|

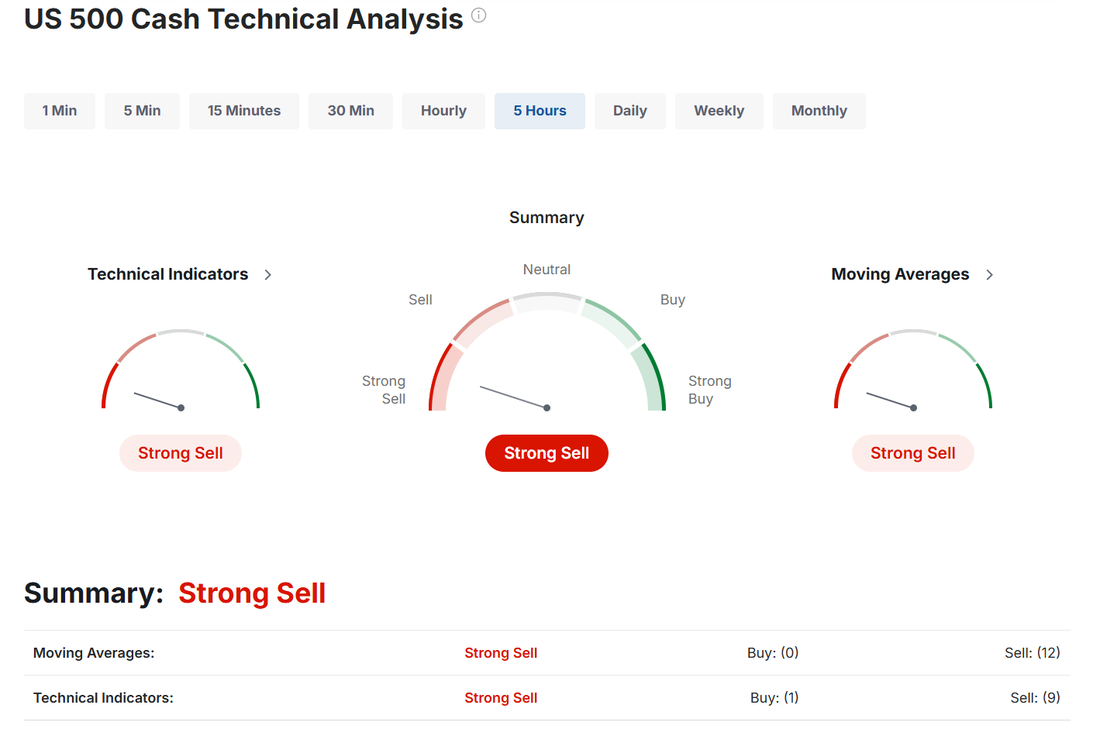

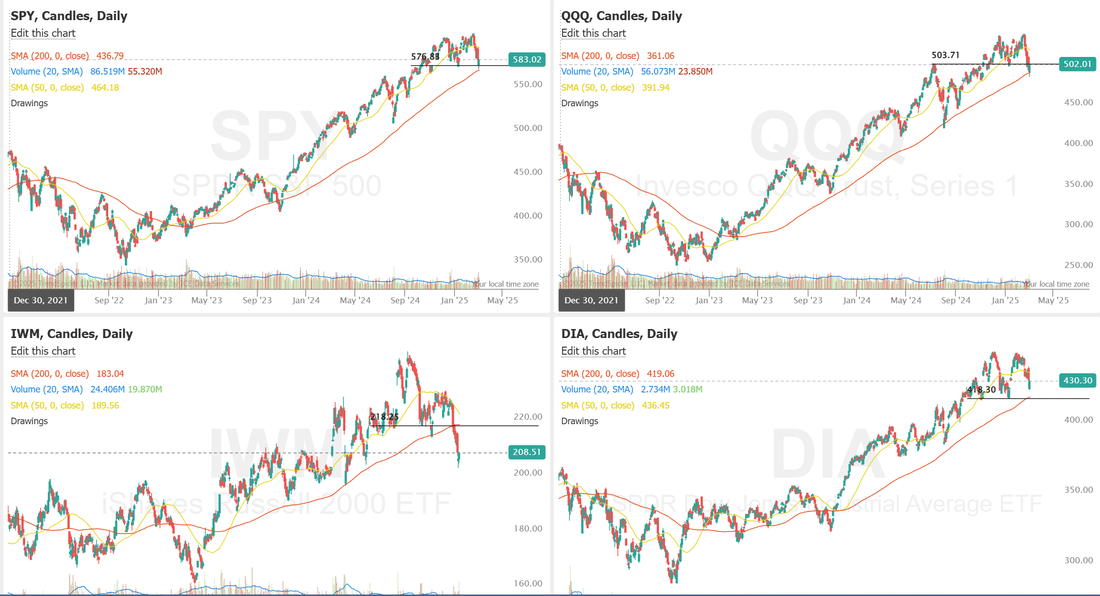

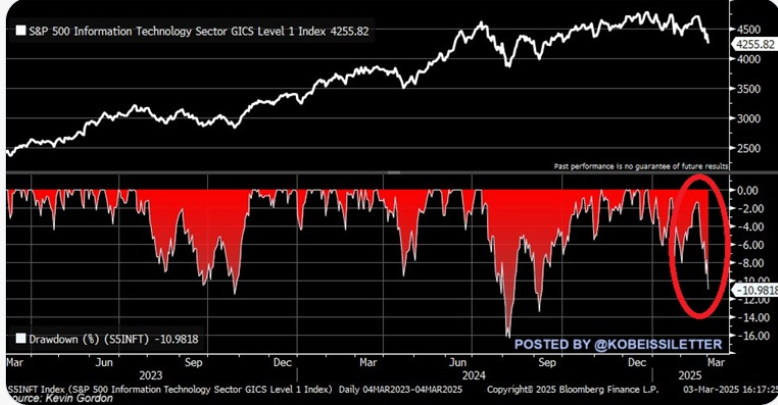

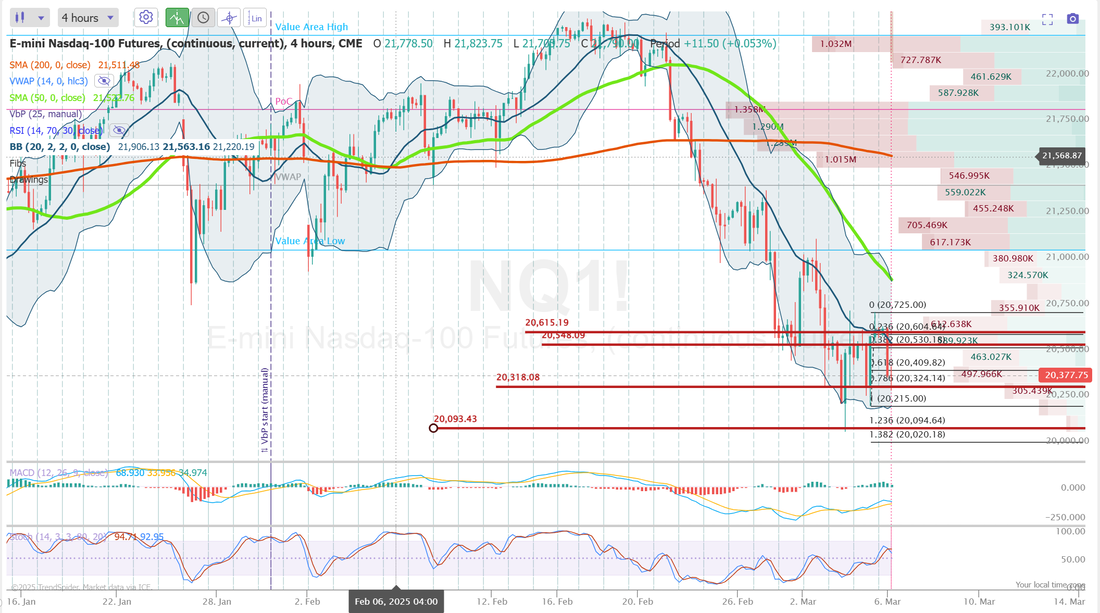

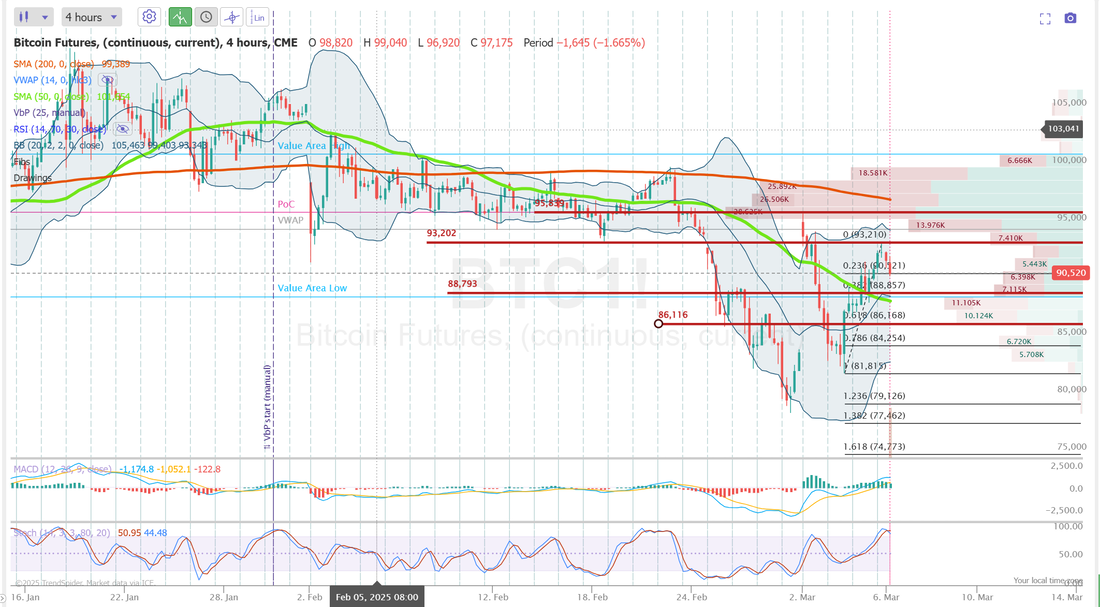

Welcome back traders! Yesterday was a solid day for us. Risk management took center stage again. We downsized our trades. Waiting until almost after the half day point and adjusted our losers quickly. I'm seeing a lot of frustrated traders out there this week. It's certainly been an unpredictable trading enviroment. One thing I might suggest is to not just scale down your size but also the number of trades you're doing. I got this email from my performance coach this morning. The question was, "Shouldn't I trade a lot to let the law of large numbers work and get good diversification?" Her anwser was, "Simplify in tough times" See the diagram below: The mental cost of focusing on too many setups in a market like this can drain your sharpness. We did that yesterday. We downsized our trades, Cut our position sizing and focused on risk management. We cut our losers quickly and didn't over positon-size on the adjustments. It meant not make money on our NDX but the result was gratifying with all the swings. Our main focus yesterday was to sit on our hands for the entire first half of the day. You know the only thing that would have been better? Sitting on our hands even longer! It was a good day overall. We didn't hit our $1,000/day income goal but in this market I'll take any day that is green. See our results below: Let's take another look at the markets. We are at such key levels. I think the next week could bring some big moves. It looked late yesterday like the bulls may be making a come back. Not so fast! /NQ futures are down -330 points as I type this. It looks like another interesting day in store for us. The day was actually very contructive for the bulls. The 200DMA's worked as they should and provided a good back stop for more bearish action. Will that be the case again today? It certainly looks like that could be put to the test. March S&P 500 E-Mini futures (ESH25) are down -0.92%, and March Nasdaq 100 E-Mini futures (NQH25) are down -1.14% this morning as higher Treasury yields, trade war worries, and disappointing tech earnings weighed on sentiment. Marvell Technology (MRVL) plunged over -16% in pre-market trading after the semiconductor company gave a Q1 revenue forecast that fell short of the highest estimates. Also, MongoDB (MDB) tumbled more than -17% in pre-market trading after the company issued below-consensus FY26 guidance. In addition, chip stocks fell in pre-market trading after Alibaba Group unveiled its latest DeepSeek competitor at a significantly lower price. Investors now await a new round of U.S. economic data and remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Moderna (MRNA) surged over +15% and was the top percentage gainer on the S&P 500 after announcing plans to launch a personalized cancer vaccine by 2027, which could represent a “quite large” revenue opportunity. Also, automobile stocks advanced after U.S. President Donald Trump gave automakers a one-month exemption from his 25% tariffs on Canada and Mexico, with General Motors (GM) climbing more than +7% and Ford Motor (F) gaining over +5%. In addition, Palantir Technologies (PLTR) rose more than +6% after William Blair upgraded the stock to Market Perform from Underperform. On the bearish side, CrowdStrike Holdings (CRWD) slid over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the cybersecurity company issued disappointing FY26 adjusted EPS guidance. The ADP National Employment report released on Wednesday showed that U.S. private nonfarm payrolls rose by 77K in February, well below the consensus estimate of 141K and the smallest increase in 7 months. At the same time, the U.S. ISM services index unexpectedly rose to 53.5 in February, stronger than expectations of 52.5. Also, the final estimate of the U.S. February S&P Global services PMI was revised higher to 51.0 from the 49.7 preliminary reading. In addition, U.S. factory orders rose +1.7% m/m in January, in line with expectations and the largest increase in 6 months. Chris Larkin at E*Trade from Morgan Stanley said that Wednesday’s jobs data isn’t “necessarily a reliable guide to what the monthly jobs report will reveal, but after last week’s jobless claims increase, [yesterday’s] miss isn’t going to ease any concerns about a softening economy.” Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that U.S. economic activity increased “slightly” since mid-January, though businesses nationwide expressed uncertainty about new policies from the Trump administration, especially regarding tariffs. Prices rose “moderately” across most regions, with several areas noting faster price increases compared to the prior period. Looking forward, firms across the country “expected potential tariffs on inputs would lead them to raise prices, with isolated reports of firms raising prices preemptively.” “Consumer spending was lower on balance, with reports of solid demand for essential goods mixed with increased price sensitivity for discretionary items, particularly among lower-income shoppers,” according to the Beige Book. The report also said that employment edged slightly higher, on balance. U.S. rate futures have priced in a 93.0% chance of no rate change and a 7.0% chance of a 25 basis point rate cut at the next FOMC meeting in March. On the earnings front, notable companies like Broadcom (AVGO), Costco (COST), Kroger (KR), Hewlett Packard Enterprise (HPE), and BJ’s Wholesale Club (BJ) are slated to release their quarterly results today. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 234K, compared to last week’s number of 242K. U.S. Unit Labor Costs and Nonfarm Productivity data will also be closely watched today. Economists forecast Q4 Unit Labor Costs to be +3.0% q/q and Nonfarm Productivity to be +1.2% q/q, compared to the third-quarter numbers of +0.8% q/q and +2.2% q/q, respectively. U.S. Trade Balance data will be reported today. Economists foresee this figure standing at -$128.30B in January, compared to -$98.40B in December. U.S. Wholesale Inventories data will be released today as well. Economists expect the final January figure to be +0.7% m/m, compared to the previous figure of -0.4% m/m. In addition, market participants will hear perspectives from Philadelphia Fed President Patrick Harker, Fed Governor Christopher Waller, Richmond Fed President Thomas Barkin, and Atlanta Fed President Raphael Bostic throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.309%, up +0.98%. My bias or lean today? Who knows! Haha. Ask Pres. Trump or Elon. It's anybodys guess right now. I've said several times this week in the live trading room that I didn't think we'd be surprised if the NDX finished up 350 points or down 350 points. Either one could make sense. We'll just simplify our setups again today and focus our 0DTE efforts soley on the SPX. It should make things simpler. I've shared plenty of bearish ideas lately. Here's a potentially bullish one. S technology stocks are struggling: The S&P 500 Information Technology sector has dropped 11.0% since its December high and officially entered a correction. This marks the third drawdown of at least 10% over the last 2 years. Magnificent 7 stocks have led the decline, erasing a whopping -$2.4 trillion in market cap over the last 3 months. On Monday, the group lost $567.5 billion in market value with Nvidia, $NVDA, accounting for ~50% of the loss. Overall, $NVDA shares have fallen -24% since their January peak. Is the Big-Tech sell-off overdone? It might be time for a tech rebound. I'm going to be selective again today and very patient on entries. While I didn't make any money scalping yesterday I think this continues to be a great scalping enviroment. We'll scalp the QQQ's today. Our Gold trade looks great and I'll look to add the put side to that today. NATH take profit. BTC 1HTE or 0DTE again. These have been amazing lately. SPX as our sole 0DTE focus. AVGO, COST, GAP potential earnings plays, Bonds look good again /ZN. Potentially starting 1DTE's on NVDA, TSLA, SMCI, MSTR for our Friday equity 0DTE setups. Let's take a look at this mornings selloff and see what key levels it's created for us, intra-day. /ES: levels have come down overnight. 5809/5847 are new resistance with 5781/5751 working as support. We are sitting right on top of the 5781 level as I type! I really like the 5751 support level. /ES futures are down -70 points as I type. It's all bearish out there right now. I think the 5751 level has a very good shot at holding today. I may start off the day with a bit of a bullish entry. /NQ: Levels have adjusted too. 20,548 and 20,615 are new resistance with 20,318 and 20,093 working as support. I'm less confident about /NQ levels than /ES. BTC: Bitcoin has brought us in over $20,000 in profits this year. It's been our best performing setup. We'll look to start another one this morning in a few mins. It might be tougher today to get a clean setup. 93,202 and 95,818 are resistance levels with 88,793 and 86,116 working as support. I'm happy we've got another zoom session this morning. Lots to look at. Lots to do! See you all shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |