|

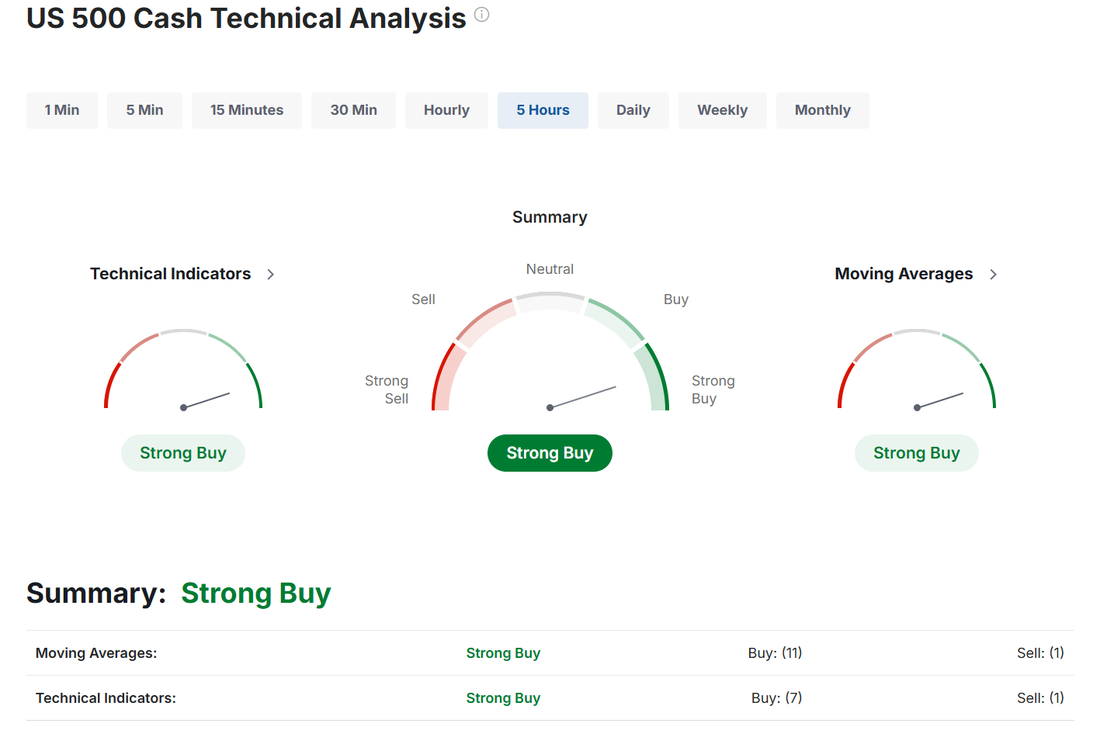

Welcome to Wednesday traders! Yesterday was another low conviction day for me. We came close to having a great day but my NDX calls finished just outside the profit zone. Fortunately scalping helped. Here's my results below: Let's take a look at the market We've rotated back to buy mode technically. We are still at a critical level that will likely determine our future directional move. You can see that the SPY is a bit stronger but all the indices we trade are still sitting right around the level we were at right before the election bump. December Nasdaq 100 E-Mini futures (NQZ24) are trending up +0.14% this morning as investors shifted their focus to a highly anticipated earnings report from AI darling Nvidia. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Super Micro Computer (SMCI) soared over +31% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the server maker appointed an independent auditor and submitted a compliance plan to Nasdaq. Also, Nvidia (NVDA) climbed more than +4% and was the top percentage gainer on the Dow after Stifel and Truist raised their price targets on the stock. In addition, Walmart (WMT) rose +3% after the retail giant posted better-than-expected Q3 results and raised its full-year guidance. On the bearish side, Incyte Corp. (INCY) slumped over -8% and was the top percentage loser on the S&P 500 after halting enrollment in a Phase 2 trial of its chronic spontaneous urticaria candidate targeting MRGPRX2 due to findings from preclinical toxicology. Economic data released on Tuesday showed that U.S. housing starts fell -3.1% m/m to 1.311M in October, weaker than expectations of 1.340M. Also, U.S. October building permits, a proxy for future construction, unexpectedly fell -0.6% m/m to 1.416M, weaker than expectations of 1.440M. Kansas City Fed President Jeffrey Schmid said on Tuesday that it remains uncertain how far interest rates can fall, although the initial cuts by the Fed are a sign of confidence that inflation is moving back to its 2% target. “The decision to lower rates is an acknowledgment of the ... growing confidence that inflation is on a path to reach the Fed’s 2% objective - a confidence based in part on signs that both labor and product markets have come into better balance in recent months,” Schmid said. Meanwhile, U.S. rate futures have priced in a 59.1% probability of a 25 basis point rate cut and a 40.9% chance of no rate change at the December FOMC meeting. Market participants are awaiting Nvidia’s third-quarter earnings report, scheduled for release after the market close, to gauge future demand for its new Blackwell AI chips, particularly after The Information reported on Sunday that these chips were experiencing overheating issues when connected to server racks designed to hold up to 72 chips. “After an exhausting election cycle, options show that NVDA results will be the most important catalyst left for the remainder of the year, notable, more so than NFP, CPI, and FOMC,” Stefano Pascale, equity derivatives strategist at Barclays, said in a note Tuesday. Prominent companies like TJX (TJX), Palo Alto Networks (PANW), Target (TGT), and Snowflake (SNOW) are also set to report their quarterly figures today. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data due later in the day. Economists estimate this figure to be -0.1M, compared to last week’s value of 2.1M. In addition, investors will be looking toward speeches from Fed Governors Lisa Cook and Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.417%, up +0.87%. My lean or bias today is bullish. It certainly looks like the resistance level prior to the election bump is now working as support. Trade docket for today: /ZN, /MNQ, /NG, DIA, DKNG, FDX, TGT, TJX, NVDA, SNOW, 0DTE's. Let's take a look at our intra-day levels. /ES: There are a couple key levels I'm watching today. 5958 is the first key resistance. It's fairly substantial. If bulls can push through it the 6000 level would be the next upside target. 5933 is the first support level with 5918 next. /NQ: Very similar chart and price action compared to the /ES. 20843 is first resistance with 20914 being the next upward target. 20730 is forst support with 20668 next. BTC: Bitcoin continues to press it's ATH levels. I don't really have a resistance level in mind. We are at or near ATH's and it's really anybody's guess how high it could go. 88870 seems to be forming as the new support level I'll see you all in the trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |