|

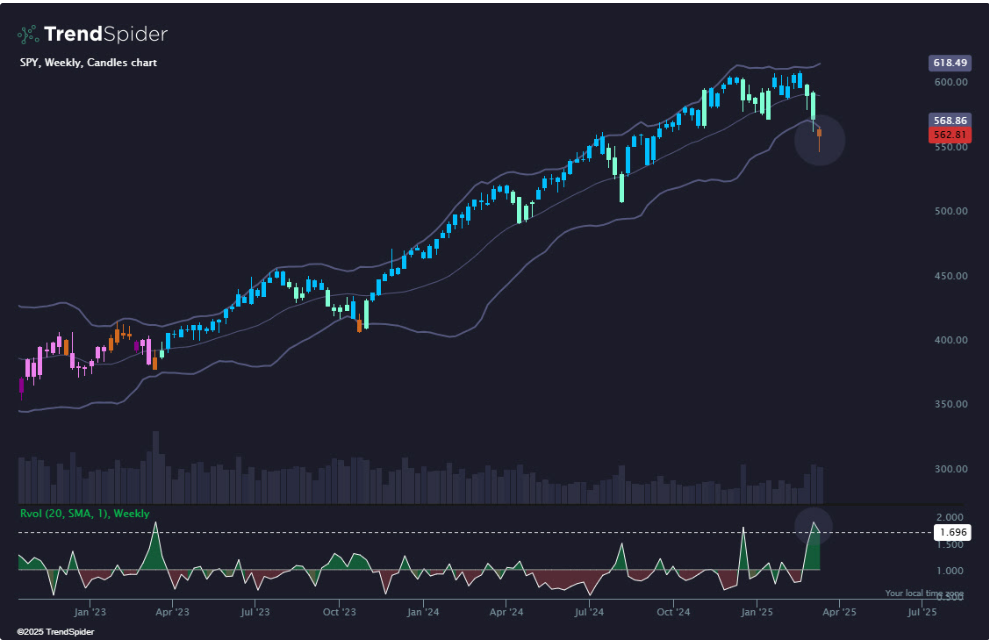

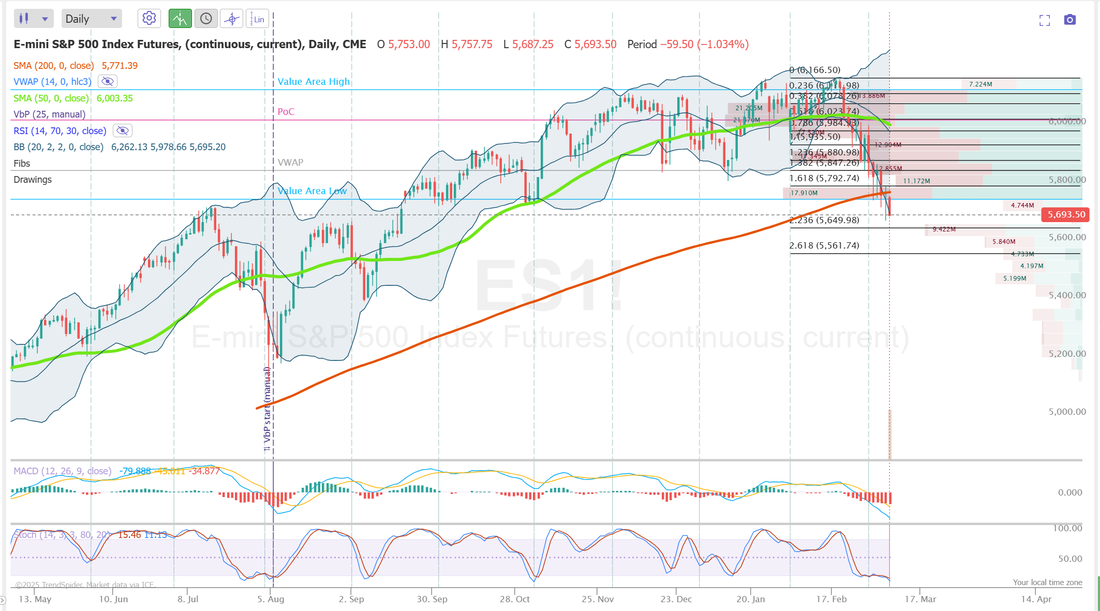

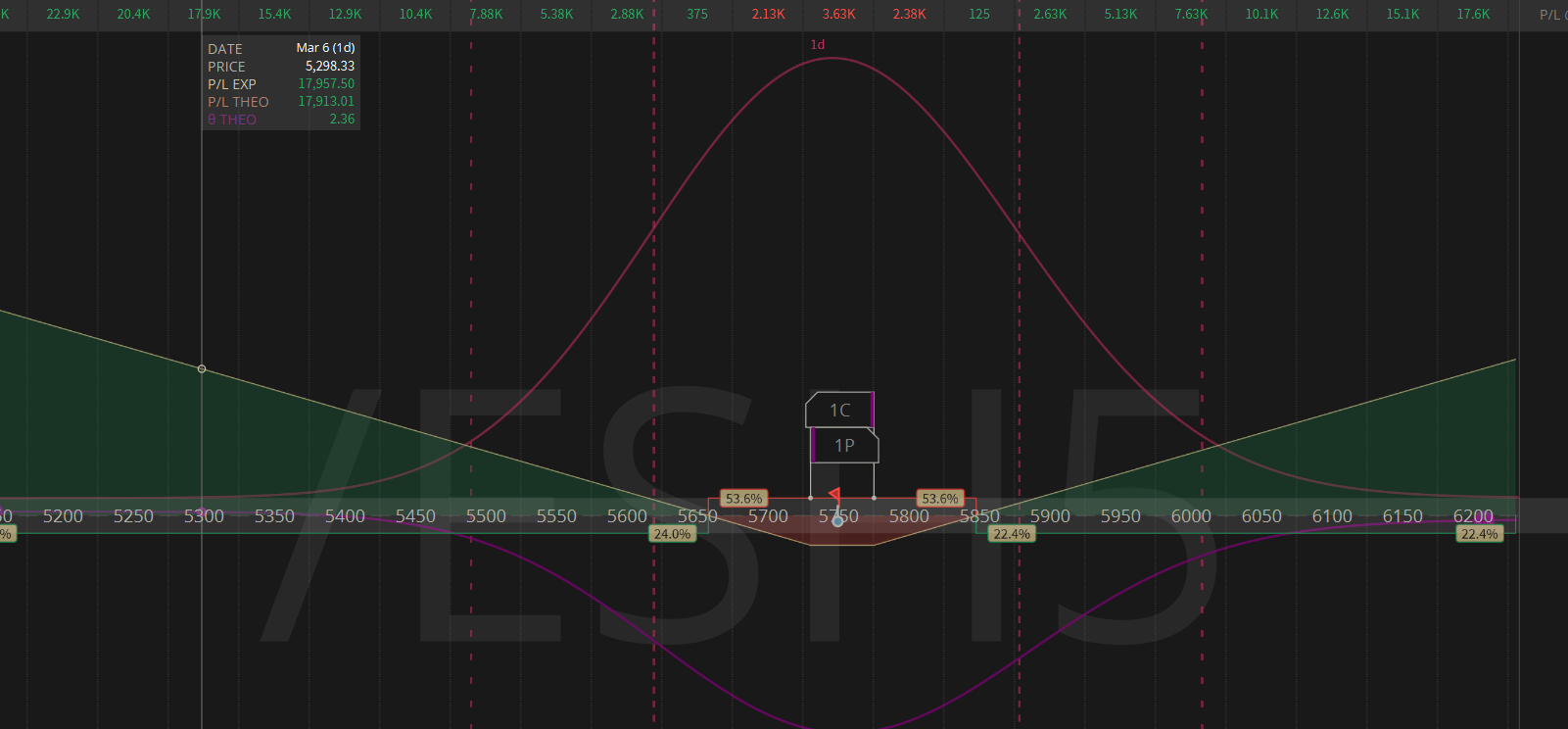

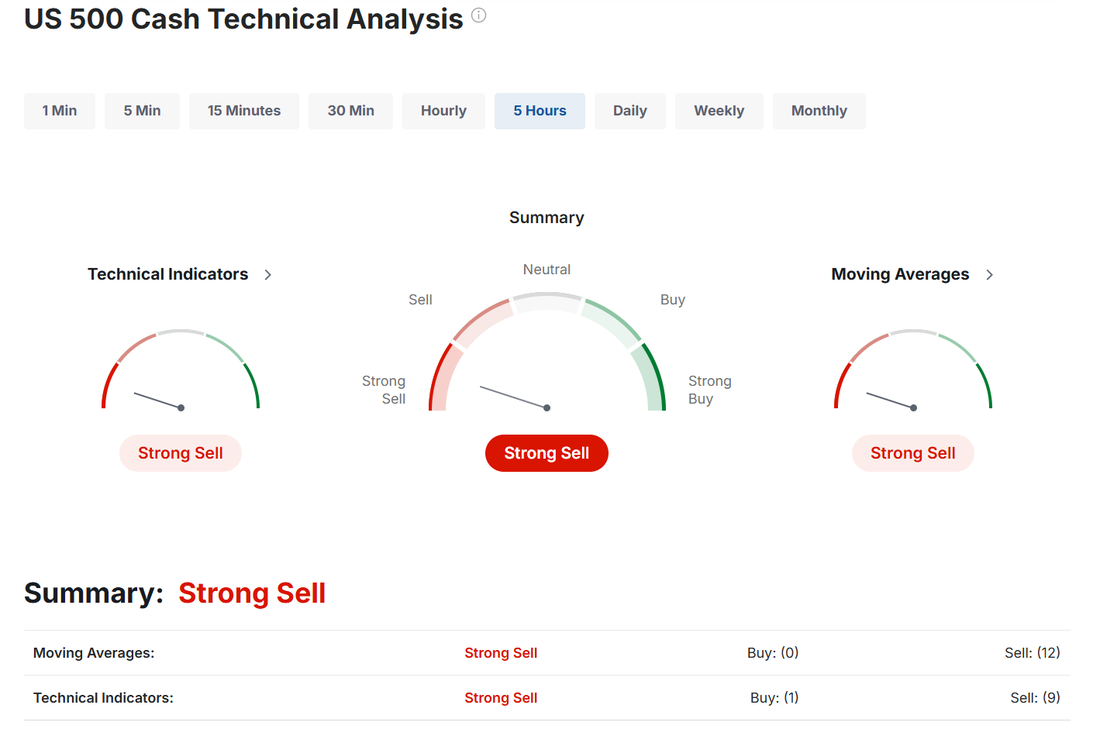

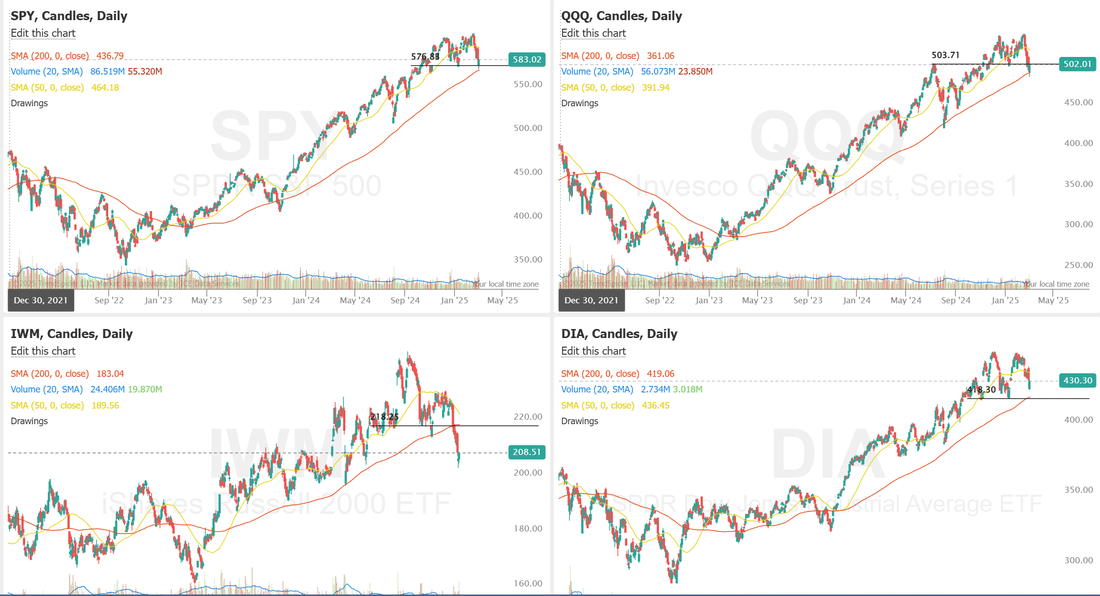

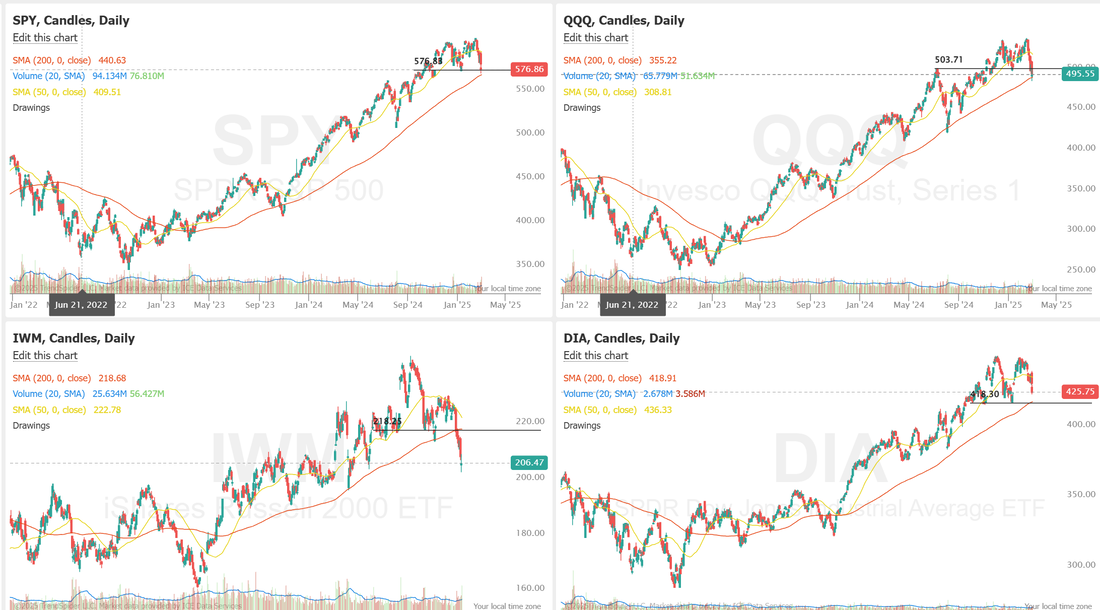

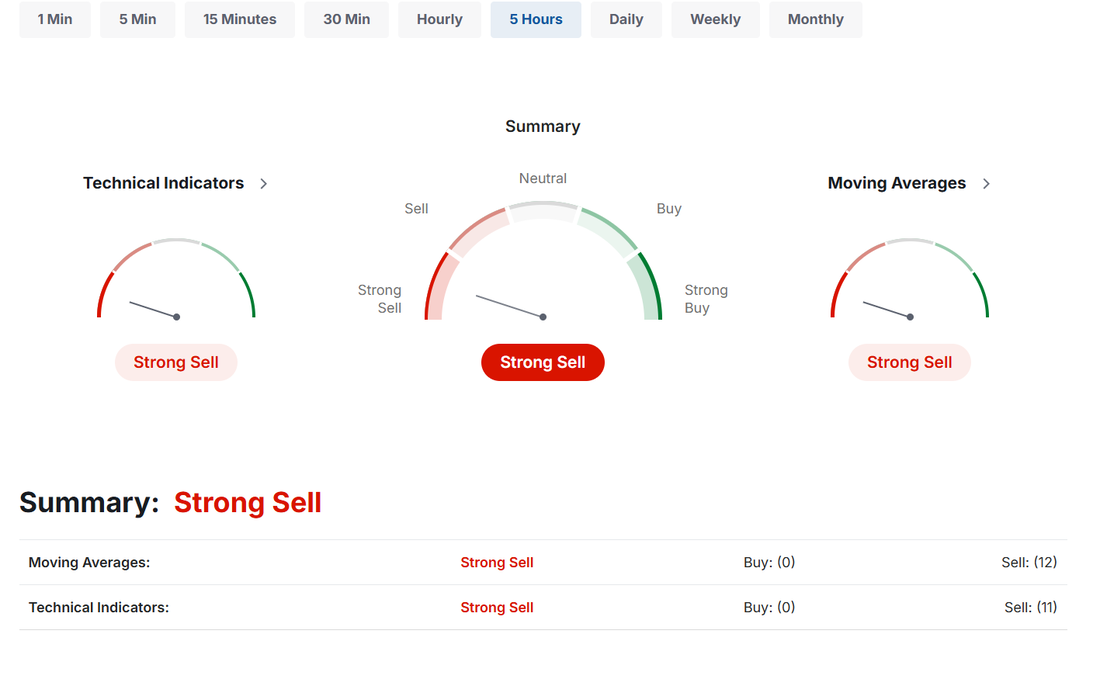

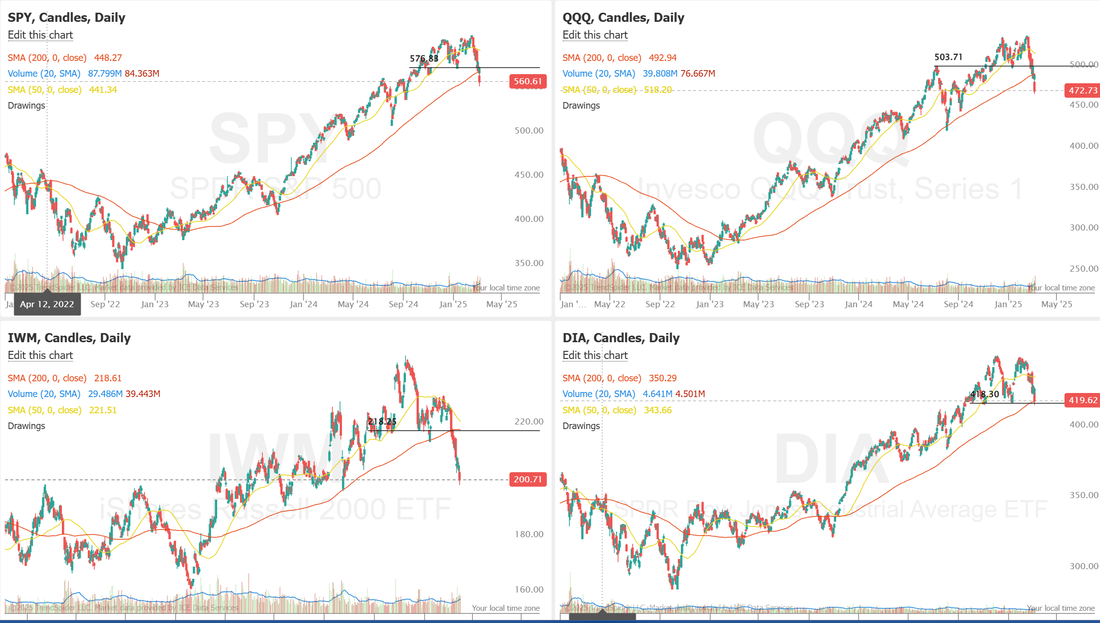

Welcome back traders to a new week of opportunities and St. Patricks day! To say that the last few weeks have been trying is a complete understatement. It's important to recognize market dynamica and change and change with the change! We've talked a lot about narrowing our focus, shortening our trading horizion and scaling down our trades. That's seemed to work well for us. To that end, I'm going to focus on mainly the day trades in the live trading room and leave the longer term trades to our ATM portfolio. That means 1HTE (0DTE) BTC trades, Theta Fairys, Scalps, Earnings trades and 0DTE's primarily on SPX. We've had a long standing goal of shooting for $1,000/day in profits. This might lower our potential but it will also help with consistency and risk management. Our ATM asset allocation portfolio is doing great in this market and could finish out the first quarter up 12%. I'm not saying we'll end the year up 40%+ but it certainly has the best of all worlds going for it right now. High I.V. with a downward trending market makes it a perfect enviroment for good results. Here's a look at how our Friday went. Let's take a look at the markets: Fridays strong move still couldn't flip us to a full buy mode but it certainly helped i were looking for bullish moves. Today could really flip either way. We are closer to a neutral rating than a buy or sell and those days are usually unpredictable. I said on Friday that even a big up day wouldn't change the technicals much and that ended up being true. It was a solid day for the bulls but nothing really changed in the bigger picture. The SPY extended its losing streak, closing the week at $562.81 (-2.26%) and marking its fourth consecutive red candle. The GoNoGo Trend Indicator, which tracks trend strength using color-coded candles, has turned neutral for the first time since October 2023. At the same time, SPY closed below the lower Bollinger Band, a rare event that has historically signaled a short-term reversal. With elevated RVOL hinting at capitulation, traders are watching closely for signs of stabilization and the next key support level. The QQQ also extended its decline last week, closing at $479.66 (-2.46%). Similar to SPY, GoNoGo Trend flashed a neutral candle along with a weekly close below the lower Bollinger Band. Notably, QQQ recorded its highest weekly volume since early August, a dynamic not seen in its peers. While these signals have historically resulted in short-term bottoms, traders are left wondering if the elevated RVOL is showing signs of capitulation or if the downtrend is just getting started. IWM cemented a strong bearish trend as the GoNoGo Trend flashed a strong 'No Go' candle for the first time in months, closing the week at $202.89 (-1.48%). Unlike SPY and QQQ, IWM has rapidly cycled through all five GoNoGo trend signals in the past five weeks. Price opened the week below the lower Bollinger Band, and that's where it stayed. With high RVOL signaling intense selling pressure, traders are watching closely to see if oversold conditions spark a relief bounce or if downside continuation is ahead. VIX1D is still elevated but coming back down to earth. Let's look at the expected moves for this week. For an FOMC week its a solid I.V. level. March S&P 500 E-Mini futures (ESH25) are down -0.47%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.48% this morning, pointing to a red opening on Wall Street after U.S. Treasury Secretary Scott Bessent characterized the market’s recent slump as healthy. Treasury Secretary Scott Bessent stated on Sunday that he isn’t concerned about the recent market slump that has erased trillions of dollars from equities. “I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said on NBC’s Meet The Press. “I‘m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation, and energy security, the markets will do great.” His remarks dash the hopes of those expecting U.S. President Donald Trump to take steps to mitigate the market impact of his policies. In addition, Bessent said there are “no guarantees” that the U.S. will avoid a recession. Investor focus this week is on the Federal Reserve’s interest rate decision, a raft of U.S. economic data, and earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed sharply higher. Ulta Beauty (ULTA) surged over +13% and was the top percentage gainer on the S&P 500 after the company reported better-than-expected Q4 results. Also, the Magnificent Seven stocks advanced, with Nvidia (NVDA) climbing more than +5% to lead gainers in the Dow and Tesla (TSLA) rising over +3%. In addition, DocuSign (DOCU) gained more than +14% after the electronic signature software company posted upbeat Q4 results and gave a strong full-year billings forecast. On the bearish side, T-Mobile US (TMUS) fell more than -1% after Citigroup downgraded the stock to Neutral from Buy. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index fell to a 2-1/3 year low of 57.9 in March, weaker than expectations of 63.1. Also, the University of Michigan’s U.S. March year-ahead inflation expectations unexpectedly rose to a 2-1/3 year high of 4.9%, higher than expectations of no change at 4.3%, while 5-year implied inflation expectations unexpectedly rose to a 32-year high of 3.9%, stronger than expectations of a decline to 3.4%. Meanwhile, a U.S. government shutdown was averted. The Senate passed a Republican spending plan on Friday by a vote of 54-46 to keep the government funded for the next six months. A White House spokesman said on Saturday that President Trump had signed it into law. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. The decision comes amid growing concerns about the potential damage that President Trump’s tariff policies could inflict on the economy. Market watchers will closely monitor the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC member forecasts regarding the path of interest rates. Economists expect policymakers’ updated projections to indicate two quarter-percentage point cuts this year. “The Fed is in a very tough spot right now, facing a more stagflationary outlook even as core inflation remains well above its medium-term target. Uncertainty around the magnitude, duration, and targets of future tariffs further complicates the monetary policy outlook. They have the potential to roil monetary policy expectations as well as financial markets,” said Scott Anderson, chief U.S. economist at BMO Capital Markets. Market participants will also focus on a spate of economic data releases this week, including U.S. Building Permits (preliminary), Housing Starts, the Export Price Index, the Import Price Index, Industrial Production, Manufacturing Production, Crude Oil Inventories, Current Account, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, Existing Home Sales, and the Conference Board’s Leading Economic Index. In addition, several notable companies like Nike (NKE), Micron Technology (MU), FedEx (FDX), Lennar (LEN), Accenture (ACN), and Carnival Corp. (CCL) are scheduled to release their quarterly results this week. Notably, Nvidia CEO Jensen Huang is set to speak this week at the company’s GPU Technology Conference, commonly known as GTC, at a time when the chipmaker is under market pressure amid the tariff-driven sell-off. Today, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. The reading will show how American consumers have fared amid a wave of headlines about potential tariffs and their impact on inflation. Economists, on average, forecast that February Retail Sales will stand at +0.6% m/m, compared to the January figure of -0.9% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at -0.4% m/m in January. Economists expect the February figure to be +0.3% m/m. The Empire State Manufacturing Index will be released today as well. Economists foresee this figure coming in at -1.90 in March, compared to 5.70 in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.286%, down -0.51%. My bias or lean today is, once again, slightly bullish. Futures are down this morning but I think the bulls from Friday will try to give it the old college try, once again today. I'm going to position our 0DTE slightly bullish out of the gate and then we can adjust as the day goes on if I'm wrong. Trade docket for today: BITO cover, QQQ scalps, 1HTE BTC, SPX 0DTE, Theta fairy after the close. Let's take a look at the intra-day levels: /ES: Very tight range today. 5649 is resistance. 5593 is support. BTC: Bitcoin is in a tight range as well.84,845 is resistance with 82,174 working as support. I look forward to seeing you all in the live trading room shortly. Let's see if we can keep our buying power down and our earnings potential up again!

0 Comments

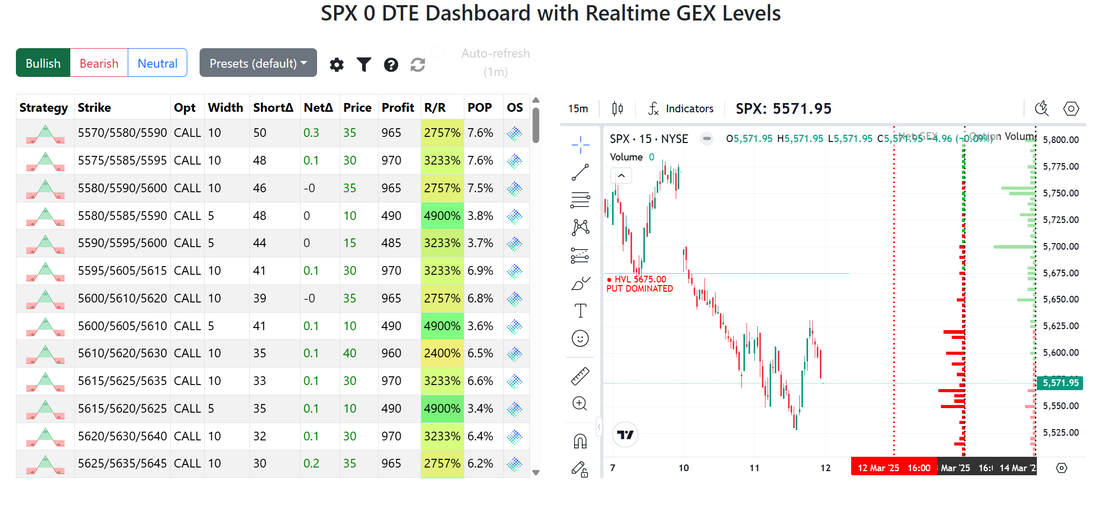

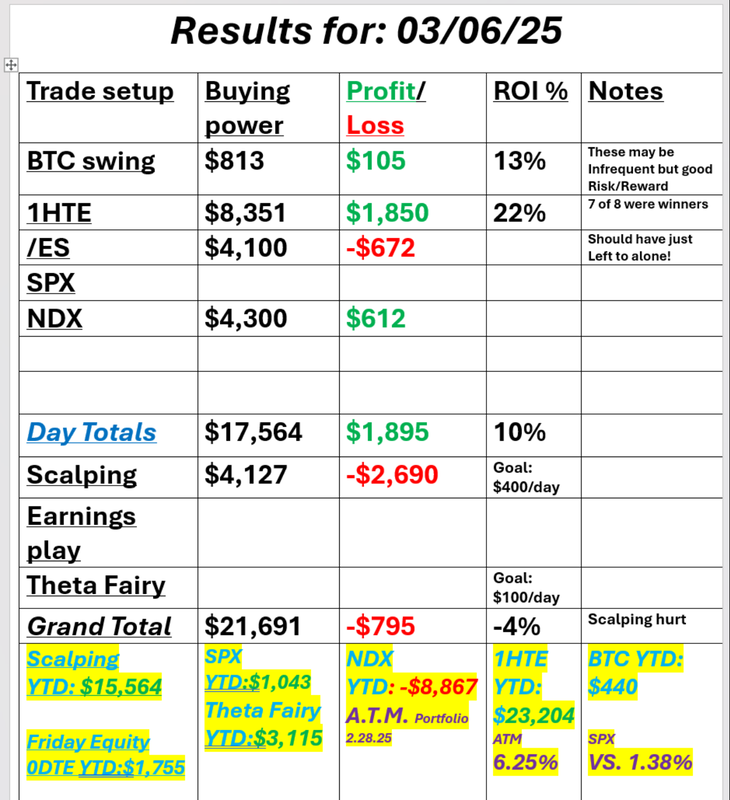

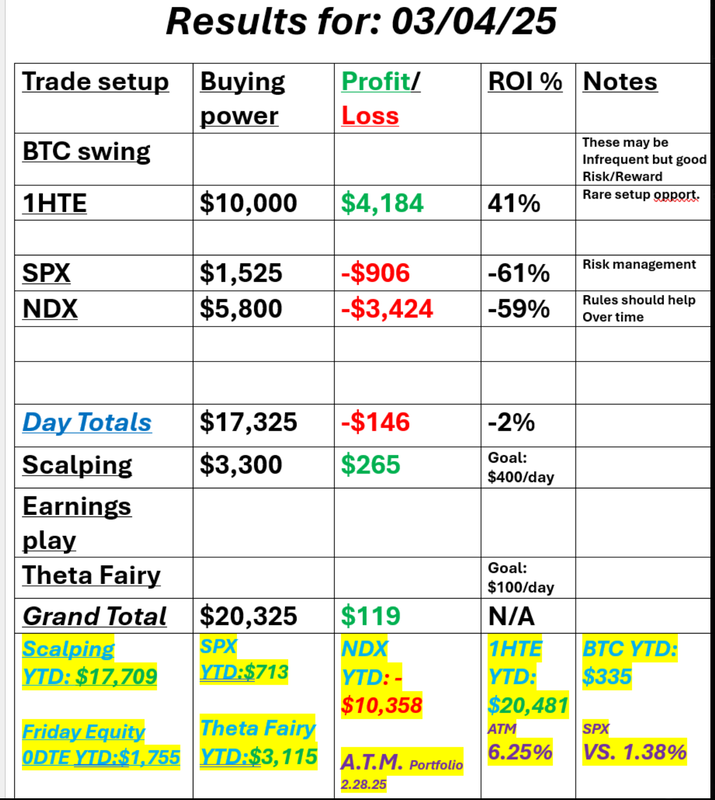

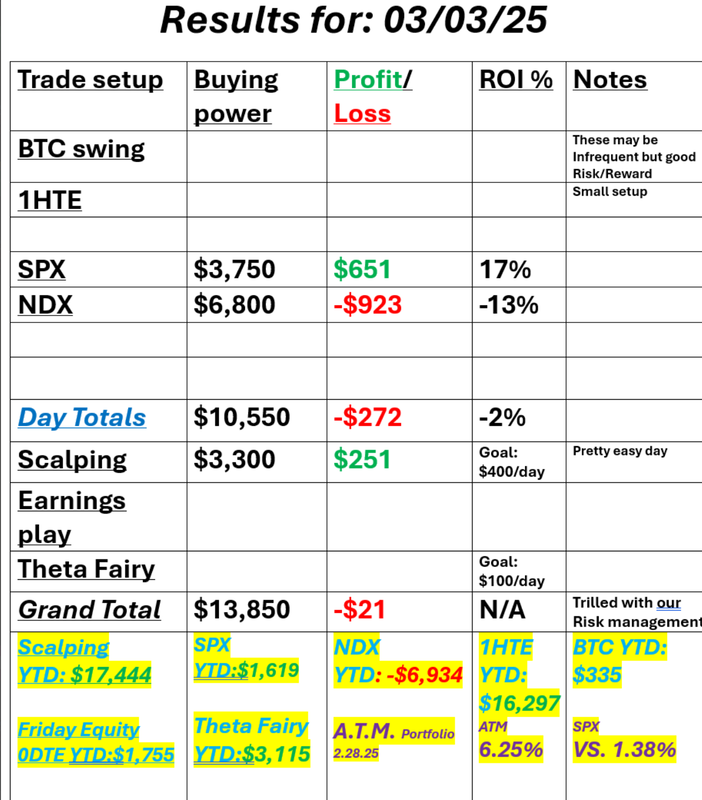

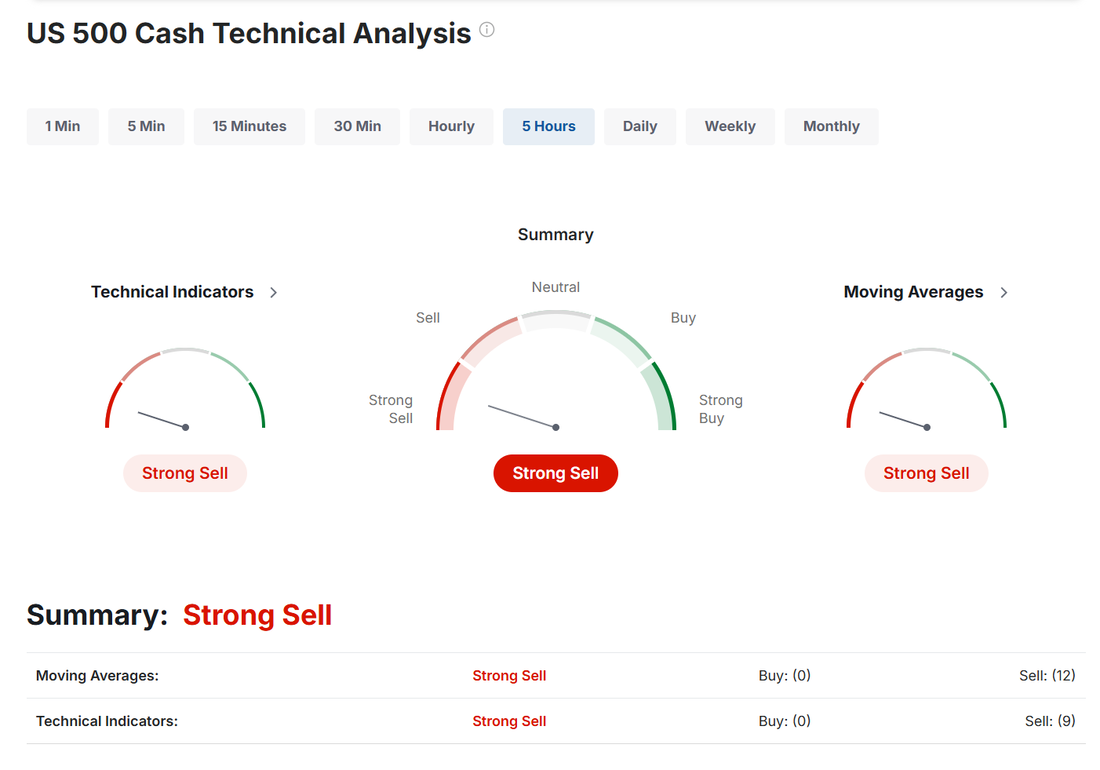

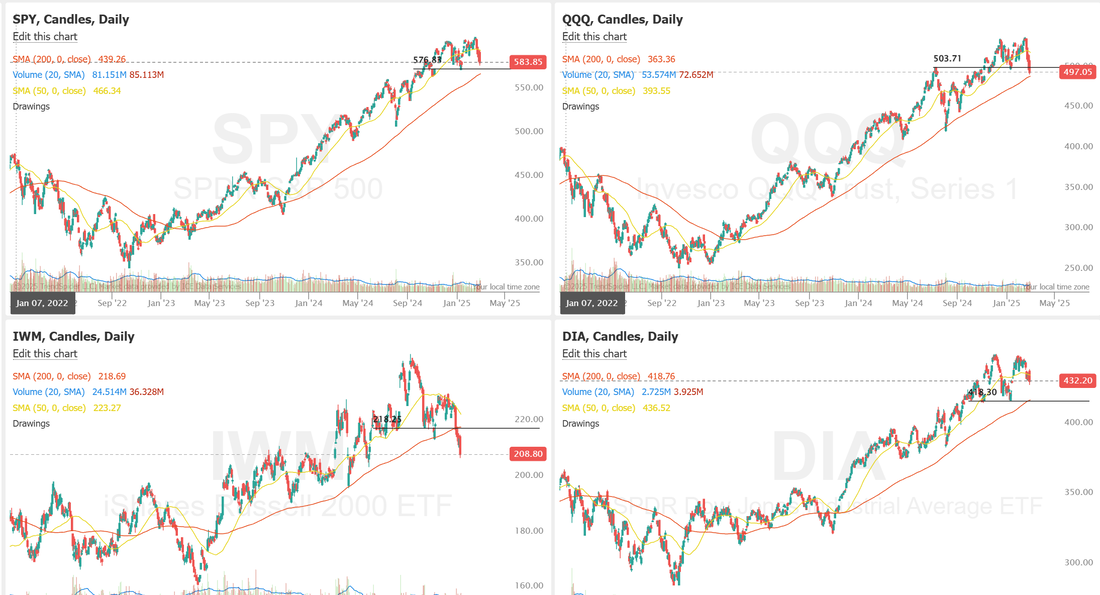

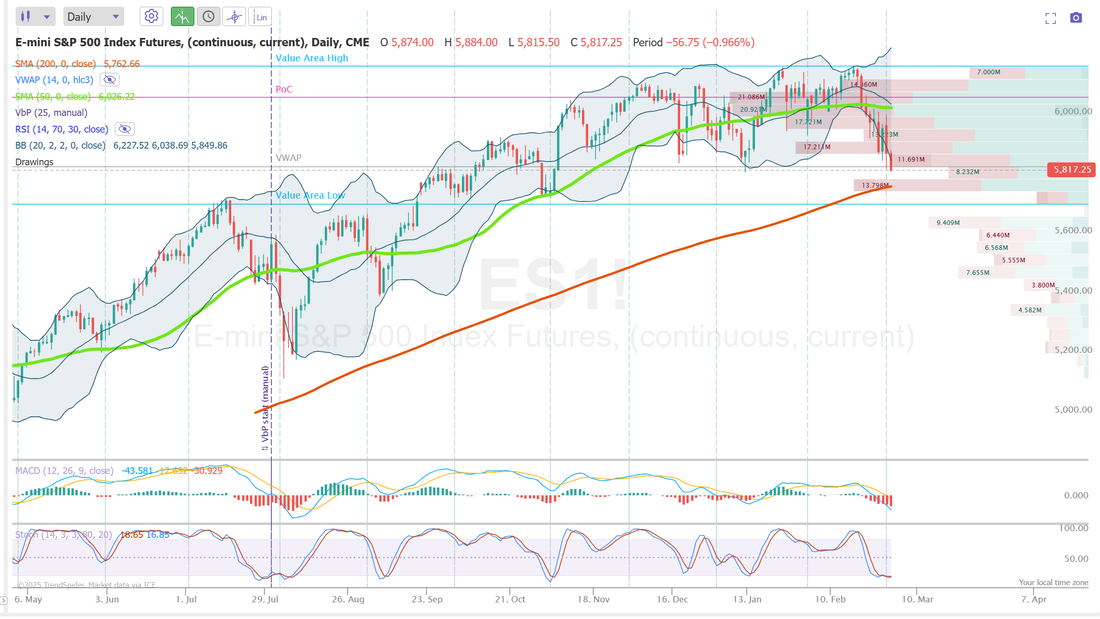

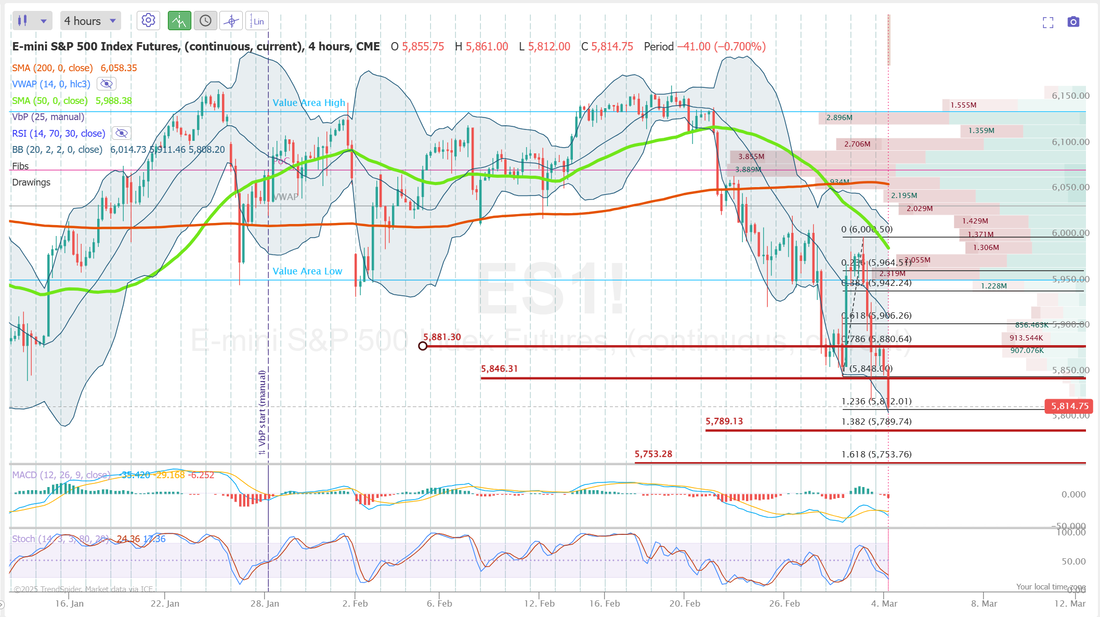

Welcome back to Friday traders! Another week of downward pressure. If it seems everyday is a down day that's because lately it is! This slide started Feb. 19th, almost one full month ago and with very few pauses, it's been straight down. We've gone to some defensive adjustments to our trading. Downsizing our buying power usage and focusing mainly on SPX 0DTE only. It's helped. The last few trading days for us have been pretty easy. Risk management is first priortiy with profits second. The one thing that sometimes gets lost with that approach is that risk management can be expensive. Whether you are using stop losses or adjustments to exit losing positions before they get too big, either way there is a cost attached to that action. It means, while you may not risk losing much, you may also limit your profits. Never the less, that still seems to be the most prudent way to trade in this bearish market. We didn't make much progress yesterday as I took two quick adjustments right out of the gate on SPX which both cost money but...we kept our risk in line. Take a look at our day: Let's take a look at the markets and see if we have a chance for a rebound today. I think we might. Technicals are still bearish but less so than they have been for the last few weeks. The red is still flowing on all the indices but, we are coming into a previous support level. Yes, it was established all the way back in Aug. of last year but it's there. Futures are up this morning as economic, tariff and government shutdown concerns ease. March S&P 500 E-Mini futures (ESH25) are up +0.80%, and March Nasdaq 100 E-Mini futures (NQH25) are up +1.01% this morning as optimism over the likely aversion of a U.S. government shutdown boosted sentiment. A day after stating that Republicans lacked the votes to pass a spending bill to keep the federal government funded through September, Senate Minority Leader Chuck Schumer said Thursday evening that he will support the bill, clearing the path for its passage. “I believe it is my job to make the best choice for the country to minimize the harms to the American people. Therefore, I will vote to keep the government open and not shut it down,” Schumer said on the Senate floor. Avoiding the government shutdown eliminates a source of uncertainty for investors, who are already on edge over U.S. economic growth amid President Donald Trump’s tariff war. In yesterday’s trading session, Wall Street’s major indices closed sharply lower. Adobe (ADBE) plunged over -13% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the software giant issued downbeat FQ2 guidance. Also, the Magnificent Seven stocks retreated, with Meta Platforms (META) sliding more than -4% and Apple (AAPL) falling over -3%. In addition, UiPath (PATH) slumped more than -15% after the software company gave disappointing full-year revenue guidance. On the bullish side, Intel (INTC) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after naming Lip-Bu Tan, the former chief executive of Cadence Design Systems, as its new CEO. Economic data released on Thursday showed that the U.S. producer price index for final demand was unchanged m/m and rose +3.2% y/y in February, weaker than expectations of +0.3% m/m and +3.3% y/y. Also, the core PPI, which excludes volatile food and energy costs, came in at -0.1% m/m and +3.4% y/y in February, weaker than expectations of +0.3% m/m and +3.6% y/y. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -2K to 220K, compared with the 226K expected. “Thursday’s inflation data is backward-looking, and the real worry is the inflationary effects that may come from tariffs, which is a wild card for markets and the Federal Reserve,” said Paul Stanley at Granite Bay Wealth Management. Meanwhile, U.S. rate futures have priced in a 97.0% chance of no rate change and a 3.0% chance of a 25 basis point rate cut at next week’s FOMC meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. The reading is expected to show a further drop in consumer sentiment amid tariff uncertainty and public-sector job cuts. Economists, on average, forecast that the preliminary March figure will stand at 63.1, compared to 64.7 in February. Also, investors and Fed officials will closely monitor the survey’s inflation expectations metrics. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.296%, up +0.47%. My bias or lean today is bullish. "Tariff talk" seems to be having less and less effect on the market. Concern over a Government shutdown had eased. We only have the Michigan sentiment forecast today as our planned news catalyst so I think today can be a building day for bulls. Futures are currently up 50 points on /ES. Trade docket today: ADUS, BITO, BKE, CMPR, WWW, BTC (probably a 0DTE today vs. 1HTE) and SPX 0DTE focus. Let's take a look at some technicals to start our day. /ES: On a bigger picture, we are back to a consolidation zone that started all the way back in July/August of last year. RSI, Stoch. MACD are all flashing oversold. On an intra-day basis futures are up a strong 55 points. 5571 is the first key launching pad with 5610 being the target for today. 5521 is support. BTC: Bitcoin is back to establishing a bullish trend. I'll likely work a 0DTE vs. a 1HTE setup today. 83,558 is first key hurdle to the upside with 84,601 working at the target. 82,028 is support. I'm excited to see what we can produce today with SPX. I think Broken wing butterflies will give us the best risk/reward setups for today. See you all in the live trading room shortly!

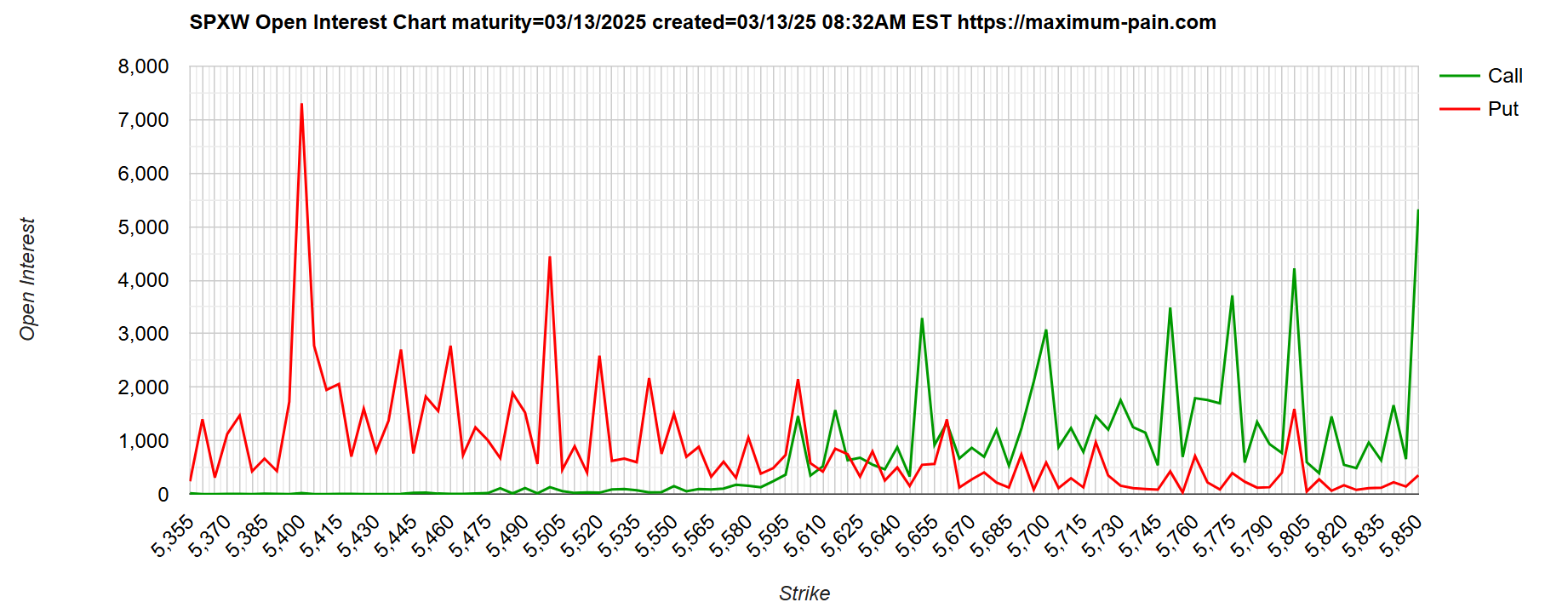

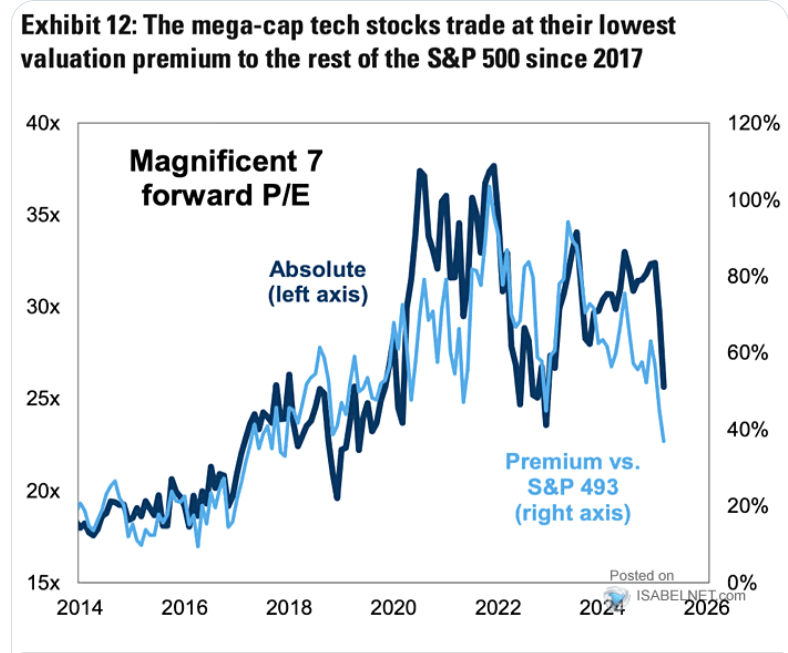

Good Thursday morning to you all! I'm just sitting here in my trading office a few hours before the cash market, listening to my tickstrike (audible order flow). It's usually pretty quite pre-market. Currently is sounds like a rapid-fire machine gun! A big buy order, then a bigger sell order. Back and forth. This is a market that defines the word erratic. In a market like this our goal yesterday was to reduce our buying power committed to trades. Enhance the risk/reward ratio. Make the setups more flexible so adjustments would (hopefully) not be needed. All those things are possible BUT, they almost always result in less potential profit. I was really happy with our results from yesterday. It seems like it's been a while since I've been able to say that. We did hit our daily goal of $1,000+ profit but more importantly we had trades that allowed us to sit back and relax. I wasn't totally happy with the structure of our SPX 0DTE yesterday but it's very close to what we are looking for. Something that gives us some protection against the big moves. Another area that was intersting was our 1HTE's on BTC. We did six of these trades yesterday and the biggest one we put on was a whopping $100 dollars. The lowest ROI potential on these was 20% with the highest 102%. These were very low probability, high profit potential setups. One common complaint you'll hear from traders about certain setups or strategies is, "the risk is too high". Remember, it's the trader that determines the risk. Not the setup. These trades are fantastic from the standpoint that you could do a $2 dollar trade if you wanted. Here's our results from yesterday: We are going to follow the same approach today, and for the foreseeable future. Scale down the number of trades. Scale down the buying power usage. Focus on thats that have a high level of "protection" built in. Understanding that their is usually a cost associatied with that which should lower our ROI potential. Light and focused docket once again today: We'll work to get our equity 0DTE for tomorrow setup today before the close. I believe we'll be going with GRPN this week. FSLR may either be in a take profit zone or due for an adjustment. QQQ scalping continues. We'll look to add the 0DTE portion back in today. SPY 0DTE continues and we'll focus once again on SPX 0DTE today vs. the NDX. Let's take a look at the markets: Markets tried to stabilize yesterday but the price action was all over the map. There may be several bullish days in the near future but until we get back above the 200DMA its not going to be a pretty picture. Technicals certainly tried to get a little better but yesterday really didn't do much to change the bearish outlook. March S&P 500 E-Mini futures (ESH25) are up +0.02%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.08% this morning as market participants look ahead to the release of crucial producer inflation data. Stock futures initially moved sharply lower on concerns about whether Washington lawmakers will avert a government shutdown this weekend. Senate Democratic leader Chuck Schumer stated his party would block a Republican spending bill to prevent a government shutdown on Saturday and called on the GOP to accept a Democratic proposal to extend funding through April 11th instead. The impending shutdown adds another layer of concern for investors already grappling with a rising unemployment rate, federal workforce reductions, and U.S. President Donald Trump’s tariff war. In yesterday’s trading session, Wall Street’s major indexes closed mixed. The Magnificent Seven stocks climbed, with Tesla (TSLA) surging over +7% to lead gainers in the S&P 500 and Nasdaq 100 and Nvidia (NVDA) advancing more than +6% to lead gainers in the Dow. Also, Intel (INTC) rose over +4% after Reuters reported that TSMC pitched chip designers Nvidia, Advanced Micro Devices, and Broadcom about acquiring stakes in a joint venture that would operate Intel’s factories. In addition, Groupon (GRPN) jumped more than +43% after the e-commerce company issued above-consensus FY25 revenue guidance. On the bearish side, Brown-Forman (BF.B) slumped over -5% after the European Union launched counter-tariffs against U.S. goods. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices rose +0.2% m/m in February, better than expectations of +0.3% m/m. On an annual basis, headline inflation eased to +2.8% in February from +3.0% in January, better than expectations of +2.9%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.2% m/m and +3.1% y/y in February, weaker than expectations of +0.3% m/m and +3.2% y/y. “[Yesterday’s] cooler-than-expected CPI reading was a breath of fresh air, but no one should expect the Fed to start cutting rates immediately. The Fed has adopted a wait-and-see posture, and given the uncertainty of how trade and immigration policy will impact the economy, they’re going to want to see more than one month of friendly inflation data,” said Ellen Zentner at Morgan Stanley Wealth Management. Meanwhile, U.S. rate futures have priced in a 97.0% probability of no rate change and a 3.0% chance of a 25 basis point rate cut at next week’s central bank meeting. On the earnings front, notable companies like DocuSign (DOCU), Dollar General (DG), and Ulta Beauty (ULTA) are slated to release their quarterly results today. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. February PPI will come in at +0.3% m/m and +3.3% y/y, compared to the previous figures of +0.4% m/m and +3.5% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect February figures to be +0.3% m/m and +3.6% y/y, matching January’s numbers. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 226K, compared to 221K last week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.331%, up +0.35%. There is a lot of open interest targeting the 5655 level on SPX Is there value now in the Mag seven? The Magnificent Seven stocks are trading at their lowest valuation premium relative to the rest of the S&P 500 since 2017, with a collective P/E ratio of 26x, the lowest level since early 2023 The recent market SELL-OFF was driven by hedge funds: Hedge funds sold global equities at the fastest rate in 4 YEARS on Friday and Monday. This has even surpassed the August 2024 flash-crash and the 2022 Bear Market. Notably, US stocks saw the sharpest de-risking. Institutional investors dumping of US stocks have been absolutely MASSIVE. Given the selling has been so wild, is this a time for a short-term pause? My lean or bias today in Neutral. The bulls have been trying the last couple of days but the technicals are just too ugly. We could have a massive up day today as still not fundamentally change the technical outlook. I think today looks a lot like yesterday. Lots of chop and erratic moves. Let's take a look at the intra-day levels on SPX and BTC since those will be our focus for today. /ES: 5634 is the first target for resistance with 5673 next. 5557 is support and oh it's a big one! This has been holding for the last three days. It needs to hold again today if the bulls have any shot of turning this ship around. A drop below this level will result in more selling. BTC: We didn't get any clean setups yesterday for our 1HTE trade so we traded small (like 20 dollar trade size small) and often. It worked well for us. It doesn't look like we'll get any better setups today so probably the same approach. Low probability of success trades with high ROI potentials and small trade size. 84,665 is resistance with 82,570 working as support. We may do more of the "range" rather than "directional" setups today. I look forward to seeing you all on zoom shortly!

Welcome to Weds. traders. We had an SPX roll working yesterday that had a nice profit zone both up and down and yeah...we couldn't catch either! The market it tricky right now, to say the least. Our 1HTE BTC trades and scalping continue to work and we'll work those again today but our 0DTE will be mostly Butterfly focused. It's about the best risk/reward right now in this crazy market. We are also working on adding the GEX data that we use to the member website so you can see all the data for yourself. More on that in a minute. Here's our results from yesterday. GEX levels may be one of the most helpful data points for 0DTE traders. If you're not familiar with GEX here's a quick rundown. A "gex level" refers to the "Gamma Exposure Level," which is a measure in options trading that indicates the potential for price movement based on the collective options positions held by market participants, essentially showing how much market makers need to hedge their positions if the underlying asset price shifts slightly; a high GEX level suggests significant potential for price volatility due to hedging activity. Key points about GEX levels:

We use these data points to find levels to set trades at. This is what it looks like. Over the next few weeks we'll be conducting some trainings on how to read the data and how to access it. I think this will be a nice addition and value add to our trading members. Let's take a look at the markets. Probably not a surprise that the technicals are still bearish. Even the last holdout, the DIA is now down below it's 200DMA. I also want to do a review today of the non-equity investment alternatives that we've talked about before but it's been a while: We'll touch on each of these in the zoom today. Rally Rd. MasterWorks Groundfloor Watchrading Academy Kalshi Real Estate fractional investing. March S&P 500 E-Mini futures (ESH25) are trending up +0.56% this morning as investors gear up for the release of crucial U.S. inflation data. Stock futures got a boost after U.S. President Donald Trump stated he doesn’t see a U.S. recession. “I don’t see it at all. I think this country’s going to boom,” he said late Tuesday at the White House. Also, Bloomberg reported that President Trump told top executives at a Business Roundtable meeting on Tuesday that he is prioritizing rapid approvals, particularly for environmental regulations, and plans to announce a major electricity project soon. He also reiterated the idea that a company’s business taxes could be lowered if it produced its goods in the U.S. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. Teradyne (TER) plunged over -17% and was the top percentage loser on the S&P 500 after the company said it expects FQ2 revenue to be flat to down -10% q/q. Also, chip stocks retreated, with GlobalFoundries (GFS) sliding more than -6% to lead losers in the Nasdaq 100 and Texas Instruments (TXN) falling over -4%. In addition, Verizon Communications (VZ) slumped more than -6% and was the top percentage loser on the Dow after the company’s chief revenue officer said Q1 is “challenging” from a competitive intensity standpoint. On the bullish side, Southwest Airlines (LUV) climbed over +8% after the airline announced plans to charge non-preferred customers for their first and second checked bags. Tuesday’s U.S. economic data showed strength in the labor market, offering some support to equities. The JOLTs job openings rose to 7.740M in January, stronger than expectations of 7.650M. “Even if the majority of this drawdown is potentially behind us, volatility may not be, and there’s a good chance the market could chop sideways for a while,” said Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team. Meanwhile, Trump’s tariff policy, geopolitical shifts surrounding Ukraine, sticky inflation, and uncertainty over the pace of the Federal Reserve’s interest-rate cuts have dampened market sentiment this year, bringing U.S. equities close to a correction. Goldman Sachs has become the latest major bank to adjust its forecast for the U.S. equity benchmark amid rising policy uncertainty and growing concerns over the world’s largest economy, cutting its year-end target for the S&P 500 Index to 6,200 from 6,500. President Trump’s 25% tariffs on steel and aluminum imports took effect today following a turbulent day at the White House, when he threatened to raise the metals tariffs on Canada to 50%. The president backed off after Ontario agreed to abandon plans for a surcharge on electricity exports to the U.S. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. February CPI will come in at +0.3% m/m and +2.9% y/y, compared to the previous numbers of +0.5% m/m and +3.0% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.2% y/y in February, compared to January’s figures of +0.4% m/m and +3.3% y/y. “It feels that this could be a lose-lose situation. A higher-than-expected reading could fuel the stagflation narrative while a weaker-than-expected print could cement recession fears,” said Julien Lafargue, chief market strategist at Barclays Private Bank. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ1 earnings results today. U.S. rate futures have priced in a 97.0% chance of no rate change and a 3.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.275%, down -0.30%. CPI is the big planned news catalyst today. It cam in below forecast so the futures are benefitting. My lean or bias today is bullish. Futures are up. CPI is tame. We've had some big moves to the downside for a while now. I think we are finally due an up day. Trade docket for today: ADUS, BKE, CMPR, QQQ scalping continues, WWW, 1HTE BTC, 0DTE SPX/NDX butterflies, SPY zebra. Let's take a look at the intra-day levels as they've changed with this mornings futures moves. /ES: Levels are particularly wide right now. That means a lot of movement could happen and we just chock it up to meaningless chop. 5673 is resistance with 5578 working as support. /NQ: Levels are a tad bit tighter than /ES. 19,854 is resistance with 19,469 working as support. BTC: 85,520 is current resistance with 82,042 working as support. I'm looking forward to a more "stress free" day in the trading room! See you all inside shortly.

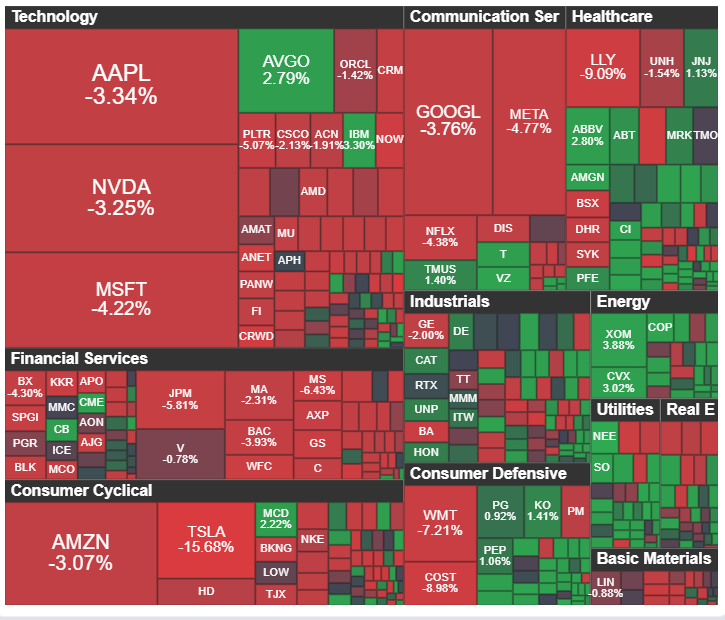

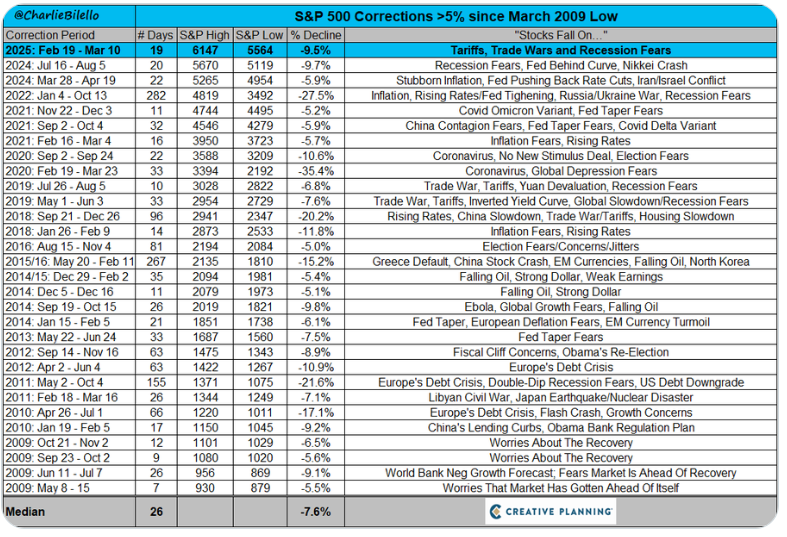

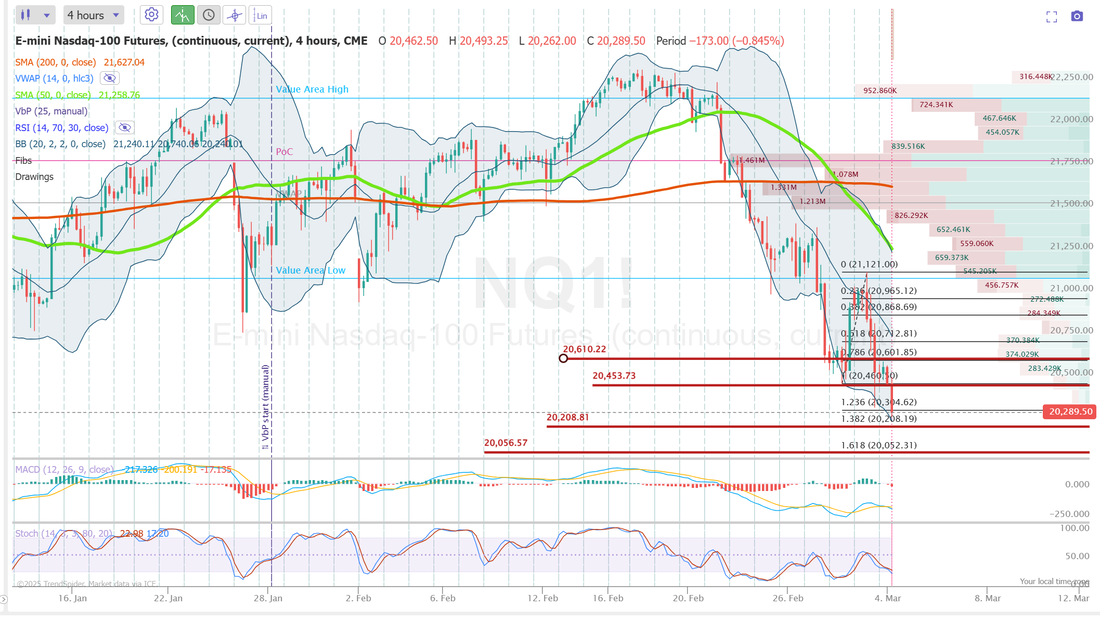

Welcome back traders! Quite the day yesterday. The biggest down day for the NDX in five years. All the major indices are negative for the year. What leads us up is usually what leads us down. Tech got clobbered. For the week it's energy that has the strength. We had a tough day, like a lot of traders yesterday but it could have been much worse. I had to scale three times into our BTC 0DTE to get it back, close to a break even. We squeaked out a small profit on our SPX late in the day but rolled a big part of it to today. It will be a great recovery IF...we get a rebound today. We'll focus on working that trade today. Probably no surprise, the technicals are bearish. The selloff yesterday pushed us closer to a bonifide bear market (down 10%+) but it also pushed us into oversold territory on the technicals. Even if we are entering a bear market, which looks more and more likely, it's typical to get a rebound today. That's the way we are playing it at the open, at least with our bullish SPX debit setup. March S&P 500 E-Mini futures (ESH25) are up +0.41%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.53% this morning, pointing to a higher open on Wall Street after yesterday’s dramatic selloff, while investors await the latest reading on U.S. job openings. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply lower, with the S&P 500, Dow, and Nasdaq 100 posting 5-3/4 month lows. The Magnificent Seven stocks sank, with Tesla (TSLA) tumbling over -15% to lead losers in the S&P 500 and Nvidia (NVDA) sliding more than -5% to lead losers in the Dow. Also, cryptocurrency-exposed stocks slumped after the price of Bitcoin dropped more than -8%, with MicroStrategy (MSTR) plunging over -16% to lead losers in the Nasdaq 100. In addition, Rocket Cos. (RKT) cratered more than -15% after agreeing to buy Redfin in a deal valued at $1.75 billion. On the bullish side, Regeneron Pharmaceuticals (REGN) climbed over +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing positive results from a late-stage trial of its Dupixent treatment. “There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs. Until there’s more clarity on trade policy, traders and investors should anticipate continued volatility,” said Chris Larkin at E*Trade from Morgan Stanley. Speculation is growing that U.S. President Donald Trump is prepared to endure economic and market hardship in pursuit of long-term goals involving tariffs and smaller government. President Trump said Sunday on the Fox News show “Sunday Morning Futures” that the U.S. economy was undergoing “a period of transition” and declined to rule out the possibility that his policies would cause a recession. Meanwhile, investors are growing increasingly anxious due to whipsawing tariff policy, with 25% tariffs on U.S. imports of steel and aluminum set to take effect on Wednesday. The levies, imposed by President Trump in February, include imports from Canada and Mexico, both major foreign suppliers, and extend to finished metal products as well. Market watchers are keenly awaiting the U.S. consumer inflation report for February, scheduled for release on Wednesday. The CPI is expected to ease slightly to +2.9% y/y from +3.0% y/y in January, while the core CPI is expected to ease to +3.2% y/y from +3.3% y/y in January. However, the data’s impact on U.S. rate-cut expectations might be limited due to increasing worries about the effects of Trump’s policies, particularly tariffs, on the economy. U.S. rate futures have priced in a 95.0% probability of no rate change and a 5.0% chance of a 25 basis point rate cut at the upcoming monetary policy meeting. Today, all eyes are focused on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the January JOLTs Job Openings will arrive at 7.650M, compared to the December figure of 7.600M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.207%, down -0.14%. My bias or lean today is slightly bullish. As I mentioned, even if we are entering a solid bear market, we usually get a bit of a retrace after a day like yesterday. We have the JOLTS numbers out this morning as the main economic catalyst so that could sway the futures market a bit, other wise I think we head higher. That being said, big picture, it doesn't look pretty. All the indices are now below their 200DMA with the exception of DIA which is just hanging on.  The S&P 500 has now fallen over 9% from its peak on February 19, the biggest pullback since last August. This is the 30th correction >5% off of a high since the March 2009 low. They all seemed like the end of the world at the time but it's always recovered. This is truly UNPRECEDENTED: US total put options volume hit over 30 million contracts over the last 5 trading days, the most EVER. Moreover, the S&P 500 ETF, $SPY, put options volume hit the 3rd highest on record last Tuesday. Is the panic just starting or nearly over? Very simple trade docket today; BITO cover for our swing trade. F, FSLR?, 1HTE (BTC), SPX (main focus) QTTB?. Let's take a look at the intra-day levels to see what's changed. /ES: Most of the levels from yesterday are still in play. We have established new support levels. The two key levels for me today are 5673 as resistance and 5559 as support. /NQ: 19,579 is near resistance. If we can break that the next level is all the way up at 19,854. Support is at 19,122. BTC: We've got a bit of stabilization happening. 84,120 is resistance with 78,419 first support and 76,837 acting as secondary support. Let's focus our efforts on our SPX roll today. If we can get a profitable exit on it by the close of business today it will be like yesterday never happened. See you all in the trading room shortly.

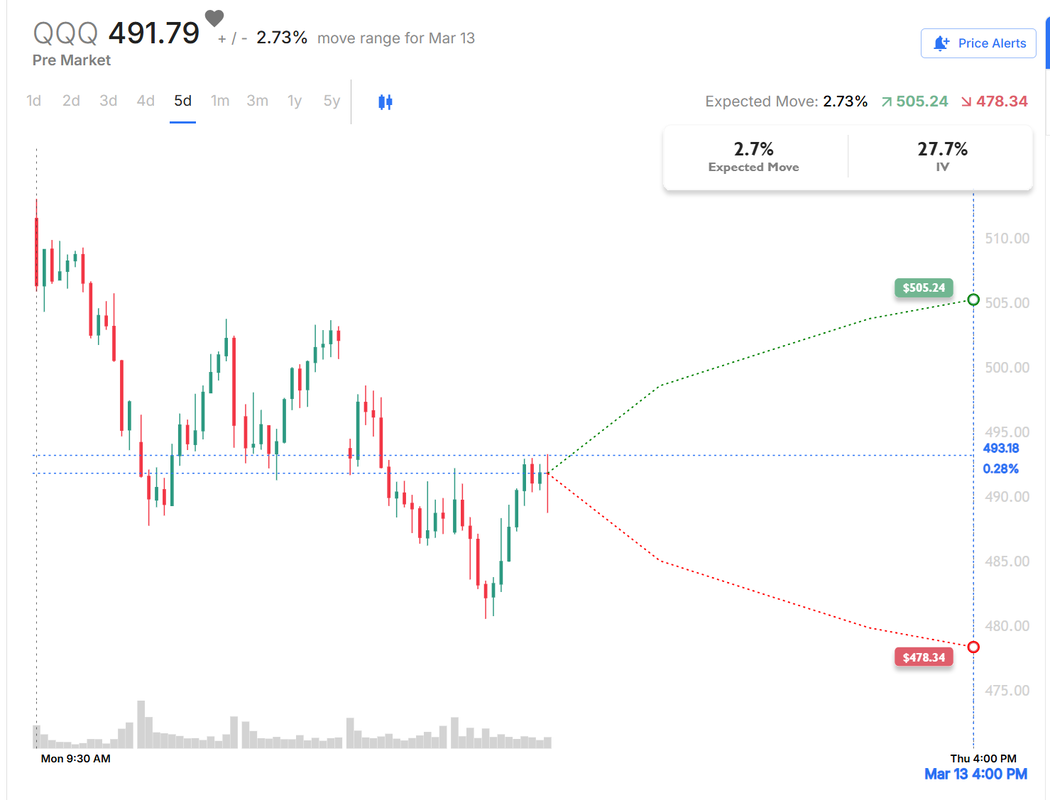

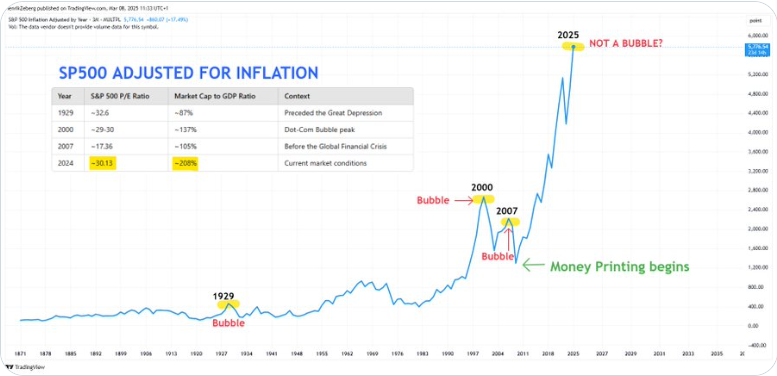

Welcome back traders. What a tough week last week. SPX recorded it's worst week in three months. The NDX fell below its 200DMA for the first time in nearly 500 trading days. My results were mixed Friday. Our long vol /ES would have hit for a profit if I would have just let the darn thing work. Here's a look at our day. Our 1HTE's on Bitcoin continue to produce for us. In a market like this it's nice to have something that diversifys you. I'll work up a detailed review of our 1HTE results from Friday for tomorrows blog. I want to talk about "playing with house money" which is what we did most of the day on Friday. Let's take a look at the markets: 200DMA is the word of the day. The IWM is already through it and has been for a while but the other major indices are still clinging on. Futures are down heavy this morning. Is today the day that we lose the 200DMA or do the bulls finally make a stand? Todays results could be a big determining factor for the next big directional move. Probably no big surprise that technicals are still in a sell mode setup. After a bearish week, SPY tested its 50-week simple moving average for the first time since October 2023 and closed at $575.92 (-3.02%). While price action remains pressured, our custom RSI ensemble indicator shows a slightly oversold reading for the first time since April 2024, when SPY formed a multi-month low. This suggests that oversold conditions across multiple timeframes may be setting the stage for a potential short-term rebound. QQQ briefly broke below its 50-week simple moving average this week but managed to bounce back, closing at $491.79 (-3.21%). This level is crucial as it marked the low of the August 5th carry trade crash. At its lowest, QQQ had fallen just over 11% from its recent peak, briefly entering official correction territory, but a late-week recovery kept it above the 10% threshold. With the same slightly oversold RSI ensemble reading as SPY, traders are left wondering if this is a bottom or the start of a long-term downtrend. IWM took the hardest hit among the major index ETFs this week, closing at $205.95 (-4.04%). Unlike SPY and QQQ, it started the week already below its 50-week simple moving average, signaling continued weakness. Our RSI ensemble indicator has been flashing oversold conditions for two consecutive weeks, yet buyers are attempting to defend a key high-volume node on the volume profile. I.V. is back! When is the last time you saw an expected weekly move above 2% for SPY? S&P 500 recorded the WORST week in 3 months. Tariff headlines, US economic uncertainty, rising bond yields globally, particularly in Germany and Japan, were behind the last week’s volatility. Meanwhile, Gold and Silver continue to outperform. This is the SP500 adjusted for inflation. A tad bit worrysome I'd say. Trade docket for today will try to focus on non-equity correlated setups. Working our weekly Bond (/ZN) trade as well as Gold (/GC) and back on the DIA after a losing week last week. BITO, GE, FRT, CPAY, TJX short additions to our pairs trades along with 1HTE and 0DTE's. Scalping will focus on the /MNQ today. My bias or lean today is bearish (big stretch, I know) with a focus on the 200DMA. Either we hold or lose that level today and that may be what determines the near term direction for the week. Let's look at the levels we are working with today: /ES: Futures have lost the 200DMA as I type. Intra-day I'm looking at the 5747 then 5790 as resistance. 5674, 5646 as support. /NQ: Futures have the Nasdaq below the 200DMA as well. /NQ intra-day. 20,088 and 20,286 is resistance with 19,765 and 19,650 working as support. BTC: Getting smacked down...again. 84,418 and 87,188 working as support. 80,290 is current support. One of the biggest purported advantages of day trading is that you start out each day in cash. It's nice to be in that position as we start another day that looks tough for the bulls. Let's be patient with our entries today. See you all in the live trading room shortly!

Welcome back traders! What a day yesterday. Premium is back! We made $500 dollars on one NDX contract with 20 min. to go in the day with a 220 point safety margin. It wasn't a layup because, as you know, that simply doesn't exsist in trading but it was about as close as you could get to free money. We'll be working the same approach today. We've got our /ES 0DTE already started and we'll trade around it today then pounce on the NDX near the close. Here's our results from yesterday. Pretty impressive profit for such low capital outlay. Blog is short and sweet today. We've got our /ES 0DTE that we'll be working today (see below) And then we have our Gold trade, Bond trade, DIA trade and Bitcoin trade all expiring today. Anyone of those may need attention before the close. /ES 0DTE, /GC, /ZN, BITO, DIA, 1HTE, NDX 0DTE in focus for today. March S&P 500 E-Mini futures (ESH25) are trending up +0.35% this morning as investors look ahead to the all-important U.S. payrolls report and remarks from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s major indices closed lower. Palantir Technologies (PLTR) slumped over -10% and was the top percentage loser on the S&P 500 amid signs of insider selling after an SEC filing revealed that director Alexander Moore sold $1.74 million worth of shares on Monday. Also, MongoDB (MDB) plunged more than -26% and was the top percentage loser on the Nasdaq 100 after the company issued below-consensus FY26 guidance. In addition, Marvell Technology (MRVL) tumbled over -19% after the semiconductor company’s Q1 revenue forecast failed to meet investors’ lofty expectations. On the bullish side, Zscaler (ZS) rose more than +2% after the cybersecurity firm posted upbeat FQ2 results and raised its full-year guidance. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -21K to 221K, compared with the 234K expected. Also, U.S. Q4 nonfarm productivity was revised higher to +1.5% q/q from +1.2% q/q, while unit labor costs were revised downward to +2.2% q/q from +3.0% q/q. In addition, the U.S. trade deficit was a record -$131.40B in January, wider than expectations of -$128.30B. Philadelphia Fed President Patrick Harker stated on Thursday that risks to the economy are increasing as businesses and consumers grow more cautious and inflationary pressures mount. Harker added that he is increasingly worried that the decline in price growth “is at risk.” Also, Atlanta Fed President Raphael Bostic said it may take several months to gauge the impact of President Trump’s policies and other factors on the economy, indicating that officials might keep rates steady until at least late spring. At the same time, Fed Governor Christopher Waller stated that he would not back a rate cut in March but sees the potential for two or possibly three reductions this year. U.S. rate futures have priced in a 91.0% probability of no rate change and a 9.0% chance of a 25 basis point rate cut at the next central bank meeting later this month. Meanwhile, Fed Chair Jerome Powell is set to deliver a keynote speech on the economic outlook at an event in New York hosted by the University of Chicago Booth School of Business later today. Also, Fed Governor Michelle Bowman, New York Fed President John Williams, and Fed Governor Adriana Kugler will speak today. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that February Nonfarm Payrolls will come in at 159K, compared to January’s figure of 143K. A survey conducted by 22V Research showed that 53% of respondents expect key U.S. jobs data to be “risk-off,” 28% “risk-on,” and 19% “mixed/negligible.” “Investors have turned their focus back to Payrolls this month after being more focused on average hourly earnings last month,” said Dennis DeBusschere, founder of 22V. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect February figures to be +0.3% m/m and +4.1% y/y, compared to the previous numbers of +0.5% m/m and +4.1% y/y. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will remain steady at 4.0% in February. U.S. Consumer Credit data will be released today as well. Economists expect this figure to be $15.60B in January, compared to the previous figure of $40.85B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.266%, down -0.37%. NFP is the big catalyst today. No lean or bias for me. No levels yet. We'll post them for you in discord as the day reacts to NFP. I'm hoping we can get multiple 1HTE's on today! See you all in the trading room shortly!

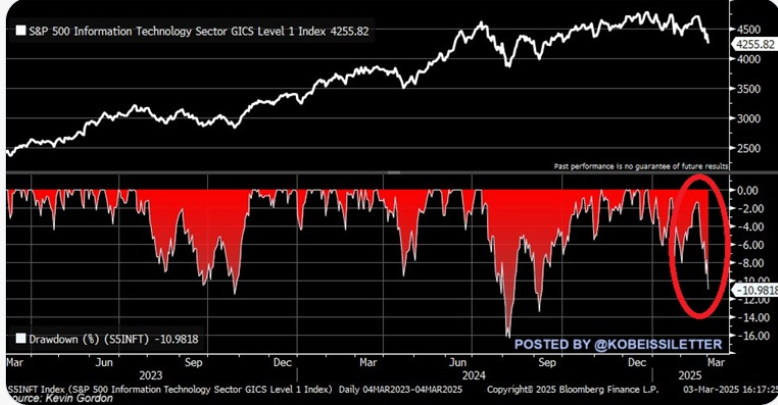

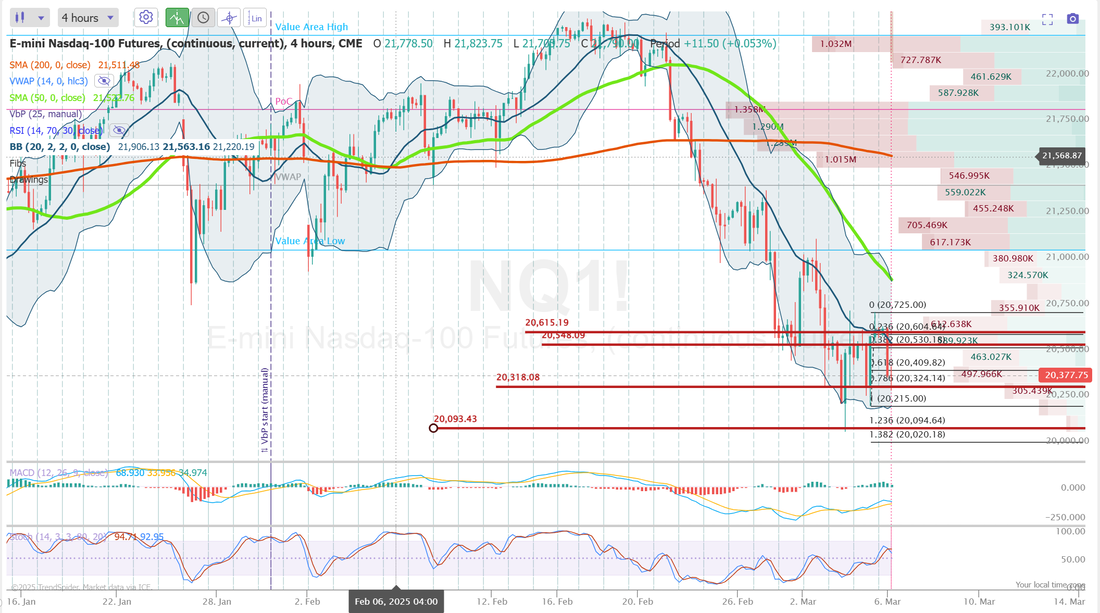

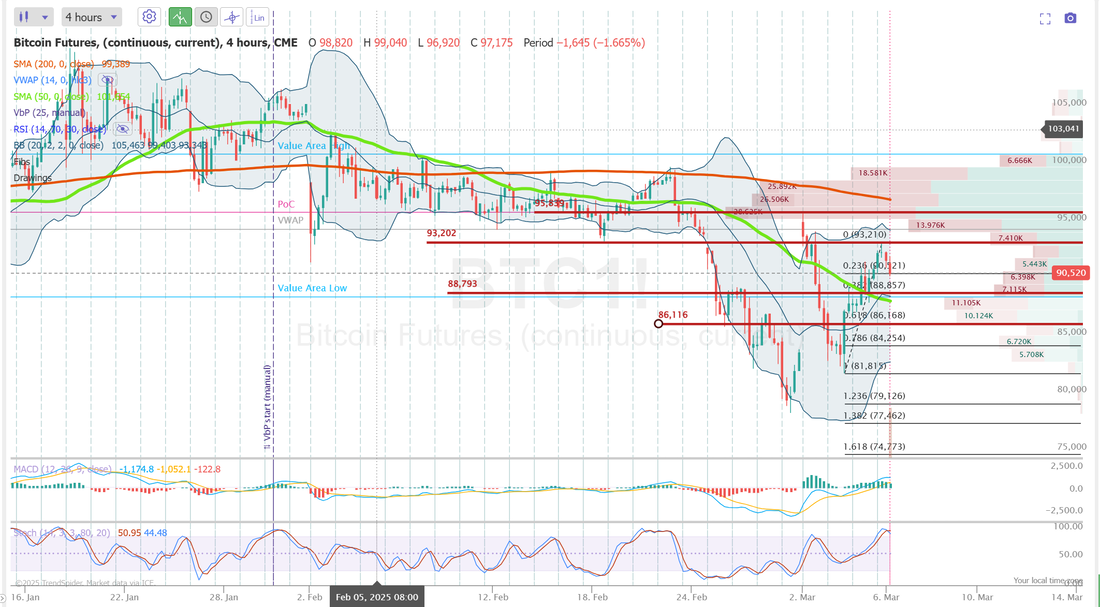

Welcome back traders! Yesterday was a solid day for us. Risk management took center stage again. We downsized our trades. Waiting until almost after the half day point and adjusted our losers quickly. I'm seeing a lot of frustrated traders out there this week. It's certainly been an unpredictable trading enviroment. One thing I might suggest is to not just scale down your size but also the number of trades you're doing. I got this email from my performance coach this morning. The question was, "Shouldn't I trade a lot to let the law of large numbers work and get good diversification?" Her anwser was, "Simplify in tough times" See the diagram below: The mental cost of focusing on too many setups in a market like this can drain your sharpness. We did that yesterday. We downsized our trades, Cut our position sizing and focused on risk management. We cut our losers quickly and didn't over positon-size on the adjustments. It meant not make money on our NDX but the result was gratifying with all the swings. Our main focus yesterday was to sit on our hands for the entire first half of the day. You know the only thing that would have been better? Sitting on our hands even longer! It was a good day overall. We didn't hit our $1,000/day income goal but in this market I'll take any day that is green. See our results below: Let's take another look at the markets. We are at such key levels. I think the next week could bring some big moves. It looked late yesterday like the bulls may be making a come back. Not so fast! /NQ futures are down -330 points as I type this. It looks like another interesting day in store for us. The day was actually very contructive for the bulls. The 200DMA's worked as they should and provided a good back stop for more bearish action. Will that be the case again today? It certainly looks like that could be put to the test. March S&P 500 E-Mini futures (ESH25) are down -0.92%, and March Nasdaq 100 E-Mini futures (NQH25) are down -1.14% this morning as higher Treasury yields, trade war worries, and disappointing tech earnings weighed on sentiment. Marvell Technology (MRVL) plunged over -16% in pre-market trading after the semiconductor company gave a Q1 revenue forecast that fell short of the highest estimates. Also, MongoDB (MDB) tumbled more than -17% in pre-market trading after the company issued below-consensus FY26 guidance. In addition, chip stocks fell in pre-market trading after Alibaba Group unveiled its latest DeepSeek competitor at a significantly lower price. Investors now await a new round of U.S. economic data and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Moderna (MRNA) surged over +15% and was the top percentage gainer on the S&P 500 after announcing plans to launch a personalized cancer vaccine by 2027, which could represent a “quite large” revenue opportunity. Also, automobile stocks advanced after U.S. President Donald Trump gave automakers a one-month exemption from his 25% tariffs on Canada and Mexico, with General Motors (GM) climbing more than +7% and Ford Motor (F) gaining over +5%. In addition, Palantir Technologies (PLTR) rose more than +6% after William Blair upgraded the stock to Market Perform from Underperform. On the bearish side, CrowdStrike Holdings (CRWD) slid over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the cybersecurity company issued disappointing FY26 adjusted EPS guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 77K in February, well below the consensus estimate of 141K and the smallest increase in 7 months. At the same time, the U.S. ISM services index unexpectedly rose to 53.5 in February, stronger than expectations of 52.5. Also, the final estimate of the U.S. February S&P Global services PMI was revised higher to 51.0 from the 49.7 preliminary reading. In addition, U.S. factory orders rose +1.7% m/m in January, in line with expectations and the largest increase in 6 months. Chris Larkin at E*Trade from Morgan Stanley said that Wednesday’s jobs data isn’t “necessarily a reliable guide to what the monthly jobs report will reveal, but after last week’s jobless claims increase, [yesterday’s] miss isn’t going to ease any concerns about a softening economy.” Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity increased “slightly” since mid-January, though businesses nationwide expressed uncertainty about new policies from the Trump administration, especially regarding tariffs. Prices rose “moderately” across most regions, with several areas noting faster price increases compared to the prior period. Looking forward, firms across the country “expected potential tariffs on inputs would lead them to raise prices, with isolated reports of firms raising prices preemptively.” “Consumer spending was lower on balance, with reports of solid demand for essential goods mixed with increased price sensitivity for discretionary items, particularly among lower-income shoppers,” according to the Beige Book. The report also said that employment edged slightly higher, on balance. U.S. rate futures have priced in a 93.0% chance of no rate change and a 7.0% chance of a 25 basis point rate cut at the next FOMC meeting in March. On the earnings front, notable companies like Broadcom (AVGO), Costco (COST), Kroger (KR), Hewlett Packard Enterprise (HPE), and BJ’s Wholesale Club (BJ) are slated to release their quarterly results today. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 234K, compared to last week’s number of 242K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast Q4 Unit Labor Costs to be +3.0% q/q and Nonfarm Productivity to be +1.2% q/q, compared to the third-quarter numbers of +0.8% q/q and +2.2% q/q, respectively. U.S. Trade Balance data will be reported today. Economists foresee this figure standing at -$128.30B in January, compared to -$98.40B in December. U.S. Wholesale Inventories data will be released today as well. Economists expect the final January figure to be +0.7% m/m, compared to the previous figure of -0.4% m/m. In addition, market participants will hear perspectives from Philadelphia Fed President Patrick Harker, Fed Governor Christopher Waller, Richmond Fed President Thomas Barkin, and Atlanta Fed President Raphael Bostic throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.309%, up +0.98%. My bias or lean today? Who knows! Haha. Ask Pres. Trump or Elon. It's anybodys guess right now. I've said several times this week in the live trading room that I didn't think we'd be surprised if the NDX finished up 350 points or down 350 points. Either one could make sense. We'll just simplify our setups again today and focus our 0DTE efforts soley on the SPX. It should make things simpler. I've shared plenty of bearish ideas lately. Here's a potentially bullish one. S technology stocks are struggling: The S&P 500 Information Technology sector has dropped 11.0% since its December high and officially entered a correction. This marks the third drawdown of at least 10% over the last 2 years. Magnificent 7 stocks have led the decline, erasing a whopping -$2.4 trillion in market cap over the last 3 months. On Monday, the group lost $567.5 billion in market value with Nvidia, $NVDA, accounting for ~50% of the loss. Overall, $NVDA shares have fallen -24% since their January peak. Is the Big-Tech sell-off overdone? It might be time for a tech rebound. I'm going to be selective again today and very patient on entries. While I didn't make any money scalping yesterday I think this continues to be a great scalping enviroment. We'll scalp the QQQ's today. Our Gold trade looks great and I'll look to add the put side to that today. NATH take profit. BTC 1HTE or 0DTE again. These have been amazing lately. SPX as our sole 0DTE focus. AVGO, COST, GAP potential earnings plays, Bonds look good again /ZN. Potentially starting 1DTE's on NVDA, TSLA, SMCI, MSTR for our Friday equity 0DTE setups. Let's take a look at this mornings selloff and see what key levels it's created for us, intra-day. /ES: levels have come down overnight. 5809/5847 are new resistance with 5781/5751 working as support. We are sitting right on top of the 5781 level as I type! I really like the 5751 support level. /ES futures are down -70 points as I type. It's all bearish out there right now. I think the 5751 level has a very good shot at holding today. I may start off the day with a bit of a bullish entry. /NQ: Levels have adjusted too. 20,548 and 20,615 are new resistance with 20,318 and 20,093 working as support. I'm less confident about /NQ levels than /ES. BTC: Bitcoin has brought us in over $20,000 in profits this year. It's been our best performing setup. We'll look to start another one this morning in a few mins. It might be tougher today to get a clean setup. 93,202 and 95,818 are resistance levels with 88,793 and 86,116 working as support. I'm happy we've got another zoom session this morning. Lots to look at. Lots to do! See you all shortly.

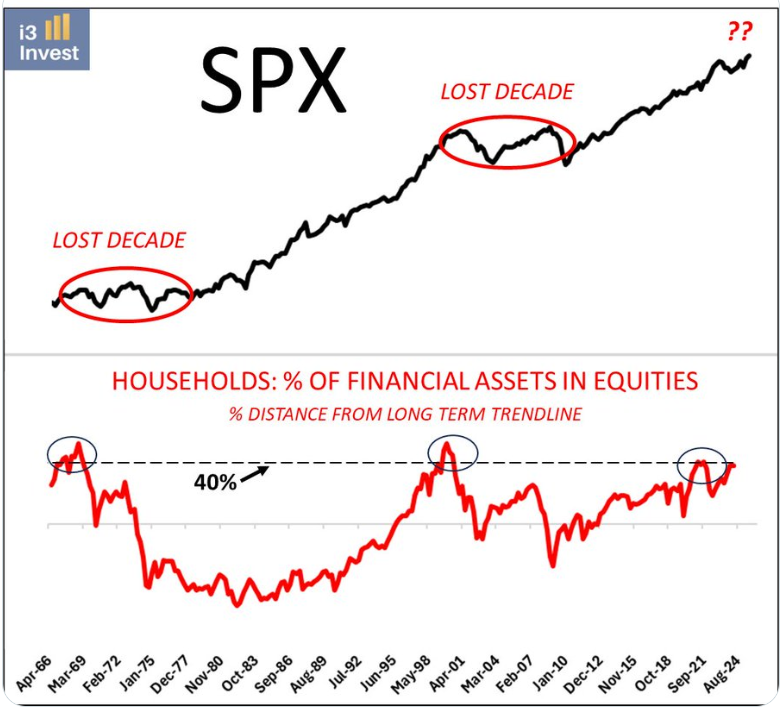

Welcome back traders! That was quite the swings we got yesterday. 500 points of movement in the last five days. We had a relatively flat day as you can see below. As I said in the trading room, it's frustrating to pull our working 0DTE's at a loss before the end of the day and then see them slide back into what would have been the profit zone at the close but, I think most of us would agree, generally we will benefit from being on the sidelines going into the close vs. white knuckling it, hoping it hits. We'll continue to do what we can to be out, regardless of the situation, before the power hour really starts ramping up. Fortunately for us, the BTC trade was a big success and saved the day. I'm going to take a vey slow, simple approach today. See my trade docket below: We'll continue to work our Gold ladder today. Scalping will be focused on the QQQ's IF...we get some directional movement. We'll try again for a 1HTE or 0DTE on BTC. I'm going to work some small 0DTE's today, later in the day. March S&P 500 E-Mini futures (ESH25) are trending up +0.73% this morning, rebounding from yesterday’s losses after U.S. Commerce Secretary Howard Lutnick said the Trump administration might dial down some trade tariffs. Lutnick said in an interview with Fox Business on Tuesday that U.S. President Donald Trump would “probably” announce a deal to lower tariffs on Canada and Mexico as early as Wednesday. He noted that tariffs would probably settle “somewhere in the middle,” with Trump “moving with the Canadians and Mexicans, but not all the way.” Investors also digested President Trump’s speech to Congress. Trump acknowledged that there could be an “adjustment period” to tariffs as he defended his policies aimed at reshaping the U.S. economy. He also urged the termination of a $52 billion semiconductor subsidy program and repeated the 25% tariffs on aluminum, copper, and steel. Investors now await a fresh batch of U.S. economic data, with a particular focus on the ADP employment report. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Best Buy (BBY) plunged over -13% and was the top percentage loser on the S&P 500 after the electronics retailer issued a weak FY26 adjusted EPS forecast. Also, bank stocks lost ground, with Citigroup (C) and Bank of America (BAC) sliding more than -6%. In addition, Tesla (TSLA) fell over -4% after preliminary data from China’s Passenger Car Association showed that the EV maker’s China vehicle deliveries tumbled 49% year-over-year to 30,688 units in February. On the bullish side, Okta (OKTA) jumped more than +24% after the company posted upbeat Q4 results and issued above-consensus FY26 guidance. Also, chip stocks advanced, with Marvell Technology (MRVL) climbing nearly +3% and Advanced Micro Devices (AMD) gaining more than +2%. New York Fed President John Williams stated on Tuesday that tariffs from the Trump administration will somewhat contribute to rising price pressures, though there remains significant uncertainty about how this will ultimately unfold. He added that he views monetary policy as being in a “good place” and sees “no need to change it” at the moment. Meanwhile, U.S. rate futures have priced in a 93.0% probability of no rate change and a 7.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the February ADP Nonfarm Employment Change will stand at 141K, compared to the January figure of 183K. Investors will also focus on the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI. Economists expect the February ISM services index to be 52.5 and the S&P Global services PMI to be 49.7, compared to the previous values of 52.8 and 52.9, respectively. U.S. Factory Orders data will be reported today. Economists foresee this figure coming in at +1.7% m/m in January, compared to the previous number of -0.9% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 0.600M, compared to last week’s value of -2.332M. On the earnings front, notable companies like Marvell Technology (MRVL), Zscaler (ZS), MongoDB (MDB), and Campbell Soup (CPB) are set to report their quarterly results today. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.254%, up +1.05%. Let's take a look at the markets: There's a couple things that jump out at me on these charts. #1. The trend is clearly down, at this point. #2. We are sitting on some very key, important levels. #3. A break of the 200DMA (The IWM is already there) would be very bearish. Counter all this with the potential that all the tariffs get resolved. That maybe this is all one big game of chicken and a bluff, used for leverage in negotiations? We may see as soon as later today. Techincals are bearish. I think we may be entering a market enviroment much like the "lost decade" where the only way to make money was trade. Buy and hold simply didn't produce. Let's take a look at the intra-day key levels: /ES: It's interesting that with all the ebbing and flowing of yesterday, todays levels are unchanged. 5846/5881 are resistance with 5789/5753 support. /NQ levels have adjusted a bit. 20582/20729 are resistance with 20328/20076 support. BTC: Our bitcoin trade yesterday was a huge win or us and really saved the day. I'm not sure we'll get that kind of setup today. 92,863 is resistance with 87232 support. I'll see you all in the live trading room shortly. Today will be a waiting game. We'll sit on our hands until we see some movement we like.

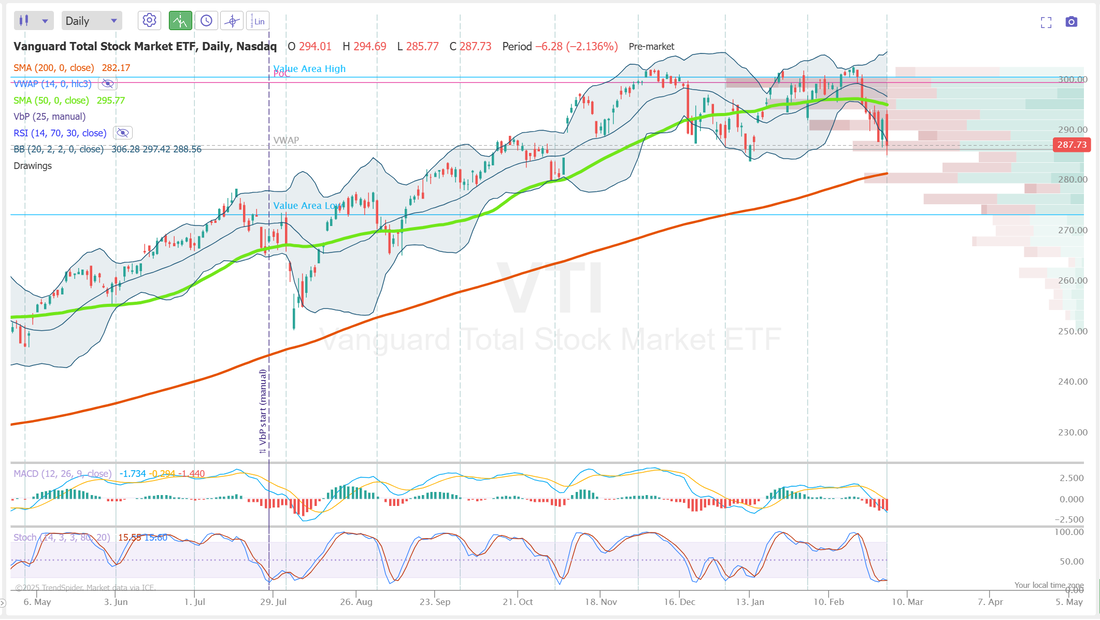

Welcome back traders! I can't express how happy I was with our results yesterday! No. We didn't make any money! But we didn't lose either and on the worst day of the year with the markets going negative for the year and the NDX down -550 and SPX down -110 at one point I was thrilled with our risk management. We implemented a couple new trade management rules and both of them helped us yesterday. If the result that we get on the worst day of the year is break even, I'll take it! We'll continue to utilize our new risk management rules today. They seem to be working. To be clear, there will be days when the force us to leave potential profits on the table but I think that's an acceptable result for the enhanced risk management. Here's a look at our results from yesterdays big down day. Staying nimble and flexible is key in this market and scalping is a great way to do that. We continue to get consistent results from our efforts there. Let's take a look at the markets: All the work the bulls put in late Friday of last week and early Monday morning in the futures was wiped out yesterday with the biggest down day of the year. The charts are back to lookiing ugly. It's a big turnaround from Friday. There's not a lot that's attractive on this matrix. SPY is just above key support. QQQ's have broken through with the 200DMA up next. DIA is relatively flat with the IWM in free fall. We initiated a long VTI trade in our ATM program yesterday. The timing could have been better! It's got a nice cash flow component attached to it so I'm sure it will be fine but the trend is now clearly down. The 200DMA is looming. That's a key support and I always assume that will hold...until it doesn't. It's a big demarcation line. RSI is also oversold with bollinger bands looking stretched. My bias or lean yesterday was slightly bullish. That turned out to be wrong. I was impressed Friday with the big push up into the close but tariff news is just too much. We talked about this this morning in our live trading room. You always want to keep tabs on economic risk and geopolitical risk. Both of those are rising now. It's hard to see a path upward in the markets currently with all these headlines. I'm starting our 0DTE's off today with some bearish setups. My bias or lean today is bearish. Trade docket for today: I think we can get a 1HTE working this morning. We'll work our /GC weekly trade. We'll add another ladder to our /MCL trade. We are scalping /MNQ, /NQ. ADUS, BKE, CBRL, CMPR additions, DIA addition, FSLR adjustment, CRWD earnings trade and both 0DTE's. Let's take a look at the intra-day levels. They were critical to our success yesterday in managing risk and I think they'll come into play again today. /ES: We are about 60 points away from the 200DMA on the daily charts. That's about as big a support level as you can get. I doubt we get there today but you never know. It will be a big test of the markets support if we do. On an intra-day basis, movement is large enough we need to pull back to a 4hr. chart. The two key resistance levels are 5846 then 5881. Support is 5789 then 5753. /NQ: Same issues on Nasdaq. We need to pull out to a 4hr. chart to get enough actionable levels. 20,453 and 20,610 are resistance with 20,208 and 20,056 support. BTC: What a day yesterday with Bitcoin! If you ever needed a clean example of what "fill the gap" means this chart is it! After a huge pop and surge to the upside with the announcement of a crypto reserve, we promptly gave it all back. I'm not sure if we can find a suitable entry level today for a 1HTE but I'm sure the premium will be rich! I look forward to seeing you all in the live trading room shortly. These types of days may seem scary but remember, as traders this is what we want! High I.V.. Downward movement (down moves almost always give us more potential than up moves) It's now on us to put good setups together!

|

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |