|

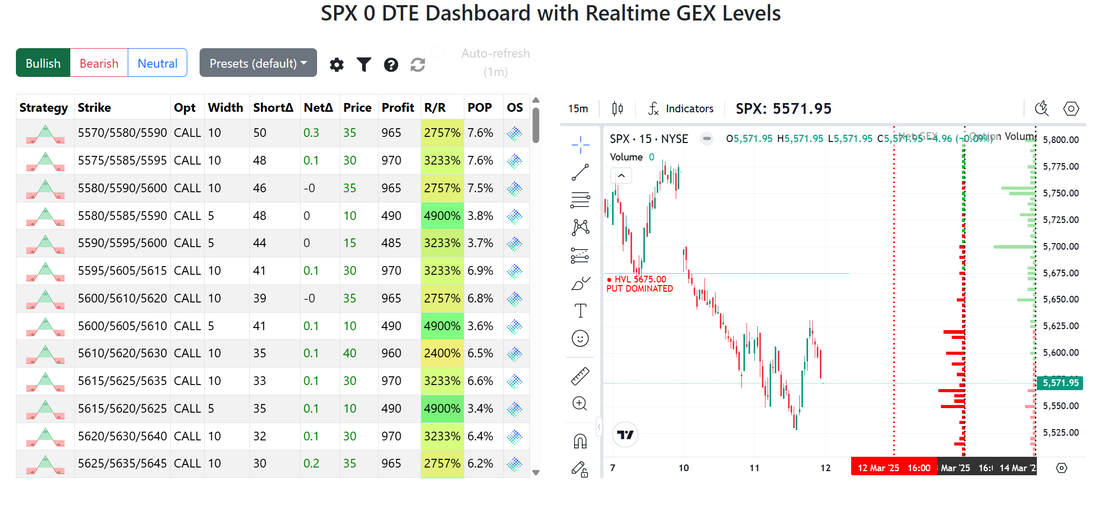

Welcome to Weds. traders. We had an SPX roll working yesterday that had a nice profit zone both up and down and yeah...we couldn't catch either! The market it tricky right now, to say the least. Our 1HTE BTC trades and scalping continue to work and we'll work those again today but our 0DTE will be mostly Butterfly focused. It's about the best risk/reward right now in this crazy market. We are also working on adding the GEX data that we use to the member website so you can see all the data for yourself. More on that in a minute. Here's our results from yesterday. GEX levels may be one of the most helpful data points for 0DTE traders. If you're not familiar with GEX here's a quick rundown. A "gex level" refers to the "Gamma Exposure Level," which is a measure in options trading that indicates the potential for price movement based on the collective options positions held by market participants, essentially showing how much market makers need to hedge their positions if the underlying asset price shifts slightly; a high GEX level suggests significant potential for price volatility due to hedging activity. Key points about GEX levels:

We use these data points to find levels to set trades at. This is what it looks like. Over the next few weeks we'll be conducting some trainings on how to read the data and how to access it. I think this will be a nice addition and value add to our trading members. Let's take a look at the markets. Probably not a surprise that the technicals are still bearish. Even the last holdout, the DIA is now down below it's 200DMA. I also want to do a review today of the non-equity investment alternatives that we've talked about before but it's been a while: We'll touch on each of these in the zoom today. Rally Rd. MasterWorks Groundfloor Watchrading Academy Kalshi Real Estate fractional investing. March S&P 500 E-Mini futures (ESH25) are trending up +0.56% this morning as investors gear up for the release of crucial U.S. inflation data. Stock futures got a boost after U.S. President Donald Trump stated he doesn’t see a U.S. recession. “I don’t see it at all. I think this country’s going to boom,” he said late Tuesday at the White House. Also, Bloomberg reported that President Trump told top executives at a Business Roundtable meeting on Tuesday that he is prioritizing rapid approvals, particularly for environmental regulations, and plans to announce a major electricity project soon. He also reiterated the idea that a company’s business taxes could be lowered if it produced its goods in the U.S. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. Teradyne (TER) plunged over -17% and was the top percentage loser on the S&P 500 after the company said it expects FQ2 revenue to be flat to down -10% q/q. Also, chip stocks retreated, with GlobalFoundries (GFS) sliding more than -6% to lead losers in the Nasdaq 100 and Texas Instruments (TXN) falling over -4%. In addition, Verizon Communications (VZ) slumped more than -6% and was the top percentage loser on the Dow after the company’s chief revenue officer said Q1 is “challenging” from a competitive intensity standpoint. On the bullish side, Southwest Airlines (LUV) climbed over +8% after the airline announced plans to charge non-preferred customers for their first and second checked bags. Tuesday’s U.S. economic data showed strength in the labor market, offering some support to equities. The JOLTs job openings rose to 7.740M in January, stronger than expectations of 7.650M. “Even if the majority of this drawdown is potentially behind us, volatility may not be, and there’s a good chance the market could chop sideways for a while,” said Daniel Skelly, head of Morgan Stanley’s Wealth Management Market Research & Strategy Team. Meanwhile, Trump’s tariff policy, geopolitical shifts surrounding Ukraine, sticky inflation, and uncertainty over the pace of the Federal Reserve’s interest-rate cuts have dampened market sentiment this year, bringing U.S. equities close to a correction. Goldman Sachs has become the latest major bank to adjust its forecast for the U.S. equity benchmark amid rising policy uncertainty and growing concerns over the world’s largest economy, cutting its year-end target for the S&P 500 Index to 6,200 from 6,500. President Trump’s 25% tariffs on steel and aluminum imports took effect today following a turbulent day at the White House, when he threatened to raise the metals tariffs on Canada to 50%. The president backed off after Ontario agreed to abandon plans for a surcharge on electricity exports to the U.S. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. February CPI will come in at +0.3% m/m and +2.9% y/y, compared to the previous numbers of +0.5% m/m and +3.0% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.2% y/y in February, compared to January’s figures of +0.4% m/m and +3.3% y/y. “It feels that this could be a lose-lose situation. A higher-than-expected reading could fuel the stagflation narrative while a weaker-than-expected print could cement recession fears,” said Julien Lafargue, chief market strategist at Barclays Private Bank. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its FQ1 earnings results today. U.S. rate futures have priced in a 97.0% chance of no rate change and a 3.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.275%, down -0.30%. CPI is the big planned news catalyst today. It cam in below forecast so the futures are benefitting. My lean or bias today is bullish. Futures are up. CPI is tame. We've had some big moves to the downside for a while now. I think we are finally due an up day. Trade docket for today: ADUS, BKE, CMPR, QQQ scalping continues, WWW, 1HTE BTC, 0DTE SPX/NDX butterflies, SPY zebra. Let's take a look at the intra-day levels as they've changed with this mornings futures moves. /ES: Levels are particularly wide right now. That means a lot of movement could happen and we just chock it up to meaningless chop. 5673 is resistance with 5578 working as support. /NQ: Levels are a tad bit tighter than /ES. 19,854 is resistance with 19,469 working as support. BTC: 85,520 is current resistance with 82,042 working as support. I'm looking forward to a more "stress free" day in the trading room! See you all inside shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

April 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |