|

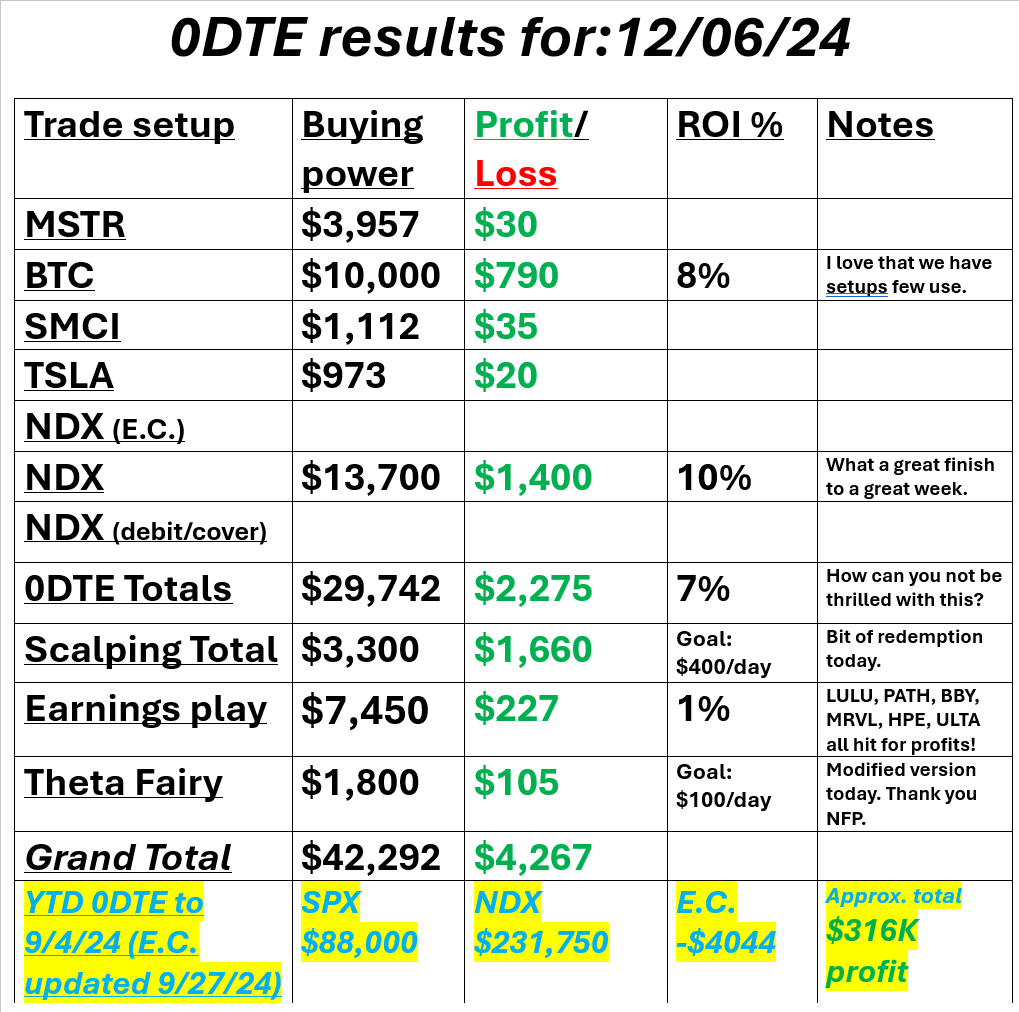

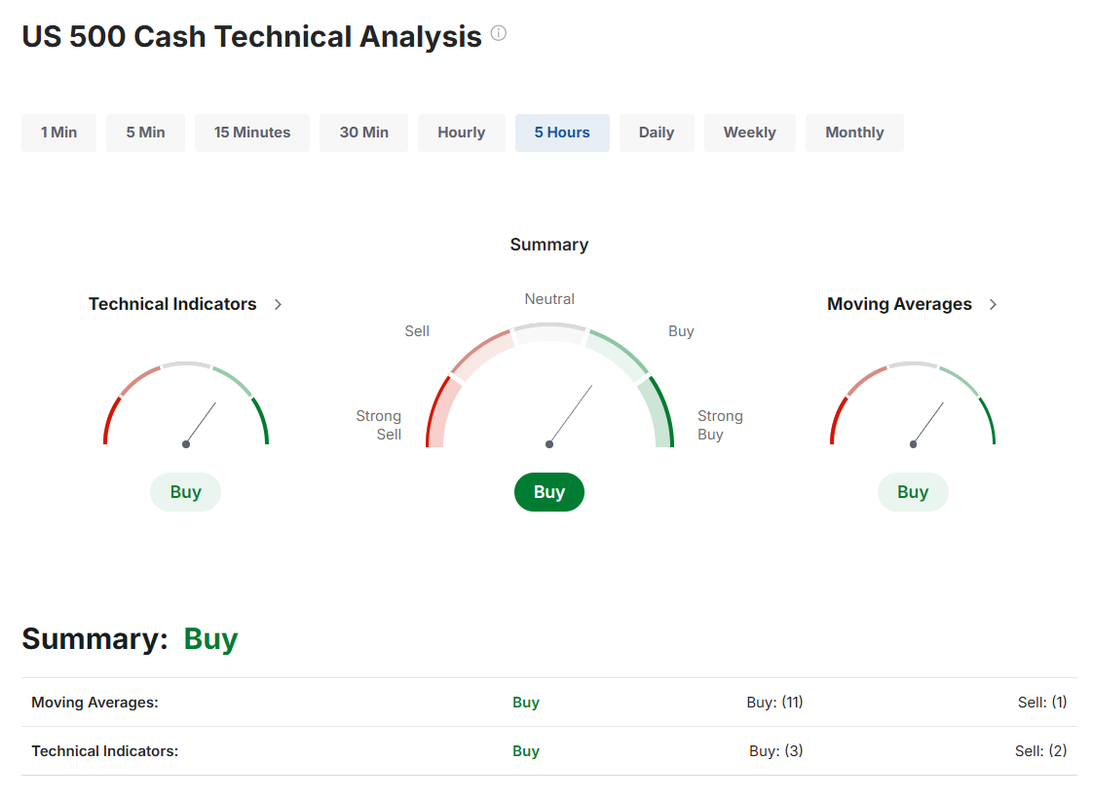

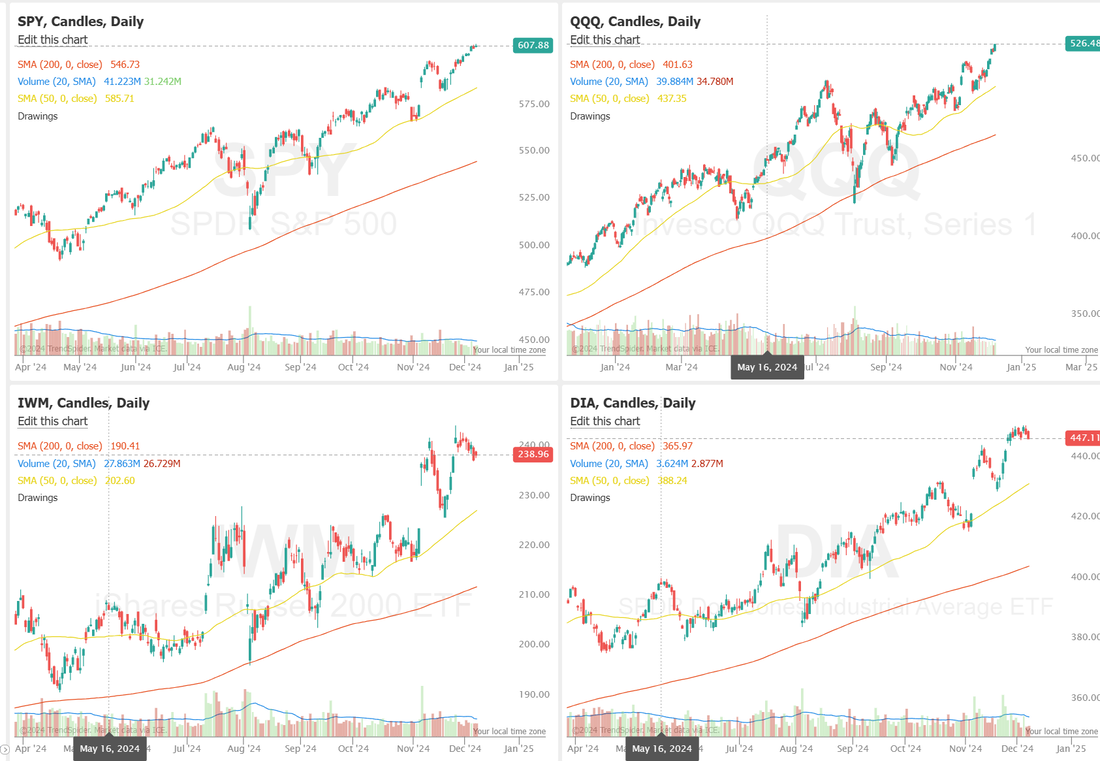

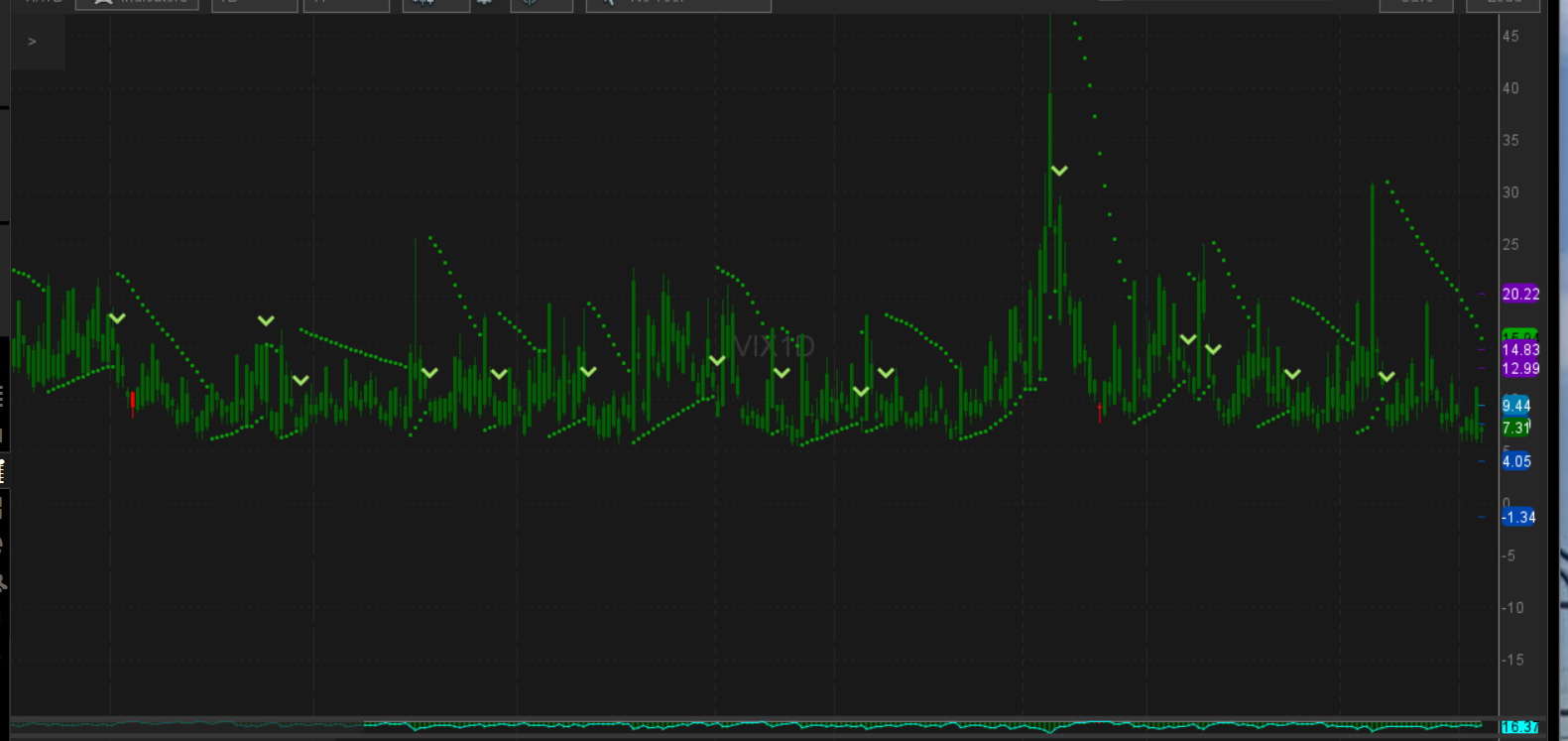

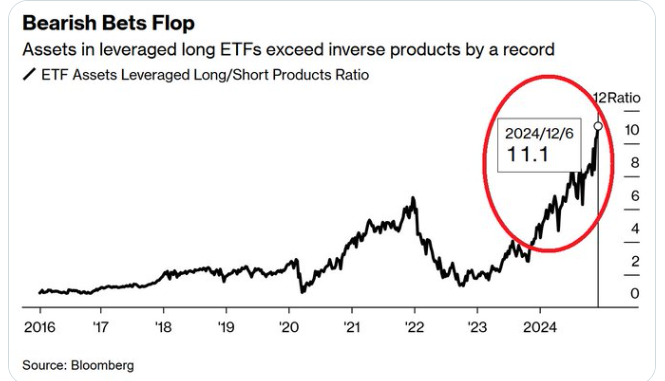

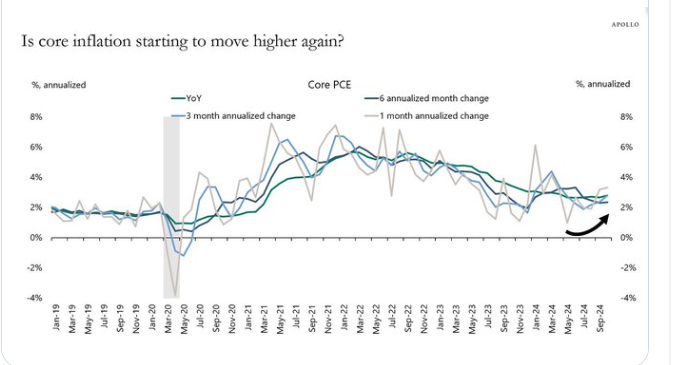

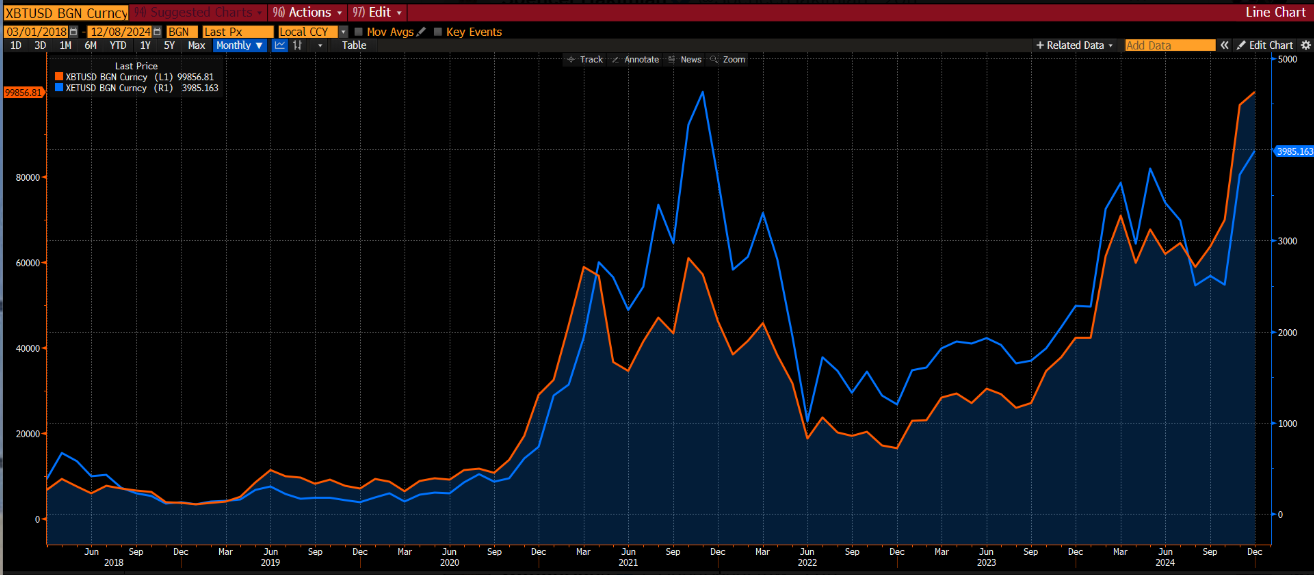

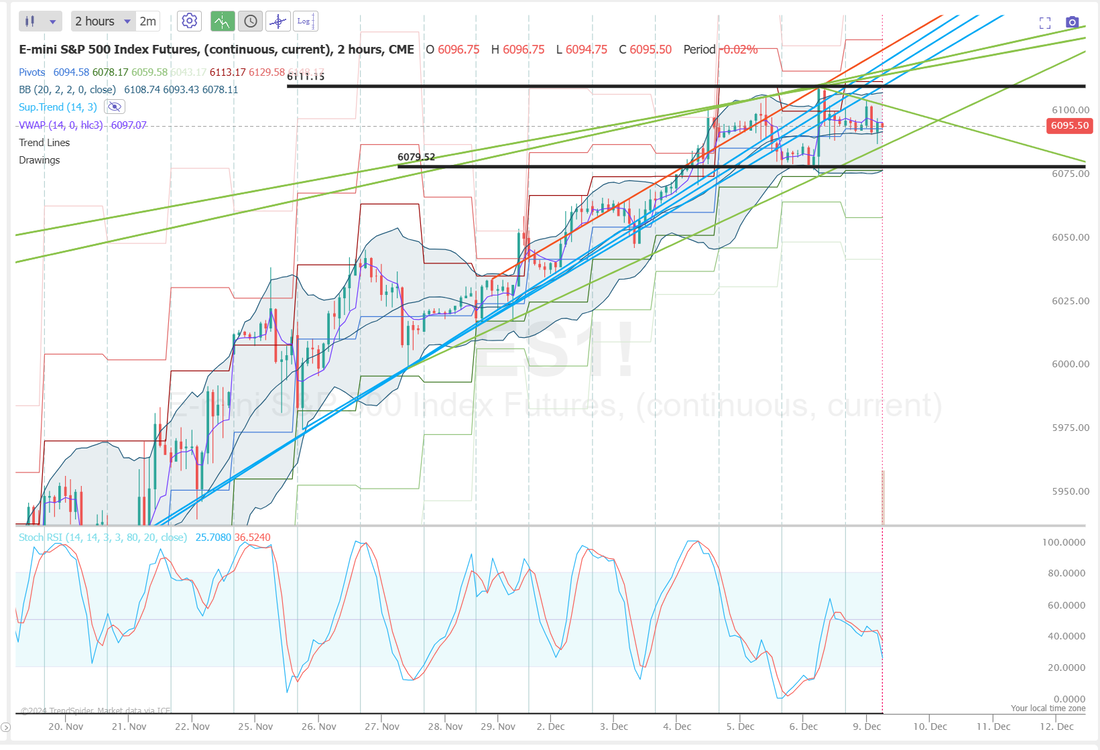

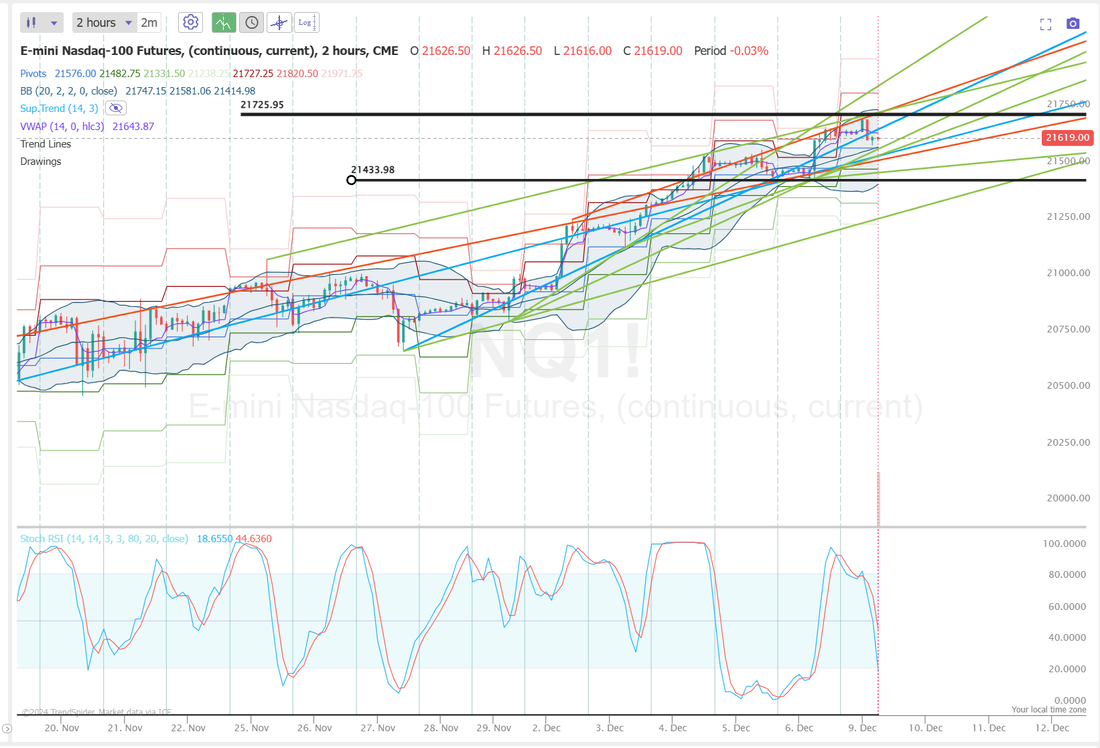

Welcome back traders! It's a new week. We just came off an absolute stellar set of results last week. Was it our highest grossing profit week ever? Not even close! It was, however a very tough market enviroment for credit traders and we do A LOT of credit trades. We had a home run day last Friday to cap of winning days all week long. I'm so grateful for last weeks results. We earned them. See our Friday results below: Who doesn't love putting $4,000 bucks in their pocket? An offshoot of this horrible I.V. enviroment has been that we've had to get more creative (and better) at setups. I'd love to say we are just brilliant traders but honestly, the setups were key. Let's take a look at the markets to start this new week. Bulls are hanging on but starting to look a bit tired. Two things appear clear. #1. The bull just keeps on marching. #2. It's looking tired. SPY is maintaining. IWM and DIA are looking more weak than strong. It's only the QQQ's that are still blasting higher. December S&P 500 E-Mini futures (ESZ24) are down -0.10%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.14% this morning as investors looked ahead to the release of U.S. inflation data later in the week, which will be scrutinized by Federal Reserve officials before their final meeting this year. In Friday’s trading session, Wall Street’s major equity averages closed mixed, with the benchmark S&P 500 and tech-heavy Nasdaq 100 notching new record highs. Lululemon Athletica (LULU) surged over +15% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the athleisure retailer posted solid Q3 results and raised its full-year guidance. Also, Hewlett Packard Enterprise (HPE) climbed more than +10% after the IT giant reported better-than-expected FQ4 results. In addition, DocuSign (DOCU) jumped over +27% after the company reported stronger-than-expected Q3 results and issued above-consensus Q4 revenue guidance. On the bearish side, Smith & Wesson Brands (SWBI) tumbled more than -20% after posting downbeat FQ2 results. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls increased by 227K in November, topping the 218K consensus estimate. At the same time, the U.S. November unemployment rate unexpectedly rose to 4.2%, weaker than expectations of no change at 4.1%. Also, U.S. average hourly earnings rose +0.4% m/m and +4.0% y/y in November, stronger than expectations of +0.3% m/m and +3.9% y/y. Finally, the University of Michigan’s U.S. consumer sentiment index rose to an 8-month high of 74.0 in December, stronger than expectations of 73.1. “[November’s] jobs report came out right in the ‘Goldilocks’ zone,” said Josh Jamner at ClearBridge Investments. “With things more or less steady, the Fed should be in a position to continue to ease monetary policy over the next several months, and recent comments suggest the pace at which they will do so will be more gradual in 2025.” Cleveland Fed President Beth Hammack stated on Friday that the U.S. central bank is “at or near” the point where it should moderate the pace of interest rate cuts, pointing to a robust economy and still-elevated inflation. Also, Fed Governor Michelle Bowman said, “I would prefer that we proceed cautiously and gradually in lowering the policy rate as inflation remains elevated.” Meanwhile, U.S. rate futures have priced in an 87.1% chance of a 25 basis point rate cut and a 12.9% probability of no rate change at the Fed’s monetary policy committee meeting later this month. In the coming week, the U.S. consumer inflation report for November will be the main highlight. Also, investors will be keeping an eye on other economic data releases, including U.S. PPI, Core PPI, Nonfarm Productivity, Unit Labor Costs, Initial Jobless Claims, Crude Oil Inventories, the Export Price Index, and the Import Price Index. Market participants will also focus on earnings reports from several high-profile companies, with Broadcom (AVGO), Adobe (ADBE), Costco (COST), Oracle (ORCL), MongoDB (MDB), Toll Brothers (TOL), AutoZone (AZO), and GameStop (GME) scheduled to release their quarterly results this week. Federal Reserve officials are in a media blackout period before the December meeting, so they are prohibited from making public comments this week. Today, investors will focus on U.S. Wholesale Inventories data, which is set to be released in a couple of hours. Economists expect the final October figure to be +0.2% m/m, compared to -0.2% m/m in September. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.161%, up +0.29%. Trade docket for today: It's a busy one. ORCL, AI, MBD, TUL, AZO potential earnings trades. /NG, CAVA?, DOCU, IWM, LRN?, MRNA, PLTR, /SI, /ZW, /MCL and CTGO, DAN, GNK and KOD adds on our pairs trades. Expected moves for the week are low, once again. That's O.K.. We've had low I.V. for weeks now and done just fine. We'll look at starting today with some Iron Flys or Chicken Iron condors. Just when you think the VIX can't go any lower...it does. A couple things I'm thinking about today. The ratio of assets in leveraged long ETFs to short ETFs hit 11.1x, the most on RECORD. The difference has TRIPLED this year and is nearly 2 TIMES larger than at the 2021 market frenzy top. Greed has rarely been greater. Here's something scary out of Apollo group: Via Apollo: "GDP growth in the third quarter came in at 2.8%, and the Atlanta Fed estimates GDP growth in the fourth quarter will be 3.3%. Combined with the recent uptrend in inflation, the probability is rising that the Fed may have to raise interest rates in 2025" Bitcoin almost 2x since 2021 peak. Ethereum still -15% off 2021 peak. Institutional demand is just not there yet for Ethereum. Bitcoin is the first mover. And its owners are getting paid for that. I think Ethereum catches up and it the better risk/reward going into 2025. We have a small long position we've been building. /ES: Is in a tight range with 6111 working as resistance and 6078 acting as support. /NQ: Over the last week the Nasdaq was the biggest winner. It finally threw of the shackles and exploded higher. 21,725 is new resistance wit 21,433 acting as support. Bitcoins been very, very good to us lately! Talk about a daily ATM machine! We'll look to put another substantial BTC trade on today. 104,704 is new resistance with 97,200 acting as support.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |