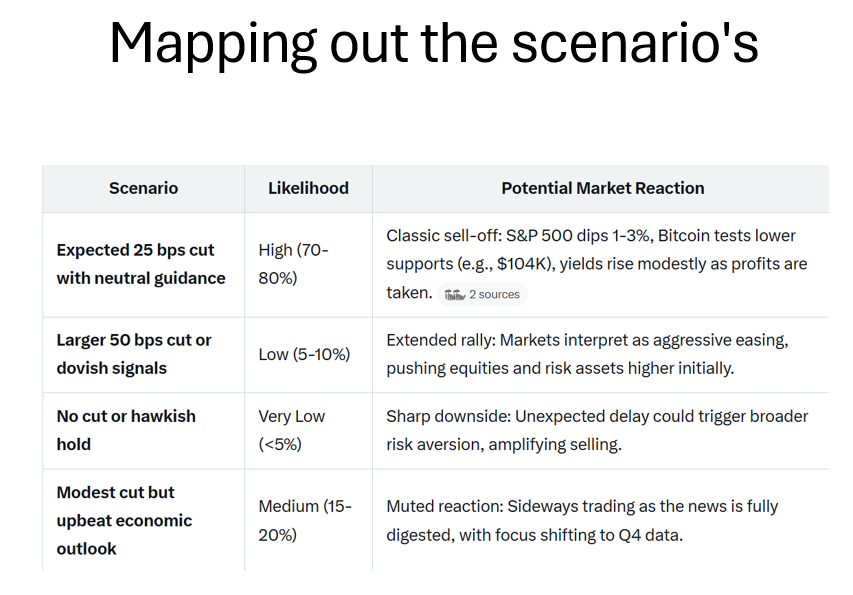

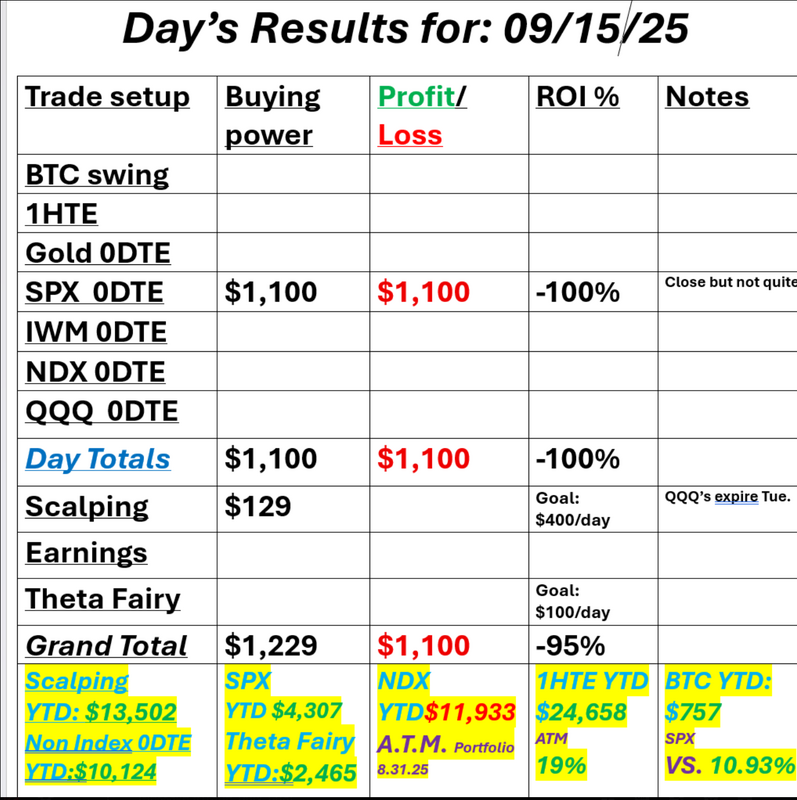

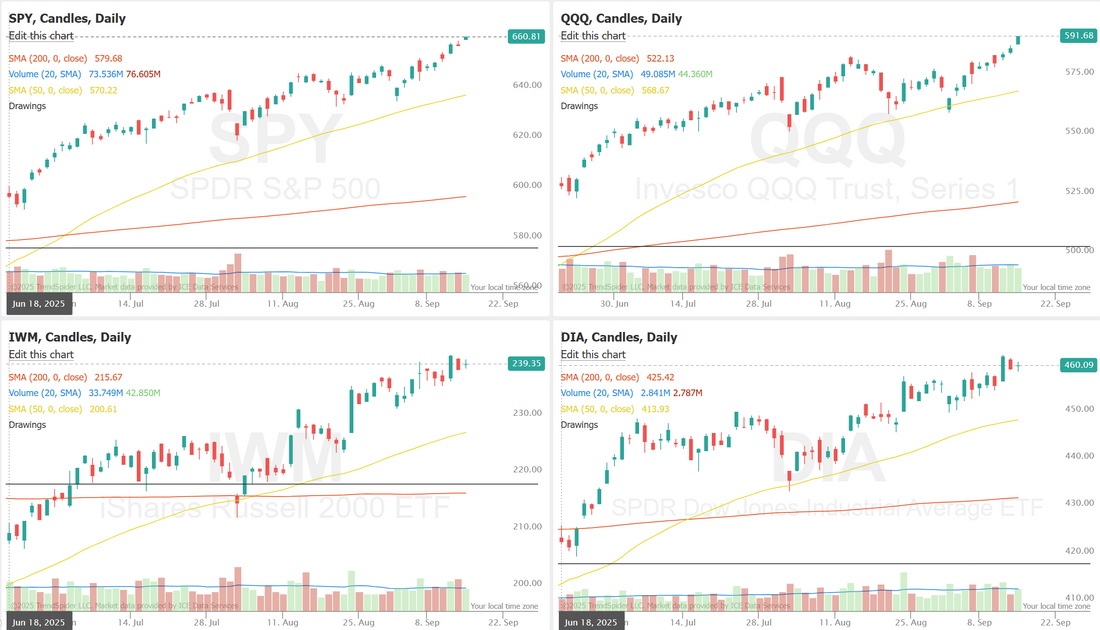

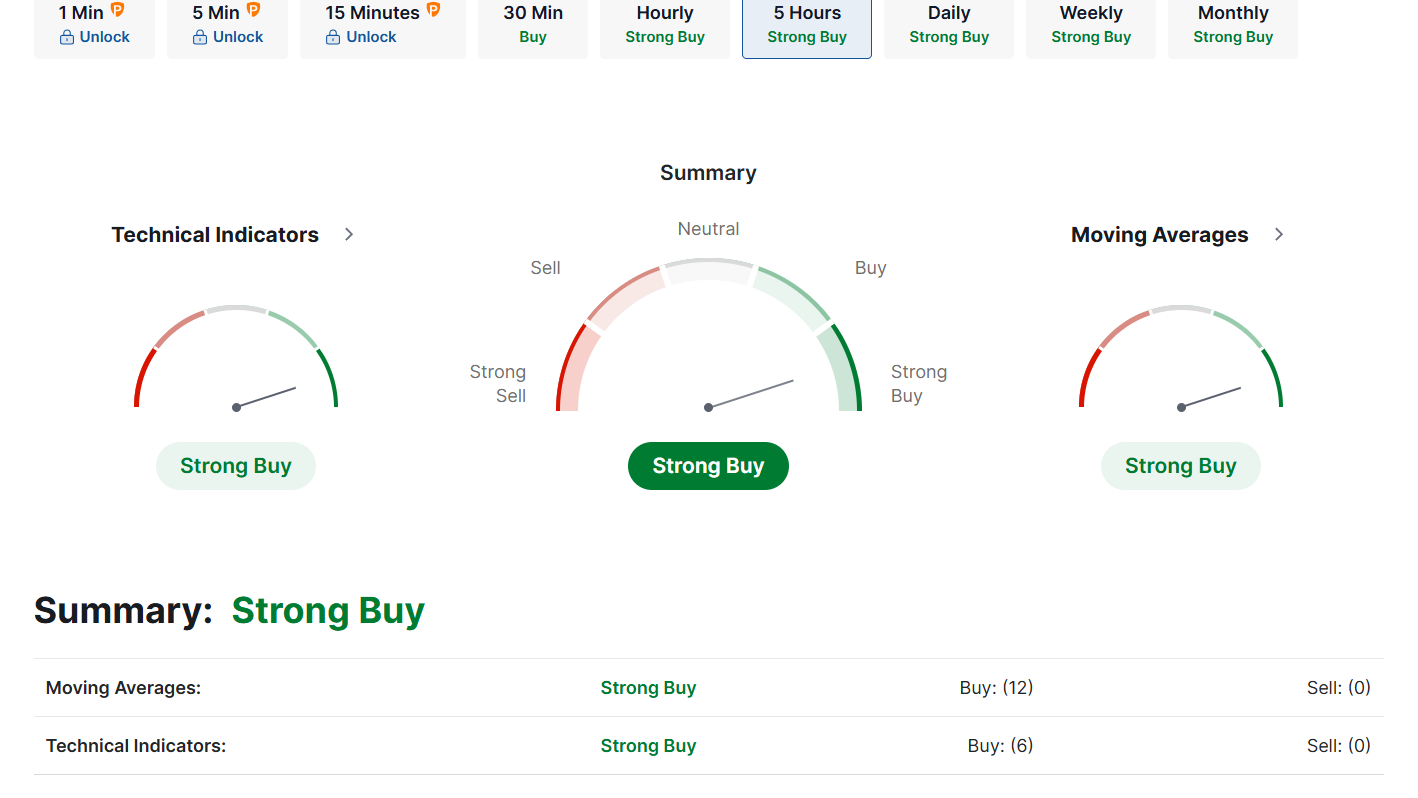

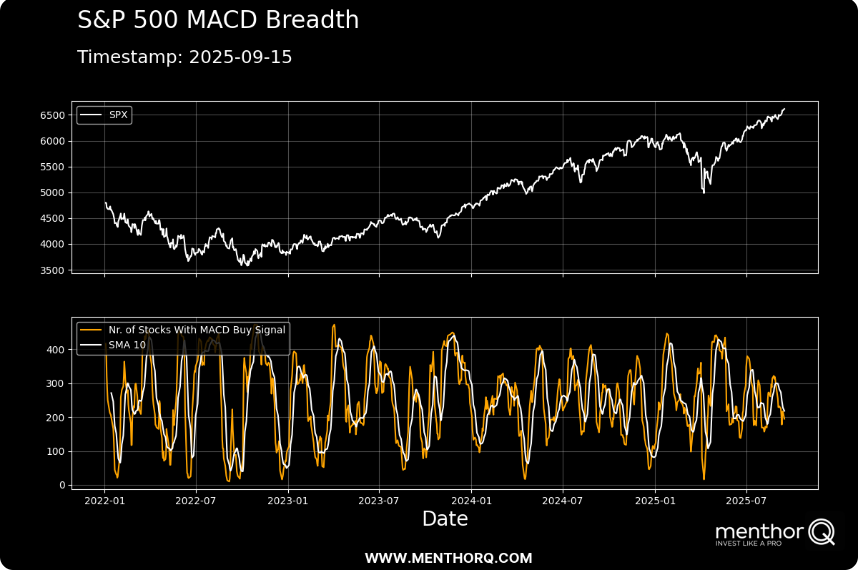

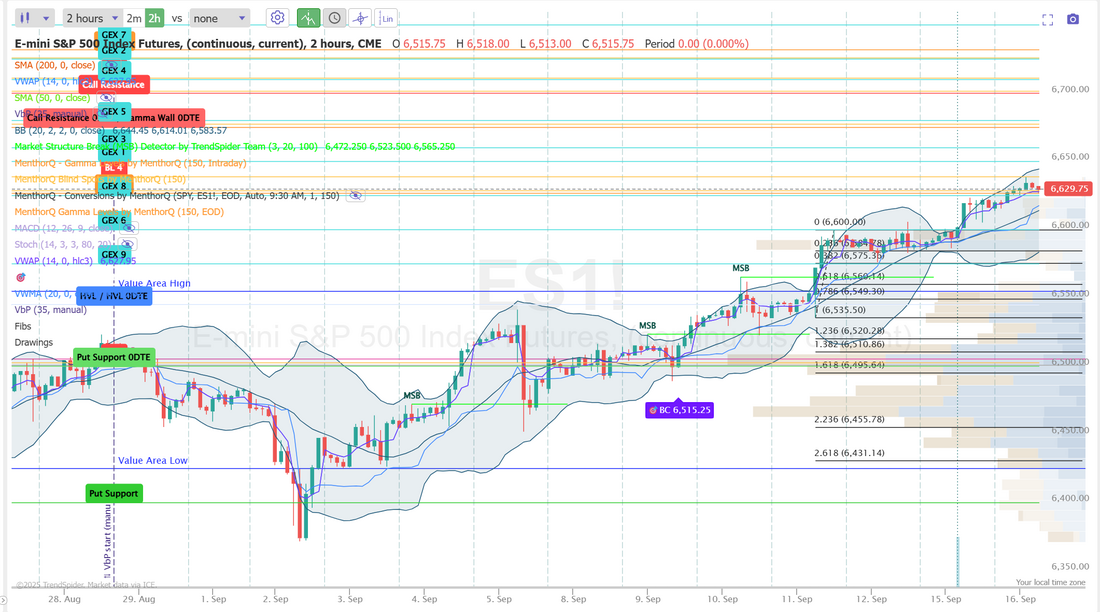

Here come the rate cut(s)The FED meets today, and we'll see Weds. What is the result? The questions are: #1. What size will the cut be? #2. What will that mean for the rest of the year and our next two decisions? #3. What will Powell say and how will he guide? It's certainly the big news item for this week's trading. We had a training session yesterday where we went over the data and what the past has taught us. Here's my projection for potential moves. This is obviously just one man's opinion (mine), but I do see some real potential for a "buy the rumor, sell the news" as a possible market reaction. I was looking for a retrace yesterday and while we got close and the risk/reward was quite good never the less, it didn't hit. Here's a look at my day. Let's take a look at the markets. Those ATH's just keep getting higher. Technicals are still firmly bullish, as you would imagine. Much like yesterday, I'm looking for more of a neutral day as traders prepare for FOMC tomorrow. September S&P 500 E-Mini futures (ESU25) are trending up +0.23% this morning as investors brace for the start of the Federal Reserve’s two-day policy meeting, where it is widely expected to cut interest rates, while also awaiting U.S. retail sales data. In yesterday’s trading session, Wall Street’s main stock indexes closed higher, with the S&P 500 and Nasdaq 100 notching new record highs. Seagate Technology (STX) climbed over +7% and was the top percentage gainer on the S&P 500 after Bank of America raised its price target on the stock to $215 from $170. Also, Alphabet (GOOGL) gained more than +4% after Citi raised its price target on the stock to $280 from $225. In addition, Tesla (TSLA) rose over +3% after CEO Elon Musk bought about $1 billion worth of the EV maker’s shares. On the bearish side, Corteva (CTVA) slumped more than -5% and was the top percentage loser on the S&P 500 after several analysts questioned the merits of a potential breakup of the agriculture company’s seed and pesticide businesses. Economic data released on Monday showed that the Empire State manufacturing index fell to a 3-month low of -8.70 in September, weaker than expectations of 4.30. The Fed kicks off its two-day meeting later in the day. The central bank is widely expected to cut the Fed funds rate by 25 basis points to a range of 4.00% to 4.25% on Wednesday. Investors will be watching Chair Jerome Powell’s post-policy meeting press conference for any indications on how quickly rates may fall from here. Following recent data painting a picture of a slowing labor market, U.S. money markets have almost fully priced in follow-up rate cuts in October and December. Market watchers will also closely parse the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which will offer key guidance on how policymakers expect the interest-rate path to unfold over the next few years. “Now the discussion will turn to how aggressively the Fed will act. The Fed may remind everyone that it may be focused on jobs now, but it hasn’t forgotten about the other half of its mandate,” said Chris Larkin at E*Trade from Morgan Stanley. In other Fed news, a federal appeals court ruled on Monday that Fed Governor Lisa Cook can continue serving at the central bank while her legal case proceeds, upholding a lower court’s decision. Also, President Trump’s economic adviser Stephen Miran is set to join the Fed’s board after the Senate confirmed him to the post on Monday night. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.2% m/m increase in August following a +0.5% m/m climb in July. Investors will also focus on U.S. Core Retail Sales data, which rose +0.3% m/m in July. Economists expect the August figure to climb +0.4% m/m. U.S. Industrial Production and Manufacturing Production data will be released today. Economists expect Industrial Production to drop -0.1% m/m and Manufacturing Production to be unchanged m/m in August, compared to the July figures of -0.1% m/m and no change m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to drop -0.1% m/m and the import price index to fall -0.2% m/m in August, compared to the previous figures of +0.1% m/m and +0.4% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.040%, up +0.12%. The SPX continues to hold near record highs, but MACD breadth signals show mixed short-term momentum. The number of stocks generating MACD buy signals has pulled back from recent peaks, with the 10-day average trending lower, suggesting participation in the rally has thinned. In the short term, this divergence could point to a need for consolidation if breadth doesn’t improve. Watching whether buy signals expand again or continue to contract will be key in gauging if the index can sustain upward momentum or faces a pause. Let's take a look at the intra-day levels I'm focused on today on /ES (still on Sept. exp) 6635, 6650, 6659, 6674 are resistance. 6624, 6600, 6585, 6576 are support. Note: The delta between the support vs. resistance levels is a lot larger. I'm not sure we get a retrace today but there certainly seems to be more potential for a big move downside vs. upside. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |