|

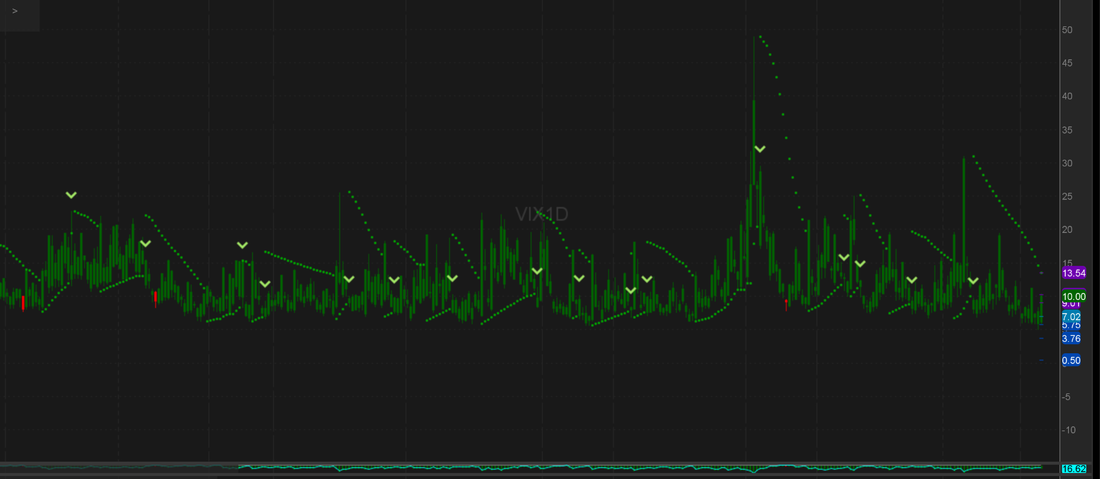

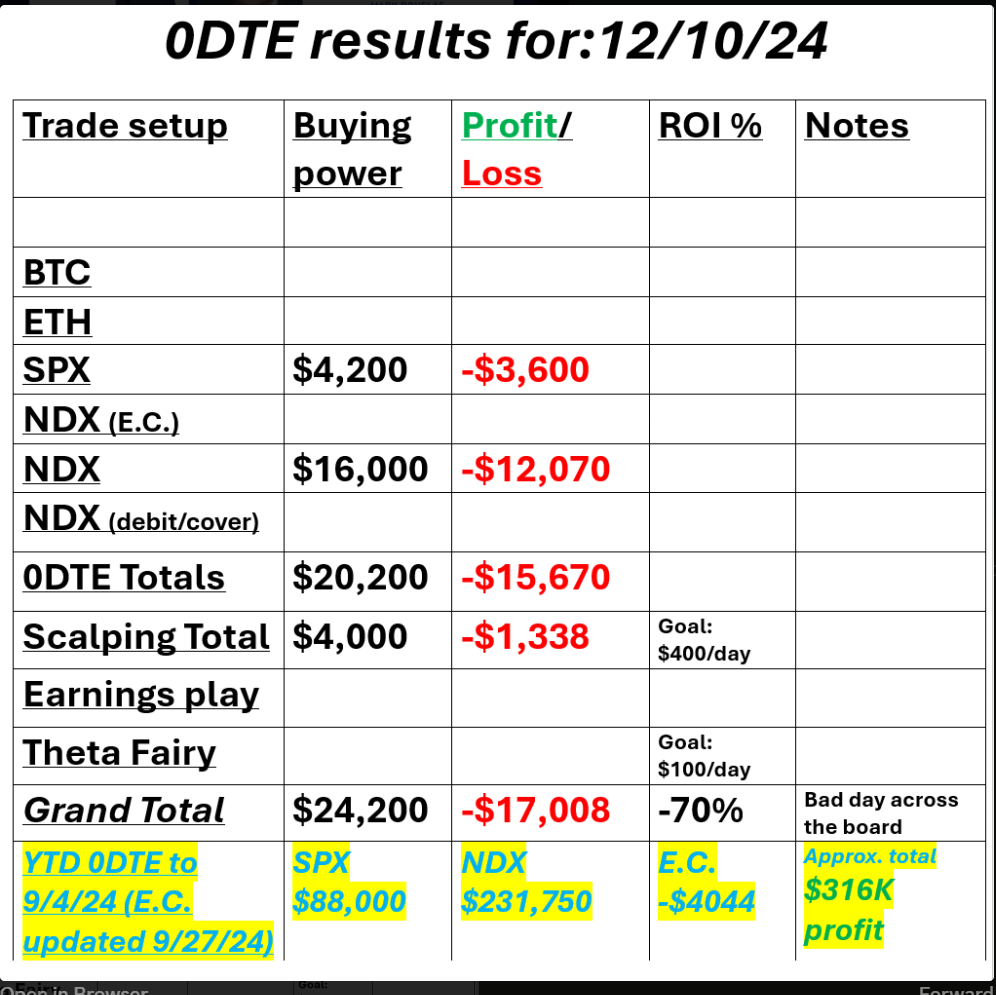

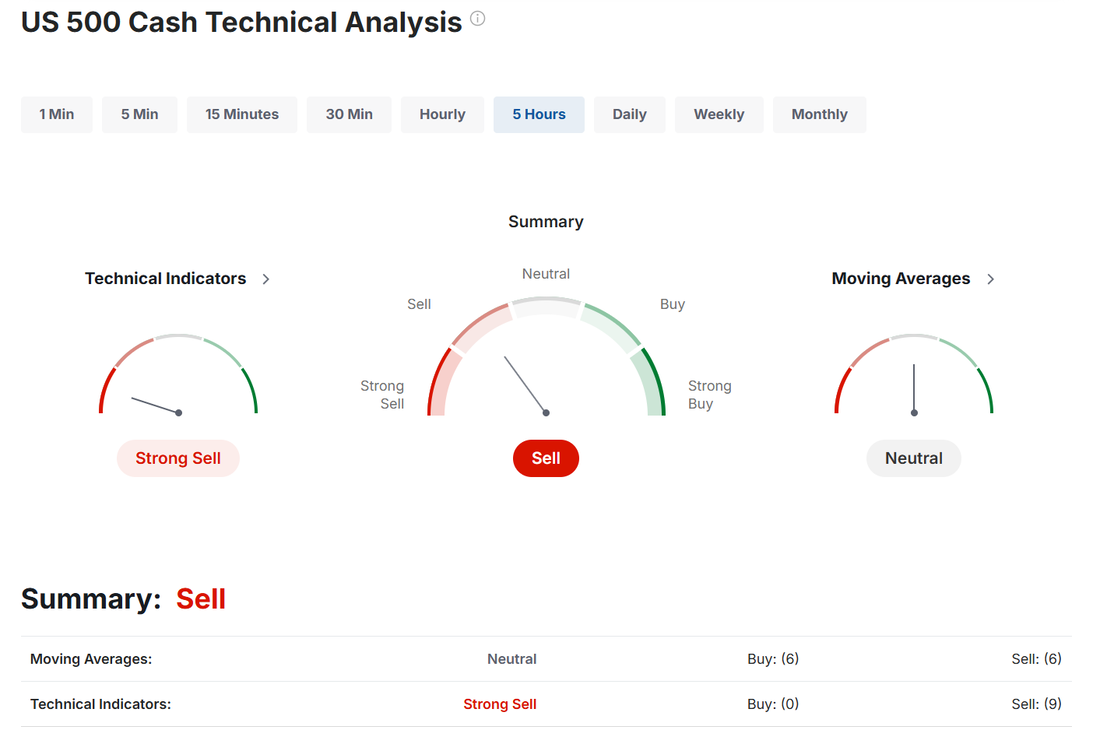

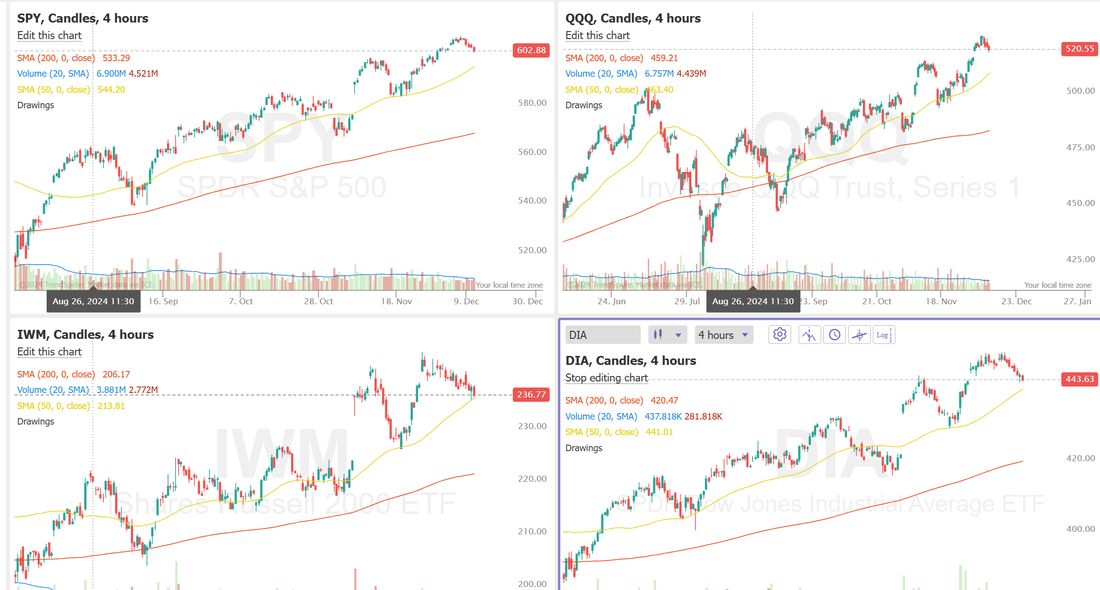

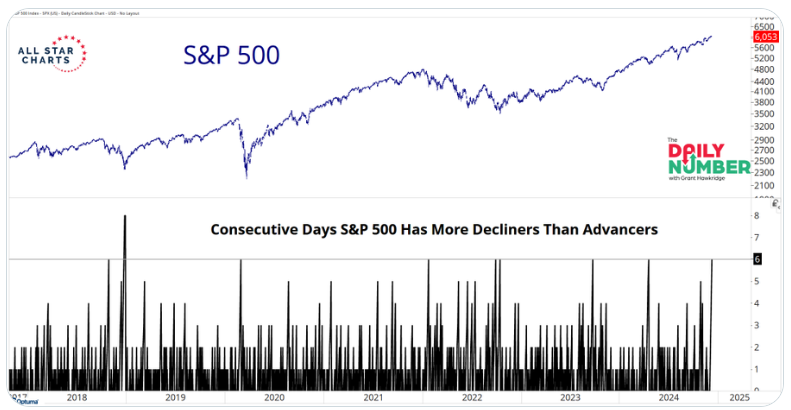

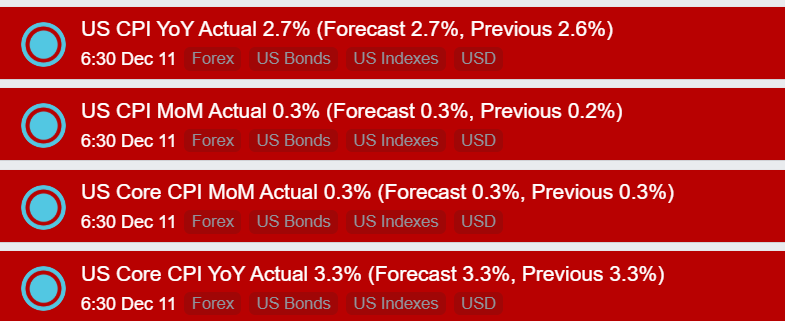

Welcome to CPI day traders! That's our main economic news driver for today. We'll see if the "buy the dip" apprears today. I was wrong yesterday. I thought we'd trend higher. Instead is was lower for most of the day. I got shellaced yesterday! Everything day trading wise lost money. What happened? Two things, I think. #1. We really need to be out of our postions prior to the power hour. Sometimes it's hard but it's but it's a real neccesity now with such low I.V. the Gamma effect is bigger. #2. If the VIX1D is below 14 we need to stick to debit anchor positions. We can work credit trades around it but the debit needs to carry the weight of the trades success/failure. Debit trades as anchor positions will lower our win % but they will get our risk/reward back in line. Were is the VIX1D now? Below 10. You can check out my miserable results from yesterday below: Let's take a look at the markets. Markets are flashing a mild sell signal. I don't buy too much into it unles the selling continues today. The rolling over continues. It's not super strong but were working on a few days now of retrace. I'm mostly focused on IWM and DIA which are both back to key consolidation zones. They are also close to their respective 50DMA. A further drop below could open up the selling. December S&P 500 E-Mini futures (ESZ24) are trending up +0.10% this morning as investors awaited the all-important U.S. inflation report for clues on whether the Federal Reserve will lower or hold interest rates next week. In yesterday’s trading session, Wall Street’s main stock indexes closed in the red. MongoDB (MDB) tumbled over -16% and was the top percentage loser on the Nasdaq 100 after the company announced that its Chief Operating Officer and Chief Financial Officer, Michael Gordon, would step down on January 31st. Also, Moderna (MRNA) slumped more than -9% and was the top percentage loser on the S&P 500 after BofA reinstated coverage of the stock with an Underperform rating. In addition, Oracle (ORCL) slid over -6% after the IT giant reported weaker-than-expected FQ2 results. On the bullish side, Walgreens Boots Alliance (WBA) soared more than +17% and was the top percentage gainer on the S&P 500 after the Wall Street Journal reported that the drugstore chain was in talks to sell itself to private equity firm Sycamore Partners. Also, Alphabet (GOOGL) climbed over +5% and was the top percentage gainer on the Nasdaq 100 after the tech titan discussed breakthroughs made through the use of its new Willow quantum computing chip. Economic data released on Tuesday showed that U.S. Q3 nonfarm productivity was unrevised at +2.2% q/q, while Q3 unit labor costs were revised lower to +0.8% q/q from +1.9% q/q, a smaller increase than expectations of +1.3% q/q. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. November CPI will come in at +0.3% m/m and +2.7% y/y, compared to the previous numbers of +0.2% m/m and +2.6% y/y. The U.S. Core CPI will also be closely watched today. Economists anticipate the core CPI to be +0.3% m/m and +3.3% y/y in November, matching October’s figures. A survey conducted by 22V Research showed that 37% of investors expect the market response to the consumer inflation report to be “risk-off.” Also, investors are evenly split between those predicting a “risk-on” reaction and those expecting it to be “mixed/negligible.” “A softer print can clear the path for a year-end rally, with the second half of December being the second strongest period of the year. On the contrary, a firmer print can revamp volatility,” a team led by Ohsung Kwon said. U.S. rate futures have priced in an 86.1% chance of a 25 basis point rate cut and a 13.9% chance of no rate change at the December FOMC meeting. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ4 earnings results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.245%, up +0.52%. CPI should be the big driver today. Our trade docket is light today. /ZW, IWM, CAVA, FDX, MRNA, 0DTE's. One thing I"m thinking about today: We have now experienced 6 consecutive days with more S&P 500 stocks declining than advancing. When we dig into the data, the top 10 stocks by market cap have an average return of 4.9% since last Monday, while the rest of the S&P 500 has an average return of -1.8%. Is this large-cap leadership going to be the theme for 2025? CPI data release: My bias or lean today: I'm back to bullish. I was wrong yesterday but I think CPI pushes us higher today. Let's take a look at the intra-day levels for our 0DTE's today: /ES looks to recapture the support level from yesterday. CPI data release is helping. 6097 is resistance with yesterdays support of 6058 still in play. Below 6058 is 6036. /NQ is much the same story. Yesterdays support/resistance is the same. Resistance at 21,704 with Support at 21,436 and a secondary support below that at 21,330. BTC: We didn't get a Bitcoin trade on yesterday. It's a little tougher when its consolidating vs. trending. We'll try again today. 100,808 continues to be resistance with support coming in around 94,639. Look for debit trade "anchor" positions for our 0DTE's until the VIX can get some juice back in it. That may not happen for a very long time unless we get a substantial retrace. See you all in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |