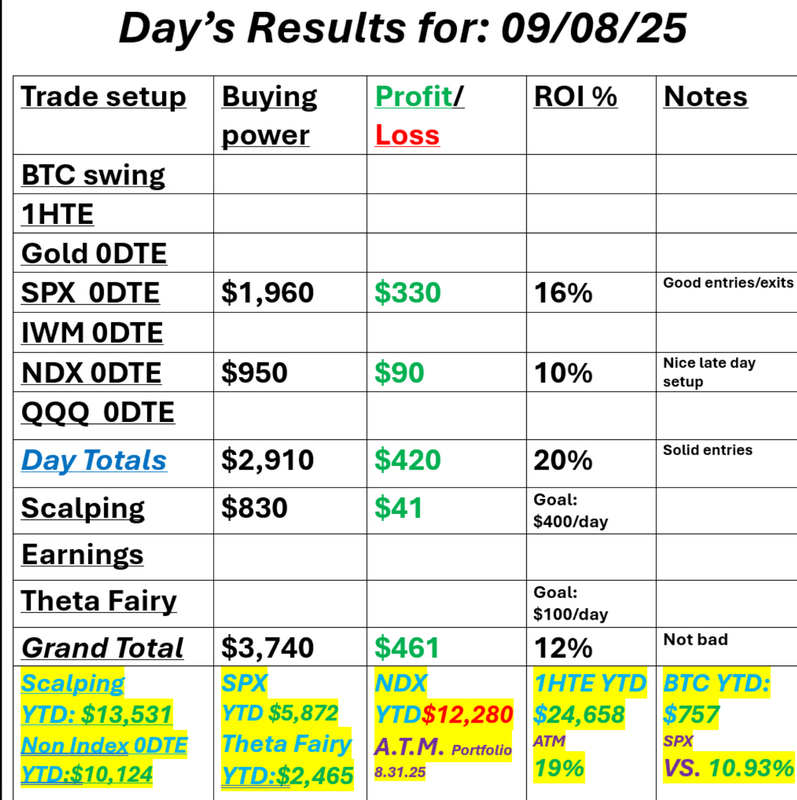

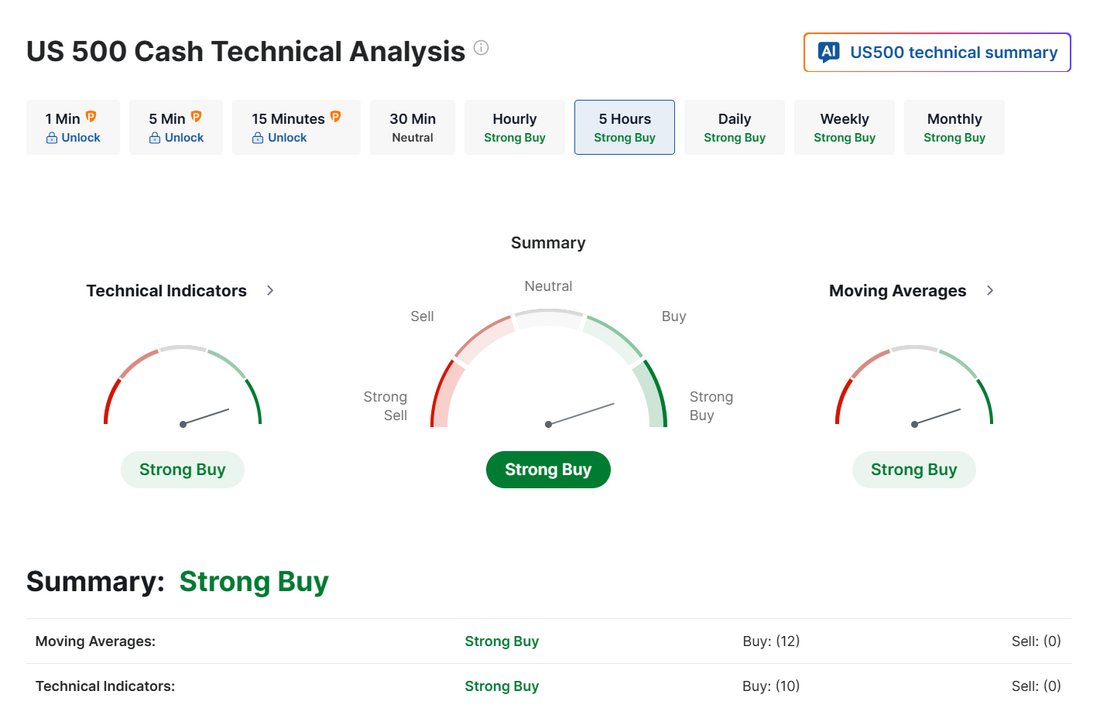

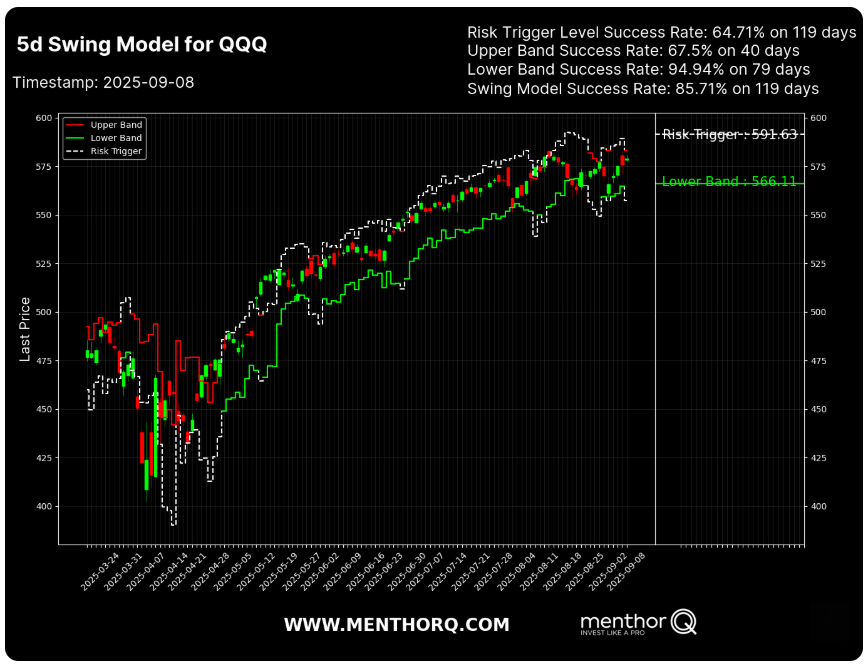

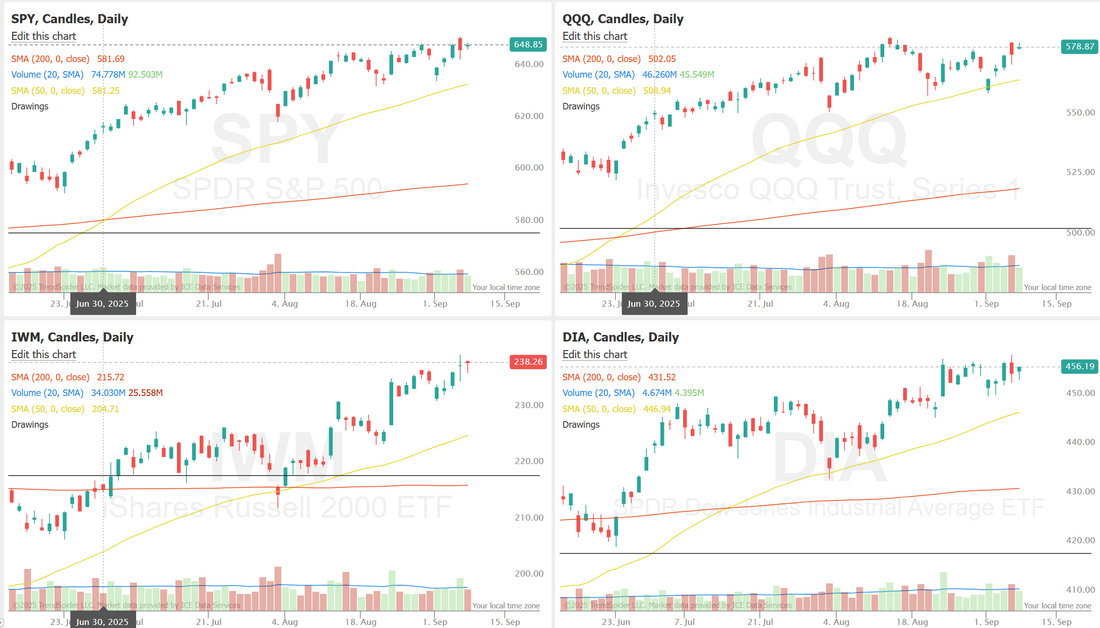

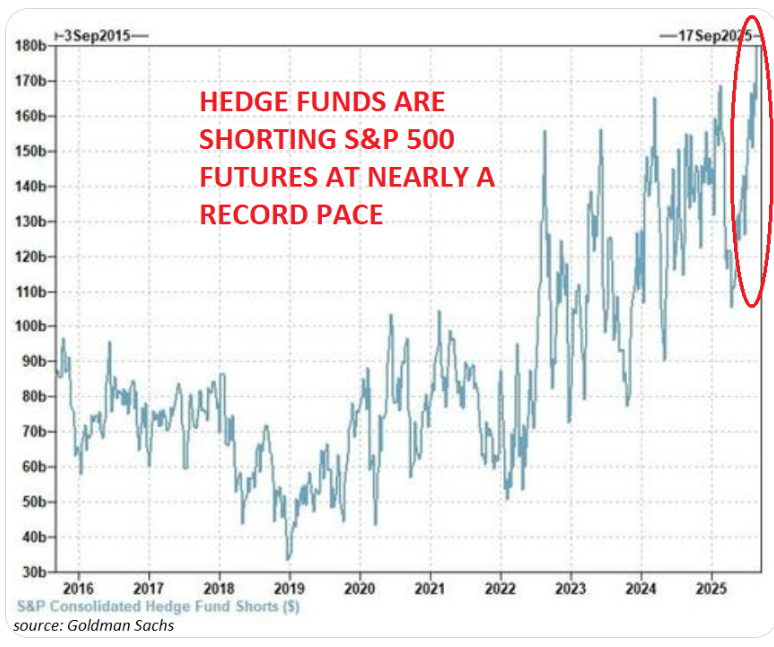

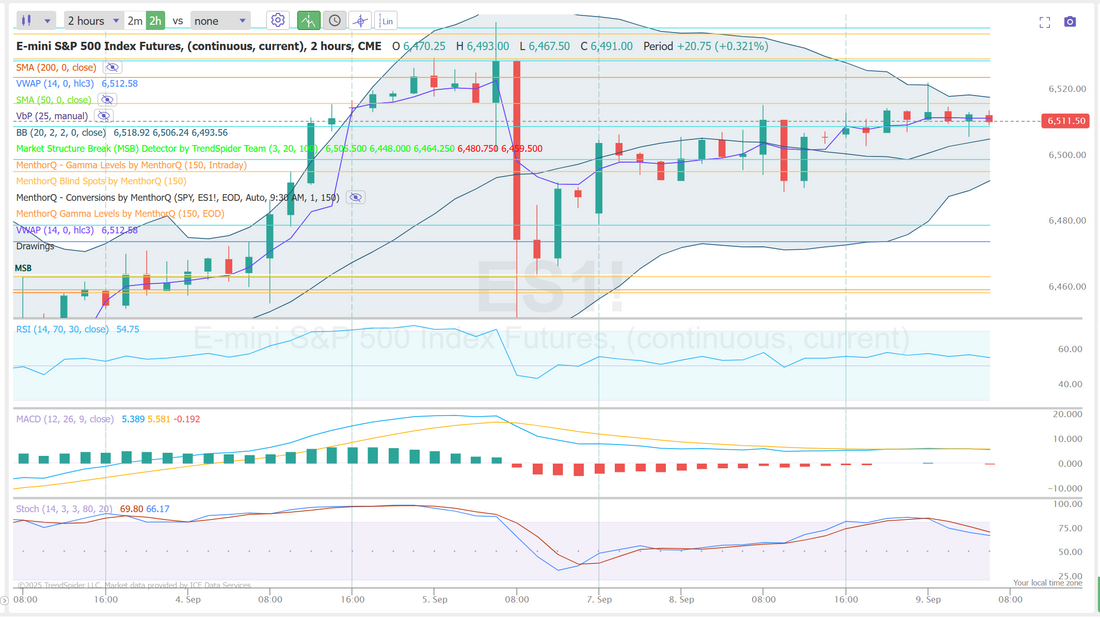

Job revisions...how bad?We get the job revision numbers today. It's generally assumed it will be revised down. the question is how much? I think it's big and that should solidify a rate cut come next week. We had a perfect day yesterday. Our entries and exits were about as well timed as can possibly be but the moves were small all day and it just wasn't enough to get our daily profit goal of $1,000+ dollars. Still, it was a solid day with everything we touched working well. See our results below: Let's take a look at the market. Bullish sentiment is holding. The SPX momentum score chart as of September 8, 2025 shows the index trading near the upper end of its recent range, with spot prices holding steady around the 6,400–6,500 zone. Momentum scores have stabilized at 4, following a brief dip to 3 in late August. This stabilization suggests that while upward strength has moderated compared to the early summer rally, there’s still enough support in the short term to maintain current levels rather than a sharp reversal. Looking at the short-term setup, the chart reflects a steady but less aggressive trend, where momentum remains constructive but not at peak levels seen in July. The key takeaway here is that the index appears to be consolidating gains while retaining enough momentum to keep the bias tilted upward in the near term, unless a new catalyst shifts sentiment. The QQQ 5-day swing model chart highlights a short-term setup where price is hovering near the upper end of its recent range. The risk trigger sits around 591.63, while the lower band support is at 566.11, which has historically shown high reliability (94.94% success rate). The swing model itself holds an overall success rate of 85.71% on 119 days, suggesting this framework has been effective in gauging directional moves. In the short term, the focus will likely be on whether QQQ can sustain momentum above the risk trigger, or if it begins pulling back toward the lower band where buyers have often stepped in. This keeps attention on volatility around these levels as the model points to a tactical inflection zone. We continue to just hang out around the ATH's. With CPI and PPI incoming we should finally get some movement. September S&P 500 E-Mini futures (ESU25) are trending up +0.17% this morning, buoyed by hopes for multiple interest rate cuts from the Federal Reserve this year, while investors await an annual review of U.S. jobs data. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Applovin (APP) surged over +11% and was the top percentage gainer on the Nasdaq 100 after S&P Dow Jones Indices announced that the stock would be added to the S&P 500 index on September 22nd. Also, chip stocks advanced, with Marvell Technology (MRVL) rising more than +4% and Broadcom (AVGO) gaining over +3%. In addition, EchoStar (SATS) jumped more than +19% after SpaceX agreed to acquire wireless spectrum from the company for about $17 billion. On the bearish side, Summit Therapeutics (SMMT) plummeted over -25% after the company released new data that raised concerns about the future of its closely-watched lung cancer drug, ivonescimab. Monday showed that U.S. consumer credit rose by $16.01 billion in July, stronger than expectations of $10.40 billion. “While the Sept. 5 report showed job growth had slowed, it doesn’t appear to be signaling a recession,” according to Invesco Global Market Strategy Office. “Slower growth, anchored inflation expectations, falling yields, and anticipated rate cuts point to an optimistic outlook for stocks.” U.S. rate futures have priced in a 100% probability of a 25 basis point rate cut and an 11.8% chance of a 50 basis point rate cut at the upcoming monetary policy meeting. Today, investors will closely monitor the Bureau of Labor Statistics’ release of its preliminary benchmark revision to payrolls for the year through March. The figure is expected to show another downward revision to March payrolls, suggesting the labor market was weakening well before the recent spell of sluggish job growth. Wells Fargo, Comerica Bank, and Pantheon Macroeconomics economists expect the revision to show that the March payroll count was nearly 800,000 lower than currently estimated, or about 67,000 fewer per month on average. Nomura Securities, Bank of America, and Royal Bank of Canada estimate that the downgrade could be closer to one million. “A big downward revision to job growth through March 2025 would have less implications for monetary policy than a downward revision to job growth in the most recent months, but it does set the stage for the broader context of how the economy has been doing. And all things equal, downward revisions to job growth increase pressure on the Fed to ease policy,” said Bill Adams, chief economist at Comerica. Market participants will also focus on earnings reports from several notable companies, with Oracle (ORCL), Synopsys (SNPS), Rubrik (RBRK), AeroVironment (AVAV), and GameStop Corp. (GME) set to release their quarterly figures today. Meanwhile, Apple (AAPL) hosts its biggest product launch event of the year today. The tech giant is expected to unveil four new iPhones at the gathering, including a new iPhone 17 Air. The Air will likely be slimmer and lighter than the base iPhone models. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.065%, up +0.49%. Hedge funds are shorting the S&P 500 futures at nearly a RECORD pace: Hedge funds short exposure to the S&P 500 futures hit $180 BILLION, an all-time high. As a share of open interest, shorts hit ~27%, the highest in 2.5 years, only below March 2023 and September 2022. Let's take a look at our key intra-day levels on /ES for our 0DTE today. 6517, 6525, 6538, 6550, are all the resistance zones. 6509, 6499, 6496, 6480 are support zones. My lean or bias yesterday was begrudgingly bullish. It's the same today. Job revisions should boost futures and they are green right now as I type. We had a good training yesterday on inverting charts to change our view and understanding of price action. We'll have another training session next Monday. Mark it on your calendar.

I'll see you all shortly in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |