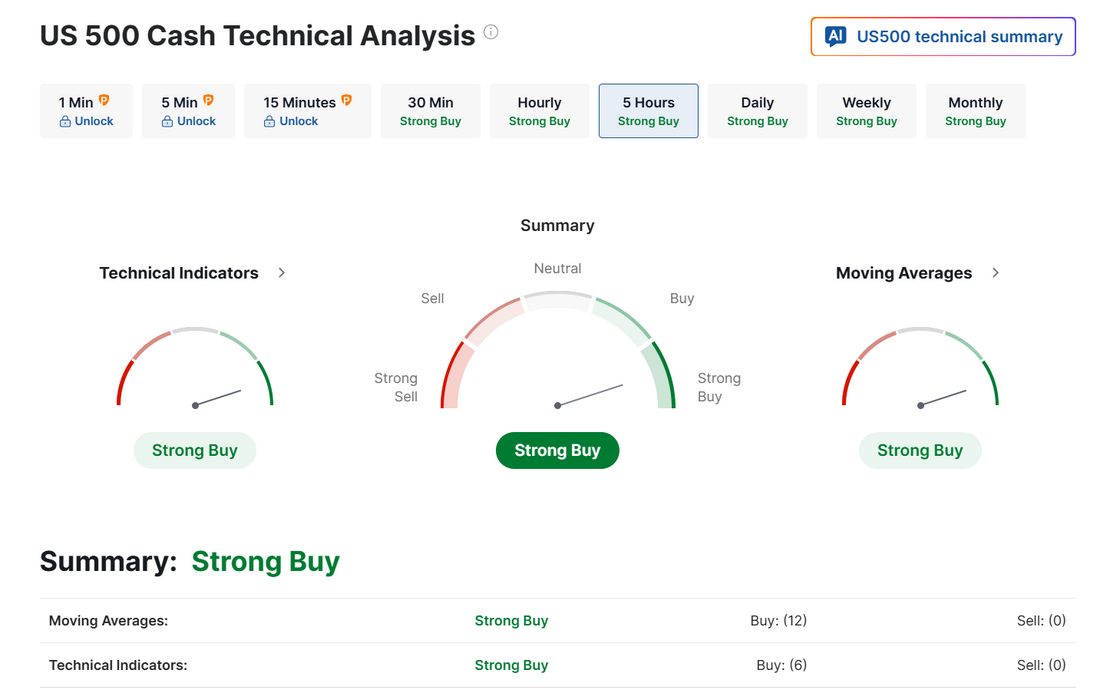

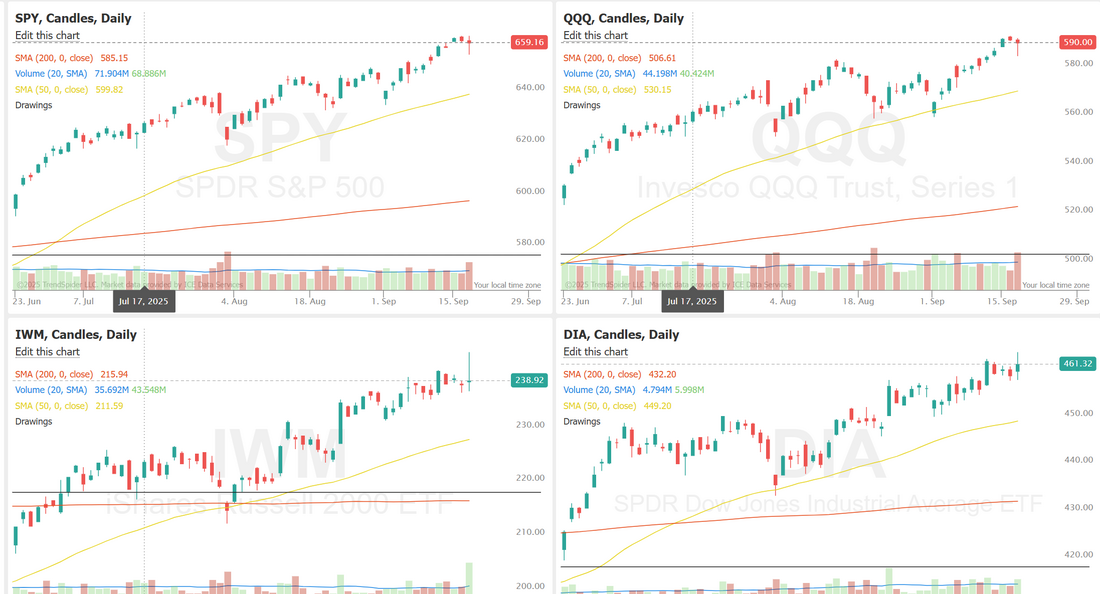

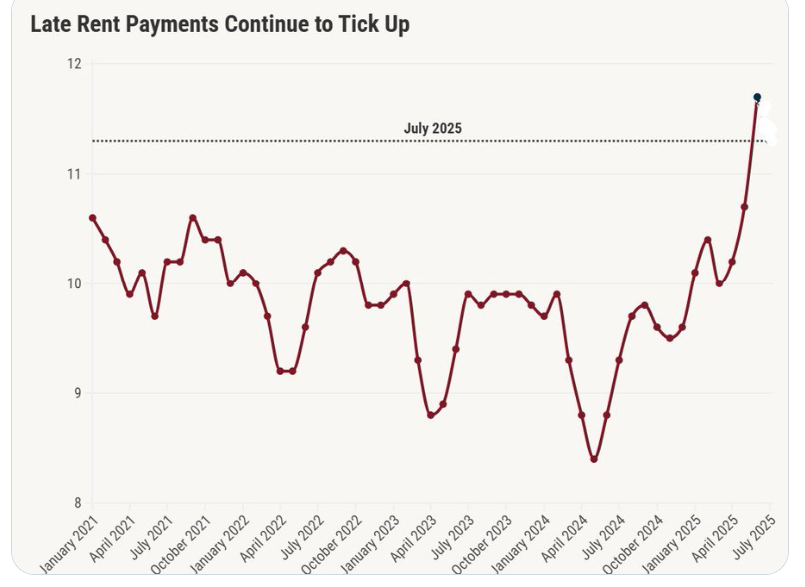

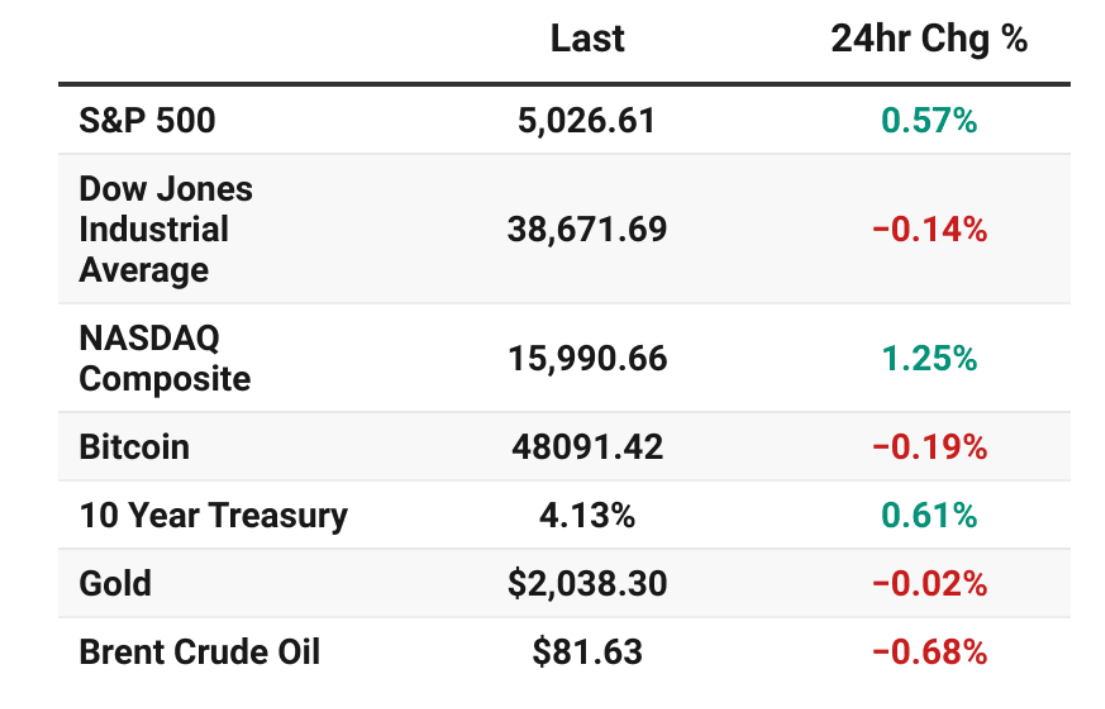

Now what?Well, we got our 25bp rate cut that most expected. What does that mean going forward now? Markets fluctuated yesterday but ended relatively flat. Futures are up this morning. We do have jobless claims incoming this morning but the market seems to like the cut so far. It will be interesting to see how the rest of the year pans out. The market has baked in two more cuts this year yet 10 FED members are looking for two rate cuts. 7 are looking for zero. 2 are looking for one. That doesn't seem like a lock on two more cuts to me. We'll see. That's why we show up each day. We had no results yesterday as we placed a 1DTE trade that we'll continue to work today. Let's take a look at the markets price action. Technicals are holding bullish. Markets are hanging on to the ATH zone. September S&P 500 E-Mini futures (ESU25) are up +0.84%, and September Nasdaq 100 E-Mini futures (NQU25) are up +1.10% this morning, pointing to a sharply higher open on Wall Street after the Federal Reserve cut interest rates for the first time since December and signaled more reductions could follow soon. As widely expected, the Federal Reserve cut interest rates yesterday. The Federal Open Market Committee voted 11-1 to lower the target range for the Fed funds rate by a quarter percentage point to 4.00%-4.25%. Newly sworn-in Governor Stephen Miran was the only policymaker to dissent, favoring a larger half-point rate cut. In a post-meeting statement, policymakers said the unemployment rate had “edged up but remains low,” adding that “downside risks to employment have risen.” At the same time, officials acknowledged that inflation has “moved up and remains somewhat elevated.” Policymakers also updated their economic projections and now anticipate two more quarter-point cuts this year. They project one quarter-point cut in 2026 and another in 2027. At a press conference, Chair Jerome Powell emphasized the Fed’s dual mandate challenges, noting that inflation pressures persist while labor-market data weakens, meaning “there’s no risk-free path” forward. Mr. Powell struck a cautious tone on the outlook for additional rate moves, saying the Fed was now in a “meeting-by-meeting situation.” In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. Nvidia (NVDA) fell over -2% and was the top percentage loser on the Dow after the Financial Times reported that China’s internet watchdog had banned the country’s biggest technology firms from buying Nvidia’s AI chips. Also, Uber Technologies (UBER) slid nearly -5% and was among the top percentage losers on the S&P 500 after rival Lyft and Alphabet’s Waymo announced plans to expand their fully autonomous ride-hailing service to Nashville in 2026. In addition, General Mills (GIS) dropped about -0.8% after the company posted weaker-than-expected FQ1 revenue. On the bullish side, Workday (WDAY) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after activist investor Elliott Investment Management disclosed a $2 billion stake in the company. Economic data released on Wednesday showed that U.S. August housing starts fell -8.5% m/m to 1.307 million, weaker than expectations of 1.370 million, while building permits, a proxy for future construction, unexpectedly fell -3.7% m/m to a 5-1/4-year low of 1.312 million, weaker than expectations of 1.370 million. Meanwhile, U.S. rate futures have priced in an 89.8% chance of a 25 basis point rate cut and a 10.2% chance of no rate change at the next FOMC meeting in October. Today, investors will focus on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists anticipate that the Philly Fed manufacturing index will stand at 1.7 in September, compared to last month’s value of -0.3. U.S. Initial Jobless Claims data will also be closely monitored today. Investors will be watching to see whether the prior week’s jump was a harbinger of a sustained downturn in the labor market or was merely a one-off. Economists estimate this figure will come in at 241K, compared to last week’s number of 263K. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the August figure to drop -0.2% m/m, compared to the previous number of -0.1% m/m. On the earnings front, notable companies such as FedEx (FDX), Lennar (LEN), and Darden Restaurants (DRI) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.047%, down -0.74%. The SPX continues to grind higher, now holding near the top of its recent range, with the momentum score firmly elevated at 5. This marks one of the strongest readings over the past few months, signaling sustained buying pressure despite intermittent pullbacks along the way. In the short term, this consistent momentum suggests that dips may find support quickly, though traders will want to monitor if the score can remain at these elevated levels any sharp downtick could hint at waning strength and open the door for consolidation. This isn't a good sign of how consumers are doing. The most absurd number in CPI? According to the US Government, the cost of health insurance has declined 20% over the last 5 years. Are CPI numbers really accurate? I don't think so. Let's take a look at the intra-day market levels. We've got some new levels to watch today: 6669, 6675, 6686 are upside resistance. 6649, 6628, 6625, 6608 are support. Big levels with big potential moves. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |