|

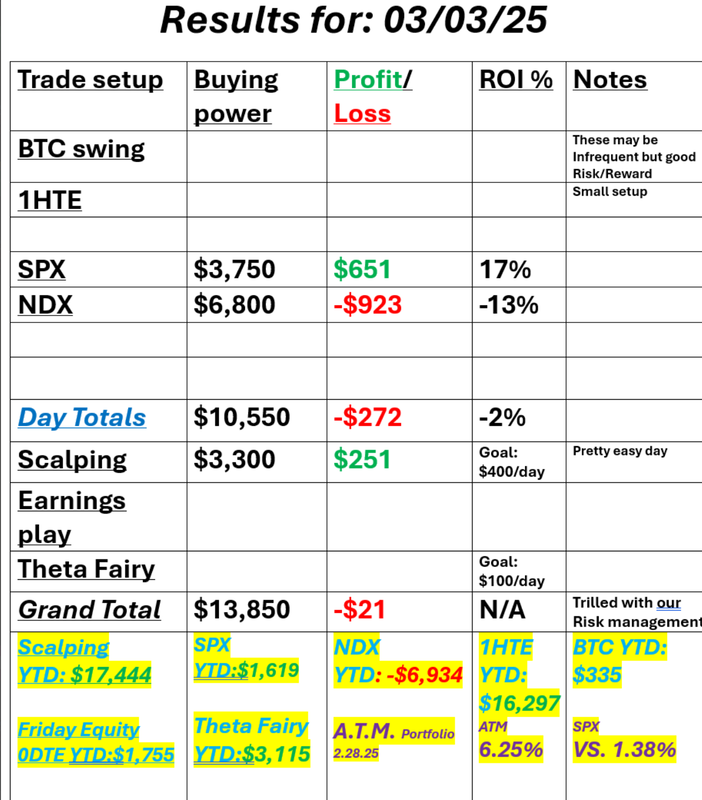

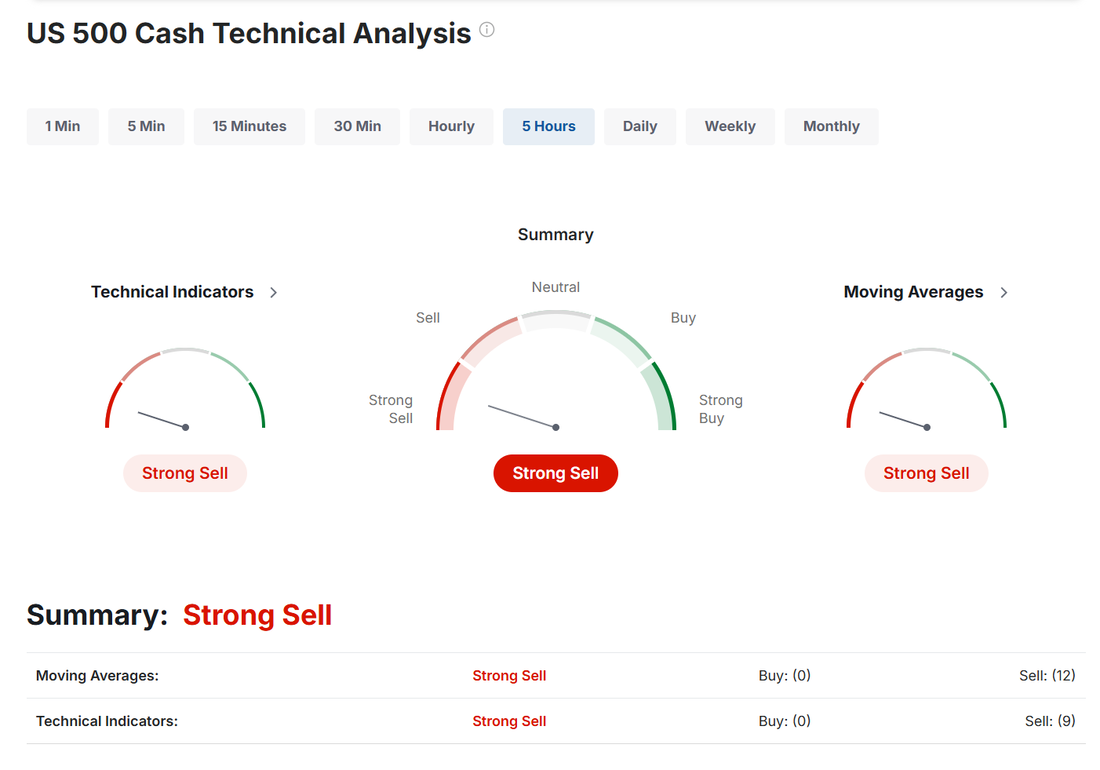

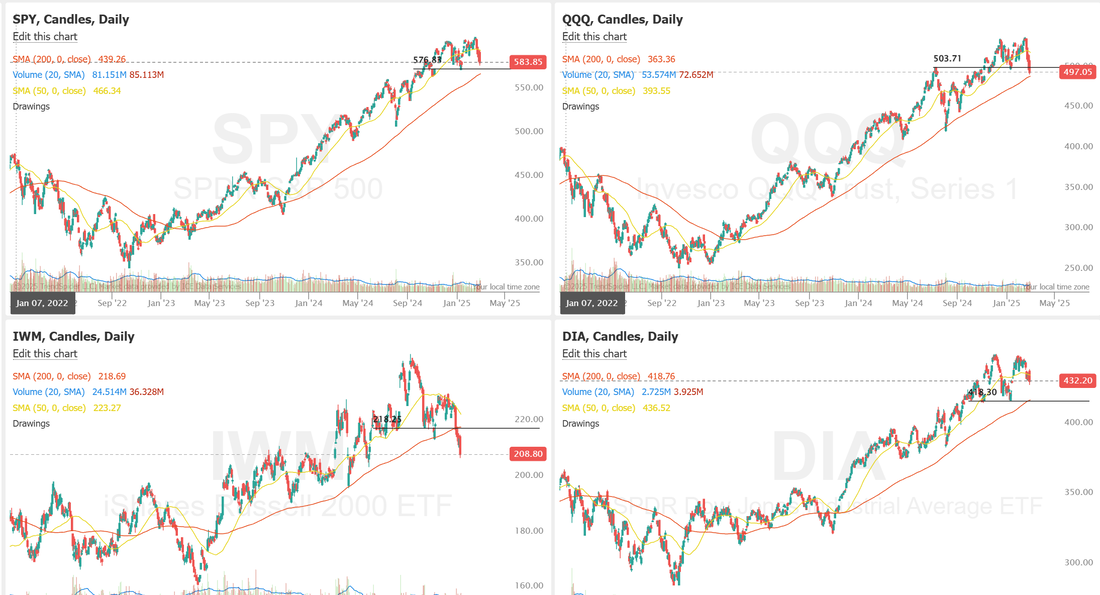

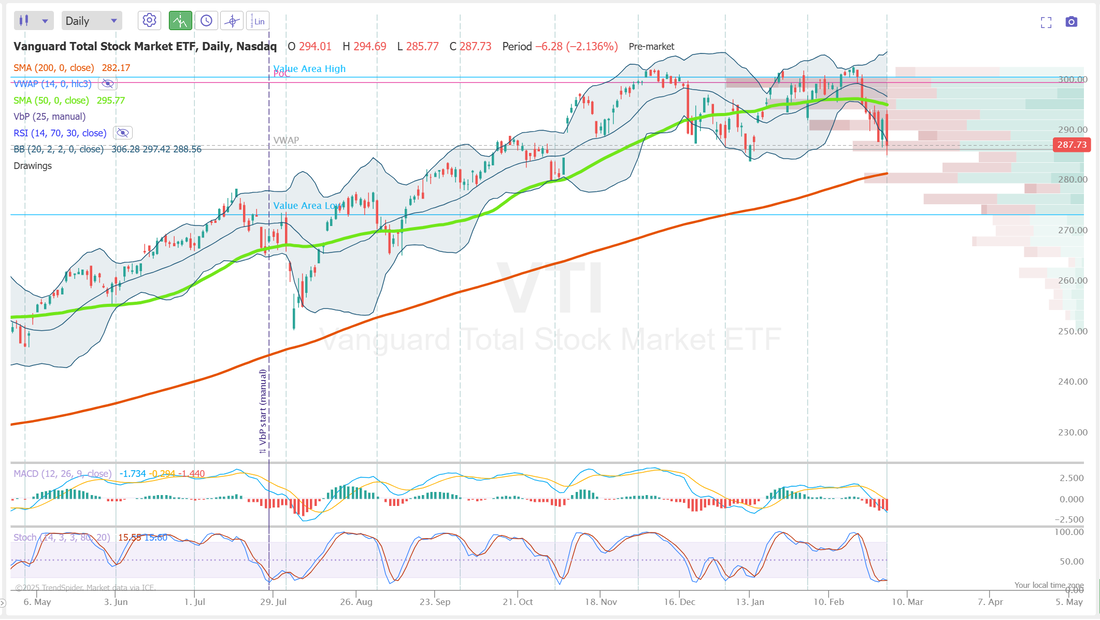

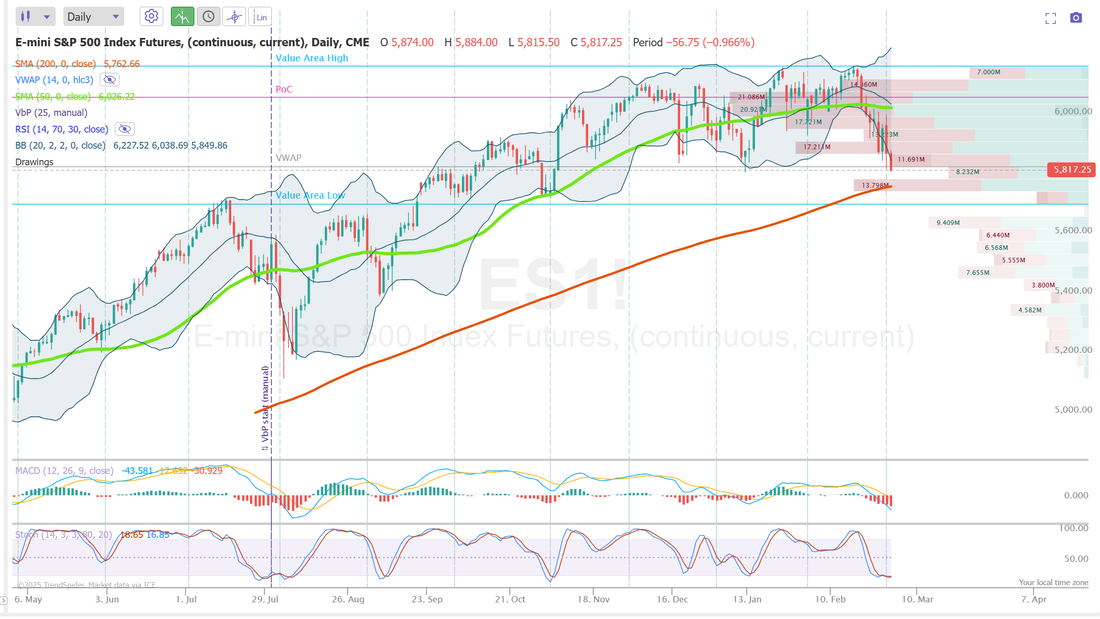

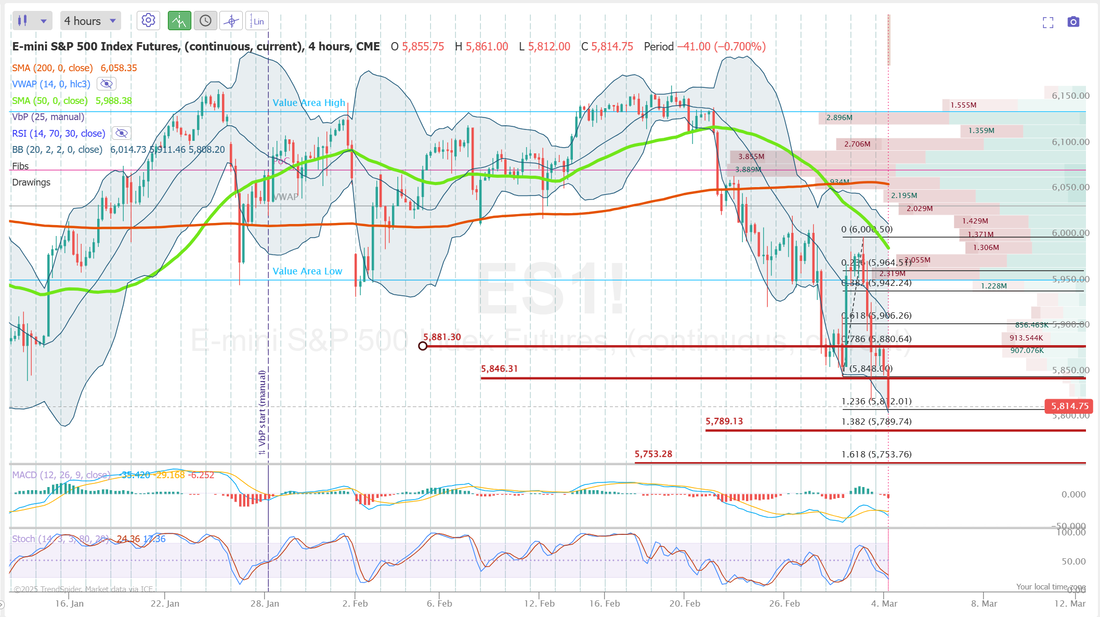

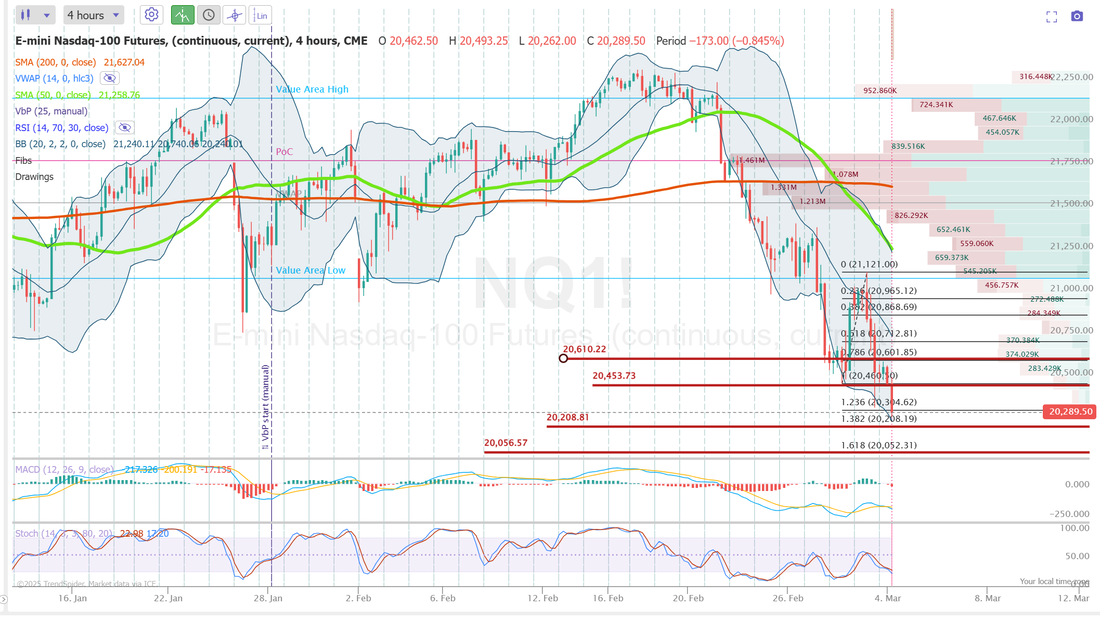

Welcome back traders! I can't express how happy I was with our results yesterday! No. We didn't make any money! But we didn't lose either and on the worst day of the year with the markets going negative for the year and the NDX down -550 and SPX down -110 at one point I was thrilled with our risk management. We implemented a couple new trade management rules and both of them helped us yesterday. If the result that we get on the worst day of the year is break even, I'll take it! We'll continue to utilize our new risk management rules today. They seem to be working. To be clear, there will be days when the force us to leave potential profits on the table but I think that's an acceptable result for the enhanced risk management. Here's a look at our results from yesterdays big down day. Staying nimble and flexible is key in this market and scalping is a great way to do that. We continue to get consistent results from our efforts there. Let's take a look at the markets: All the work the bulls put in late Friday of last week and early Monday morning in the futures was wiped out yesterday with the biggest down day of the year. The charts are back to lookiing ugly. It's a big turnaround from Friday. There's not a lot that's attractive on this matrix. SPY is just above key support. QQQ's have broken through with the 200DMA up next. DIA is relatively flat with the IWM in free fall. We initiated a long VTI trade in our ATM program yesterday. The timing could have been better! It's got a nice cash flow component attached to it so I'm sure it will be fine but the trend is now clearly down. The 200DMA is looming. That's a key support and I always assume that will hold...until it doesn't. It's a big demarcation line. RSI is also oversold with bollinger bands looking stretched. My bias or lean yesterday was slightly bullish. That turned out to be wrong. I was impressed Friday with the big push up into the close but tariff news is just too much. We talked about this this morning in our live trading room. You always want to keep tabs on economic risk and geopolitical risk. Both of those are rising now. It's hard to see a path upward in the markets currently with all these headlines. I'm starting our 0DTE's off today with some bearish setups. My bias or lean today is bearish. Trade docket for today: I think we can get a 1HTE working this morning. We'll work our /GC weekly trade. We'll add another ladder to our /MCL trade. We are scalping /MNQ, /NQ. ADUS, BKE, CBRL, CMPR additions, DIA addition, FSLR adjustment, CRWD earnings trade and both 0DTE's. Let's take a look at the intra-day levels. They were critical to our success yesterday in managing risk and I think they'll come into play again today. /ES: We are about 60 points away from the 200DMA on the daily charts. That's about as big a support level as you can get. I doubt we get there today but you never know. It will be a big test of the markets support if we do. On an intra-day basis, movement is large enough we need to pull back to a 4hr. chart. The two key resistance levels are 5846 then 5881. Support is 5789 then 5753. /NQ: Same issues on Nasdaq. We need to pull out to a 4hr. chart to get enough actionable levels. 20,453 and 20,610 are resistance with 20,208 and 20,056 support. BTC: What a day yesterday with Bitcoin! If you ever needed a clean example of what "fill the gap" means this chart is it! After a huge pop and surge to the upside with the announcement of a crypto reserve, we promptly gave it all back. I'm not sure if we can find a suitable entry level today for a 1HTE but I'm sure the premium will be rich! I look forward to seeing you all in the live trading room shortly. These types of days may seem scary but remember, as traders this is what we want! High I.V.. Downward movement (down moves almost always give us more potential than up moves) It's now on us to put good setups together!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |