|

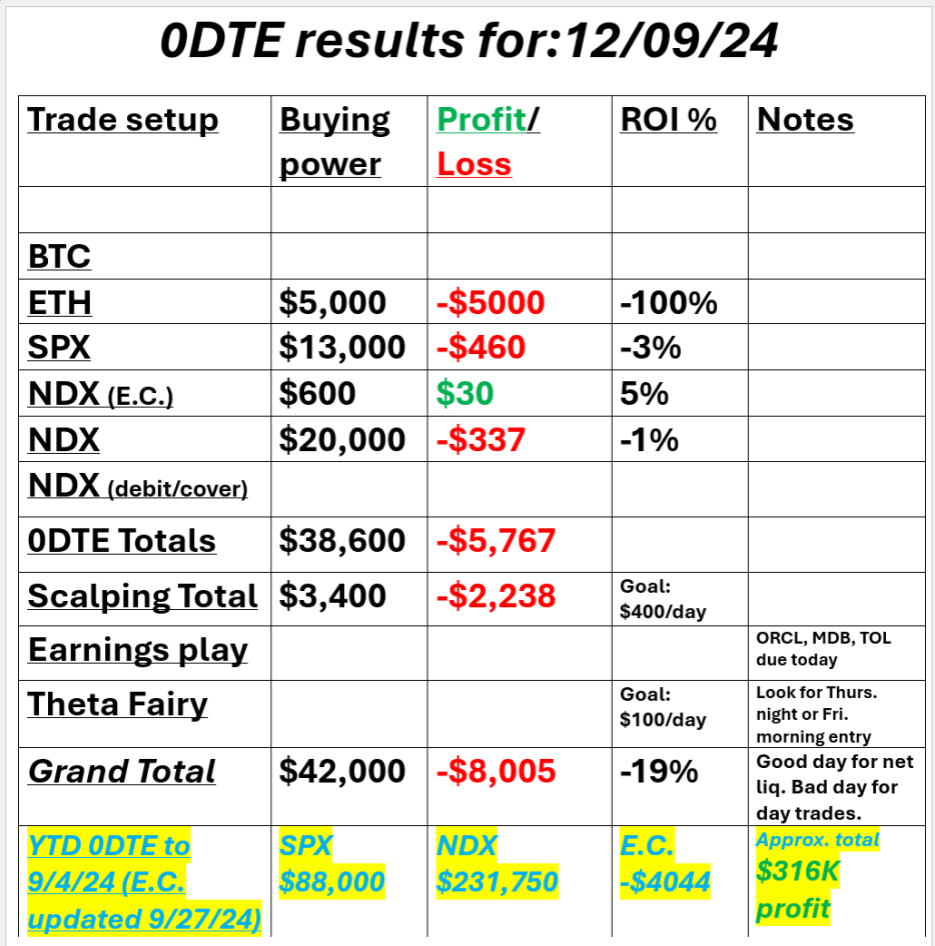

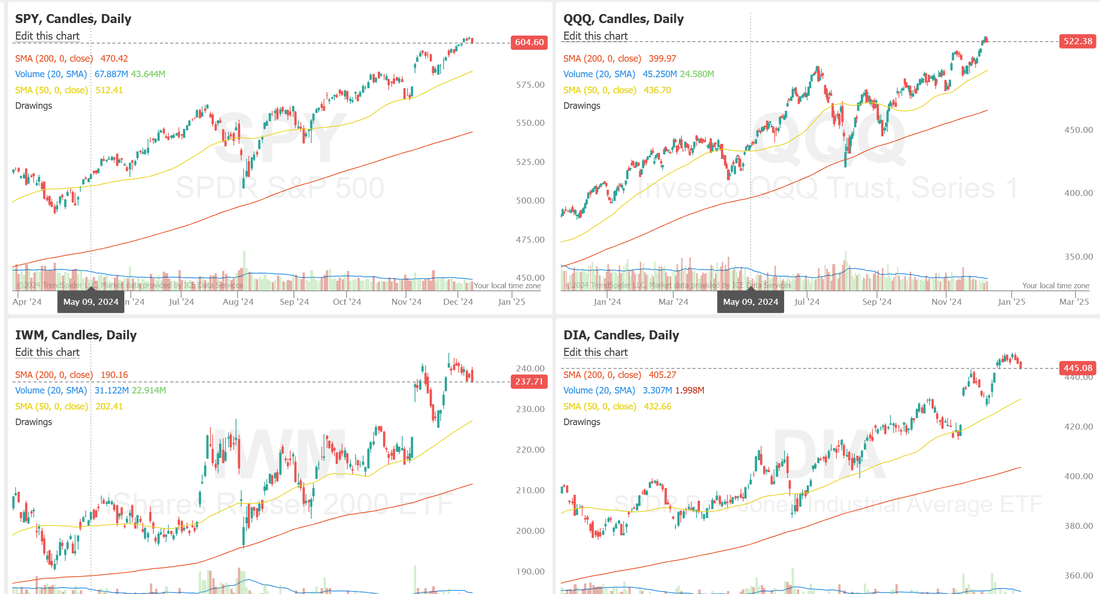

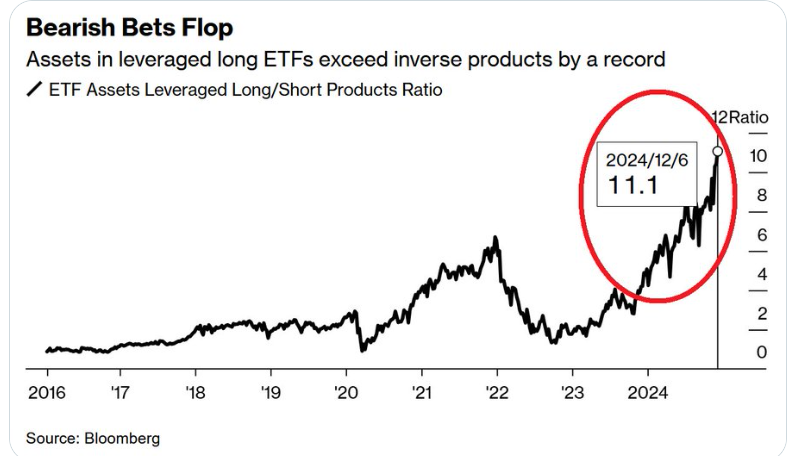

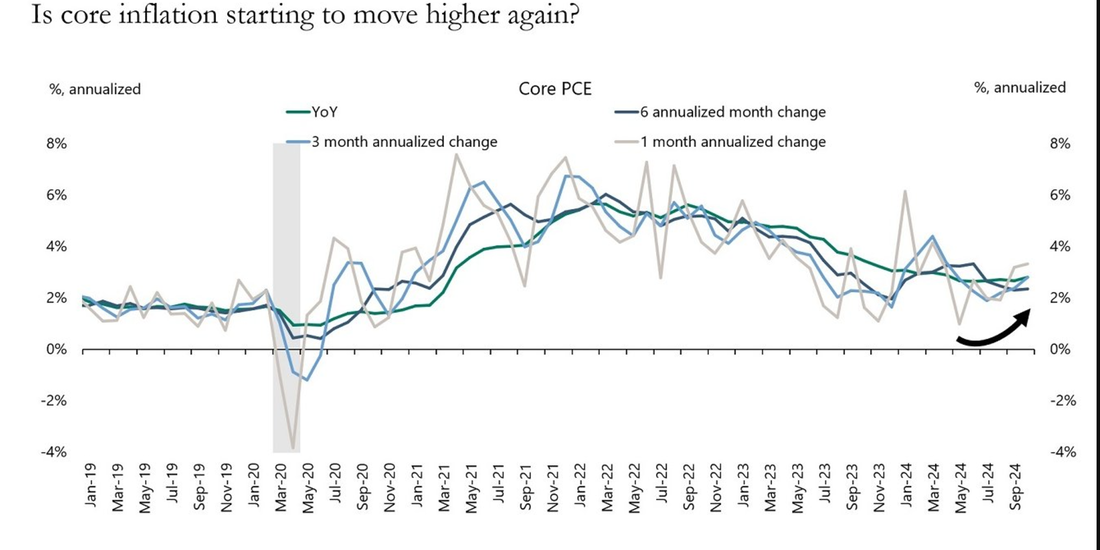

Welcome back traders! We had a very mixed day yesterday. Our net liq. (or account value) was up nicely on the day but virtually every day trade lost money. DOCU, NatGas, IWM, LRN, MRNA, PLTR, UAL all worked together to rescue the day. Let's see if we can get BOTH day trades and the model porfolio to work together today. Here's our results from yesterday. Yesterday brought the first real selloff we've seen in about a month! The question today is, does it get bought up or is it the trigger we've been waiting for to usher in a downside move? I favor the "buy the dip" as that's what's happend on EVERY single sell like this over the majority of this year. Technicals swung to a neutral to start the day. We are absolutely seeing a retrace or, in a best case scenario, a pause in the major indicies but...we are also back to key support levels in the weakest of the two. The IWM and the DIA. Today could be key. Will they hold or not? My bias or lean today is that A) the "buy the dip" that has happened some much this year after sell days continues and B) the critical support levels that we are back to on IWM and DIA hold. This puts me as slightly bullish today. December S&P 500 E-Mini futures (ESZ24) are up +0.03%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.04% this morning after three major U.S. benchmark indices finished the regular session lower as investors grew more cautious ahead of Wednesday’s release of a key U.S. inflation report. In yesterday’s trading session, the benchmark S&P 500 and tech-heavy Nasdaq 100 retreated from record highs, while the blue-chip Dow dropped to a 1-1/2 week low. Omnicom Group (OMC) plunged over -10% and was the top percentage loser on the S&P 500 after agreeing to acquire Interpublic Group in a deal valued at $13.3 billion, excluding debt. Also, Comcast (CMCSA) slid more than -9% after the head of its cable business said the company expects a Q4 broadband subscriber loss of just over 100,000. In addition, Nvidia (NVDA) fell over -2% after China Central Television reported that the State Administration for Market Regulation had launched an investigation into the chipmaker over alleged violations of anti-monopoly laws. On the bullish side, Hershey (HSY) climbed more than +10% and was the top percentage gainer on the S&P 500 after Bloomberg reported that Mondelez International was exploring an acquisition of the chocolate maker. Economic data released on Monday showed that U.S. wholesale inventories rose +0.2% m/m in October, in line with expectations. Meanwhile, market participants are awaiting the U.S. consumer inflation report for November, due on Wednesday, that will help shape the outlook for Federal Reserve monetary policy. The CPI is expected to pick up slightly to +2.7% y/y from +2.6% y/y in October, while the core CPI is projected to remain unchanged from October at +3.3% y/y. “This Wednesday’s inflation data may hold the key to the Fed’s next move,” said Jay Woods at Freedom Capital Markets. “So far results have been in line with economists’ expectations and haven’t scared the market. However, an upward surprise should raise eyebrows at the Fed and could put another rate cut on pause.” U.S. rate futures have priced in an 86.1% chance of a 25 basis point rate cut and a 13.9% chance of no rate change at December’s policy meeting. Today, investors will focus on U.S. Unit Labor Costs and Nonfarm Productivity data, set to be released in a couple of hours. Economists forecast final Q3 Unit Labor Costs to be +1.3% q/q and Nonfarm Productivity to be +2.3% q/q, compared to the second-quarter numbers of +0.4% q/q and +2.5% q/q, respectively. Investors will also keep an eye on earnings reports from several notable companies today, including AutoZone (AZO), Ferguson (FERG), and GameStop (GME). In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.217%, up +0.41%. Here's a couple items I'm thinking about today: The ratio of assets in leveraged long ETFs to short ETFs hit 11.1x, the most on RECORD. The difference has TRIPLED this year and is nearly 2 TIMES larger than at the 2021 market frenzy top. Greed has rarely been greater. Core inflation actually seems to be rising! Could this put the FED in a position to actually need to raise rates next year? ORCL, MDB, TOL, GME, PLAY, AZO?, /HG, /MCL, /SI, DOCU, MRNA, PLTR, UAL, 0DTE's. Let's look at our intra-day levels for 0DTE's. /ES: Two key areas of focus for me today. 6098 is resistance with 6058 acting as support. Below 6058 there is a LOT of downside potential. /NQ: 21,701 is a clear resistance with 21,423 working as support. We had some pretty decent selling volume yesterday and that support level was tested several times and held. If we lose that today it could usher in more selling. That support level of 21,423 is my main focus today. BTC: Crypto, specifically ETH is what hurt my results the most yesterday. We are now into a new trading range on Bitcoin with 100,696 working as resistnace and 94,585 as support. We were incredibly fortunate that our account net liq was up yesterday with the poor results of the day trades. The model portfolio looks like it's set to do its part, once again today so let's see if we can do our part on the day trades.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |