|

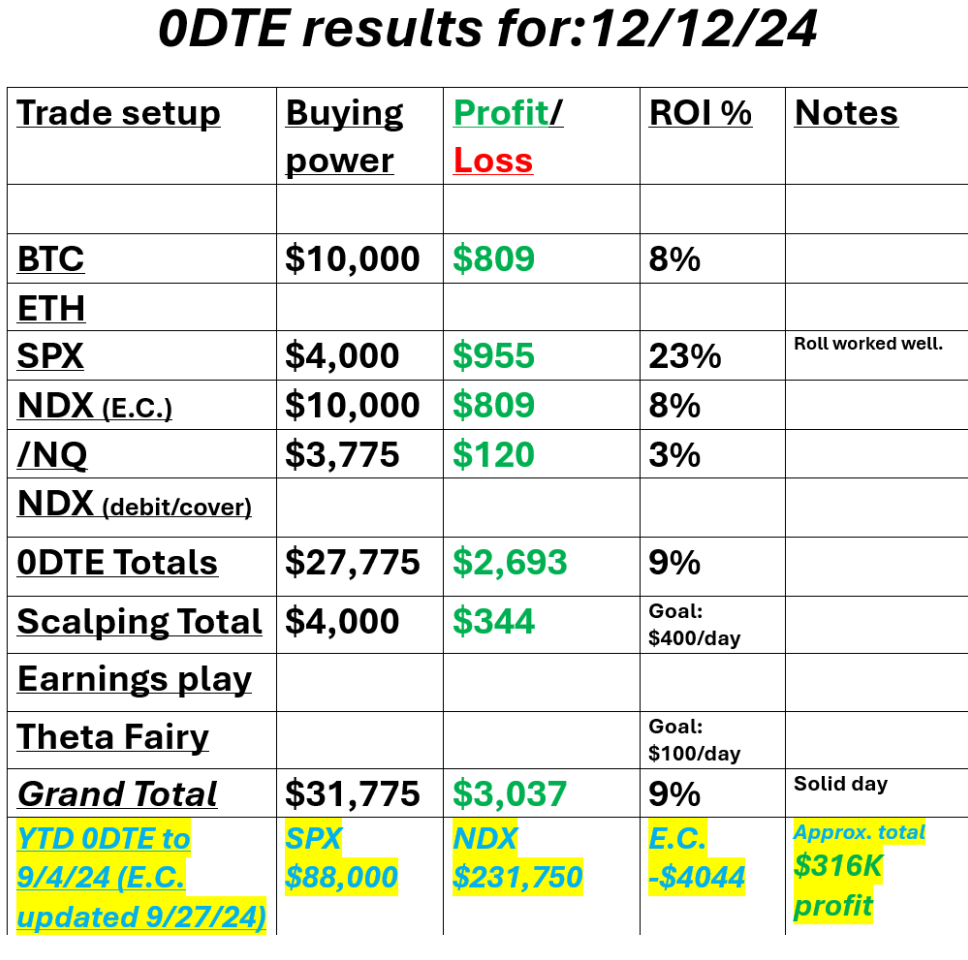

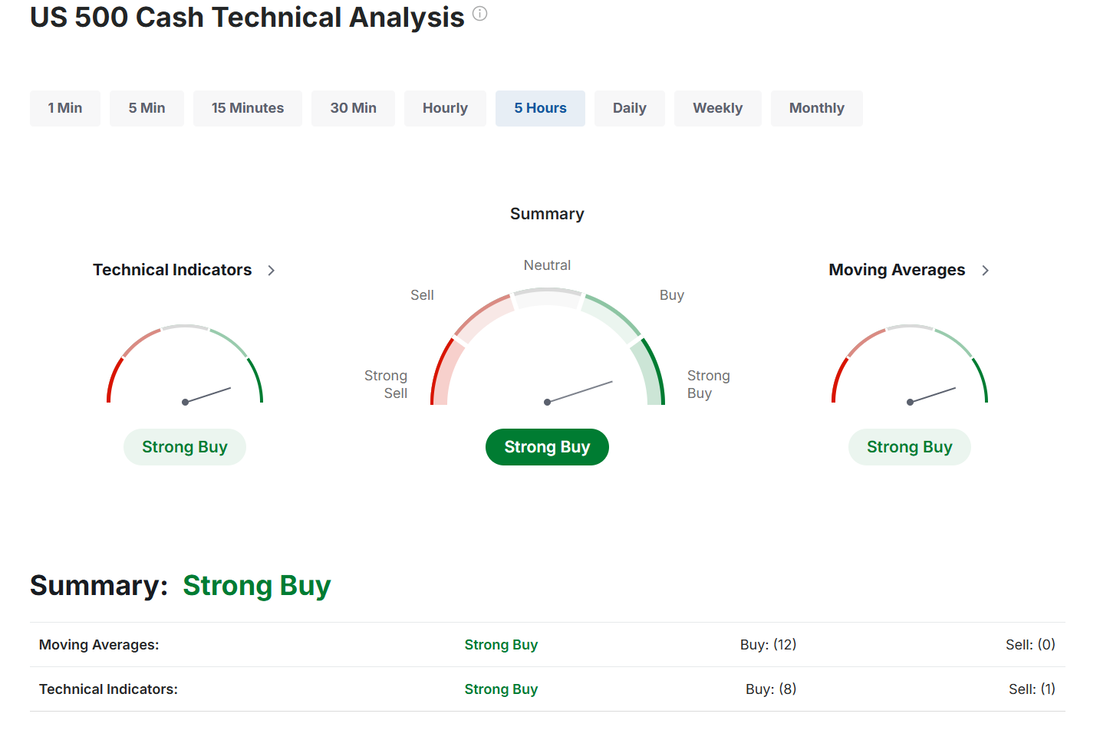

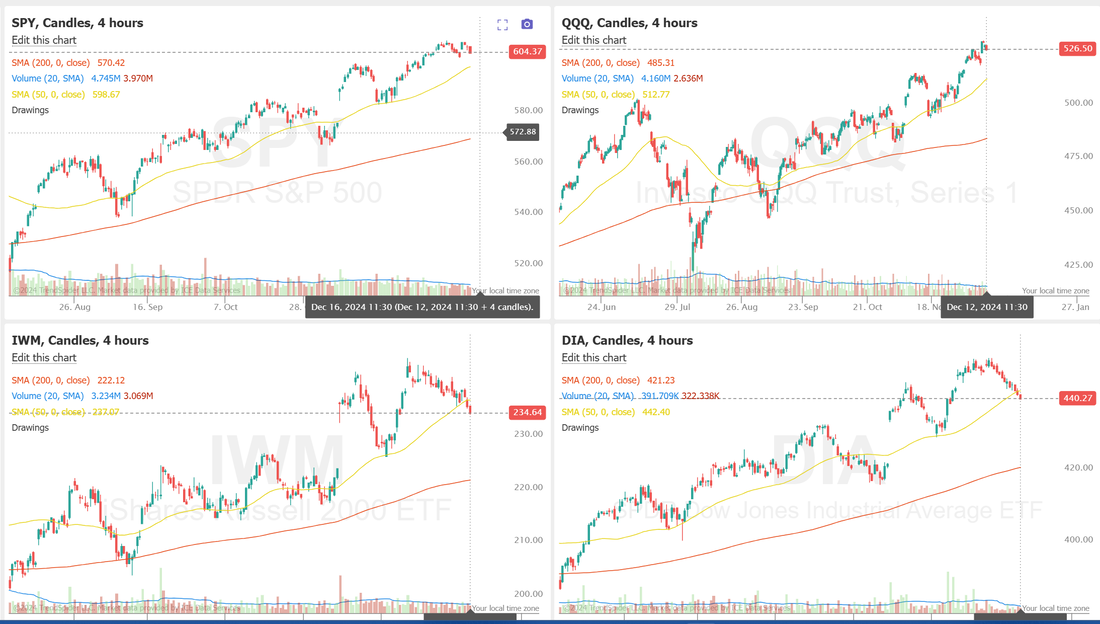

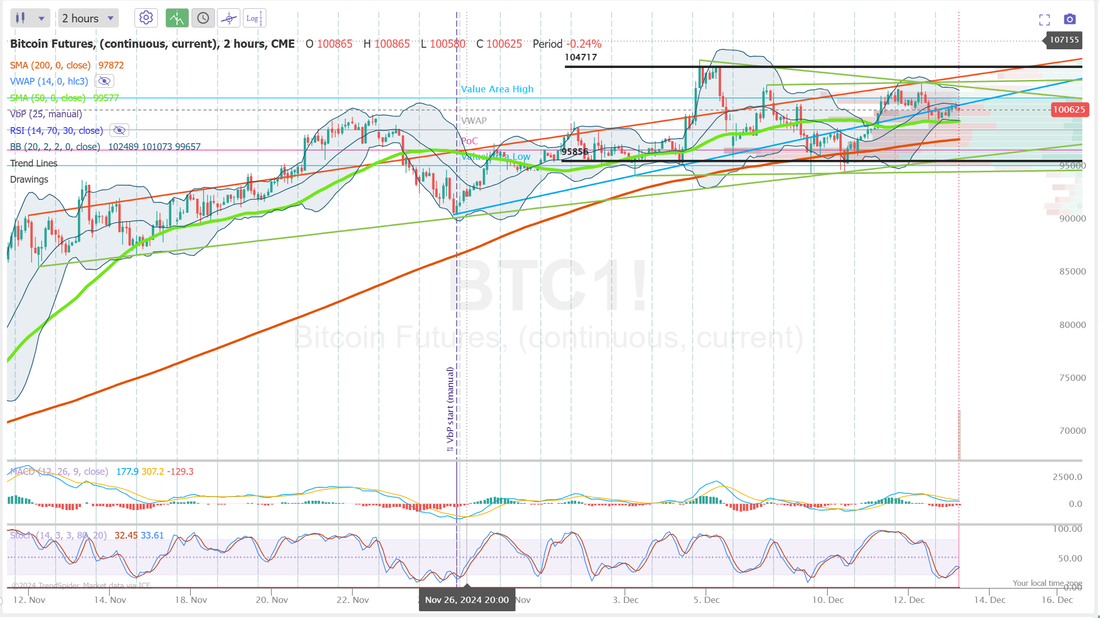

Good morning and good Friday to you all! We had a solid day yesterday. Nat gas took a little work to get back in line but when doesn't it!. See our results below: Let's take a look at the markets: Bullish bias is pretty locked in, I'd say. We are seeing a break though between the QQQ's and SPY vs. the DIA and IWM. Both the IWM and DIA are now down through there respective 50DMA. That's bearish looking to me. The $DJIA has casually dropped over 1,000 points since last week's peak and nobody's even taking about it... Trade docket for today: Should be super easy and stress-free. We've got oil (/MCL) that we'll be working and possibly a take profit on MRNA/MRK pairs trade although it will likely continue into next week and finally, our 0DTE's. The Event contract 0DTE's have been better than our standard setups lately. We'll look to get all three of those back on today as well as some butterfly setups on NDX and SPX. We may look for 0DTE opportunites on MSTR, TSLA, and SMCI as well, although the premium doesn't look good right now. We switched out our normal weekly credit strangles this week with a copper, silver and wheat trade and those don't need any attention today. Let's take a look at the intra-day levels for our 0DTEs. /ES: Exact same levels as yesterday. It's a wide "chop zone" of 50+ points. 6103 is still resistance with 6058 acting as support. Once again...I think a couple of well placed butterflies around PoC and large vol nodes might be the best setup for today. /NQ: Nasdaq has been on a tear lately. Levels today are the same as yesterday but I don't think any of us would be surprised if we broke through the resistance line. Resistance at 21909 and support at 21433. We'll work some butterflies on NDX as well today. They will likely be lower probabilities of success but much better potential payouts than SPX. BTC: Bitcoin has really been an excellent 0DTE for us lately. It also continues to channel in a "chop zone". 104717 is still resistance and 95858 is acting as support. Depending on available premium and pricing as well as, of course, price action, I may look to double my recent exposure on our BTC day trade from 10K to 20K. We'll see... My lean or bias today: Full on bullish. I could be a contrarian looking for the reversal to the downside but that may be a suckers game right now. The market just seems to want to go higher. See you all in the live trading room! Also...have a great weekend!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |