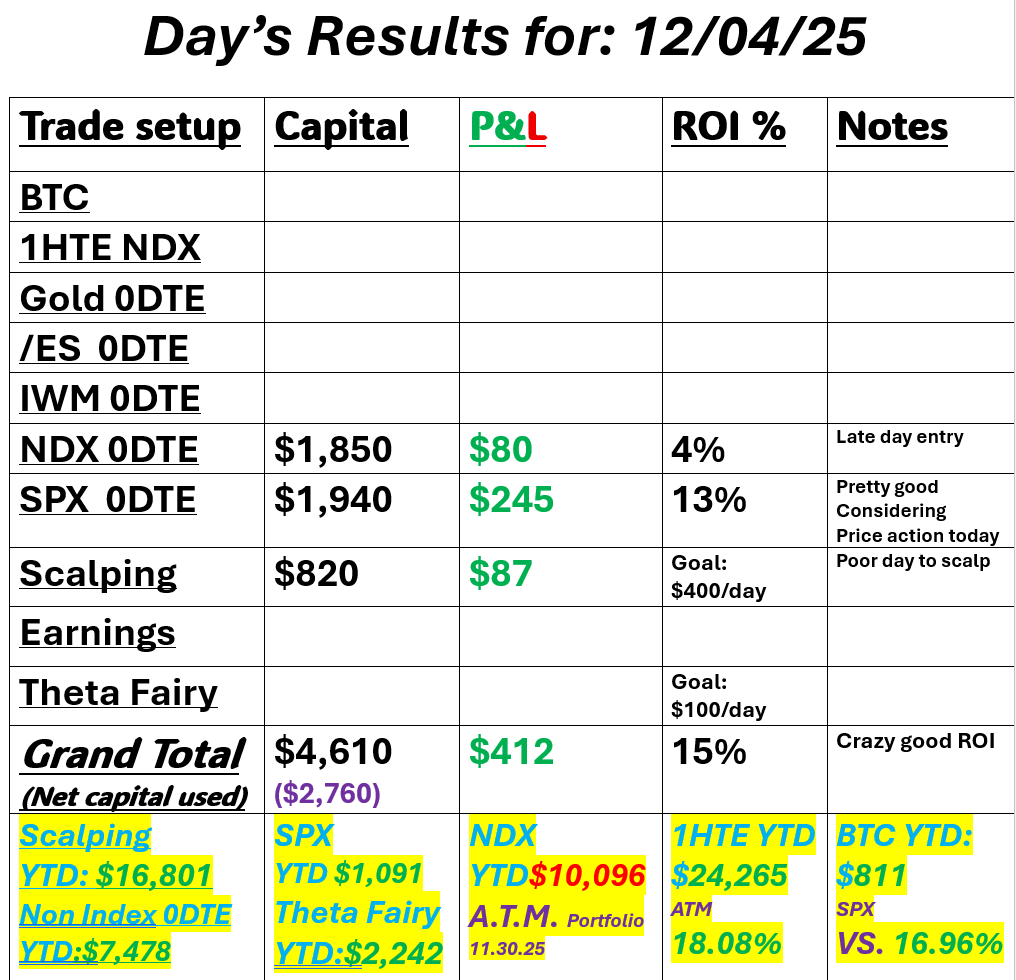

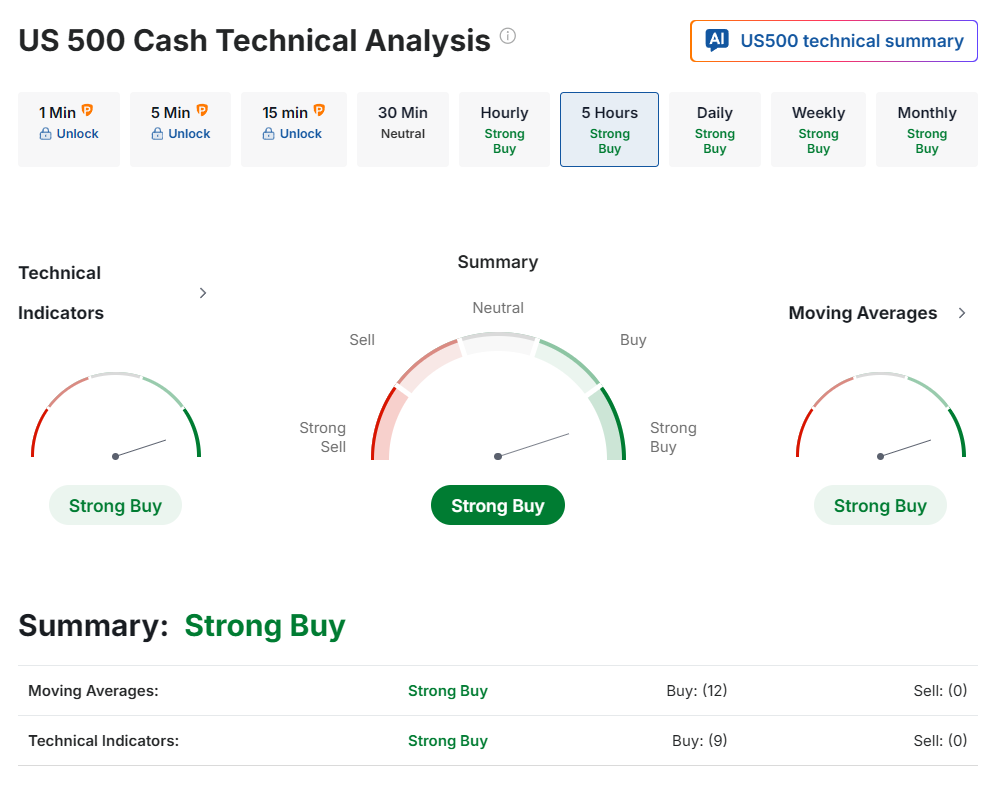

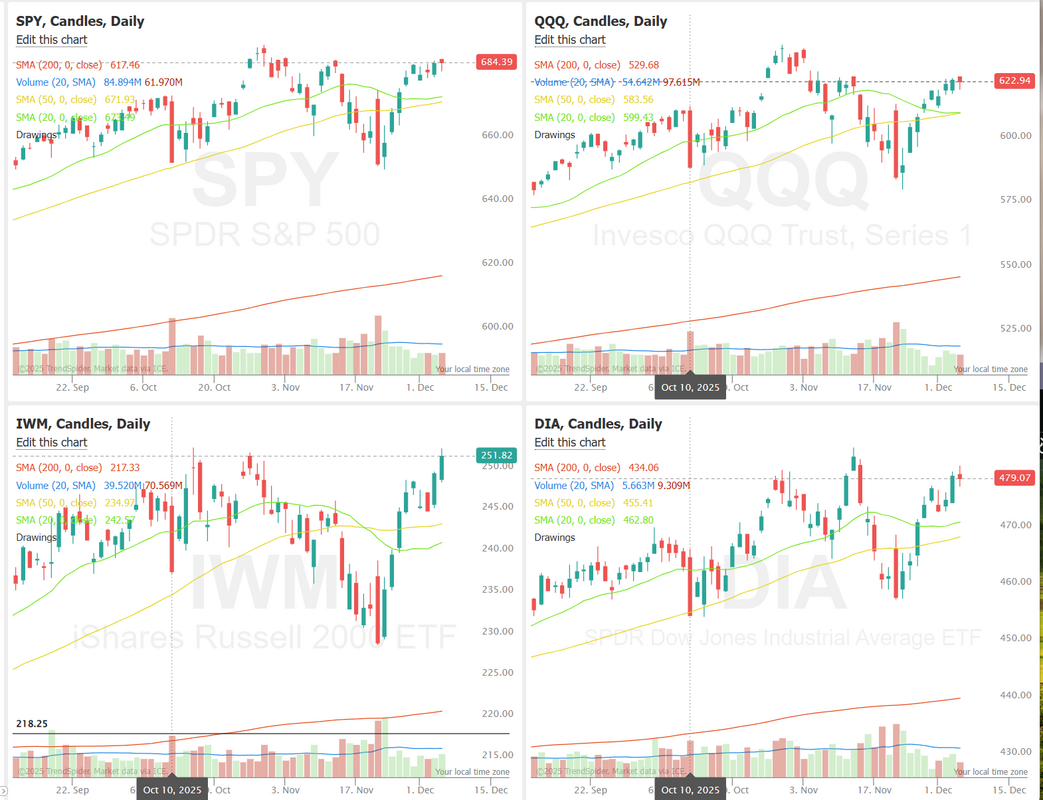

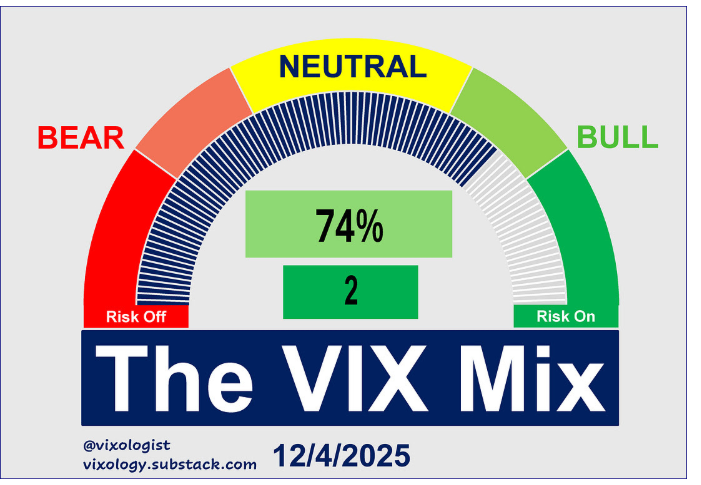

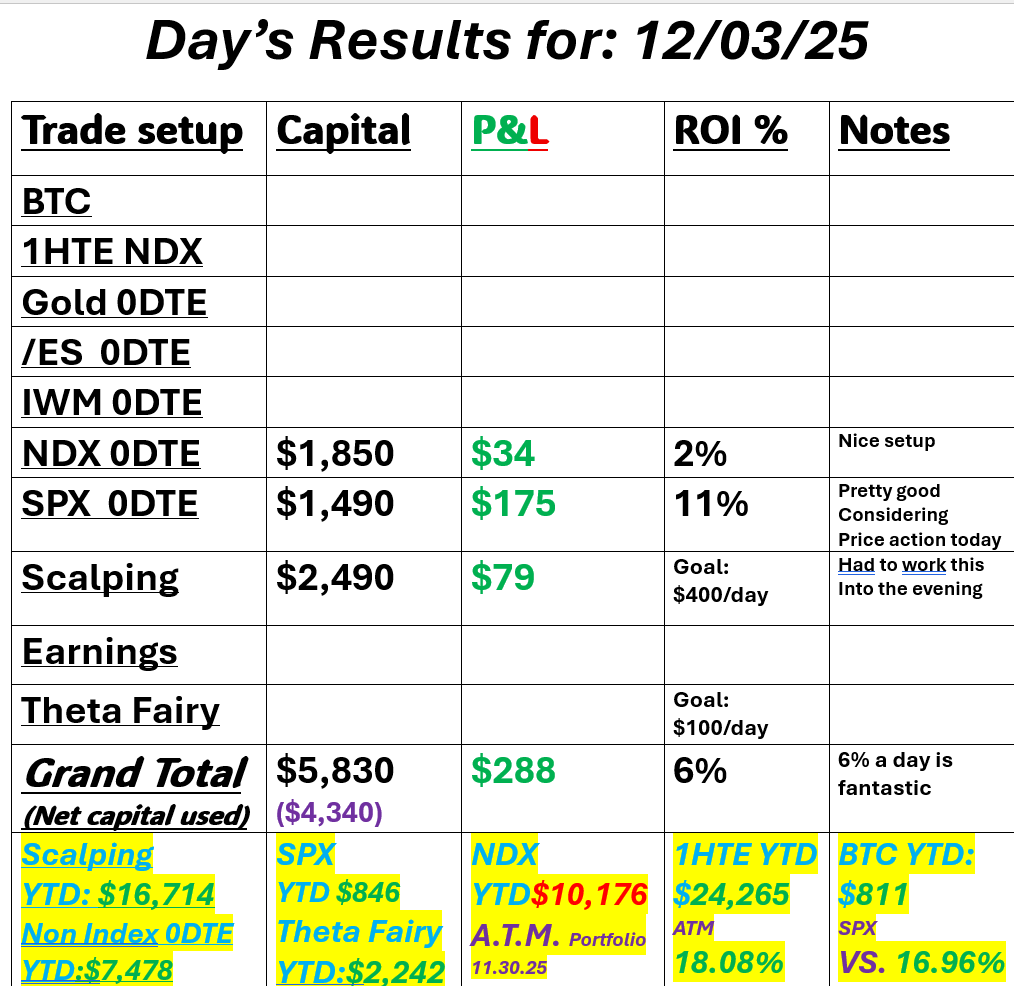

There is a trade setup for every day.Last week was amazing for us. Every day a winner. Great. Last week had some really good setups. This week? Well, Monday and Tuesday were blah as traders didn't want to take positions prior to FOMC. Yesterday was a big "wait and see" until the end of the day. Two very big traders I follow on Twitter just said, "take this week off" and walked away. This always blows my mind. Yes, this week has not presented the amazing setups we'd like to see but never the less, we've made money every day. That's the power of options. Regardless of market conditions, Up, down, neutral. High I.V, Low I.V. There are setups that can work. Are they as juicy as we'd like? Not always, but there are always trades to be had. Even if it's a 1HTE setup on Bitcoin. We had some nice setups yesterday for FOMC. Did we get rich? No. But we just keep bring in the green. Here's a look at our day. Let's take a look at the markets. Technicals are back to bullish after the move yesterday. Although we do see a bit of Jekyll and Hyde action in the futures. It was really the interest rate sensitive IWM that got the best of yesterdays FOMC news. December S&P 500 E-Mini futures (ESZ25) are down -0.35%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.65% this morning as Oracle rekindled worries about the massive spending tied to artificial intelligence, overshadowing optimism over the Federal Reserve’s latest interest-rate cut. Oracle Corporation (ORCL) plunged over -10% in pre-market trading after the software and cloud-computing company posted weaker-than-expected FQ2 cloud sales and raised its full-year capital expenditures forecast. The company’s results brought renewed attention to concerns over tech valuations and whether heavy spending on AI infrastructure will ultimately pay off. Investors will get another read on the AI trade’s strength when Broadcom releases its earnings after the close. Notably, stock index futures pared earlier losses of more than 1% as dip buyers stepped in. Lower bond yields today are also helping limit losses in equity futures. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. GE Vernova (GEV) surged over +15% and was the top percentage gainer on the S&P 500 after the energy company increased its earnings projections and boosted its dividend and share buyback authorization. Also, Nike (NKE) rose more than +3% and was the top percentage gainer on the Dow after Guggenheim initiated coverage of the stock with a Buy rating and $77 price target. In addition, Photronics (PLAB) jumped over +45% after the company posted better-than-expected FQ4 results and provided upbeat FQ1 guidance. On the bearish side, shares of mobile grocery delivery firms slipped after Amazon.com announced it had expanded same-day delivery for perishable groceries to more than 2,300 cities and towns, with Uber Technologies (UBER) falling more than -5% to lead losers in the S&P 500 and DoorDash (DASH) dropping over -4%. Economic data released on Wednesday showed that the U.S. employment cost index rose +0.8% q/q in the third quarter, weaker than expectations of +0.9% q/q. As widely expected, the Federal Reserve lowered interest rates for the third consecutive time yesterday. The Federal Open Market Committee voted 9-3 to lower the target range for the Fed funds rate by a quarter percentage point to 3.50%-3.75%. Fed Governor Stephen Miran dissented in favor of a half-point rate cut, while Kansas City Fed President Jeff Schmid and Chicago Fed President Austan Goolsbee dissented in favor of keeping rates unchanged. In its post-meeting statement, the committee made a slight adjustment to its language, suggesting greater uncertainty about the timing of its next rate cut. In their updated economic projections, officials’ median forecasts pointed to one quarter-percentage-point cut in 2026 and another in 2027. In addition, policymakers authorized new purchases of short-term Treasury securities to ensure an “ample” level of bank reserves. At a press conference, Chair Jerome Powell indicated that the Fed had likely done enough to ease the threat to employment while keeping rates sufficiently high to continue easing inflation pressures. “This further normalization of our policy stance should help stabilize the labor market while allowing inflation to resume its downward trend toward 2% once the effects of tariffs have passed through,” Powell said. “The Fed emphasized that future moves will be data-dependent, shifting firmly to a meeting-by-meeting approach,” said Daniel Siluk, a portfolio manager at Janus Henderson Investors. Meanwhile, U.S. rate futures have priced in an 80.1% chance of no rate change and a 19.9% chance of a 25 basis point rate cut at the conclusion of the Fed’s January meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 220K, compared to last week’s number of 191K. U.S. Trade Balance data for September will also be released today. The data was originally scheduled for release on November 4th, but was delayed due to the government shutdown. Economists anticipate that the trade deficit will widen to -$62.5 billion from -$59.6 billion in August. U.S. Wholesale Inventories data will be released today as well. Economists forecast that the final September figure will come in at +0.1% m/m. In addition, market participants will monitor earnings reports from several notable companies, with Broadcom (AVGO), Costco (COST), Ciena Corp. (CIEN), and Lululemon Athletica (LULU) scheduled to report their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.143%, down -0.67%. We just finished our 12-part series yesterday, and it was a very insightful study. Today, we'll be looking at one of the most infamous books Wall Street has ever seen. There's some amazing stuff here. If you want to see how we find positions we want to be assigned on in our ATM portfolio (that consistently beats the SP500) you won't want to miss it. Come join us in our live Zoom. Let's take a look at the intraday /ES levels we'll be working on today: 6873, 6881, 6888, 6900 are resistance levels. 6863, 6857, 6851, 6845 are support. We've got a sweet setup already working from yesterday for our SPX 0DTE. We'll build our day out around this position. See you all shortly. Today should be a "banger" as the kids like to say!

0 Comments

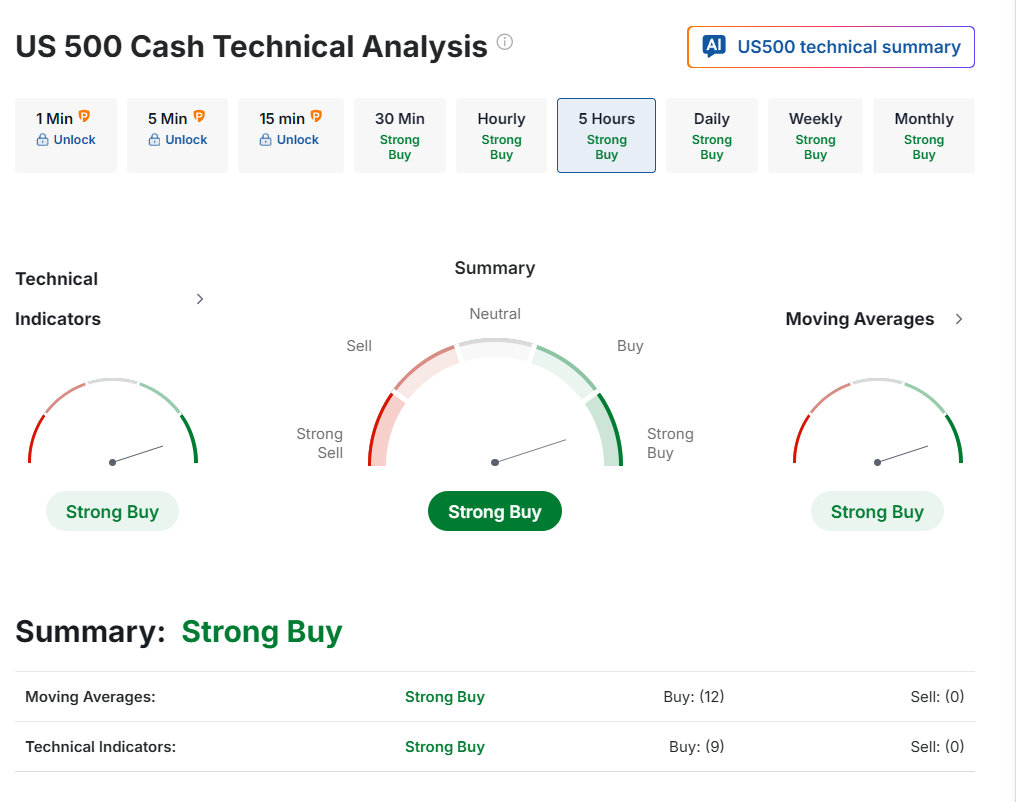

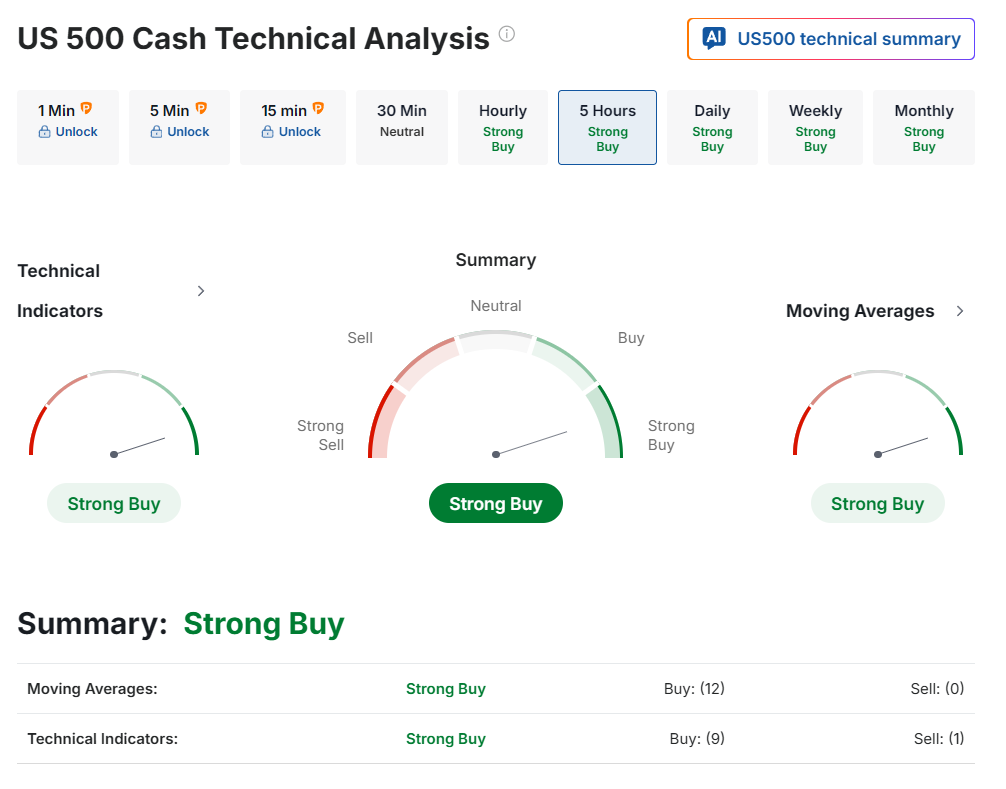

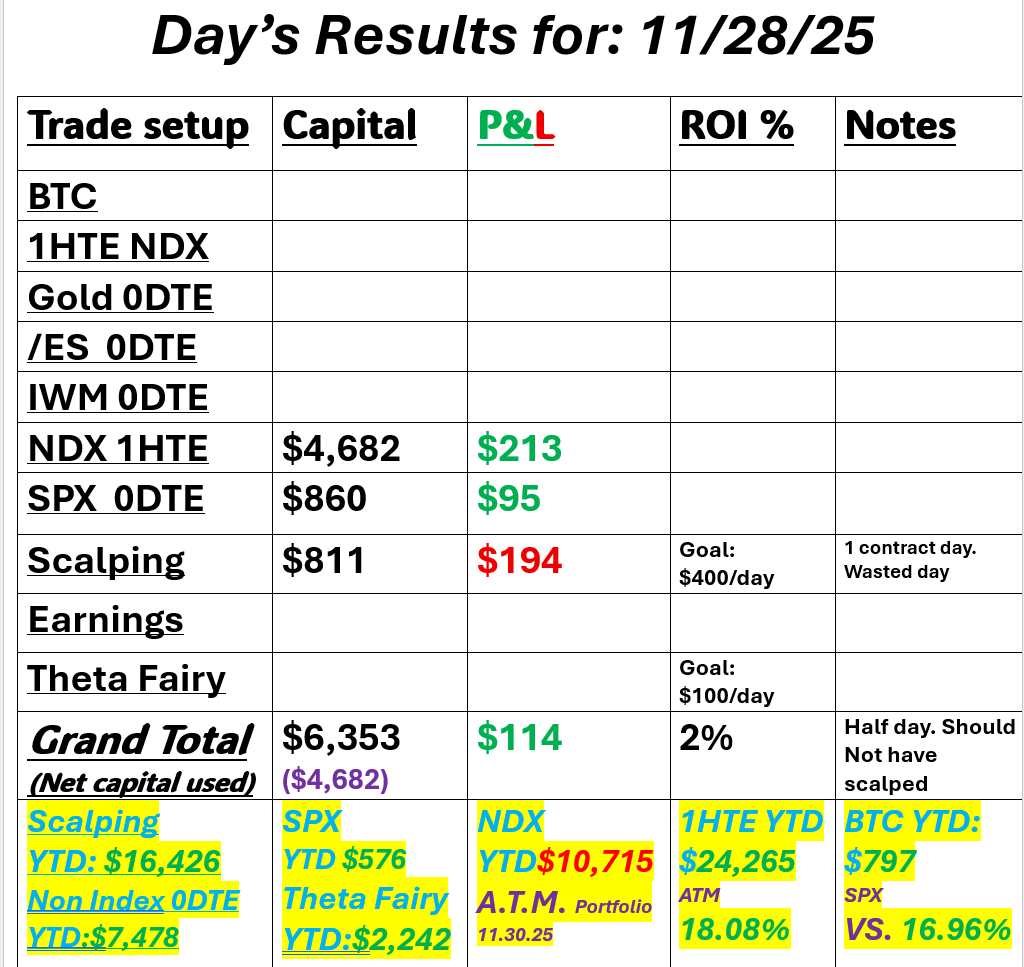

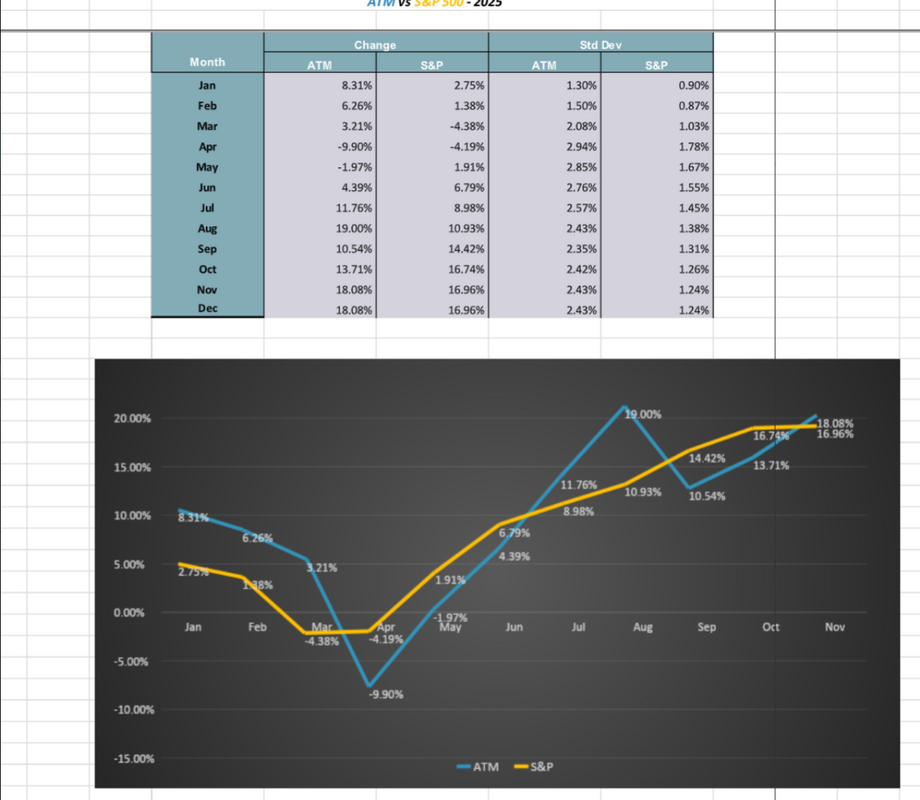

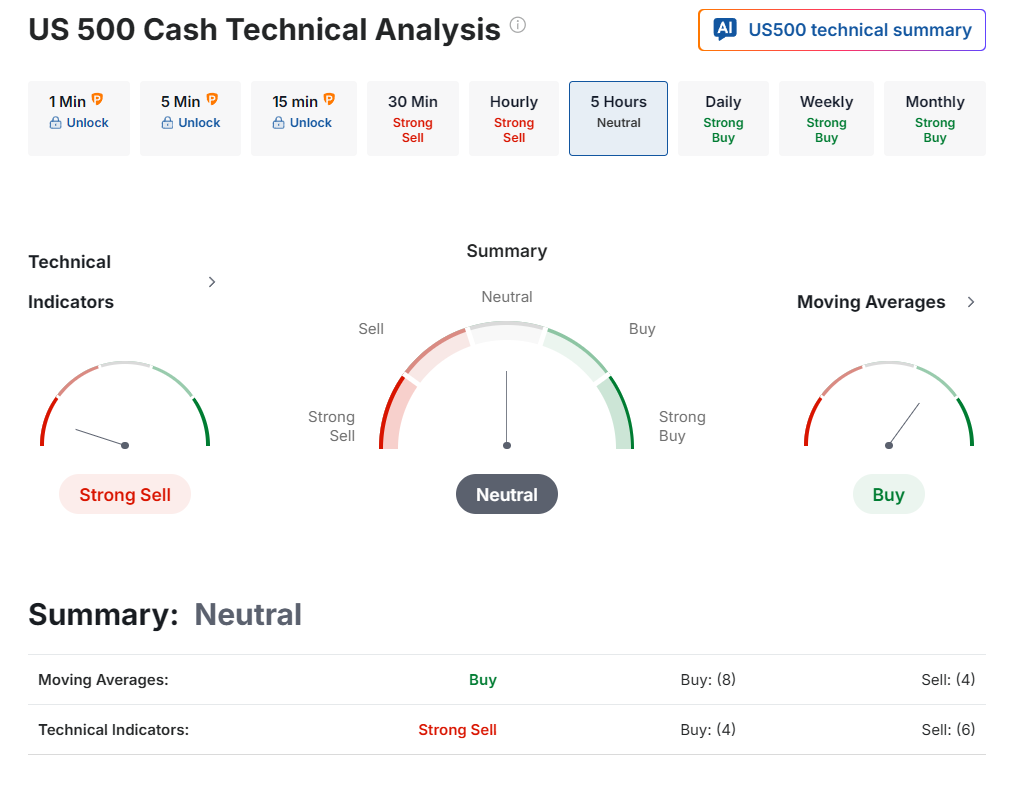

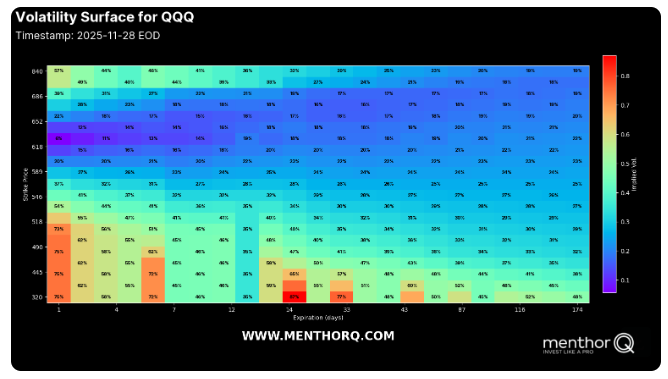

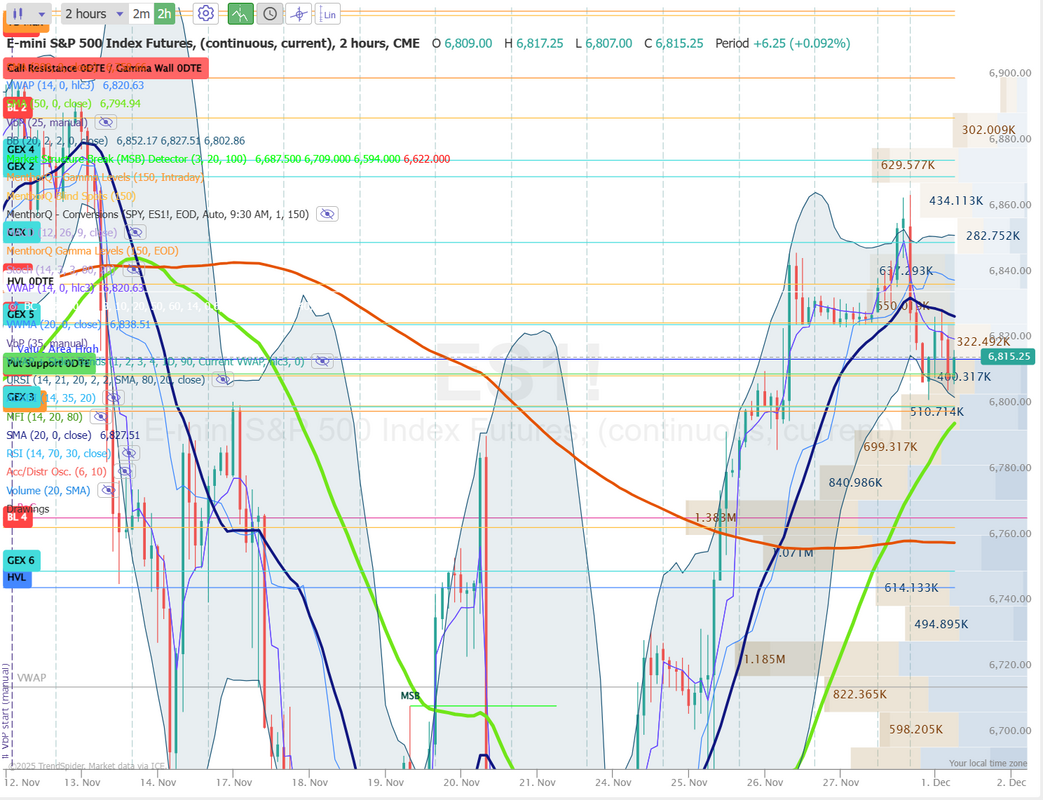

FOMC day and 19.8%Today is FOMC day. The expected rate cut is not the news. What Powell says about next year and how a deeply divided Fed will work itself out is the real story. Also, the great Warren Buffett is set to retire. Considered one of the best investors to have ever lived. His long-term track record is 19.8% average annual return. A return, by the way, that doubles (trounces) the stock market. Remember that 24% a year doubles your money every three years. You don't need better than that. If you can do that, you are in an elite group and your money will compound just fine. I'm super proud of our ATM portfolio. Entering its sixth year with an average yearly return of 26%. Trouncing the market isn't an easy task. We had a good day yesterday. It was another tough day and my only mistake was trying to scalp on a day that had no real scalping opportunities. Still, we found some places to may money and finished green on the day. Here's a look at our day. Let's take a look at the markets. Technicals are breaking down as we await the FOMC. Neither the bulls nor the bears want to take a substantive position this week ahead of FOMC. Today, we finish our 12-book study with Trade Your Way to Financial Freedom by Van K. Tharp I'm excited about today's study. I personally think this book is one of the "must-reads" for traders. Join us today before the FOMC announcement on our live Zoom feed. This one is a must-attend. December S&P 500 E-Mini futures (ESZ25) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.11% this morning as investors refrain from making big bets ahead of the Federal Reserve’s final interest rate decision of the year, with all eyes on the central bank’s outlook for interest rates in 2026. Higher bond yields today are weighing on stock index futures. The 10-year T-note yield rose two basis points to 4.20%, extending its advance as investors grew more cautious about the pace of rate cuts next year. In yesterday’s trading session, Wall Street’s major indexes ended mixed. AutoZone (AZO) slumped over -7% and was the top percentage loser on the S&P 500 after the company posted weaker-than-expected FQ1 results. Also, JPMorgan Chase (JPM) slid more than -4% and was the top percentage loser on the Dow after its consumer banking chief, Marianne Lake, said firmwide expenses in 2026 would total roughly $105 billion. In addition, Toll Brothers (TOL) fell over -2% after the homebuilder reported weaker-than-expected FQ4 earnings and gave cautious 2026 deliveries guidance. On the bullish side, Ares Management (ARES) climbed more than +7% after S&P Dow Jones Indices announced that the asset manager would be added to the S&P 500 index on December 11th. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings rose to a 5-month high of 7.670 million in October, stronger than expectations of 7.140 million. Separately, the Conference Board’s leading economic index for the U.S. fell -0.3% m/m in September, in line with expectations. “It’s hard to read too much into the JOLTs report – the outperformance in job openings is ostensibly hawkish…, but the pace of layoffs rose too,” according to Vital Knowledge’s Adam Crisafulli. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to deliver a 25 basis point rate cut for a third straight meeting. That would take the Fed funds rate to a range of 3.50% to 3.75%. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for clues on next year’s interest rate path. Market participants will also scrutinize the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer guidance on how policymakers expect the interest rate path to unfold over the next few years. The implied move in the U.S. stock market following the Fed’s decision is just under 1% in either direction, according to data from Strategas Group. A swing of that magnitude would mark the largest post-Fed-Meeting move in the S&P 500 index since March. “It’s not too much of an exaggeration to say that the rate cut is actually the least important part of this meeting,” said Tom Essaye, founder of The Sevens Report. The market “cares much more that the Fed signals it will continue to cut rates and does not signal a pause in the rate-cut cycle.” Meanwhile, White House National Economic Council Director Kevin Hassett, the frontrunner in President Trump’s search to replace Mr. Powell, said on Tuesday he believes there is ample room to significantly lower rates, potentially by more than a quarter-point cut. “If the data suggests that we could do it, then — like right now — I think there’s plenty of room to do it,” Hassett said. On the economic data front, investors will focus on the U.S. Employment Cost Index, which is set to be released in a couple of hours. The ECI was originally scheduled for release on October 31st, but was delayed due to the government shutdown. Economists expect this figure to come in at +0.9% q/q in the third quarter, the same as in the second quarter. The EIA’s weekly crude oil inventories report will also be released today. Economists expect this figure to be -1.2 million barrels, compared to last week’s value of 0.6 million barrels. On the earnings front, prominent companies such as Oracle (ORCL), Adobe (ADBE), and Synopsys (SNPS) are set to report their quarterly figures today. Oracle’s results will attract particular attention amid concerns over lofty tech valuations and whether massive AI investments will ultimately deliver returns. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.210%, up +0.45%. The SPX momentum setup is stabilizing again, with the momentum score climbing back to its upper range (near 5) after several weeks of choppy readings. Price action has also firmed, with the index holding above recent swing lows and grinding toward the upper end of its short-term range. In the very near term, the key thing to watch is whether SPX can maintain this renewed momentum strength, as past rebounds to a score of 5 have often coincided with brief follow-through attempts. If momentum slips back toward the mid-range again, it would signal that buyers are losing control of the current bounce and that the index may be stuck in a sideways consolidation. QQQ’s 1-month skew continues to show a clear put-side bias, with the risk-reversal sitting in the upper-third of its 3-month range (≈74th percentile). This suggests that traders are still paying a relative premium for downside protection even as spot prices have recovered from the late-November dip. The white 25-delta risk-reversal line has been grinding higher, indicating persistent demand for puts over calls. In the short term, this kind of elevated skew often reflects a market that’s stabilizing but still carrying hedging pressure, useful to keep in mind if volatility picks up again or if QQQ retests recent support levels. On FOMC days, I don't give levels or a directional bias as those are less accurate on days like today. Powell's testimony is all that really matters. We have an overnight Theta fairy that we'll work up to the FOMC minutes release, then we'll work our 0DTE after Powell speaks.

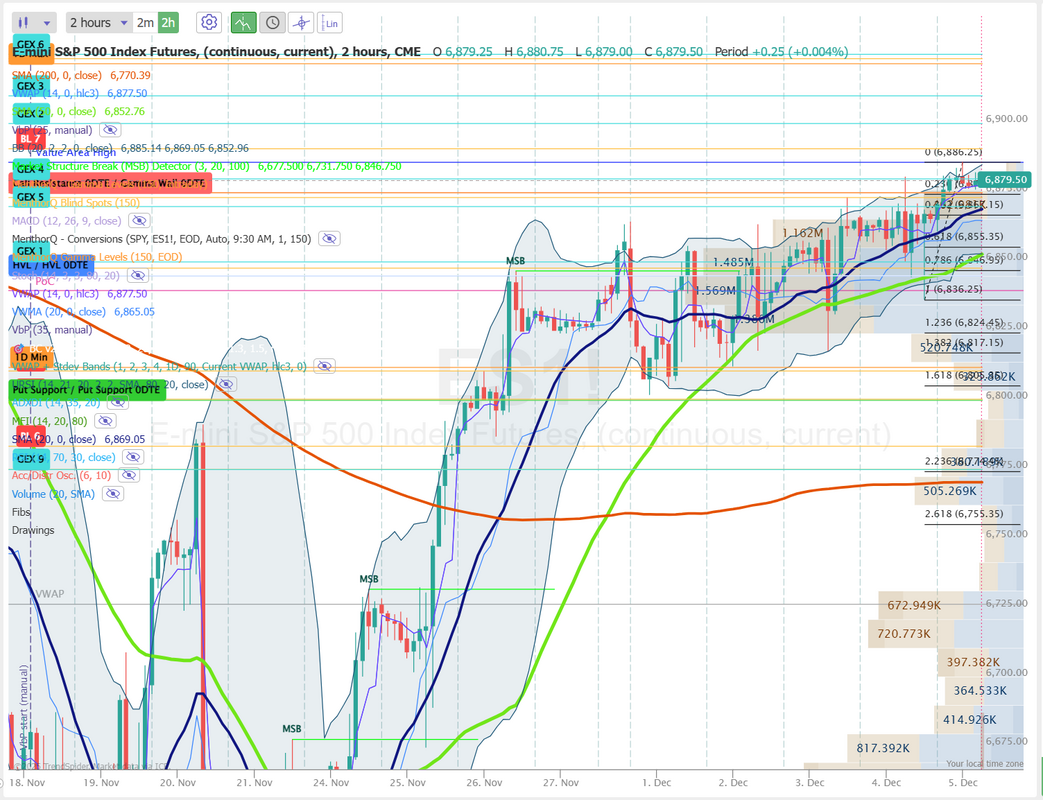

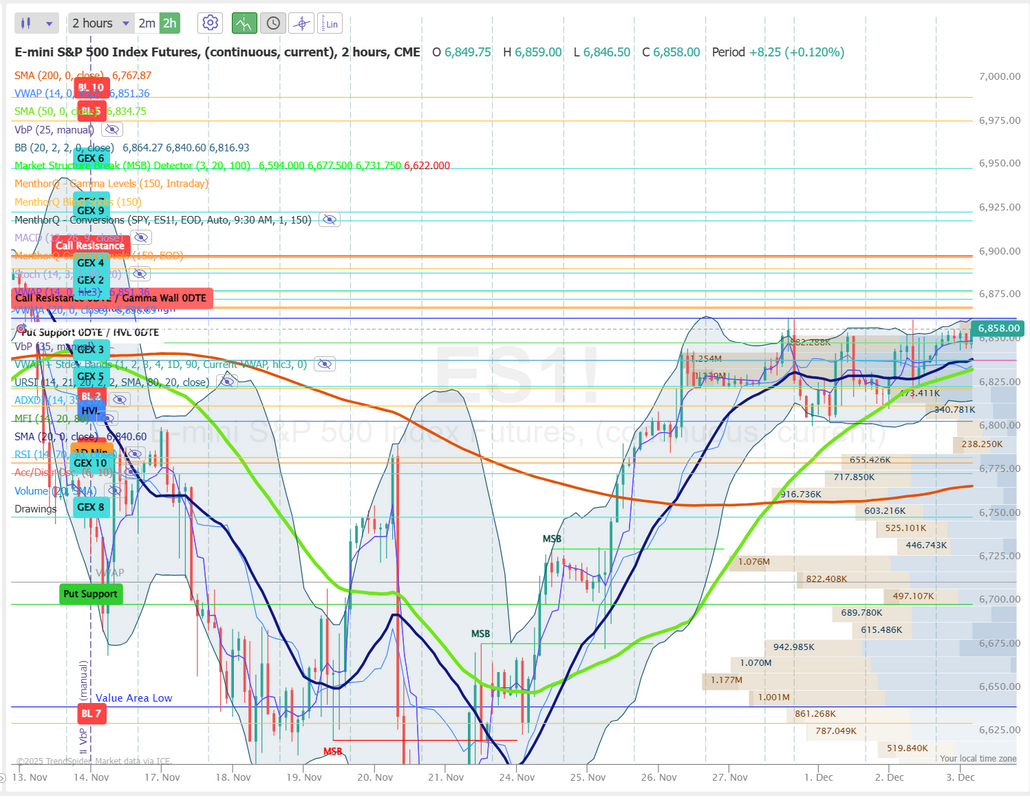

See you all on Zoom shortly! Levels, levels and more levels.I'm a big believer in humility as a wonderful human trait and that "pride cometh before the fall". This is accurate in life but especially important in trading. The minute you think you've got it figured out and are "hot stuff" the market has a way of smacking you upside the head! Our trades are no different and any other traders. Some win and some lose but...one thing I do brag about and am very proud of, is our levels. Win, lose or draw on the day, our levels are usually pretty spot on. It's what we base all our trading off of. It's our "secret sauce" here. Yesterday however was on another level! I told our traders before the open it could be a "yucky" day. No body wants to really commits, either way, before FOMC. (Frankly today could be the same). We were down most of the day but kept working it. Stayed patient and darned if we didn't hit both our resistance area and target area within 1 point! Here's a look at our day. Let's take a look at the markets. Sitting so close to ATH's, nobody wants to commit before FOMC tomorrow. We start the day with a technical neutral rating. That seems very appropriate but also gives no guidance. December S&P 500 E-Mini futures (ESZ25) are trending up +0.07% this morning as investors gear up for the start of the Federal Reserve’s two-day policy meeting, while also awaiting the delayed reading on U.S. job openings. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Marvell Technology (MRVL) slumped about -7% and was the top percentage loser on the Nasdaq 100 after Benchmark downgraded the stock to Hold from Buy and withdrew its price target. Also, Tesla (TSLA) slid more than -3% after Morgan Stanley downgraded the stock to Equal Weight from Overweight. In addition, CoreWeave (CRWV) fell over -2% after the cloud computing firm announced plans to offer $2 billion worth of convertible senior notes due 2031 in a private placement. On the bullish side, Paramount Skydance (PSKY) climbed more than +9% and was the top percentage gainer on the S&P 500 after the company launched a hostile takeover bid for Warner Bros. Discovery at $30 per share in cash. The Fed kicks off its two-day meeting later in the day. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 3.50% to 3.75% on Wednesday. Investors will closely follow Chair Jerome Powell’s post-policy meeting press conference for clues on next year’s interest rate path. Market watchers will also scrutinize the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer guidance on how policymakers expect the interest-rate path to unfold over the next few years. “The tone of Chair Powell’s press conference and accompanying statement will be critical,” wrote Deutsche Bank AG strategist Jim Reid. “We expect Powell to emphasize that the hurdle for further cuts in early 2026 is high, signaling a near-term pause. This guidance will be key to maintaining credibility.” On the economic data front, investors will focus on the U.S. JOLTs Job Openings figures for October, set to be released in a couple of hours. Notably, the October JOLTs report will include figures for September. The report will provide investors with additional insight into the health of the U.S. labor market. Economists, on average, forecast that the JOLTs Job Openings will arrive at 7.2 million. The Conference Board’s Leading Economic Index for the U.S. will also be released today. Economists expect the September figure to drop -0.3% m/m, compared to the previous number of -0.5% m/m. Meanwhile, the Bureau of Labor Statistics said on Monday it will skip publication of its delayed October PPI report and instead roll those figures into a rescheduled November report set for publication on January 14th. On the earnings front, notable companies like AutoZone (AZO), Ferguson (FERG), AeroVironment (AVAV), and GameStop Corp. (GME) are slated to release their quarterly results today. In tariff news, U.S. President Donald Trump threatened to impose a 5% levy on imports from Mexico, accusing the country of violating a 1944 treaty that obligates it to deliver millions of gallons of water to the U.S. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.162%, down -0.26%. The S&P 500 is trading at nearly 24x forward P/E ratio, the 2nd-highest among major global stock markets. Meanwhile, Wall Street expects as much as a +16% rise in the S&P 500 in 2026. Do you think our ATM portfolio can beat the market results again in 2026? My money (literally) says yes! The SPX option score has stabilized near the upper end of its range, hovering around 4–5, which signals improving short-term sentiment compared with the mid-November softness. Price action has also firmed, with the index carving out a series of higher lows and pushing back toward the recent 6,900 level. In the very near term, this combination, stronger option score plus recovering spot price, suggests traders are leaning more constructively, especially if the index can hold above the mid-6,800 zone that has acted as a pivot. However, the score has flipped quickly before, so watching whether it sustains another high reading over the next few sessions will be key to gauging whether momentum builds or stalls. Let's take a look at the intraday /ES levels once again. Today may be another "malaise" like yesterday. I don't expect much movement before FOMC. That doesn't mean we can't profit (see yesterday), but we'll likely need to work for it. 6863, 6870* (20.50PMA on 2hr. chart convergence), 6875, 6883, 6894 are resistance levels. 6856, 6850, 6844, 6836, 6830 are support levels. We had an excellent training yesterday, and tomorrow will be our last in our 12-part series on must-read books. We'll end with on one of the best books ever for traders. Trade Your Way to Financial Freedom by Van K. Tharp. It's an absolute must for serious traders. Please join us tomorrow in our live Zoom feed.

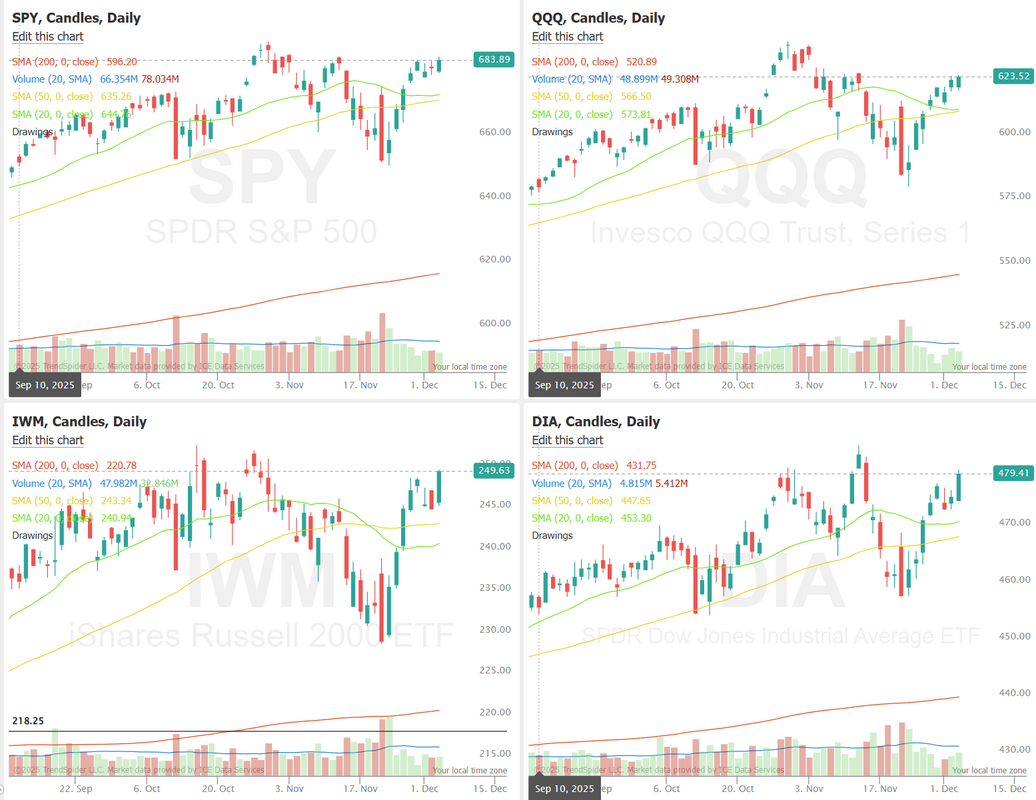

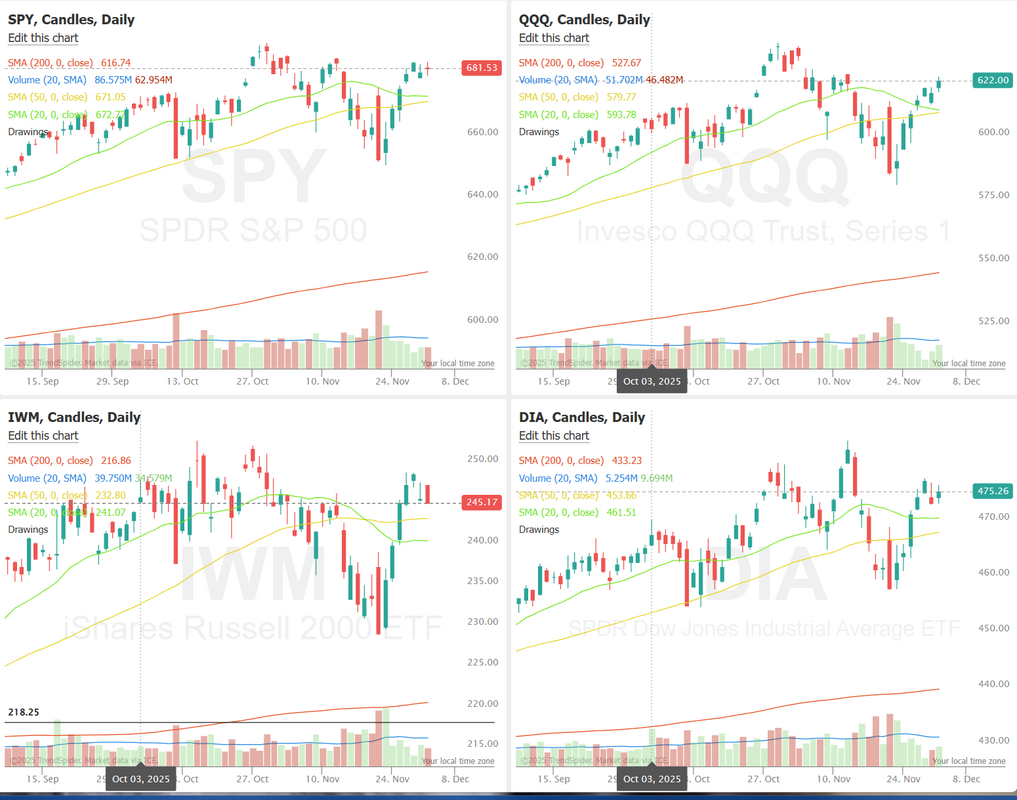

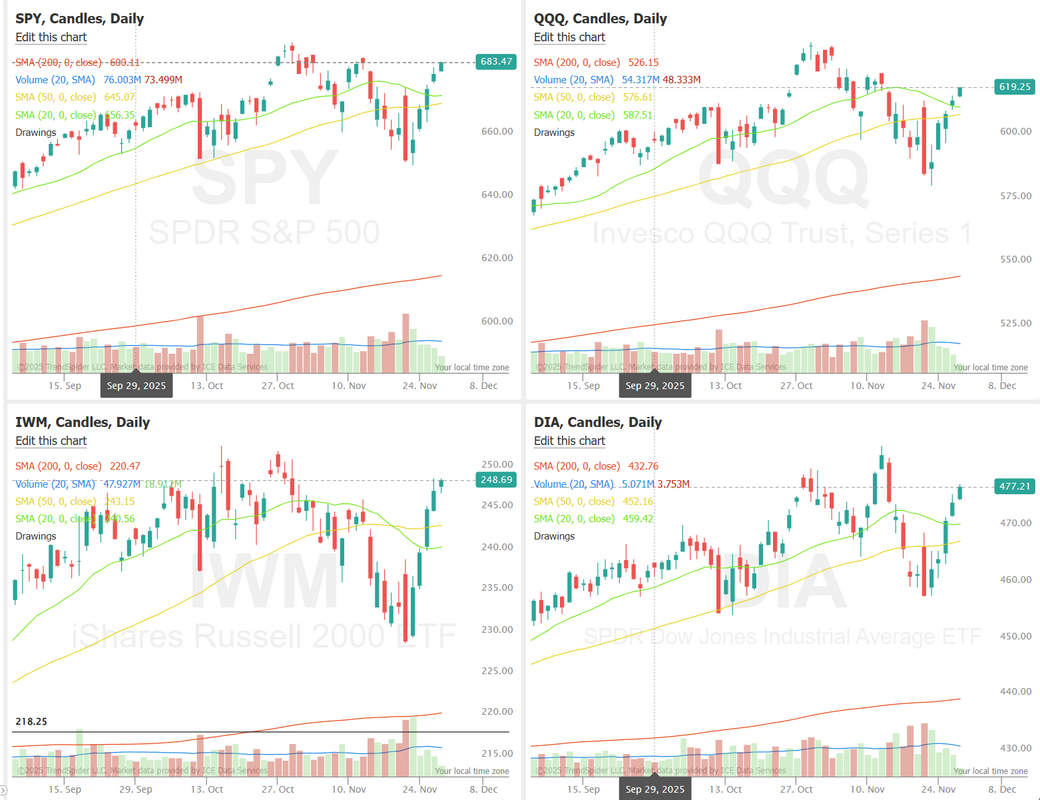

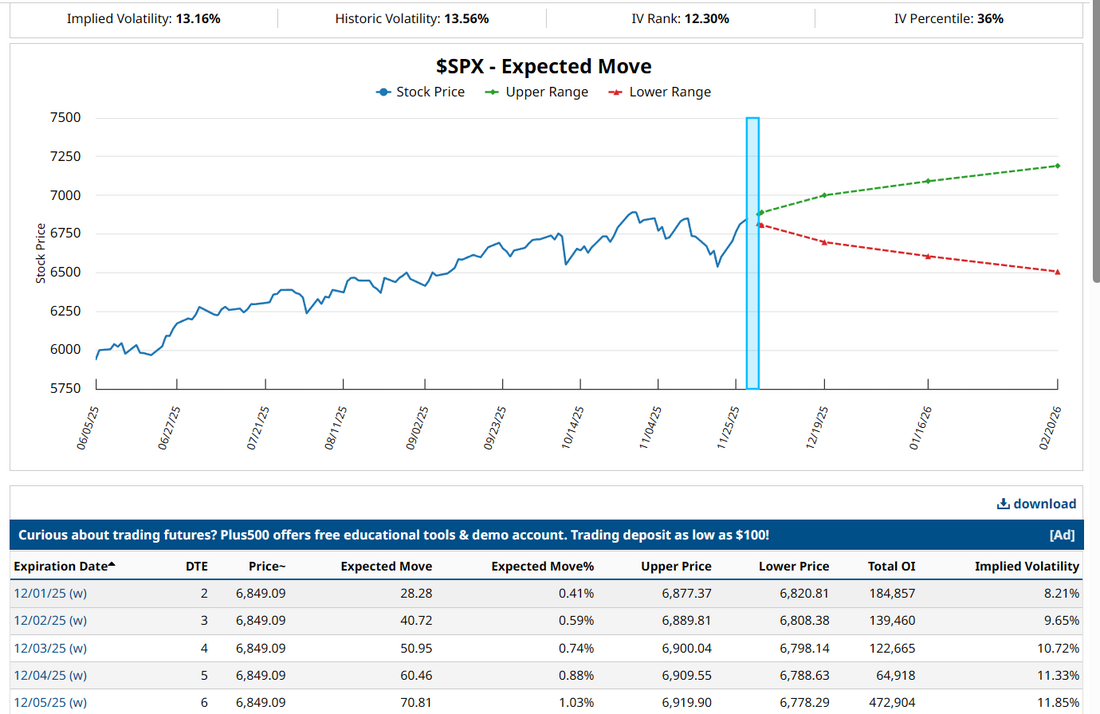

See you all shortly in the live trading room! Let's make some more money today. FOMC this week.Welcome back to a new week of trading. I hope your weekend went well. We had a church Christmas party on Sat. and an extended family party (62 relatives!) on Sun. so I'm a bit Christmas'ed out! This week we get FOMC on Weds. and another rate cut looks likely. The focus should be on the FEDS ' looking comments about 2026. How many rate cuts will we get? We had an excellent run of profit last week. Our ATM portfolio continues to power into the close of 2025 and should, once again, beat the SP500 for return. In spite of the fact that price action was muted most of last week, our day trades all worked as well. Here's a look at our Friday results. Our end-of-day .40-cent trade turned in a 350% gain, which helped. Let's take a look at the markets: Technicals are still hanging onto the buy mode signal. Markets seem to be waiting around for FOMC to drop. The question is, has the rate cut already been priced in? SPY was the weakest of the major indexes last week, finishing nearly unchanged at $685.69 (+0.33%). However, the Chande Absolute Trend Strength (CHATS) Indicator turned candles green for the first time in weeks, reflecting a shift toward strengthening momentum and renewed trend persistence. With SPY pressing toward all-time highs, a fresh CHATS flip often signals the early stages of a re-acceleration phase rather than exhaustion. QQQ led the major indexes last week, closing at $625.48 (+1.00%) and finishing Friday with a green CHATS candle. The Polymarket rate-cut odds have surged since late November and recently crossed above the odds of no cut. This shift in expectations helped reinforce the bullish reversal, supporting continued risk-on positioning in growth and tech ahead of the upcoming FOMC decision. Small caps continued to show strength last week, with IWM closing at $250.77 (+0.84%) and pressing just below all-time highs. As one of the most rate-sensitive equity groups, IWM has been quick to respond to the sharp rise in Polymarket rate-cut odds over the past several weeks. With the FOMC decision just days away, the question now is whether a highly anticipated cut becomes a sell-the-news event or if improving rate expectations fuel a breakout to new highs. The latest SPX breadth readings show short-term participation beginning to firm up, with the number of stocks reclaiming their 5-, 20-, and 50-day SMAs ticking higher after a period of compression. While none of the breadth measures are signaling an extreme, the upward curl across all three windows suggests improving internal momentum rather than a narrow, index-driven move. In the short term, continued follow-through in the 5-day SMA breadth is a key sign to watch, sustained expansion there often precedes broader strength in the 20- and 50-day cohorts. Conversely, if these small upticks stall or roll over, it may indicate the rally is losing participation under the surface even if headline price holds steady. Let's look at the weekly expected move in the SPX. Sitting at a 1.16% expectation. That's low for an FOMC week. Today's training is on the book How to Make Money in Stocks by William J. O'Neil. We've only got one more book to go on our list of top 12 books every trader should read. Come join us today for another valuable training session. December S&P 500 E-Mini futures (ESZ25) are up +0.12%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.23% this morning, pointing to a higher open on Wall Street as investors look ahead to the Federal Reserve’s final monetary policy committee meeting of the year, where another rate cut is widely expected. In Friday’s trading session, Wall Street’s major equity averages ended in the green. Ulta Beauty (ULTA) surged over +12% and was the top percentage gainer on the S&P 500 after the retailer reported stronger-than-expected Q3 results and raised its full-year guidance. Also, chip stocks gained ground, with Micron Technology (MU) rising more than +4% and GlobalFoundries (GFS) advancing over +3%. In addition, Warner Bros. Discovery (WBD) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after Netflix agreed to acquire the company for about $72 billion. On the bearish side, DocuSign (DOCU) slumped over -7% after the software company issued soft Q4 revenue guidance. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, rose +0.2% m/m and +2.8% y/y in September, compared to expectations of +0.2% m/m and +2.9% y/y. Also, U.S. September personal spending rose +0.3% m/m, in line with expectations, and personal income grew +0.4% m/m, stronger than expectations of +0.3% m/m. In addition, the University of Michigan’s preliminary U.S. consumer sentiment index rose to 53.3 in December, stronger than expectations of 52.0. Finally, U.S. consumer credit rose by $9.18 billion in October, weaker than expectations of $11.8 billion. “Overall, the [PCE Inflation] data was consistent with another 25 basis point Fed cut [in December], but it doesn’t suggest any urgency for the Fed to accelerate the pace of cuts in 2026,” said BMO’s Ian Lyngen. The Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 3.50% to 3.75%, especially after last week’s ADP payroll report pointed to falling private-sector jobs. “Momentum is now firmly behind a third 25 basis-point easing for the year. While there is some nervousness about the potential for inflation to remain elevated due to tariff-induced price hikes, the news on the jobs market is increasingly concerning,” according to ING economist James Knightley. With next year’s rate path uncertain, Mr. Powell’s remarks will be closely monitored. Market watchers will also scrutinize the Fed’s quarterly “dot plot” in its Summary of Economic Projections, as they look to gauge how quickly and how far interest rates will fall next year. Investors will also keep an eye on U.S. economic data this week. The U.S. JOLTs Job Openings for October and weekly jobless claims will provide investors with additional insight into the health of the labor market. Notably, the October JOLTs report will include figures for September. Other noteworthy data releases include the Employment Cost Index, Unit Labor Costs (preliminary), Nonfarm Productivity (preliminary), and Trade Balance. In addition, several prominent companies, including Broadcom (AVGO), Oracle (ORCL), Adobe (ADBE), Costco (COST), and AutoZone (AZO), are slated to release their quarterly results this week. On Friday, the Fed’s blackout period ends, with central bank officials Paulson, Hammack, and Goolsbee set to deliver remarks. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.151%, up +0.27%. Let's take a look at our intraday /ES levels. It was a very quiet overnight session. We may be able to get another Theta fairy working tonight. 6894, 6900, 6905, 6911, 6925 are resistance zones. 6884, 6880, 6875, 6871, 6864 are support. Let's see if we can repeat last weeks string of success's. I look forward to seeing you all in the live trading room shortly!

PCE dayWe are finally starting to get back to a normal flow of economic reports, after the Government shutdown ended. PCE report this morning could be the driver for the days price action. Yesterday was once again, a slow "normal" day in the markets. We got trades working early so that helped. Overall it was another solid day for us. This whole week had been very consistent as far as results go. Here's a look at our day: Let's take a look at the markets: Bullish bias continues into today. PCE report may change that but bulls look to still be in charge. The bulls are looking a bit tired here, with the exception of the interest rate sensitive IWM which powered to a new ATH. December S&P 500 E-Mini futures (ESZ25) are trending up +0.16% this morning, extending their advance toward a new all-time high, while investors look ahead to the release of the Federal Reserve’s first-line inflation gauge. In yesterday’s trading session, Wall Street’s major indices closed mixed. Chip stocks retreated, with Intel (INTC) sliding over -7% to lead losers in the S&P 500 and Nasdaq 100, and ON Semiconductor (ON) falling more than -4%. Also, Snowflake (SNOW) slumped over -11% as the cloud storage company’s Q4 product revenue guidance disappointed investors. In addition, Genesco (GCO) plummeted more than -30% after the company posted downbeat Q3 results and cut its full-year guidance. On the bullish side, Dollar General (DG) surged over +14% and was the top percentage gainer on the S&P 500 after the budget retailer posted better-than-expected Q3 results and raised its full-year guidance. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -27K to a 3-year low of 191K, compared with the 219K expected. Separately, U.S. factory orders rose +0.2% m/m in September, weaker than expectations of +0.3% m/m. “Overall, the net takeaway from the [jobless claims] data served to confirm the crosscurrents evident in the labor landscape,” said Ian Lyngen at BMO Capital Markets. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. The core PCE price index for September was originally scheduled for release on October 31st, but was delayed due to the government shutdown. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.9% y/y in September, the same as in August. “[Recent] soft core CPI and PPI reports suggest that tariffs continue to have more bark than bite with regard to inflation, and this should also be reflected in [the] September core PCE deflator,” according to ING economist James Knightley. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists expect September Personal Spending to rise +0.3% m/m and Personal Income to grow +0.3% m/m, compared to the August figures of +0.6% m/m and +0.4% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today. Economists foresee the preliminary December figure coming in at 52.0, compared to 51.0 in November. The Fed’s Consumer Credit report will be released today as well. Economists expect the U.S. Consumer Credit to be $11.8 billion in October, compared to the previous figure of $13.1 billion. Meanwhile, the U.S. November jobs report, originally scheduled for release today, was pushed back to December 16th due to the shutdown. That release will also incorporate the October payroll figures. U.S. rate futures have priced in an 87.2% chance of a 25 basis point rate cut and a 12.8% chance of no rate change at next week’s monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.110%, up +0.02%. The SPX momentum setup continues to stabilize, with the Momentum Score returning to the upper end of its range after a choppy period through mid-November. Price action has tightened near recent highs, and the index is now forming a short-term consolidation zone just below the 6900 level. With momentum back at 5, the market appears to be regaining directional strength, and the recent series of higher lows suggests buyers are defending dips more aggressively. In the near term, traders may watch whether SPX can push cleanly above last week’s highs to confirm renewed upside pressure, while a failure to hold the rising short-term troughs could signal another momentum fade. The VIX is implying a slight risk on environment. Let's take a look at our intraday /ES levels for 0DTE setups. 6886, 6892, 6900, 6909, 6921 are resistance levels. 6875, 6868, 6855, 6847, 6836 are support. Once again, PCE could be the driver today so lets see how it moves at the open. Let's finish off the week strong with another daily profit!

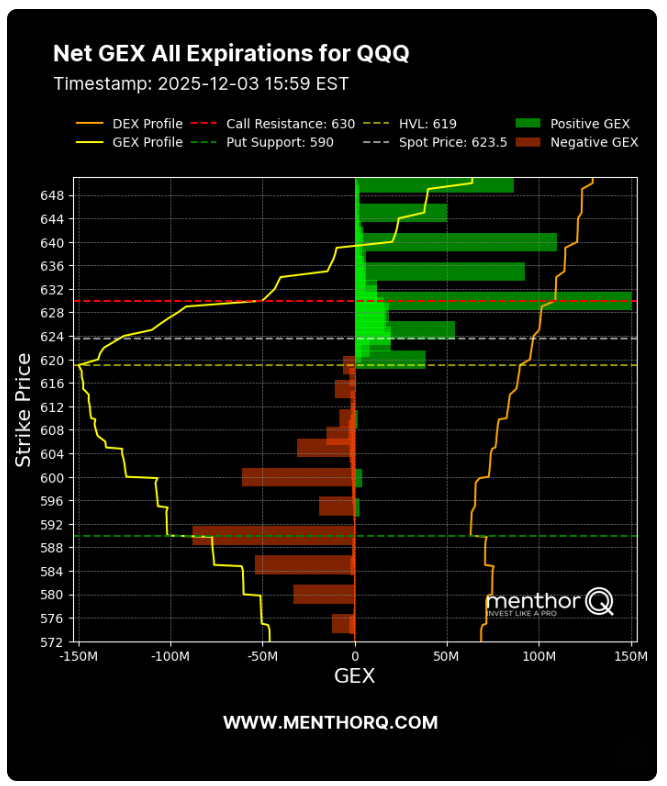

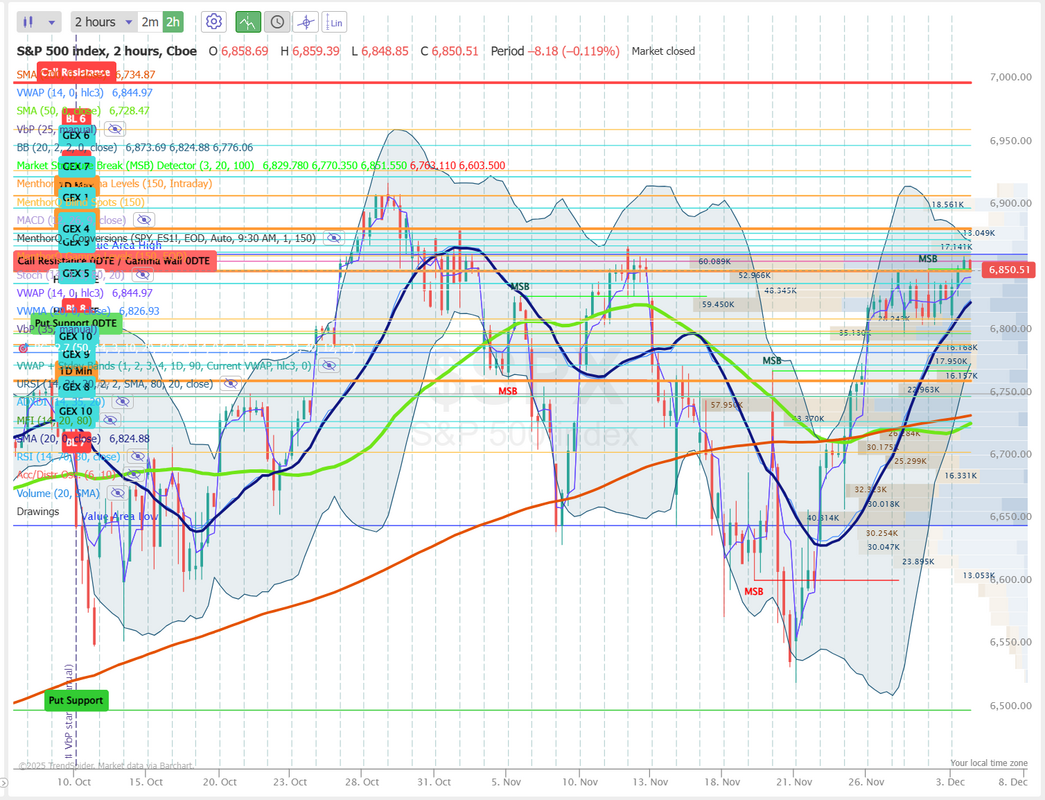

Has "normalization" returned?It's always important as day traders to remember how myopic we can get. The last three trading days have been slow, consistent, small moves. This is what we used to get last year. It was no biggie to throw on a credit Iron condor and let it ride. Risk/reward is always bad with a 70+ delta setup but it didn't matter. Moves were small and the trade was generally easy to manage. This year has been the opposite. Big moves and directional debit trades have been the go to. Are we returning to a "boring" market? It feels wrong to trade short Iron condors in this market but that's the trade the keeps coming to the top of the list. Today looks like another potentially slow day. We'll see. That's why we show up every day. We had an easy day yesterday but couldn't squeeze and "home runs" in. I had to take our short scalping position into the evening to finally grab a profit. Here's a look at the day we had: Let's take a look at the markets. We are clinging to a buy signal but it sure looks tired to me. IWM and DIA had strong bullish days yesterday but the SPY and QQQ are starting to look tired. Todays training will focus on Japanese Candlestick Charting Techniques by Steve Nison. Considered the "Grandfather of candlesticks". This is considered the bible of candlesticks. It should be another good one. Come join us in our live zoom feed and enrich your trading knowledge! The SPX is stabilizing near recent highs, and the option score has climbed back to its strongest reading in weeks, signaling improving short-term sentiment from the derivatives market. This upswing in the score suggests traders are positioning more confidently after a choppy period in mid-November, with fewer signs of hedging pressure and a tilt toward supportive flows. In the near term, the combination of firming price action and a high option score points to reduced downside momentum, making upcoming sessions important for confirming whether buyers can maintain control as SPX approaches overhead resistance. The QQQ Net GEX setup shows a supportive options landscape, with the spot price sitting near 623 and a notable pocket of positive GEX building above, helping dampen volatility on small pullbacks. The chart highlights put support around 590, meaning dealer positioning could act as a stabilizing buffer if price drifts lower. On the upside, call resistance near 630 marks a zone where dealer hedging flows may start to slow upward momentum, creating a tactical ceiling in the short term. With heavy negative GEX concentrated below and a growing positive cluster forming closer to spot, near-term flows lean toward a market that may trade in a contained range unless a clean break of these hedging levels forces dealers to adjust exposure. Let's look at the intraday levels on /ES for our 0DTE setups. 6857, 6864, 6875, 6884* (top of my range for today) are resistance levels. 6850* (big demarcation line), 6841, 6812* (big gap down zone), 6003 are support. Let's keep our winning streak going today! See you all shortly!

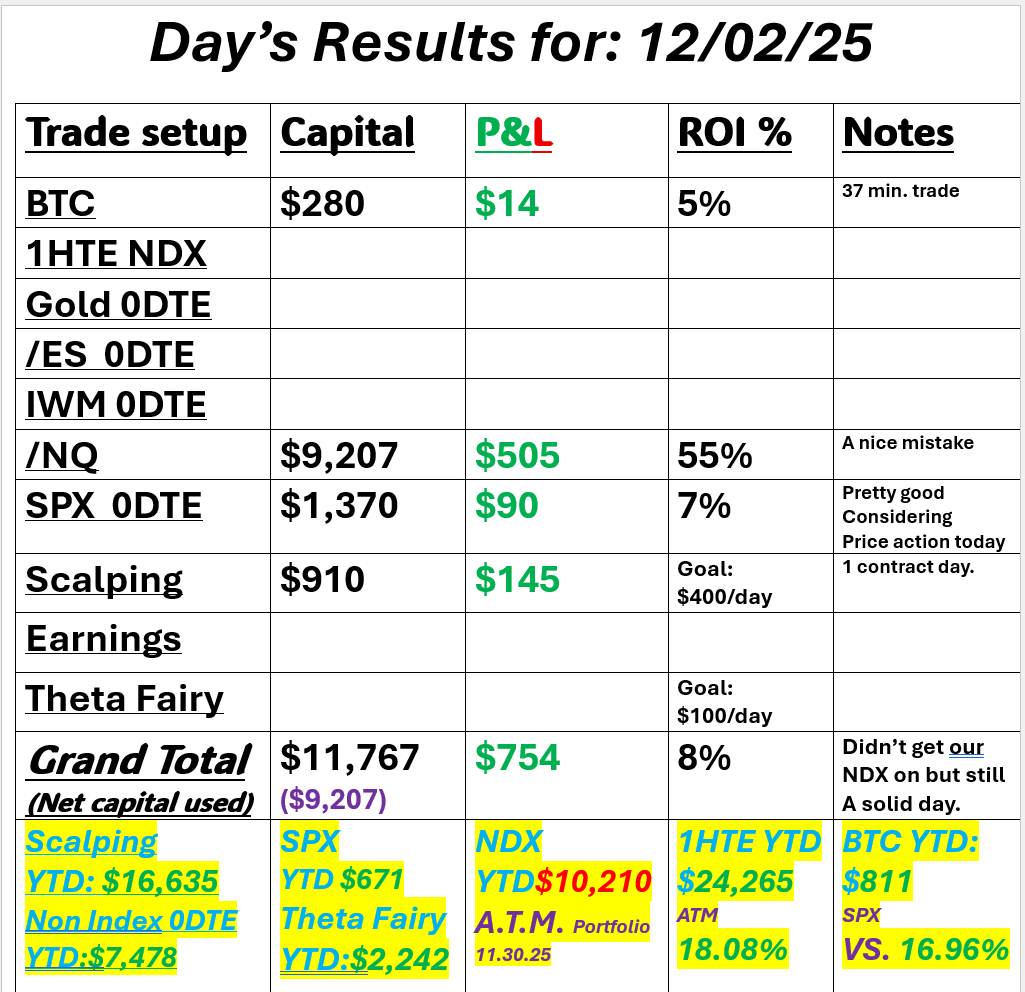

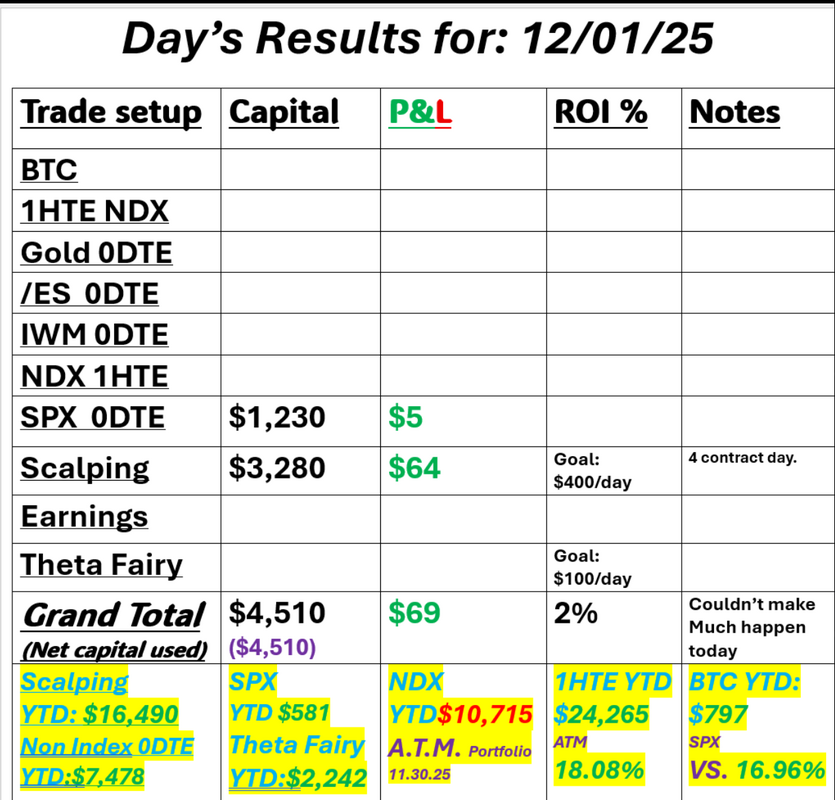

Nassim Taleb's randomnessMonday's training session focused on Nassim's book "Fooled by Randomness". It's a must-read for serious traders. One quote we focused on was •Mild success stems from skill, wild success from luck: Consistent, moderate achievements can often be credited to effort and ability, but extreme outliers are typically the result of variance and fortunate timing. Sometimes trades make money, and we feel like we are smart. That we know what we are doing. The reality is that not all winning trades are great trades. Sometimes the randomness of high-variance activities (trading qualifies) can make us look better than we are. Not all "winning" trades are winners. Sometimes it's just luck. It was just coincidental that we'd had that training on Monday, because I started yesterday with a $500 profit in a few minutes in our scalping room. I was surprised to see it up that much until I realized I'd scalped the /NQ vs. the /MNQ. That's 10X the size if you aren't familiar. Instead of a $900 trade, it was a $9,000 entry. To be fair to myself, it was a good entry and would have still been profitable if I'd hit the /MNQ entry, but to also be clear, there was a mistake. Regardless, we had a solid day yesterday. This price action continues to present a challenge to me on the SPX. It's a bit all over the place, but nonetheless, still a nice day. This type of price action isn't a great trading environment for me. Here's a look at our day yesterday. I didn't get a blog post up yesterday. We installed a new computer to run the scalping zoom and that took longer than expected. Our day was green but not by much. Still...green is green. Let's take a look at the markets this morning. Bulls have staged a nice comeback over the last week. Do they have enough juice to keep pushing? They seemed a bit tired yesterday. Technicals are all bullish this morning. December S&P 500 E-Mini futures (ESZ25) are trending up +0.16% this morning as traders bet that a new round of U.S. economic data will reinforce expectations for a Federal Reserve rate cut next week. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the S&P 500 and Nasdaq 100 notching 2-1/2-week highs. Chip stocks advanced, with Intel (INTC) climbing over +8% to lead gainers in the Nasdaq 100 and NXP Semiconductors N.V. (NXPI) rising more than +7%. Also, Boeing (BA) surged more than +10% and was the top percentage gainer on the S&P 500 and Dow after Chief Financial Officer Jay Malave said he expects the company to generate low-single-digit positive free cash flow next year. In addition, MongoDB (MDB) jumped over +22% after the database software company posted upbeat Q3 results and raised its full-year guidance. On the bearish side, Symbotic (SYM) tumbled more than -21% after Goldman Sachs downgraded the stock to Sell from Neutral with a price target of $47. “Although our breadth and trend indicators showed some improvement last week, more time and technical evidence are needed for a ‘buy’ signal to occur” in the stock market, according to Craig Johnson at Piper Sandler. U.S. President Donald Trump said on Tuesday he plans to announce his choice to lead the Federal Reserve in early 2026. “We’ll be announcing somebody, probably early next year, for the new chairman of the Fed,” Trump said during a Cabinet meeting at the White House. Bloomberg News reported last week that White House National Economic Council Director Kevin Hassett is viewed as the leading candidate to succeed Powell, a pick investors see as aligned with President Trump’s push for lower rates. Meanwhile, U.S. rate futures have priced in an 87.0% chance of a 25 basis point rate cut and a 13.0% chance of no rate change at the December FOMC meeting. Today, all eyes are on the U.S. ADP private payrolls report, which is set to be released in a couple of hours. Economists, on average, forecast that the November ADP Nonfarm Employment Change will stand at 5K, compared to the October figure of 42K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the November ISM services index to be 52.0 and the S&P Global services PMI to be 55.0, compared to the previous values of 52.4 and 54.8, respectively. U.S. Industrial Production and Manufacturing Production data for September will be released today. The reports were originally scheduled for release on October 17th, but were delayed due to the government shutdown. Economists expect Industrial Production to rise +0.1% m/m and Manufacturing Production to rise +0.1% m/m in September, compared to the August figures of +0.1% m/m and +0.2% m/m, respectively. U.S. Export and Import Price Indexes for September will come in today. The figures were originally scheduled for release on October 17th, but were delayed due to the shutdown. Economists anticipate the export price index to rise +0.1% m/m and the import price index to rise +0.1% m/m in September, compared to the previous figures of +0.3% m/m and +0.3% m/m, respectively. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.9 million barrels, compared to last week’s value of 2.8 million barrels. On the earnings front, notable companies like Salesforce (CRM), Snowflake (SNOW), and Dollar Tree (DLTR) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.083%, down -0.12%. The SPX momentum score has pushed back to 5, reflecting a short-term improvement in trend strength after the recent pullback. Price action has also stabilized, with the index reclaiming the bulk of last week’s losses and holding above the mid-range of the recent consolidation zone. In the near term, the key focus is whether SPX can maintain this renewed momentum and push through the late-November swing highs; if the momentum score slips again, it would signal weakening follow-through and a market that’s reverting back into choppy range-bound behavior. Overall, the metric suggests short-term strength, but continuation will depend on how price behaves around nearby resistance. Today's training is on the book: The Disciplined Trader by Mark Douglas. This is a book we talk about a lot in our trading room so it should be a great review. Join us in our live zoom feed today. My lean or bias today: I'm leaning bullish. It seems like the bulls gas tank is running a bit on the empty side but technicals, futures and overall market structure are all leaning bullish to start the day. Let's take a look at the intraday /ES levels for our 0DTE trading. 6865* (key resistance level), 6871, 6879, 6891, 6900 are all resistance levels. 6850, 6839* (key support. 20/50PMA on 2hr. chart convergence zone), 6826, 6814, 6805 are support levels. Let's work on continuing our win streak! See you all shortly in the live trading room.

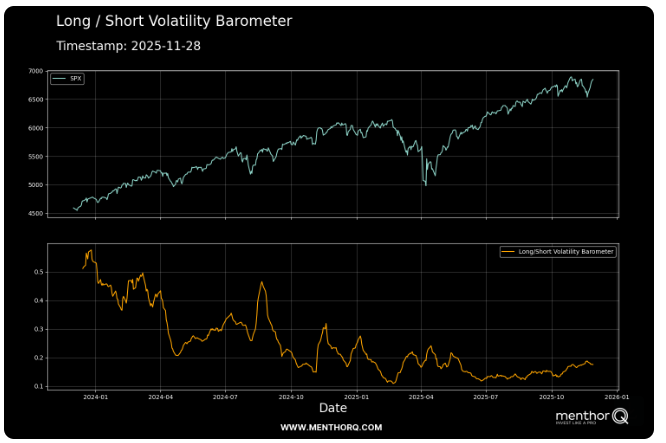

What a great time of year.Welcome to December! Where has the year gone? I hope you all had a great, somewhat extended weekend. I love this time of year. So much gratitude during Thanksgiving and now into the celebration of Christ. We don't have many family traditions but one big one is to go out to our land in central Utah and cut down a Christmas tree the weekend after Thanksgiving. It's so much work but I love it. I hope your celebrations are wonderful as well. We had an easy day on Friday. Half days usually treat us fairly well. The quick theta erosion means a credit trade is usually the way I go. It is tricky because you don't usually have time to adjust or alter your initial setup. It either works or it doesn't. I marred my day by trying to scalp. That was a waste of time on a day like that. Here's a look at our results. Quarterly results are also updated for our ATM portfolio. We continue to outpace the market, if only by the slimmest of margins. Our big news for the ATM portfolio is that auto trading is coming! You'll never need to even open your laptop of hit an enter key to follow our asset allocation model. A model which has averaged 26% a year since inception and outpaced the market by 148%. If you want to see how you can position your portfolio to consistently beat the market with less potential risk and protect your downside in the process you can feel free to schedule a one-on-one zoom call with me here: Let's take a look at the market: We start off the new month with a neutral rating. Not much help there. Markets seem to be trying to work their way back to ATH'S. SPY closed the week higher at $683.05 (+3.65%), pushing the index back to within 1% of its all-time high. Price tested the lower LinkLine, a volatility-aware Heikin-Ashi channel created by James Chellis, for the first time since early 2025 and bounced decisively. With SPY now reclaiming the year-to-date volume point of control, the path toward a new all-time high is becoming increasingly favorable. QQQ rebounded sharply last week, closing at $619.20 (+4.92%). A bullish MACD cross just confirmed as the ETF charged back above its YTD volume point of control, even as its top holding, NVDA, ended the week in the red. Given that it can hold above its LinkLine support, the bullish momentum will likely stay intact. Small-caps led the bullish charge last week, with IWM closing near its all-time highs at $248.63 (+5.48%). A bullish MACD crossover confirmed early last week, and momentum strengthened steadily throughout the week, though overall volume remained muted during the holiday period. With PCE on deck, the rate-sensitive small-cap space is likely to see heightened volatility. The Long/Short Volatility Barometer for SPX continues to stabilize near the lower end of its two-year range, suggesting a muted appetite for long-volatility positioning even as the index pushes into fresh recovery highs. In the short term, this low-volatility posture often aligns with tighter trading ranges and a market more responsive to incremental catalysts rather than broad directional swings. If the barometer remains compressed while SPX grinds higher, it may indicate that volatility sellers are still in control, keeping near-term moves contained. However, any sudden uptick in the barometer, especially from these depressed levels would signal a shift in volatility demand that could precede sharper price swings. The QQQ volatility surface shows a clear pocket of elevated implied volatility concentrated in the near-term, especially around shorter expirations and lower strike prices, where IV readings cluster in the 60–80% range. This indicates that the market is assigning more uncertainty to short-dated downside scenarios, while volatility tapers sharply as expirations extend, reflecting a calmer outlook further out on the curve. Mid-range strikes hold more moderate IV levels, suggesting a more balanced risk profile around the current spot. In the short term, this skewed surface points to a market that is pricing in event-driven fluctuations or hedging demand concentrated in the immediate horizon, making near-dated options more sensitive to shifts in sentiment or catalysts. Our training today will focus on Fooled by Randomness by Nassim Nicholas Taleb. Please join our live zoom feed. These sessions are always valuable. My lean or bias today: With a neutral rating and PCE (finally) coming out this morning it's anybody's guess but don't get too twisted by the futures being down. (/ES -44 and /NQ -223 as I type). If the NDX opens down -200 points but climbs back 100+ and you put on a bullish play, the market will still post a -100 point "loss" but your day was bullish. Start from the open and work from there. In other words, Depending on how PCE is received, we could have a bullish reaction. December S&P 500 E-Mini futures (ESZ25) are down -0.57%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.68% this morning, pointing to a lower open on Wall Street as Treasury yields climbed following hawkish comments from Bank of Japan Governor Kazuo Ueda. Treasury yields tracked Japanese government bond yields higher after BOJ Governor Kazuo Ueda offered his strongest signal yet of a rate hike this month. Ueda said on Monday that the central bank “will consider the pros and cons of raising the policy interest rate and make decisions as appropriate” by assessing the economy, inflation, and financial markets both domestically and overseas. Ueda’s remarks prompted investors to shift away from risky assets. Investor focus this week is on a fresh batch of U.S. economic data, with particular attention on the long-delayed U.S. PCE inflation reading, as well as earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500, Dow, and Nasdaq 100 notching 2-week highs. Chip stocks climbed, with Intel (INTC) jumping over +10% to lead gainers in the S&P 500 and Nasdaq 100, and Analog Devices (ADI) rising more than +2%. Also, energy stocks gained ground after the price of WTI crude rose over +1%, with Diamondback Energy (FANG) advancing over +2% and Devon Energy (DVN) rising more than +1%. In addition, cryptocurrency-exposed stocks rose after Bitcoin rebounded past the $90,000 level, with Riot Platforms (RIOT) surging over +7% and MARA Holdings (MARA) climbing more than +6%. On the bearish side, Tilray (TLRY) tumbled over -21% after the cannabis company announced it would implement a one-for-ten reverse stock split, effective Monday. This week, the September reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. The Bureau of Economic Analysis will release the long-delayed PCE price data, along with personal income and spending figures, on Friday. “[Recent] soft core CPI and PPI reports suggest that tariffs continue to have more bark than bite with regard to inflation, and this should also be reflected in this week’s September core PCE deflator,” according to ING economist James Knightley. Other noteworthy data releases include ADP private employment figures, the Export Price Index, the Import Price Index, the S&P Global Services PMI, the ISM Non-Manufacturing PMI, Initial Jobless Claims, Consumer Credit, and the University of Michigan’s Consumer Sentiment Index (preliminary). The Fed is also set to publish industrial production data for September. Any indications of labor-market weakness or slowing economic activity would further bolster expectations for a Fed rate cut this month. U.S. rate futures have priced in an 87.6% chance of a 25 basis point rate cut and a 12.4% chance of no rate change at the conclusion of the Fed’s December meeting. Meanwhile, U.S. President Donald Trump said on Sunday he has made his choice for the next Fed chair after signaling clearly that he expects his nominee to deliver interest rate cuts. “I know who I am going to pick, yeah,” Trump told reporters on Air Force One, without giving a name. “We’ll be announcing it.” Investors will also turn their attention to earnings releases from several high-profile names. Prominent companies such as Salesforce (CRM), CrowdStrike Holdings (CRWD), Marvell Technology (MRVL), Snowflake (SNOW), Hewlett Packard Enterprise (HPE), and MongoDB (MDB) are scheduled to report their quarterly results this week. U.S. central bankers are in a media blackout period before the December 9-10 policy meeting, so they are prohibited from making public comments on the economic outlook or policy this week. Fed policy limits the extent to which FOMC participants and staff can speak publicly or grant interviews during Fed blackout periods. Today, investors will focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI data, set to be released in a couple of hours. Economists expect the November ISM manufacturing index to be 49.0 and the S&P Global manufacturing PMI to be 51.9, compared to the previous values of 48.7 and 52.5, respectively. Also, Fed Chair Jerome Powell is scheduled to deliver brief remarks and join a panel discussion with Michael Boskin and Condoleezza Rice on George Shultz and his economic policy contributions later today at the Hoover Institution’s George P. Shultz Memorial Lecture Series in Stanford, California. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.041%, up +0.52%. Nothing special with the implied vol this week. Let's take a look at intraday /ES levels for our 0DTE setups. 6825, 6838, 6851, 6864 are resistance levels. It looks like futures will be starting in a hole this morning. 6814, 6809, 6799, 6787 are support levels. Let's make it a great day! See you all shortly in the live trading room!

Happy belated ThanksgivingWelcome back! I hope you all had a wonderful day off yesterday. Those of you who know me know I am a big believer in gratitude. I keep a daily gratitude journal and Thanksgiving is a great focusing tool for me. I'm super grateful for all of you. Our interactions. Our comradery. Trading can be a very solitary and lonely pursuit. It's nice to have a community to trade with. We had a solid day Weds. with some 2-1-1 ratio setups. Today is looking like a tricky one. It was already tricky in that it's only a half day. That generally means we'll just get one shot on 0DTE's. No time to adjust and work it. It either works or it doesn't. It got worse this morning with CME futures being halted due to a "cooling" issue with one of their servers? Weird times...internet outages etc. I have a feeling one day soon we'll all go to log on to the internet and it will just be gone! LOL. Anyway, this may mean no scalping for us today as well as no levels to give you. This makes today's blog a short one. December S&P 500 E-Mini futures (ESZ25) were indicated up +0.10% before a technical outage at the Chicago Mercantile Exchange disrupted trading. Trading of futures and options on the Chicago Mercantile Exchange was halted for several hours on Friday, disrupting some of the world’s most liquid futures markets. “Due to a cooling issue at CyrusOne data centers, our markets are currently halted,” according to CME Group’s website. “Support is working to resolve the issue in the near term and will advise clients of pre-open details as soon as they are available,” it said. Investors turned to exchange-traded funds tied to Wall Street’s major indexes as a barometer of broader market sentiment. SPDR’s S&P 500 ETF (SPY) rose +0.25% in pre-market trading. Today, the U.S. stock markets will be open for half a session, with trading ending at 1 p.m. Eastern Time. In Wednesday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Robinhood Markets (HOOD) surged over +10% and was the top percentage gainer on the S&P 500 after announcing it had acquired a majority stake in LedgerX, a U.S.-based derivatives exchange, giving it entry into the prediction markets. Also, chip stocks gained ground, with Marvell Technology (MRVL) climbing more than +5% and Advanced Micro Devices (AMD) rising over +3%. In addition, Dell Technologies (DELL) advanced more than +5% after the IT and PC giant raised its full-year revenue guidance. On the bearish side, Workday (WDAY) slumped over -7% and was the top percentage loser on the S&P 500 as the human resources software provider’s Q3 subscription revenue disappointed investors. Economic data released on Wednesday showed that U.S. durable goods orders rose +0.5% m/m in September, in line with expectations, and core durable goods orders, which exclude transportation, rose +0.6% m/m, stronger than expectations of +0.2% m/m. Also, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -6K to a 7-month low of 216K, compared with the 226K expected. At the same time, the U.S. Chicago PMI fell to 36.3 in November, weaker than expectations of 44.3. “Overall, it was a stronger-than-expected round of [economic] data that has reinforced the notion that there are crosscurrents and mixed performance in the real economy. That being said, there is nothing within the reports that will derail the FOMC from cutting by 25 basis points on Dec. 10,” according to Ian Lyngen at BMO Capital Markets. The Fed said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity was little changed in recent weeks. “Outlooks were largely unchanged overall. Some contacts noted an increased risk of slower activity in coming months, while some optimism was noted among manufacturers,” according to the Beige Book. The report noted that employment declined slightly and prices increased at a moderate pace. The report also said multiple districts, including New York, Atlanta, and Minneapolis, reported that spending by higher-income consumers remained resilient, while spending weakened among low- and middle-income households. Economists stated that nothing in the report challenged expectations for a December rate cut. Meanwhile, U.S. rate futures have priced in an 84.7% probability of a 25 basis point rate cut and a 15.3% chance of no rate change at the December FOMC meeting. The U.S. economic data slate is empty on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.010%, up +0.35%. Our technical matrix is not too useful this morning with CME futures shut down. We can look at the price action from Weds. Bulls continued to attempt to clear the 20/50DMA's. Futures were pointing slightly positive last night when they stopped trading. What that means for today's open is anybody's guess. That's all I've got for today folks. Let's get in the trading room early and see what we get get working.

Are we back?The selloff over the last few weeks really looked like it had legs but these past few days have really dashed the hope of the bears. We are back above the 50DMA on all the indices we watch and back above the trailing 20DMA on all but the QQQ's. We've got jobless claims and durable goods that cold throw a change up into the mix but the bulls seem like they want to run. I went way bigger on my 0DTE yesterday than I usually do and I paid the price. It was close all day but close doesn't count. I'll work to get back to normal position sizing today. Scalping brought in a little. It's been our most consistent earner this year. Our ATM portfolio is going into it's sixth year! What a run it's been. Trouncing the SP500 by 142% better over that time frame with an avg. ROI of 26% a year vs. the 14.2% of the market. Even so, it's time for some upgrades! Before the start of next year we are working on reducing costs. This means cutting or eliminating commission costs that are a drag on our performance. The big news is automation. No more going into your account each day to make adjustments. It can truly be auto pilot. Reducing overhead drag can only help performance and automation is something our members have been asking for. For current ATM members please read the word doc. posted in discord this morning for a brief overview. If possible, please attend our zoom session today in the live trading room (or watch the replay). I'll spend some time talking about the upgrades. Today's training will be focused on the book. Manias, Panics, and Crashes by Charles P. Kindleberger Please join us in our zoom feed today. These are always beneficial. More than half of the 1.6% US GDP growth in the first 6 months of this year came from AI-related spending, according to Barclays. Is that healthy? Bitcoin was trading in lockstep with the Mag 7 stocks until the last month and a half. Now Bitcoin is down 15% over the past year versus a 25% gain for the Mag 7. Question: is Bitcoin the leader here with Mag 7 weakness to follow or are we going to see a sharp Bitcoin recovery? When Zoom ($ZM) was $600/sh in 2020, it had $20 million in income. Now, Zoom is $87/sh with $2 billion in income. What does that tell you about the current Ai companies? December S&P 500 E-Mini futures (ESZ25) are up +0.34%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.42% this morning, buoyed by rising expectations for a Federal Reserve rate cut next month, while investors await a new round of U.S. economic data. In yesterday’s trading session, Wall Street’s major indexes closed higher. Keysight Technologies (KEYS) climbed over +10% and was the top percentage gainer on the S&P 500 after the technology company posted upbeat FQ4 results and issued above-consensus FQ1 guidance. Also, Applied Materials (AMAT) advanced +5% and was among the top percentage gainers on the Nasdaq 100 after UBS upgraded the stock to Buy from Neutral with a price target of $285. In addition, homebuilder stocks climbed after the benchmark 10-year T-note yield fell to a 3-1/2-week low, with Builders FirstSource (BLDR) surging over +8% and D.R. Horton (DHI) rising more than +5%. On the bearish side, Nvidia (NVDA) slid over -2% and was the top percentage loser on the Dow after The Information reported that Meta Platforms was in discussions to spend billions on Google’s AI chips. Economic data released on Tuesday showed that U.S. retail sales rose +0.2% m/m in September, weaker than expectations of +0.4% m/m, and core retail sales, which exclude motor vehicles and parts, grew +0.3% m/m, in line with expectations. Also, the U.S. Conference Board’s consumer confidence index fell to a 7-month low of 88.7 in November, weaker than expectations of 93.5. In addition, the U.S. producer price index for final demand rose +0.3% m/m and +2.7% y/y in September, in line with expectations. Finally, data from ADP Research showed that U.S. companies shed an average of 13,500 jobs per week in the four weeks ending November 8th. “Downbeat economic data is delivering gains to stock and bond bulls alike, as weaker-than-expected retail sales and consumer confidence numbers coincide with accelerating job losses and rising odds of a December Fed cut,” said Jose Torres, senior economist at Interactive Brokers. Meanwhile, Bloomberg reported that White House National Economic Council Director Kevin Hassett has emerged as the leading candidate to become the next Fed chair, a choice investors view as aligned with President Trump’s push for lower rates. U.S. rate futures have priced in an 80.8% chance of a 25 basis point rate cut and a 19.2% chance of no rate change at December’s monetary policy meeting. Today, investors will focus on U.S. Durable Goods Orders and Core Durable Goods Orders data for September, set to be released in a couple of hours. The figures were originally scheduled for release on October 27th, but were delayed due to the government shutdown. Economists expect September Durable Goods Orders to climb +0.5% m/m and Core Durable Goods Orders to rise +0.2% m/m, compared to the prior numbers of +2.9% m/m and +0.3% m/m, respectively. U.S. Initial Jobless Claims data will also be closely monitored today. Economists estimate this figure will come in at 226K, compared to last week’s number of 220K. The U.S. Chicago PMI will be released today. Economists forecast the November figure at 44.3, compared to the previous value of 43.8. The EIA’s weekly crude oil inventories report will be released today as well. Economists expect this figure to be -1.3 million barrels, compared to last week’s value of -3.4 million barrels. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The report will likely underscore weakness in employment and activity. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. On the earnings front, farm and construction equipment maker Deere & Company (DE) is set to report its FQ4 results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.002%, up +0.05%. Let's take a look at the market: We've locked in on bullish techincals to start the day, once again. Those moving averages that were resistance and now back to working as support. The latest SPX SMA breadth charts show an uptick in participation, with the number of stocks holding above their 5-, 20-, and 50-day SMAs beginning to rebound after a recent soft patch. This subtle rise, especially in the shorter-term 5-day breadth, suggests early signs of stabilization after a bout of weakness. The 20- and 50-day readings remain in mid-range territory, which signals that broader market support is still tentative, but improving breadth at the margins can help gauge whether any bounce in the index has real internal backing. In the near term, watching whether these breadth lines can push higher or slip back below their moving averages may help clarify whether the market’s latest lift has momentum behind it or is simply another brief rotation. The NDX Net GEX setup is showing a clear imbalance that highlights where options hedging flows may influence short-term index behavior. The strongest pocket of negative GEX sits near 23,950 also marked as call-side resistance, suggesting that moves toward this level could encounter dealer-driven headwinds. Meanwhile, a meaningful cluster of positive GEX appears around 24,000, aligning with put-side support and an area where hedging flows may help stabilize dips. With spot trading near 25,019, the profile shows a relatively supportive zone below while resistance remains dense several hundred points underneath spot, implying that the index is currently sitting above its main hedging “gravity points.” In the near term, monitoring how price behaves as it drifts closer to these high-GEX bands can offer context on whether dealer hedging flows are more likely to dampen volatility or amplify directional swings. Let's look at the intraday levels for /ES today. 6815, then a big gap up to 6844, 6850, 6861 as resistance levels. 6790, then a big gap down to 6770, 6760, 6751 are support levels. I look forward to seeing you all in zoom today. We've got a lot to discuss.

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |