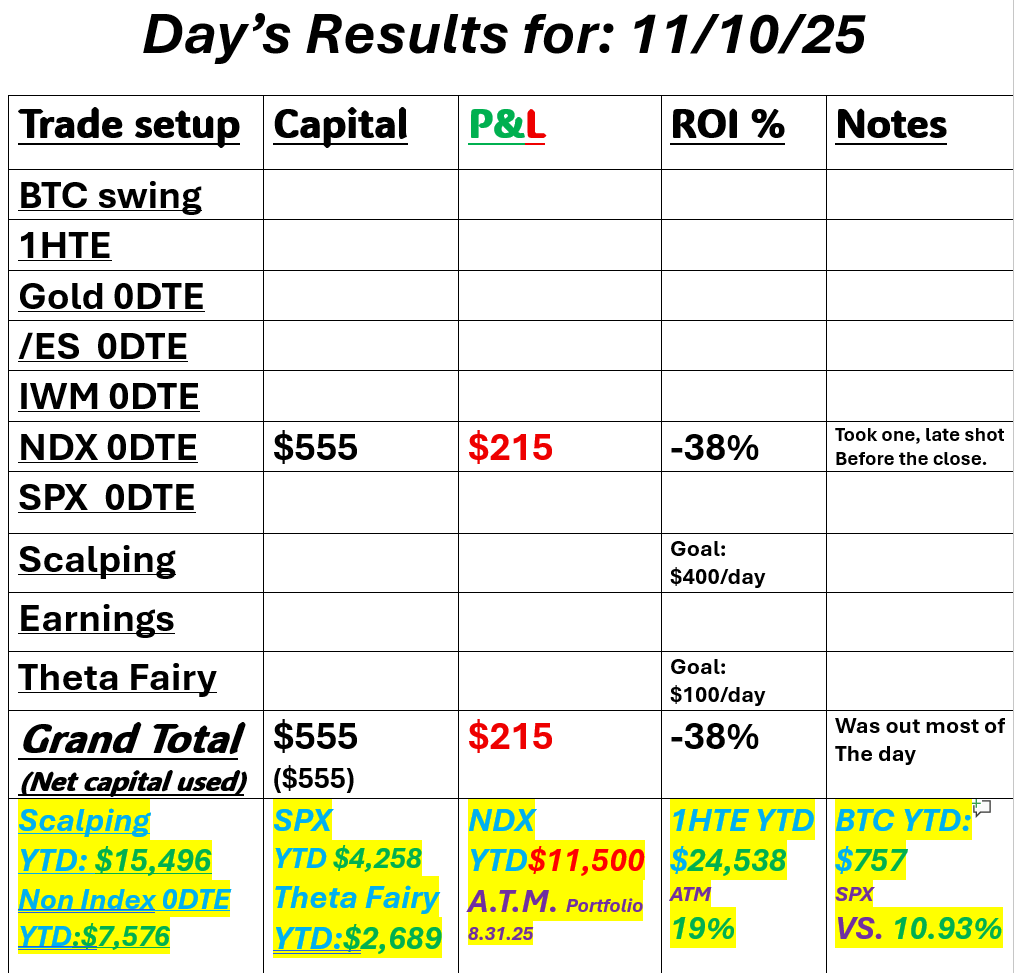

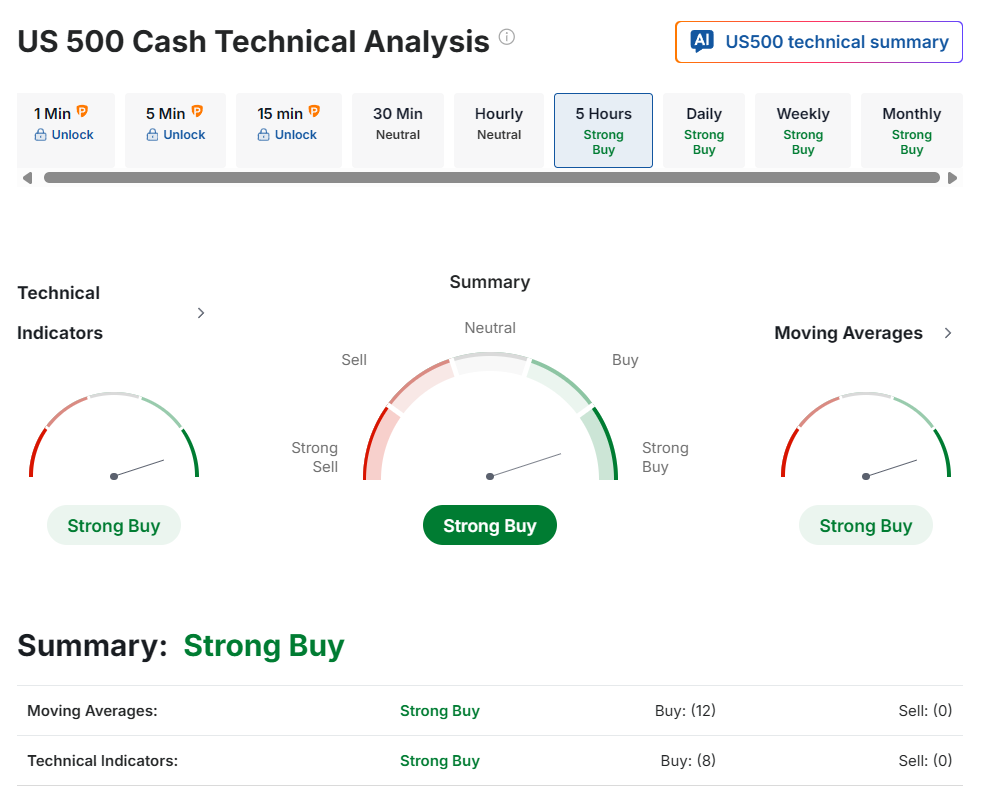

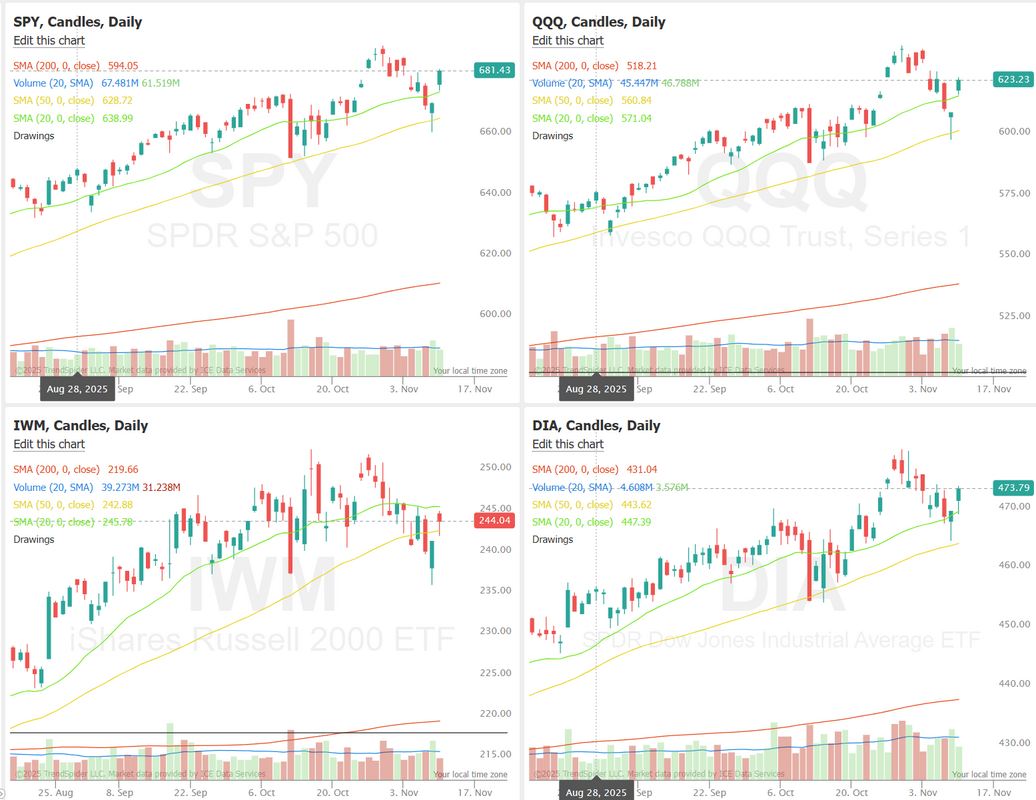

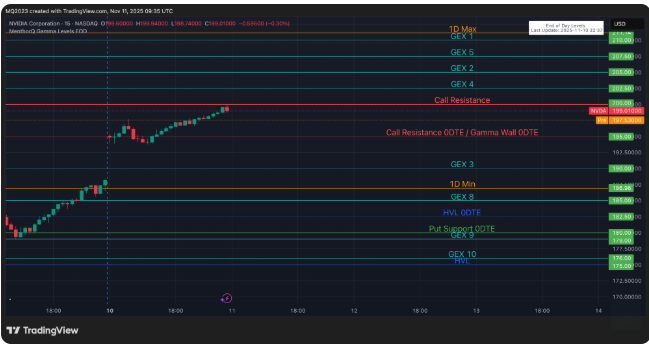

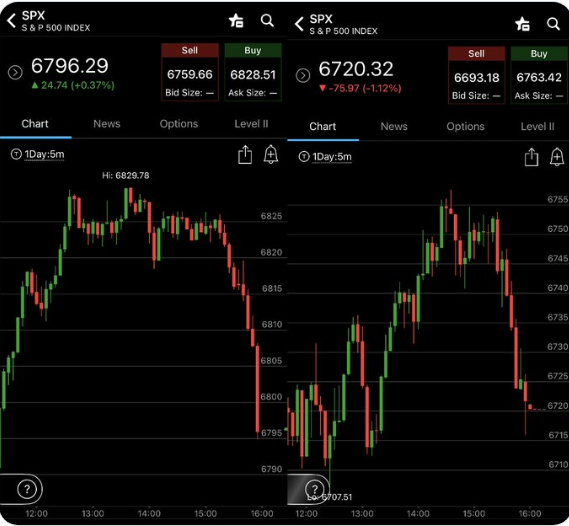

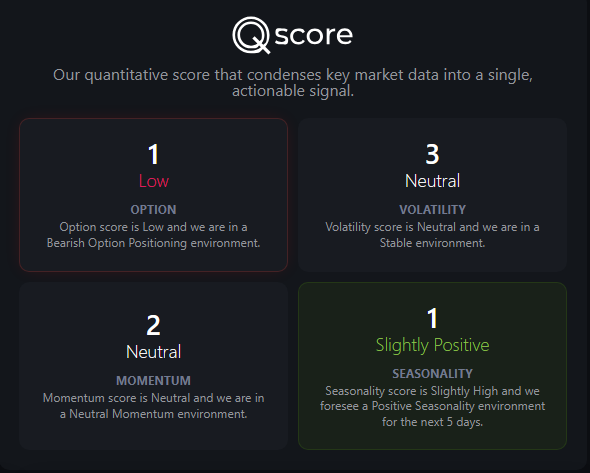

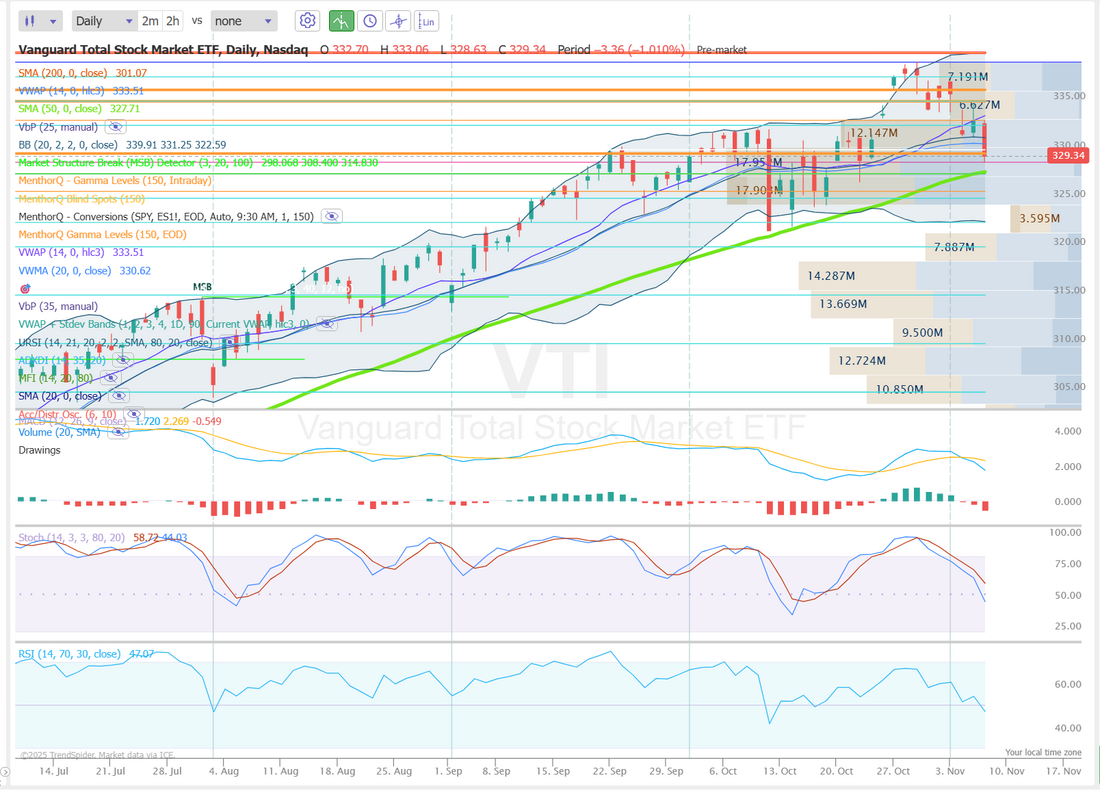

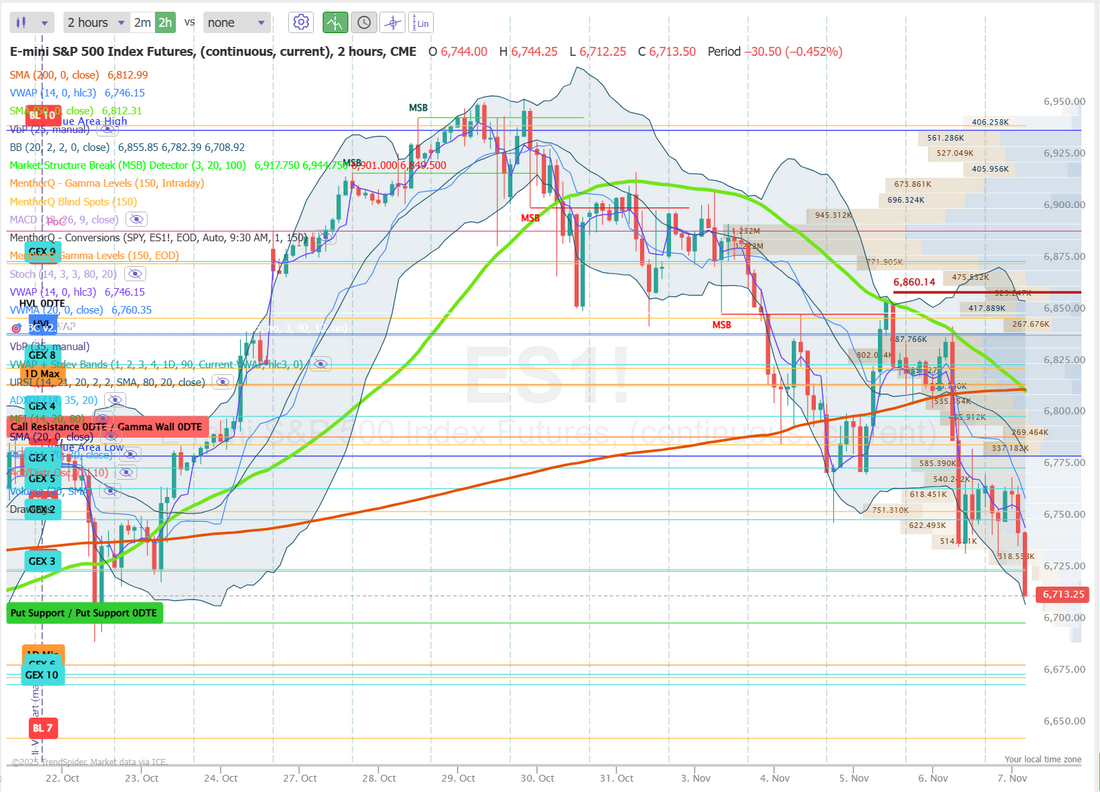

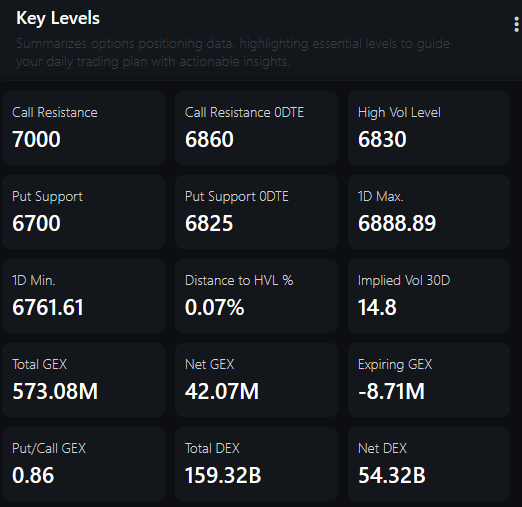

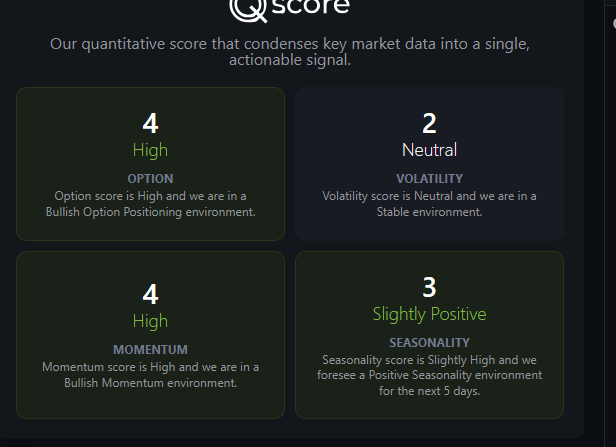

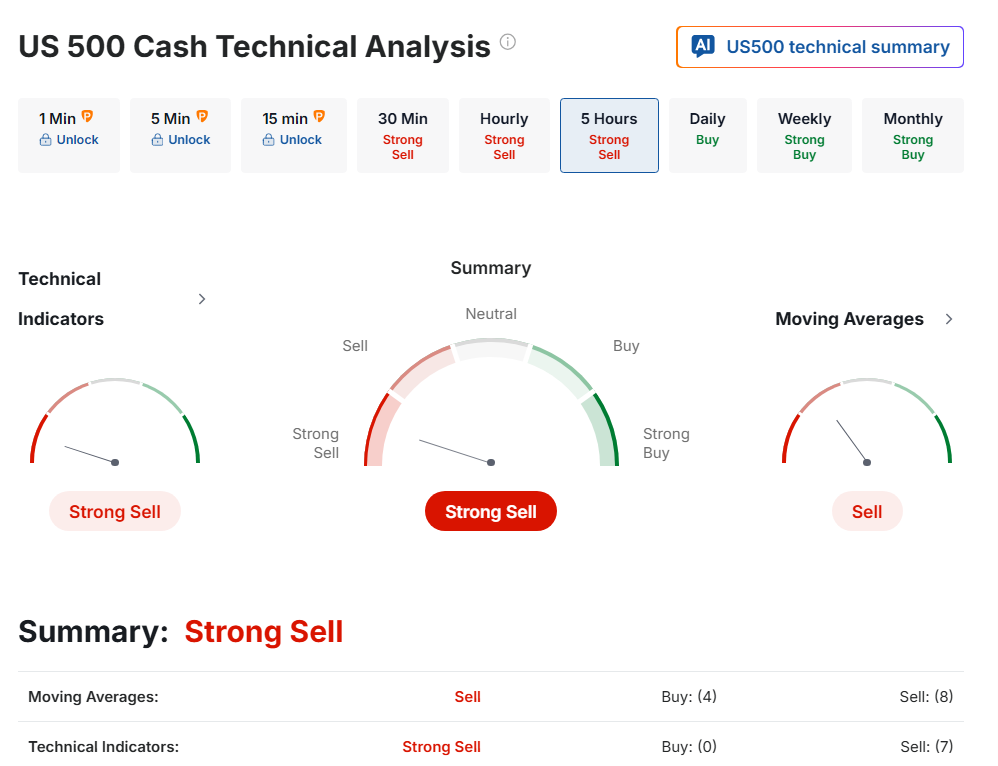

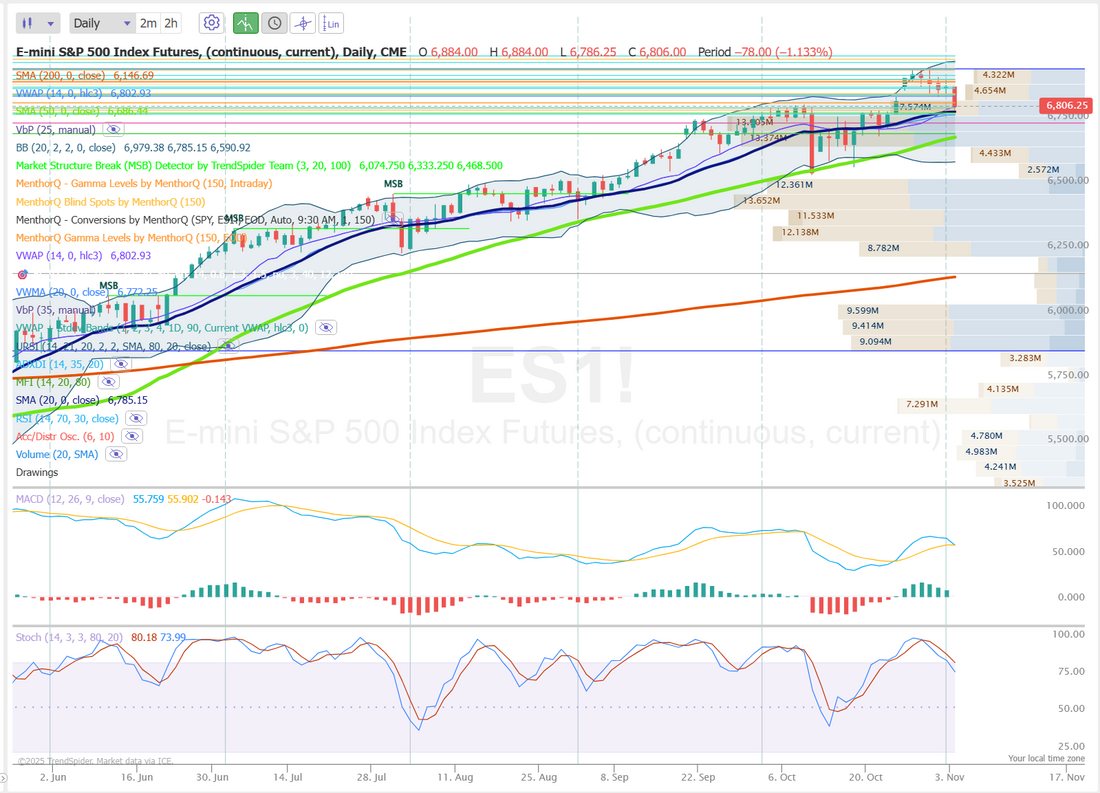

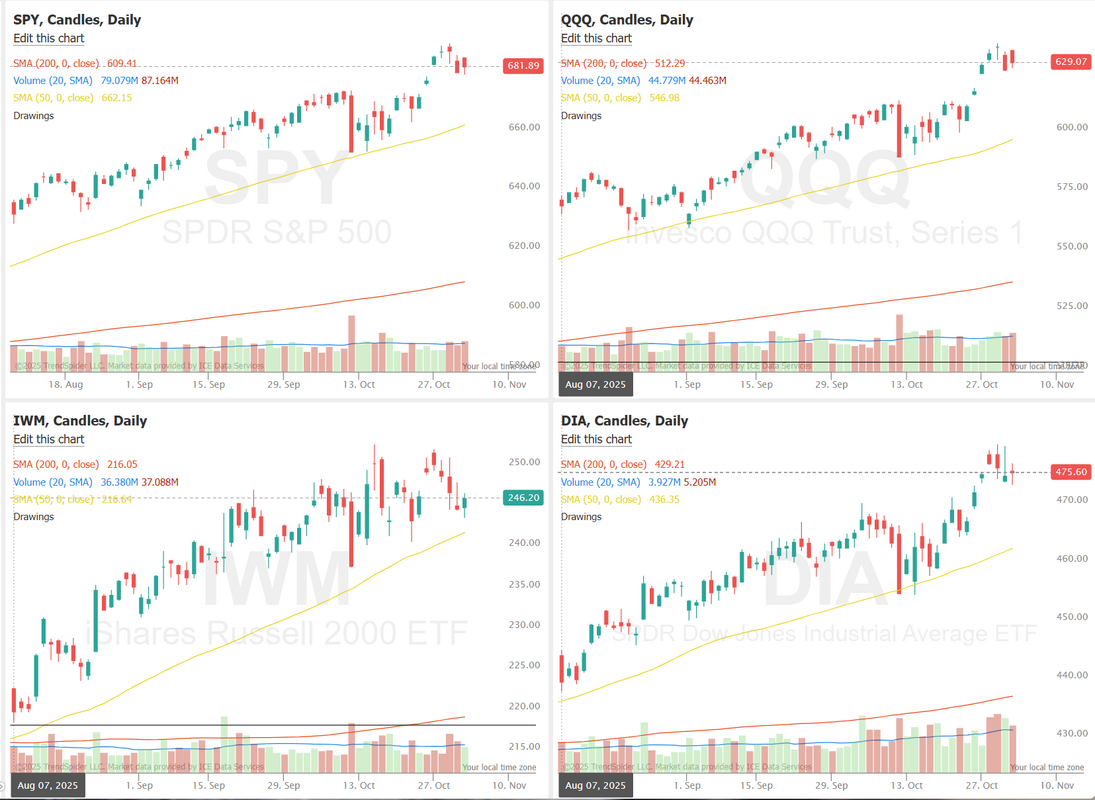

Does yesterday change the trend?We had a monster rebound yesterday after five very weak trading sessions. News that an end to the Govt. shutdown was near was enough to initiate a big relief rally. That makes sense. Some moves are harder to understand but this has generally been the pattern on re-openings. The real question is about its sustainability. Will this usher in another bull leg or is it only temporary? Futures are a tad weak this morning as we start the process of finding out. Word is it could be as early as tomorrow to get the Govt. back open. Let's see if it becomes a "buy the rumor, sell the news" event or not. I was out of commission most of the day yesterday with some low blood pressure issues. I did take one trade late in the day, looking for an NDX retrace going into the close but quickly got stopped out. Here's a look at it. Not much of a day for me. Let's take a look at the market. Technicals are pointing bullish after yesterdays big push higher. Yesterday's move higher was a solid gap up move. The question now is, will this gap get filled? Futures are suggesting it's a real possibility this morning. The SPX option score is rebounding sharply after a brief pullback, aligning with a short-term bounce in spot prices following recent weakness. The score’s quick recovery to higher levels suggests renewed option market confidence and possibly a shift toward increased call positioning or reduced hedging activity. Price action shows the index stabilizing after testing support near recent lows, hinting that volatility compression could favor range-bound consolidation before the next directional move. In the near term, maintaining momentum above the mid-range levels will be key for sustaining bullish sentiment, while a drop in the option score could quickly reintroduce short-term downside pressure. I wanted to take a moment and look at the bellwether A.I. stock (Nvidia). There seems to be a bit of a waning in A.I. stocks as more concerns of valuations and profitability come online. It seems to be at a crucial level. NVIDIA’s price action is consolidating near a key call resistance zone around $200, where significant gamma exposure (GEX) concentration suggests dealers may begin to hedge defensively if momentum stalls. The Gamma Wall at $195 marks a notable inflection level holding above it keeps the short-term tone stable, while a break below could open room toward support levels near $190 and $185. On the upside, if NVIDIA can sustain strength through $200, option positioning could fuel a gamma squeeze toward the next resistance clusters around $205–$210. The setup highlights a tightly balanced market where option flows may heavily influence short-term direction. Of course, it goes without saying that as NVDA goes so goes most of the tech and A.I. marketplace. This is a key one to watch. December S&P 500 E-Mini futures (ESZ25) are down -0.22%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.39% this morning, pointing to a lower open on Wall Street after yesterday’s rally amid renewed concerns over the valuations of some of the biggest beneficiaries of the AI boom. Sentiment weakened as Nvidia (NVDA) fell over -1% in pre-market trading after Japan’s SoftBank Group disclosed it had sold its entire $5.83 billion stake in the chipmaker, reigniting valuation concerns. Separately, CoreWeave (CRWV), which provides rental access to powerful AI chips, slumped more than -9% in pre-market trading after cutting its full-year revenue guidance. Also adding to the negative sentiment on Tuesday was a Wall Street Journal report stating that China will expedite rare earth export approvals for most firms while excluding those tied to the U.S. military. The move added fresh uncertainty about the durability of the trade truce between the world’s two largest economies. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. The Magnificent Seven stocks advanced, with Nvidia (NVDA) climbing over +5% to lead gainers in the Dow and Alphabet (GOOGL) rising more than +4%. Also, chip stocks rallied, with Micron Technology (MU) gaining over +6% and Advanced Micro Devices (AMD) rising more than +4%. In addition, TreeHouse Foods (THS) jumped over +22% after Investindustrial agreed to acquire the food processing company for about $2.9 billion. On the bearish side, health insurance stocks slumped after lawmakers moved closer to ending the shutdown without securing an extension of Affordable Care Act subsidies, with Oscar Health (OSCR) tumbling more than -17% and Centene (CNC) sliding over -8% to lead losers in the S&P 500. A record 42-day U.S. government shutdown is poised to end as soon as Wednesday after the Senate passed a temporary funding bill, with Democrats providing enough votes to push the measure through. The package now heads to the Republican-controlled House for a final vote before advancing to President Trump’s desk. Once the government reopens, a wave of delayed economic reports is expected to be released, helping to clarify the outlook for interest rates. “Reopening would not only boost sentiment, but also open the way for data releases, which could provide more insight into the health of the U.S. jobs market and, more broadly, the U.S. economy ahead of next month’s Federal Reserve interest-rate decision,” said Fiona Cincotta at City Index. Meanwhile, Vail Hartman, Delaney Choi, and Ian Lyngen at BMO Capital Markets noted that it would take several weeks for the market to receive all the data delayed since the start of the shutdown. Jim Reid of Deutsche Bank stated that, based on historical precedent from the 2013 shutdown, September’s jobs report could be one of the first to be released, potentially within three business days of the government’s reopening. Assuming the government reopens and data collection resumes, Fed officials will still face data compiled through retroactive surveys and other methods—if they are published at all. Analysts cautioned that the Bureau of Labor Statistics would likely be unable to gather and process data for both the October and November CPI reports ahead of the December FOMC meeting. And this comes at a time when the Fed is the most divided in recent memory. St. Louis Fed President Alberto Musalem said on Monday that he expects the U.S. economy to rebound sharply early next year, emphasizing that policymakers should exercise caution when considering further rate cuts. “It is very important that we tread with caution, because I believe there’s limited room for further reductions without monetary policy becoming overly accommodative,” Musalem said. At the same time, San Francisco Fed President Mary Daly said the economy is likely experiencing a slowdown in demand and cautioned against keeping rates too high for too long. Also, Fed Governor Stephen Miran said that better-than-expected inflation data and continued signs of labor market weakness support the case for a third consecutive rate cut in December. U.S. rate futures have priced in a 63.6% chance of a 25 basis point rate cut and a 36.4% chance of no rate change at the December FOMC meeting. The bond market is closed today for the Veterans Day holiday. Will they or won't they?One big question is will the FED lower rates again at its next meeting? A big part of that guessing game comes down to interpreting the data that had yet to be released, due to the shutdown. Several observers are noting that it will take quite a while to compile and release all that backlogged data. It's likely that some will still be pending when the FED needs to make a decision. Futures are almost down to a coin toss as to whether or not we get another cut this year. My lean or bias today: I'm going to lean or look for more bearishness. Yesterdays pop was understandable but I think the recent A.I. weakness and overall softness in the market, combined with weak futures offer the bears up another shot to refill the gap and continue the move lower. Let's take a look at some intraday levels. The daily chart on VTI doesn't offer up much guidance. Technicals and price action put us more neutral than anything. On a tighter 2-hour. chart on /ES, we have a couple of big levels and lots of tiny levels. Pretty normal after a big move like we got yesterday. There is a big Gamma wall of resistance at 6884 and a big Gamma wall of support at 6700. That leaves a lot of levels in between. I'll work to point these out in Discord as the day progresses, so keep your chat room open as the day goes forward. Warren Buffett is known for many, many wise quotes. One of my favorites is, "In the short term the market is a voting machine. In the long term it's a weighing machine." This simply means in the short term individual (or collective) opinion can move stocks is crazy ways but ultimately, at the end of the day, fundamentals come home to roost. There have been (and will continue to be) many Meme stocks that had spectacular runs in the short term, only to come back to reality over time, as fundamentals took focus. It may be too early to call the A.I. stocks to this category of investments but it's something I'm certainly watching, and we are selectively building small, short positions in several of them in our ATM portfolio.

I look forward to seeing you all in the live trading room today. Today may not offer up the opportunities of yesterday, but I think it will still be a good one.

0 Comments

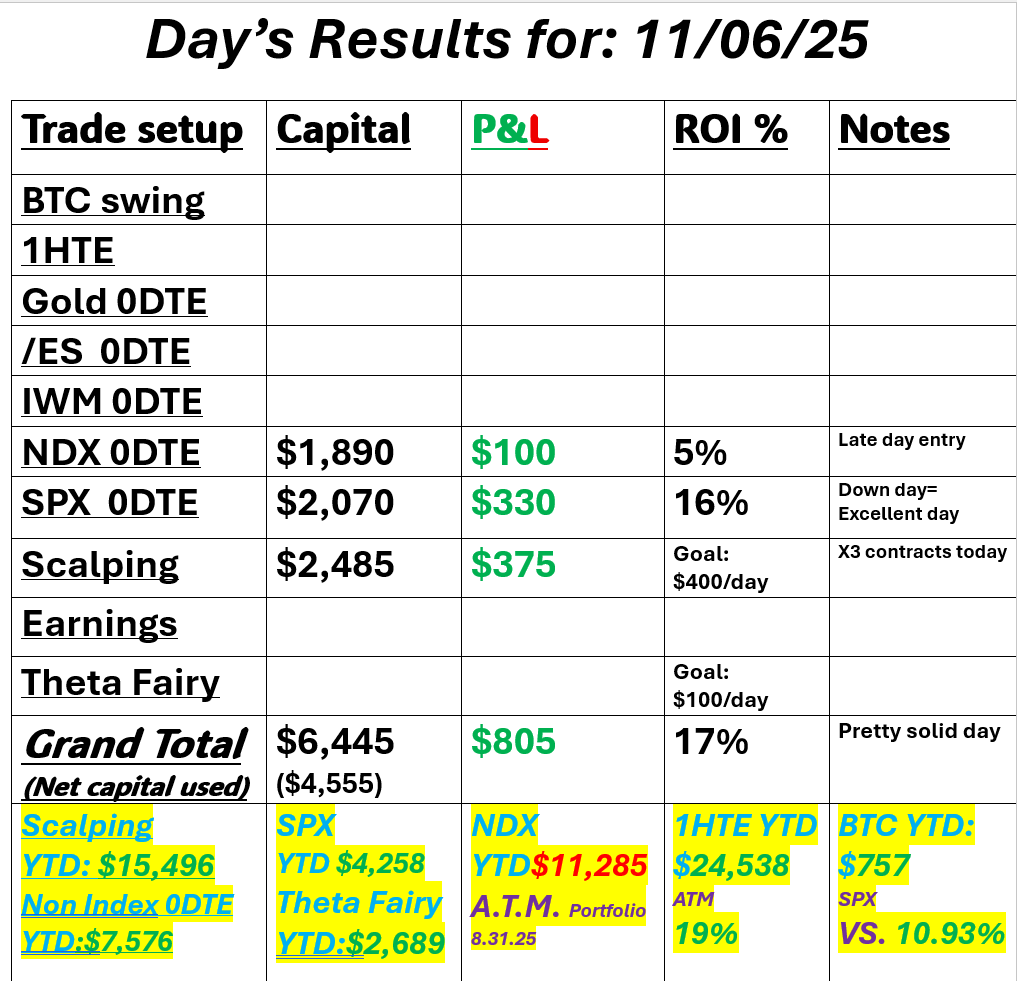

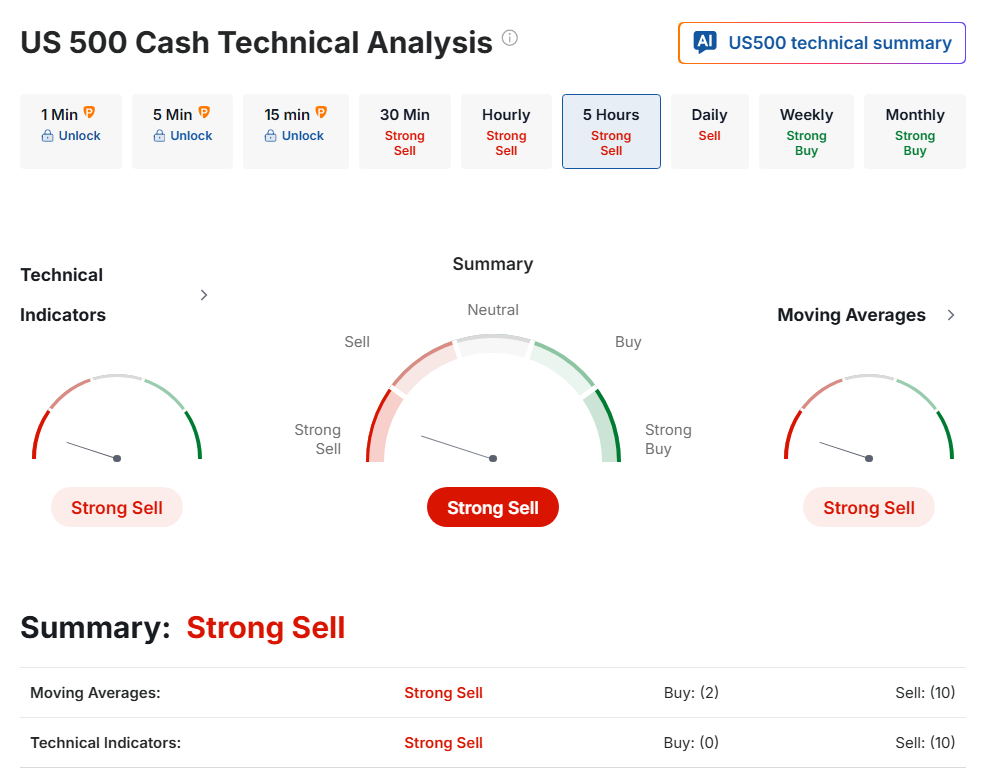

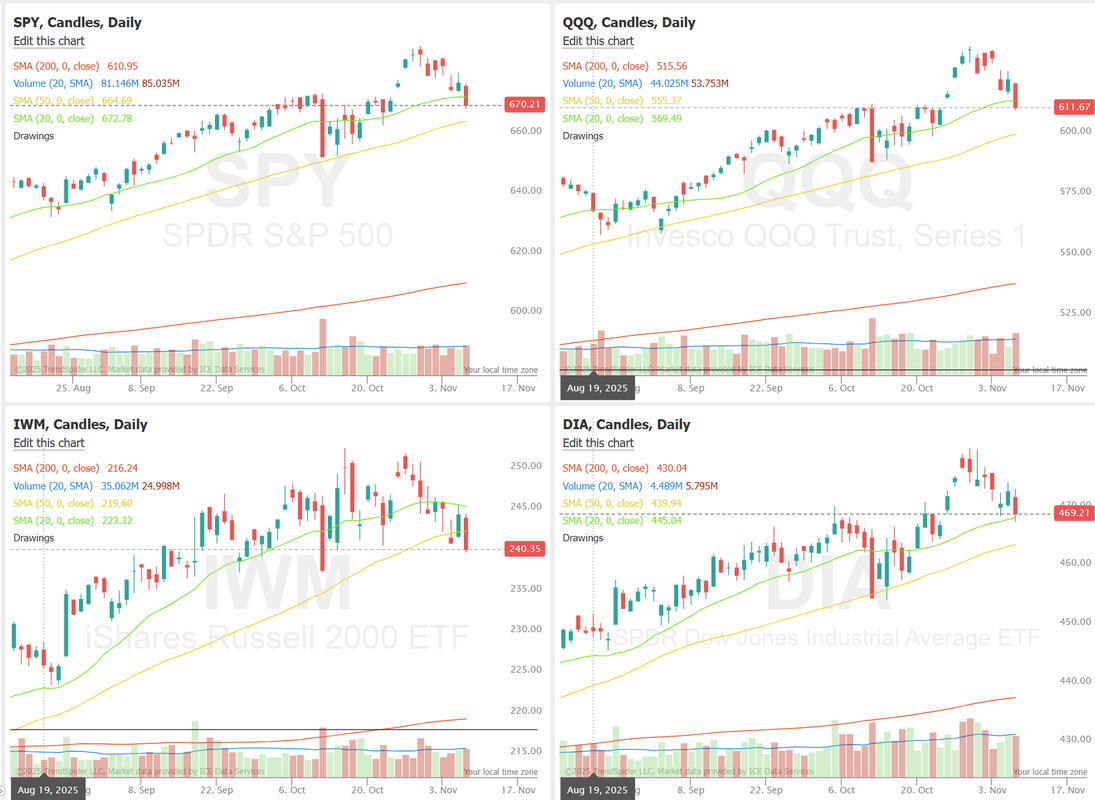

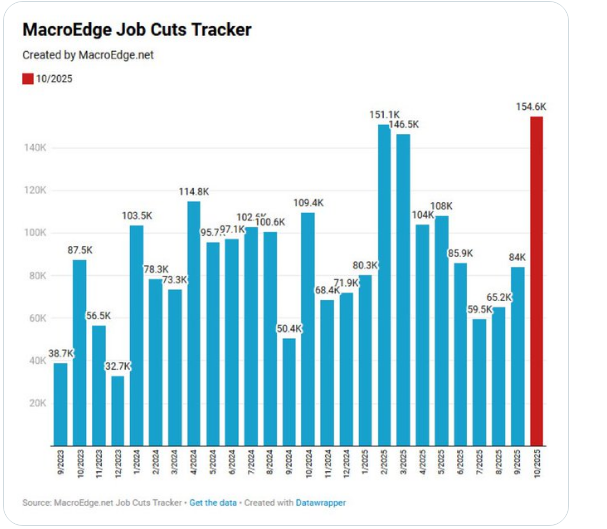

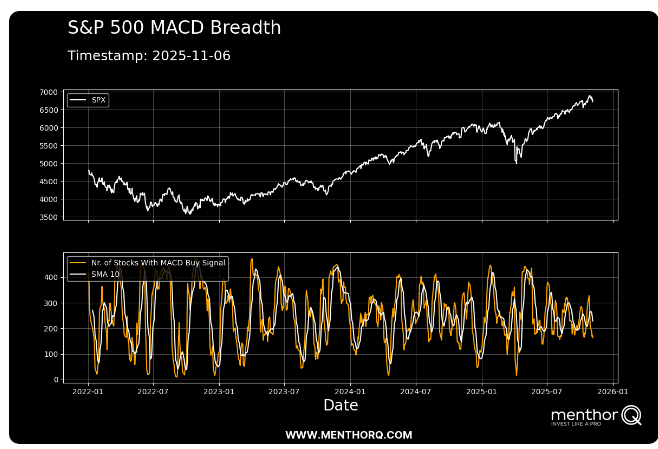

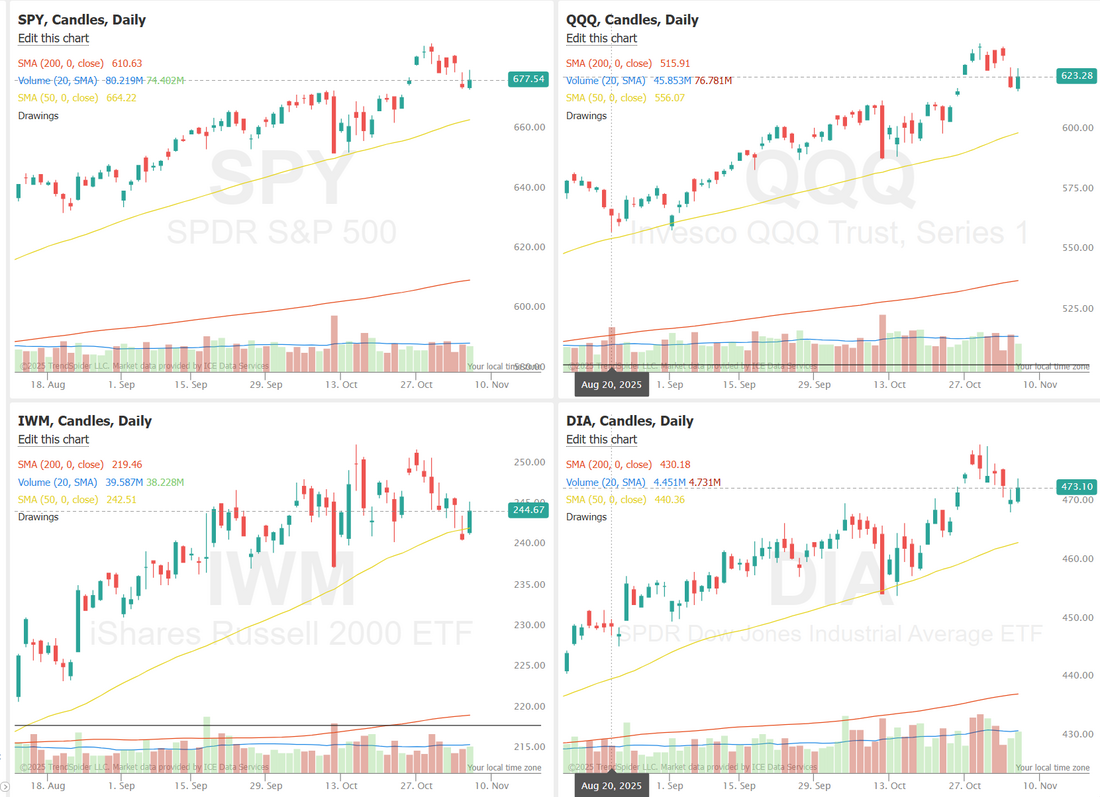

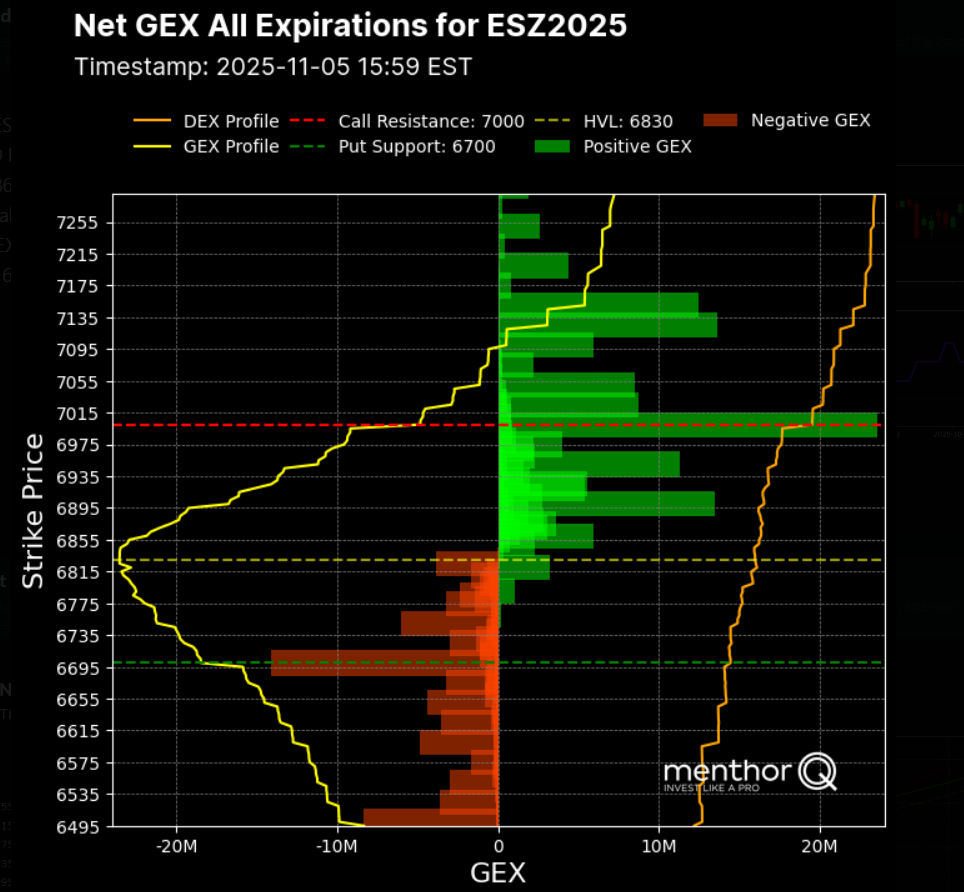

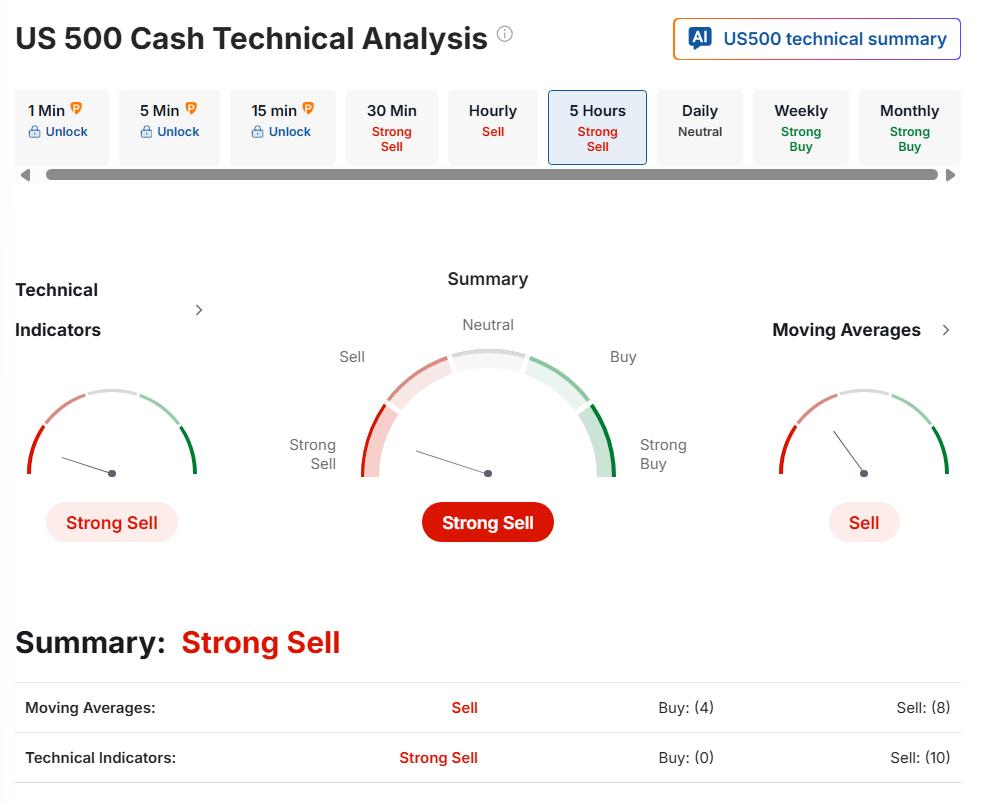

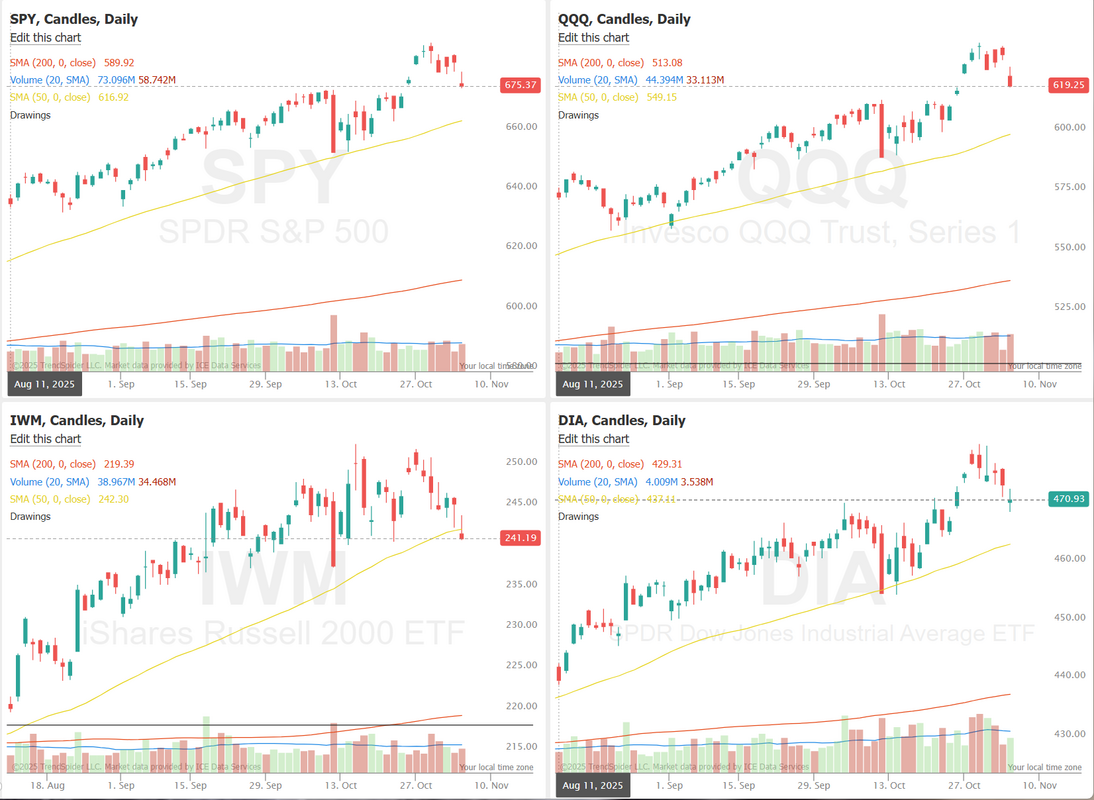

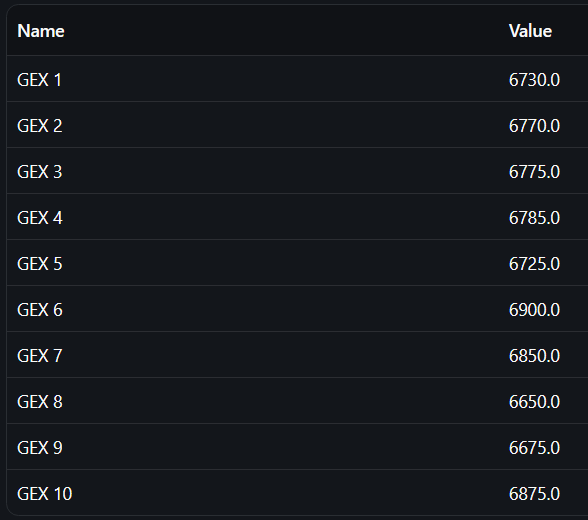

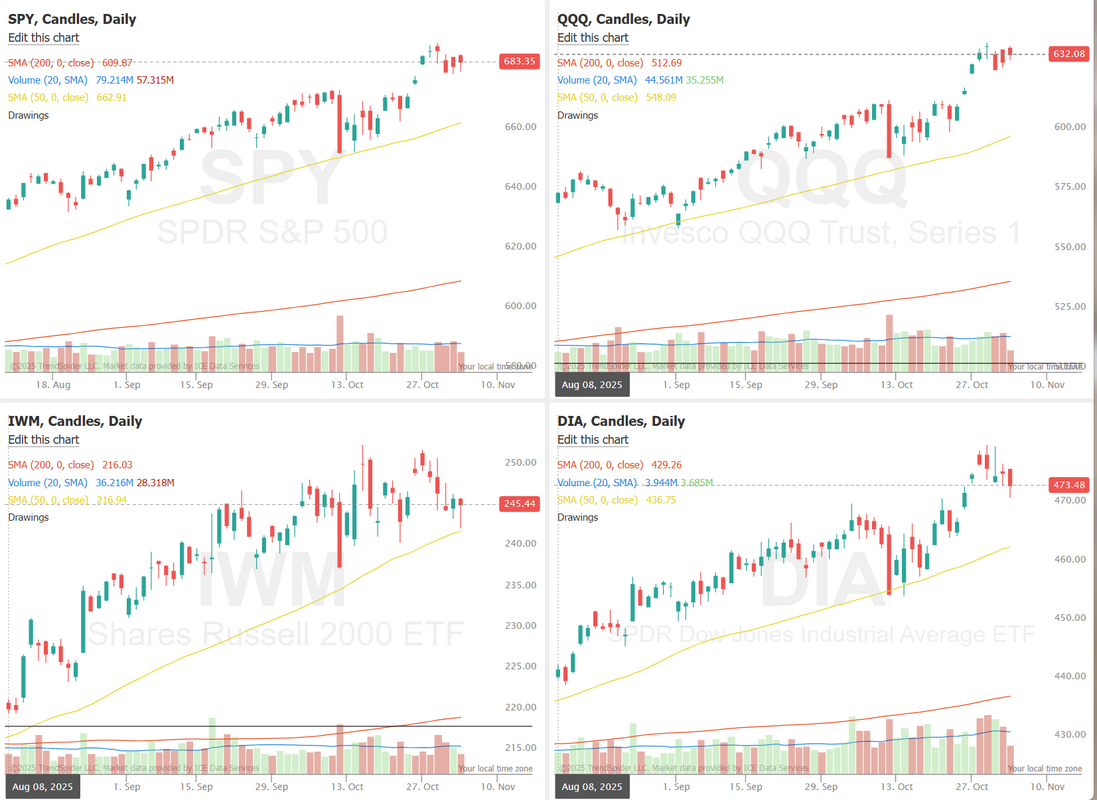

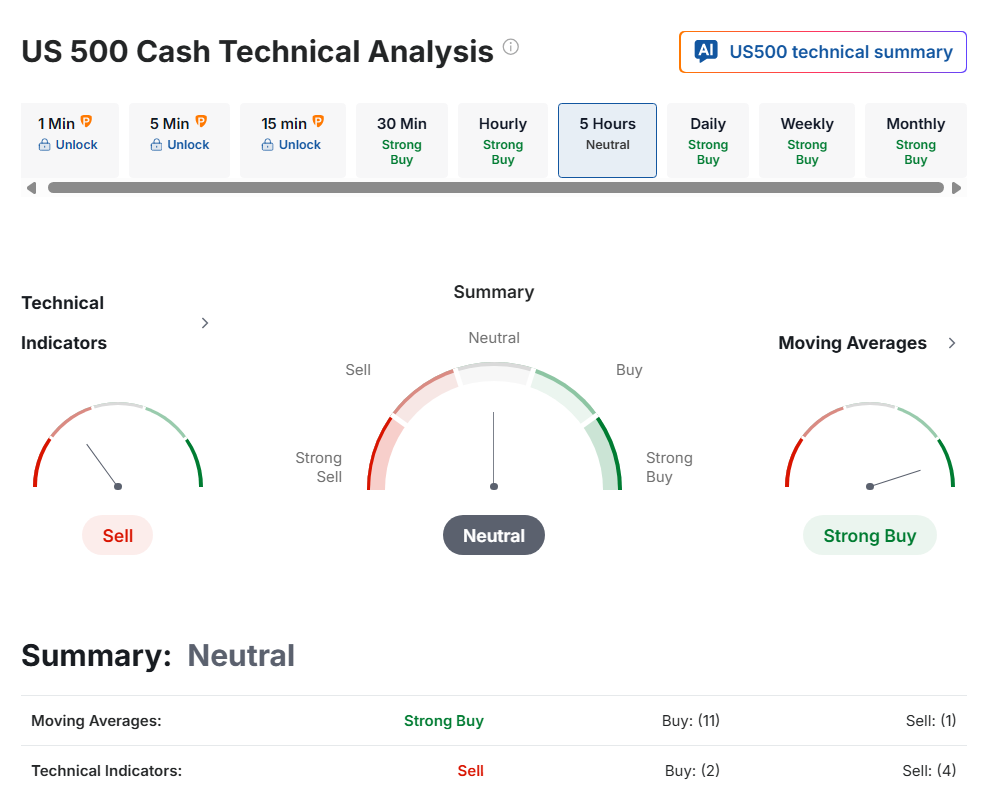

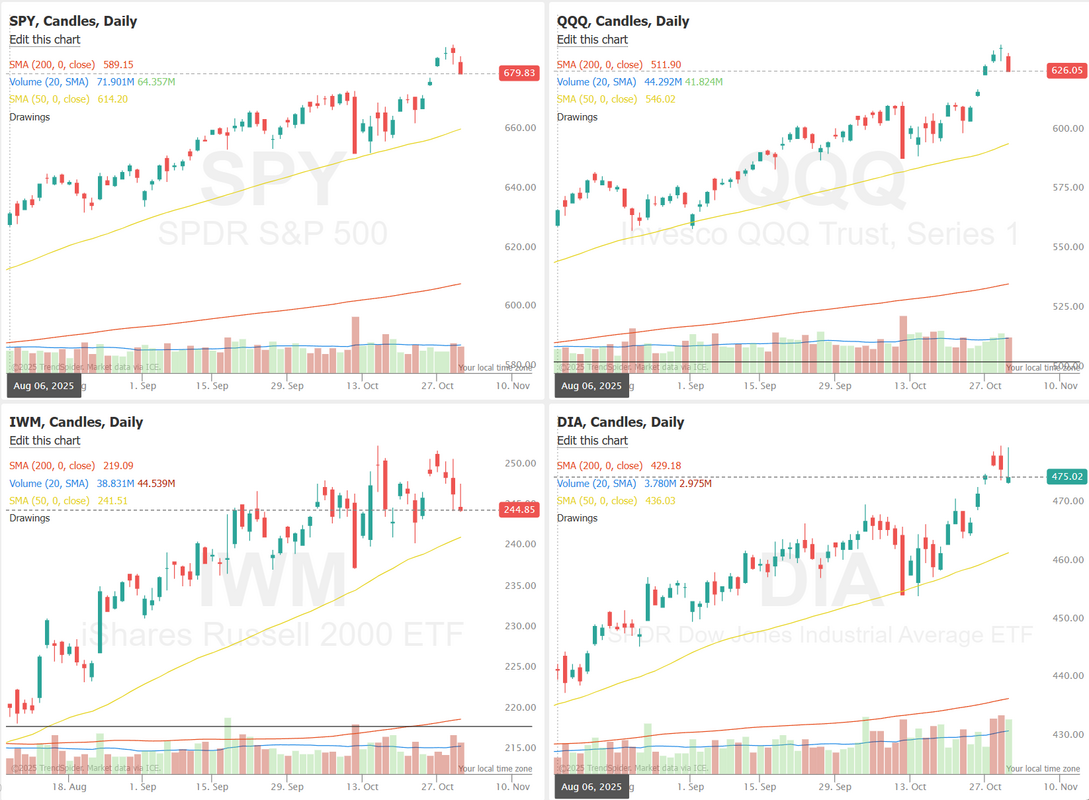

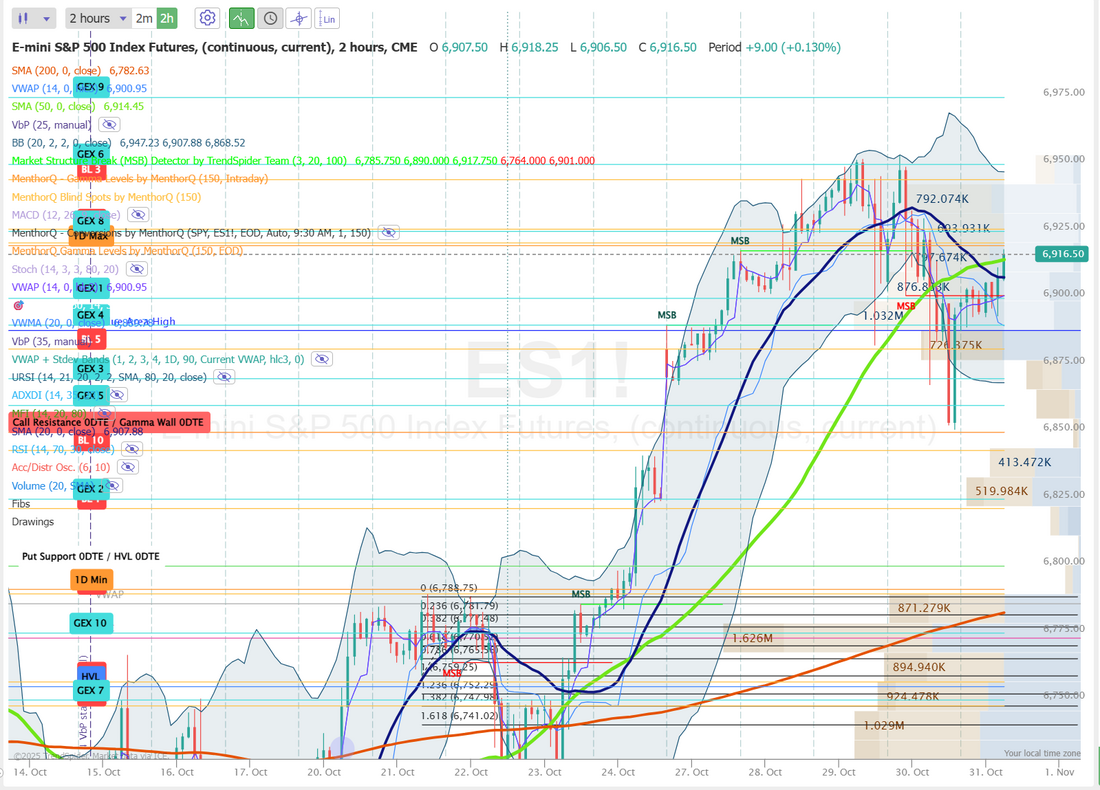

Goodbye 20DMA. Hello 50DMA!Well...as Phil Collins likes to say, it's another day in paradise. Have our rain dance prayers finally been answered? All we've ever asked for is a down trending market. Is that so big an ask? LOL. I don't know. After two strong, back to back years of gains the market looked tired at the start of 2025 and I thought, if there was any year that looked poised to go down, this was the year. Instead its just held it's ground. I dare so however, this current rollover looks like it could be the real deal. The market seems to be getting tired of A.I. and Quantum computing stocks with no revenues or earnings to speak of. We love them, of course, from the short side. Our ATM portfolio is poised to profit again today if the market keeps dropping. We had a stellar day yesterday. Everything hit for us. Take a look below: We had some excellent levels to work off yesterday. Today should be no different. There are some key support/resistance zones that have formed up. I'll touch on those in a moment. Let's look at the markets. Technicals are flashing sell. As I mentioned above, We blew through the 20DMA yesterday on the SPY and QQQ. The 50DMA looks like it's incoming. A break below that would be glorious. IWM as already done so. My lean or bias for today is bearish. Let's go bears! December S&P 500 E-Mini futures (ESZ25) are down -0.26%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.30% this morning, extending yesterday’s losses as investors remain concerned about weak labor market data and lofty tech valuations. Investors are now awaiting the release of the University of Michigan’s preliminary reading on U.S. consumer sentiment and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s major indices ended sharply lower. Most members of the Magnificent Seven stocks retreated, with Tesla (TSLA) and Nvidia (NVDA) dropping over -3%. Also, chip stocks slumped, with Advanced Micro Devices (AMD) sliding over -7% and Qualcomm (QCOM) falling more than -3%. In addition, DoorDash (DASH) plunged over -17% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the food-delivery company reported weaker-than-expected Q3 EPS and issued soft Q4 adjusted EBITDA guidance. On the bullish side, Datadog (DDOG) jumped more than +23% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the software maker posted upbeat Q3 results and raised its full-year guidance. Data from outplacement firm Challenger, Gray & Christmas released on Thursday showed that U.S. companies announced 153,074 job cuts in October, nearly three times higher than the same month last year and the highest for any October since 2003. Separately, Revelio Labs data showed that the U.S. shed 9,100 nonfarm jobs in October after adding 33,000 in the previous month. “We are sticking to our view that the Fed will deliver a follow-up 25 basis-point cut in December because restrictive Fed policy can worsen the already fragile employment backdrop,” said Elias Haddad at Brown Brothers Harriman & Co. Still, a slew of remarks from Fed officials on Thursday regarding inflation left traders uncertain about whether a December rate cut will materialize. Cleveland Fed President Beth Hammack said monetary policy needs to keep putting downward pressure on inflation, which she views as too high and a greater risk than labor market weakness. Also, Fed Governor Michael Barr said policymakers still have work to do in bringing down inflation to the central bank’s 2% target while ensuring the labor market is solid. In addition, Chicago Fed President Austan Goolsbee said a lack of official inflation data during the shutdown makes him cautious about cutting rates. Finally, St. Louis Fed President Alberto Musalem said the central bank needs to maintain downward pressure on inflation, warning that interest rates are nearing a level where that pressure could diminish. U.S. rate futures have priced in a 66.0% chance of a 25 basis point rate cut and a 34.0% chance of no rate change at the next FOMC meeting in December. Meanwhile, the longest government shutdown in U.S. history is now in its 38th day. U.S. officials have said they will reduce air traffic by 10% at 40 major airports starting today to ease pressure on air-traffic controllers who remain unpaid due to the shutdown. Economists noted that every week of the shutdown reduces quarterly annualized growth by 0.1 to 0.2 percentage points. Still, several lawmakers have expressed optimism that the shutdown could end this weekend. In light of the shutdown, the publication of October’s nonfarm payrolls report, average hourly earnings, and unemployment rate, originally set for today, will be delayed. Still, the University of Michigan’s U.S. Consumer Sentiment Index will be released today. Economists, on average, forecast that the preliminary November figure will stand at 53.0, compared to 53.6 in October. The Fed’s Consumer Credit report will also be released today. Economists expect the U.S. Consumer Credit to be $10.4 billion in September, compared to the previous figure of $0.4 billion. In addition, market participants will be looking toward speeches from Fed Vice Chair Philip Jefferson, New York Fed President John Williams, and Fed Governor Stephen Miran. On the earnings front, notable companies like Constellation Energy (CEG), KKR & Co. (KKR), Enbridge (ENB), and Duke Energy (DUK) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.106%, up +0.32%. The last two days the SPX dropped about 30 handles in 30 mins. This is a nice sign of weak hands. Markets can't hold going into the close. Everyone wants to be risk-off overnight. If you're worried about jobs numbers, you should be. Job cuts are skyrocketing. The S&P 500 MACD Breadth chart highlights a moderate cooling in short-term momentum as the number of stocks with active MACD buy signals has eased from recent peaks. While the SPX index remains in an uptrend, breadth readings show fewer constituents participating in the rally, suggesting a potential pause or minor consolidation phase ahead. Historically, similar dips in MACD breadth have preceded short-term pullbacks or sideways movement before trend resumption. In the near term, traders may watch whether breadth stabilizes or rebounds, as a renewed rise in MACD buy signals could confirm fresh upside participation across sectors. Gamma has flipped negative! Quant score in plummeting. Let's take a look at our intraday readings. We've got a textbook sell rating on the market right now. Rollover on Stoch, RSI, MACD. We just need a break below the 50DMA (green line) to really lock this bearish trend down. 6725, 6740, 6749, 6754, 6766 are resistance levels. 6711, 6700, 6680, 6674, 6660, 6644 are support. We had another great training session yesterday on Attribution analysis. Join us Monday for a training session on the Options smile skew. It should be another good one! I'll see you all shortly in the live trading room. Remember...there ain't no market like a down market. Let's go bears!

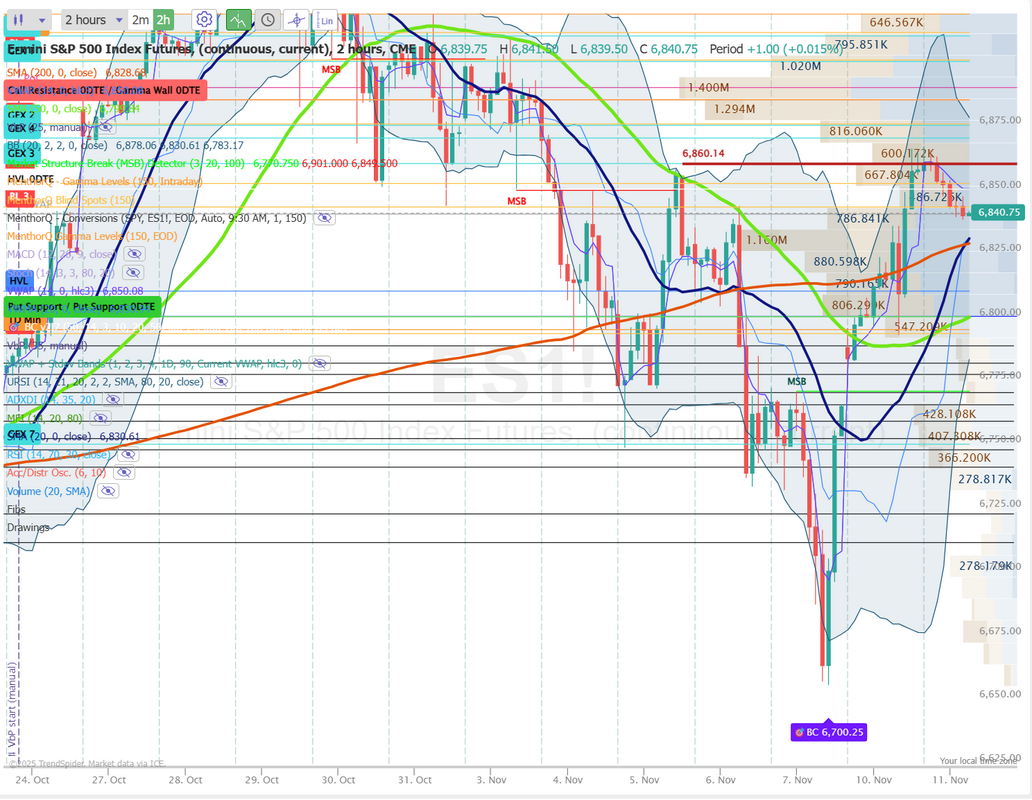

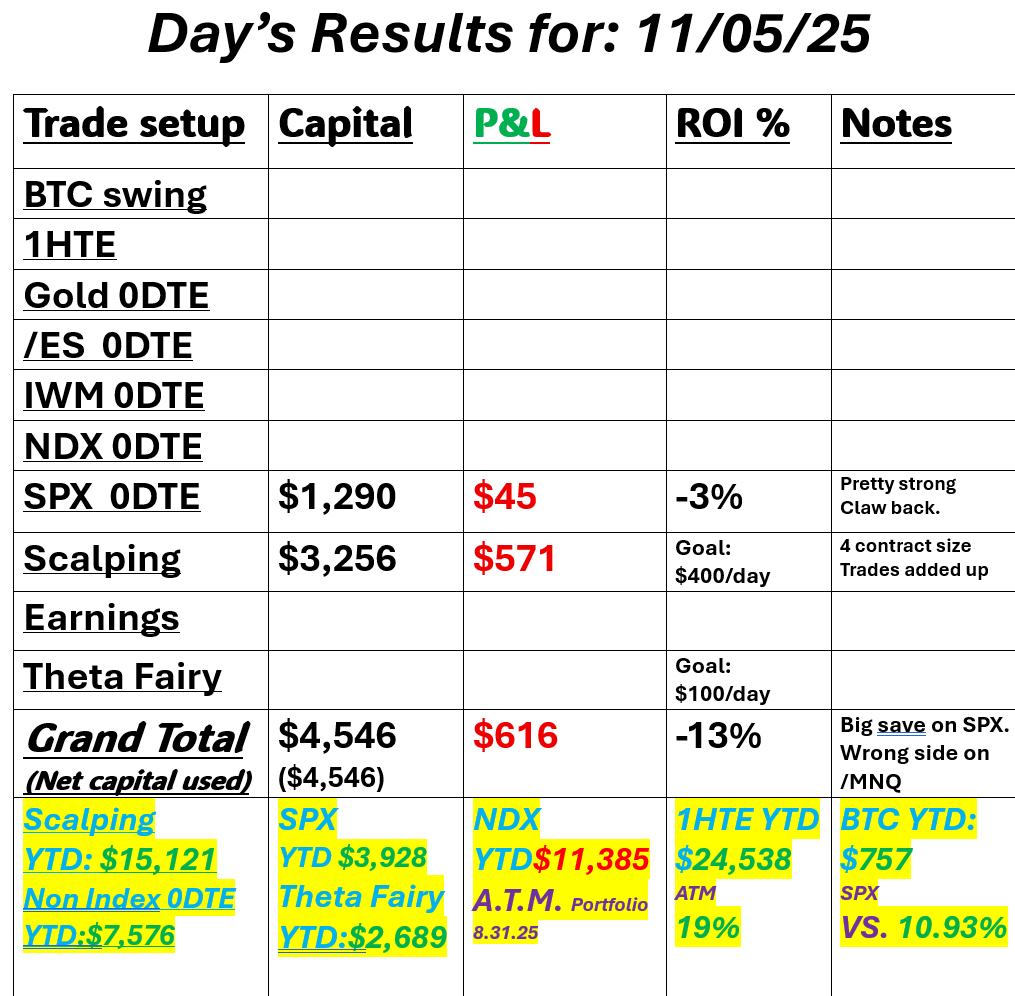

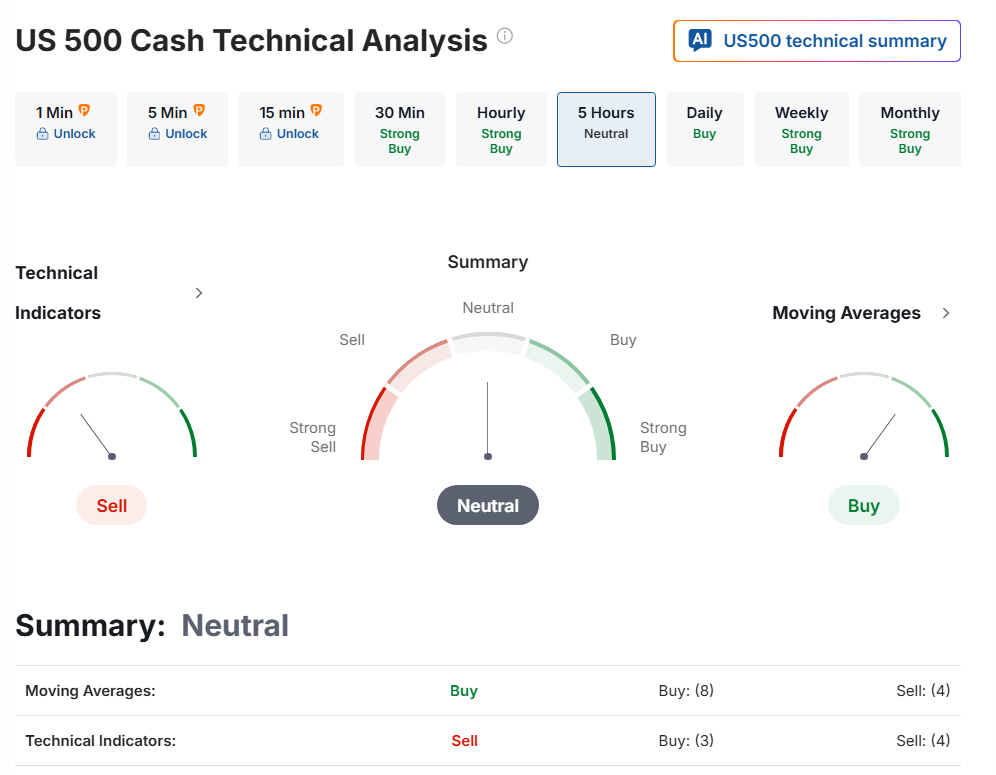

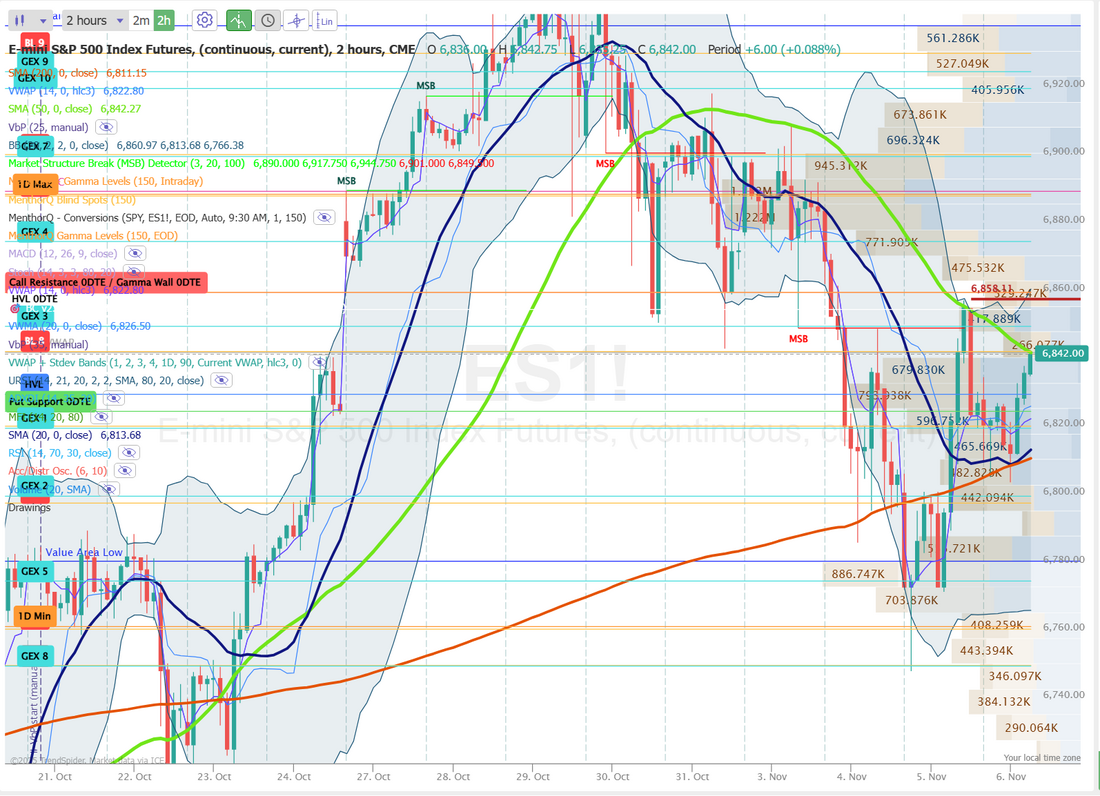

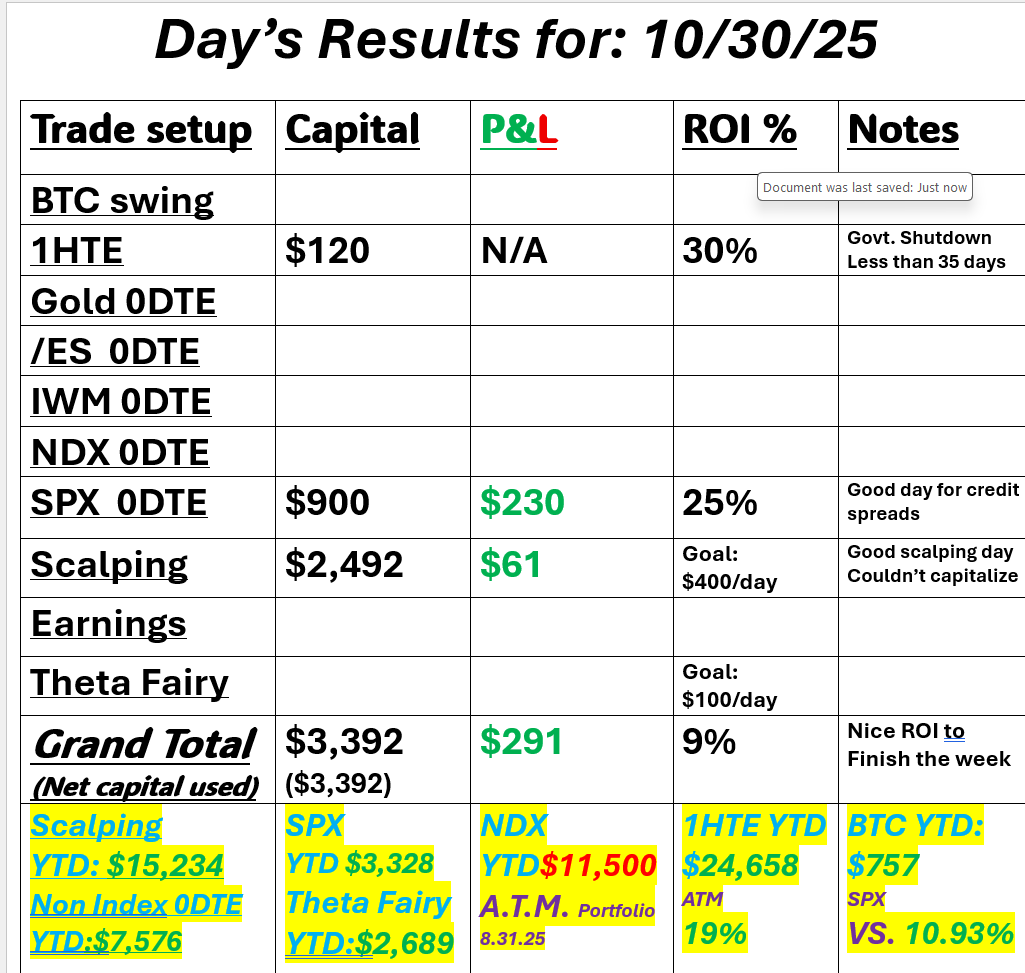

Big recovery=Big win?Lot's of lessons for me in yesterdays trading session. Both with our 0DTE SPX and Scalping the /MNQ futures. I got upside down on our SPX early in the day. Down about $1,000 dollars. I generally try to keep risk at no more than $500. We had an amazing reversal trade that almost brought us back to profits. It would have been almost $600 of profit IF, I would have abided by our level analysis and waited a bit longer to enter the retrace setup. I got a bit ahead of myself and our laid out gameplan. In scalping I went with 4 contracts which is a bit heavier than normal but the main issue was looking for the retrace a bit too early. It came. Again, I was just too anticipatory. I love the retrace trade. You can call me Scott "reversion to the mean" Stewart. The problem comes when it doesn't show up.. or shows up too late. A $45 dollar loss on SPX is hard to categorize as a win until you understand you were staring down a $1,000 loss. Today is a new day. Here's a look at my day. Let's take a look at the markets. Technicals are in a bit of a flux. Neutral rating to start today. That's always a tough one to read so I'll be a bit more patient to get started today. I would actually call yesterday a bearish day. Yes the IWM and DIA had a well deserved push higher after lots of negative days but the SPY and QQQ actually had a very bearish finish to the day, despite being up strong most of the day. December S&P 500 E-Mini futures (ESZ25) are up +0.16%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.20% this morning, pointing to a higher open on Wall Street as Treasury yields fell amid growing expectations for a Federal Reserve rate cut in December. Bond yields fell after data from outplacement firm Challenger, Gray & Christmas showed that U.S. companies announced the highest number of job cuts for any October in over two decades, prompting traders to increase wagers on a rate cut next month. Investors now await a slew of speeches from Federal Reserve officials for more clues on the interest rate outlook. Still, concerns over lofty tech valuations persisted, limiting gains in U.S. equity futures. Qualcomm (QCOM) fell over -2% in pre-market trading, becoming the latest chipmaker to issue upbeat guidance that nonetheless failed to impress investors. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the green. Chip stocks rallied, with Micron Technology (MU) climbing over +8% and Marvell Technology (MRVL) rising more than +6%. Also, Amgen (AMGN) surged over +7% and was the top percentage gainer on the Dow after the biotech giant posted upbeat Q3 results and raised its full-year guidance. In addition, Lumentum Holdings (LITE) jumped more than +23% after the company reported better-than-expected FQ1 results and issued strong FQ2 guidance. On the bearish side, Zimmer Biomet Holdings (ZBH) plunged over -15% and was the top percentage loser on the S&P 500 after the maker of knee and hip replacements posted weaker-than-expected Q3 sales. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 42K in October, stronger than expectations of 32K. Also, the U.S. ISM services index rose to 52.4 in October, stronger than expectations of 50.7. At the same time, the U.S. October S&P Global services PMI was revised lower to 54.8 from the preliminary reading of 55.2. Fed Governor Stephen Miran said on Wednesday that the ADP report showing an increase in employment at companies was “a welcome surprise,” though he reiterated that interest rates should be lower. U.S. rate futures have priced in a 67.3% probability of a 25 basis point rate cut and a 32.7% chance of no rate change at December’s monetary policy meeting. Third-quarter corporate earnings season rolls on, with notable companies like ConocoPhillips (COP), Airbnb (ABNB), Monster Beverage (MNST), Vistra Corp. (VST), Warner Bros Discovery (WBD), and Take-Two Interactive Software (TTWO) slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also hear perspectives from Fed Governors Christopher Waller and Michael Barr, along with New York Fed President John Williams, Cleveland Fed President Beth Hammack, and Philadelphia Fed President Anna Paulson, throughout the day. Meanwhile, the U.S. government shutdown has entered its 37th day. The shutdown has become the longest in U.S. history, surpassing the previous record on Tuesday night. In light of the shutdown, the publication of weekly jobless claims as well as preliminary third-quarter nonfarm productivity and unit labor costs data, originally set for today, will be delayed. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.139%, down -0.48%. The SPX Volatility Score chart indicates a cooling in short-term volatility after a brief spike in mid-October. While the index remains near its recent highs, the modest pullback in the volatility score suggests a more stable, range-bound environment as traders digest recent gains. Price action has shown resilience above the 6,700 zone, but fading volatility could mean tighter intraday swings and reduced momentum in the immediate term. If volatility picks up again, it may coincide with renewed market catalysts such as earnings or macro data releases, key short-term factors to watch as the SPX tests whether this consolidation becomes a pause before continuation or a shift toward rebalancing. We were too occupied with our SPX trade yesterday to get into our Attribution training. We'll hit it today. Come join us. I try to with hold a lean or bias on neutral rated mornings. It's just too much of a coin toss. Futures are trending higher and looking to open strong. Let's look at the setups for today's 0DTE SPX trade based off /ES futures levels. Quant score building momentum. GEX levels across all expirations. Intraday levels. 6842 (current level as I type) is key 50PMA on 2hr. chart. 6850 is also key (MSB- Market structure break level), 6860, 6875, 6890 are the remaining resistance levels for me today. Support starts at 6830, 6825, 6820, 6810, 6800. I look forward to seeing you all in the live trading room shortly. Yesterday was a great save. Let's see if we can just skip the "save" part today and go straight to profit.

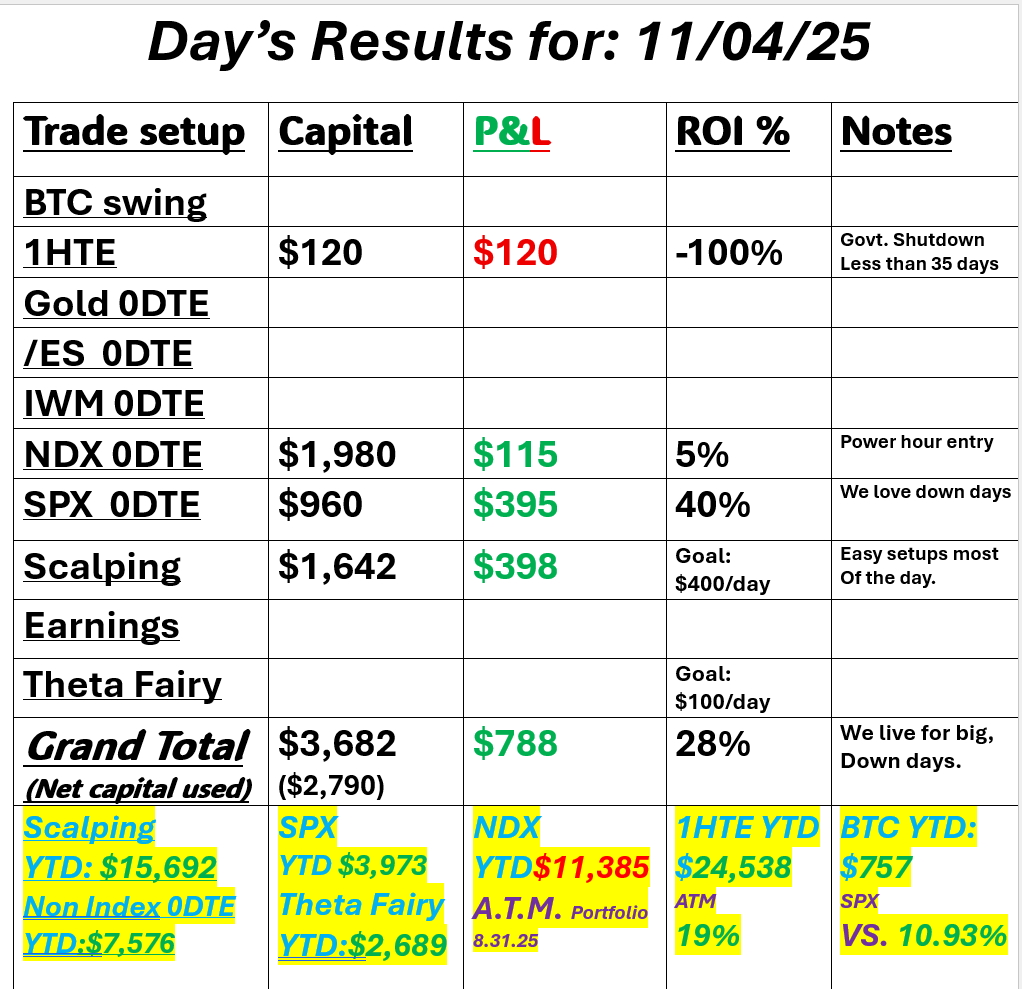

Down market = Up profitsYesterday was everything we (I) ask for as traders. I've talked endlessly about how I love big down days. Let me expand on why I think they are the best trading environment. #1. Movement. As traders we just want movement. Nice clean (not erratic) moves. This is obviously the best situation for our scalping efforts. It also lends itself to the use of debit trades. Those give us a bit better leverage than credit setups. #2. Down trends. Markets usually have bigger moves down than up. It also pumps I.V. into the options premium, making credit trades better risk/reward. In short, downward trending days give us the best chance to use all our tools. Scalping, Debit and credit trades. Here's a look at our day yesterday. Let's take a look at the markets. Sell mode it still engaged this morning although, futures are trying to fight back as I type. Do I see an actual bearish trend? Maybe on the IWM and DIA but SPY and QQQ have really just made a round trip from where they broke out to the upside a couple weeks ago. December Nasdaq 100 E-Mini futures (NQZ25) are trending down -0.57% this morning as investors digested weak earnings from notable tech players such as Advanced Micro Devices and Super Micro Computer, while concerns over lofty tech valuations continued to weigh on sentiment. Advanced Micro Devices (AMD) slid over -4% in pre-market trading after the chipmaker’s Q4 revenue guidance failed to impress investors. Also, Super Micro Computer (SMCI) plunged more than -9% in pre-market trading after the server maker posted weaker-than-expected FQ1 results and gave a disappointing FQ2 adjusted EPS forecast. Investors now await the U.S. ADP employment report and a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s major indexes closed sharply lower. The Magnificent Seven stocks retreated, with Tesla (TSLA) sliding over -5% and Nvidia (NVDA) falling nearly -4%. Also, chip stocks slumped, with Micron Technology (MU) dropping over -7% and Intel (INTC) falling more than -6%. In addition, Palantir Technologies (PLTR) sank over -7% amid valuation concerns, despite the data analytics company reporting upbeat Q3 results and raising its full-year revenue guidance. On the bullish side, Expeditors International of Washington (EXPD) climbed more than +10% and was the top percentage gainer on the S&P 500 after the company posted better-than-expected Q3 results. “This reinforces our thinking that the stock market is ripe for some sort of material pullback over the near-term, no matter where it’s going over the intermediate/longer-term,” said Matt Maley at Miller Tabak. On the trade front, China’s Customs Tariff Commission of the State Council announced on Wednesday that it will extend the suspension of a 24% tariff on some U.S. goods for another year while keeping a 10% duty in place, as part of the trade truce agreed at last month’s Trump-Xi summit. The commission also stated that it would lift tariffs of up to 15% on certain U.S. agricultural products. In addition, China will remove export controls against 15 U.S. entities and extend the suspension of such measures for another year for 16 others. The measures are set to take effect on November 10th. Third-quarter corporate earnings season continues, and investors await new reports from prominent companies today, including McDonald’s (MCD), Applovin (APP), Qualcomm (QCOM), Arm (ARM), Robinhood Markets (HOOD), McKesson (MCK), and DoorDash (DASH). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. On the economic data front, all eyes are on the U.S. ADP private payrolls report, which is set to be released in a couple of hours. The report will provide fresh insights into the health of the labor market. Economists, on average, forecast that the October ADP Nonfarm Employment Change will stand at 32K, compared to the September figure of -32K. The U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI will also be closely monitored today. Economists expect the October ISM services index to be 50.7 and the S&P Global services PMI to be 55.2, compared to the previous values of 50.0 and 54.2, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -2.5 million barrels, compared to last week’s value of -6.9 million barrels. Meanwhile, the U.S. government shutdown has entered its 36th day, becoming the longest in history. On Tuesday, the Senate failed for the 14th time to pass a bill that would have reopened the government through November 21st. Still, lawmakers from both parties have hinted at the emerging outlines of a deal to end the shutdown, potentially as soon as this week. The Supreme Court is set to hear arguments later today in the case against President Trump’s use of the International Emergency Economic Powers Act to impose sweeping tariffs. The court will hear arguments from three lawyers, one representing the Trump administration and two representing the small businesses and states contesting the legality of the tariffs. U.S. rate futures have priced in a 69.9% chance of a 25 basis point rate cut and a 30.1% chance of no rate change at the December FOMC meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, down -0.05%. My lean or bias today: Not sure. Futures have been on a wild ride overnight. Absolutely tanking and then fighting back only to slip again and now fighting back...again. Every sell this year has been bought up. Technicals are bearish. Futures are red (although coming back) and yet I have a feeling today will be an up day. Todays training will be on Attribution analysis. This should be another good one. Tune in live at 12:00 noon MT. The SPX option score chart shows a short-term softening in sentiment following the recent push to local highs near 6,900, as the option score dropped sharply from 5 to 1, hinting at a cooling of bullish positioning in the derivatives market. This pullback aligns with the minor retracement seen in spot prices after a strong multi-week rally. The data suggests that option flows have turned more cautious, possibly reflecting traders hedging recent gains or anticipating short-term consolidation. If the option score stabilizes and rebounds, it could indicate renewed demand for upside exposure, but for now, the momentum appears to favor a pause or mild correction as markets digest recent strength. Intraday Gamma Levels 0DTE for SPX on 2025-11-05Spot Price used: Last Intraday Price (not provided explicitly, analysis based on levels) Date: 2025-11-05 Primary LevelsCall Resistance:

Let's take a look at the chart for intraday levels on /ES. 6800 is the first BIG resistance level. It's a big phycological level as well as the 200 period M.A. on the 2hr. chart 6821, 6825, 6839, 6850 (another big level). Support levels start at 6781. Bears need to get below this level to continue any downside bias. 6775, 6765, 6759 are the next levels. I'll see you all in the live trading room shortly. Let's see if the bulls can take hold today.

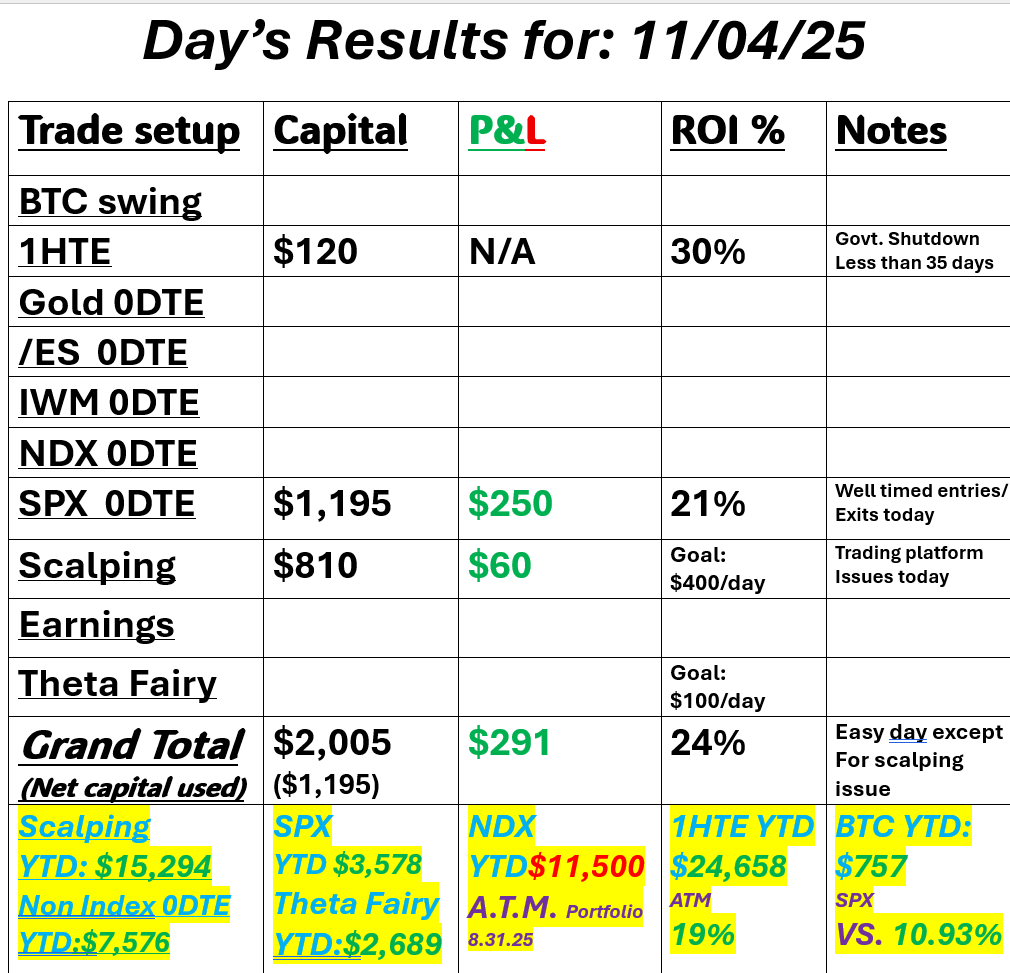

Buy the dip today?We've got a nice selloff in the the futures this morning. You know me. I love down days. Better movement and better premium to work with. The question is, are you going to buy the dip? That's been what's worked all year. I'm still cautiously optimistic we can get a "real" rollover and change of direction going. Call me a bearish optimist! We had a solid day yesterday even though my scalping interface was messed up in the morning. Tastys active V2 platform seems to not work as often as it does function properly. Here's a look at our day. Let's take a look at the markets. We start the day with a sell signal. Futures are down as I type. We've had a lot of these weak days followed by small retraces to the downside, only to be bought up and take us even higher. We all know at some point the "buy the dip" will stop working and the "sell the rip" will take over. We just don't know when. Today maybe? We've got some nice sell side action going right now in the futures. We'll see. That's why we show up every day. The S&P 500 momentum score remains elevated near its upper range, signaling sustained strength in short-term price action after weeks of consistent upside. Despite a few pauses, the index continues to hold above key recent support levels, with momentum readings steady at the maximum score of 5, a sign that trend-following strategies may still find underlying resilience in the current structure. However, the tight clustering near recent highs suggests some consolidation could unfold as markets digest prior gains. In the short term, traders may watch for whether the index can maintain this elevated momentum or begin to cool if profit-taking increases, particularly ahead of key macro events and earnings updates. December S&P 500 E-Mini futures (ESZ25) are down -1.01%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -1.31% this morning as quarterly results from AI bellwether Palantir failed to impress investors and Wall Street executives cautioned about a potential correction due to sky-high valuations. Palantir Technologies (PLTR) slumped over -7% in pre-market trading amid valuation concerns, despite the company reporting upbeat Q3 results and raising its full-year revenue guidance. Morgan Stanley’s Ted Pick and Goldman Sachs’ David Solomon were among Wall Street executives at a Hong Kong summit who cautioned that markets might be facing a significant pullback, while noting that pullbacks are a normal part of market cycles. Also, Mike Gitlin, president and chief executive officer of Capital Group, which manages about $3 trillion in assets, said that corporate earnings remain strong but “what’s challenging are valuations.” Also weighing on sentiment were mixed remarks from Federal Reserve officials. Chicago Fed President Austan Goolsbee said on Monday, “I’m not decided going into the December meeting. I am nervous about the inflation side of the ledger, where you’ve seen inflation above the target for four and a half years, and it’s trending the wrong way.” Also, Fed Governor Lisa Cook said she views the risk of further labor market weakness as outweighing the risk of rising inflation, though she refrained from explicitly supporting another rate cut next month. In addition, San Francisco Fed President Mary Daly said policymakers should “keep an open mind” about the possibility of a rate cut in December. By contrast, Fed Governor Stephen Miran said monetary policy remains restrictive and that he will continue to push for larger interest rate cuts. “The Fed is too restrictive, neutral is quite a ways below where current policy is,” Miran said. Investors now await a fresh batch of corporate earnings reports. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. IDEXX Laboratories (IDXX) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the veterinary medicine company posted upbeat Q3 results and raised its full-year guidance. Also, Amazon.com (AMZN) climbed +4% and was the top percentage gainer on the Dow after the tech giant’s cloud unit signed a $38 billion agreement to provide OpenAI with Nvidia GPUs. In addition, Kenvue (KVUE) jumped over +12% after Kimberly-Clark agreed to acquire the Tylenol maker for about $40 billion. On the bearish side, Charter Communications (CHTR) slid more than -4% and was the top percentage loser on the Nasdaq 100 after KeyBanc and Bernstein downgraded the stock. Economic data released on Monday showed that the U.S. ISM manufacturing index unexpectedly fell to 48.7 in October, weaker than expectations of 49.4. At the same time, the U.S. October S&P Global manufacturing PMI was revised higher to 52.5, stronger than expectations of 52.2. “With U.S. data softening and Fed officials keeping policy optionality alive, investors are reassessing positioning rather than chasing risk,” said Billy Leung, an investment strategist at Global X Management. U.S. rate futures have priced in a 72.1% chance of a 25 basis point rate cut and a 27.9% chance of no rate change at the next FOMC meeting in December. Third-quarter corporate earnings season rolls on, with investors awaiting fresh reports from high-profile companies today, including Advanced Micro Devices (AMD), Shopify (SHOP), Uber Technologies (UBER), Arista Networks (ANET), Amgen (AMGN), Pfizer (PFE), and Spotify (SPOT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Investors will also focus on a speech from Fed Vice Chair for Supervision Michelle Bowman. Meanwhile, the U.S. government shutdown has entered its 35th day, with bipartisan negotiations reportedly gaining momentum and making progress. The government shutdown is set to become the longest in history, surpassing the 35-day shutdown that occurred during President Trump’s first term in 2018-2019. In light of the shutdown, the publication of September JOLTs job openings, factory orders, and trade data, originally set for today, will be delayed. Goldman Sachs analysts said in a note that the current U.S. government shutdown appears poised to have the most significant economic impact of any shutdown on record. “Not only is it likely to run longer than the 35-day partial shutdown in 2018-2019, it is much broader than prior lengthy shutdowns, which affected only a few agencies,” the analysts said. They noted that a prolonged shutdown could more heavily impact federal spending and investment and might also spill over into private-sector activity. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.091%, down -0.39%. We had a really solid training session yesterday on the R-multiple. Tomorrow we'll discuss attribution analysis. Come join us on our live zoom feed. My lean or bias today is bearish. I'm "optimistic" we can finally get something working to the downside. Let's look at our intraday levels. This morning's futures have created some new levels. On the daily chart, we are close to a full-on sell signal. The 20-day moving average at 6782 could come into play. If we lose the 50DMA at 6686, the next target would be the 50DMA. 6820, 6845, 6851, 6864 are resistance levels. 6799, 6794 (200 PMA on 2hr. chart), 6776, 6767 are support levels. I look forward to seeing you all in the live trading room shortly. We've got exactly what we want to start the day; #1. Movement. #2. Movement to the downside. So let's see what we can do with it!

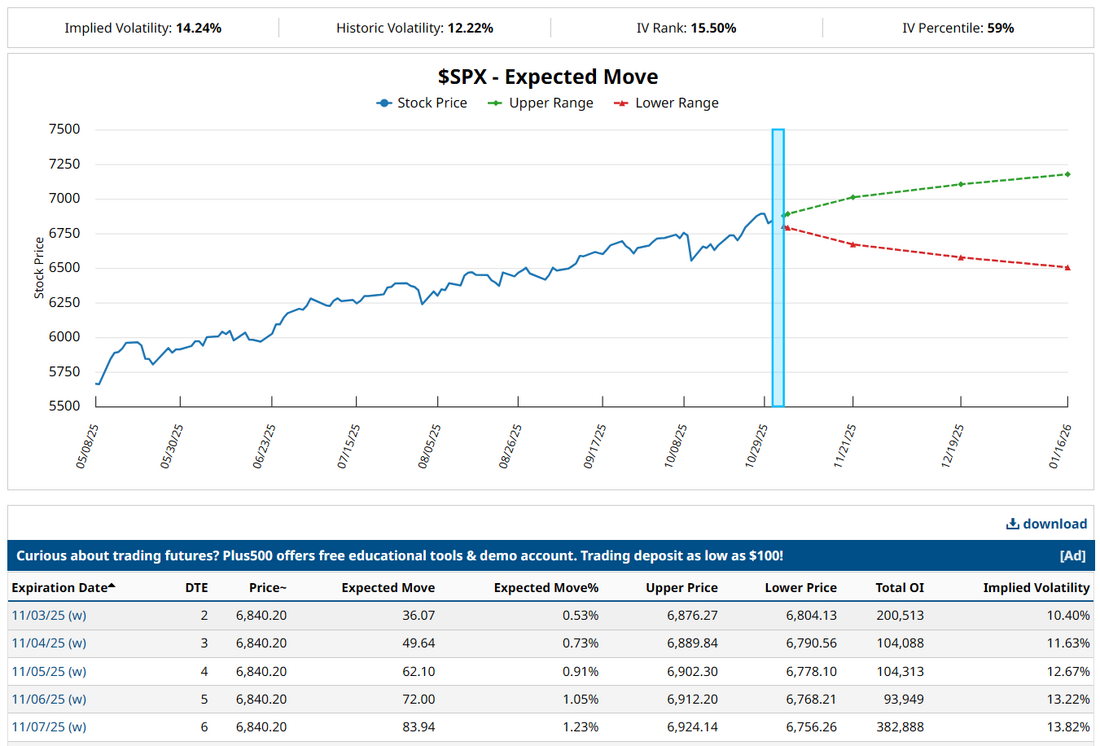

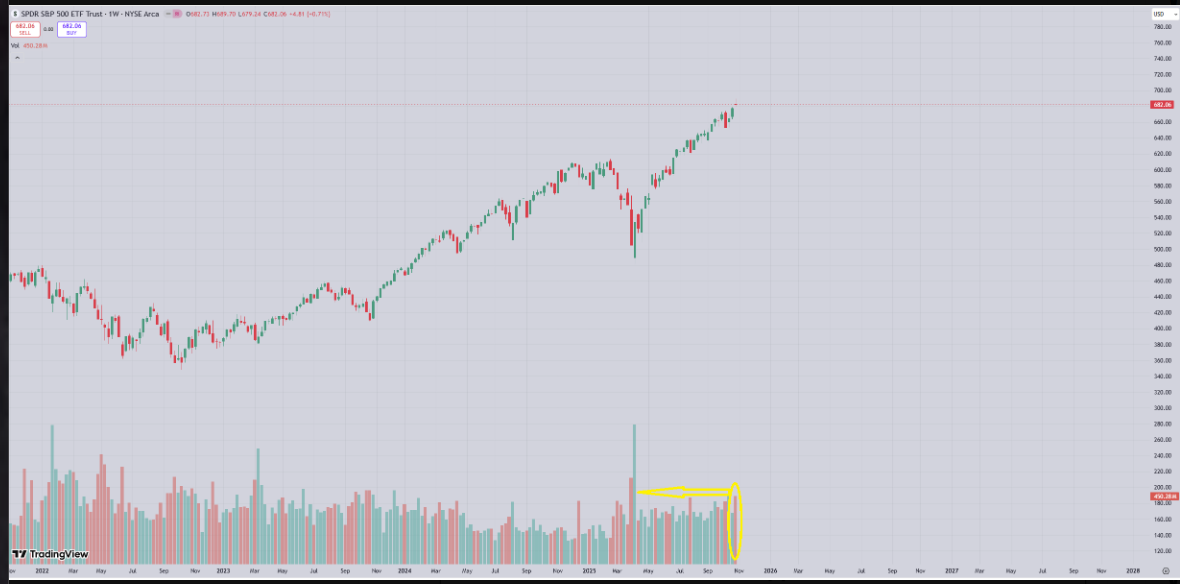

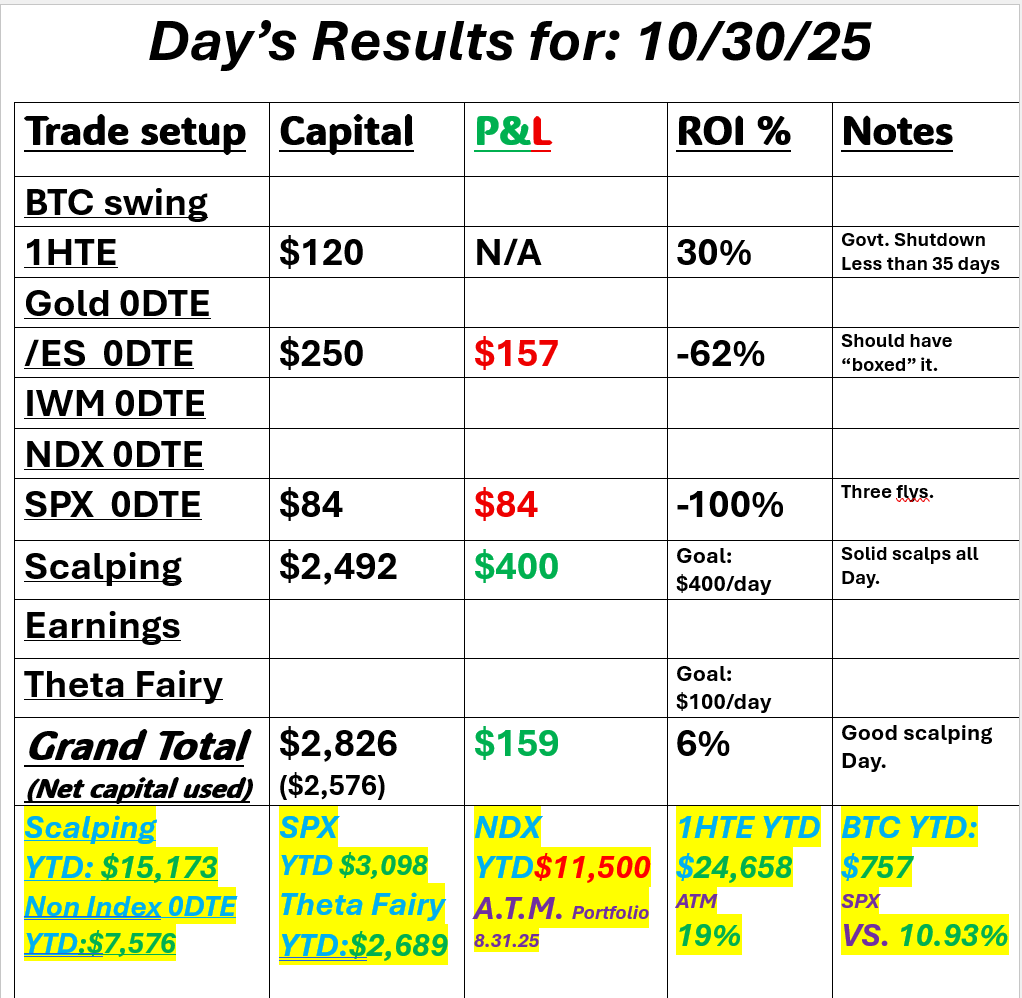

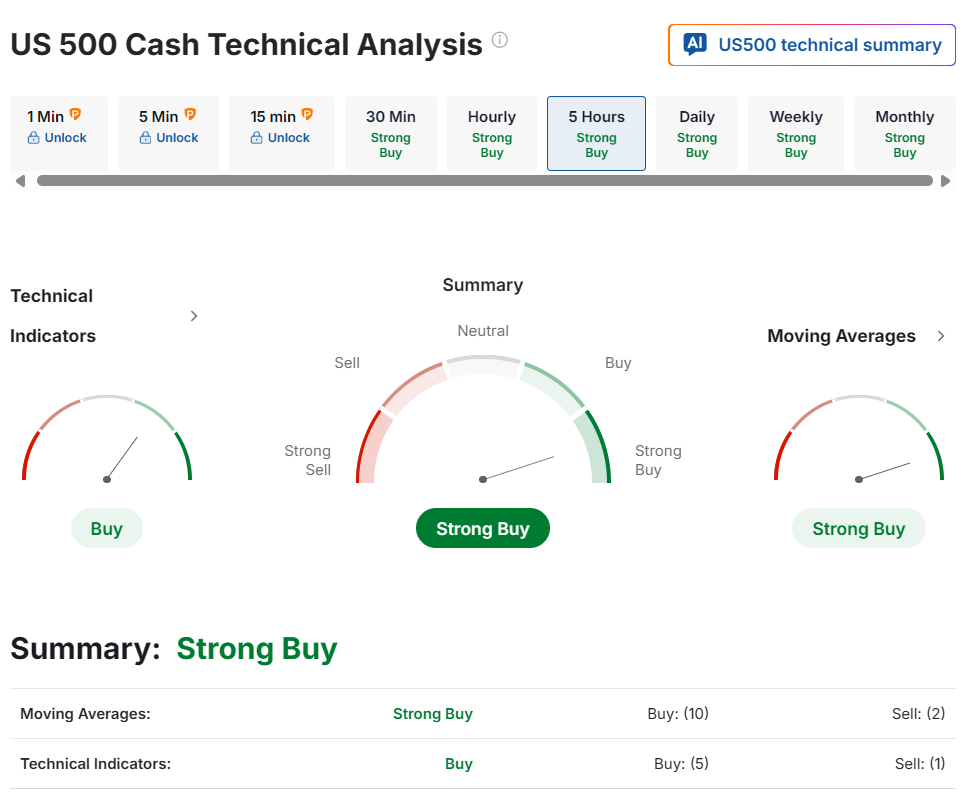

It's November folks!I can't even believe it! So crazy. Where did the summer go? I have to confess, I didn't get out and do all I wanted this year. Time is precious. We've got to make the most of it. I hope your weekend was grand. The wife is out of town so it was a lot of dog walks for me. Nice to get out of the house and away from the screens for a bit. We're back at it today with the start of a fresh month. Friday was strong (and easy) for us. Credits were juicy to start the day and we never needed to make any adjustments. Here's a look at our day. Let's look at the market. The daily chart doesn't really show the movement we got Friday. It was truly an up and down day. It should have been a perfect day for scalping but I couldn't get much working. Technicals are neutral to start the day. Futures are up across the board. I think this morning may be a "wait and see" day. My lean or bias, as I said is more wait and see. Futures are all green this morning but there's some decent resistance above current levels. I think it's best this morning to let the initial trend develop. December S&P 500 E-Mini futures (ESZ25) are up +0.42%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.57% this morning, pointing to further gains on Wall Street as strong tech earnings and easing U.S.-China trade tensions continued to buoy sentiment. Investor attention this week is on a new wave of corporate earnings reports, with key releases from data analytics software developer Palantir and chipmaker Advanced Micro Devices, alongside remarks from Federal Reserve officials and U.S. private-sector economic data. In Friday’s trading session, Wall Street’s major equity averages closed higher. Amazon.com (AMZN) surged over +9% and was the top percentage gainer on the Dow and Nasdaq 100 after the tech and online retailing giant posted upbeat Q3 results and issued solid Q4 revenue guidance. Also, Twilio (TWLO) soared more than +19% after the communications software provider reported better-than-expected Q3 results and gave above-consensus Q4 guidance. In addition, Brighthouse Financial (BHF) jumped over +24% after the Financial Times reported that Aquarian Holdings was in advanced talks to take the company private. On the bearish side, DexCom (DXCM) plunged more than -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after interim CEO Jake Leach said during the company’s Q3 earnings call that 2026 revenue growth could fall short of analysts’ expectations. Economic data released on Friday showed that the U.S. Chicago PMI rose to 43.8 in October, stronger than expectations of 42.3. Kansas City Fed President Jeff Schmid said on Friday that he voted against last Wednesday’s 25 basis point rate cut because he’s concerned that economic growth and investment could fuel upward pressure on inflation. “By my assessment, the labor market is largely in balance, the economy shows continued momentum, and inflation remains too high,” Schmid said in a statement. Also, Dallas Fed President Lorie Logan and Cleveland Fed President Beth Hammack said they would have preferred to keep interest rates unchanged. At the same time, Atlanta Fed President Raphael Bostic said he “eventually got behind” the decision to lower rates, noting that monetary policy remains “in restrictive territory” even after the cut. U.S. rate futures have priced in a 69.3% probability of a 25 basis point rate cut and a 30.7% chance of no rate change at the conclusion of the Fed’s December meeting. Third-quarter corporate earnings season continues in full flow, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Qualcomm (QCOM), Arm (ARM), Palantir (PLTR), Shopify (SHOP), Uber Technologies (UBER), Applovin (APP), McDonald’s (MCD), and Robinhood Markets (HOOD). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also parse comments from a slew of Fed officials, following Chair Jerome Powell’s warning last Wednesday against assuming another rate cut in December. Fed Vice Chair Philip Jefferson, Fed Governor Lisa Cook, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Michael Barr, New York Fed President John Williams, Cleveland Fed President Beth Hammack, Fed Governor Christopher Waller, Philadelphia Fed President Anna Paulson, St. Louis Fed President Alberto Musalem, and Fed Governor Stephen Miran are scheduled to speak this week. Their views of the economy and labor market will be scrutinized closely, as official data releases remain delayed due to the month-long government shutdown. The U.S. government shutdown has entered its 34th day. Democratic senators once again called on President Trump to personally step in to help end the government shutdown as the standoff entered a critical week, with the lapse on track to become the longest in history. If the shutdown continues, the publication of official U.S. economic data scheduled for this week, including the key U.S. jobs report for October, will be delayed. It would mark the second consecutive nonfarm payrolls report delayed due to the shutdown. This leaves investors focusing on private-sector data, with the ADP employment report being the highlight. The report will provide fresh insights into the health of the labor market. Other noteworthy private-sector data releases include the ISM survey on U.S. services sector activity and the University of Michigan’s preliminary Consumer Sentiment Index. Today, investors will focus on the U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI data, set to be released in a couple of hours. Economists expect the October ISM manufacturing index to be 49.4 and the S&P Global manufacturing PMI to be 52.2, compared to the previous values of 49.1 and 52.0, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.088%, down -0.34%. Looking at the expected move for the week. 1.23% for the week on SPX. Not high. Not low. Looks like a typical week of premium potential. S&P500. Ended last week with a gravestone doji on the highest volume since we bottomed out in April. This is typically a sign of a reversal coming, need to see follow through this week for confirmation. If you aren't familiar with the gravestone doji: A gravestone doji has a distinctive "inverted T" shape that shows a battle between buyers (bulls) and sellers (bears).

When a gravestone doji appears, it suggests a shift in market sentiment.

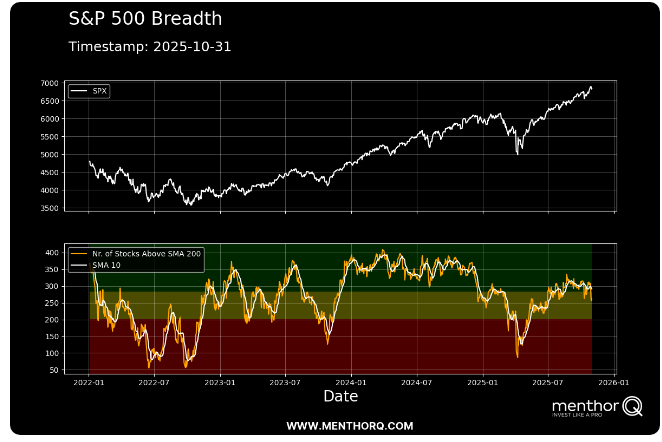

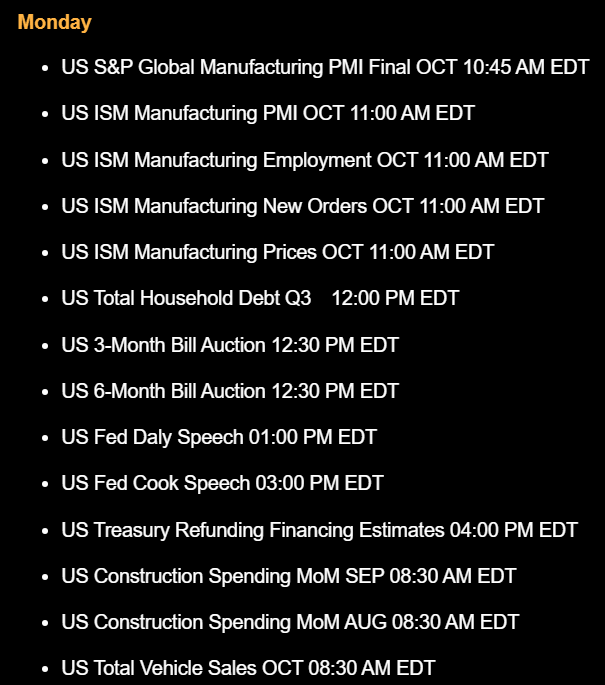

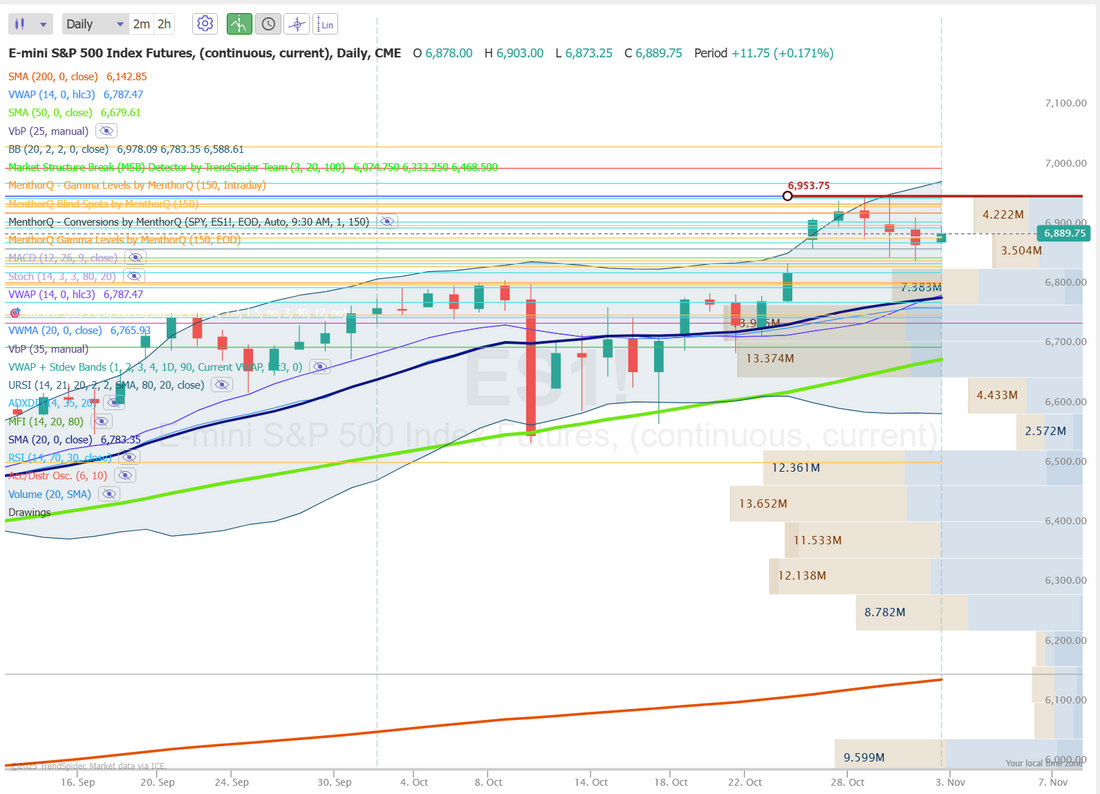

Today's training is a good one. We'll cover R and R-multiple calculations and talk about the different ways you can calculate ROI. Join us at 12:00 noon MDT in our live Zoom feed. The S&P 500 breadth chart shows that while the index continues to push toward new highs, market participation is narrowing, the number of stocks above their 200-day moving average has stalled around mid-range levels. This suggests that recent gains are being driven by a smaller group of large-cap names rather than broad-based strength. Short-term, breadth momentum (SMA 10) has flattened, hinting that the rally may be losing internal support unless participation improves. Traders may watch for whether breadth rebounds toward the upper green zone, a sign of renewed confirmation, or dips lower, which could signal near-term consolidation or rotation beneath the surface. Mondays key (planned) news catalysts. Let's look at some key intraday levels for us today on /ES for 0DTE trading. 6953 has been a brick wall for the last week. Bulls can't get a break above it. Intraday levels seem well formed. 6900, 6909, 6925, 6935, 6940 are resistance with 6888 the first step for bears. Then comes 6875, 6865, 6850, 6844 for support. I look forward to seeing you all in the live trading room today. Let's make it a great start to the week!

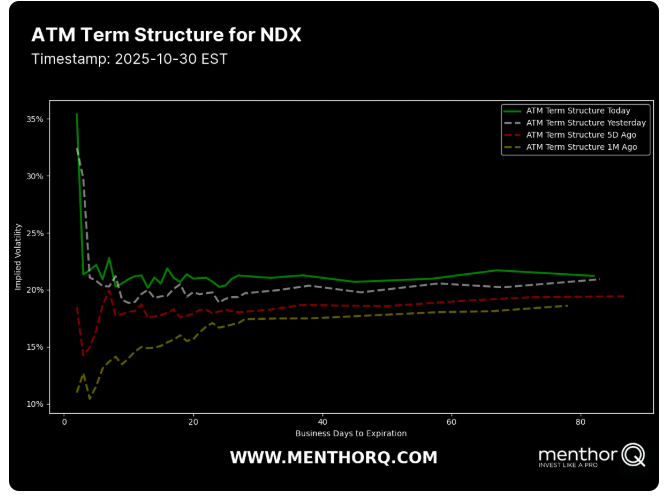

Happy HalloweenMy better half is out of town visiting her family in the pacific northwest for a few days but she'll be celebrating Halloween hard. I think she likes it more than Christmas. The market seems to like it as well. We are getting this morning what I thought we would get yesterday. I thought META, MSFT, GOOG earnings would pop us as well but they didn't pull through. Good trade news combined with solid AAPL/AMZN earnings are doing it today. We continue to see the duality of this market. Any hint of bad news tanks us. It's a tentative bull and yet, every dip gets bought. We had a small profit yesterday but excellent risk/reward. Here's a look at our day: Let's take a look at the market. With the strong futures this morning we are right back to bullish technicals. Just when the roll over looks like it's taking hold, we get another "buy the dip" morning. December Nasdaq 100 E-Mini futures (NQZ25) are trending up +1.15% this morning as strong quarterly results and guidance from Amazon and Apple boosted sentiment. Amazon.com (AMZN) jumped over +12% in pre-market trading after the tech and online retailing giant posted the strongest growth rate in nearly three years in its cloud unit in the third quarter and issued solid Q4 revenue guidance. Also, Apple (AAPL) rose more than +1% in pre-market trading after the iPhone maker reported better-than-expected FQ4 results and provided an upbeat sales forecast for the holiday quarter. In yesterday’s trading session, Wall Street’s major indices ended in the red. Meta Platforms (META) plunged over -11% and was the top percentage loser on the Nasdaq 100 after the maker of Facebook and Instagram reported weaker-than-expected Q3 EPS and raised its full-year total expense forecast. Also, Microsoft (MSFT) fell nearly -3% after the technology behemoth reported FQ1 revenue growth in its Azure cloud-computing unit that failed to meet the highest expectations. In addition, Chipotle Mexican Grill (CMG) tumbled over -18% and was the top percentage loser on the S&P 500 after the burrito chain cut its full-year comparable restaurant sales guidance. On the bullish side, C.H. Robinson Worldwide (CHRW) soared more than +19% and was the top percentage gainer on the S&P 500 after the freight and logistics company posted better-than-expected Q3 adjusted EPS and raised its 2026 operating income guidance. Third-quarter corporate earnings season continues, and investors await reports today from notable companies such as Exxon Mobil (XOM), AbbVie (ABBV), Chevron (CVX), and Colgate-Palmolive (CL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Market participants will also hear perspectives from Dallas Fed President Lorie Logan, Atlanta Fed President Raphael Bostic, and Cleveland Fed President Beth Hammack throughout the day. Meanwhile, the U.S. government shutdown has entered its 31st day, with no clear resolution in sight. In light of the government shutdown, the publication of the September core PCE price index, Personal Spending and Personal Income data, as well as the third-quarter Employment Cost Index, originally set for today, will be delayed. Still, the U.S. Chicago PMI will be released today. Economists forecast the October figure at 42.3, compared to the previous value of 40.6. The Congressional Budget Office stated earlier this week that the four-week government shutdown will trim real annualized GDP growth by 1 percentage point this quarter, with the impact intensifying the longer it continues. U.S. rate futures have priced in a 68.8% chance of a 25 basis point rate cut and a 31.2% chance of no rate change at the December FOMC meeting. Notably, a move in December was almost fully priced in before this week’s FOMC meeting. Fed Chair Jerome Powell on Wednesday threw some cold water on market expectations of another rate cut in December when he said, “A further reduction in the policy rate at our December meeting is not a foregone conclusion—far from it. Policy is not on a preset course.” “With uncertainty around Fed policy going forward and the ongoing government shutdown, there is the potential for volatility,” said Chris Fasciano at Commonwealth Financial Network. “But companies across a large swath of the economy continue to report solid earnings. On top of that, we’ve seen good news on trade policy, particularly with China. These should provide decent tailwinds for investors.” In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.111%, up +0.34%. The SPX option score remains elevated near recent highs, signaling that option market sentiment continues to lean constructive even as spot prices show a mild pullback from peak levels. This suggests traders are maintaining bullish or neutral positioning, potentially reflecting confidence in short-term support holding after a strong upward stretch. However, the slight dip in the score toward the end hints at waning momentum and some hedging activity as volatility expectations edge higher. In the near term, monitoring whether the score stabilizes above mid-range levels will be key, sustained strength could reinforce buying conviction, while further erosion may point to a shift toward consolidation or profit-taking behavior. The NDX ATM term structure shows a notable uptick in short-dated implied volatility, with front-end contracts rising sharply compared to both yesterday and last week. This suggests that near-term uncertainty has increased, likely reflecting upcoming catalysts such as earnings or macro data releases. Beyond the short end, the curve flattens around the 20–22% range, implying that longer-dated volatility remains anchored, with traders pricing the current spike as temporary rather than structural. The steep front-end slope signals that options markets are bracing for short-term swings, but the contained back end highlights confidence in medium-term stability if volatility events pass without major disruption. My lean or bias today is bullish. The "buy the dip" effect seems to be back in effect this morning. Let's take a look at the intra-day levels on /ES for our 0DTE setups. I feel like we have some pretty clear levels to work with today. 6919, 6925, 6944, 6950 are resistance with 6907, 6900, 6889, 6880 working as support. Let's see if we can finish off the week strong! See you all shortly in the live trading room. Enjoy the holiday and have a great weekend.

Powell gives a small surpriseFOMC has come and gone. Powell made it crystal clear that a Dec. rate cut was not a given. The algos grabbed that quickly and tanked the market. While we slowly worked our way back up towards the close, it was a cautious note that inflation is still real and stagflation (although he rarely uses that word) is a big problem. The big trio of META, GOOG, MSFT all reported earnings after the close. It was a mixed bag of results. We had (have) a 1DTE /ES trade on that expires today but we did scalp on and off. FOMC days are usually good scalping days. Here's a look at our results. Let's take a look at the markets. Technicals are still holding firmly bullish. Are we getting a topping pattern here? Who knows? It could just be a pause before we hit another ATH but we know, at some point we'll get a retrace. December S&P 500 E-Mini futures (ESZ25) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ25) are down -0.11% this morning as investors weigh the outcome of the highly anticipated Trump-Xi meeting, mixed Big Tech earnings, and a cautious Federal Reserve. U.S. President Donald Trump and Chinese President Xi Jinping met in person for the first time in six years on Thursday, emerging from what Trump described as “an amazing meeting.” Mr. Trump announced that fentanyl tariffs would be lowered from 20% to 10% effective immediately. The decision was part of a broader framework to ease trade tensions, which Trump said included China’s agreement to lift restrictions on the global trade of its rare earth elements. China’s commerce ministry said it would suspend rare earth export controls for one year, while the U.S. agreed to keep reciprocal tariffs suspended for the same period. China also agreed to resume purchases of U.S. soybeans. The meeting’s outcome was broadly in line with market expectations. Investors also digested earnings reports from a trio of U.S. tech giants. Alphabet (GOOGL) surged over +7% in pre-market trading after the Google-parent posted upbeat Q3 results. At the same time, Meta Platforms (META) slumped more than -7% in pre-market trading after the maker of Facebook and Instagram reported weaker-than-expected Q3 EPS. Also, Mark Zuckerberg’s pledge to ramp up spending on artificial intelligence has renewed investor concerns that the company may lack a clear path to returns on these investments. In addition, Microsoft (MSFT) fell about -3% in pre-market trading after the technology behemoth reported FQ1 revenue growth in its Azure cloud-computing unit that failed to meet lofty expectations. Investors now await earnings reports from Magnificent Seven companies Apple and Amazon. As widely expected, the Federal Reserve cut interest rates yesterday. The Federal Open Market Committee voted 10-2 to lower the target range for the Fed funds rate by a quarter percentage point to 3.75%-4.00%, the lowest in three years. Governor Stephen Miran once again dissented, advocating for a larger half-point rate cut. At the same time, Kansas City Fed President Jeff Schmid said he would have preferred to leave rates unchanged. In a post-meeting statement, officials reiterated that “job gains have slowed” and noted that “risks to employment rose in recent months.” Policymakers also described economic growth as “moderate” and stated that inflation “has moved up since earlier this year and remains somewhat elevated.” In addition, officials agreed to stop shrinking the Fed’s $6.6 trillion asset portfolio starting December 1st. At a press conference, Chair Jerome Powell threw some cold water on market expectations of another rate cut in December. “In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December. A further reduction in the policy rate at our December meeting is not a foregone conclusion—far from it. Policy is not on a preset course,” he said. The Fed chair also noted that the absence of economic data during the ongoing government shutdown could prompt policymakers to take a more cautious approach. “Given these dissents on both sides, it might be difficult to put a down payment on December,” said Neil Dutta at Renaissance Macro Research. U.S. rate futures have priced in a 70.4% chance of a 25 basis point rate cut and a 29.6% chance of no rate change at the next FOMC meeting in December. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. Nvidia (NVDA) rose about +3% after U.S. President Donald Trump said he plans to discuss the chipmaker’s Blackwell AI processors with Chinese President Xi Jinping. Also, Teradyne (TER) jumped more than +20% and was the top percentage gainer on the S&P 500 after the automatic test equipment designer posted upbeat Q3 results and issued above-consensus Q4 guidance. In addition, Caterpillar (CAT) surged over +11% and was the top percentage gainer on the Dow after the maker of heavy construction equipment reported stronger-than-expected Q3 results. On the bearish side, Fiserv (FI) plummeted more than -44% and was the top percentage loser on the S&P 500 after the financial-technology company posted downbeat Q3 results and cut its full-year adjusted EPS guidance. Economic data released on Wednesday showed that U.S. pending home sales were unchanged m/m in September, weaker than expectations of +1.6% m/m. Third-quarter corporate earnings season rolls on. Today, market participants will pay close attention to earnings reports from Magnificent Seven companies Apple (AAPL) and Amazon.com (AMZN). High-profile companies such as Eli Lilly (LLY), Mastercard (MA), Merck & Co. (MRK), Gilead (GILD), and Altria (MO) are also set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. Investors will also parse comments today from Fed Vice Chair for Supervision Michelle Bowman and Dallas Fed President Lorie Logan. Meanwhile, the U.S. government shutdown has entered its 30th day, with no clear resolution in sight. In light of the government shutdown, the publication of the advance estimate of third-quarter gross domestic product and weekly jobless claims, originally set for today, will be delayed. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.067%, up +0.20%. The SPX Volatility Risk Premium (VRP) has turned modestly positive at 1.2%, with implied volatility now sitting in the overvalued range and positioned near the 32nd percentile of its 3-month history. This suggests that option pricing has slightly outpaced realized volatility as the index continues its upward momentum. In the short term, this setup points to a market environment where traders may be paying up for downside protection, even as spot prices push toward new highs. Historically, such conditions can indicate short-term caution or hedging activity rather than outright fear. If realized volatility remains subdued and spot prices stabilize above recent resistance, implied vol could ease, potentially tightening the VRP again in the coming sessions. The SPY 1-month skew shows a notable call bias, sitting near the 8th percentile of its 3-month range, which suggests that upside options are relatively more favored than downside protection. This shift often reflects improving sentiment or short-term optimism as traders position for potential follow-through in the recent market rally. The 25-delta risk reversal remains well below the neutral zone, indicating that demand for calls has outpaced puts after a period of balanced skew. In the short term, this configuration implies a market leaning toward tactical bullish positioning, but also one that could be sensitive to shifts in volatility or macro catalysts that challenge this optimism. Let's take a look at our intraday levels on /ES for 0DTE today. 6931, 6940, 6950 are resistance levels. 6907, 6900, 6890 are support. My lean or bias today is a bit bearish. Earnings came is mixed and Powell threw a bucket of cold water of future rate cuts. Today could be a good day for the bulls to sit on the side lines. Zoom Note for today: I've got to run my wife to the airport this morning at 11:30 A.M. MDT so I'll be away for about an hour from our zoom feed. We'll work our trades around that.

See you all in the zoom shortly. FOMC and Powell dayToday's the day. The market is banking on another rate cut. We usually sit on our hands for most of the day until Powell speaks but we do have a 1DTE /ES trade already working so we'll see how that develops as the day progresses. I had some technical issues this morning so I'm getting started on todays post a bit late and as such, it will be a bit shorter. We'll go over our intraday levels in our zoom session. Yesterday was a bust for me. We focus on multiple strategies and trades so that if one doesn't work we can still have a solid day. Pretty much everything lost for me yesterday. I'm o.k. with the SPX result I went 1 for 4 there so risking only $260 feels like a win but overall it was just a bad day. Here's a look at my results. As I mentioned, we have an /ES 1DTE trade already working. It's profitable as I type. I may pull it. Build on it or just sit on it, depending on how the day develops. We could add a credit call spread to it that removes risk to the upside and minimizes risk to the downside. Something like this. Again, lets just see how we open up. We'll try to get two trainings in today. One on the R-multiple and one on Jessie Livermore discipline. We should have the time as we wait until Powell speaks. December S&P 500 E-Mini futures (ESZ25) are up +0.19%, and December Nasdaq 100 E-Mini futures (NQZ25) are up +0.35% this morning, buoyed by ongoing tech and AI momentum, while investors await the Federal Reserve’s interest rate decision and U.S. megacap tech earnings. Stock index futures were boosted by a more than +3% rise in Nvidia (NVDA) in pre-market trading after U.S. President Donald Trump said he plans to discuss the chipmaker’s Blackwell AI processors with Chinese President Xi Jinping. Also aiding sentiment, President Trump said on Wednesday that he expects to sign a trade agreement with China when he meets with Xi on Thursday. Trump also said he plans to reduce tariffs the U.S. has imposed on Chinese goods due to the fentanyl crisis. However, higher bond yields today are limiting gains in U.S. equity futures. Traders warned that any hawkish comments from Fed Chair Jerome Powell at his post-policy meeting press conference could trigger fresh volatility in the world’s largest bond market. In yesterday’s trading session, Wall Street’s major indexes closed at record highs. Nvidia (NVDA) climbed nearly +5% after CEO Jensen Huang delivered the keynote speech at the company’s GTC event, stating that the AI industry has “turned a corner” and announcing new partnerships and technologies. Also, Microsoft (MSFT) rose about +2% after the software giant finalized a new agreement with OpenAI that will give it a 27% ownership stake in the ChatGPT-maker valued at around $135 billion. In addition, Regeneron Pharmaceuticals (REGN) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted better-than-expected Q3 results. On the bearish side, Alexandria Real Estate Equities (ARE) cratered more than -19% and was the top percentage loser on the S&P 500 after the life-science-focused REIT posted downbeat Q3 results and cut its full-year adjusted FFO guidance. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index fell to 94.6 in October, stronger than expectations of 93.4. Also, the U.S. August S&P/CS HPI Composite - 20 n.s.a. eased to +1.6% y/y from +1.8% y/y in July, stronger than expectations of +1.4% y/y. In addition, the U.S. Richmond Fed manufacturing index rose to -4 in October, stronger than expectations of -11. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to deliver a 25 basis point rate cut for a second consecutive meeting. That would take the Fed funds rate to a range of 3.75% to 4.00%, the lowest level since late 2022. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for clues on how far and how fast interest rates may fall from here. Notably, U.S. money markets have almost fully priced in a follow-up rate cut in December. Market participants will also watch for signals on when policymakers may stop shrinking the bank’s $6.6 trillion securities portfolio. Third-quarter corporate earnings season continues in full force. Investors will be closely monitoring earnings reports today from a trio of the Magnificent Seven companies—Microsoft (MSFT), Alphabet (GOOGL), and Meta Platforms (META). They will be seeking assurances that the multibillion-dollar investments in computing infrastructure will continue and ultimately deliver returns. Prominent companies like Caterpillar (CAT), ServiceNow (NOW), Boeing (BA), Verizon (VZ), KLA Corp. (KLAC), and CVS Health Corp. (CVS) are also scheduled to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. “We expect another strong round of megacap tech earnings reports, given the relentless demand for AI technology and infrastructure,” said Clark Bellin at Bellwether Wealth. “While profitability in AI remains an unknown, investors for right now are willing to overlook this as the AI arms race heats up.” On the economic data front, investors will focus on the National Association of Realtors’ pending home sales data, set to be released in a couple of hours. Economists forecast the September figure at +1.6% m/m, compared to the previous figure of +4.0% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -0.9 million barrels, compared to last week’s value of -1 million barrels. Meanwhile, the U.S. government shutdown has entered its 29th day, with no clear resolution in sight. The shutdown means that official U.S. economic data continue to be delayed. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.992%, up +0.23%. Technicals are still bullish The attempt for new ATH's continues. Let's see how the morning goes. This afternoon is really when the sparks should fly. See you all shortly!

Rate cut guaranteed?FOMC is coming up tomorrow. Markets are all but guaranteeing another rate cut is coming along with the promise of one more in Dec. Bulls are pushing us to new ATH's with a big gap up yesterday. We are in new territory here. It get a bit tougher to divine resistance zones when you're constantly hitting new ATH's. Yesterday was disappointing for me. We bailed on our SPX before it turned red. Our scalping and gold are rolled into today. I tried a retrace setup near the end of the day on NDX that didn't work. Here's a look at my day: I'll continue to work our scalp and gold trade today. Let's take a look at the markets: Bullish bias is pretty entrenched. Gap up yesterday morning and strength all day into new ATH's. December S&P 500 E-Mini futures (ESZ25) are trending down -0.02% this morning, taking a breather after a record-breaking rally, while investors await the start of the Federal Reserve’s two-day policy meeting, a new round of corporate earnings reports, and U.S. private-sector economic data. In yesterday’s trading session, Wall Street’s main stock indexes closed at record highs. The Magnificent Seven stocks climbed, with Tesla (TSLA) rising over +4% and Nvidia (NVDA) advancing more than +2% to lead gainers in the Dow. Also, Qualcomm (QCOM) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after introducing new chips and computers for the lucrative AI data center market. In addition, Avidity Biosciences (RNA) soared more than +42% after Novartis agreed to acquire the company in a deal valued at about $12 billion. On the bearish side, rare earth stocks slumped after Treasury Secretary Scott Bessent said he anticipated China would postpone the implementation of its stricter export controls on rare earths, with USA Rare Earth (USAR) sliding over -8% and MP Materials (MP) falling more than -7%. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to deliver a 25 basis point rate cut on Wednesday, particularly after last Friday’s mostly favorable September inflation data. That would take the Fed funds rate to a range of 3.75% to 4.00%, the lowest level since late 2022. Investors will closely follow Chair Jerome Powell’s post-policy meeting press conference for clues on how far and how fast interest rates may fall from here. U.S. money markets have almost fully priced in a follow-up rate cut in December. Third-quarter corporate earnings season is in full swing, with investors looking ahead to new reports from prominent companies today, including Visa (V), UnitedHealth Group (UNH), Booking (BKNG), United Parcel Service (UPS), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +7.2% increase in quarterly earnings for Q3 compared to the previous year, marking the smallest rise in two years. “With the Fed on track to cut rates, extending the run would appear to hinge on this week’s lineup of high-profile earnings releases. And it may, barring any surprises in U.S.-China trade negotiations,” said Chris Larkin at E*Trade from Morgan Stanley. On the economic data front, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the October CB Consumer Confidence index will stand at 93.4, compared to last month’s figure of 94.2. The U.S. S&P/CS HPI Composite - 20 n.s.a. will also be reported today. Economists expect the August figure to ease to +1.4% y/y from +1.8% y/y in July. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -11 in October, compared to the previous value of -17. Meanwhile, the U.S. government shutdown has entered its 28th day, with no clear resolution in sight. The shutdown means that official U.S. economic data continue to be delayed. Allianz Research estimates that the shutdown has likely already shaved 0.45 percentage points off fourth-quarter annualized GDP growth. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.973%, down -0.58%. The SPX option score has climbed back to its upper range, coinciding with a strong rebound in spot prices to fresh short-term highs near 6,850. The sustained improvement in option sentiment suggests a renewed risk-on tone among market participants after weeks of consolidation. From a short-term perspective, the recent uptick in call activity and volatility compression could indicate that traders are positioning for continued upside momentum, though the index is nearing overextended territory. Monitoring whether the option score can stay elevated in the coming sessions will be key, a quick drop back toward neutral would hint at profit-taking or fading confidence in the current rally. Let's take a look at the new intraday levels for our 0DTE for today on /ES. There are only three major levels I'm looking at today. 6917 is the demarcation point for bullish/bearish price action. Above is bullish. Below is bearish. 6870 is major overhead resistance with 6874 major support. We've got a lot of our trades already rolled into this morning so we'll work those first today. See you all in the live trading room shortly!

|

Archives

January 2026

AuthorScott Stewart likes trading, motocross and spending time with his family. |