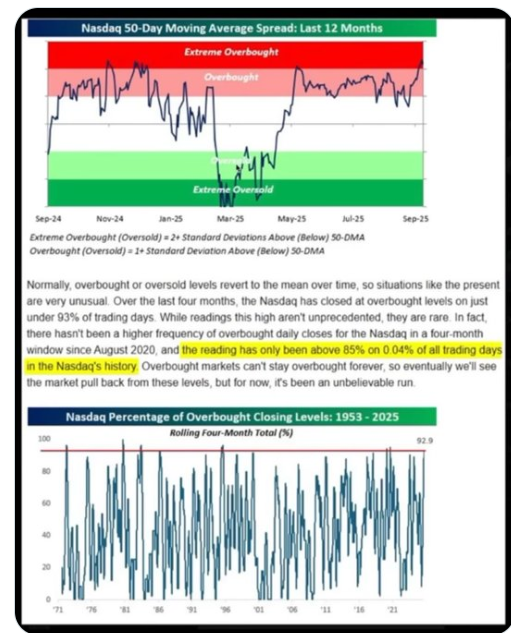

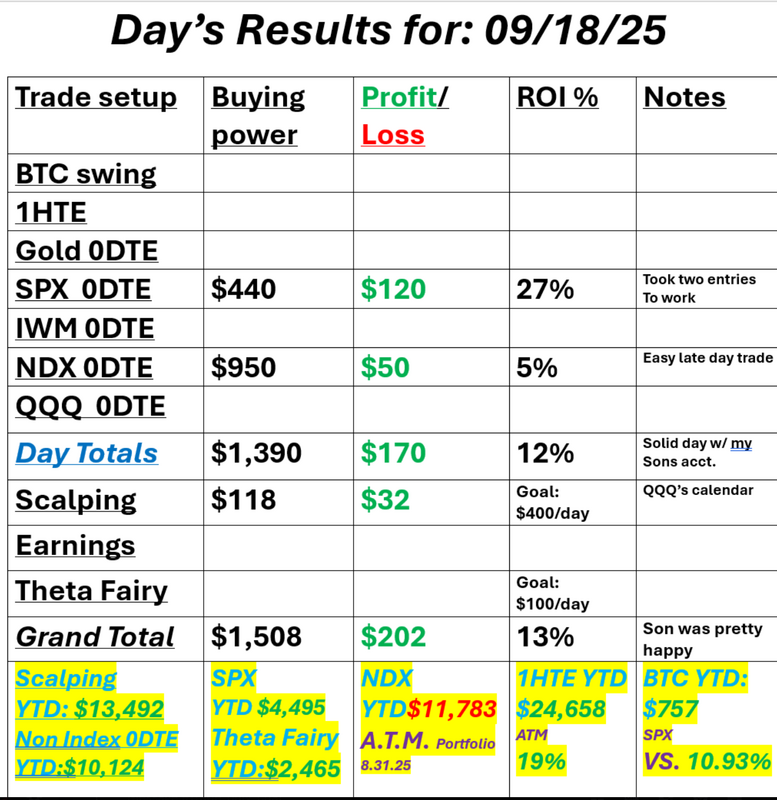

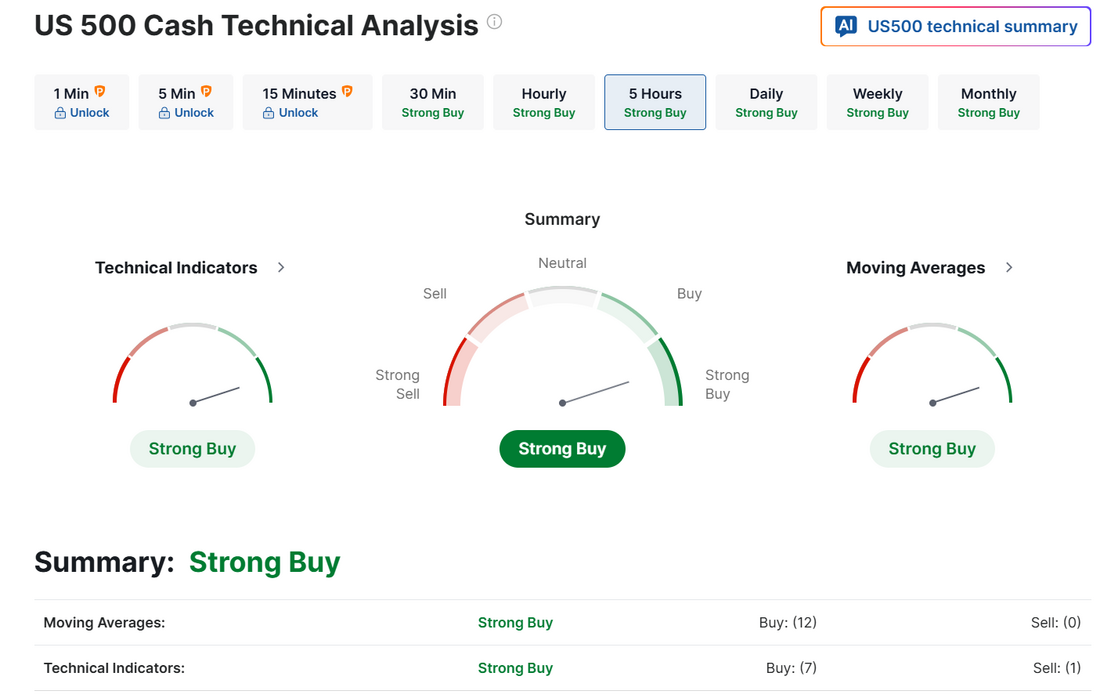

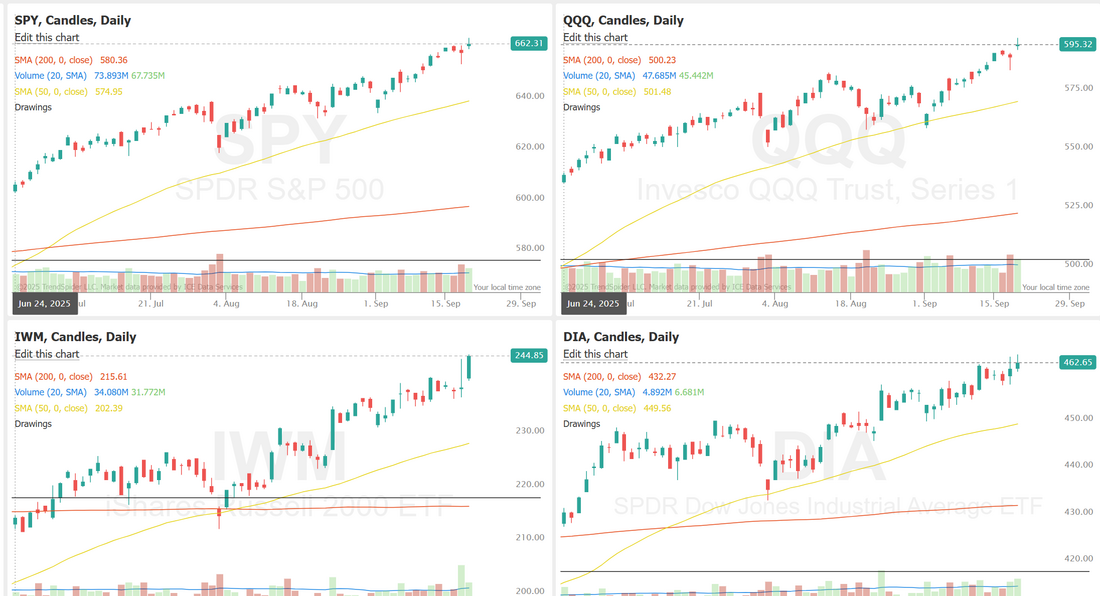

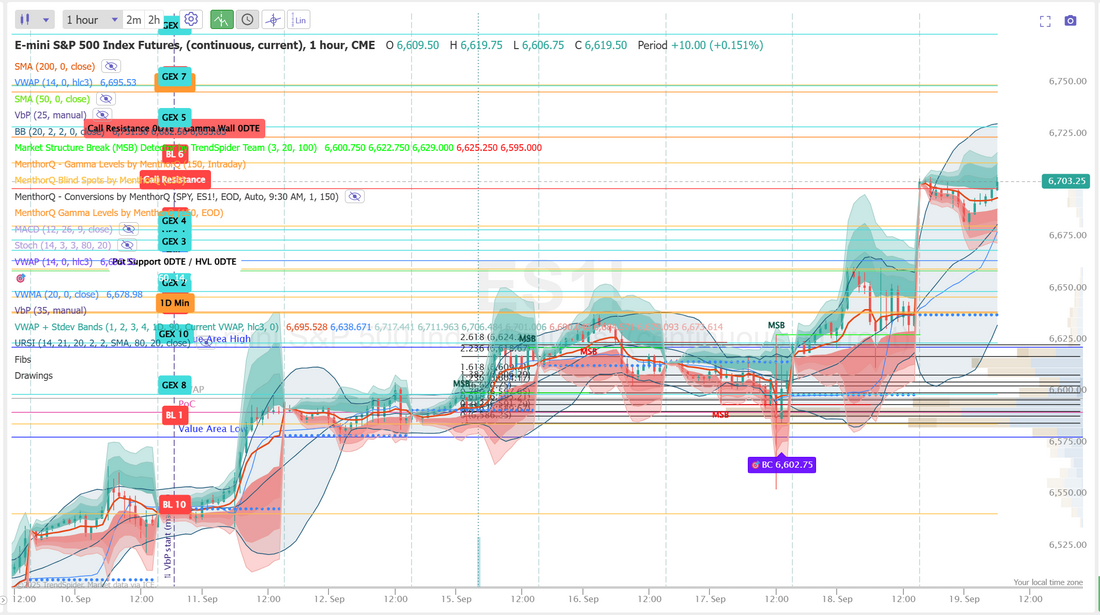

How much higher?The market got it's rate cut and certainly seems to like it. We continue to hit new ATH's over and over. How much more gas in the tank do the bulls have? Who knows? Certainly I don't. I had a reality check with my emotions yesterday as my wife and I talked to a good friend who got a life insurance payout. She needs the income from it to support herself and was asking if putting it all into the market right now was a good idea. I had a visceral reaction! These valuation levels are getting scary. If you've been around long enough to have gone through the 2000 tech bubble burst and 2008 financial crisis you too may have some PTSD! This article I read early this morning is a good read. Keep some powder dry folks. That's all I'll say. https://www.telegraph.co.uk/business/2025/09/18/a-stock-market-crash-may-be-just-around-the-corner/ Nasdaq has closed “overbought” on more than 90% of days in the last 4 months. That’s only happened 0.04% of the time in history. When markets get this stretched, volatility doesn’t disappear ~ it’s actually building up kinetic energy. Japan’s stock market falls -2.5% as Japanese bond yields extend their run into record territory. Japan is just a glimpse of what will happen to the U.S. if we do not solve our deficit spending crisis. It might just be my optics but everything I see right now points to an overvalued market. We had a solid day yesterday. It was a small capital allocation as I have been trading in my sons small $2,000 acct. He's home for a week and wanted to see what we could do. I think he's pretty happy with the results and it also shows we don't need to use $10,000 dollars every day to get good results. Let's take a look at the markets as they continue to climb and climb. Not surprisingly, technicals remain bullish. What can you say? The Russell especially is on fire! September S&P 500 E-Mini futures (ESU25) are trending up +0.17% this morning, extending yesterday’s gains, while investors await a phone call between U.S. President Donald Trump and Chinese President Xi Jinping. Trump and Xi are scheduled to speak at 9 a.m. Washington time, or 9 p.m. in Beijing. The conversation is expected to decide TikTok’s future and could also help ease trade tensions between the world’s two largest economies. “A deal for the social media app might act as a catalyst for improving the relationship between the two largest economies amid an ongoing trade war,” according to Danske Bank strategists. In yesterday’s trading session, Wall Street’s major indices ended in the green, with the S&P 500, Nasdaq 100, and Dow notching new record highs. Intel (INTC) jumped over +22% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after Nvidia said it would invest $5 billion in the chipmaker as part of a partnership to jointly develop PC and data center chips. Also, CrowdStrike Holdings (CRWD) surged more than +12% after the cybersecurity company gave a strong fiscal 2027 forecast for net new annual recurring revenue growth. In addition, 89bio (ETNB) spiked over +85% after Roche agreed to acquire the company for $3.5 billion. On the bearish side, FactSet Research Systems (FDS) plunged more than -10% and was the top percentage loser on the S&P 500 after the company posted weaker-than-expected FQ4 adjusted EPS and issued soft FY26 guidance. Economic data released on Thursday showed that the U.S. Philly Fed manufacturing index rose to an 8-month high of 23.2 in September, stronger than expectations of 1.7. Also, the number of Americans filing for initial jobless claims in the past week fell by -33K to 231K, compared with the 241K expected. At the same time, the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in August, weaker than expectations of -0.2% m/m. “The Federal Reserve is cutting interest rates during a time when stocks are at record highs and the economy is still growing. This dynamic is bullish for stocks,” said Robert Schein at Blanke Schein Wealth Management. U.S. rate futures have priced in a 91.9% probability of a 25 basis point rate cut and an 8.1% chance of no rate change at the next central bank meeting in October. Meanwhile, Wall Street is bracing for a quarterly event known as “triple-witching,” during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. According to data from SpotGamma, options tied to about $6.3 trillion in stocks and equity indexes are set to expire today, making the September expiration one of the three largest triple-witching events on record. However, market watchers are largely downplaying its significance. “The quarterly option expiry is increasingly becoming a non-event, especially when volatility is low,” said Garrett DeSimone, head quant at OptionMetrics. “So don’t expect big price jumps [on] the Monday post expiry.” The U.S. economic data slate is empty on Friday. However, investors will likely focus on a speech from San Francisco Fed President Mary Daly. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.122%, up +0.46%. My lean or bias today is bullish because...well, because what else can you be? This ride will stop at some point and reverse. It always does. The unanswerable questions are when and by how much? We shared some insightful training Monday of this week and yesterday. Mondays are usually the designated days for our trainings. I'm not sure what will be on the agenda for this coming Monday but I'm sure it will be helpful! Be sure to tune into the zoom feed then! The SPX continues to edge higher toward fresh highs, but the seasonality score has recently slipped back into negative territory after holding neutral-to-positive for much of early September. This shift suggests that short-term seasonal patterns may be less supportive over the coming sessions, even as price action remains firm. In the near term, traders may want to watch whether the index can sustain its upward momentum against this seasonal headwind, as further weakness in the score could signal a period of consolidation or slower gains. Let's take a look at our intra-day levels for today on /ES: NOTE: We are rolling over now to the Dec. Futures contract. That is the /ESZ5. Note the difference in levels. Charts will look more "normalzed" after a full days trading data is compiled. 6712, 6725, 6730, 6746 are resistance zones. 6699, 6681, 6675, 6671, 6660 are support. Keep in mind Volume profile level on the 15 min. chart is around 6095.

I look forward to seeing you all in the live trading room shortly. Let's have a great finish to the week!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |