|

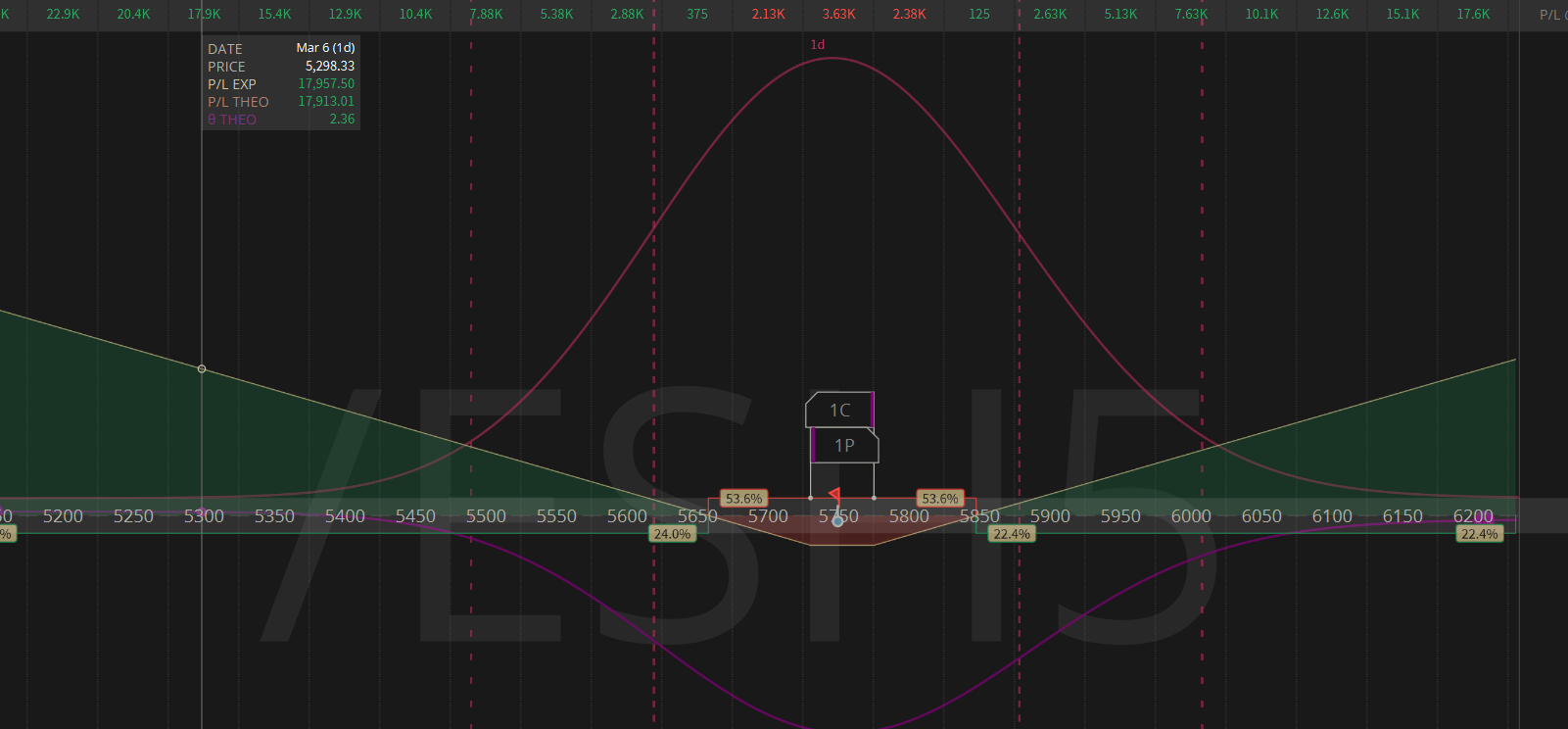

Welcome back traders! What a day yesterday. Premium is back! We made $500 dollars on one NDX contract with 20 min. to go in the day with a 220 point safety margin. It wasn't a layup because, as you know, that simply doesn't exsist in trading but it was about as close as you could get to free money. We'll be working the same approach today. We've got our /ES 0DTE already started and we'll trade around it today then pounce on the NDX near the close. Here's our results from yesterday. Pretty impressive profit for such low capital outlay. Blog is short and sweet today. We've got our /ES 0DTE that we'll be working today (see below) And then we have our Gold trade, Bond trade, DIA trade and Bitcoin trade all expiring today. Anyone of those may need attention before the close. /ES 0DTE, /GC, /ZN, BITO, DIA, 1HTE, NDX 0DTE in focus for today. March S&P 500 E-Mini futures (ESH25) are trending up +0.35% this morning as investors look ahead to the all-important U.S. payrolls report and remarks from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s major indices closed lower. Palantir Technologies (PLTR) slumped over -10% and was the top percentage loser on the S&P 500 amid signs of insider selling after an SEC filing revealed that director Alexander Moore sold $1.74 million worth of shares on Monday. Also, MongoDB (MDB) plunged more than -26% and was the top percentage loser on the Nasdaq 100 after the company issued below-consensus FY26 guidance. In addition, Marvell Technology (MRVL) tumbled over -19% after the semiconductor company’s Q1 revenue forecast failed to meet investors’ lofty expectations. On the bullish side, Zscaler (ZS) rose more than +2% after the cybersecurity firm posted upbeat FQ2 results and raised its full-year guidance. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -21K to 221K, compared with the 234K expected. Also, U.S. Q4 nonfarm productivity was revised higher to +1.5% q/q from +1.2% q/q, while unit labor costs were revised downward to +2.2% q/q from +3.0% q/q. In addition, the U.S. trade deficit was a record -$131.40B in January, wider than expectations of -$128.30B. Philadelphia Fed President Patrick Harker stated on Thursday that risks to the economy are increasing as businesses and consumers grow more cautious and inflationary pressures mount. Harker added that he is increasingly worried that the decline in price growth “is at risk.” Also, Atlanta Fed President Raphael Bostic said it may take several months to gauge the impact of President Trump’s policies and other factors on the economy, indicating that officials might keep rates steady until at least late spring. At the same time, Fed Governor Christopher Waller stated that he would not back a rate cut in March but sees the potential for two or possibly three reductions this year. U.S. rate futures have priced in a 91.0% probability of no rate change and a 9.0% chance of a 25 basis point rate cut at the next central bank meeting later this month. Meanwhile, Fed Chair Jerome Powell is set to deliver a keynote speech on the economic outlook at an event in New York hosted by the University of Chicago Booth School of Business later today. Also, Fed Governor Michelle Bowman, New York Fed President John Williams, and Fed Governor Adriana Kugler will speak today. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that February Nonfarm Payrolls will come in at 159K, compared to January’s figure of 143K. A survey conducted by 22V Research showed that 53% of respondents expect key U.S. jobs data to be “risk-off,” 28% “risk-on,” and 19% “mixed/negligible.” “Investors have turned their focus back to Payrolls this month after being more focused on average hourly earnings last month,” said Dennis DeBusschere, founder of 22V. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect February figures to be +0.3% m/m and +4.1% y/y, compared to the previous numbers of +0.5% m/m and +4.1% y/y. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will remain steady at 4.0% in February. U.S. Consumer Credit data will be released today as well. Economists expect this figure to be $15.60B in January, compared to the previous figure of $40.85B. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.266%, down -0.37%. NFP is the big catalyst today. No lean or bias for me. No levels yet. We'll post them for you in discord as the day reacts to NFP. I'm hoping we can get multiple 1HTE's on today! See you all in the trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |