|

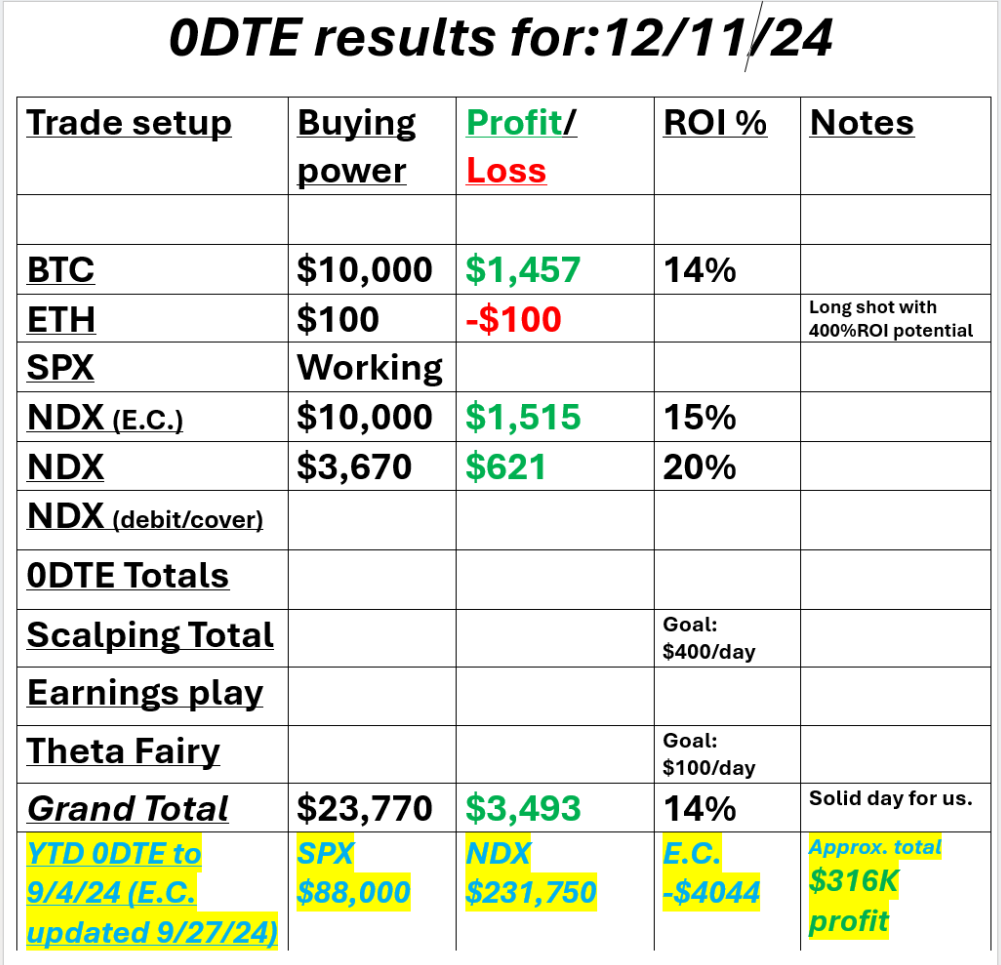

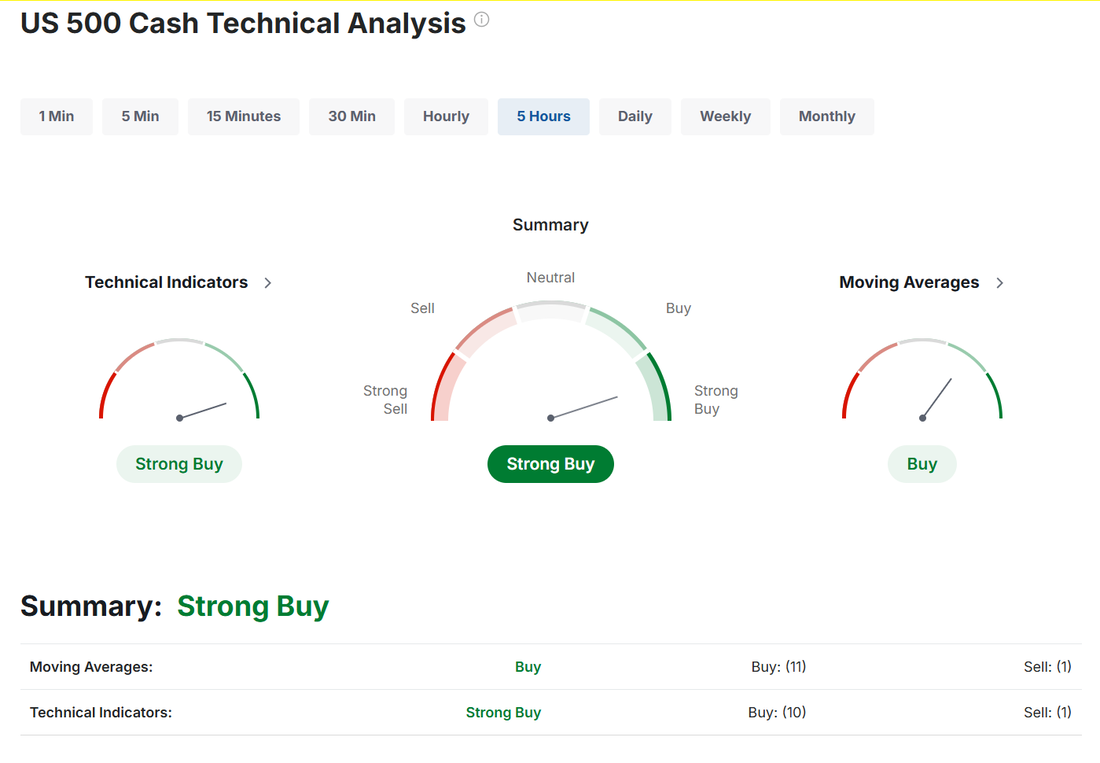

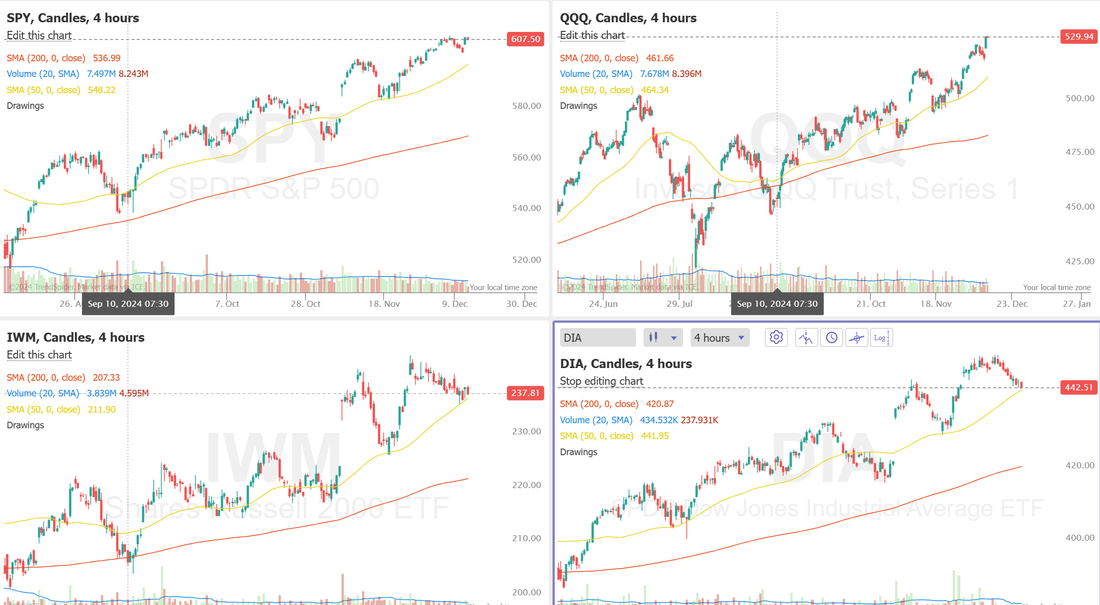

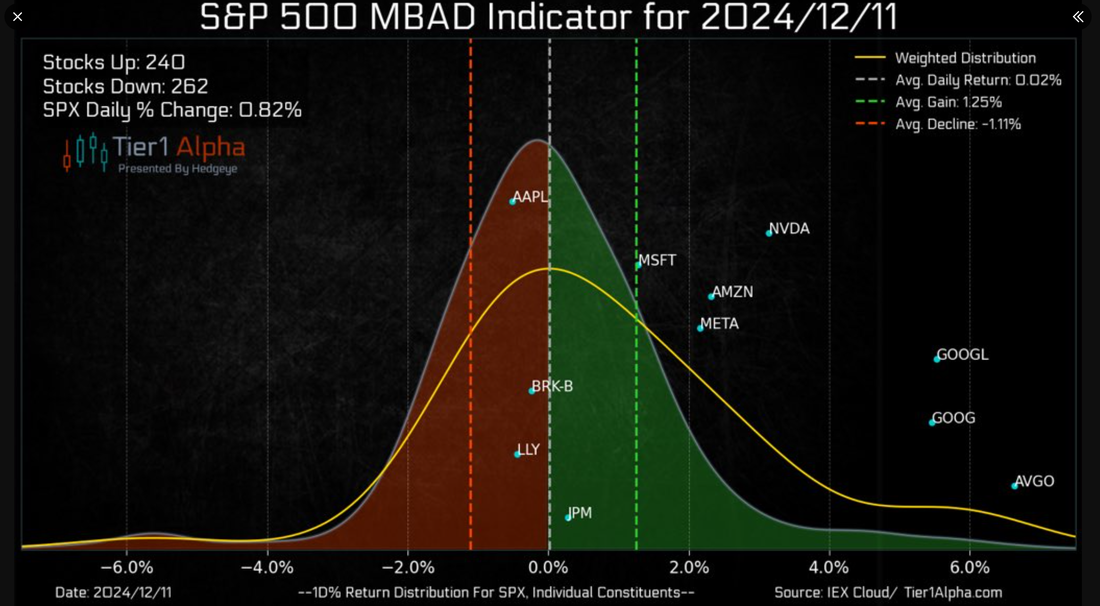

Welcome back traders! CPI came and went. Now we have PPI and Jobless claims kicking off today. I was super happy with our results yesterday. Not because it was a home run day but rather, risk management was strong. Debit trades folks...that's a better risk/reward right now. Here's our results from yesterday. Let's take a look at what's happening in the market. Yesterdays rally brought the technicals back to buy mode. Most indices were actually flat to down but the QQQ's continue to rip. Up to new ATH. December S&P 500 E-Mini futures (ESZ24) are down -0.15%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.23% this morning as Treasury yields marched higher, while investors awaited crucial U.S. producer inflation data as well as the European Central Bank’s interest rate decision. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the tech-heavy Nasdaq 100 notching a new record high. Broadcom (AVGO) climbed over +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after The Information reported that Apple was working with the chipmaker on a server chip exclusively designed for artificial intelligence. Also, megacap technology stocks advanced, with Tesla (TSLA) gaining more than +5% and Nvidia (NVDA) rising over +3%. In addition, GameStop (GME) rose more than +7% after the videogame retailer reported a surprise Q3 profit. On the bearish side, Walgreens Boots Alliance (WBA) slid over -5% after analysts cast doubt on the likelihood of Sycamore Partners acquiring the drugstore chain. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices increased +0.3% m/m in November, in line with expectations. On an annual basis, headline inflation picked up to +2.7% in November from +2.6% in October, in line with expectations. Also, the November core CPI, which excludes volatile food and fuel prices, remained unchanged from October at +3.3% y/y, right on expectations. “The debate for the FOMC next week between cut or skip is over. This inflation print should be risk asset friendly and provide a tailwind to equity markets as we move through one of the strongest seasonal periods of the year,” said Jeff Schulze at ClearBridge Investments. Meanwhile, U.S. rate futures have priced in a 98.6% chance of a 25 basis point rate cut at the upcoming monetary policy meeting. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. November PPI will come in at +0.2% m/m and +2.6% y/y, compared to the previous figures of +0.2% m/m and +2.4% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect November figures to be +0.2% m/m and +3.2% y/y, compared to October’s numbers of +0.3% m/m and +3.1% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure to arrive at 221K, compared to last week’s number of 224K. On the earnings front, notable companies like Broadcom (AVGO), Costco (COST), and Ciena (CIEN) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.300%, up +0.66%. Short trade docket today. Most of our model portfolio is good to hold, as is. /ZW and 0DTE;s on the agenda today. Even with an "up" day, more stocks are declining than gaining. Let's take a look at our intra-day levels for our 0DTE setups: /ES; Yesterdays levels guide us into todays setup. 6104 is resistance with 6058 acting as suppport. /NQ: 21,912 is resistance with 21,430 acting as support. BTC: 104,719 is resistance with 96,071 acting as support. PPI numbers are out. Hotter than expected. My bias or lean today is bearish. With a hot PPI and the QQQ's hitting a new ATH yesterday while there were more decliners than advancers makes me think we pull back today. See you all in the trading room soon. We have two 0DTE's already going that should cash flow for us today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |