|

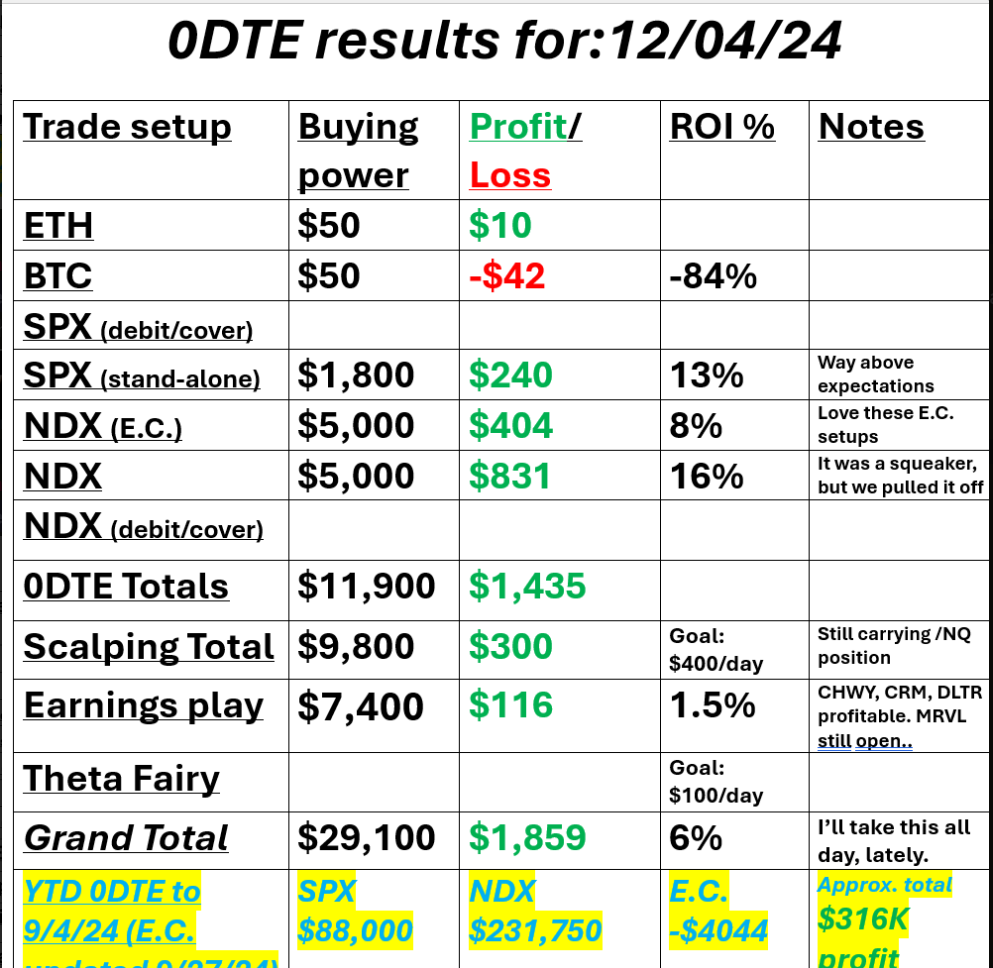

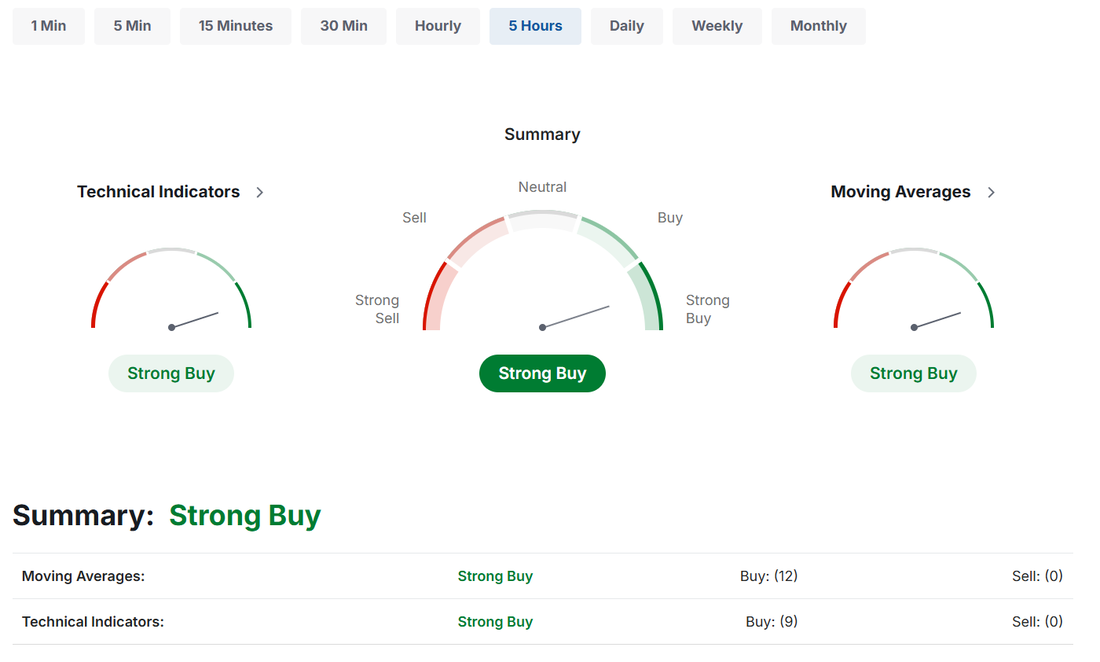

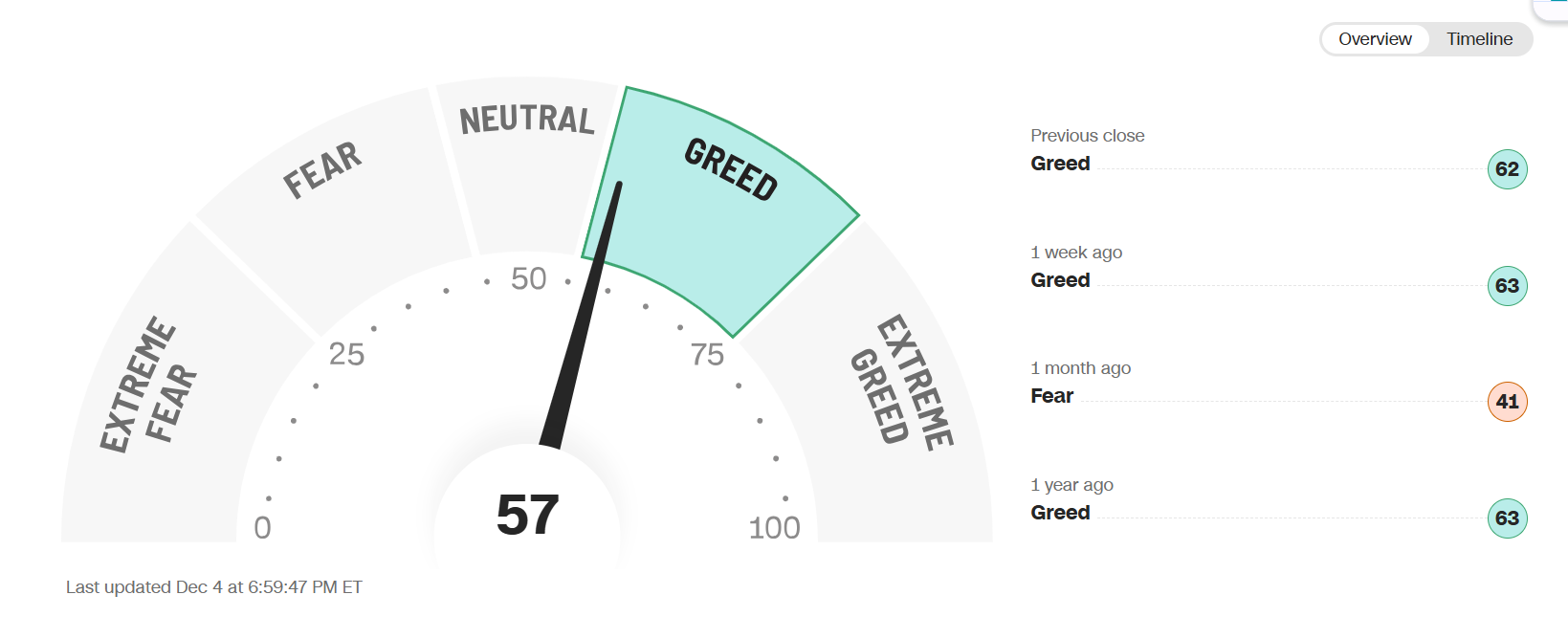

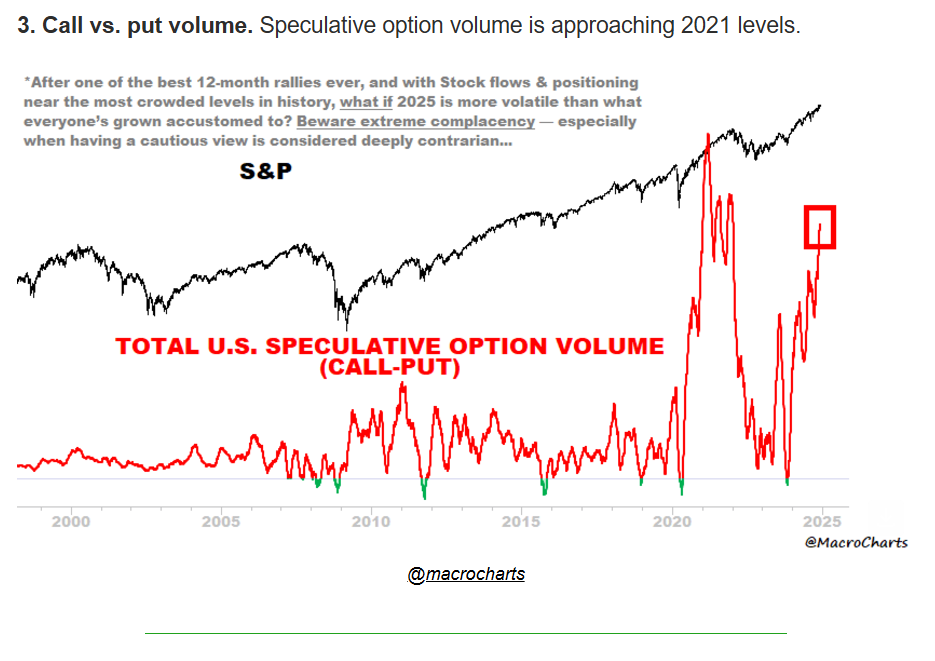

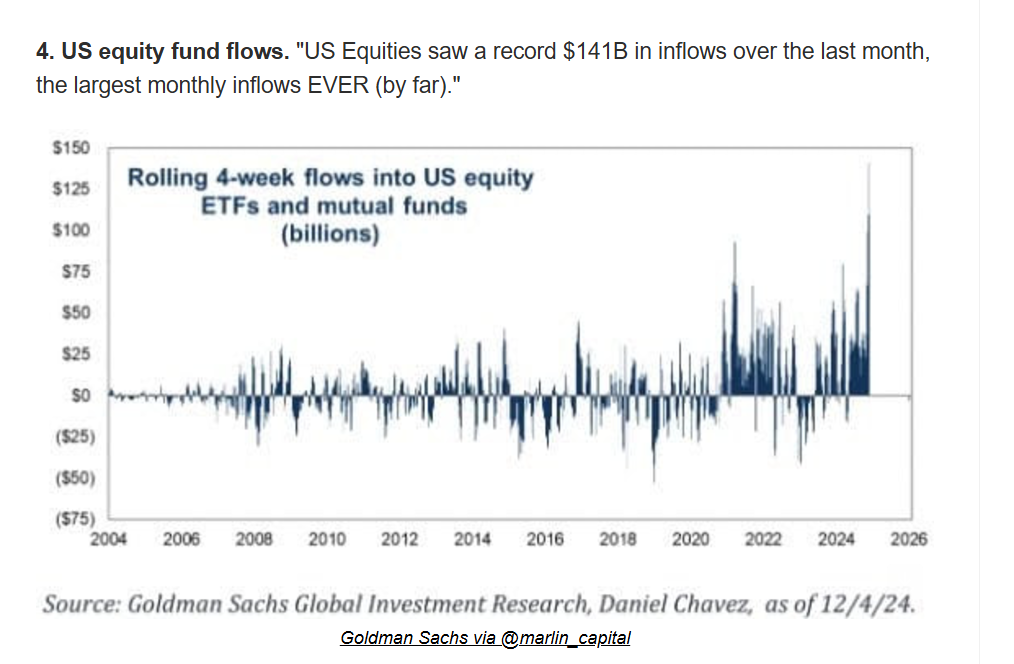

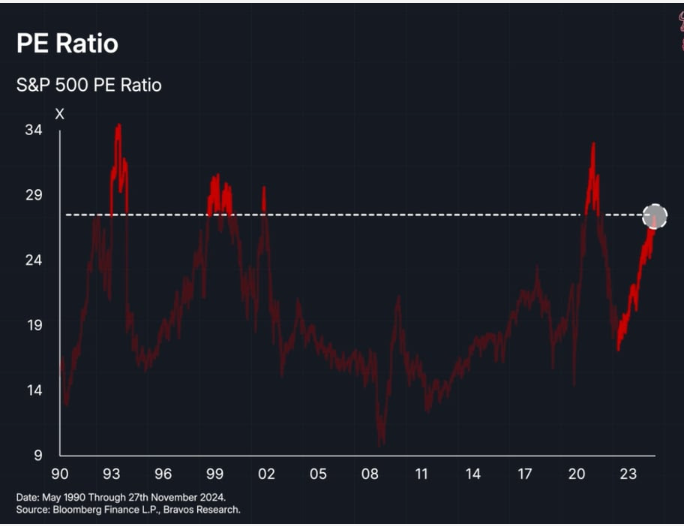

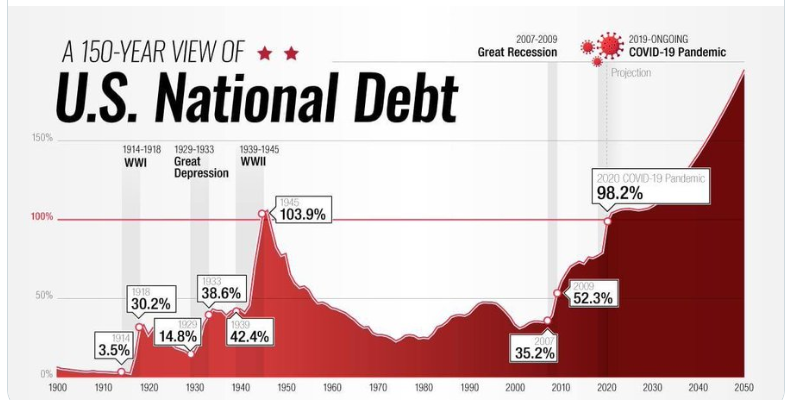

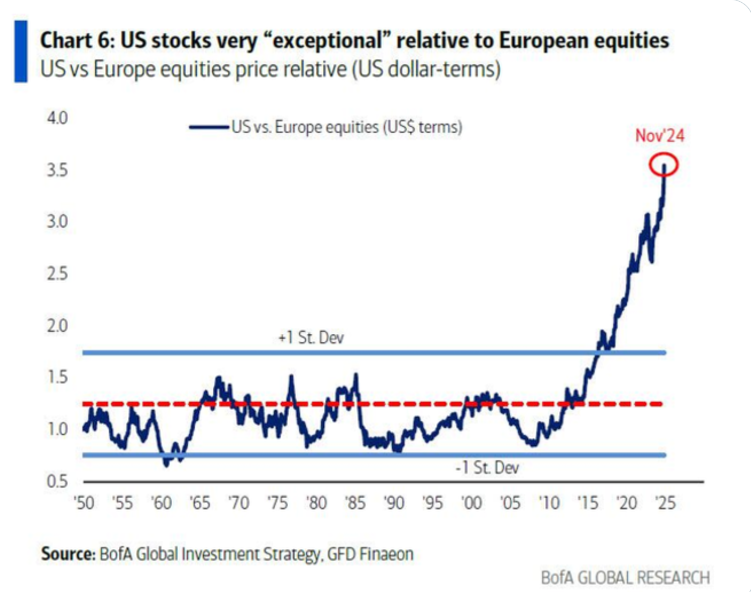

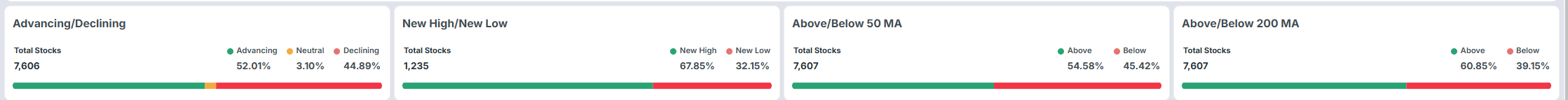

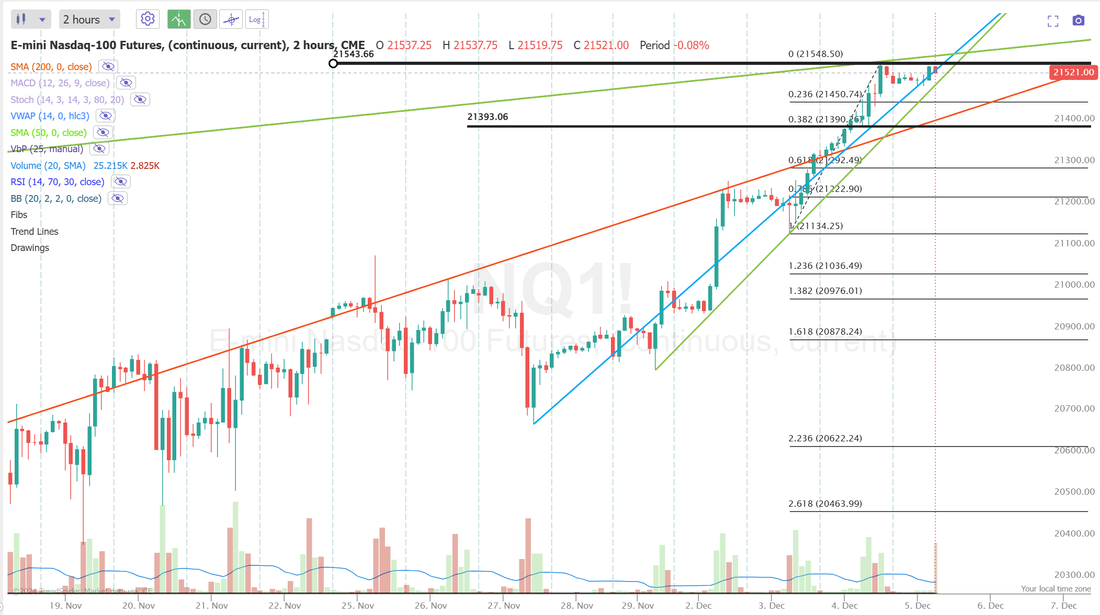

What a day yesterday! This is such a tough market for credit traders. If you build soley credit setups, even if you win you lose because your risk/reward is horrible and you are trading setups with no positive expectancy. If you trade debit setups you need big moves and those have been rare. Traders are really between a rock and a hard place right now. We stayed on top of our setups and managed risk well. Even with the cost of adjustments our day went pretty darn well. Our net liq was up and all our 0DTE's made money with the exception of our small BTC trade. Check our performance below: Let's take a look at the markets. Technicals are still bullish. It would take a pretty decent retrace to change that at this point. "ATH's all day long" seems to be the theme right now. IWM is wavering a bit but it sure looks like we are coiling to push higher. We are at an amazing 12 days of up, up, up on the SPX. It WILL pause and retrace at some point...it always does but when? Nobody knows. The fear and greed index isn't off the charts greedy as you'd suspect when we keep bouncing to new ATH's. No matter how much bullishness we get, I wouldn't be doing my job if I didn't make the counter argument for downside. The market's PE ratio has climbed to heights seen only 2 times before - in 2021 and the late 1990s. Currently, it’s sitting in the 90th percentile of the last 40 years. The US govt brings in about $5 trillion per year in revenue from taxes, fees and tariffs. The US govt is on pace to spend about $1.4 trillion for interest payments on the $36 trillion in debt during 2025. That will be about 28% of all govt revenue going to interest payments. The last time U.S. stocks were this overvalued versus the rest of the world was... well, never. As strong as the market is the A/D line isn't that impressive and you'd think more stocks would be above their respective 50/200 DMA. Volume has been dropping during this current bull run going all the way back to October. December S&P 500 E-Mini futures (ESZ24) are down -0.05%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.13% this morning, taking a breather after yesterday’s rally, while investors turned their attention to U.S. jobless claims numbers due later today and key non-farm payrolls data scheduled for Friday. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher, with the S&P 500, the Dow, and the Nasdaq 100 posting new all-time highs. Marvell Technology (MRVL) soared over +23% and was the top percentage gainer on the Nasdaq 100 after the company posted upbeat Q3 results and issued above-consensus Q4 guidance. Also, Salesforce (CRM) climbed about +11% and was the top percentage gainer on the S&P 500 and Dow after the software giant reported better-than-expected Q3 revenue and raised the lower end of its full-year revenue forecast. In addition, Pure Storage (PSTG) surged over +22% after the data storage company reported stronger-than-expected Q3 results and lifted its annual revenue outlook. On the bearish side, The Campbell’s Company (CPB) slid more than -6% after reporting weaker-than-expected FQ1 net sales. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 146K in November, down from 184K in October (revised from 233K) and missing the consensus estimate of 152K. Also, the U.S. November ISM services index fell to 52.1, weaker than expectations of 55.7. In addition, the final estimate of the U.S. November S&P Global services PMI was revised lower to 56.1 from the 57.0 preliminary reading. Finally, U.S. factory orders rose +0.2% m/m in October, in line with expectations. Fed Chair Jerome Powell said Wednesday that the U.S. economy is in “very good shape.” He added that policymakers could afford to be “a little more cautious” with lowering rates. Also, St. Louis Fed President Alberto Musalem stated, “It seems important to maintain policy optionality, and the time may be approaching to consider slowing the pace of interest rate reductions or pausing, to carefully assess the current economic environment, incoming information, and evolving outlook.” In addition, San Francisco Fed President Mary Daly stated that there is no immediate urgency to lower rates. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity saw a slight increase in November following little change in previous months, with U.S. businesses becoming more optimistic about demand prospects. The report noted that modest or moderate growth in three regions offset flat or slightly declining activity in two others. The Fed’s districts also reported that prices increased at a modest pace. “Though growth in economic activity was generally small, expectations for growth rose moderately across most geographies and sectors,” according to the Beige Book. “Business contacts expressed optimism that demand will rise in coming months. Consumer spending was generally stable.” U.S. rate futures have priced in a 74.0% chance of a 25 basis point rate cut and a 26.0% chance of no rate change at December’s policy meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists estimate this figure to arrive at 215K, compared to last week’s number of 213K. The U.S. Trade Balance data will be released today as well. Economists forecast this figure to stand at -$75.70B in October, compared to the previous figure of -$84.40B. On the earnings front, notable companies like Dollar General (DG), Kroger (KR), DocuSign (DOCU), Hewlett Packard Enterprise (HPE), GitLab (GTLB), Lululemon Athletica (LULU), and Ulta Beauty (ULTA) are scheduled to report their quarterly figures today. In addition, market participants will be looking toward a speech from Richmond Fed President Thomas Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.214%, up +0.77%. My bias or lean today is more neutral. Two weeks of nothing but up? I think we are due for a pause. DOCU, HPE, ULTA, FIVE, /MNQ, /NQ scalping should finish this position up today. BBY?, MRVL, LULU, Possible Theta Fairy after the close, 0DTE's. Don't sleep on the E.C. setups, especially Bitcoin today. They could be good. Let's take a look at the intra-day levels for us today: /ES: We are pinched into an incredibly tight range to start today. Jobless claims numbers may shake us out to one side or the other. 6101 is earn term resistance and 6079 is support. A break above would be bullish for my setups. A break below would provide for bearish setups. /NQ: Nasdaq has a very asymmetric setup going into today. Resistance is close and support is a ways down. Would anyone be surprised to see a 300 point downday? Resistance is close at 21,549 with support down at 21,393. BTC: Well...? It did it! Absolutely crazy. Bitcoin pushed over $100,000 mark. As I've mentioned many times, I'm not a "crypto" guy. I don't understand it. It's not backed by anything. It holds no "store of value" which, by the way, is the main definition of "currency". The risk/reward was compelling though. I opened a Coinbase.com account and would add a few hundred dollars each month. Small enought that if it went bust it wouldn't be a big deal. When I got to $4,000 invested I thought, "that's enough". That account hit $19,000 last night! Woulda, coulda , shoulda. I guess we just hold now until it hits $1,000,000 right? Right? BTC Levels: 105,379 is new resistance with the all important 100,000 working as support. I'm keen to get a bigger size BTC trade on today. I'm super happy with our results yesterday. If we could do that again today I'd be thrilled.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |