|

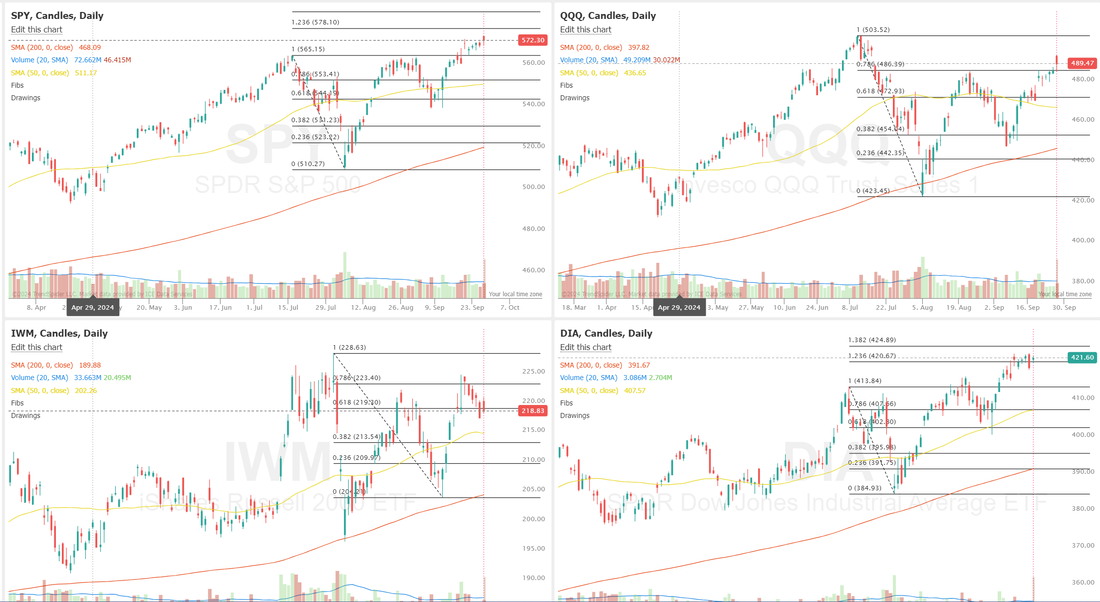

Welcome back traders. We've had a really stellar week so far. Yesterday was amazing for us. It wasn't easy. We had both our put side and call side threatened on our NDX trades but we navigated it well. Is was another "excellent" day for us will all our day trades producing profit and my net liq up almost $6,000 dollars. Our Nat gas and Corn trade are positioned to really generate some income over the next month. Here's a look at our results. Markets are still working the bullish bias. While the bullishness persists, I continue to look to establish a short, cash flow setup for the DIA in both our model portfolio and the A.T.M. program. It's looking a little toppy. December S&P 500 E-Mini futures (ESZ24) are trending down -0.04% this morning as investors braced for the release of the Federal Reserve’s first-line inflation gauge, which will offer further insights into the trajectory of U.S. interest rates. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Micron Technology (MU) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the memory chipmaker posted upbeat Q4 results and provided a strong Q1 revenue forecast. Also, Southwest Airlines (LUV) climbed more than +5% after the carrier lifted its Q3 revenue-per-capacity guidance and unveiled a new $2.5 billion stock buyback program. In addition, Accenture (ACN) gained over +5% after the company reported better-than-expected Q4 results and issued above-consensus Q1 revenue guidance. On the bearish side, Super Micro Computer (SMCI) tumbled over -12% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the Wall Street Journal reported the U.S. Justice Department is investigating the company. The U.S. Commerce Department said Thursday that the Q2 GDP growth estimate remained at +3.0% (q/q annualized) in its final print, in line with expectations. Also, U.S. August durable goods orders were unchanged m/m, better than the -2.8% m/m expected, while core durable goods orders rose +0.5% m/m, stronger than expectations of +0.1% m/m. In addition, U.S. pending home sales rose +0.6% m/m in August, weaker than expectations of +0.9% m/m. Finally, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -4K to a 4-month low of 218K, compared with 224K expected. “If there’s a problem in the labor market, it’s not showing up in the weekly jobless claims data. Numbers like this will likely keep soft-landing hopes alive and well,” said Chris Larkin at E*Trade from Morgan Stanley. Fed Governor Lisa Cook stated Thursday that she “wholeheartedly” backed the central bank’s decision last week to reduce interest rates by a half percentage point, pointing to a cooling labor market and easing inflation. “In thinking about the path of policy moving forward, I will be looking carefully at incoming data, the evolving outlook, and the balance of risks,” Cook said. Meanwhile, U.S. rate futures have priced in a 49.2% chance of a 25 basis point rate cut and a 50.8% probability of a 50 basis point rate cut at the November FOMC meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.7% y/y in August, compared to the previous figures of +0.2% m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists forecast August Personal Spending to be at +0.3% m/m and August Personal Income to come in at +0.4% m/m, compared to the July numbers of +0.5% m/m and +0.3% m/m, respectively. U.S. Wholesale Inventories preliminary data will come in today. Economists anticipate the August figure to be +0.2% m/m, matching the +0.2% m/m recorded in July. The U.S. Michigan Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 69.0 in September, compared to 67.9 in August. In addition, market participants will be looking toward a speech from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.783%, down -0.32%. My bias or lean today is more neutral. Once again, we've got bullish price action thats looking more and more like its running out of steam. Super low volume with less and less buyers showing up. Trade docket for today: /MNQ and QQQ for scalping. BB, COSt, CRM, FDX, NEM, IWM?, ORCL, PYPL, QQQ/SPY, SHOP, UPST, 0DTE's. Let's take a look at the intra-day levels for 0DTE's. /ES: The market appears to be flattening out. 5814 is first resistance with 5821 following and 5830 being the big one. This is the ATH. 5800 is first support with 5790 then 5771 the big one. It's PoC on 2hr. chart. /NQ: Nasdaq is still lagging the SP500 in terms of performance. 20419 is first resistance with 20468 next. 20536 is the recent high and a push above that would be very bullish. 20231 is the main support level target. Its the 50 period M.A. on the 2 hr. chart. Below that we could see a decent sized retrace. BTC: Bitcoin has been on a very nice run this whole month. 66,000 is the key upside resistance level with 64752 as support. Let's finish strong today, going into the weekend!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |