|

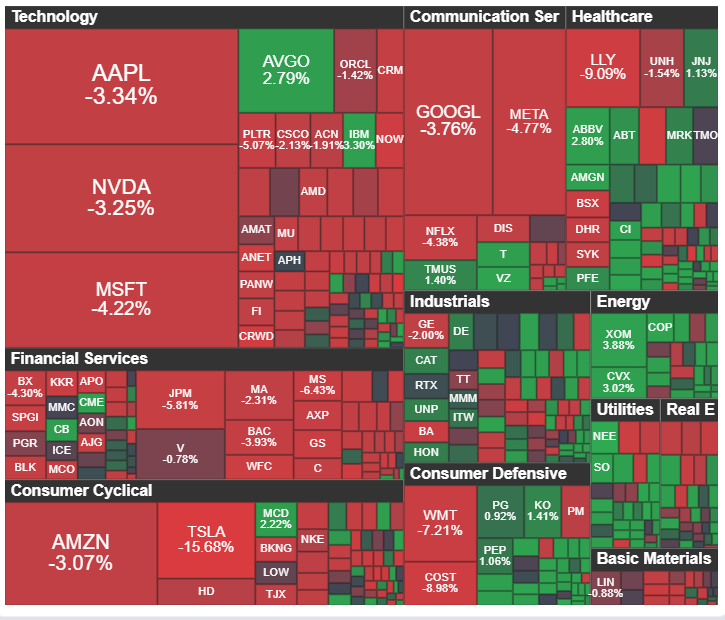

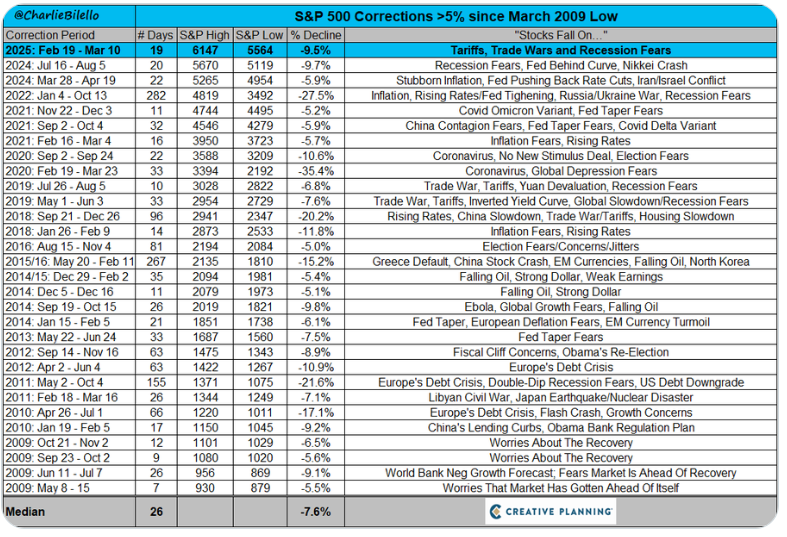

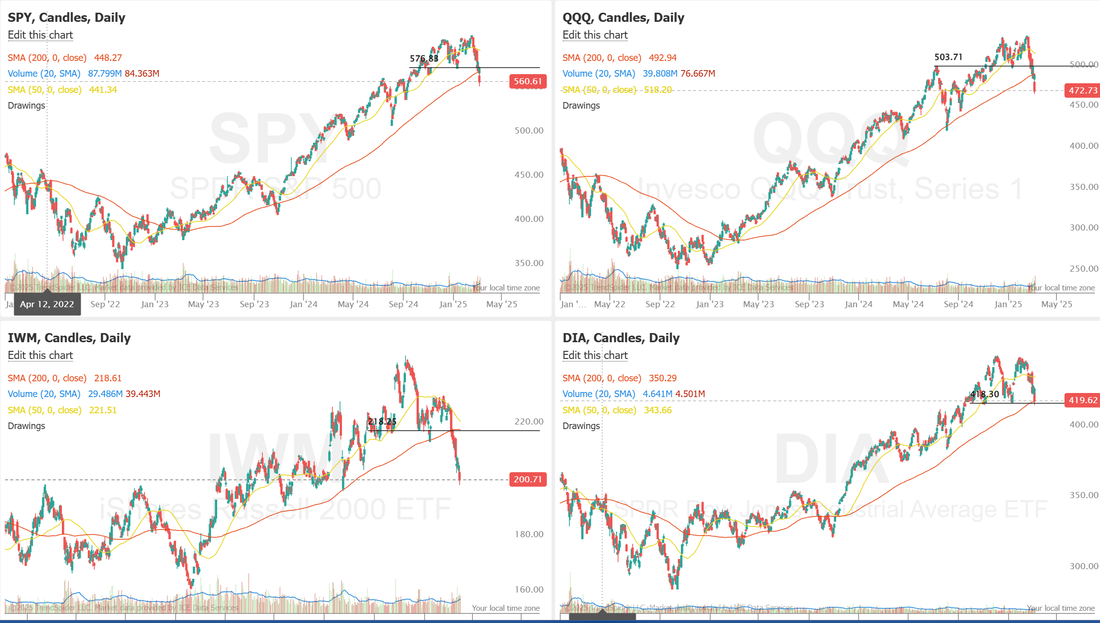

Welcome back traders! Quite the day yesterday. The biggest down day for the NDX in five years. All the major indices are negative for the year. What leads us up is usually what leads us down. Tech got clobbered. For the week it's energy that has the strength. We had a tough day, like a lot of traders yesterday but it could have been much worse. I had to scale three times into our BTC 0DTE to get it back, close to a break even. We squeaked out a small profit on our SPX late in the day but rolled a big part of it to today. It will be a great recovery IF...we get a rebound today. We'll focus on working that trade today. Probably no surprise, the technicals are bearish. The selloff yesterday pushed us closer to a bonifide bear market (down 10%+) but it also pushed us into oversold territory on the technicals. Even if we are entering a bear market, which looks more and more likely, it's typical to get a rebound today. That's the way we are playing it at the open, at least with our bullish SPX debit setup. March S&P 500 E-Mini futures (ESH25) are up +0.41%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.53% this morning, pointing to a higher open on Wall Street after yesterday’s dramatic selloff, while investors await the latest reading on U.S. job openings. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply lower, with the S&P 500, Dow, and Nasdaq 100 posting 5-3/4 month lows. The Magnificent Seven stocks sank, with Tesla (TSLA) tumbling over -15% to lead losers in the S&P 500 and Nvidia (NVDA) sliding more than -5% to lead losers in the Dow. Also, cryptocurrency-exposed stocks slumped after the price of Bitcoin dropped more than -8%, with MicroStrategy (MSTR) plunging over -16% to lead losers in the Nasdaq 100. In addition, Rocket Cos. (RKT) cratered more than -15% after agreeing to buy Redfin in a deal valued at $1.75 billion. On the bullish side, Regeneron Pharmaceuticals (REGN) climbed over +5% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing positive results from a late-stage trial of its Dupixent treatment. “There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs. Until there’s more clarity on trade policy, traders and investors should anticipate continued volatility,” said Chris Larkin at E*Trade from Morgan Stanley. Speculation is growing that U.S. President Donald Trump is prepared to endure economic and market hardship in pursuit of long-term goals involving tariffs and smaller government. President Trump said Sunday on the Fox News show “Sunday Morning Futures” that the U.S. economy was undergoing “a period of transition” and declined to rule out the possibility that his policies would cause a recession. Meanwhile, investors are growing increasingly anxious due to whipsawing tariff policy, with 25% tariffs on U.S. imports of steel and aluminum set to take effect on Wednesday. The levies, imposed by President Trump in February, include imports from Canada and Mexico, both major foreign suppliers, and extend to finished metal products as well. Market watchers are keenly awaiting the U.S. consumer inflation report for February, scheduled for release on Wednesday. The CPI is expected to ease slightly to +2.9% y/y from +3.0% y/y in January, while the core CPI is expected to ease to +3.2% y/y from +3.3% y/y in January. However, the data’s impact on U.S. rate-cut expectations might be limited due to increasing worries about the effects of Trump’s policies, particularly tariffs, on the economy. U.S. rate futures have priced in a 95.0% probability of no rate change and a 5.0% chance of a 25 basis point rate cut at the upcoming monetary policy meeting. Today, all eyes are focused on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the January JOLTs Job Openings will arrive at 7.650M, compared to the December figure of 7.600M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.207%, down -0.14%. My bias or lean today is slightly bullish. As I mentioned, even if we are entering a solid bear market, we usually get a bit of a retrace after a day like yesterday. We have the JOLTS numbers out this morning as the main economic catalyst so that could sway the futures market a bit, other wise I think we head higher. That being said, big picture, it doesn't look pretty. All the indices are now below their 200DMA with the exception of DIA which is just hanging on.  The S&P 500 has now fallen over 9% from its peak on February 19, the biggest pullback since last August. This is the 30th correction >5% off of a high since the March 2009 low. They all seemed like the end of the world at the time but it's always recovered. This is truly UNPRECEDENTED: US total put options volume hit over 30 million contracts over the last 5 trading days, the most EVER. Moreover, the S&P 500 ETF, $SPY, put options volume hit the 3rd highest on record last Tuesday. Is the panic just starting or nearly over? Very simple trade docket today; BITO cover for our swing trade. F, FSLR?, 1HTE (BTC), SPX (main focus) QTTB?. Let's take a look at the intra-day levels to see what's changed. /ES: Most of the levels from yesterday are still in play. We have established new support levels. The two key levels for me today are 5673 as resistance and 5559 as support. /NQ: 19,579 is near resistance. If we can break that the next level is all the way up at 19,854. Support is at 19,122. BTC: We've got a bit of stabilization happening. 84,120 is resistance with 78,419 first support and 76,837 acting as secondary support. Let's focus our efforts on our SPX roll today. If we can get a profitable exit on it by the close of business today it will be like yesterday never happened. See you all in the trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |