|

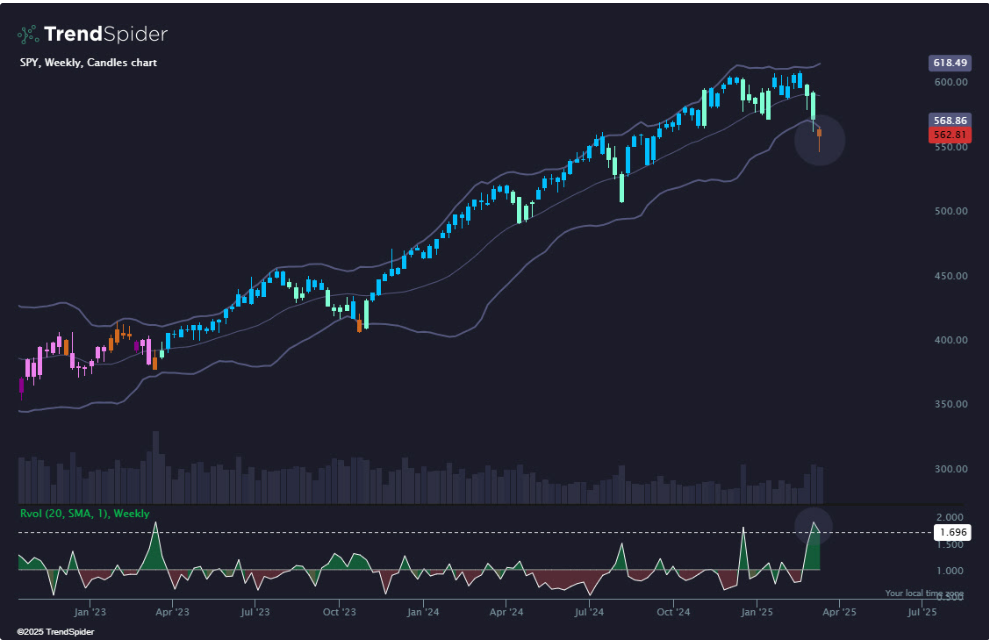

Welcome back traders to a new week of opportunities and St. Patricks day! To say that the last few weeks have been trying is a complete understatement. It's important to recognize market dynamica and change and change with the change! We've talked a lot about narrowing our focus, shortening our trading horizion and scaling down our trades. That's seemed to work well for us. To that end, I'm going to focus on mainly the day trades in the live trading room and leave the longer term trades to our ATM portfolio. That means 1HTE (0DTE) BTC trades, Theta Fairys, Scalps, Earnings trades and 0DTE's primarily on SPX. We've had a long standing goal of shooting for $1,000/day in profits. This might lower our potential but it will also help with consistency and risk management. Our ATM asset allocation portfolio is doing great in this market and could finish out the first quarter up 12%. I'm not saying we'll end the year up 40%+ but it certainly has the best of all worlds going for it right now. High I.V. with a downward trending market makes it a perfect enviroment for good results. Here's a look at how our Friday went. Let's take a look at the markets: Fridays strong move still couldn't flip us to a full buy mode but it certainly helped i were looking for bullish moves. Today could really flip either way. We are closer to a neutral rating than a buy or sell and those days are usually unpredictable. I said on Friday that even a big up day wouldn't change the technicals much and that ended up being true. It was a solid day for the bulls but nothing really changed in the bigger picture. The SPY extended its losing streak, closing the week at $562.81 (-2.26%) and marking its fourth consecutive red candle. The GoNoGo Trend Indicator, which tracks trend strength using color-coded candles, has turned neutral for the first time since October 2023. At the same time, SPY closed below the lower Bollinger Band, a rare event that has historically signaled a short-term reversal. With elevated RVOL hinting at capitulation, traders are watching closely for signs of stabilization and the next key support level. The QQQ also extended its decline last week, closing at $479.66 (-2.46%). Similar to SPY, GoNoGo Trend flashed a neutral candle along with a weekly close below the lower Bollinger Band. Notably, QQQ recorded its highest weekly volume since early August, a dynamic not seen in its peers. While these signals have historically resulted in short-term bottoms, traders are left wondering if the elevated RVOL is showing signs of capitulation or if the downtrend is just getting started. IWM cemented a strong bearish trend as the GoNoGo Trend flashed a strong 'No Go' candle for the first time in months, closing the week at $202.89 (-1.48%). Unlike SPY and QQQ, IWM has rapidly cycled through all five GoNoGo trend signals in the past five weeks. Price opened the week below the lower Bollinger Band, and that's where it stayed. With high RVOL signaling intense selling pressure, traders are watching closely to see if oversold conditions spark a relief bounce or if downside continuation is ahead. VIX1D is still elevated but coming back down to earth. Let's look at the expected moves for this week. For an FOMC week its a solid I.V. level. March S&P 500 E-Mini futures (ESH25) are down -0.47%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.48% this morning, pointing to a red opening on Wall Street after U.S. Treasury Secretary Scott Bessent characterized the market’s recent slump as healthy. Treasury Secretary Scott Bessent stated on Sunday that he isn’t concerned about the recent market slump that has erased trillions of dollars from equities. “I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said on NBC’s Meet The Press. “I‘m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation, and energy security, the markets will do great.” His remarks dash the hopes of those expecting U.S. President Donald Trump to take steps to mitigate the market impact of his policies. In addition, Bessent said there are “no guarantees” that the U.S. will avoid a recession. Investor focus this week is on the Federal Reserve’s interest rate decision, a raft of U.S. economic data, and earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages closed sharply higher. Ulta Beauty (ULTA) surged over +13% and was the top percentage gainer on the S&P 500 after the company reported better-than-expected Q4 results. Also, the Magnificent Seven stocks advanced, with Nvidia (NVDA) climbing more than +5% to lead gainers in the Dow and Tesla (TSLA) rising over +3%. In addition, DocuSign (DOCU) gained more than +14% after the electronic signature software company posted upbeat Q4 results and gave a strong full-year billings forecast. On the bearish side, T-Mobile US (TMUS) fell more than -1% after Citigroup downgraded the stock to Neutral from Buy. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index fell to a 2-1/3 year low of 57.9 in March, weaker than expectations of 63.1. Also, the University of Michigan’s U.S. March year-ahead inflation expectations unexpectedly rose to a 2-1/3 year high of 4.9%, higher than expectations of no change at 4.3%, while 5-year implied inflation expectations unexpectedly rose to a 32-year high of 3.9%, stronger than expectations of a decline to 3.4%. Meanwhile, a U.S. government shutdown was averted. The Senate passed a Republican spending plan on Friday by a vote of 54-46 to keep the government funded for the next six months. A White House spokesman said on Saturday that President Trump had signed it into law. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. The decision comes amid growing concerns about the potential damage that President Trump’s tariff policies could inflict on the economy. Market watchers will closely monitor the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC member forecasts regarding the path of interest rates. Economists expect policymakers’ updated projections to indicate two quarter-percentage point cuts this year. “The Fed is in a very tough spot right now, facing a more stagflationary outlook even as core inflation remains well above its medium-term target. Uncertainty around the magnitude, duration, and targets of future tariffs further complicates the monetary policy outlook. They have the potential to roil monetary policy expectations as well as financial markets,” said Scott Anderson, chief U.S. economist at BMO Capital Markets. Market participants will also focus on a spate of economic data releases this week, including U.S. Building Permits (preliminary), Housing Starts, the Export Price Index, the Import Price Index, Industrial Production, Manufacturing Production, Crude Oil Inventories, Current Account, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, Existing Home Sales, and the Conference Board’s Leading Economic Index. In addition, several notable companies like Nike (NKE), Micron Technology (MU), FedEx (FDX), Lennar (LEN), Accenture (ACN), and Carnival Corp. (CCL) are scheduled to release their quarterly results this week. Notably, Nvidia CEO Jensen Huang is set to speak this week at the company’s GPU Technology Conference, commonly known as GTC, at a time when the chipmaker is under market pressure amid the tariff-driven sell-off. Today, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. The reading will show how American consumers have fared amid a wave of headlines about potential tariffs and their impact on inflation. Economists, on average, forecast that February Retail Sales will stand at +0.6% m/m, compared to the January figure of -0.9% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at -0.4% m/m in January. Economists expect the February figure to be +0.3% m/m. The Empire State Manufacturing Index will be released today as well. Economists foresee this figure coming in at -1.90 in March, compared to 5.70 in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.286%, down -0.51%. My bias or lean today is, once again, slightly bullish. Futures are down this morning but I think the bulls from Friday will try to give it the old college try, once again today. I'm going to position our 0DTE slightly bullish out of the gate and then we can adjust as the day goes on if I'm wrong. Trade docket for today: BITO cover, QQQ scalps, 1HTE BTC, SPX 0DTE, Theta fairy after the close. Let's take a look at the intra-day levels: /ES: Very tight range today. 5649 is resistance. 5593 is support. BTC: Bitcoin is in a tight range as well.84,845 is resistance with 82,174 working as support. I look forward to seeing you all in the live trading room shortly. Let's see if we can keep our buying power down and our earnings potential up again!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |