|

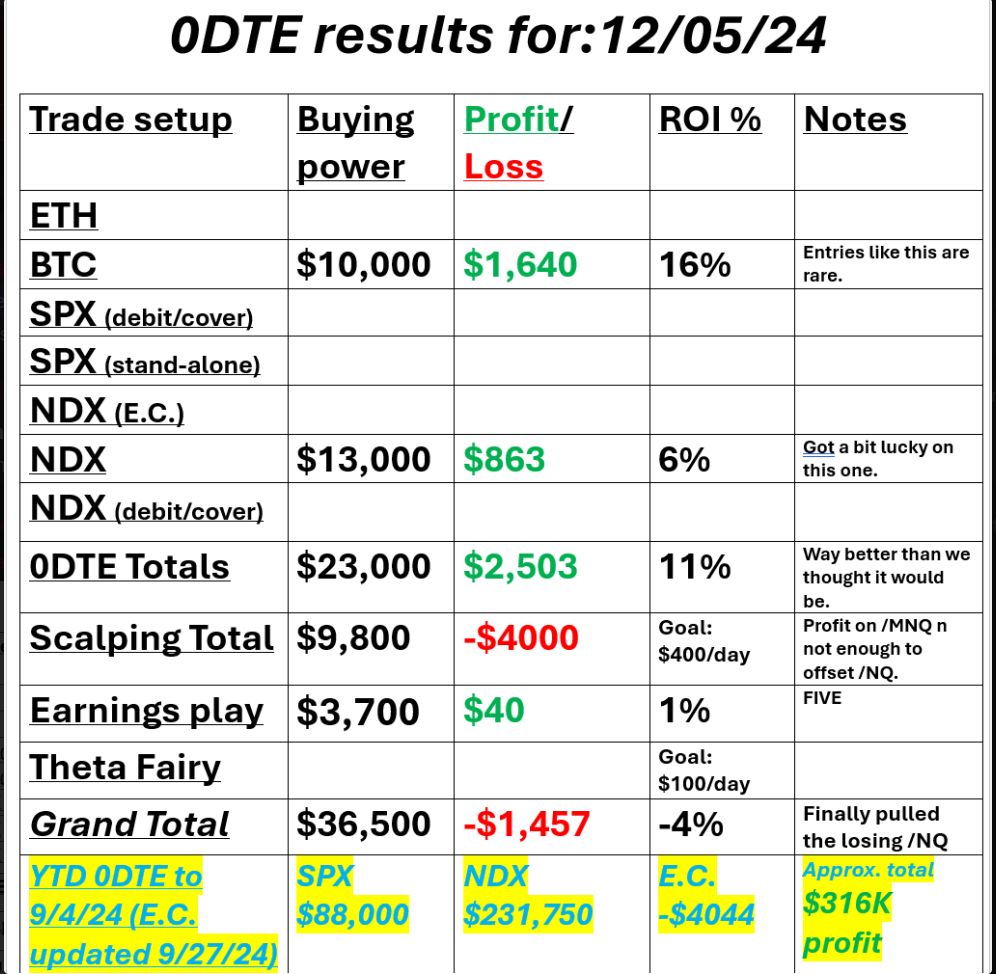

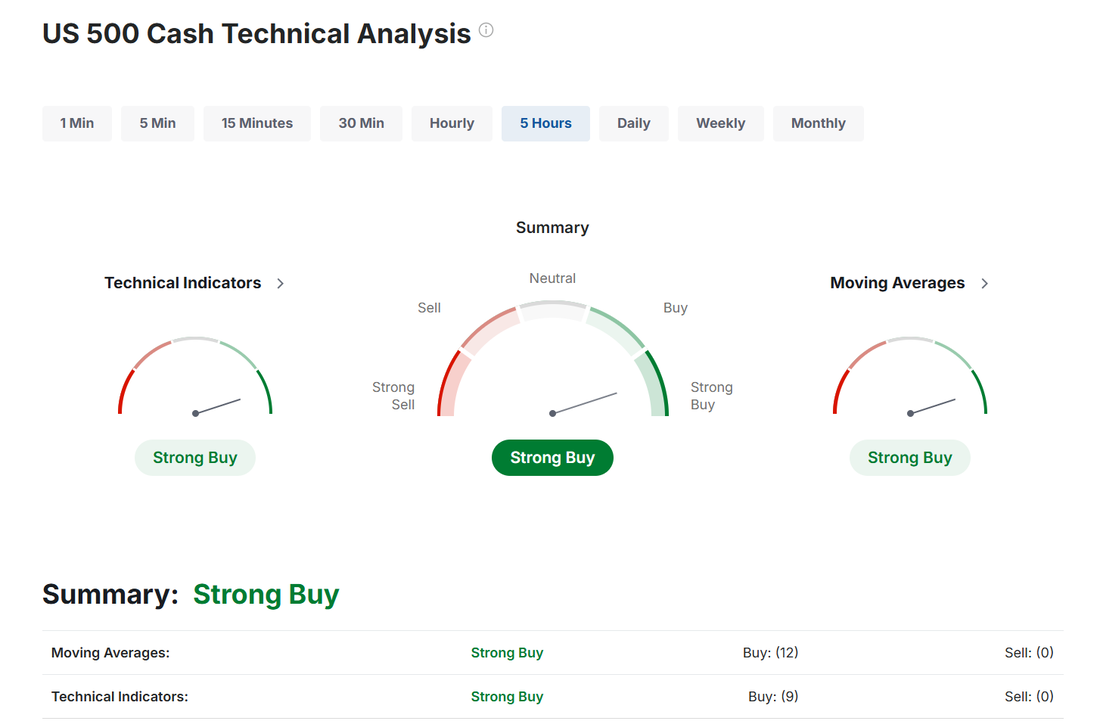

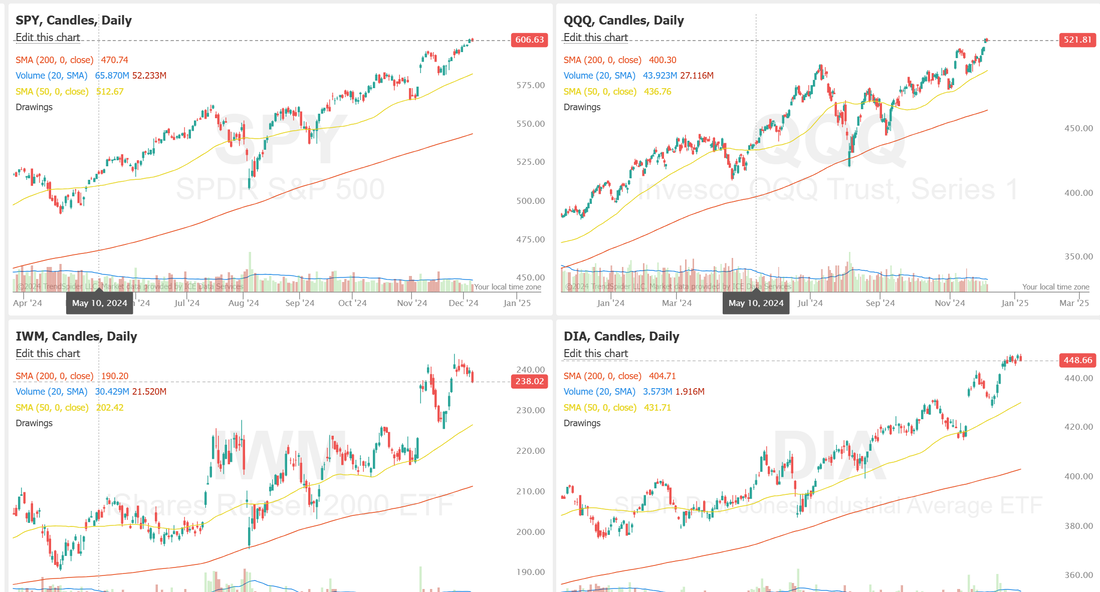

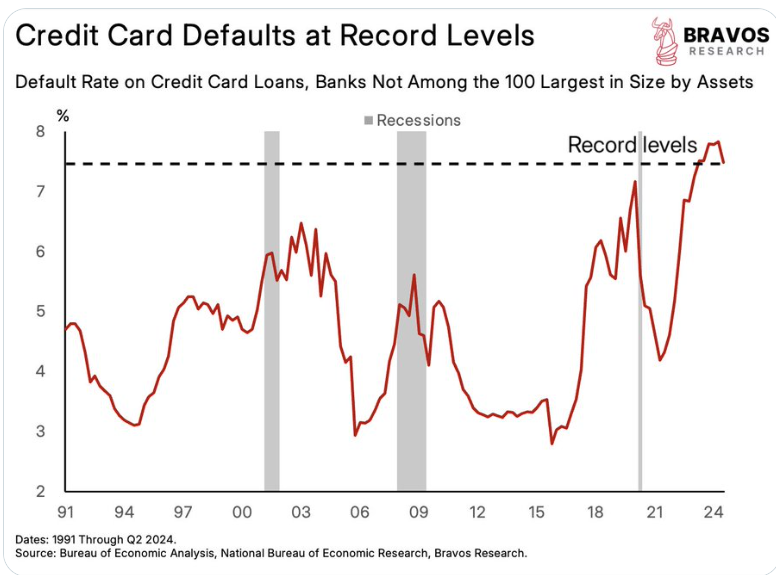

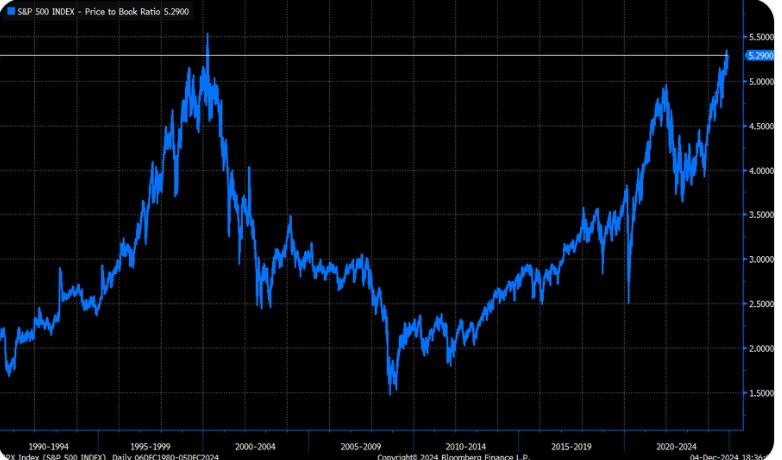

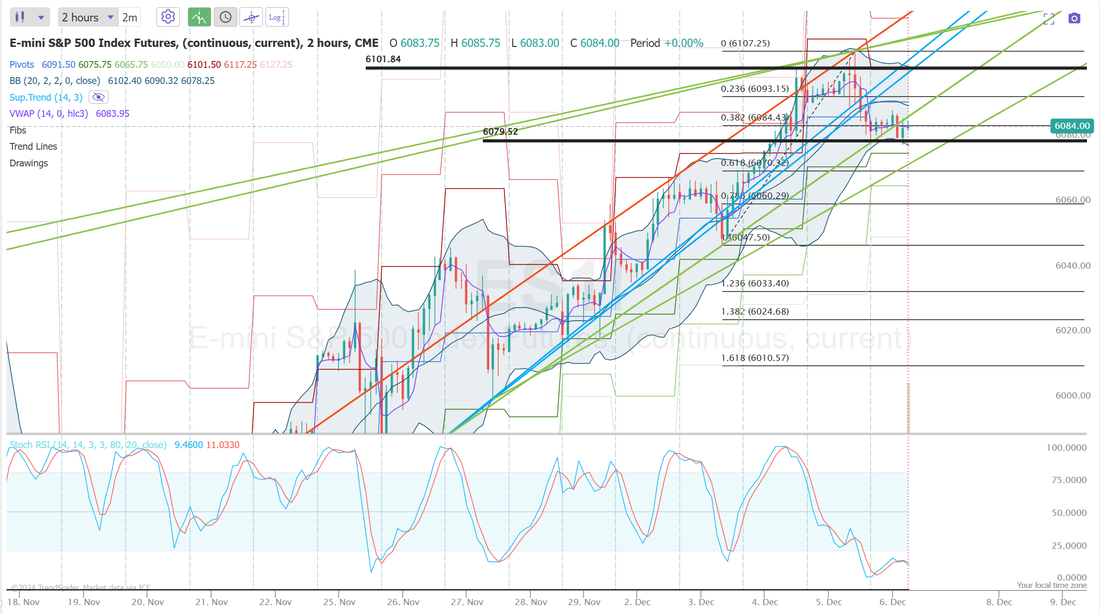

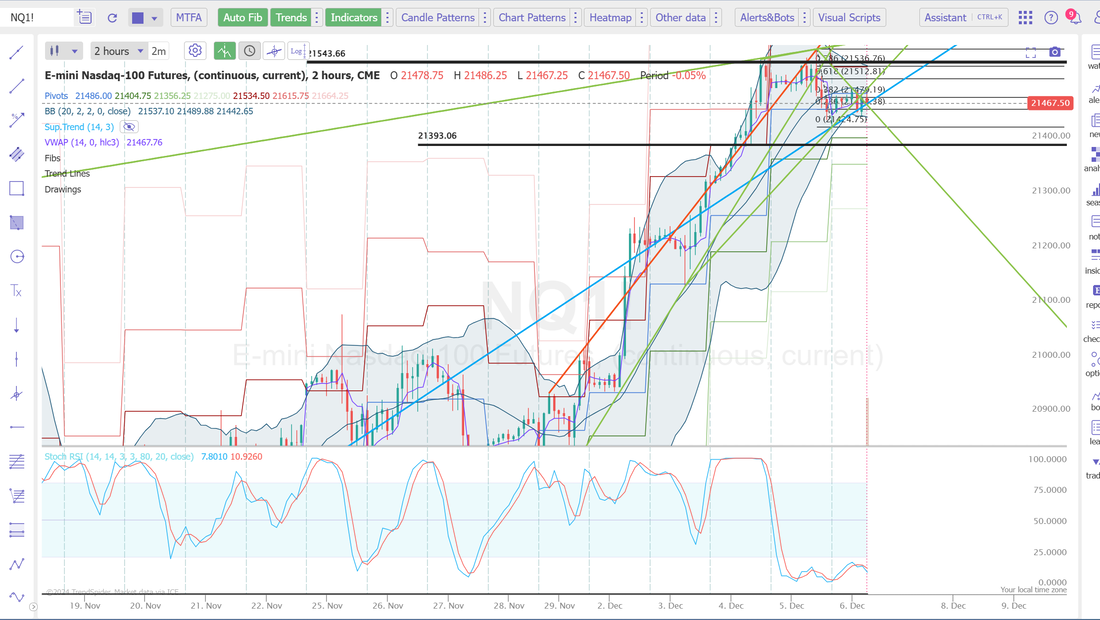

Welcome to Friday! I have to say, I'm pretty happy with our week so far. It's been a week of different setups but it largely worked out for us. Here's our results from yesterday: Markets still look bullish: We continue to bounce along the ATH lines with IWM continuing to show the most weakness. Our IWM trade it built with a bit of a brearish slant. December S&P 500 E-Mini futures (ESZ24) are trending down -0.08% this morning as investors cautiously awaited the all-important U.S. jobs report that will help determine whether the Federal Reserve will lower or hold interest rates later this month. In yesterday’s trading session, Wall Street’s major indices ended lower. Synopsys (SNPS) plunged over -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chip design software firm provided below-consensus 2025 revenue guidance. Also, SentinelOne (S) slumped more than -13% after the cybersecurity company reported a wider-than-expected Q3 loss. In addition, American Eagle Outfitters (AEO) tumbled over -14% after reporting weaker-than-expected Q3 revenue and cutting its full-year comparable sales forecast. On the bullish side, Brown-Forman (BF.B) climbed more than +10% and was the top percentage gainer on the S&P 500 after the company posted upbeat FQ2 results. Also, Tesla (TSLA) gained over +3% after BofA raised its price target on the stock to $400 from $350. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by +9K to a 6-week high of 224K, compared with the 215K expected. Also, the U.S. October trade deficit narrowed to -$73.80B from -$83.80B in September, better than expectations of -$75.70B. “We’ll get a fuller picture from [Friday’s] monthly jobs report, but for now, the story continues to be a labor market that occasionally appears to bend, but avoids breaking,” said Chris Larkin at E*Trade from Morgan Stanley. Meanwhile, U.S. rate futures have priced in a 67.5% chance of a 25 basis point rate cut and a 32.5% chance of no rate change at December’s monetary policy meeting. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that November Nonfarm Payrolls will come in at 218K, compared to October’s figure of 12K. A survey conducted by 22V Research revealed that 45% of investors expect key U.S. jobs data to be “mixed/negligible,” 32% anticipate it will be “risk-off,” and 23% foresee “risk-on.” U.S. Average Hourly Earnings data will also be closely watched today. Economists expect November figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.4% m/m and +4.0% y/y. The U.S. Unemployment Rate will be reported today. Economists foresee this figure to remain steady at 4.1% in November. The University of Michigan’s U.S. Consumer Sentiment Index will come in today. Economists forecast the preliminary December figure to be 73.1, up from last month’s figure of 71.8. U.S. Consumer Credit data will be released today as well. Economists expect this figure to stand at $10.10B in October, compared to the previous figure of $6.00B. In addition, market participants will be anticipating speeches from Chicago Fed President Austan Goolsbee, Cleveland Fed President Beth Hammack, and San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.195%, up +0.32%. My lean or bias today is still neutral. That worked fairly well for us yesterday. We seem to be pausing here for now. A couple things I'm thinking about today: Credit card defaults are rising at record levels This is WORSE than the 2008 Financial Crisis S&P 500 price to book basically at 2000 levels. Not sure if you all remember 2000? QQQ scalping. BBY, DOCU, HPE, LULU, MRNA, MRVL, PATh, ULTA, 0DTE's, /ES (Thetafairy). Let's take a look at our intra-day levels for 0DTE's. /ES. We've rotated from the resistance band to the support band. 6093 is first resistance today with 6101 next. 6079 is first support with 6070 and 6060 next. /NQ. Range is a bit bigger here. 21,542 is resistance with 21,389 support. Not much change from yesterday. BTC: Taking a pause after the massive explosion to the upside. 103,445 new resistance with 96,304 working now as support. Let's get a nice solid finish to the week! Our Theta fairy and earnings trades could be a nice finish today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |