|

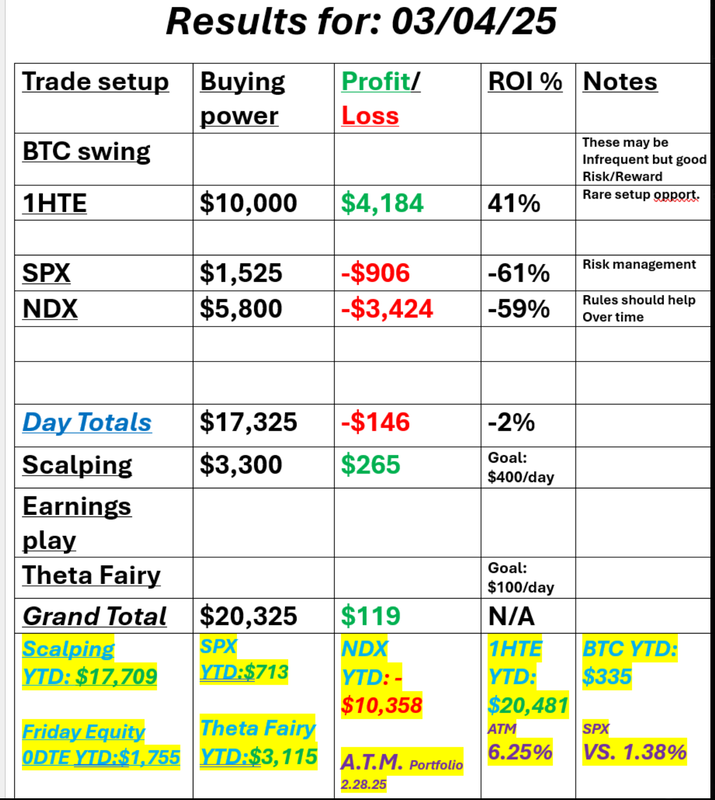

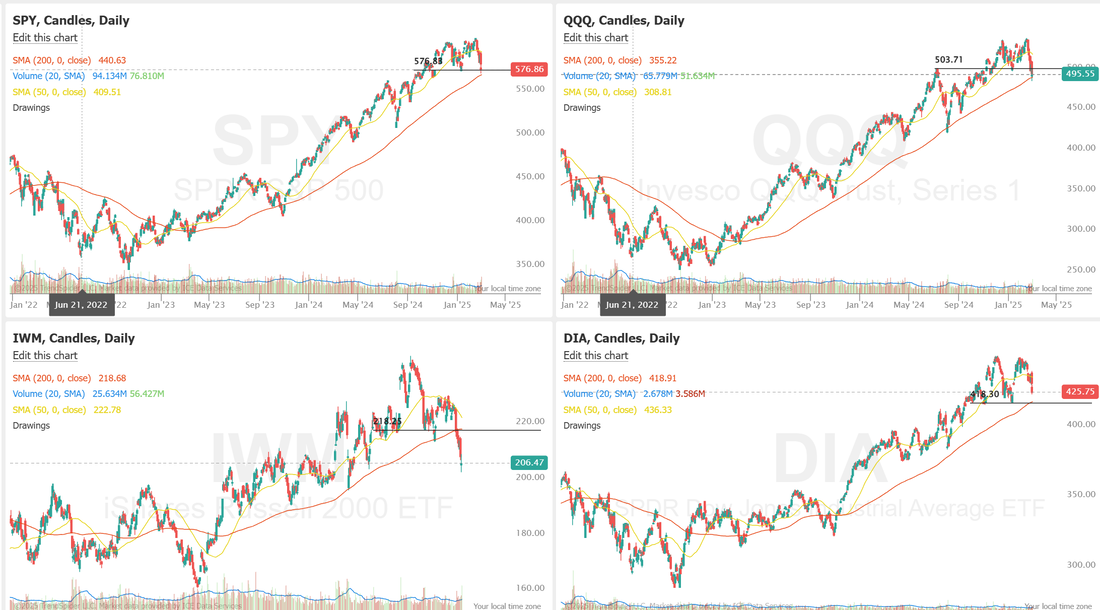

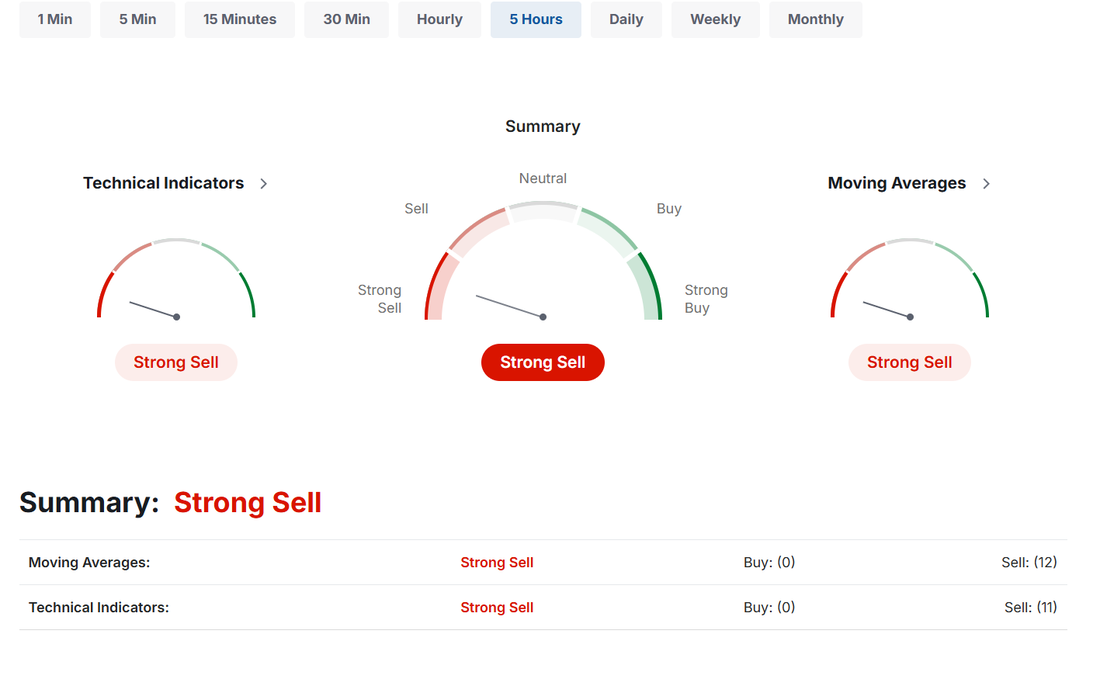

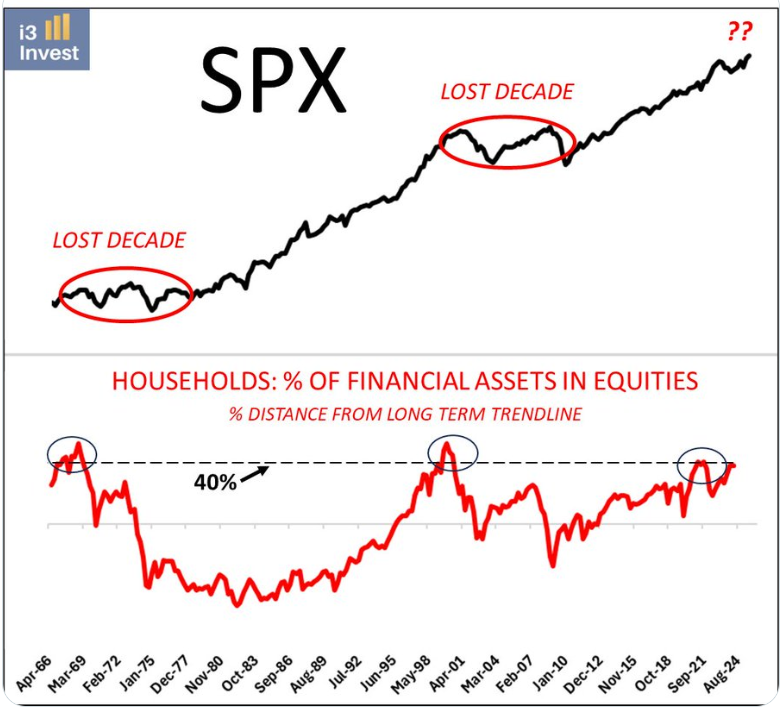

Welcome back traders! That was quite the swings we got yesterday. 500 points of movement in the last five days. We had a relatively flat day as you can see below. As I said in the trading room, it's frustrating to pull our working 0DTE's at a loss before the end of the day and then see them slide back into what would have been the profit zone at the close but, I think most of us would agree, generally we will benefit from being on the sidelines going into the close vs. white knuckling it, hoping it hits. We'll continue to do what we can to be out, regardless of the situation, before the power hour really starts ramping up. Fortunately for us, the BTC trade was a big success and saved the day. I'm going to take a vey slow, simple approach today. See my trade docket below: We'll continue to work our Gold ladder today. Scalping will be focused on the QQQ's IF...we get some directional movement. We'll try again for a 1HTE or 0DTE on BTC. I'm going to work some small 0DTE's today, later in the day. March S&P 500 E-Mini futures (ESH25) are trending up +0.73% this morning, rebounding from yesterday’s losses after U.S. Commerce Secretary Howard Lutnick said the Trump administration might dial down some trade tariffs. Lutnick said in an interview with Fox Business on Tuesday that U.S. President Donald Trump would “probably” announce a deal to lower tariffs on Canada and Mexico as early as Wednesday. He noted that tariffs would probably settle “somewhere in the middle,” with Trump “moving with the Canadians and Mexicans, but not all the way.” Investors also digested President Trump’s speech to Congress. Trump acknowledged that there could be an “adjustment period” to tariffs as he defended his policies aimed at reshaping the U.S. economy. He also urged the termination of a $52 billion semiconductor subsidy program and repeated the 25% tariffs on aluminum, copper, and steel. Investors now await a fresh batch of U.S. economic data, with a particular focus on the ADP employment report. In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Best Buy (BBY) plunged over -13% and was the top percentage loser on the S&P 500 after the electronics retailer issued a weak FY26 adjusted EPS forecast. Also, bank stocks lost ground, with Citigroup (C) and Bank of America (BAC) sliding more than -6%. In addition, Tesla (TSLA) fell over -4% after preliminary data from China’s Passenger Car Association showed that the EV maker’s China vehicle deliveries tumbled 49% year-over-year to 30,688 units in February. On the bullish side, Okta (OKTA) jumped more than +24% after the company posted upbeat Q4 results and issued above-consensus FY26 guidance. Also, chip stocks advanced, with Marvell Technology (MRVL) climbing nearly +3% and Advanced Micro Devices (AMD) gaining more than +2%. New York Fed President John Williams stated on Tuesday that tariffs from the Trump administration will somewhat contribute to rising price pressures, though there remains significant uncertainty about how this will ultimately unfold. He added that he views monetary policy as being in a “good place” and sees “no need to change it” at the moment. Meanwhile, U.S. rate futures have priced in a 93.0% probability of no rate change and a 7.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Today, all eyes are focused on the U.S. ADP Nonfarm Employment Change data, which is set to be released in a couple of hours. Economists, on average, forecast that the February ADP Nonfarm Employment Change will stand at 141K, compared to the January figure of 183K. Investors will also focus on the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI. Economists expect the February ISM services index to be 52.5 and the S&P Global services PMI to be 49.7, compared to the previous values of 52.8 and 52.9, respectively. U.S. Factory Orders data will be reported today. Economists foresee this figure coming in at +1.7% m/m in January, compared to the previous number of -0.9% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 0.600M, compared to last week’s value of -2.332M. On the earnings front, notable companies like Marvell Technology (MRVL), Zscaler (ZS), MongoDB (MDB), and Campbell Soup (CPB) are set to report their quarterly results today. Later today, the Fed will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Fed districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.254%, up +1.05%. Let's take a look at the markets: There's a couple things that jump out at me on these charts. #1. The trend is clearly down, at this point. #2. We are sitting on some very key, important levels. #3. A break of the 200DMA (The IWM is already there) would be very bearish. Counter all this with the potential that all the tariffs get resolved. That maybe this is all one big game of chicken and a bluff, used for leverage in negotiations? We may see as soon as later today. Techincals are bearish. I think we may be entering a market enviroment much like the "lost decade" where the only way to make money was trade. Buy and hold simply didn't produce. Let's take a look at the intra-day key levels: /ES: It's interesting that with all the ebbing and flowing of yesterday, todays levels are unchanged. 5846/5881 are resistance with 5789/5753 support. /NQ levels have adjusted a bit. 20582/20729 are resistance with 20328/20076 support. BTC: Our bitcoin trade yesterday was a huge win or us and really saved the day. I'm not sure we'll get that kind of setup today. 92,863 is resistance with 87232 support. I'll see you all in the live trading room shortly. Today will be a waiting game. We'll sit on our hands until we see some movement we like.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |