn't happened in months and can be viewed as very bearish. The SPX is pulling back from its recent highs, and the option score has slipped toward the lower end of its range, reflecting a cooling in short-term bullish appetite. Price action shows a series of lower highs forming over the past several sessions, hinting at a shift in momentum as sellers become more active on bounces. In the near term, the index appears to be consolidating between roughly 6,650 and 6,750, with repeated failures to reclaim the upper end of that zone. A continued low option score suggests hedging demand may be elevated, which can keep intraday swings choppy. Traders watching the short term may focus on whether SPX can stabilize above recent support or if another dip in the option score precedes a retest of last week’s lower levels. Systematic flows in the Nasdaq appear to be rolling over, with the Q-CTA position trending lower just as the index itself shows signs of losing momentum after its recent peak. The sharp pullback in model-driven exposure suggests that trend-following programs are reducing risk as upside conviction softens. In the short term, this reduction in systematic demand could leave the index more sensitive to broader market volatility, especially if price continues to drift away from recent highs. Traders may watch whether Q-CTA positioning stabilizes or continues to unwind, as that shift often influences short-term liquidity and directional pressure. December S&P 500 E-Mini futures (ESZ25) are trending down -0.31% this morning as investors continue to unload risk assets while awaiting Nvidia’s earnings and a pivotal U.S. jobs report. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Dell Technologies (DELL) plunged over -8% and was the top percentage loser on the S&P 500 after Morgan Stanley double-downgraded the stock to Underweight from Overweight with a price target of $110. Also, most chip stocks slumped, with Qualcomm (QCOM) sliding more than -4% and Marvell Technology (MRVL) falling over -3%. In addition, Hewlett Packard Enterprise (HPE) dropped more than -7% after Morgan Stanley downgraded the stock to Equal Weight from Overweight. On the bullish side, Alphabet (GOOGL) rose over +3% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Berkshire Hathaway disclosed a $4.9 billion stake in Google’s parent. Economic data released on Monday showed that the Empire State manufacturing index unexpectedly rose to a 1-year high of 18.70 in November, stronger than expectations of 6.10. Also, U.S. construction spending unexpectedly rose +0.2% m/m in August, stronger than expectations of -0.2% m/m. Fed Vice Chair Philip Jefferson said on Monday that risks to the labor market appear tilted to the downside, while reiterating that policymakers should move cautiously as interest rates approach neutral. At the same time, Fed Governor Christopher Waller reiterated his view that the central bank should lower interest rates again in December, pointing to a weak labor market. Meanwhile, initial jobless claims came in at 232K for the week ending October 18th, according to the Labor Department’s website. Data for the prior three weeks were not available. U.S. rate futures have priced in a 53.6% probability of no rate change and a 46.4% chance of a 25 basis point rate cut at the conclusion of the Fed’s December meeting. Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. The report was originally scheduled for release on October 2nd, but was delayed due to the government shutdown. Economists expect this figure to rise +1.4% m/m in August, following a -1.3% m/m drop in July. Market participants will also parse comments today from Fed Governor Michael Barr and Richmond Fed President Tom Barkin. On the earnings front, home improvement chain Home Depot (HD) is slated to release its Q3 results today. Earnings reports from big retailers throughout the week will provide additional insight into the health of the economy. Investor attention for the remainder of the week is squarely focused on Nvidia’s earnings report and the delayed September jobs report, with both events set to play a key role in shaping the outlook for markets throughout the rest of 2025. “The monthly jobs report would normally dominate this week’s economic calendar, but with the AI trade struggling the past couple of weeks, Nvidia’s earnings are once again looking like a key piece of the market’s momentum puzzle,” said Chris Larkin at E*Trade from Morgan Stanley. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.108%, down -0.56%. The US federal debt surged +$620 billion during the 43-day government shutdown, to a record $38.151 trillion. This marks a +$14.4 billion increase per day. The break in directional correlation between $SPX & $BTC quite profound. Happens rarely. Considering the depth of the sell off in crypto $SPX actually holding up quite well. So far. Risk is it spreads of course, flip side: Once $BTC bottoms markets could rip higher with it. TBD. This is absolutely WILD: Retail investors have BOUGHT THE DIP every single week in 2025 whenever the S&P 500 fell over -1%, the 6th consecutive year their dip-buying rate stayed above 50. Meanwhile, institutional investors became dip buyers for the first time since 2019. Guess what? Premium is back! Did I mention that? That means our vaunted Theta Fairy trade is back in play! We've got a modified version working for us today and likely will be able to get another one working this evening so keep your alerts on in discord for the working timestamp post. Yesterday we had a solid (and long) training session on part I of the top 12 books every trader should read. Tomorrow we start part II. Make sure to tune in. Implied I.V. is up in the 82% percentile. Should be another good day for premium collection. My lean or bias today is bearish. It kind of has to be. We've had a lot of selling the past few days, so a rebound could be in the cards, but technicals are ugly, and we are below the 50DMA. Plus, who doesn't love a down market? Let's look at the intraday /ES levels for 0DTE setups today. 6675, 6691, 6700, 6725,6731 are resistance levels. 6650, 6633, 6625, 6618, 660, 6574 are support. I look forward to seeing you all today in the live trading room. The market looks like it's shaping up to give us an ample opportunity to make a nice profit again today. Now it's up to us to capitalize on that opportunity.

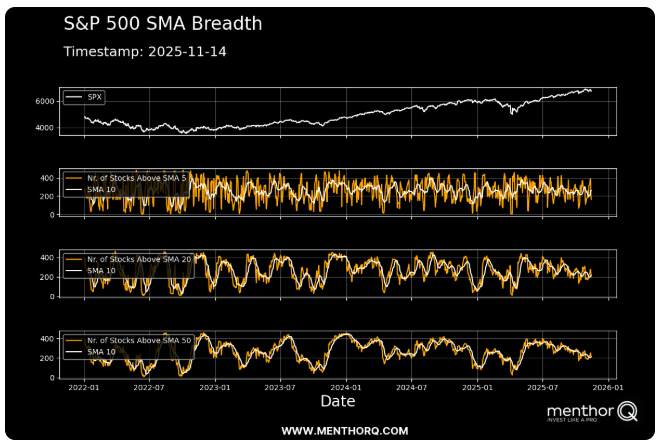

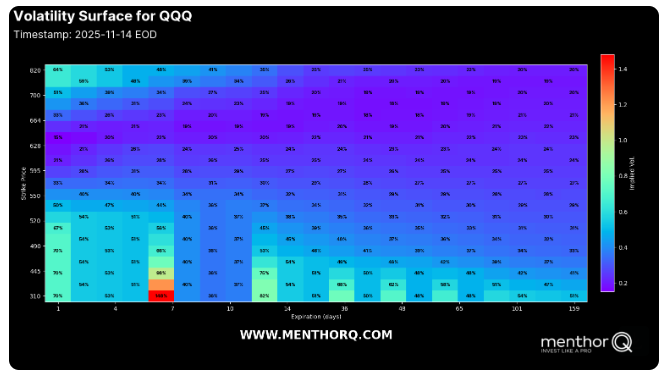

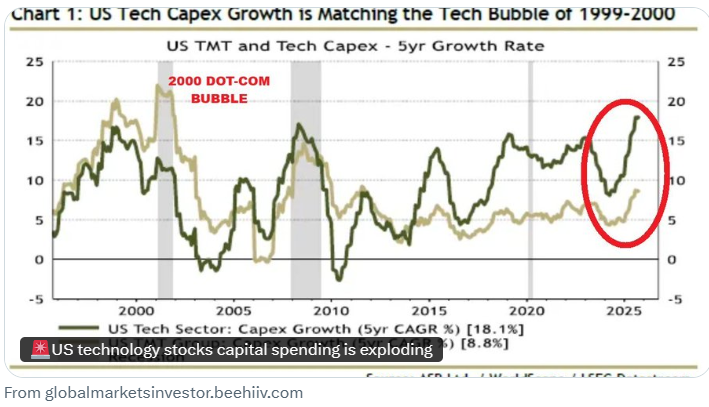

The data flow is back on.Finally, after more than a month without any economic data the spigot gets turned back on. It appears some of the data will be truncated but it's a step in the right direction. We've got NVDA earnings this week which may be even more important but it's looking less and less likely we get a rate cut next month. What a tricky day Friday. Bearish action in the morning with a big reversal later in the day. The market is in the throws of trying to divine a direction. We had to adjust our SPX which cut most of our profit potential there however it was a great day for scalping...again. Also, our ATM portfolio continues to hold up well to all this movement. We are not quite back to a new ATH there yet but we are close. Here's a look at our trades for Friday. Today may be an interesting day for an NDX 0DTE. Premium is rich. Let's take a look at the markets. We start the day off with a sell signal technically. Really interesting candles from Friday. They are green because futures started low and we finished higher by end of day but it was still a down day. The trend still continues to look bearish to me. The latest SPX breadth readings across the 5-, 20-, and 50-day SMAs show a short-term improvement in participation, with the number of stocks trading above their respective moving averages stabilizing after a recent pullback. The 5-day breadth is especially choppy but has begun to turn higher, suggesting a pickup in very near-term buying pressure. The 20- and 50-day breadth measures remain in mid-range territory, indicating that while broader momentum hasn’t fully shifted, selling pressure has eased. In the short term, traders may watch whether these breadth lines continue pushing above their 10-day smoothers, continued follow-through would signal strengthening internal support for the index’s recent bounce, while a quick rollover would hint at fragility beneath the surface. The QQQ volatility surface shows a clear skew toward elevated implied volatility at the very short-dated expirations, especially for deep out-of-the-money puts, where IV spikes above 70% and even over 100% in isolated strikes. This indicates strong demand for near-term downside protection, often a sign that traders are bracing for short-horizon catalysts or increased index movement. As expirations extend beyond two weeks, the surface flattens considerably, suggesting expectations for volatility to normalize over time. In the short term, the contrast between high front-end IV and relatively steady longer-dated levels highlights a market leaning defensive in the immediate window but not committing to a sustained volatility regime shift. The SPX continues to hold near recent highs, but the Q-CTA positioning line has rolled over sharply, showing a clear reduction in systematic long exposure. This type of divergence price holding up while trend-following models begin to pare risk, often reflects fading momentum beneath the surface. In the short term, systematic flows may be less supportive than in previous weeks, which could leave the index more sensitive to volatility spikes or macro headlines. While not predictive on its own, the shift in Q-CTA positioning suggests a more cautious posture from rules-based strategies as the market navigates this elevated zone. Monday news catalysts. US tech CAPEX is EXPLODING: Tech capital expenditure has grown more over the last 5 years than during the 2000 dot-com bubble. Is this sustainable and will it pay off? Is this AI CapEx bubble and will burst? This week we'll have a three part training on the top 12 books traders should read. We'll hit four each training session, Mon. Weds. Thurs. on our live zoom feed. Make sure to join in. These are always beneficial. Expected move for the SPX this week is 1.69%. That's some good premium. Credit trades may make more sense this week. December S&P 500 E-Mini futures (ESZ25) are up +0.02%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.09% this morning, pointing to a muted open on Wall Street as cautious sentiment prevailed at the start of a busy week. Investor focus this week is on an earnings report from AI bellwether Nvidia, the minutes of the Federal Reserve’s latest policy meeting, and the release of long-delayed U.S. jobs data. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Most semiconductor stocks fell, with Lam Research (LRCX) sliding over -3% and ON Semiconductor (ON) dropping more than -2%. Also, Stubhub Holdings (STUB) tumbled about -21% after the company did not provide guidance for the current quarter. In addition, Bristol-Myers Squibb (BMY) slipped more than -4% after ending a trial of its experimental drug milvexian for stroke and blood-clot prevention due to disappointing data. On the bullish side, DoorDash (DASH) climbed over +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Needham called the stock’s recent pullback a buying opportunity and reiterated its Buy rating with a $275 price target. “The general trend has been to buy the dip, which could provide a respite. Retail investors may be spooked temporarily, but are likely to come back in if they believe the long-term story driving many of the names that have been gutted remains intact,” said Melissa Brown at SimCorp. Kansas City Fed President Jeff Schmid said on Friday that further interest rate cuts could do more to entrench higher inflation than to support the labor market. Also, Dallas Fed President Lorie Logan said, “I think it would be hard to support another rate cut unless we were to get convincing evidence that inflation is really coming down faster than my expectations or that we were seeing more than the gradual cooling that we’ve been seeing in the labor market.” In addition, Atlanta Fed President Raphael Bostic indicated that although he backed the most recent two rate cuts, he wasn’t yet persuaded about another move next month. Meanwhile, U.S. rate futures have priced in a 55.4% chance of no rate change and a 44.6% chance of a 25 basis point rate cut at the next FOMC meeting in December. In tariff news, the White House removed duties on imported coffee, bananas, and beef on Friday amid surging prices for some grocery staples. All eyes will be on Nvidia (NVDA) this week, dubbed “the most important stock on Earth” by Goldman Sachs, as the semiconductor giant reports its quarterly earnings on Wednesday. Nvidia’s earnings reports have been market-moving since May 2023, when the company delivered the revenue growth forecast that reverberated globally. Skepticism toward the AI trade is now at its highest level since before Nvidia’s 2023 forecast, putting pressure on the company to deliver with its upcoming report. Retailers such as Walmart (WMT), Home Depot (HD), TJX Companies (TJX), Lowe’s (LOW), and Target (TGT), along with notable companies like Palo Alto Networks (PANW), Intuit (INTU), and Copart (CPRT), are also set to release their quarterly results this week. Market participants continue to await further updates to economic data calendars from official statistics agencies. The Bureau of Labor Statistics said it will publish the September jobs report on Thursday, and the Census Bureau announced it will proceed with releasing reports on August construction spending, factory orders, and the trade balance. The data will gradually help clarify the state of the U.S. economy, though they’ll be more backward-looking than usual. Investors will also monitor private-sector data this week, including preliminary purchasing managers’ surveys on U.S. manufacturing and services sector activity, the National Association of Realtors’ existing home sales data, and the University of Michigan’s Consumer Sentiment Index. In addition, market watchers will parse the Fed’s minutes from the October 28-29 meeting, set for release on Wednesday, amid growing concerns over the central bank’s ability to cut interest rates next month. The FOMC lowered its benchmark rate last month for the second time this year, though Chair Jerome Powell cautioned that a December reduction is far from a “foregone conclusion.” Since then, a slew of Fed officials have voiced skepticism about the need for a rate cut next month, citing lingering uncertainty about inflation. Investors will hear perspectives from Fed officials Jefferson, Waller, Williams, Barr, Hammack, Cook, Goolsbee, Paulson, and Logan throughout the week. Today, investors will focus on the New York Fed-compiled Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists expect the November figure to come in at 6.10, compared to 10.70 in October. The construction spending report for August will also be released today. Economists forecast this figure to be -0.2% m/m, compared to -0.1% m/m in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.127%, down -0.53%. My lean or bias today is bearish. I think the bulls are starting to take center stage here. Let's see if they can run with it. We can only hope! Let's take a look at the intraday /ES levels: Lots of tight levels this morning. 6752, 6759, 6765, 6770, 6777, 6781 are resistance levels. 6741, 6732, 6730, 6725, 6722, 6711 are support. Let's make it happen today folks. I look forward to seeing you shortly in the live trading room.

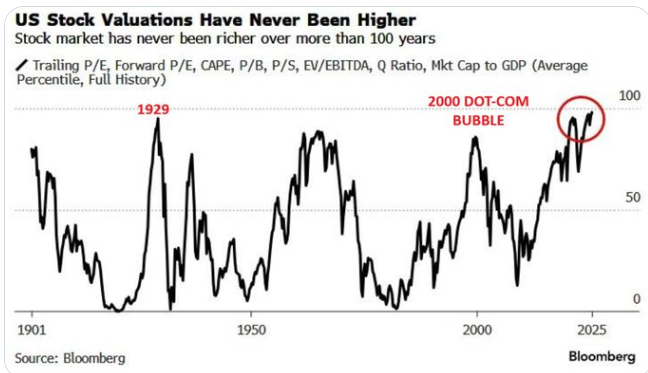

Hey 50DMA! Bye bye bye.We lost the 20DMA on the SPY and QQQ yesterday and we are losing the 50DMA this morning (as I type). We've been waiting for the bearish trend to really take hold. To quantify how big the last two days rollover is, our delta on our ATM portfolio just turned positive! We generally try to always carry a negative delta. Might be time to add some more shorts! We had a STELLAR day yesterday. Low risk...high return... small trade size. Perfect for a day like yesterday. 6% ROI on the day and small buying power. Today may be the same. Keep risk low. Let's take a look at the markets. No surprise. Bears are in full effect this morning. As mentioned, yesterday we lost the 20DMA yesterday and it sure looks like we are set to lose the 50DMA this morning. December S&P 500 E-Mini futures (ESZ25) are down -0.97%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -1.29% this morning, pointing to further losses on Wall Street as worries over stretched tech valuations persisted and investors questioned whether the Federal Reserve was still on track to cut rates in December. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply lower. The Magnificent Seven stocks sank, with Tesla (TSLA) slumping over -6% and Nvidia (NVDA) falling more than -3%. Also, chip stocks slid, with Intel (INTC) and Lam Research (LRCX) dropping over -5%. In addition, Walt Disney (DIS) plunged more than -7% and was the top percentage loser on the Dow after the entertainment giant posted weaker-than-expected FQ4 revenue. On the bullish side, Cisco Systems (CSCO) rose over +4% and was the top percentage gainer on the Dow and Nasdaq 100 after the networking-equipment company reported better-than-expected FQ1 results and raised its full-year guidance. “The question now is whether the market’s recent exuberance has run its course. After a stellar rally since April, technology shares look increasingly overvalued and overstretched, with sentiment tempered by a lack of fresh catalysts and a lull in economic data,” according to Fawad Razaqzada at Forex.com. U.S. President Donald Trump signed legislation to end the longest shutdown in U.S. history late on Wednesday. The government reopening removes one source of investor uncertainty, paving the way for the release of delayed economic data, including the September jobs report, as early as next week. The Bureau of Labor Statistics is expected to issue a calendar in the coming days outlining new release dates for delayed data. President Trump’s top economic adviser, Kevin Hassett, told Fox News’ America’s Newsroom on Thursday that the October jobs report will be published without an unemployment rate reading. The data will be critical in shaping interest rate-cut expectations ahead of the Fed’s December meeting. Stubbornly high inflation and the weakening labor market are deepening the divide among Fed officials over the best path forward for interest rates. Cleveland Fed President Beth Hammack said on Thursday she remains focused on price stability even as the labor market weakens, emphasizing that reaching the central bank’s 2% inflation target is essential. Also, San Francisco Fed President Mary Daly said it is too early to determine whether policymakers should cut rates in December. In addition, St. Louis Fed President Alberto Musalem said policymakers should proceed cautiously with further rate cuts while inflation remains above the central bank’s target. Finally, Minneapolis Fed President Neel Kashkari said he did not support the last rate cut, though he remains undecided on the appropriate course of action for the December policy meeting. Meanwhile, U.S. rate futures have priced in a 49.6% chance of a 25 basis point rate cut and a 50.4% chance of no rate change at December’s policy meeting. On the trade front, a senior Trump administration official told reporters Thursday that the U.S. will eliminate tariffs on bananas, coffee, beef, and select apparel and textile goods under framework agreements with Argentina, Ecuador, Guatemala, and El Salvador, as part of efforts to address elevated food prices. Today, investors will focus on speeches from Kansas City Fed President Jeff Schmid, Dallas Fed President Lorie Logan, and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.114%, up +0.41%. I want to take a moment to talk about (IMHO) the best way to approach the management of your hard earned capital. Three distinct approaches. #1. Scalping. #2. 0DTE's. #3. A unique asset allocation, passive portfolio. Scalping is what's kept me paying bills when I first started and had a minuscule amount of capital. It's a great way to have a good shot at generating daily income to live off, regardless of market conditions. 0DTE's keep you active and you only have to be right for a few hours a day. Our ATM portfolio takes 5 min. a day to manage. Has daily cash flow, carries shorts and well as longs. These all combine for a nice mix on days like yesterday. If you didn't make money yesterday or are worried about today it's not because you are a bad trader. You may just need a better strategy to manage your capital. This has NEVER happened: US stock market valuations have hit the highest level in modern history. Not even the periods before the 1930s Great Depression or the 2000 Dot-Com Bubble saw such expensive US stocks. US equities have never been more expensive. Let's take a look at the intraday /ES levels. Should be another exciting day. 6690 first key resistance. 6702, 6750, 6766 are all resistance zones. 6679 is first support zone. 6660 is a big potential buy zone. 6651, 6625 are last big support zones for me today. Let's finish strong today. It should be a great opportunity day. It's up to us now to capitalize! See you shortly in the live trading room.

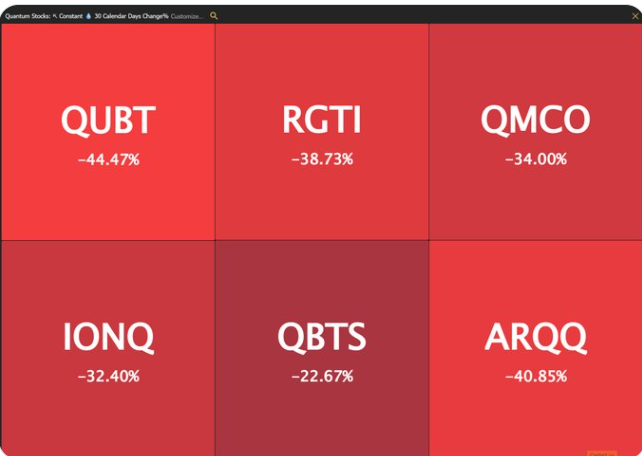

Everything's fixed!... for a few weeks.Well, the Government is back open. There's a lot of euphoria over it. Remember this isn't anything permanent. This budget fix will last a whopping 78 days before the next potential shutdown! Talk about just kicking the can down the road. That's fine for us traders. It just insures more uncertainty and volatility which is what we crave. I start my trading day early. Scanning charts, news and looking at the futures. Some mornings I just salivate and can't wait to get started. Some mornings are less exciting. Yesterday was the latter for me. If felt like a neutral technical day or even an FOMC morning where prices just float around with no inherent direction. I made a commitment to trade small and balance the cost of our SPX debit with what I thought could be a good day for scalping. It worked out o.k. I kept risk as small as I possibly could. 5-wide debit on SPX and only one contract on /MNQ scalping. The SPX didn't hit but risk was small all day. Today may be better with the potential for a "buy the rumor, sell the news" day. Do we sell back off today? It's certainly possible. Here's a look at my small day yesterday. On the plus side, our ATM asset allocation model continues to perform well. Heading into the last part of the year. Let's take a look at the markets: Technicals are still holding to a buy mode to start the day. The DIA continues to explode to the upside but everything else is a bit blah. December S&P 500 E-Mini futures (ESZ25) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.08% this morning as investors weigh the outlook for the Federal Reserve’s interest rate path following the end of the longest government shutdown in U.S. history. U.S. President Donald Trump signed a spending bill to reopen the government late Wednesday, a measure passed by the Republican-controlled House after a record-long 43-day shutdown. The legislation cleared the House on a 222 to 209 vote, largely along party lines. The package extends federal government funding through January 30th and includes full-year funding for the Department of Agriculture, military construction, and the legislative branch. It will ensure that federal employees, including air-traffic controllers, receive their pay and return hundreds of thousands of furloughed government workers to their jobs. In yesterday’s trading session, Wall Street’s major indices ended mixed, with the Dow notching a new all-time high. Advanced Micro Devices (AMD) climbed +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after forecasting faster sales growth over the next five years, fueled by strong demand for its data center products. Also, On Holding (ONON) jumped about +18% after the company posted upbeat Q3 results and raised its full-year guidance for revenue growth and adjusted EBITDA margin. In addition, BILL Holdings (BILL) surged over +11% after Bloomberg reported that the business-payments company was exploring options, including a potential sale. On the bearish side, most members of the Magnificent Seven stocks fell, with Meta Platforms (META) and Tesla (TSLA) sliding more than -2%. The government reopening removes one source of investor uncertainty, paving the way for the release of delayed economic data, including the September jobs report, as early as next week. The data will be critical in shaping rate-cut expectations ahead of the Fed’s December meeting. Still, White House Press Secretary Karoline Leavitt said on Wednesday that the October jobs and inflation reports are “likely never” to be published because of the shutdown. “All of that economic data released will be permanently impaired, leaving our policymakers at the Fed flying blind at a critical period,” Leavitt told reporters. Fed officials remain divided over which risk is more pressing—inflation or the weakening labor market. Boston Fed President Susan Collins said on Wednesday she favored keeping rates unchanged, given still-solid growth that could slow or hinder progress in bringing down inflation. Also, Atlanta Fed President Raphael Bostic stated that inflation remains the bigger risk to the economy and that he prefers keeping rates unchanged until it’s clear the central bank is on track to achieve its 2% target. “Despite shifts in the labor market, the clearer and urgent risk is still price stability,” Bostic said. At the same time, Fed Governor Stephen Miran reiterated that U.S. monetary policy is overly restrictive, arguing that easing housing inflation is helping to reduce overall price pressures. Meanwhile, U.S. rate futures have priced in a 53.9% probability of a 25 basis point rate cut and a 46.1% chance of no rate change at the next FOMC meeting in December. Today, market participants will hear perspectives from San Francisco Fed President Mary Daly, Minneapolis Fed President Neel Kashkari, St. Louis Fed President Alberto Musalem, and Cleveland Fed President Beth Hammack. On the economic front, investors will focus on the EIA’s weekly crude oil inventories report, set to be released in a couple of hours. Economists expect this figure to be 1.0 million barrels, compared to last week’s value of 5.2 million barrels. On the earnings front, prominent companies like Walt Disney (DIS) and Applied Materials (AMAT) are scheduled to report their quarterly figures today. According to Bloomberg Intelligence, S&P 500 companies are on track to post a +14.6% increase in Q3 profits from a year earlier, nearly twice the level analysts had projected. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.072%, up +0.17%. The S&P 500 breadth chart shows encouraging short-term improvement in market participation. The number of stocks trading above their 200-day moving average is starting to rise again, diverging positively from the 10-day moving average (SMA 10), which had been flattening out. This widening gap suggests that broader segments of the market are regaining strength, with more stocks participating in the recent index rebound. If this upward breadth momentum continues, it could reinforce short-term resilience in the S&P 500, as stronger participation often supports price stability and potential continuation of the prevailing trend. Markets generally perform quite well after a Government shutdown. Quantum stocks continue to retrace and we continue to short them in our ATM portfolio. Let's take a look at the intraday levels on /ES. 6867, 6875, 6880, 6891, 6900 are resistance levels. 6860, 6850, 6843, 6839, 6827 are support. No training session for today. My "off" day on Monday threw my schedule into a bit of flux. We'll be back next Monday with a whole new training module so make sure and tune in then on our live Zoom feed.

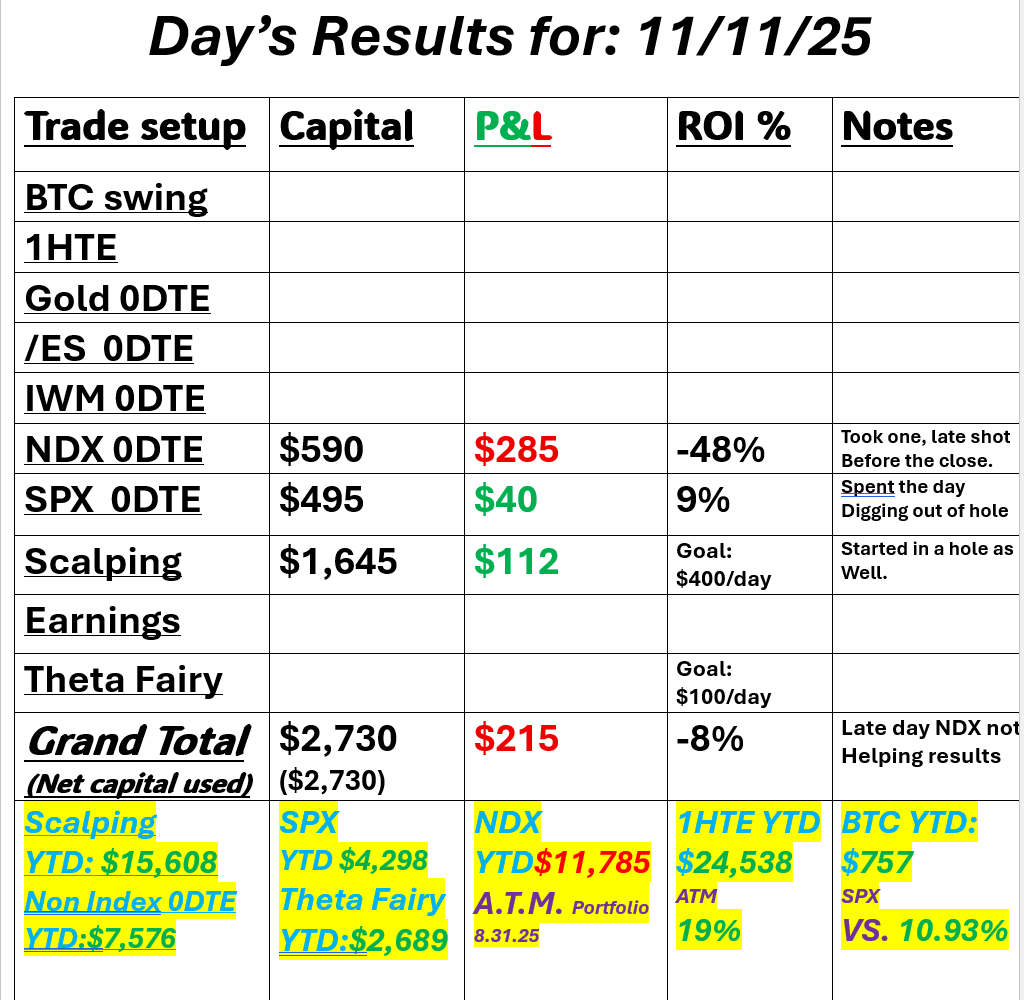

I'll see you all shortly in the live trading room. I think today could be another good opportunity for scalping. Govt. back=Risk on?It looks like the Govt. shutdown could be over as soon as today. Futures are liking it and I'm going to assume that it will be risk on trading until we do get the eventual opening. Yesterday was spent digging out of holes. I started the scalping day down about $400 and down about $250 on SPX 0DTE. I was pretty happy to be able to turn those two around however a late day NDX failed...again. Two in a row there. Here's a look at my day. Not much to show for it. Let's take a look at the markets. Technicals are popping to the upside. Futures are looking for the Govt. re-open. Price action was impressive yesterday with the Dow which absolutely popped! Everything else was pretty flat. December S&P 500 E-Mini futures (ESZ25) are trending up +0.35% this morning as optimism that the U.S. government shutdown is nearing an end boosted sentiment. A record 43-day U.S. government shutdown is poised to end as soon as today after the Senate passed a temporary funding bill. Reopening the government now depends on the House, which is set to return to Washington to consider the package. It would fund most parts of the government through January 30th and some agencies through September 30th. If approved, the bill will be sent to President Donald Trump, who has already voiced his support for the legislation. Investor focus is also on remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Paramount Skydance (PSKY) climbed over +9% and was among the top percentage gainers on the S&P 500 after the entertainment company issued above-consensus Q4 revenue guidance. Also, FedEx (FDX), often seen as a bellwether for the economy, rose more than +5% after the company projected that its profit this quarter would improve from a year ago. In addition, RealReal (REAL) jumped over +38% after the company posted better-than-expected Q3 results and raised its full-year revenue guidance. On the bearish side, Nvidia (NVDA) fell nearly -3% and was the top percentage loser on the Dow after Japan’s SoftBank Group disclosed it had sold its entire stake in the chipmaker for $5.83 billion. Once the government reopens, a wave of delayed economic reports is expected to be released, helping to clarify the outlook for interest rates. Jim Reid of Deutsche Bank stated that, based on historical precedent from the 2013 shutdown, September’s jobs report could be one of the first to be released, potentially within three business days of the government’s reopening. In the absence of official data, investors have turned to alternative indicators, including a report from ADP released on Tuesday. That report showed that the private sector lost an average of 11,250 jobs per week during the four weeks ending October 25th. The figures suggest that the labor market weakened in the latter half of October compared with the earlier part of the month. Separately, economists at Goldman Sachs estimated that U.S. payrolls fell by 50,000 in October after accounting for employees participating in the government’s deferred resignation program. Today, market participants will parse comments from a slew of Fed officials, including Williams, Paulson, Waller, Bostic, Miran, and Collins. Their remarks will be scrutinized closely amid the ongoing debate over whether another rate cut is needed at the December meeting. Meanwhile, U.S. rate futures have priced in a 63.4% chance of a 25 basis point rate cut and a 36.6% chance of no rate change at next month’s monetary policy meeting. On the earnings front, notable companies such as Cisco (CSCO), TransDigm Group (TDG), and GlobalFoundries (GFS) are slated to release their quarterly results today. According to Bloomberg Intelligence, S&P 500 companies are on track to post a +14.6% increase in Q3 profits from a year earlier, nearly twice the level analysts had projected. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, up +0.44% The SPX Momentum Score shows signs of stabilization after recent short-term volatility, suggesting that bullish momentum may be regaining traction. The price has rebounded from last week’s dip and is now approaching prior resistance levels near the recent highs, supported by an improving momentum reading climbing back toward the upper range. This rebound indicates a potential shift in short-term sentiment as buyers regain control following a brief consolidation phase. However, given the choppy behavior over the past few sessions, traders appear focused on confirming sustained strength above these levels before committing to a broader directional move. Todays training session we be another Jessie Livermore segment on "How to grow your wealth starting with zero". It should be another good session. Please tune in. My lean or bias today: It should be bullish. Technicals are all pointing up. Risk on seems to be back. The Govt. WILL open up at some point. Today? We're not sure but when it does it could provide an upward pop to the indices. Even if short term in nature. Today could be tricky It could be easy to get trapped in a bearish move when the news hits and markets pop. Be diligent today. Let's take a look at the intraday levels on /ES. Several key levels. 6900* (key resistance), 6920, 6928* (key resistance) 6936, 6960* (key resistance). 6889, 6875, 6860, 6850, 6843* (key support) I look forward to seeing you all back on zoom today. See you shortly!

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |