|

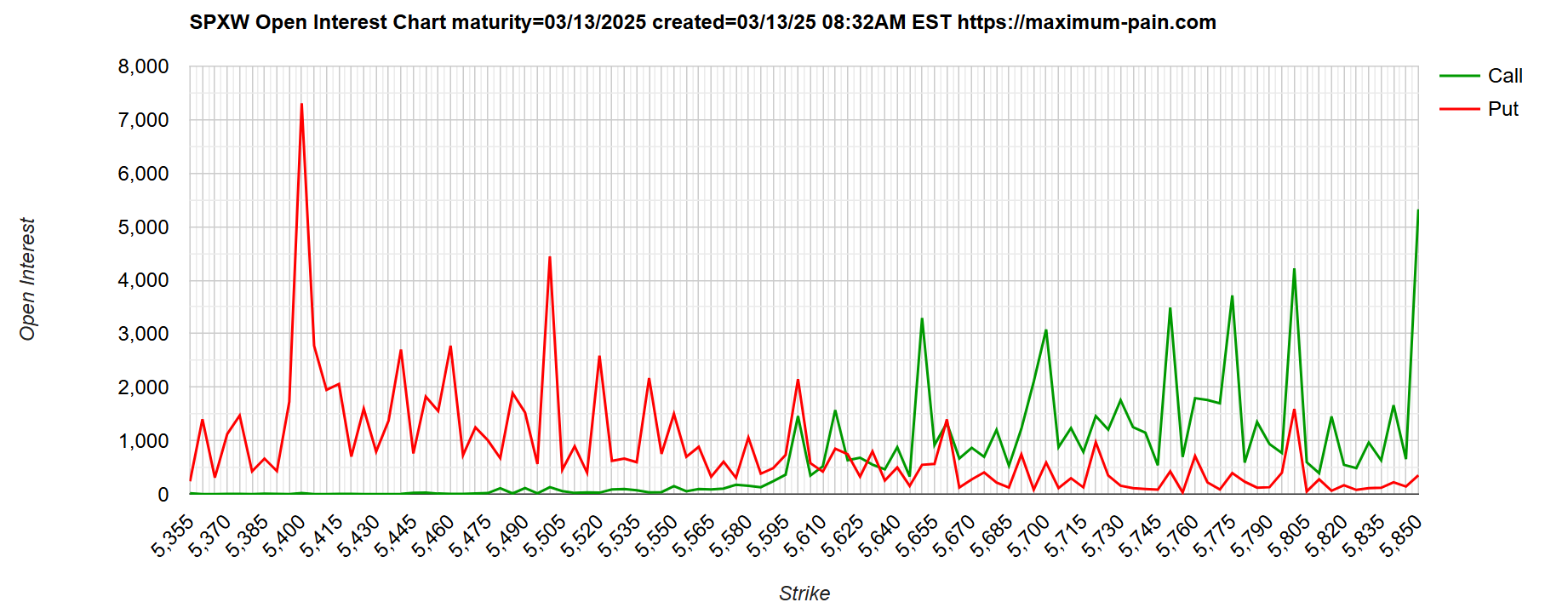

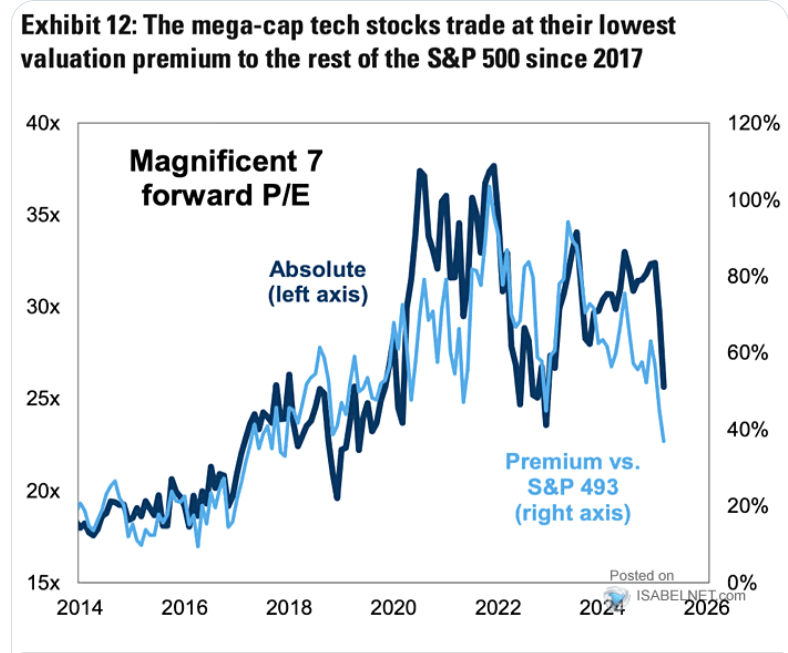

Good Thursday morning to you all! I'm just sitting here in my trading office a few hours before the cash market, listening to my tickstrike (audible order flow). It's usually pretty quite pre-market. Currently is sounds like a rapid-fire machine gun! A big buy order, then a bigger sell order. Back and forth. This is a market that defines the word erratic. In a market like this our goal yesterday was to reduce our buying power committed to trades. Enhance the risk/reward ratio. Make the setups more flexible so adjustments would (hopefully) not be needed. All those things are possible BUT, they almost always result in less potential profit. I was really happy with our results from yesterday. It seems like it's been a while since I've been able to say that. We did hit our daily goal of $1,000+ profit but more importantly we had trades that allowed us to sit back and relax. I wasn't totally happy with the structure of our SPX 0DTE yesterday but it's very close to what we are looking for. Something that gives us some protection against the big moves. Another area that was intersting was our 1HTE's on BTC. We did six of these trades yesterday and the biggest one we put on was a whopping $100 dollars. The lowest ROI potential on these was 20% with the highest 102%. These were very low probability, high profit potential setups. One common complaint you'll hear from traders about certain setups or strategies is, "the risk is too high". Remember, it's the trader that determines the risk. Not the setup. These trades are fantastic from the standpoint that you could do a $2 dollar trade if you wanted. Here's our results from yesterday: We are going to follow the same approach today, and for the foreseeable future. Scale down the number of trades. Scale down the buying power usage. Focus on thats that have a high level of "protection" built in. Understanding that their is usually a cost associatied with that which should lower our ROI potential. Light and focused docket once again today: We'll work to get our equity 0DTE for tomorrow setup today before the close. I believe we'll be going with GRPN this week. FSLR may either be in a take profit zone or due for an adjustment. QQQ scalping continues. We'll look to add the 0DTE portion back in today. SPY 0DTE continues and we'll focus once again on SPX 0DTE today vs. the NDX. Let's take a look at the markets: Markets tried to stabilize yesterday but the price action was all over the map. There may be several bullish days in the near future but until we get back above the 200DMA its not going to be a pretty picture. Technicals certainly tried to get a little better but yesterday really didn't do much to change the bearish outlook. March S&P 500 E-Mini futures (ESH25) are up +0.02%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.08% this morning as market participants look ahead to the release of crucial producer inflation data. Stock futures initially moved sharply lower on concerns about whether Washington lawmakers will avert a government shutdown this weekend. Senate Democratic leader Chuck Schumer stated his party would block a Republican spending bill to prevent a government shutdown on Saturday and called on the GOP to accept a Democratic proposal to extend funding through April 11th instead. The impending shutdown adds another layer of concern for investors already grappling with a rising unemployment rate, federal workforce reductions, and U.S. President Donald Trump’s tariff war. In yesterday’s trading session, Wall Street’s major indexes closed mixed. The Magnificent Seven stocks climbed, with Tesla (TSLA) surging over +7% to lead gainers in the S&P 500 and Nasdaq 100 and Nvidia (NVDA) advancing more than +6% to lead gainers in the Dow. Also, Intel (INTC) rose over +4% after Reuters reported that TSMC pitched chip designers Nvidia, Advanced Micro Devices, and Broadcom about acquiring stakes in a joint venture that would operate Intel’s factories. In addition, Groupon (GRPN) jumped more than +43% after the e-commerce company issued above-consensus FY25 revenue guidance. On the bearish side, Brown-Forman (BF.B) slumped over -5% after the European Union launched counter-tariffs against U.S. goods. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices rose +0.2% m/m in February, better than expectations of +0.3% m/m. On an annual basis, headline inflation eased to +2.8% in February from +3.0% in January, better than expectations of +2.9%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.2% m/m and +3.1% y/y in February, weaker than expectations of +0.3% m/m and +3.2% y/y. “[Yesterday’s] cooler-than-expected CPI reading was a breath of fresh air, but no one should expect the Fed to start cutting rates immediately. The Fed has adopted a wait-and-see posture, and given the uncertainty of how trade and immigration policy will impact the economy, they’re going to want to see more than one month of friendly inflation data,” said Ellen Zentner at Morgan Stanley Wealth Management. Meanwhile, U.S. rate futures have priced in a 97.0% probability of no rate change and a 3.0% chance of a 25 basis point rate cut at next week’s central bank meeting. On the earnings front, notable companies like DocuSign (DOCU), Dollar General (DG), and Ulta Beauty (ULTA) are slated to release their quarterly results today. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. February PPI will come in at +0.3% m/m and +3.3% y/y, compared to the previous figures of +0.4% m/m and +3.5% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect February figures to be +0.3% m/m and +3.6% y/y, matching January’s numbers. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 226K, compared to 221K last week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.331%, up +0.35%. There is a lot of open interest targeting the 5655 level on SPX Is there value now in the Mag seven? The Magnificent Seven stocks are trading at their lowest valuation premium relative to the rest of the S&P 500 since 2017, with a collective P/E ratio of 26x, the lowest level since early 2023 The recent market SELL-OFF was driven by hedge funds: Hedge funds sold global equities at the fastest rate in 4 YEARS on Friday and Monday. This has even surpassed the August 2024 flash-crash and the 2022 Bear Market. Notably, US stocks saw the sharpest de-risking. Institutional investors dumping of US stocks have been absolutely MASSIVE. Given the selling has been so wild, is this a time for a short-term pause? My lean or bias today in Neutral. The bulls have been trying the last couple of days but the technicals are just too ugly. We could have a massive up day today as still not fundamentally change the technical outlook. I think today looks a lot like yesterday. Lots of chop and erratic moves. Let's take a look at the intra-day levels on SPX and BTC since those will be our focus for today. /ES: 5634 is the first target for resistance with 5673 next. 5557 is support and oh it's a big one! This has been holding for the last three days. It needs to hold again today if the bulls have any shot of turning this ship around. A drop below this level will result in more selling. BTC: We didn't get any clean setups yesterday for our 1HTE trade so we traded small (like 20 dollar trade size small) and often. It worked well for us. It doesn't look like we'll get any better setups today so probably the same approach. Low probability of success trades with high ROI potentials and small trade size. 84,665 is resistance with 82,570 working as support. We may do more of the "range" rather than "directional" setups today. I look forward to seeing you all on zoom shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |