|

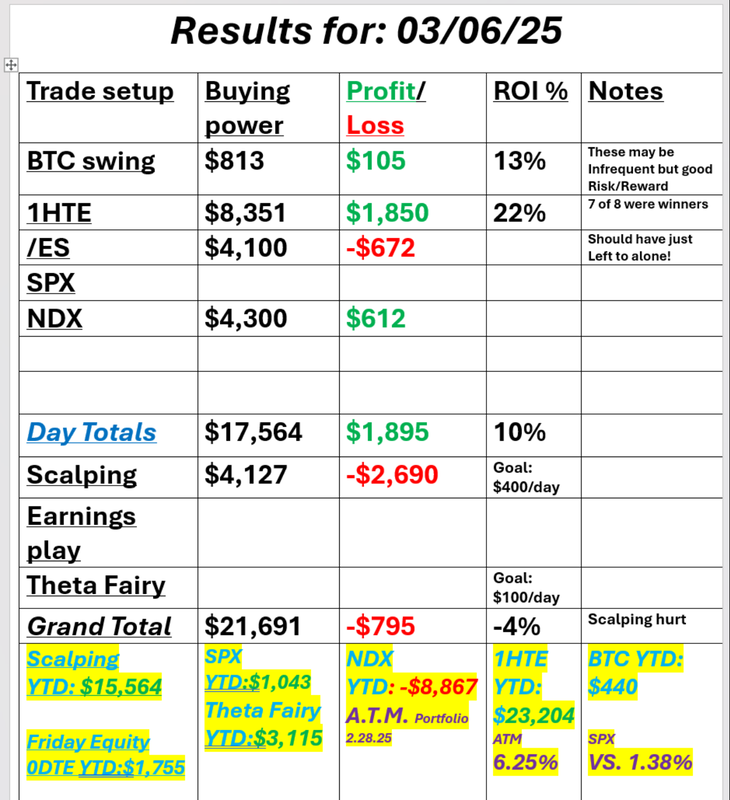

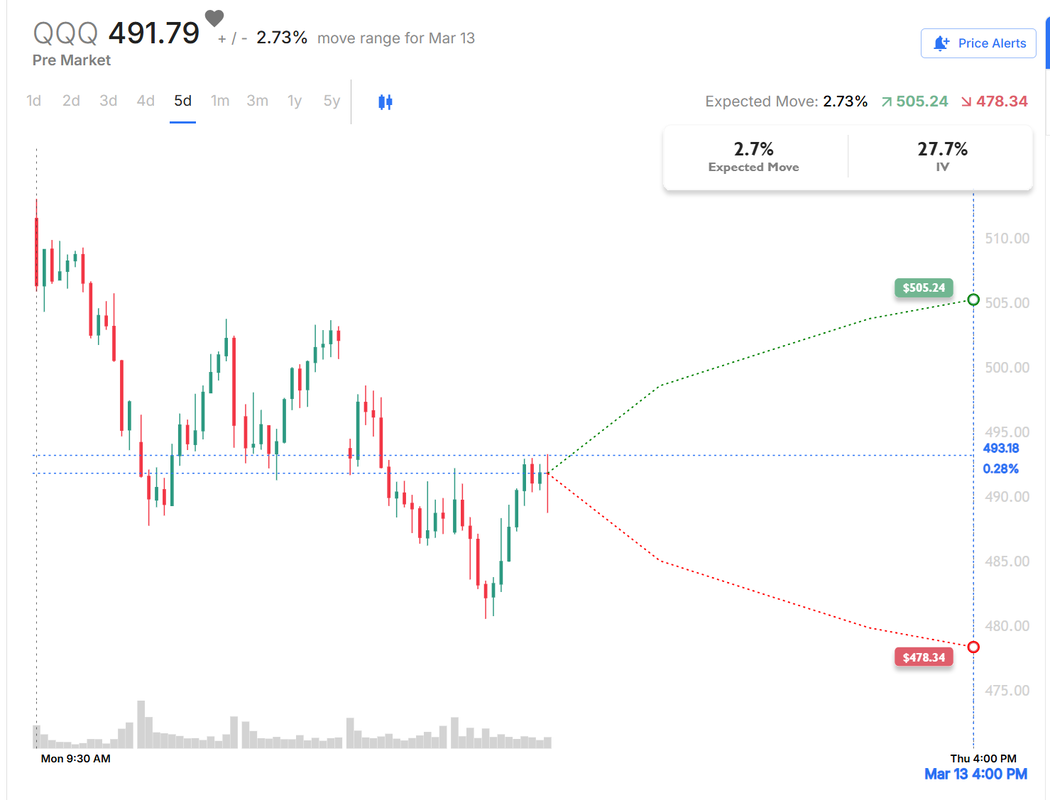

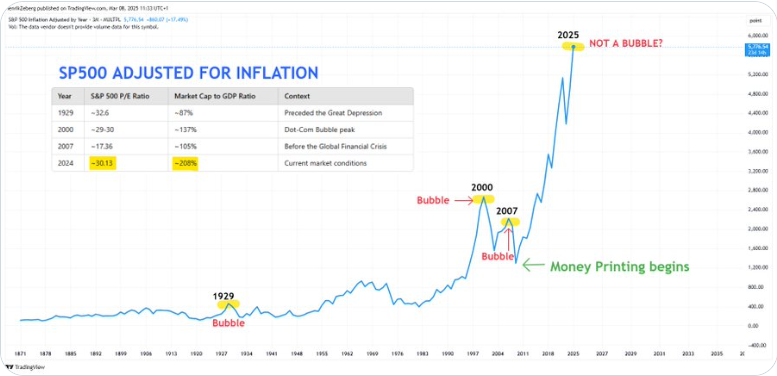

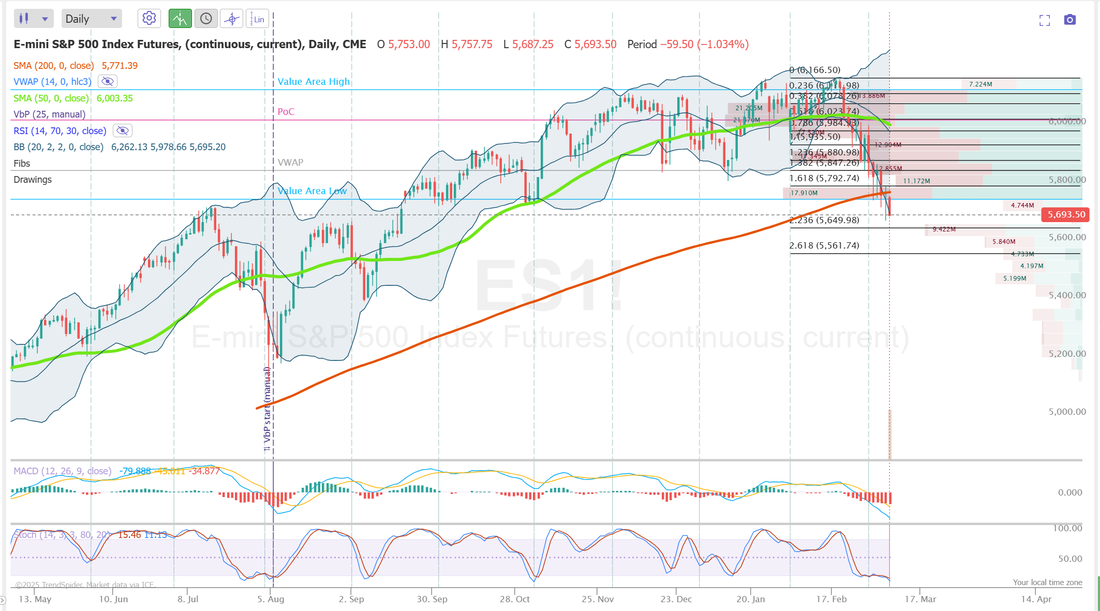

Welcome back traders. What a tough week last week. SPX recorded it's worst week in three months. The NDX fell below its 200DMA for the first time in nearly 500 trading days. My results were mixed Friday. Our long vol /ES would have hit for a profit if I would have just let the darn thing work. Here's a look at our day. Our 1HTE's on Bitcoin continue to produce for us. In a market like this it's nice to have something that diversifys you. I'll work up a detailed review of our 1HTE results from Friday for tomorrows blog. I want to talk about "playing with house money" which is what we did most of the day on Friday. Let's take a look at the markets: 200DMA is the word of the day. The IWM is already through it and has been for a while but the other major indices are still clinging on. Futures are down heavy this morning. Is today the day that we lose the 200DMA or do the bulls finally make a stand? Todays results could be a big determining factor for the next big directional move. Probably no big surprise that technicals are still in a sell mode setup. After a bearish week, SPY tested its 50-week simple moving average for the first time since October 2023 and closed at $575.92 (-3.02%). While price action remains pressured, our custom RSI ensemble indicator shows a slightly oversold reading for the first time since April 2024, when SPY formed a multi-month low. This suggests that oversold conditions across multiple timeframes may be setting the stage for a potential short-term rebound. QQQ briefly broke below its 50-week simple moving average this week but managed to bounce back, closing at $491.79 (-3.21%). This level is crucial as it marked the low of the August 5th carry trade crash. At its lowest, QQQ had fallen just over 11% from its recent peak, briefly entering official correction territory, but a late-week recovery kept it above the 10% threshold. With the same slightly oversold RSI ensemble reading as SPY, traders are left wondering if this is a bottom or the start of a long-term downtrend. IWM took the hardest hit among the major index ETFs this week, closing at $205.95 (-4.04%). Unlike SPY and QQQ, it started the week already below its 50-week simple moving average, signaling continued weakness. Our RSI ensemble indicator has been flashing oversold conditions for two consecutive weeks, yet buyers are attempting to defend a key high-volume node on the volume profile. I.V. is back! When is the last time you saw an expected weekly move above 2% for SPY? S&P 500 recorded the WORST week in 3 months. Tariff headlines, US economic uncertainty, rising bond yields globally, particularly in Germany and Japan, were behind the last week’s volatility. Meanwhile, Gold and Silver continue to outperform. This is the SP500 adjusted for inflation. A tad bit worrysome I'd say. Trade docket for today will try to focus on non-equity correlated setups. Working our weekly Bond (/ZN) trade as well as Gold (/GC) and back on the DIA after a losing week last week. BITO, GE, FRT, CPAY, TJX short additions to our pairs trades along with 1HTE and 0DTE's. Scalping will focus on the /MNQ today. My bias or lean today is bearish (big stretch, I know) with a focus on the 200DMA. Either we hold or lose that level today and that may be what determines the near term direction for the week. Let's look at the levels we are working with today: /ES: Futures have lost the 200DMA as I type. Intra-day I'm looking at the 5747 then 5790 as resistance. 5674, 5646 as support. /NQ: Futures have the Nasdaq below the 200DMA as well. /NQ intra-day. 20,088 and 20,286 is resistance with 19,765 and 19,650 working as support. BTC: Getting smacked down...again. 84,418 and 87,188 working as support. 80,290 is current support. One of the biggest purported advantages of day trading is that you start out each day in cash. It's nice to be in that position as we start another day that looks tough for the bulls. Let's be patient with our entries today. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |