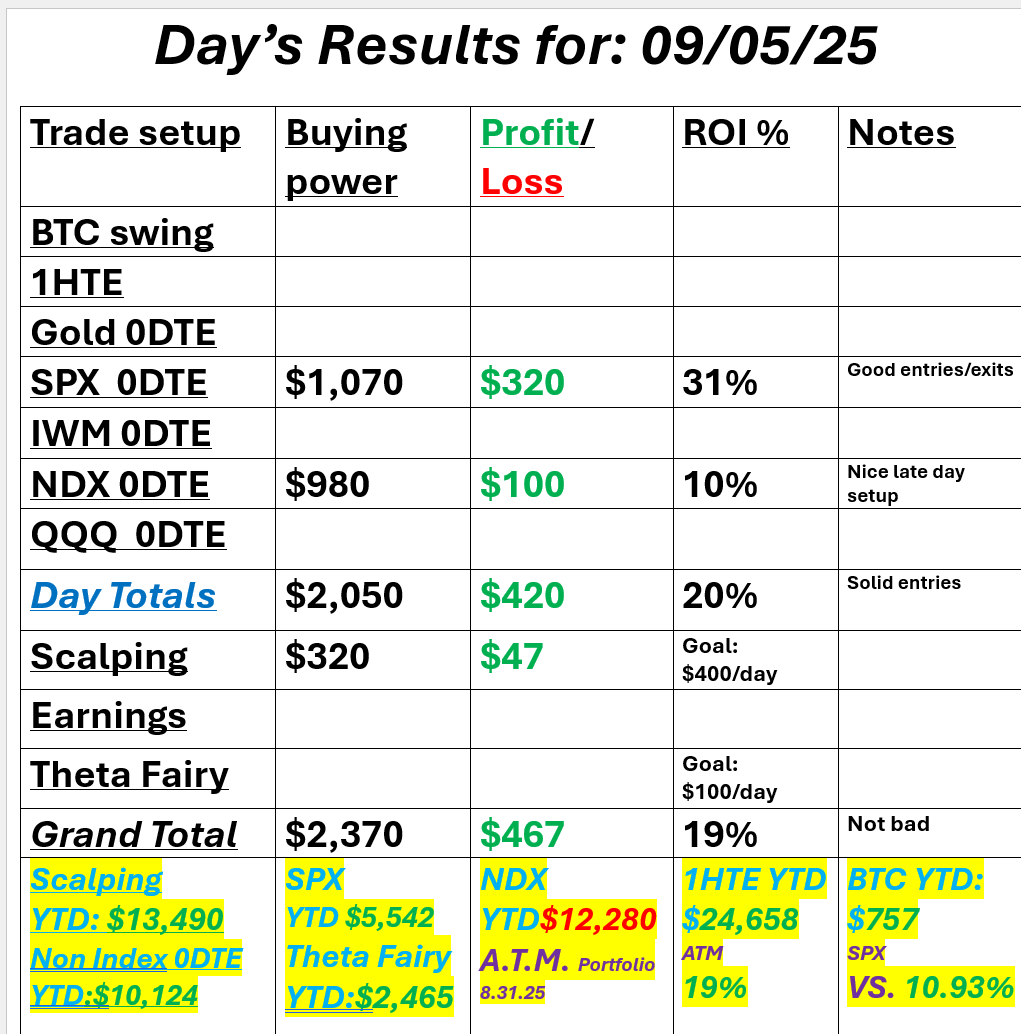

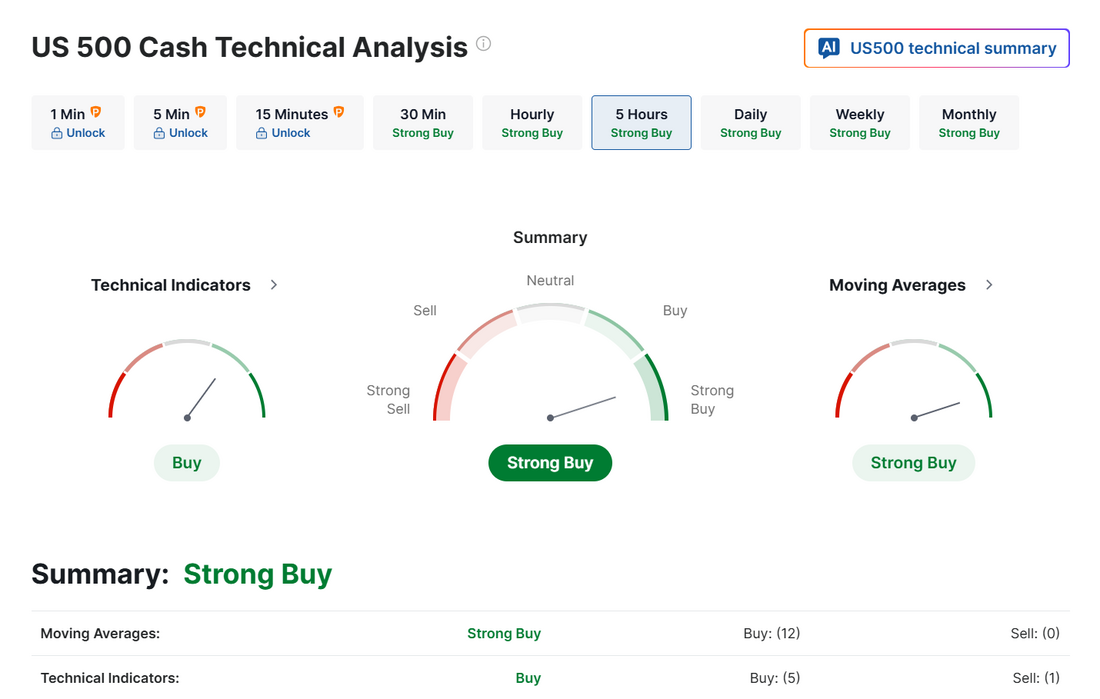

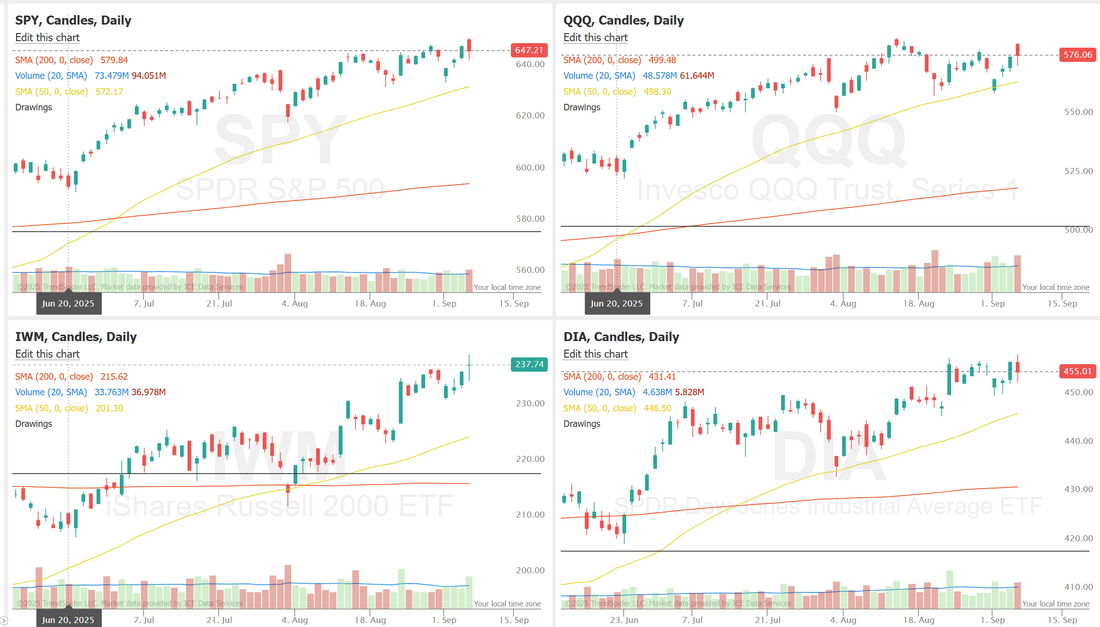

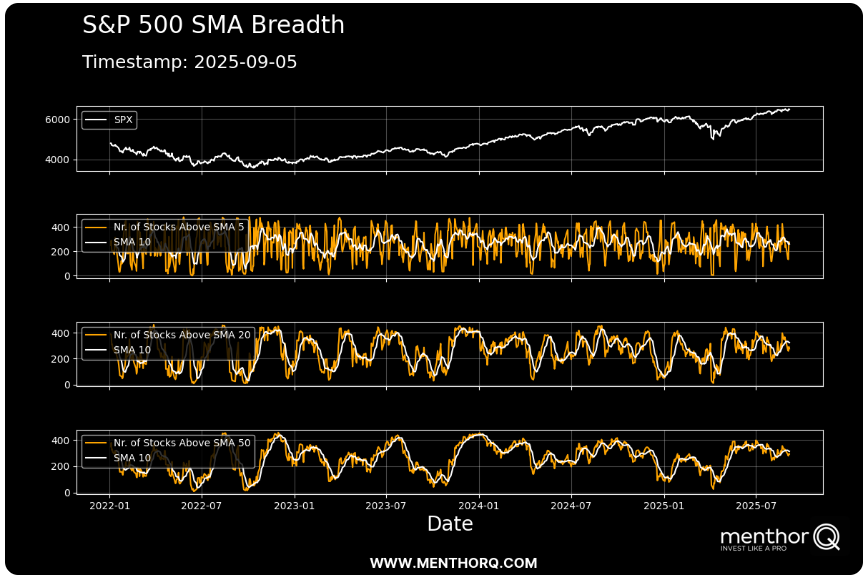

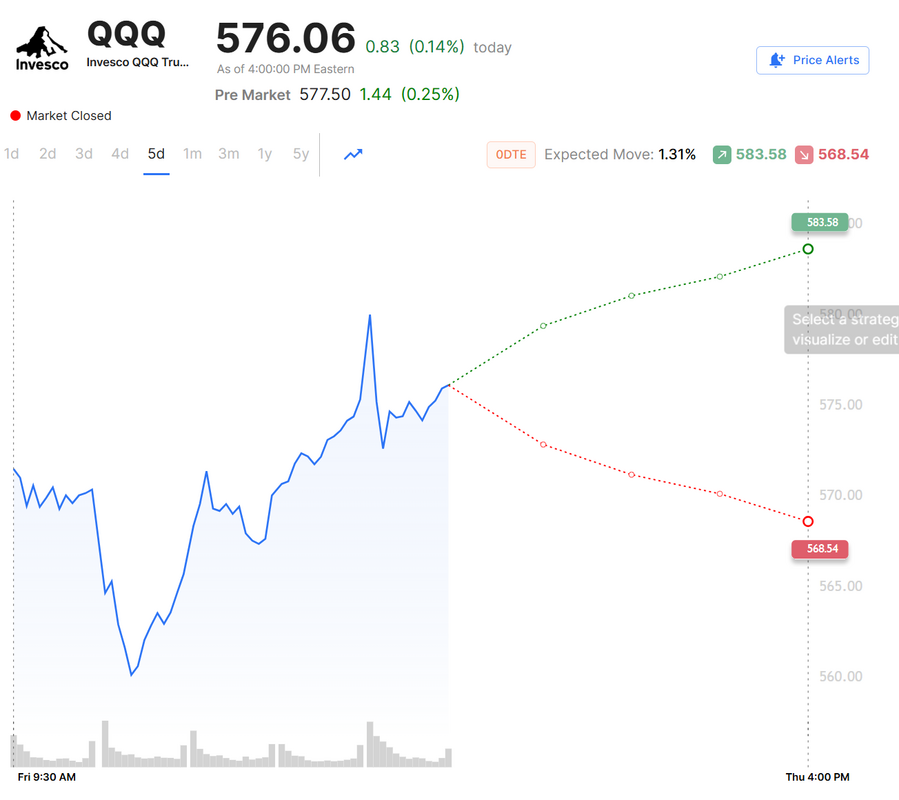

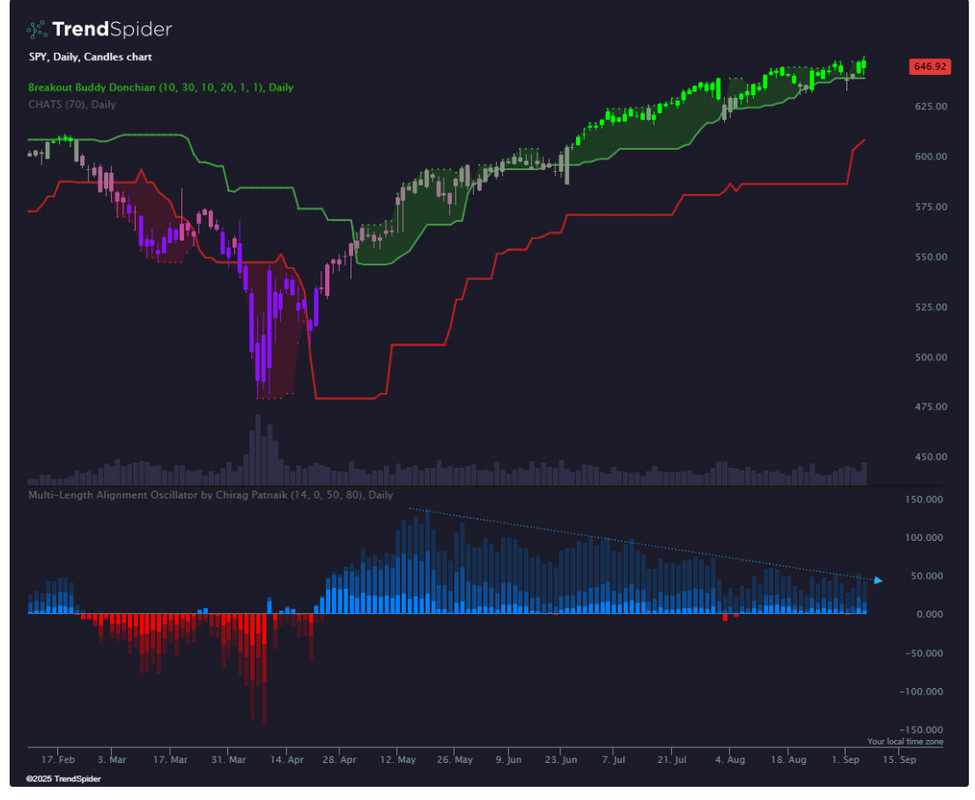

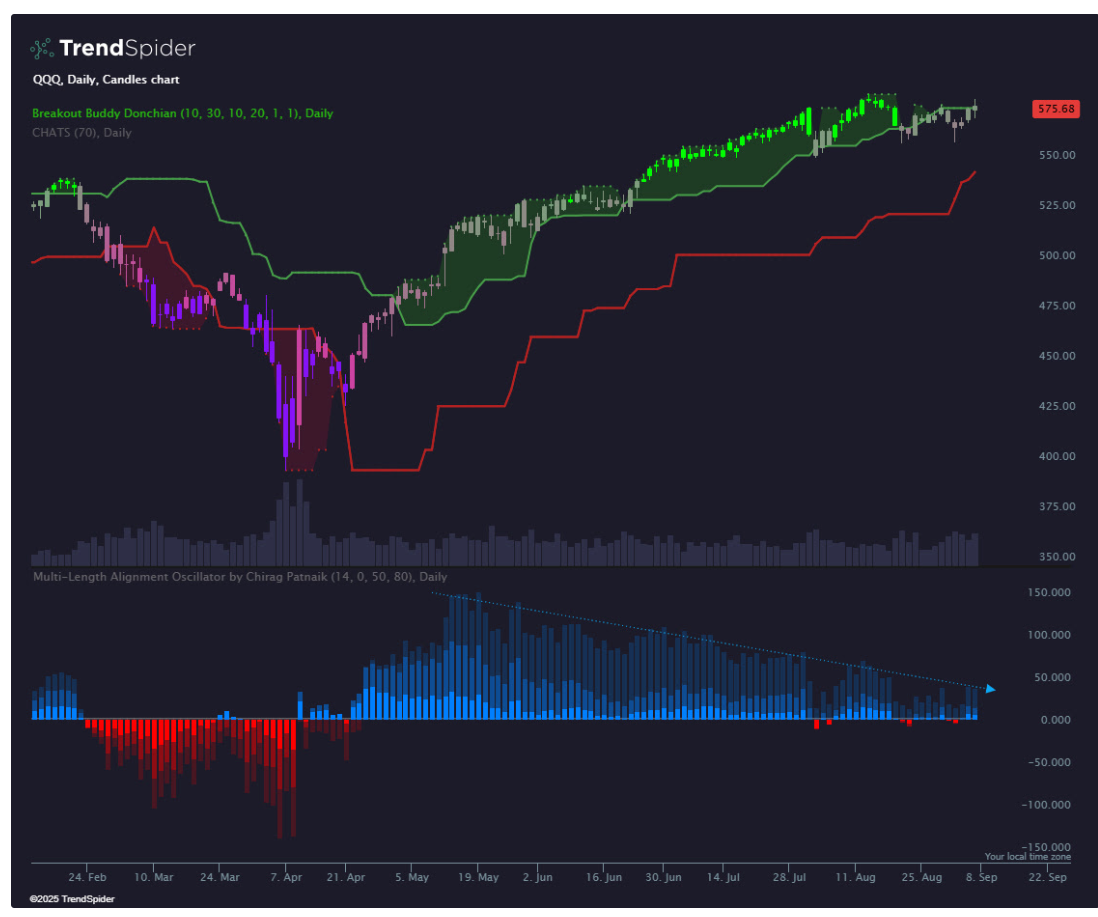

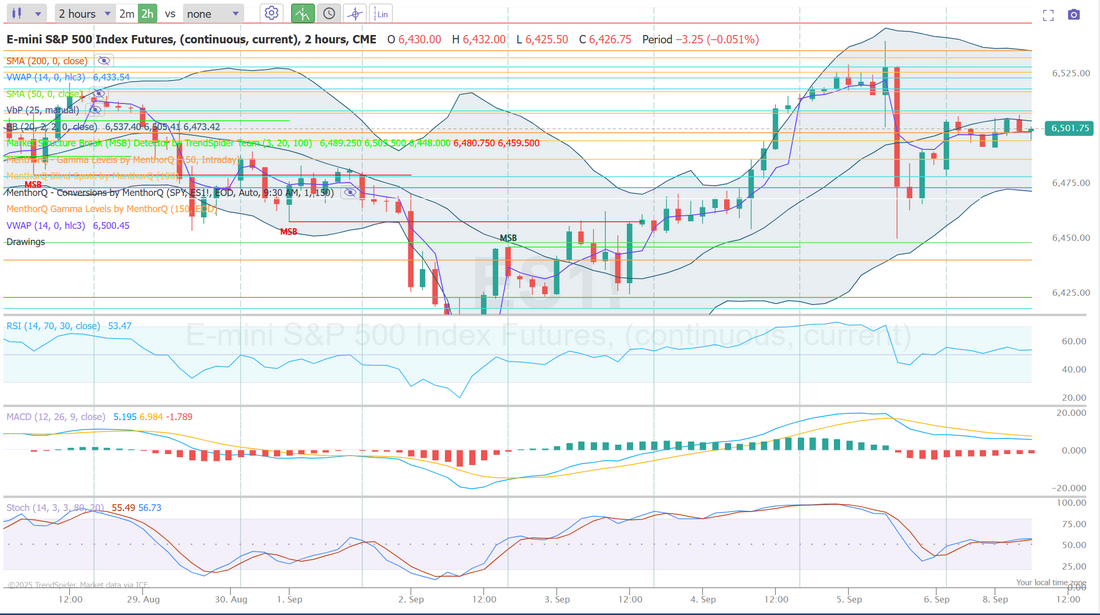

Invert...always invert - Charlie Munger Welcome to a new trading week! We've got another exciting training module for you today based on the great Charlie Munger. We have a trading mantra "Hope for the best, expect the worst". It's based on Charlie Mungers call to "Invert, always invert". We'll apply this today to some of the top favored stocks in todays market. We had a good day Friday with our 0DTE's and scalping. I finally cut bait on our LULU trade after a disappointing reaction to earnings. We continue to cash flow it in our ATM portfolio. Here's a look at our day trades. Let's check on market statistics. Bullish sentiment looks strong here. ATH's were not able to hold on Friday. We continue to look a little "toppy" here. The S&P 500 SMA breadth chart highlights how broad participation is shaping the current rally. The top panel shows the index steadily climbing toward fresh highs, while the breadth measures below track how many individual stocks are trading above their short-, medium-, and longer-term moving averages (SMA 5, 20, and 50). In the short term, the SMA 5 breadth looks choppy, showing frequent reversals a sign of near-term noise and rapid rotations. The SMA 20 and 50 breadths are holding in the mid-range, suggesting that while not all stocks are trending strongly, participation remains relatively healthy compared to previous dips. For traders watching breadth as a confirmation tool, the takeaway is that short-term fluctuations are active, but the medium-term trend still shows enough support to sustain market momentum, provided breadth doesn’t roll over sharply in the coming days. Let's take a look at the I.V. for the week and expected moves. I.V. is still in the dumps. It continues to make debit trades more attractive. The SPY hit another new all-time high last week, closing modestly higher at $647.24 (+0.32%). Price remains above the upper channel of the Chande Breakout Buddy, signaling that bullish momentum is still in play. However, the Multi-Length Alignment Oscillator is trending lower, suggesting signs of internal weakness as the rally grinds higher with diminishing strength. QQQ climbed to $576.06 (+0.99%) last week, as Broadcom’s blowout earnings gave the Nasdaq-100 a lift. Still, the index failed to reclaim green bullish candles on the Chande Breakout Buddy, and a new short-term red column emerged on the Multi-Length Alignment Oscillator. Among the major indexes, big tech is showing the most pronounced loss of momentum. Let's look at our intra-day levels on /ES: 6509, 6517, 6530, 6537 are resistance areas. 6496, 6488, 6479, 6475, 6450 are support zones. September S&P 500 E-Mini futures (ESU25) are up +0.26%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.34% this morning, pointing to a higher open on Wall Street as investors boosted their expectations for how much the Federal Reserve will cut interest rates this year. This week, investor focus is squarely on the release of key U.S. inflation data. In Friday’s trading session, Wall Street’s major equity averages closed in the red. Lululemon Athletica (LULU) tumbled over -18% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the athleisure company cut its full-year guidance for the second time in a row. Also, Kenvue (KVUE) slumped more than -9% after the Wall Street Journal reported that the Department of Health and Human Services plans to release a report linking autism to pregnant women’s use of the company’s Tylenol painkiller. In addition, Copart (CPRT) fell over -2% after reporting weaker-than-expected FQ4 revenue. On the bullish side, Broadcom (AVGO) surged over +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the semiconductor and software company posted upbeat FQ3 results and issued above-consensus FQ4 revenue guidance. Bloomberg also reported that the chipmaker partnered with OpenAI to make AI accelerators. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose by 22K in August, weaker than expectations of 75K. Also, the U.S. unemployment rate ticked up to a 3-3/4-year high of 4.3% in August, in line with expectations. In addition, U.S. August average hourly earnings rose +0.3% m/m and +3.7% y/y, in line with expectations. “Bad news for employment is good news for investors wanting lower rates. A September cut is a near certainty, and October is increasingly in play,” said David Russell at TradeStation. Chicago Fed President Austan Goolsbee said on Friday that he remains undecided about what stance to take at the September meeting, pointing to upcoming inflation data. “I want to get more information. I’m still undecided as we’re going into this,” Goolsbee told Bloomberg Television. “We’ve got to look at the inflation side too.” U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut and a 9.9% chance of a 50 basis point rate cut at next week’s monetary policy meeting. Meanwhile, U.S. President Donald Trump said late on Friday that White House economic adviser Kevin Hassett, Fed Governor Christopher Waller, and former Fed Governor Kevin Warsh are the finalists to replace Jerome Powell as the central bank’s chair. “You could say those are the top three,” Trump told reporters. The U.S. consumer inflation report for August will be the main highlight this week. Slower price growth could reinforce expectations for a series of rate cuts after a likely move in September, while hotter-than-expected inflation may lead investors to price in a more cautious pace of easing. Market watchers will assess the extent to which hefty U.S. tariffs are passing through to consumers. HSBC economists said, “As reciprocal tariffs finally took effect in early August, markets will be keen to see if the August data reflect any uptick in prices from higher tariffs.” Other noteworthy data releases include the U.S. PPI, the Core PPI, Wholesale Inventories, Initial Jobless Claims, and the University of Michigan’s Consumer Sentiment Index (preliminary). Market participants will also closely monitor the Bureau of Labor Statistics’ release of its preliminary benchmark revision to payrolls for the year through March. The figure is expected to show another downward revision to March payrolls, suggesting the labor market was weakening well before the recent spell of sluggish job growth. Fed Governor Christopher Waller recently projected that monthly job creation will be reduced by an average of about 60,000. In addition, several notable companies like Oracle (ORCL), Adobe (ADBE), Synopsys (SNPS), Kroger (KR), and Chewy (CHWY) are scheduled to release their quarterly results this week. U.S. central bankers are in a media blackout period before the September 16-17 policy meeting, so they are prohibited from making public comments this week. Apple (AAPL) is expected to unveil the new iPhone 17 at its Tuesday event, with other models likely to be introduced, including a slimmer “Air” version and other “Pro” models. Also, several major tech companies are set to deliver presentations at the annual Goldman Sachs Communacopia + Technology Conference, with Nvidia (NVDA) scheduled for Monday, Meta (META) and Broadcom (AVGO) for Tuesday, and Microsoft (MSFT) for Wednesday. Today, investors will focus on U.S. Consumer Credit data. Economists expect this figure to be $10.40 billion in July, compared to the previous figure of $7.37 billion. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.084%, up +0.05%. My lean or bias today is a very non committal buillishness. We seem to have support here. Futures are up, as I type so I'll start my day with a bullish lean. I'll see you all in the live trading room shortly. I'm looking forward to our training today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |